Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…

Risk assets would perform well over 12 months only if inflation falls to 2% without triggering a recession. That would be unprecedented. We recommend investors stay defensive.

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

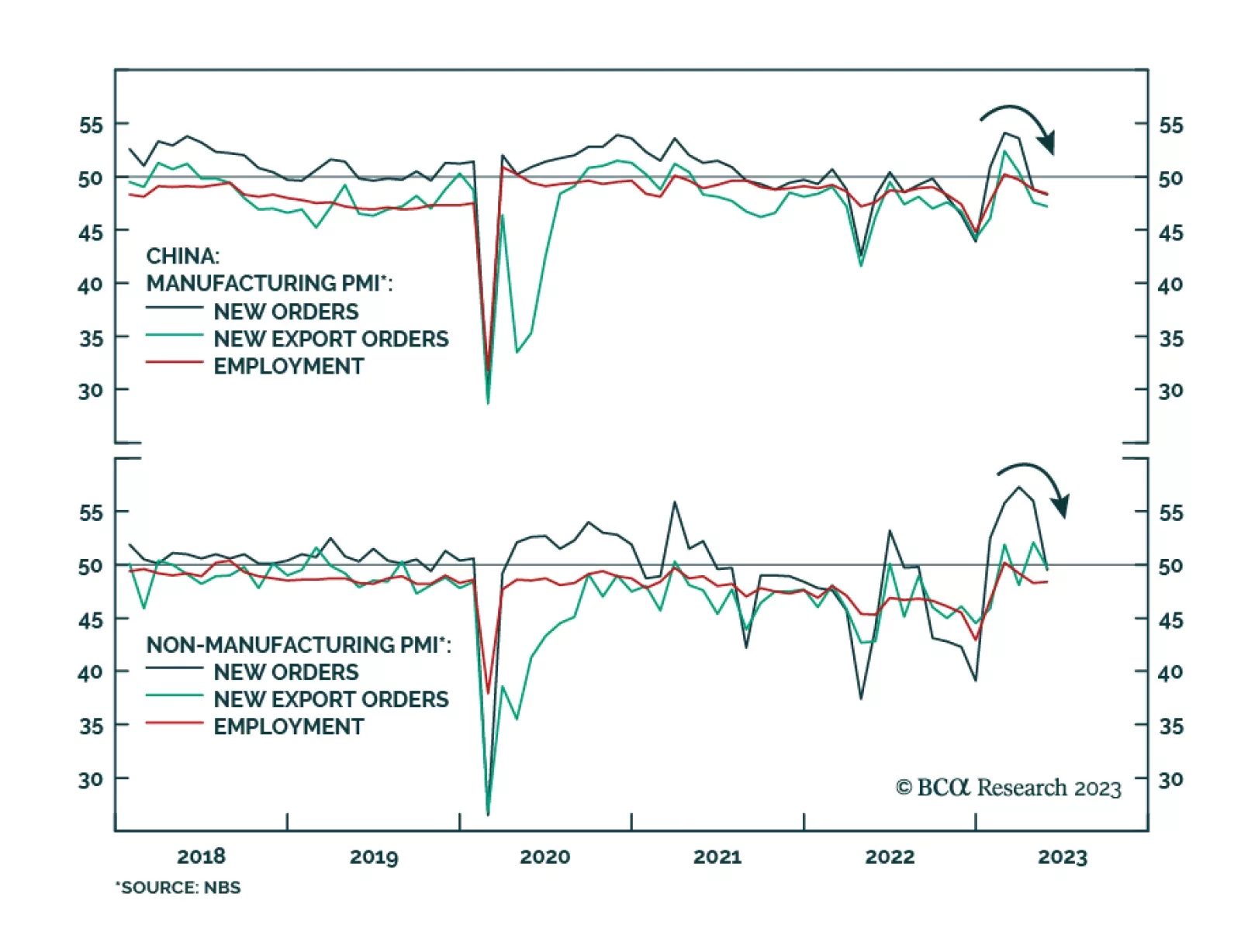

Chinese economic data releases continue to disappoint. Wednesday’s NBS PMI release showed the composite PMI dropped from 54.4 to 52.9 in May – the lowest since January. Importantly, the Manufacturing PMI unexpectedly…

Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…

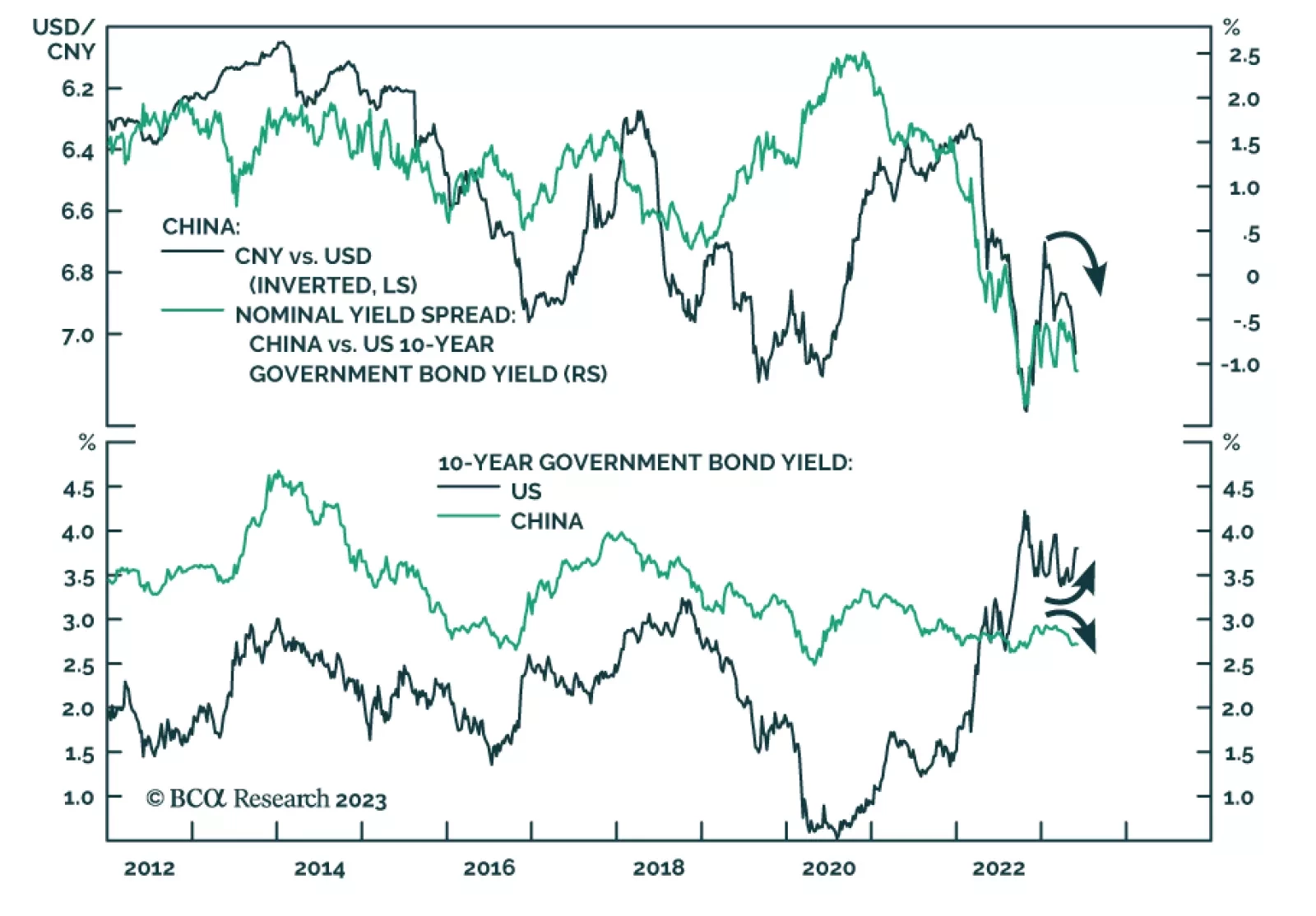

The Chinese currency has underperformed most of its emerging market peers so far this year, depreciating by 2.5% vis-à-vis the US dollar. RMB weakness is consistent with the signal from other Chinese risk assets including…

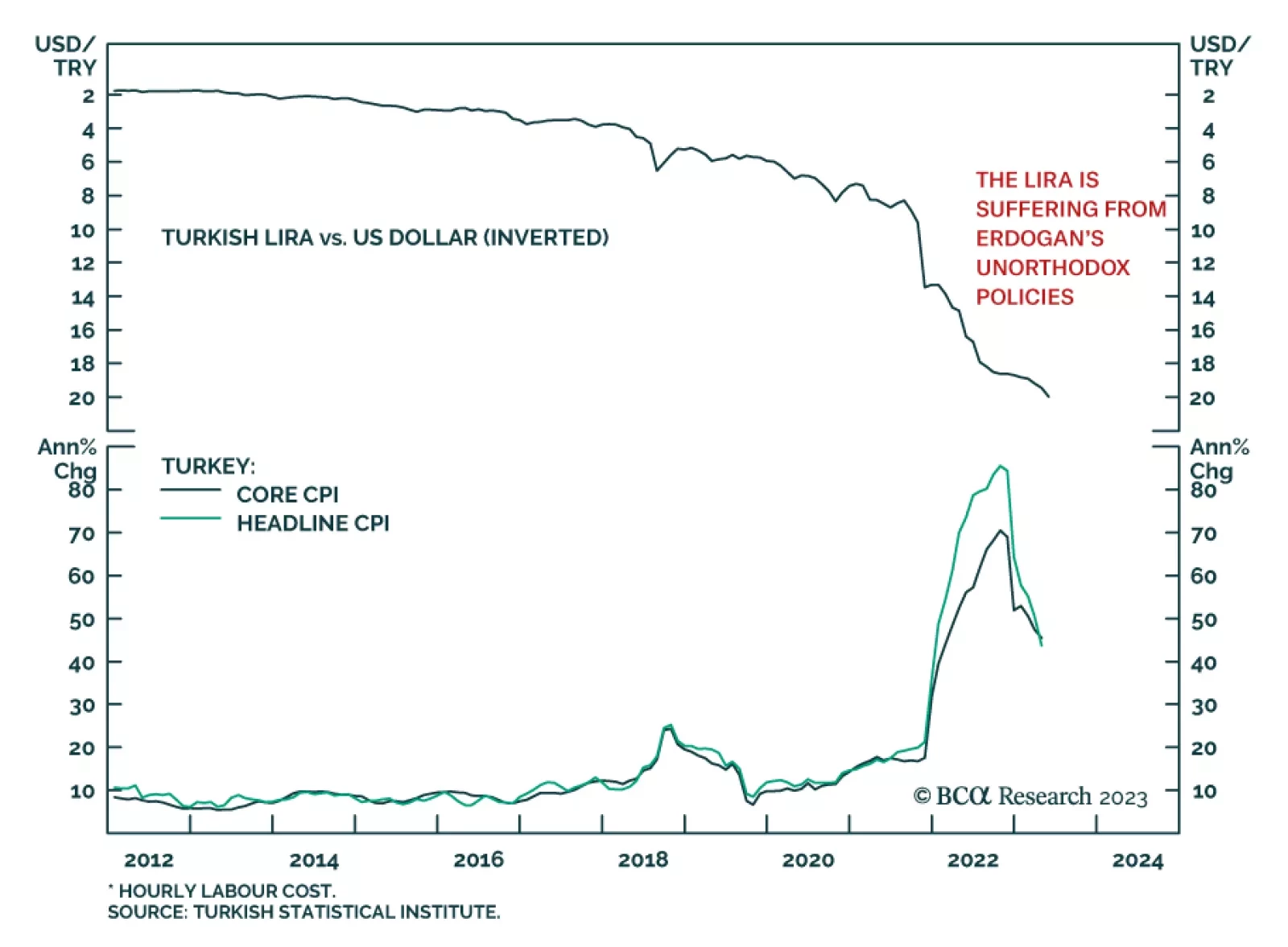

The Turkish lira hit a fresh record low on news that President Recep Tayyip Erdogan secured another five-year term following Sunday’s run-off election. Notably, despite an economic crisis (including headline CPI inflation…

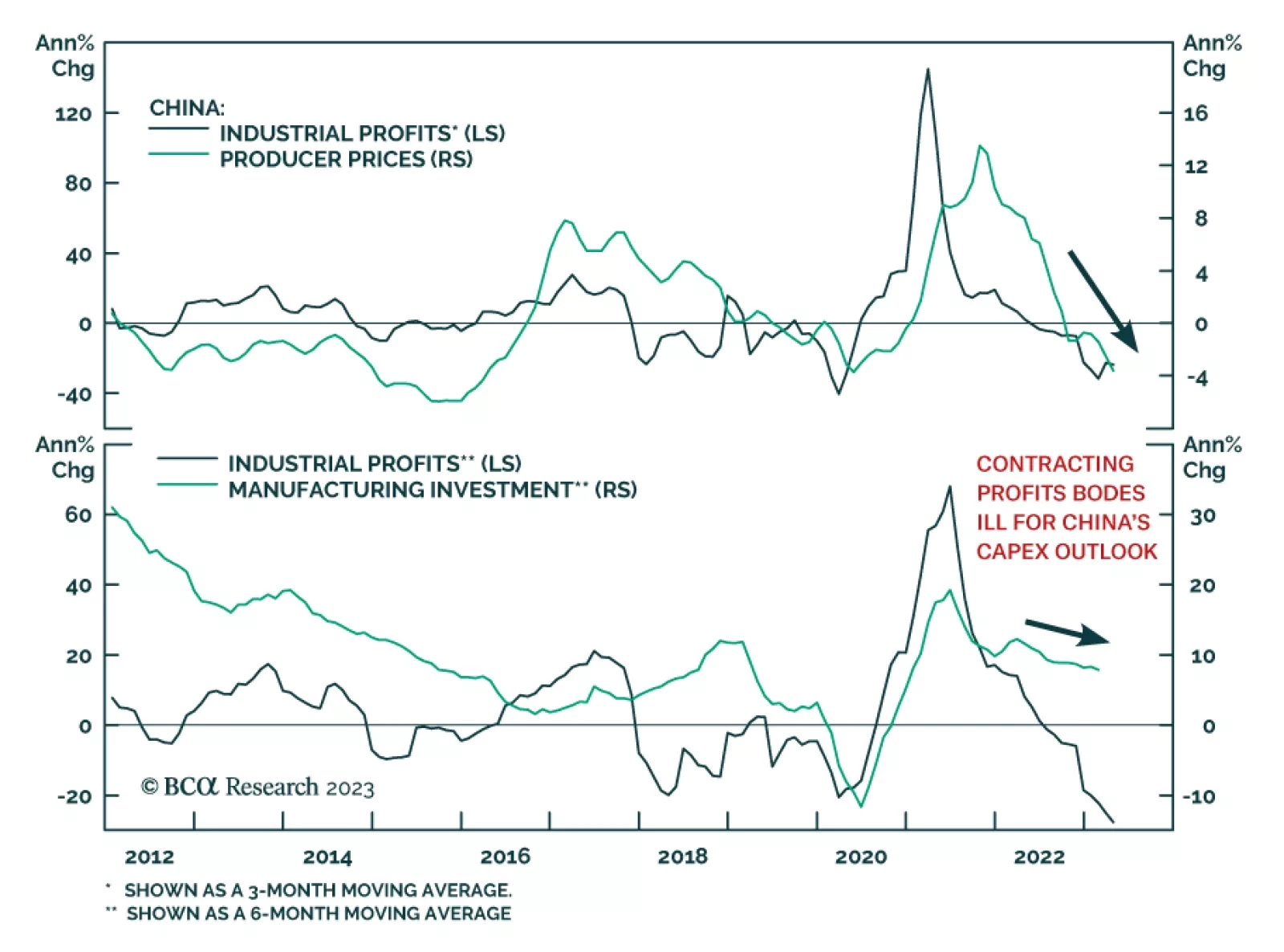

Profits of Chinese industrial firms dropped by 20.6% y/y in the first four months of 2023, extending the contraction that began in the second half of last year. Notably, the weakness remains particularly pronounced across the…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

We expect the CCP to pivot toward more fiscal stimulus – and less credit stimulus – this year, which will put a bid under energy and metals prices. On the back of this view, at tonight’s close we are getting long 4Q23 Brent futures…