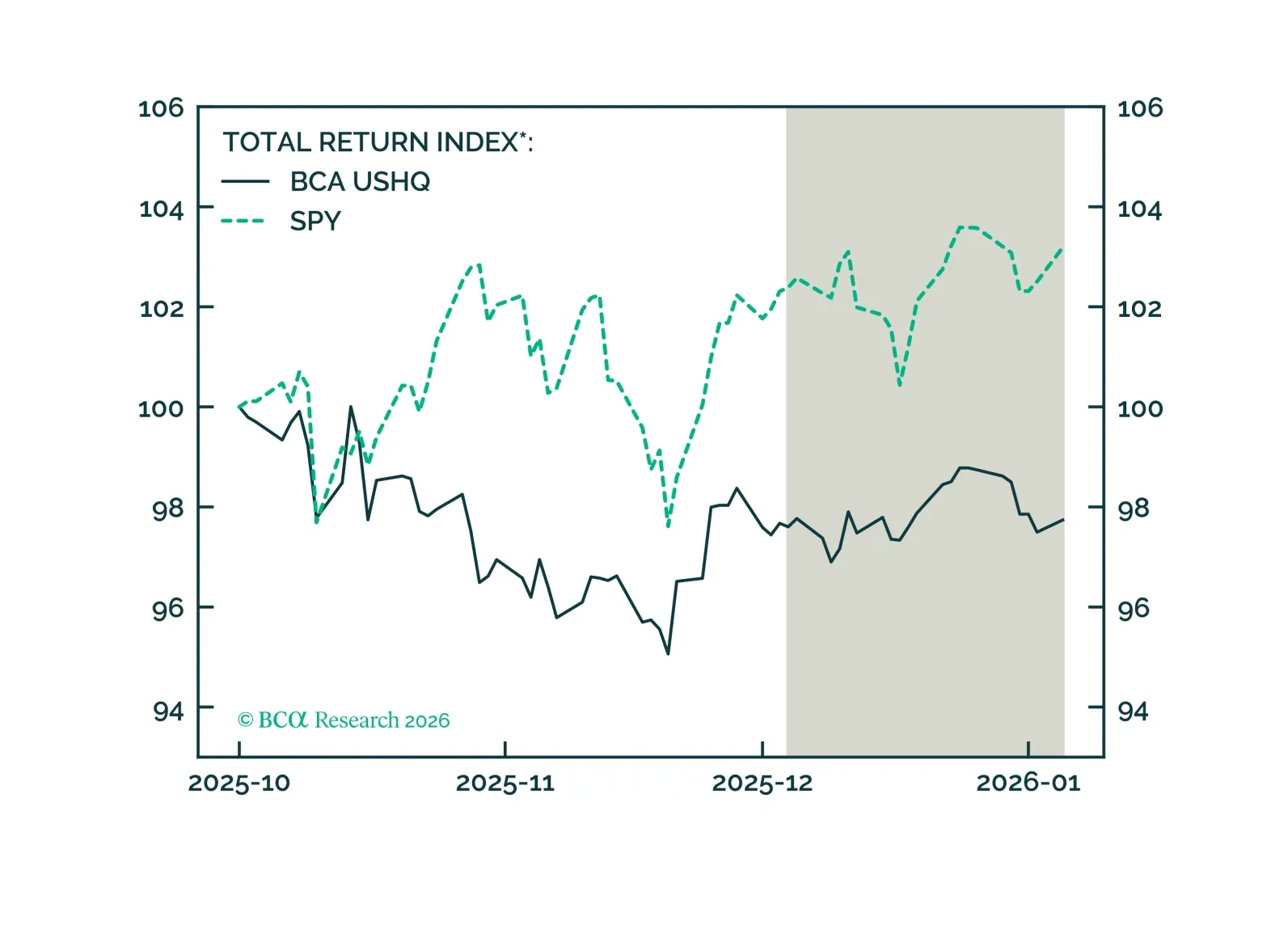

The US High Quality portfolio underperformed its benchmark through December, returning 0.14%, while its SPY benchmark returned 0.78%. On a trailing three-month basis, the USHQ portfolio’s performance was weaker than the benchmark,…

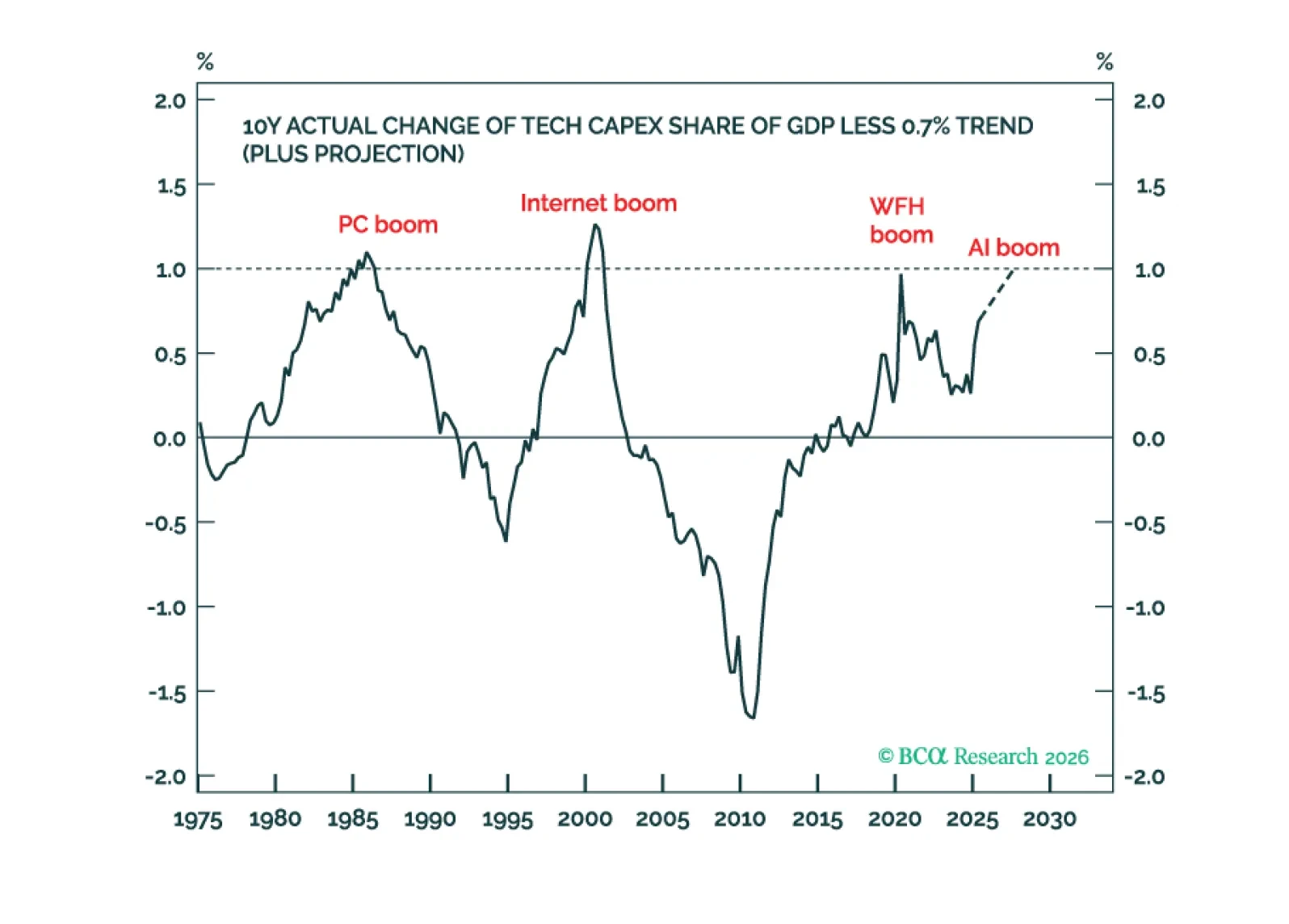

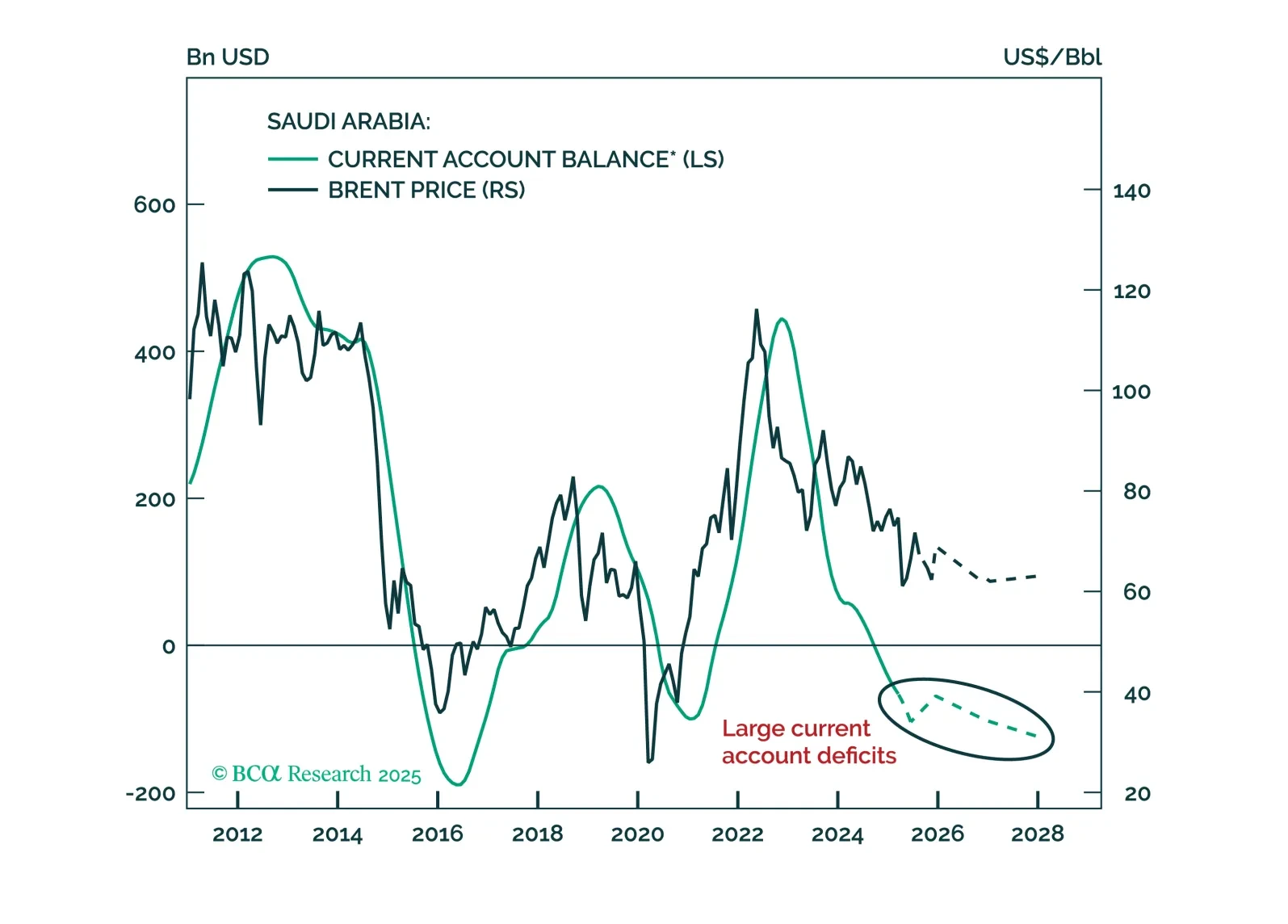

2026 has closer parallels with 2021 than with 2000 because an ultra-accommodative Fed can prolong the stock market rally even as a tech capex boom ends. Plus, a new tactical trade is short silver versus gold.

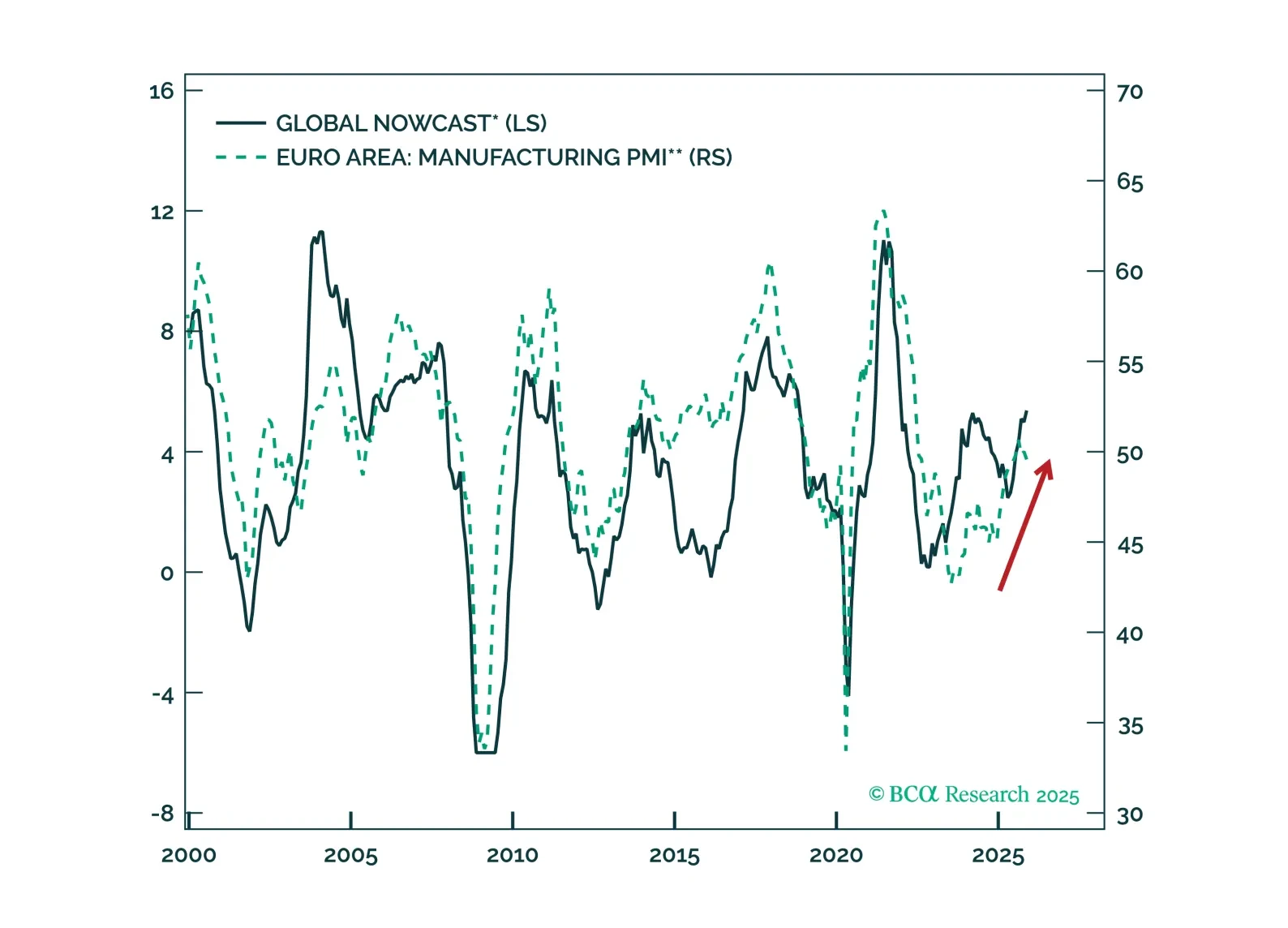

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

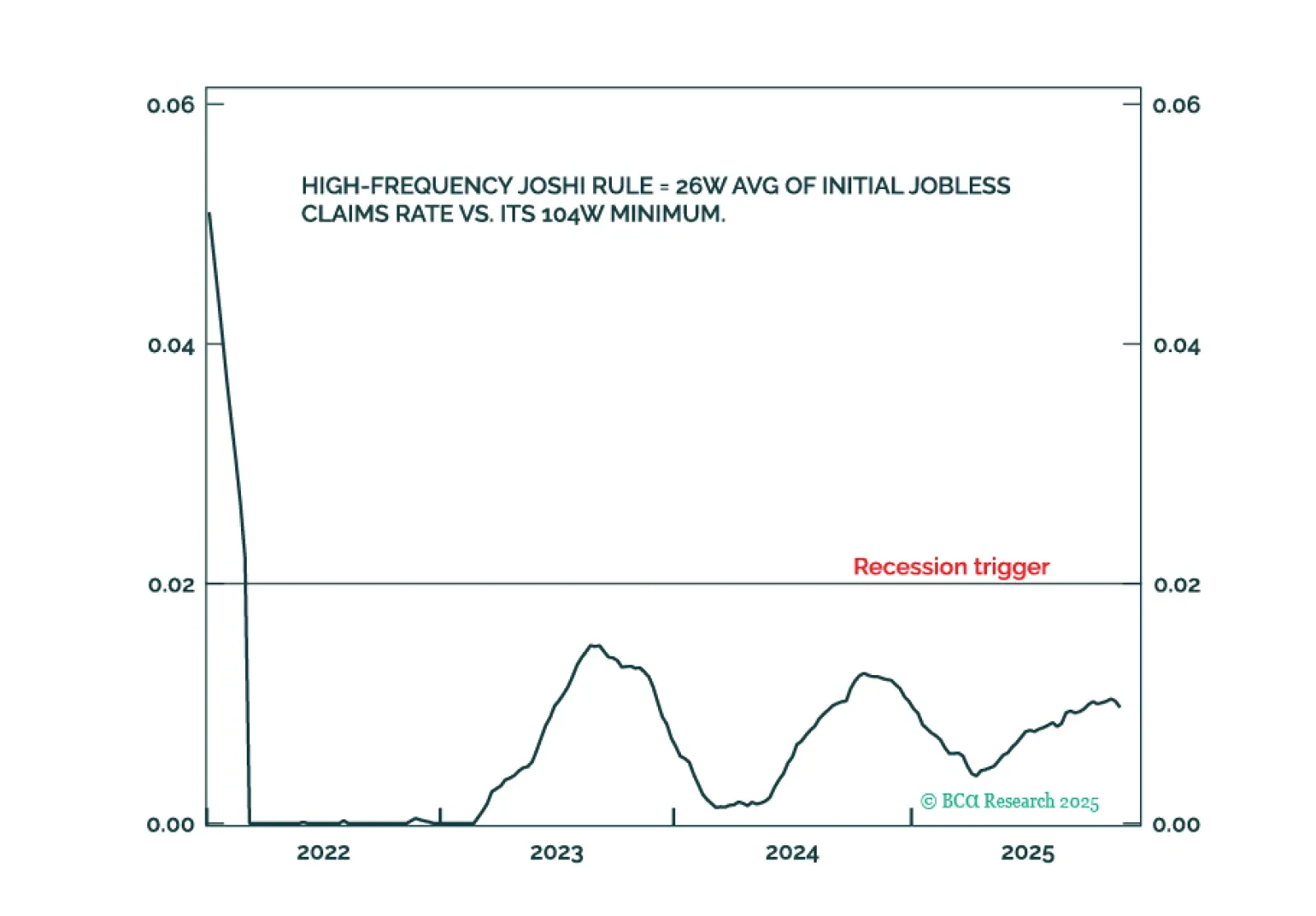

The high-frequency Joshi Rule confirms that the US labour market is holding up. Equity investors should regard 5-10 percent selloffs as tactical buying opportunities. Bond investors should stay underweight US duration. Plus, a new…

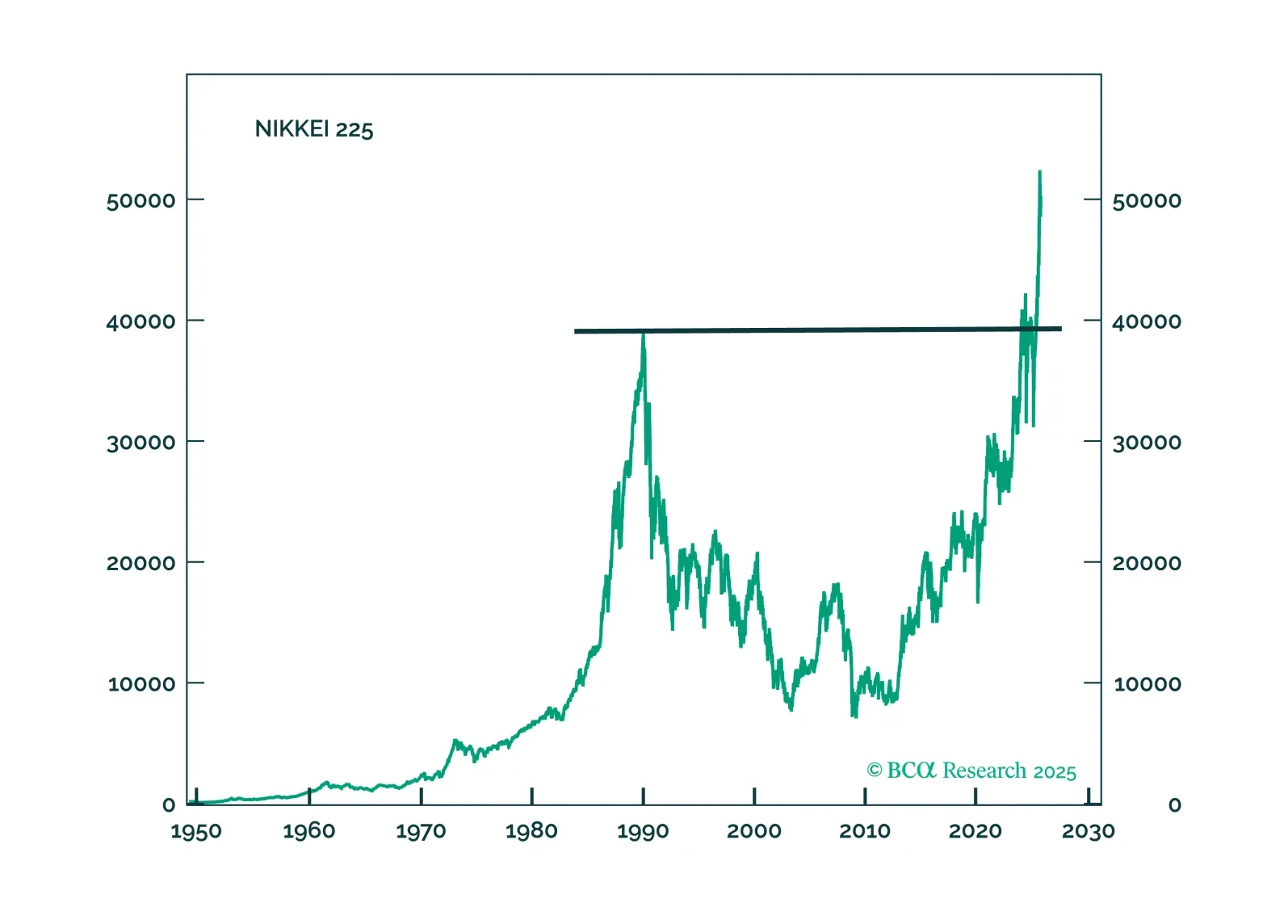

Japanese financial assets will finally have unfettered access to outsized returns. This performance will come in fits and starts, but we are comfortable laying our cards down on buying the yen, and Japanese industrial stocks.