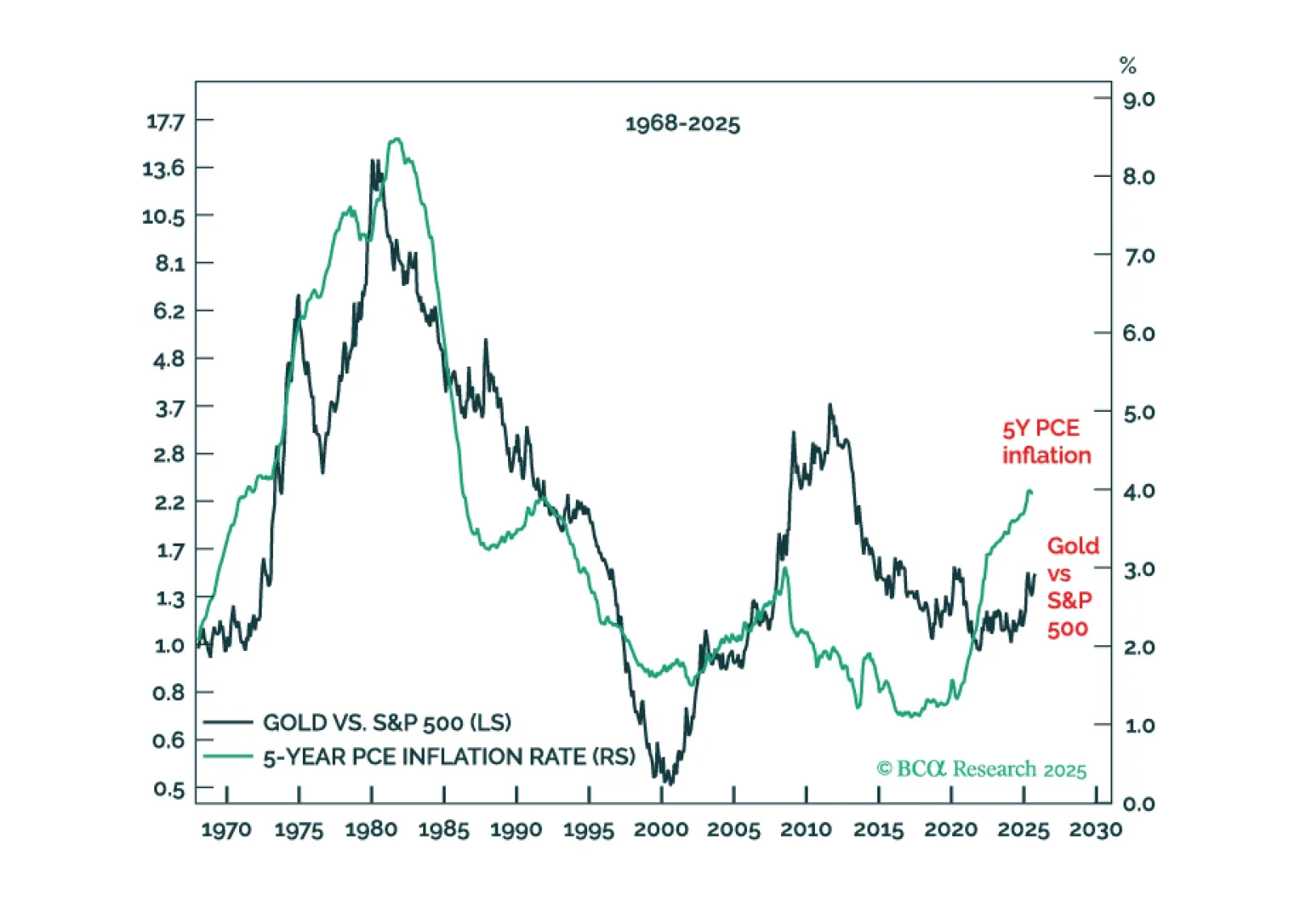

Long-term investors should own gold. The network effect that makes gold the physical ‘insurance asset’ of choice will generate long-term outperformance. But long-term investors should also own bitcoin. The network effect that makes…

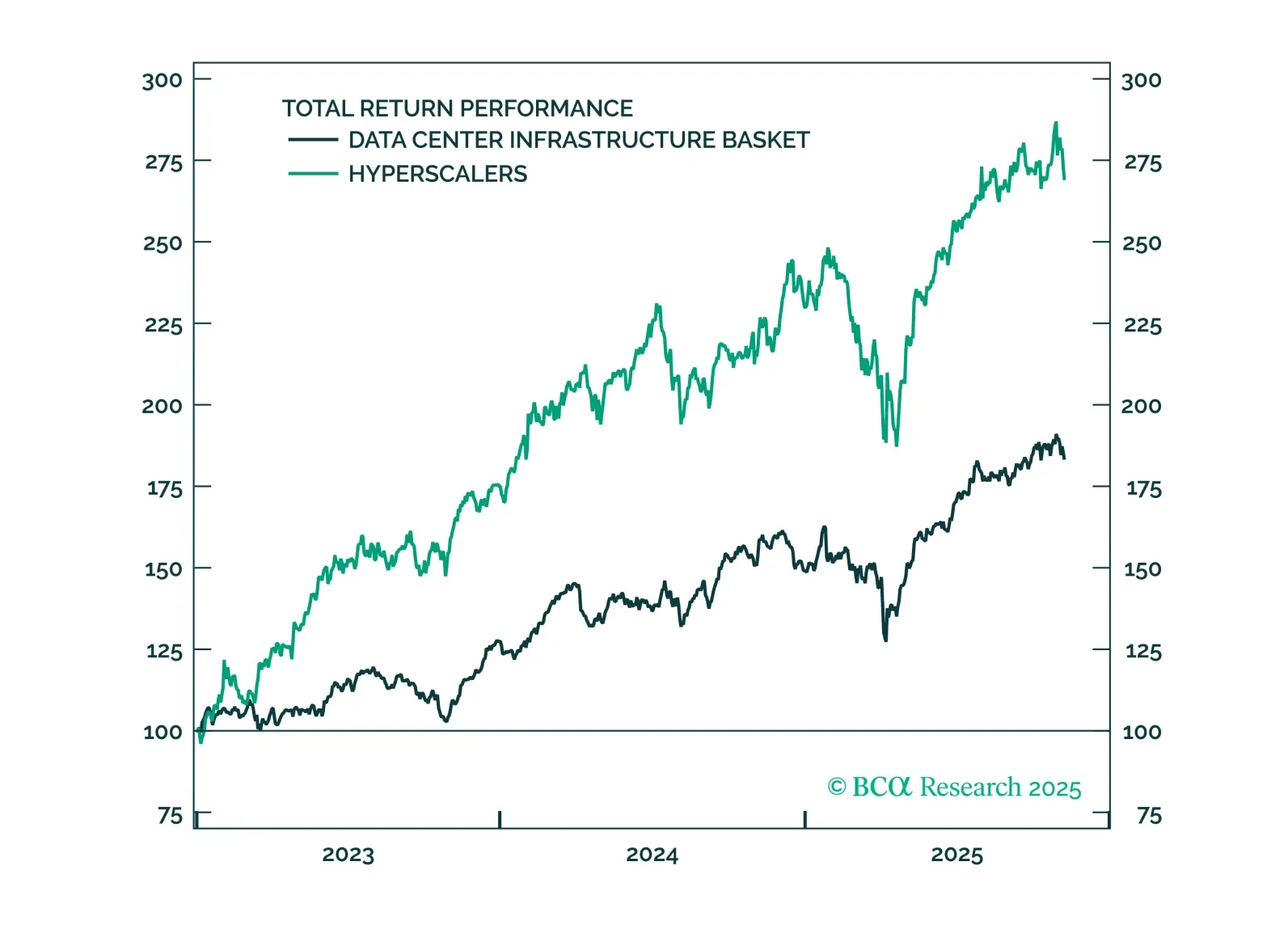

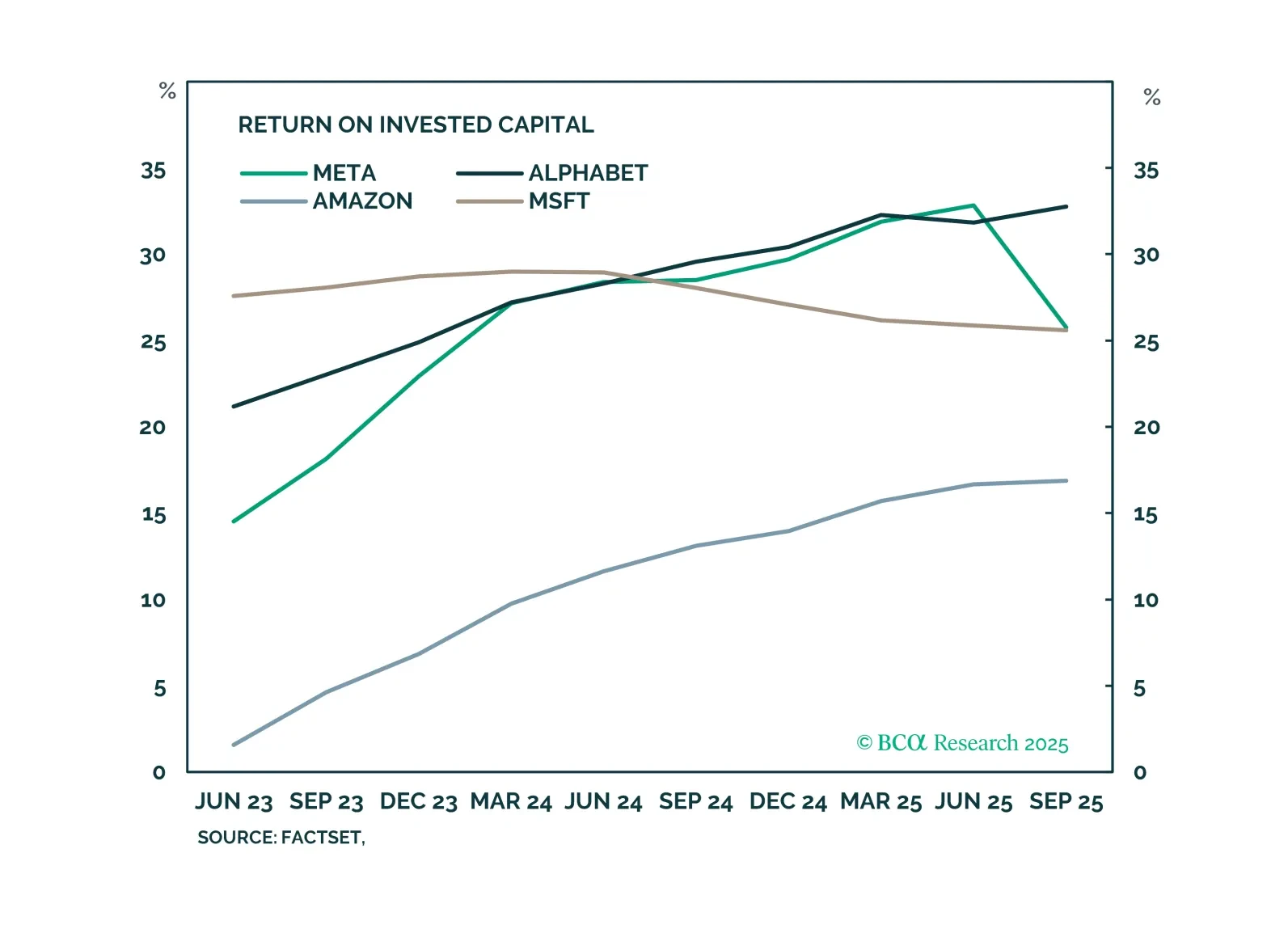

Investor reaction to Meta’s GenAI is an admonition against overspending, rather than a sign of a fraying GenAI rally. Other hyperscalers’ investments are driven by buoyant demand and remain profitable. With valuations stretched and…

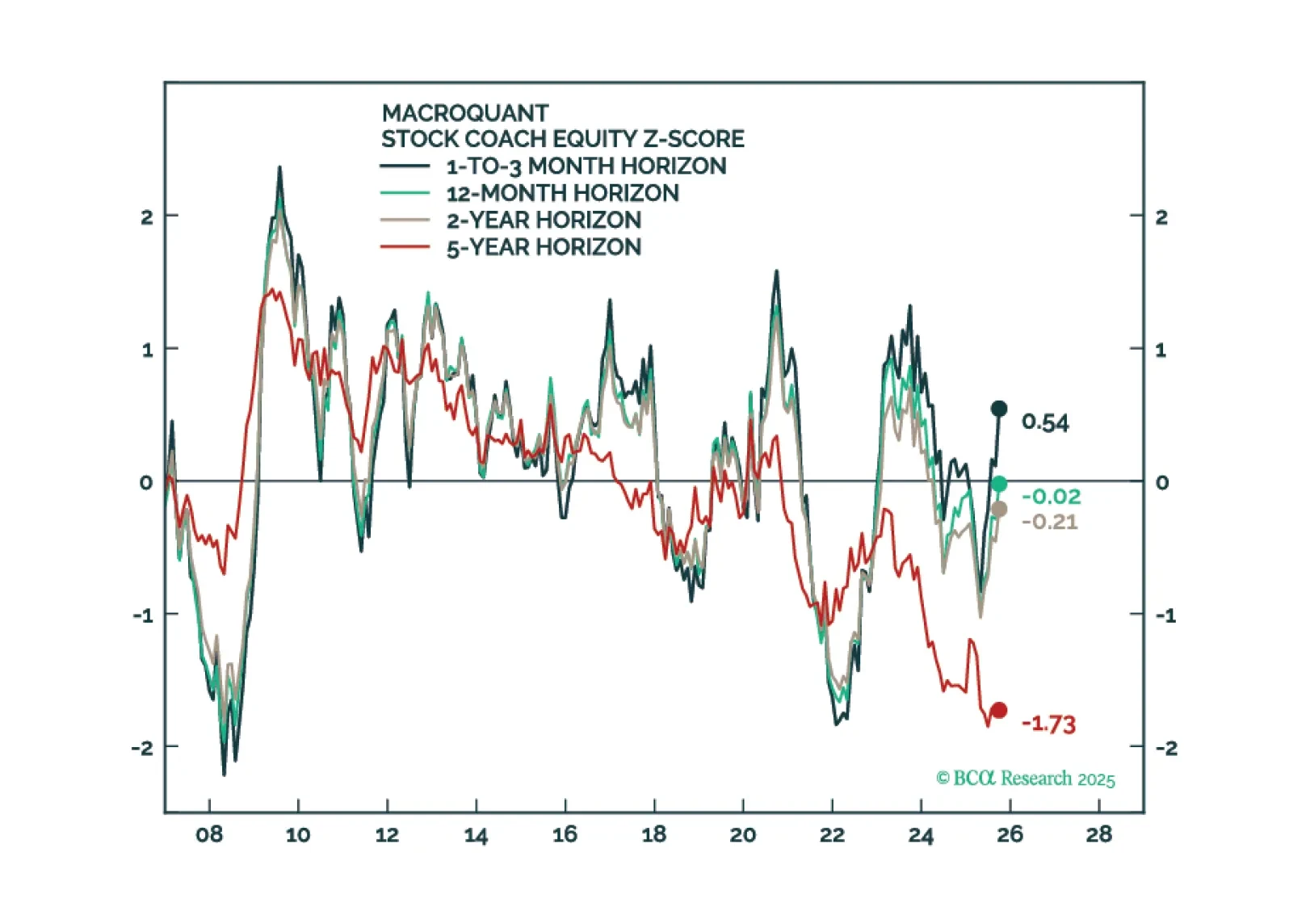

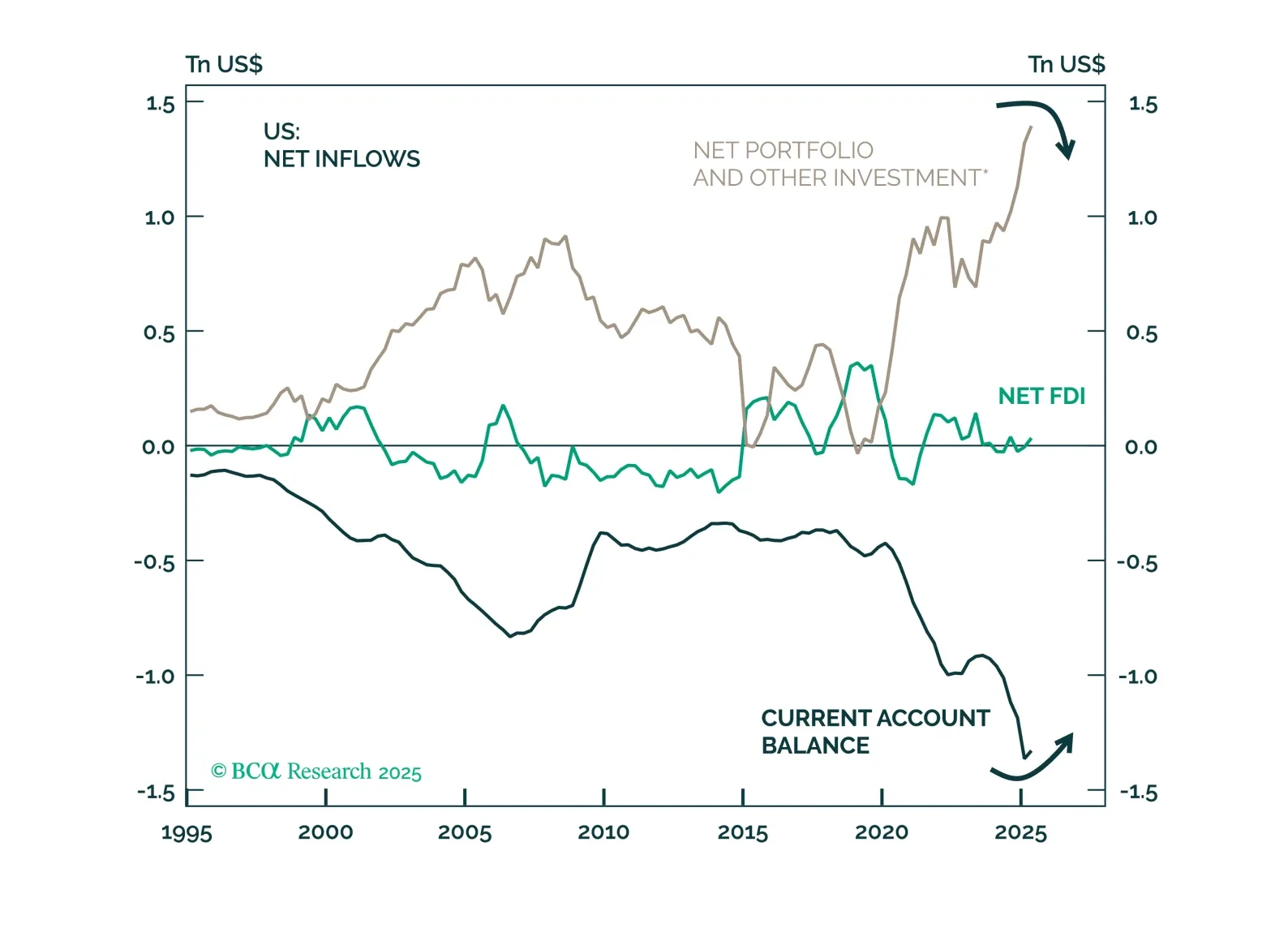

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

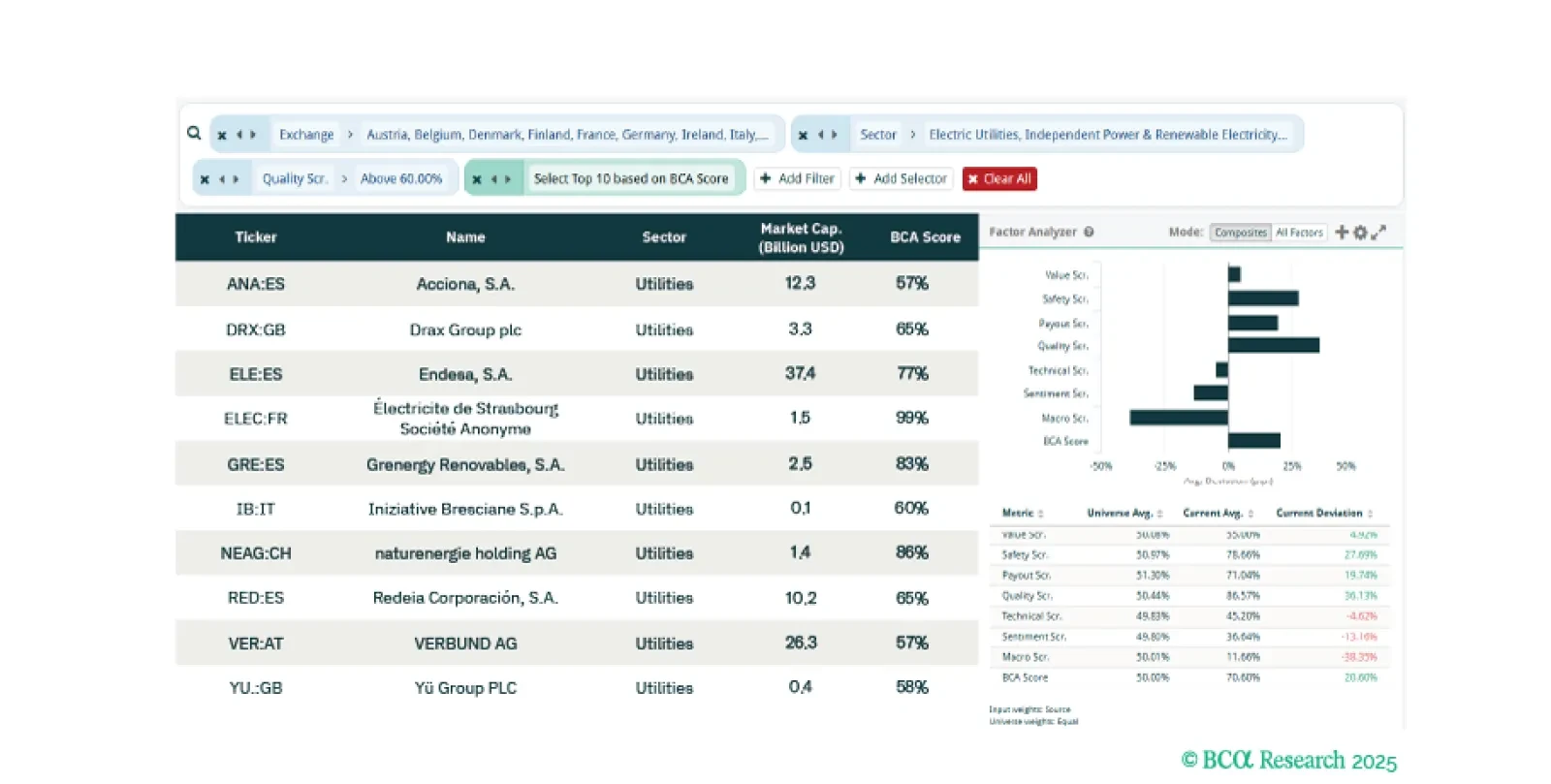

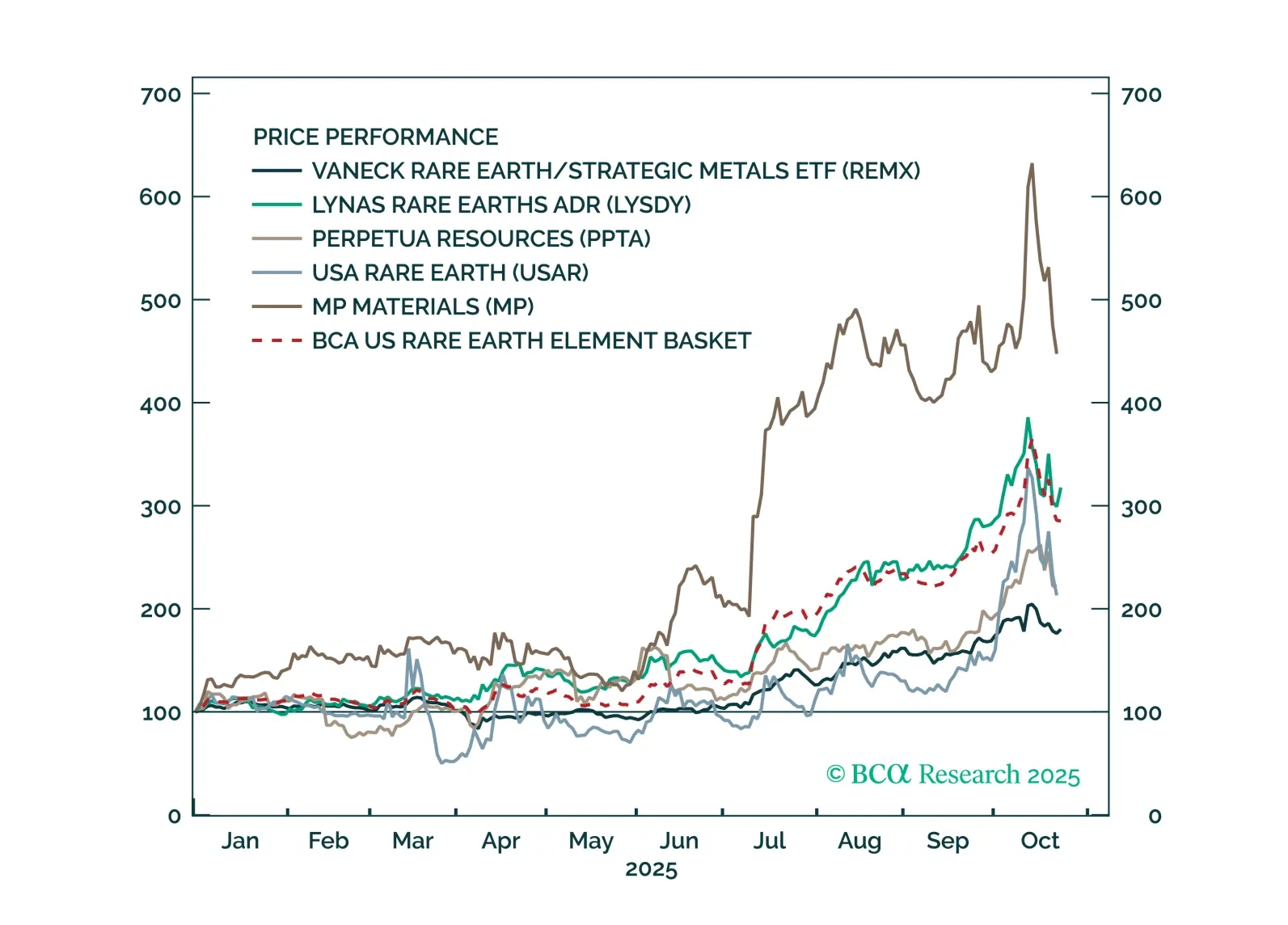

This week, our screeners explore opportunities arising from Europe’s electrification, identify high-quality Rare Earth plays, and propose a portfolio to hedge against a major global conflict.

China’s Fourth Plenum outlined priorities for its 2026–2030 plan, emphasizing household consumption and technological upgrading but signaling continuity over change. The document highlights a rebalancing toward consumption as a share…

In this week’s note, we share the main implications for European investors from what was discussed at the BCA Conference in New York and provide a short list of the questions most frequently asked by investors we met recently in…