Assuming yesterday’s policy rate hike is a sign that Turkey is finally veering towards orthodox economic policies; should investors rush in?

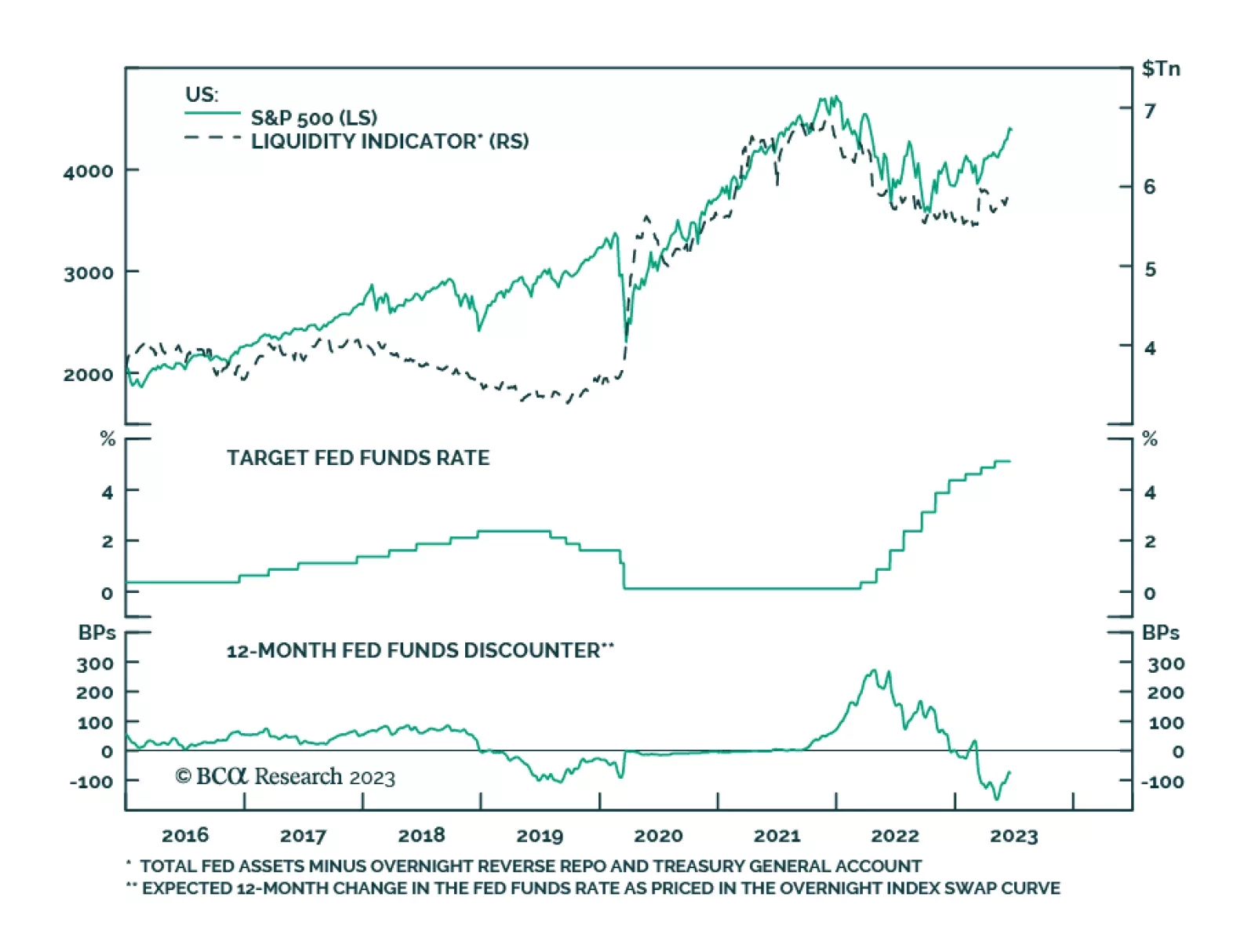

According to BCA Research’s US Bond Strategy service, when the Fed’s interest rate and balance sheet policies are sending opposite signals, listen to interest rates. There seems to be some worry among investors…

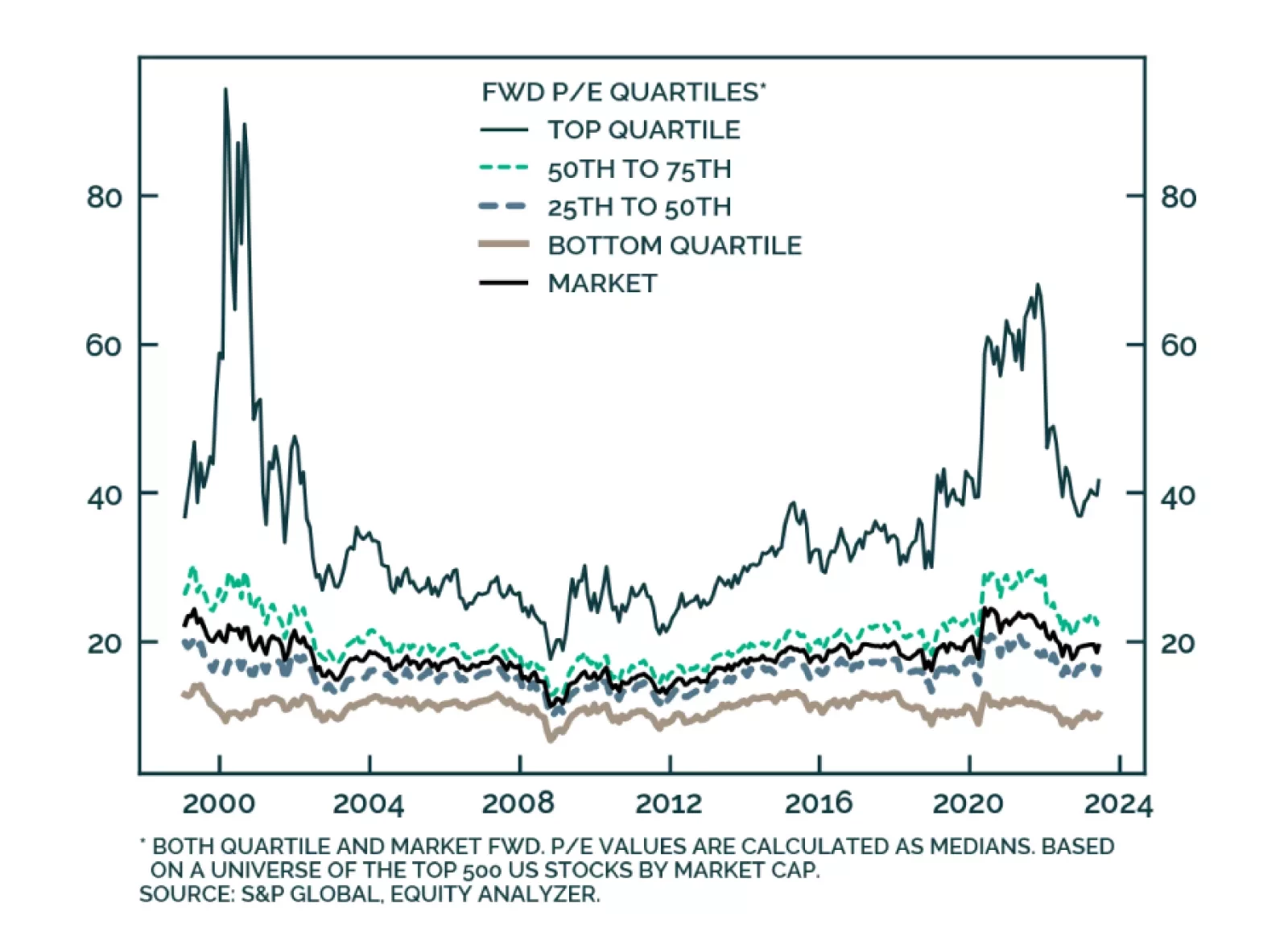

For the most part, the US equity rally has been rather narrow this year – concentrated among stocks that investors perceive will be the key winners of recent AI developments. In the first five months of the year, only three…

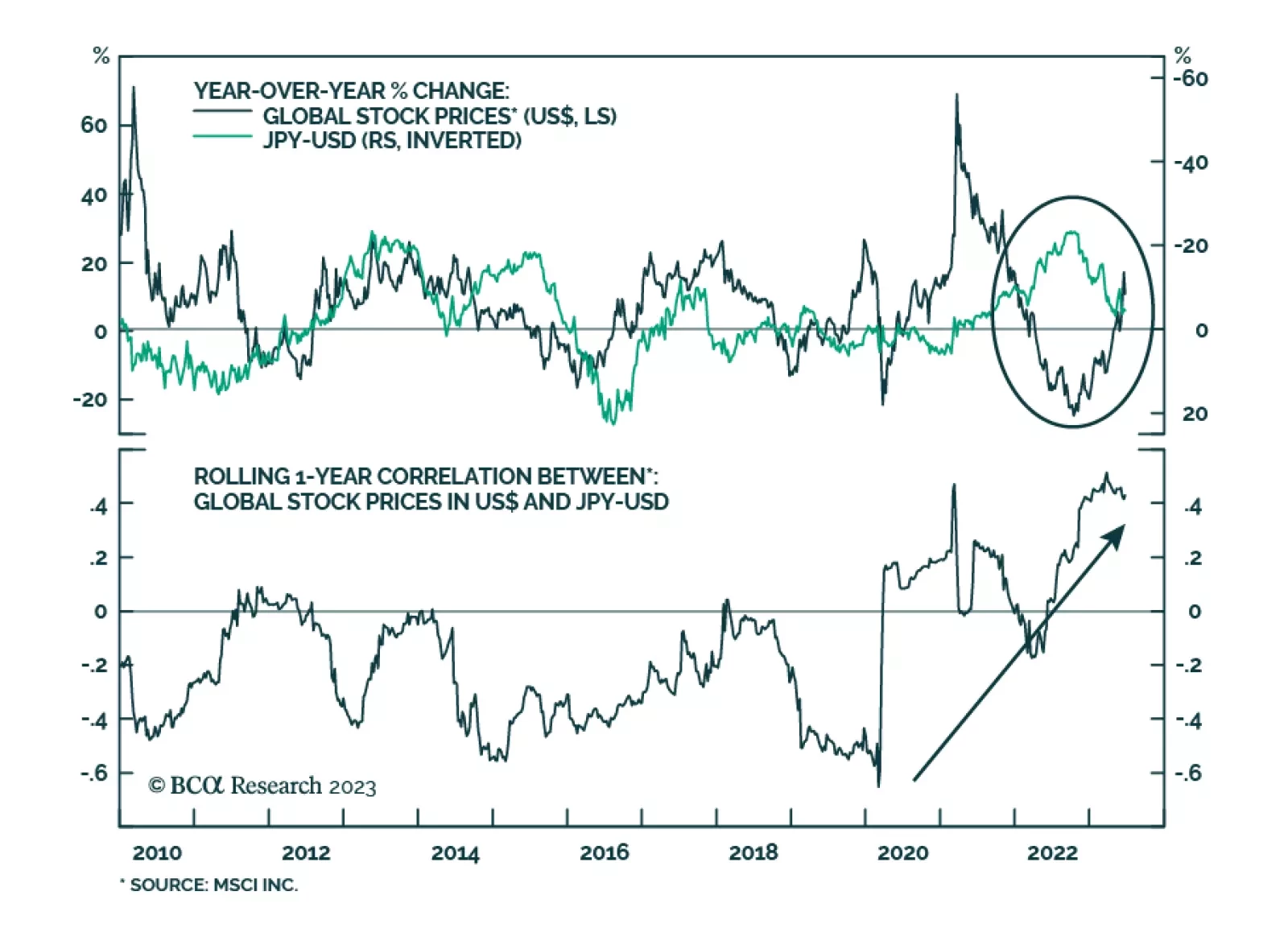

The Japanese yen is typically a counter-cyclical currency. As shown in the chart above, the correlation between global stock prices and the yen is usually negative. However, over the past year, the yen’s correlation with…

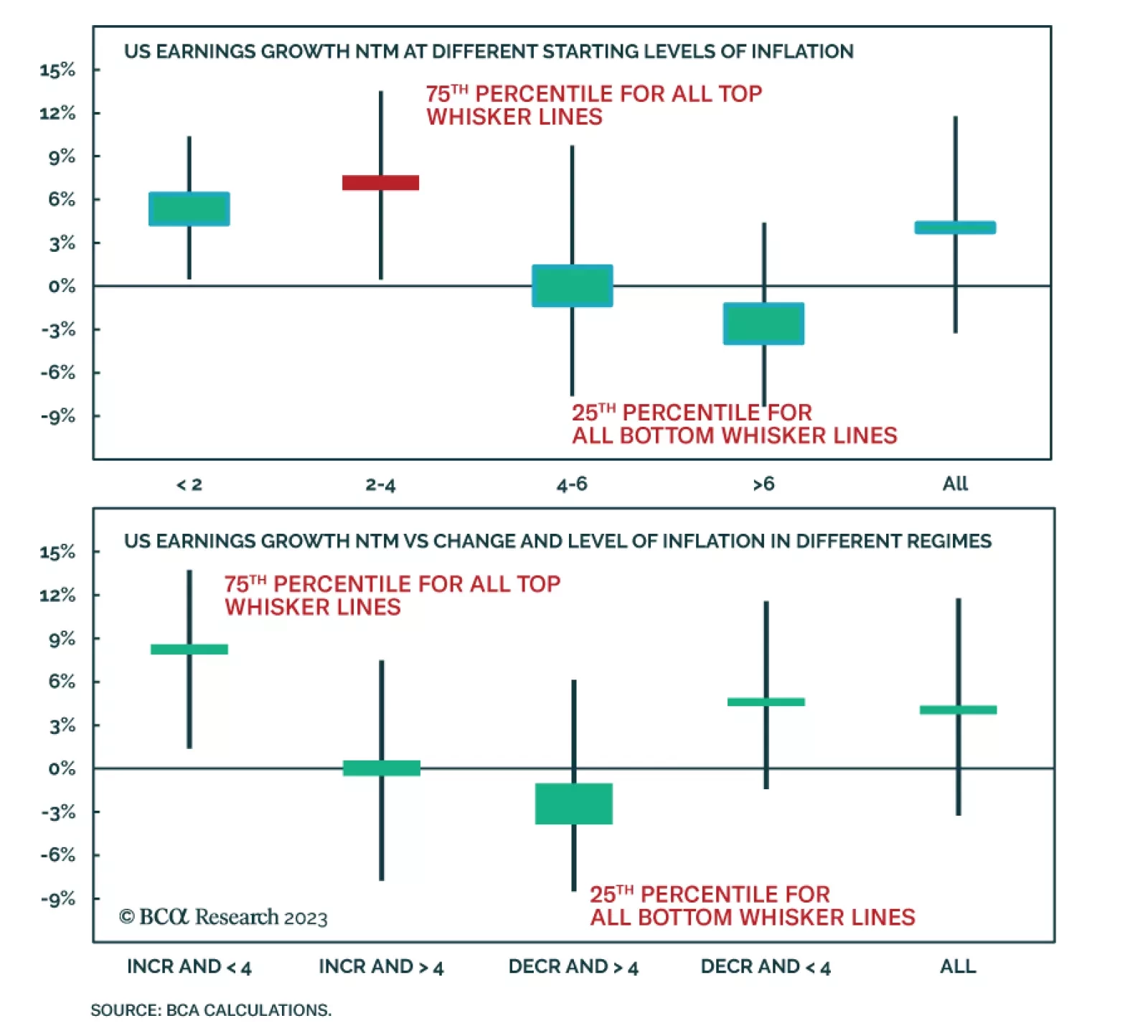

High levels of inflation distort cross-period comparisons of both earnings and sales and mask real earnings growth rates. Last year is a case in point: While in nominal terms, earnings (including Energy) have been contracting for…

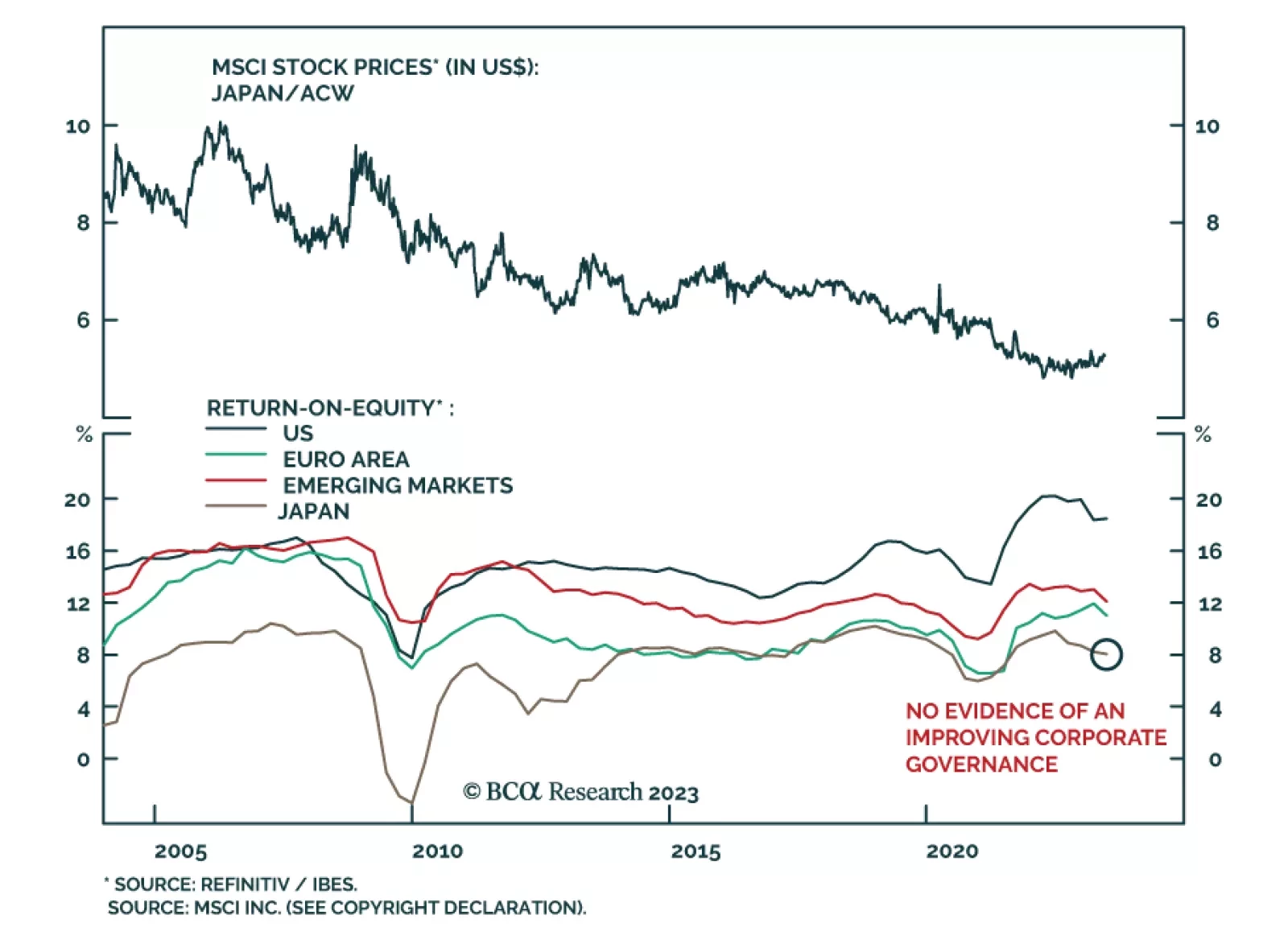

Japanese equities have been outperforming their global peers in recent months. Their 8.5% rally so far in Q2 exceeds the MSCI’s All Country World Index’s 5.6% gain over this period. Japan has not experienced the…

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

The S&P 500 is up 23% since October 2022 and is now trading at a punchy trailing price-to-earnings (P/E) ratio of 21 times. These metrics have naturally amplified bear calls on the market. The bear camp which has been caught…

As the S&P 500 nears our 4,500 target, we review the rationale behind the call to assess its merit.

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…