How to play China's reopening? What are the dichotomies in the performance of China's plays in financial markets? Why has the Chinese central bank tightened liquidity since October and what has been the impact on local rates and the…

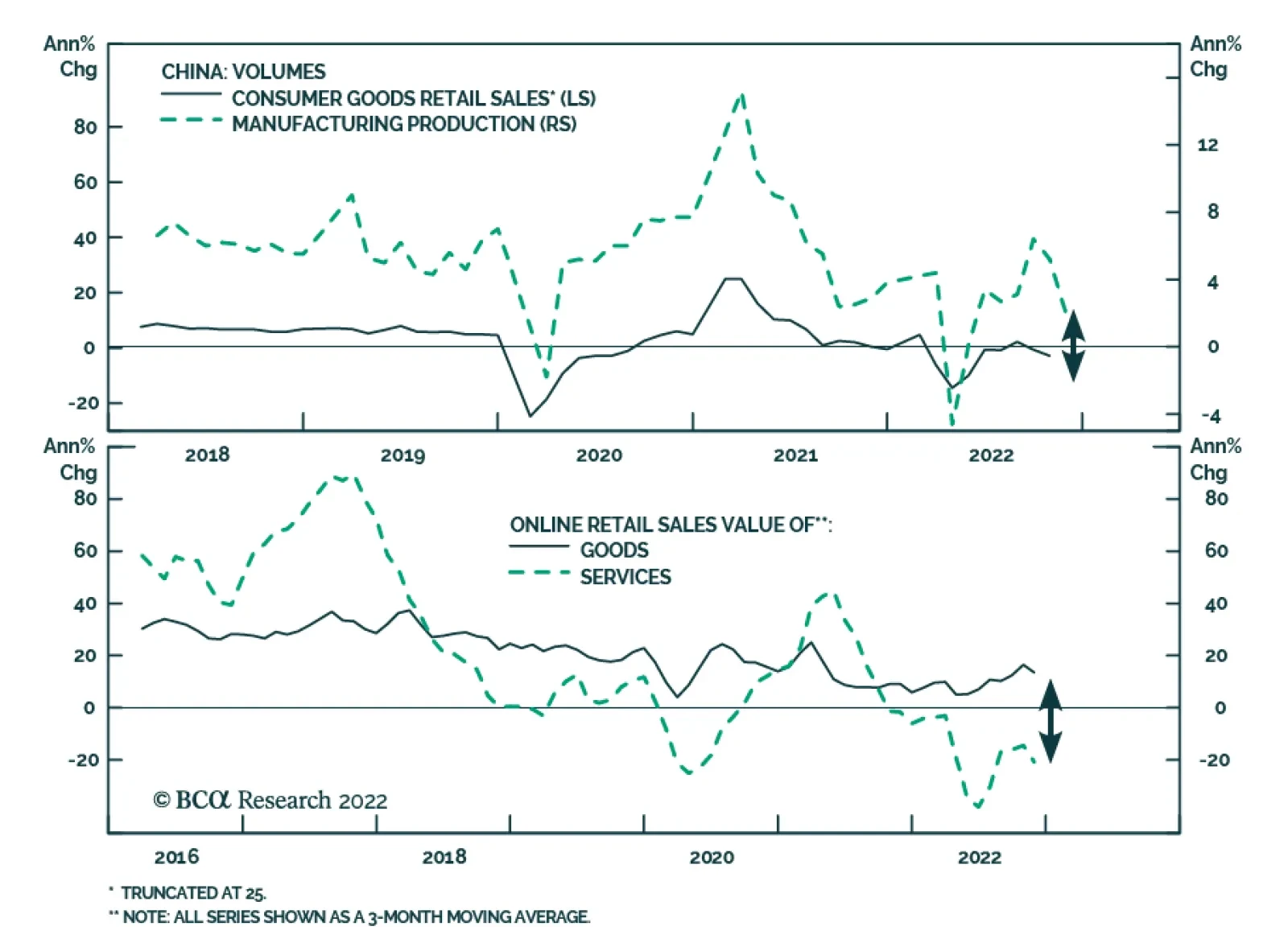

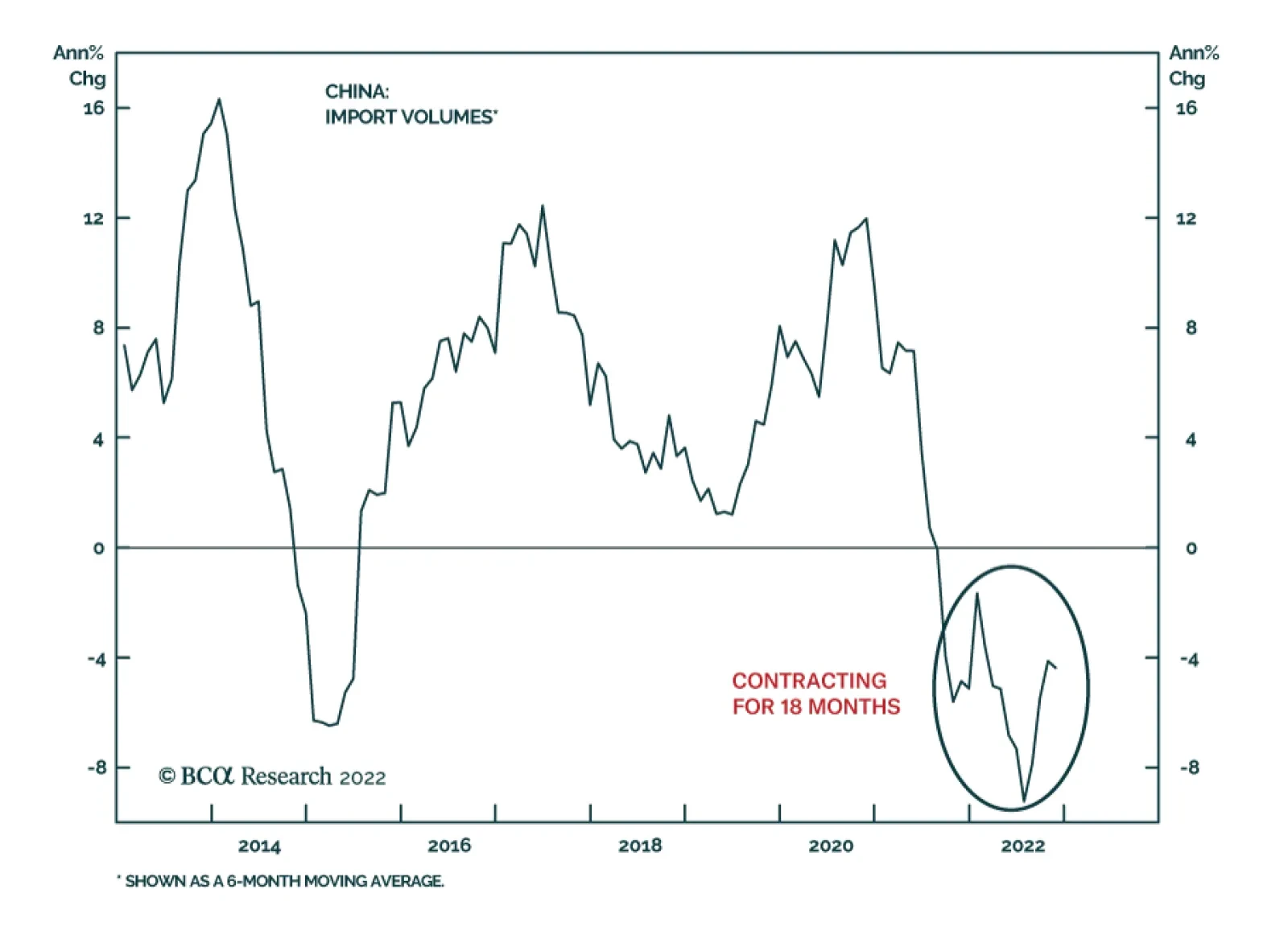

China's economic recovery will be led by consumer spending on services rather than the industrial sector. The current equity market leadership – outperformance by tech stocks – is unsustainable. Persistent deflationary forces will…

Slowing growth would be bad for equities, but so would stronger growth since it would mean more rate hikes.

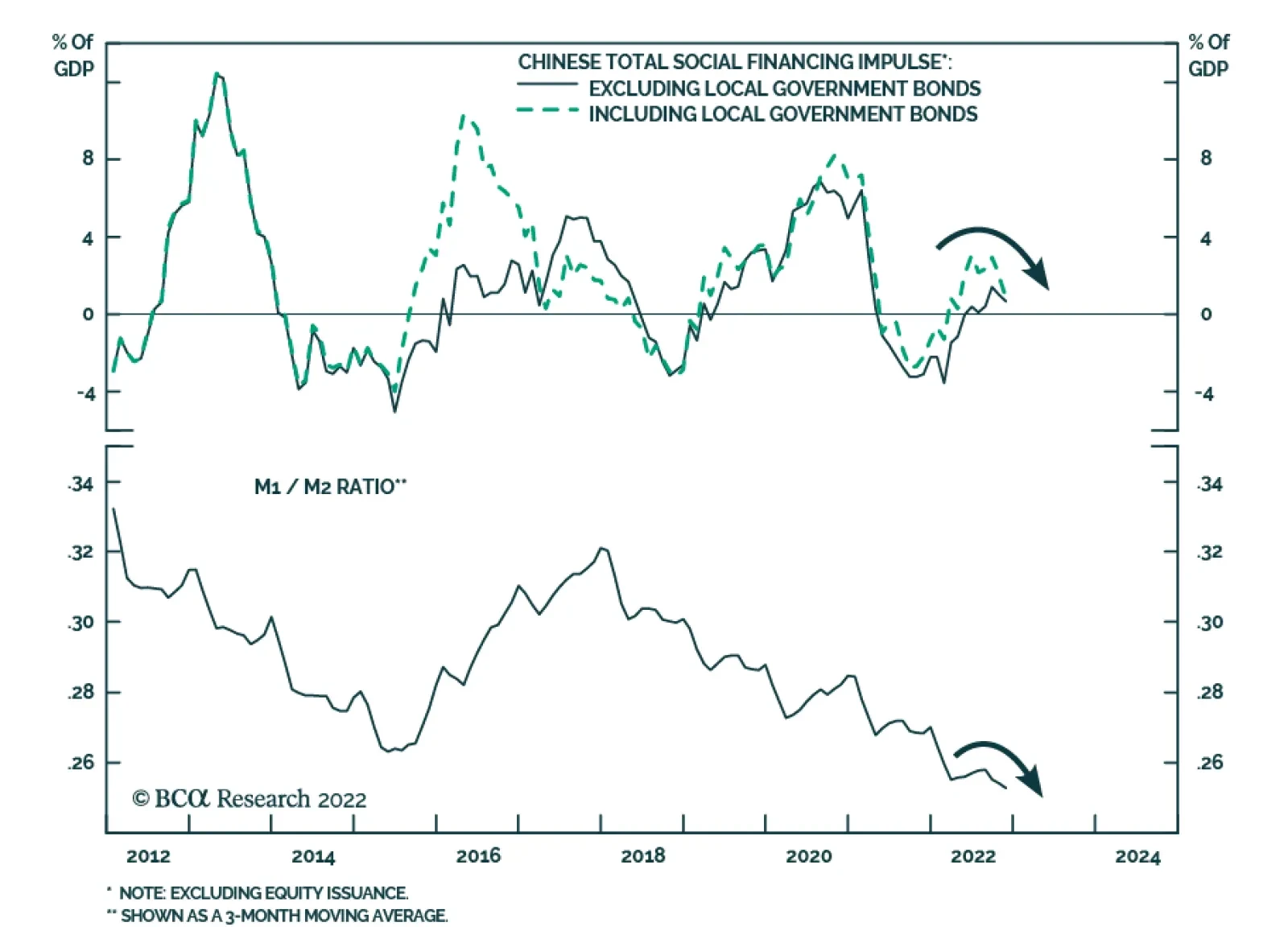

In Section I, we note that the global growth outlook has modestly deteriorated over the past month, despite an improving 12-month outlook for Chinese domestic demand in response to the imminent end of the nation’s “dynamic zero-COVID…

Vietnamese stocks can remain shaky for a few more months. But they have cheapened considerably, and equity portfolios with longer terms investment horizon should overweight them in EM, Emerging Asia and Frontier Market portfolios.

The November Chinese economic data released on Thursday all missed expectations. The contraction in retail sales deepened from 0.5% y/y to 5.9% y/y in November (below expectations of 4.0%). Moreover, industrial production…

According to BCA Research’s China Investment Strategy service, China’s reopening is much more positive for the Chinese economy than it is for the rest of the world. Reopening will boost service sector activity and…

Chinese credit rebounded in November, after plunging in the preceding month. New loans expanded by CNY 1.2 trillion, double October’s levels. Similarly, aggregate financing – a broad measure of credit and liquidity…