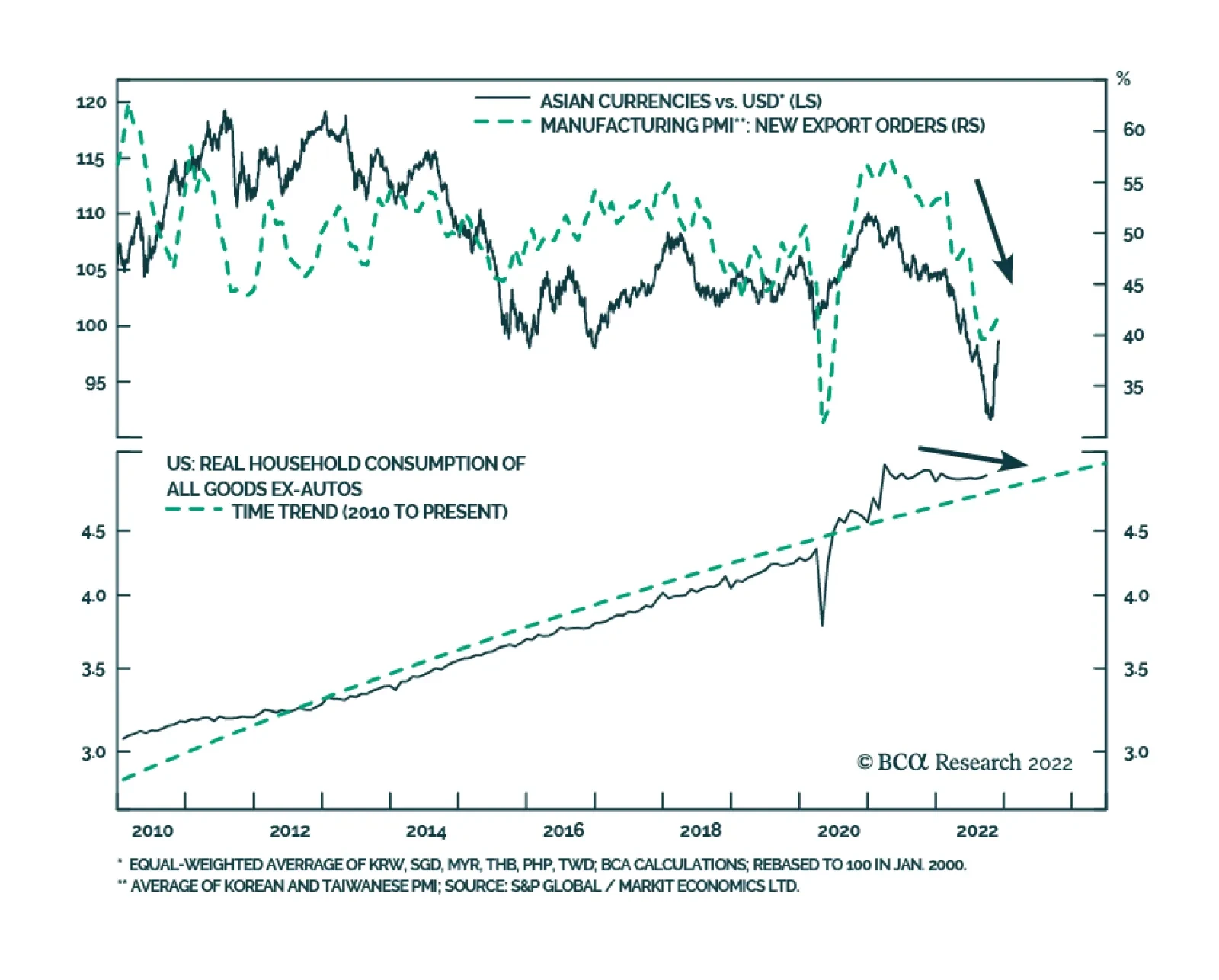

Chinese investable stocks and the Asian currencies index posted the largest positive post-GFC abnormal returns among major financial market assets in November. Investor optimism about a potential relaxation of pandemic measures…

This week we present our Portfolio Allocation Summary for December 2022.

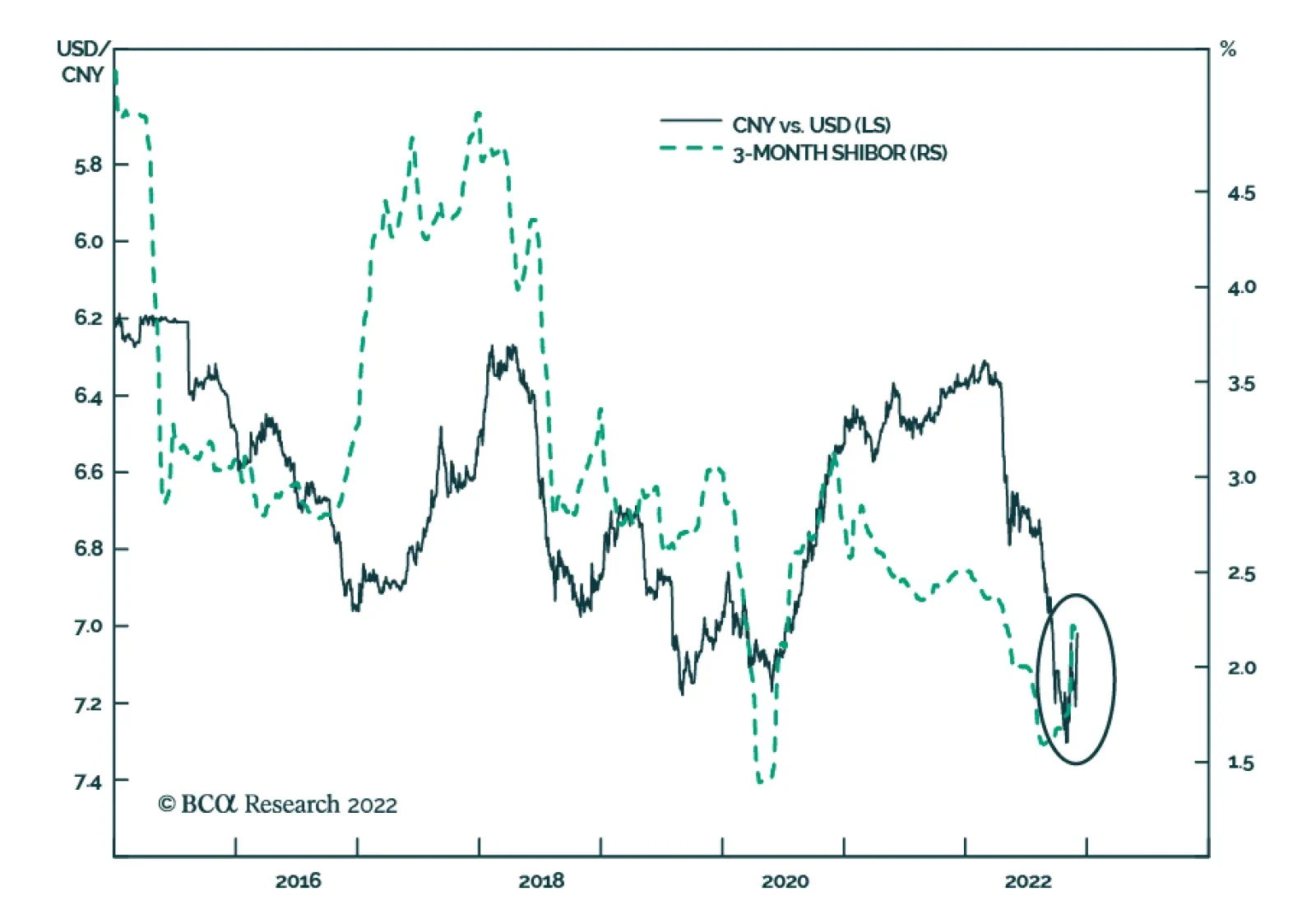

The Chinese Renminbi recently made a sharp U-turn. Year-to-date weakness has given way to a 4.9% appreciation versus the USD since the end of October. This rally occurred against the backdrop of broad-based US dollar depreciation…

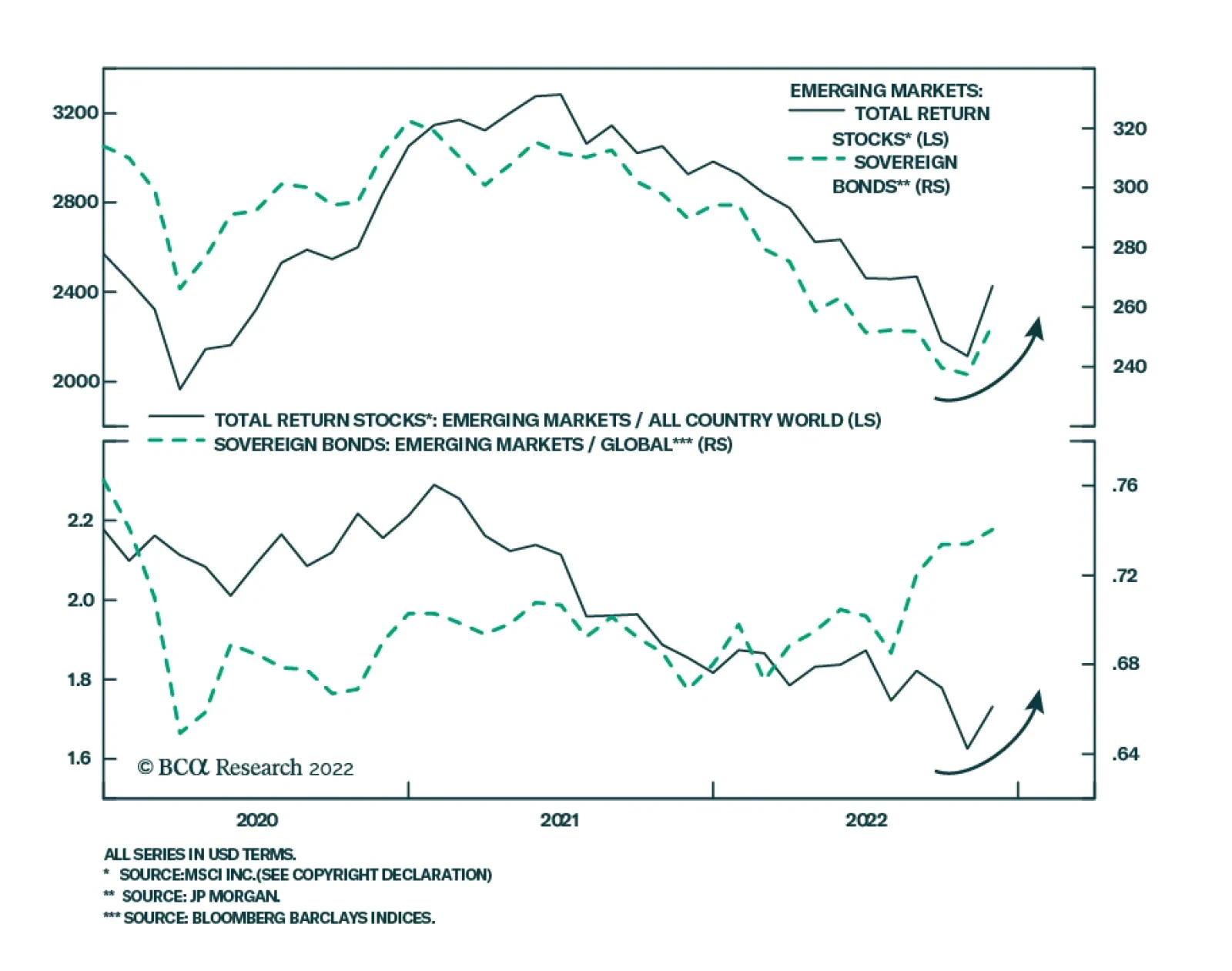

Emerging Markets equities and bonds have staged an impressive rally. The MSCI Emerging Markets index and the JPM GBI EM Global Diversified Composite Total Return index advanced by 15% and 7%, respectively, in November in US…

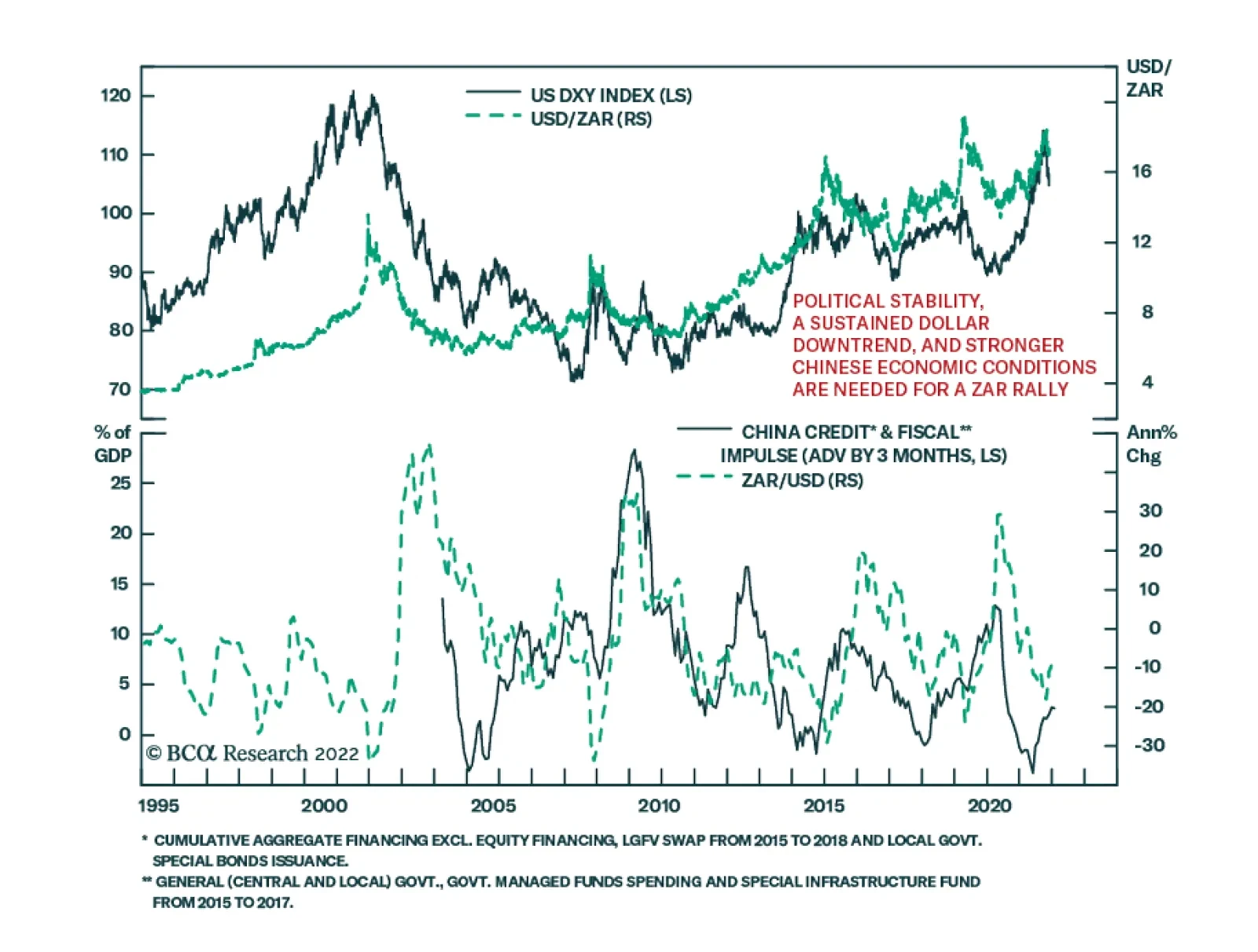

Over the past week, the South African rand was a key underperformer in the currency space. Despite broad-based dollar weakness, USD/ZAR ended the weak 2.4% higher. Heightened domestic political uncertainty triggered the South…

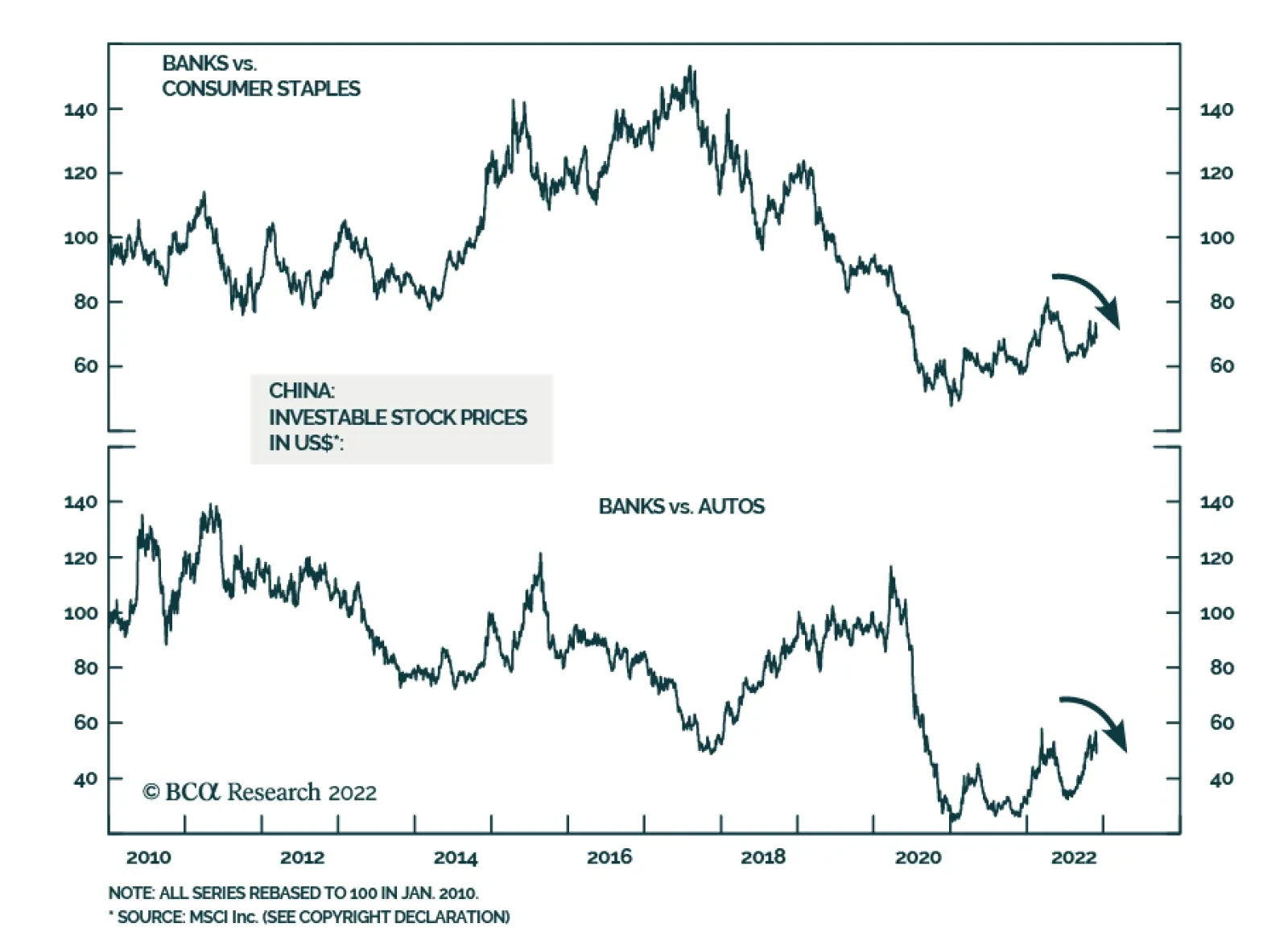

BCA Research’s China Investment Strategy service recommends a new relative equity trade: short Chinese bank stocks / long Chinese consumer staples and auto stocks. Authorities are once again using banks to finance…

Is China completely abandoning its dynamic zero-COVID policy? When will the economy start recovering? What are the implications for Chinese stocks and China-related assets?

Have authorities provided enough financing to property…