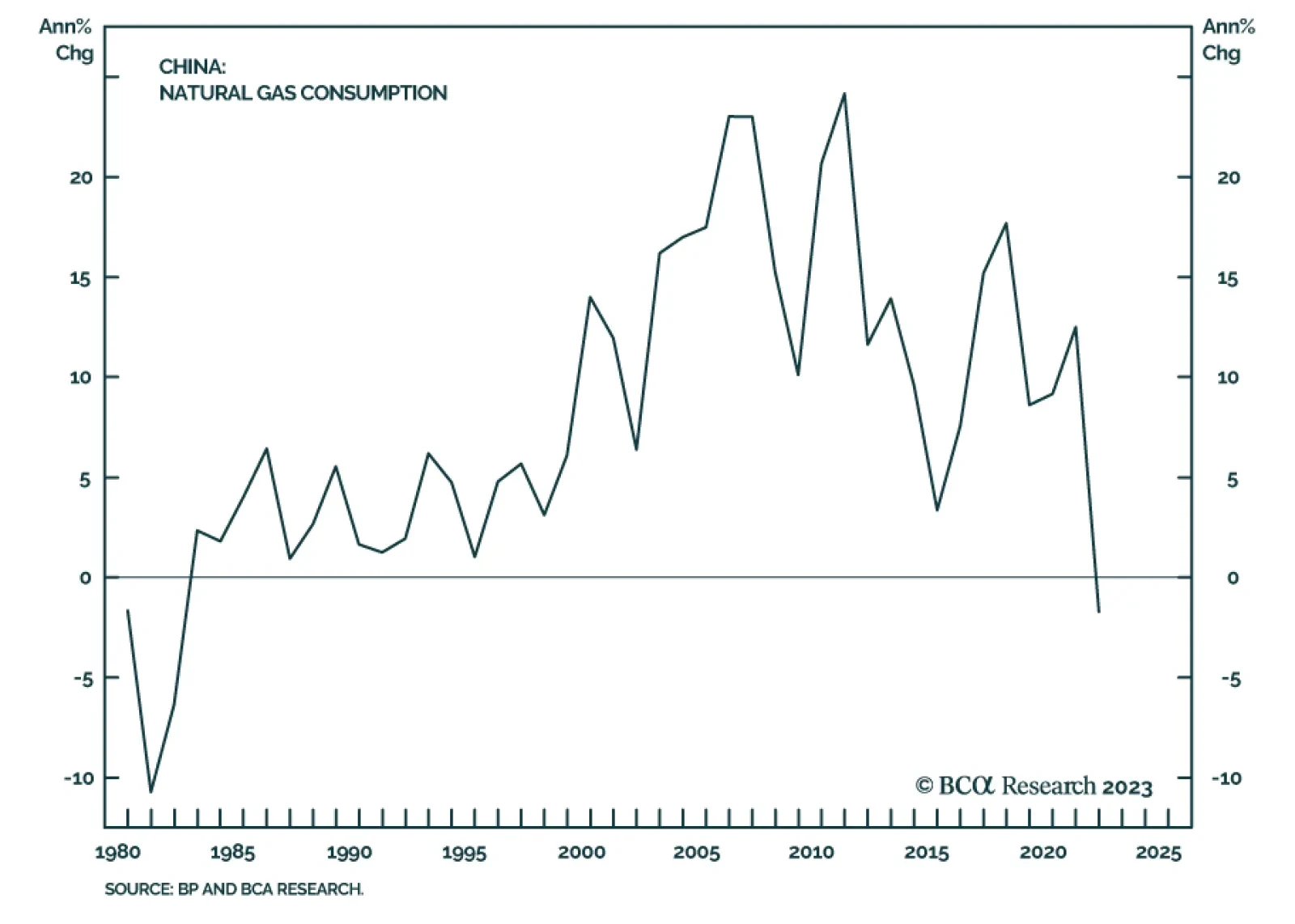

Global natural gas prices have collapsed over the past few months. Prices at the Dutch Title Transfer Facility dropped by 88% since August. According to our China Investment strategists, lower prices will attract Chinese demand…

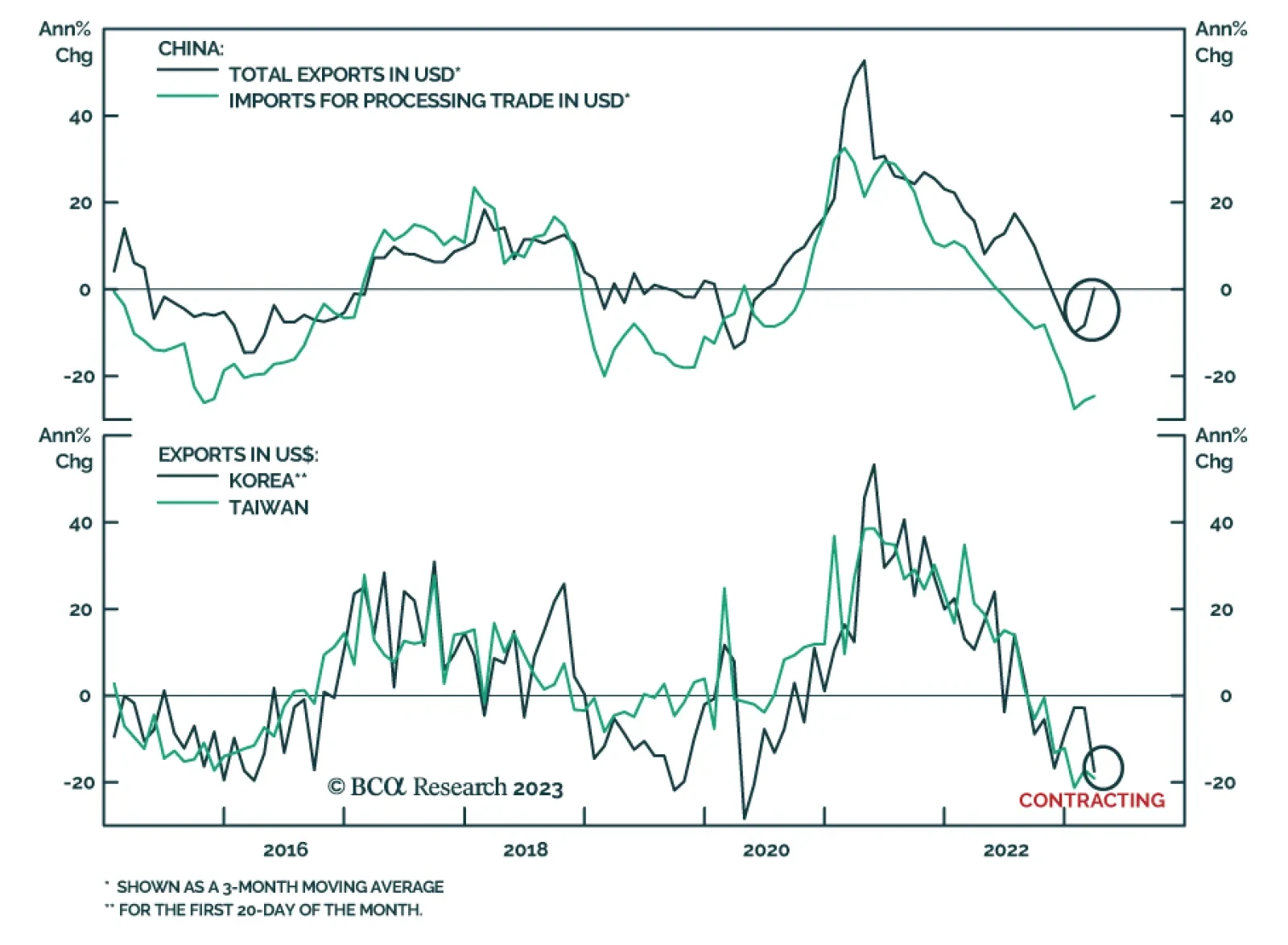

Chinese trade data delivered a strong positive surprise on Thursday. Exports jumped by 14.8% y/y in USD terms in March following five consecutive months of contraction and beating expectations of a 7.1% y/y decline. In particular…

There are several widespread market narratives regarding US inflation, the Fed’s policy, global manufacturing/trade and China’s recovery that we disagree with. In this report, we explain our reasoning and where it puts us in terms of…

The Gulf’s political economy – particularly that of KSA – drives the supply side of oil-price discovery. This has been evolving since 2017, when OPEC 2.0 was formed. It is now fundamental to the market. We expect Brent to average $95…

No, the secular rise in geopolitical risk has not peaked. EU-China trade ties underscore the multipolar context, but this multipolarity is unbalanced, as the US has not reached a new equilibrium with its rivals. While the second…

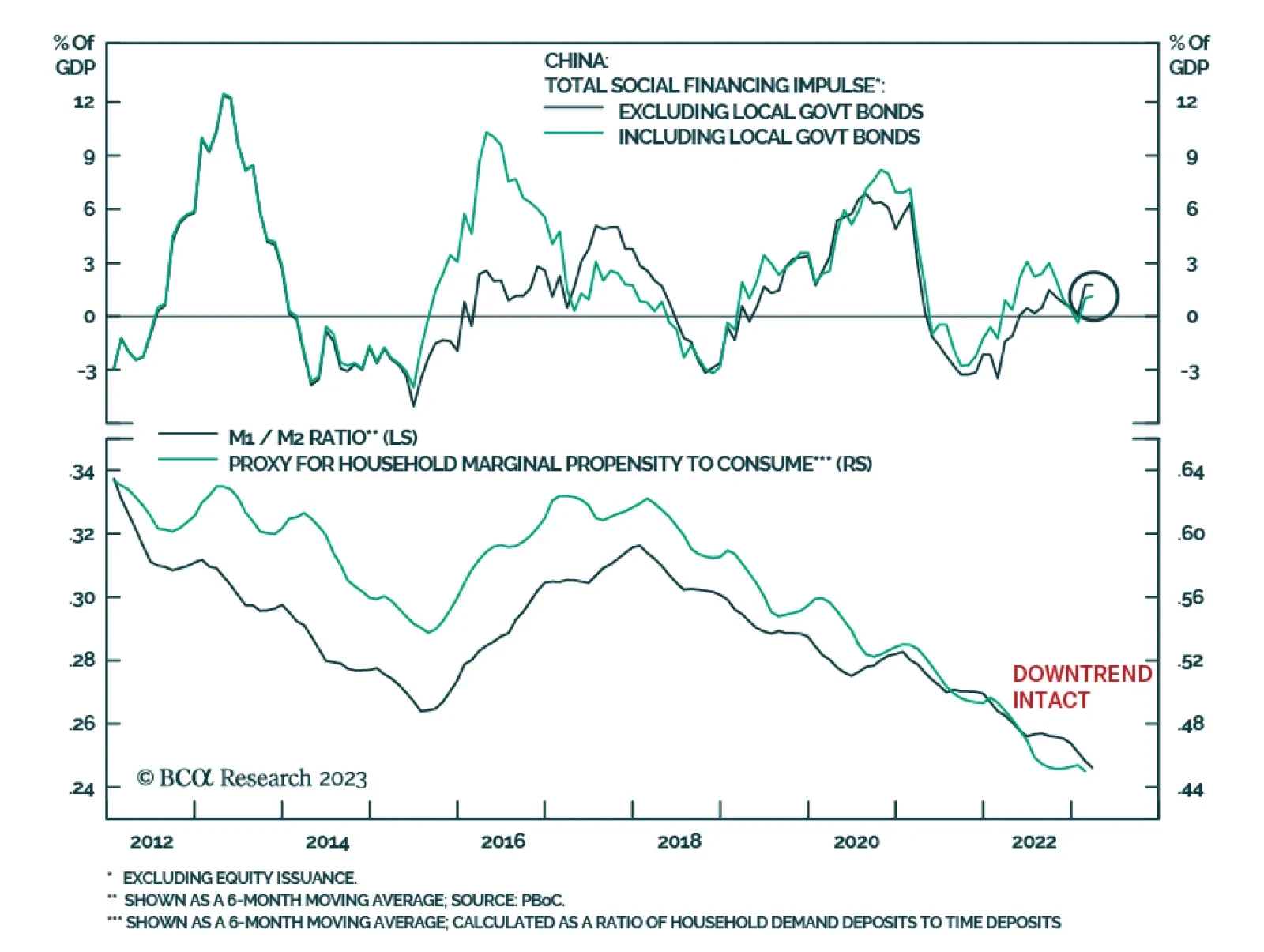

Data released on Tuesday painted a mixed picture of the Chinese economy. On the one hand, Chinese credit growth accelerated and beat consensus estimates. Total social financing jumped by CNY 5.38 trillion in March, exceeding…

Is there a lot of cash on the sidelines ready to be deployed? Would the US recession not be bearish for the US dollar and help EM like it did in the early 2000s? Why can the US investment playbook of the past 15-25 years not be used…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

This week we present our Portfolio Allocation Summary for April 2023.