Our Portfolio Allocation Summary for January 2024.

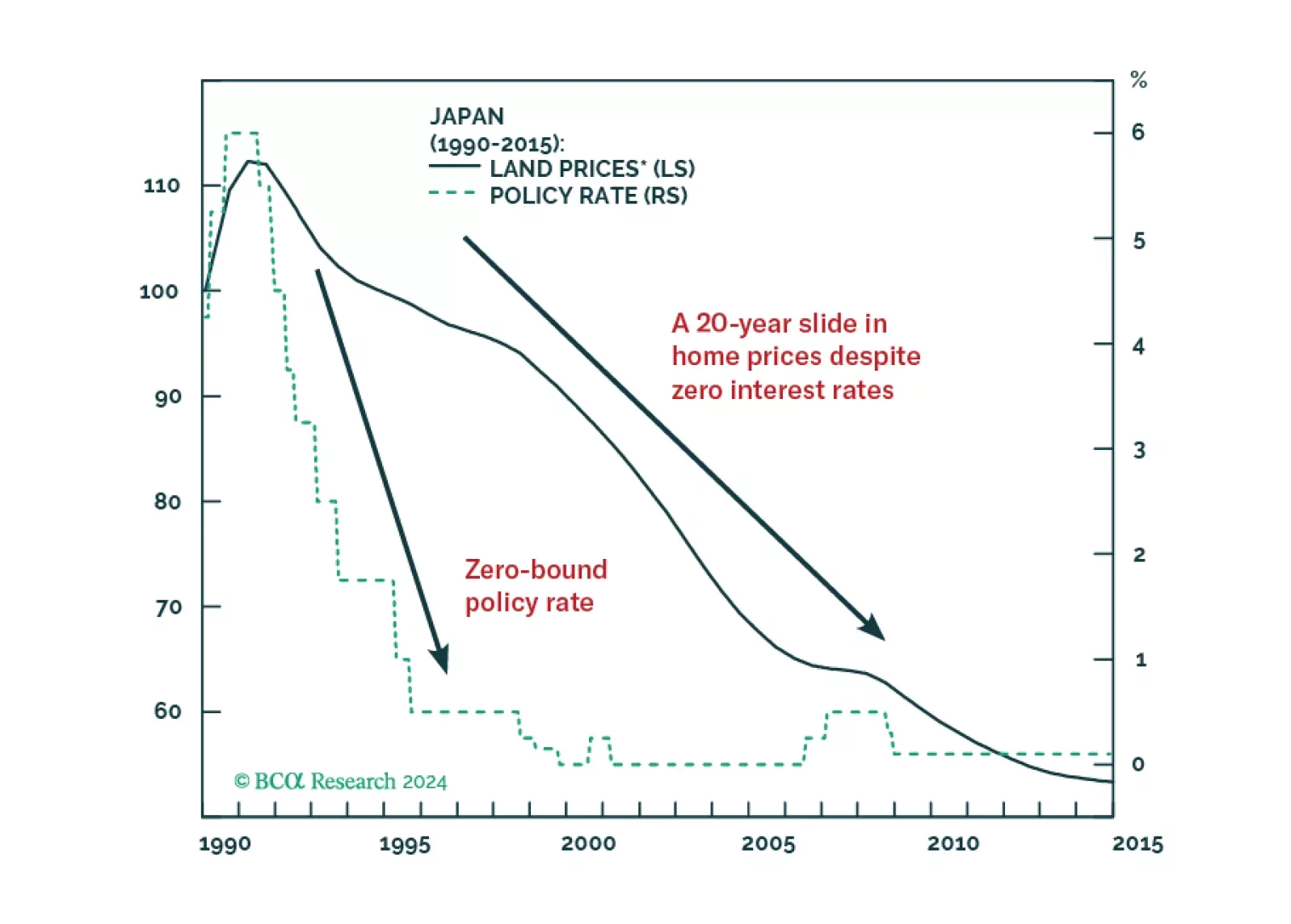

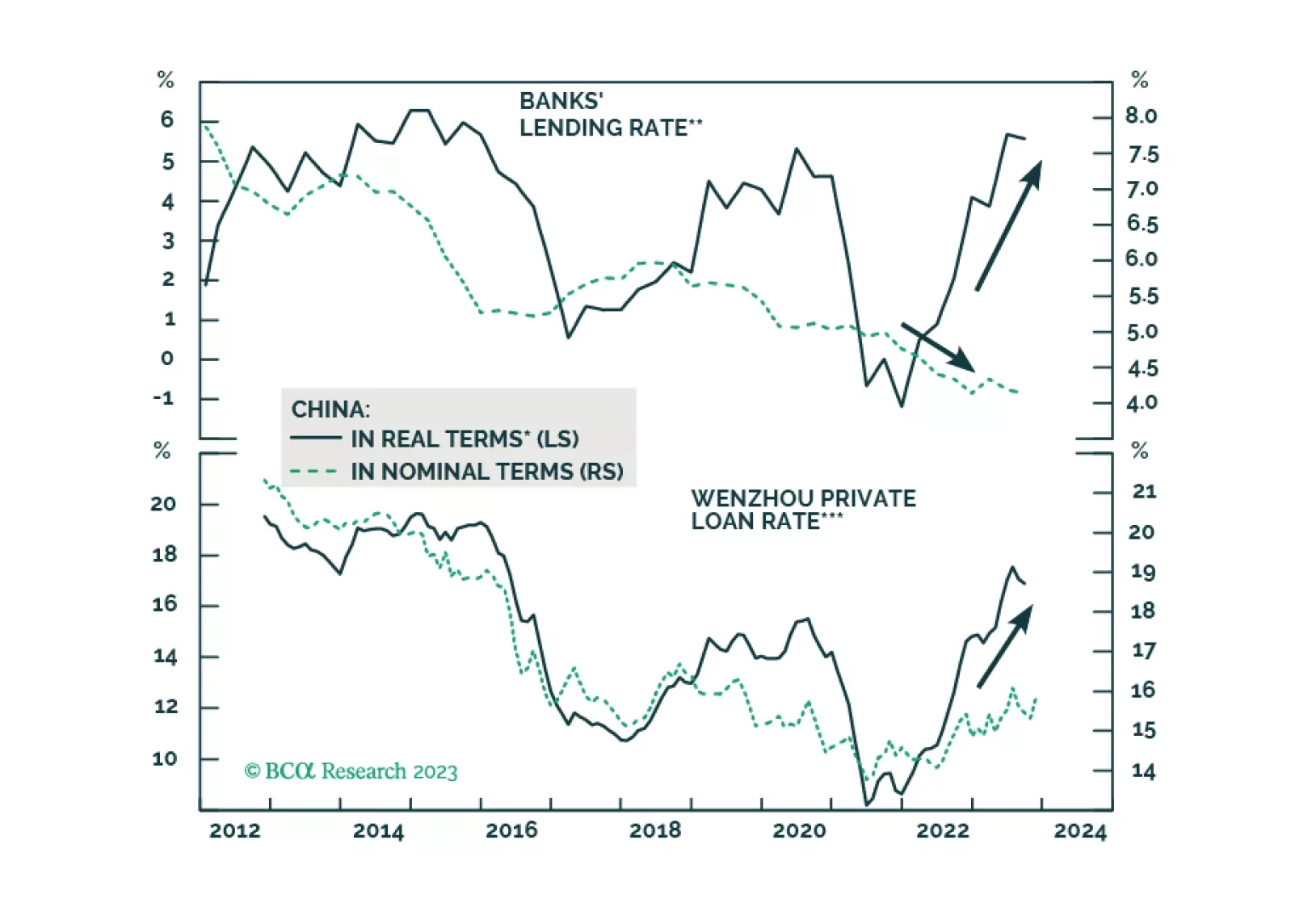

A low multiplier effect of stimulus will reduce the magnitude of the rebound in China's business activities in 2024. The housing market downturn will likely persist, and the ongoing household deleveraging also poses a significant…

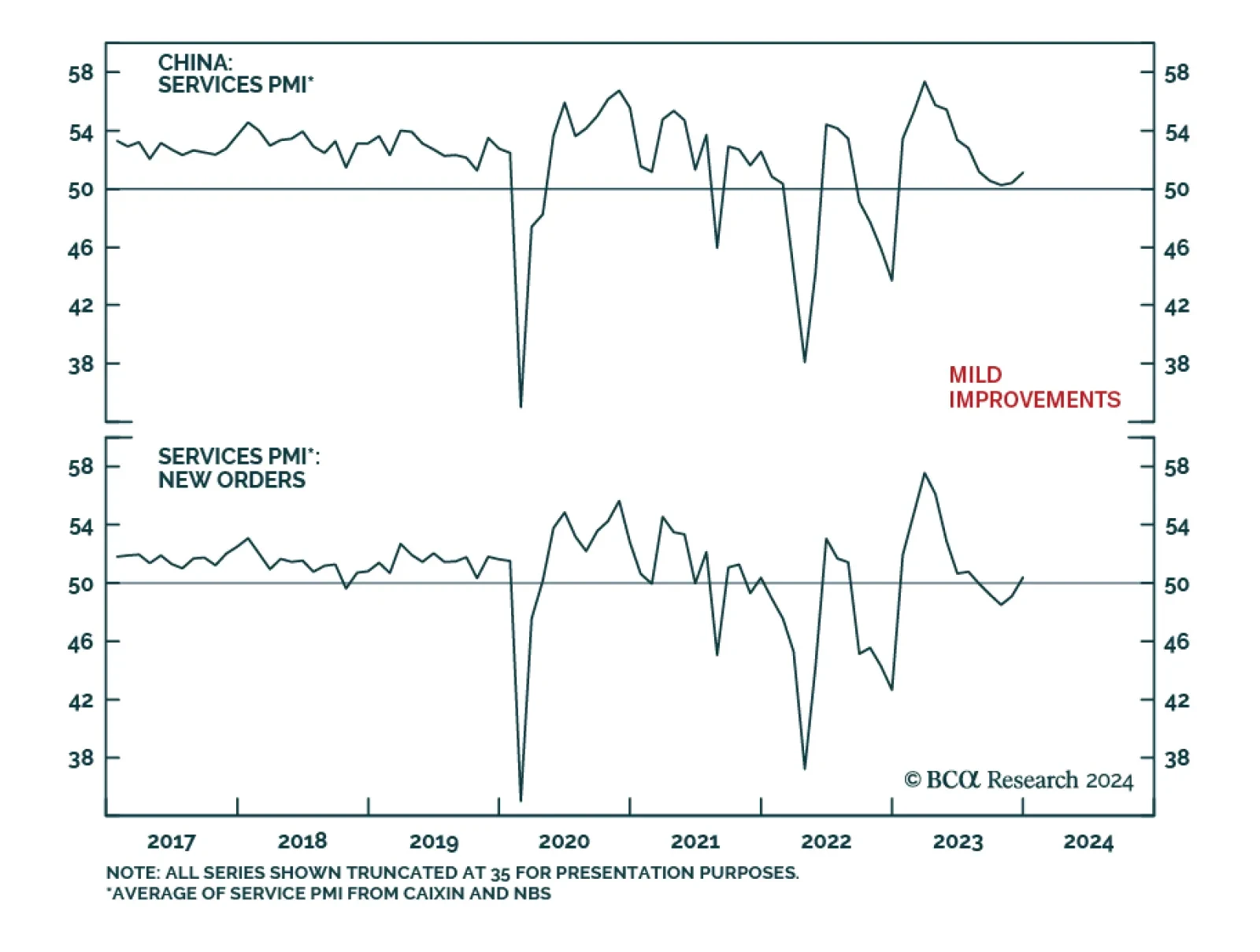

China’s Caixin PMI delivered a positive signal on Thursday. The Services index climbed from 51.5 to 52.9 in December, beating expectations it would remain more or less unchanged. The improvement in the Services PMI lifted…

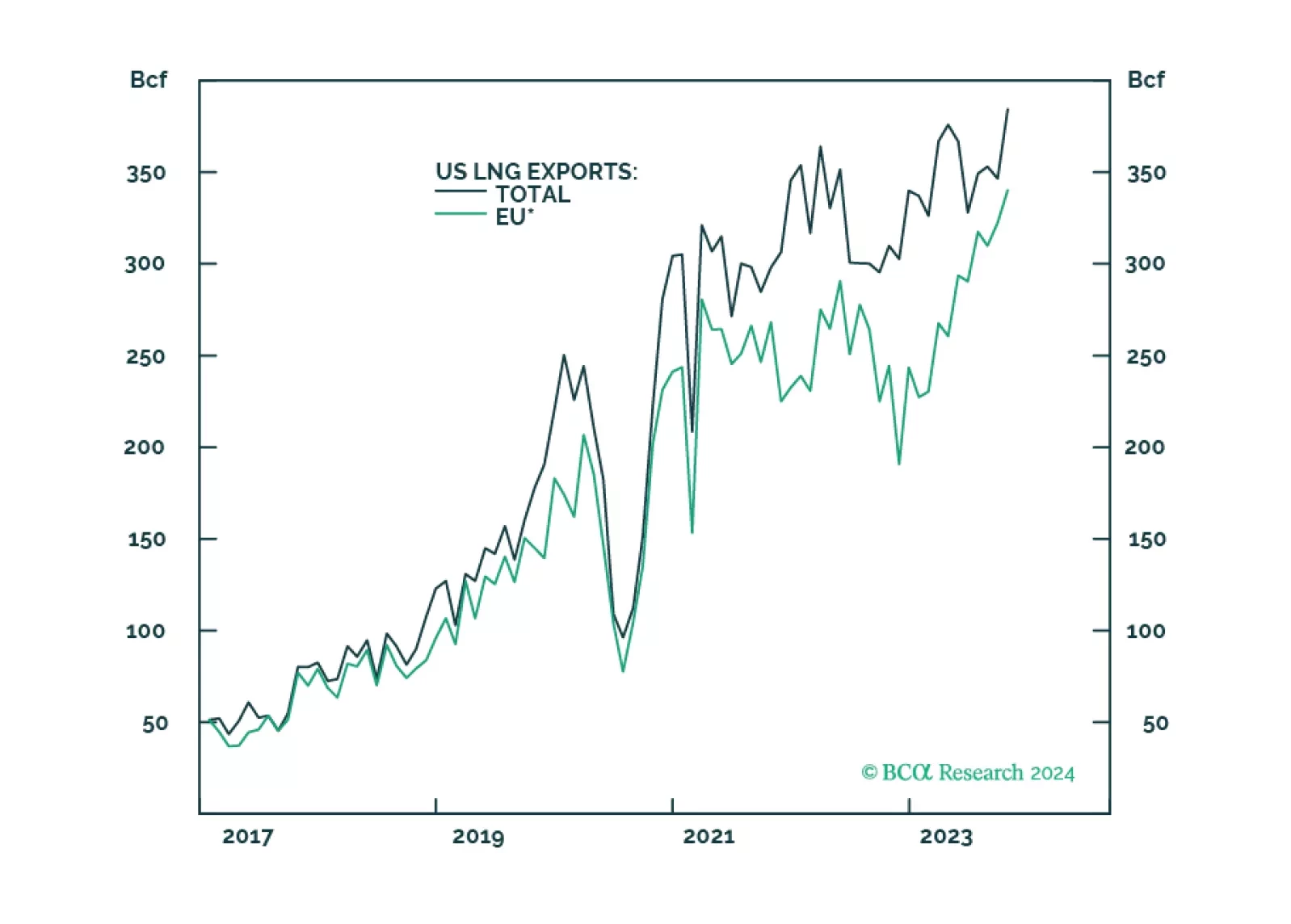

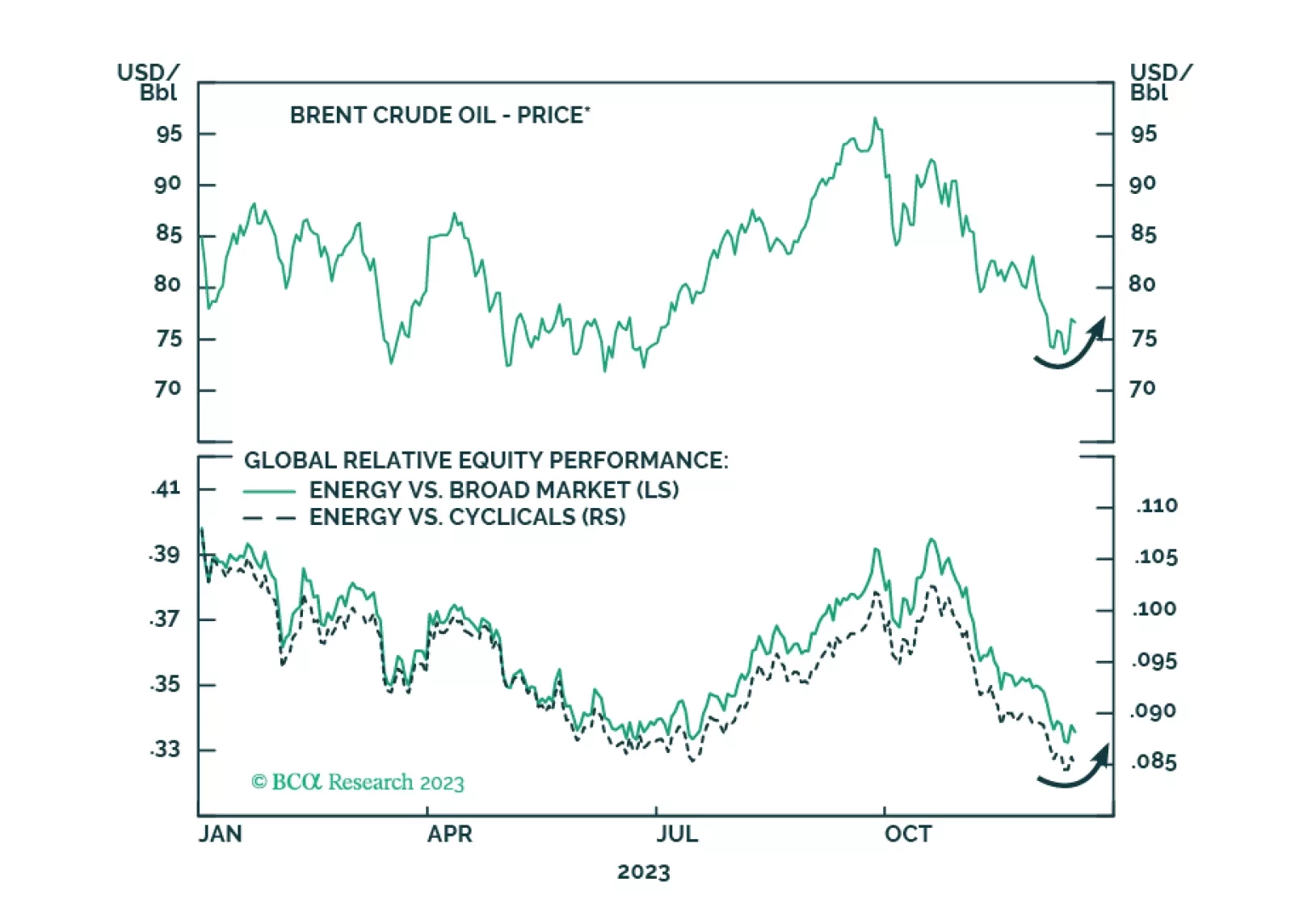

The attacks on Red Sea commercial tankers by Iran’s Yemeni proxies, the Houthi movement, are an inflation risk inasmuch as they lengthen voyage times for any shipping forced to avoid the Bab el-Mandeb Strait. The risk of an expansion…

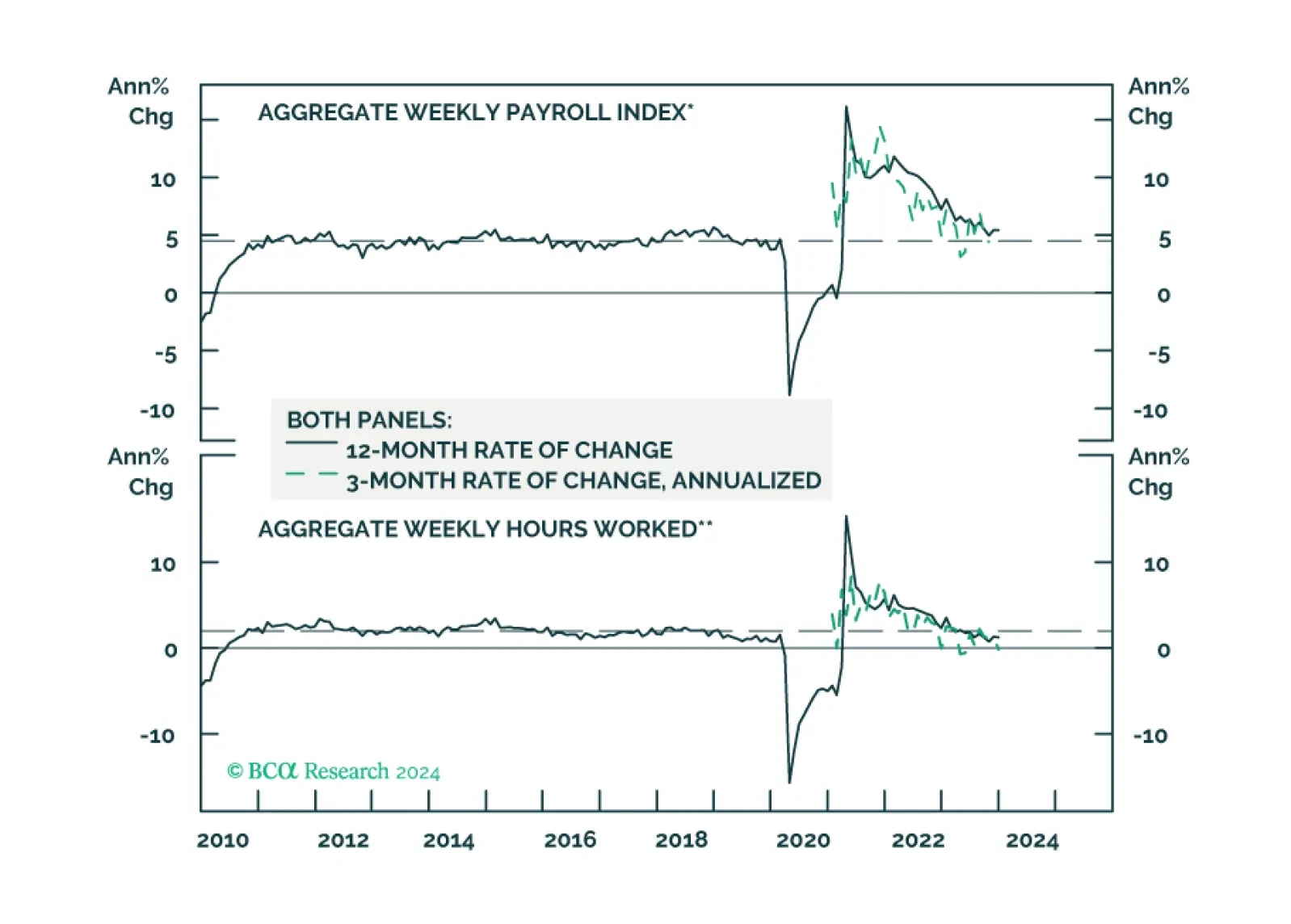

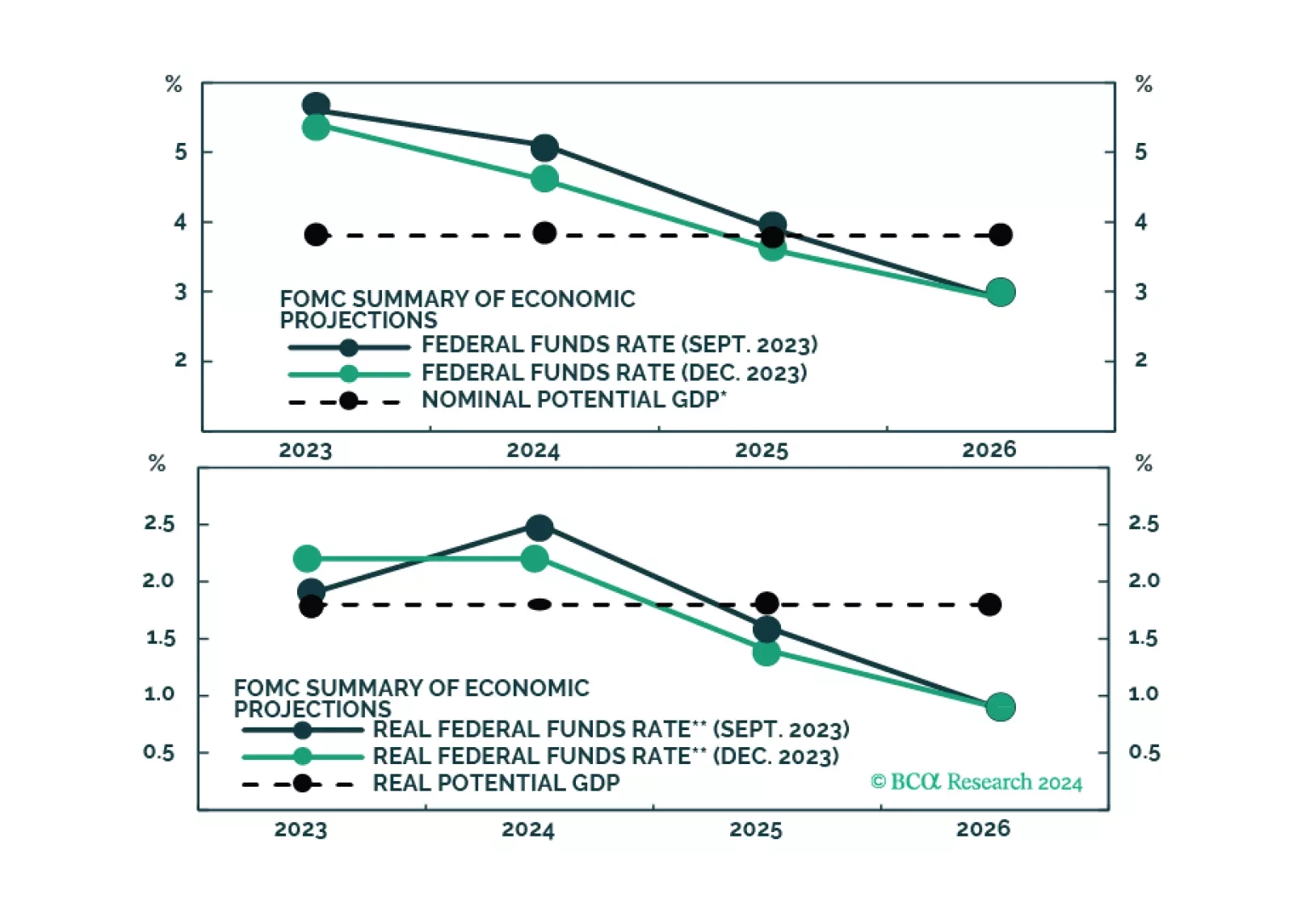

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

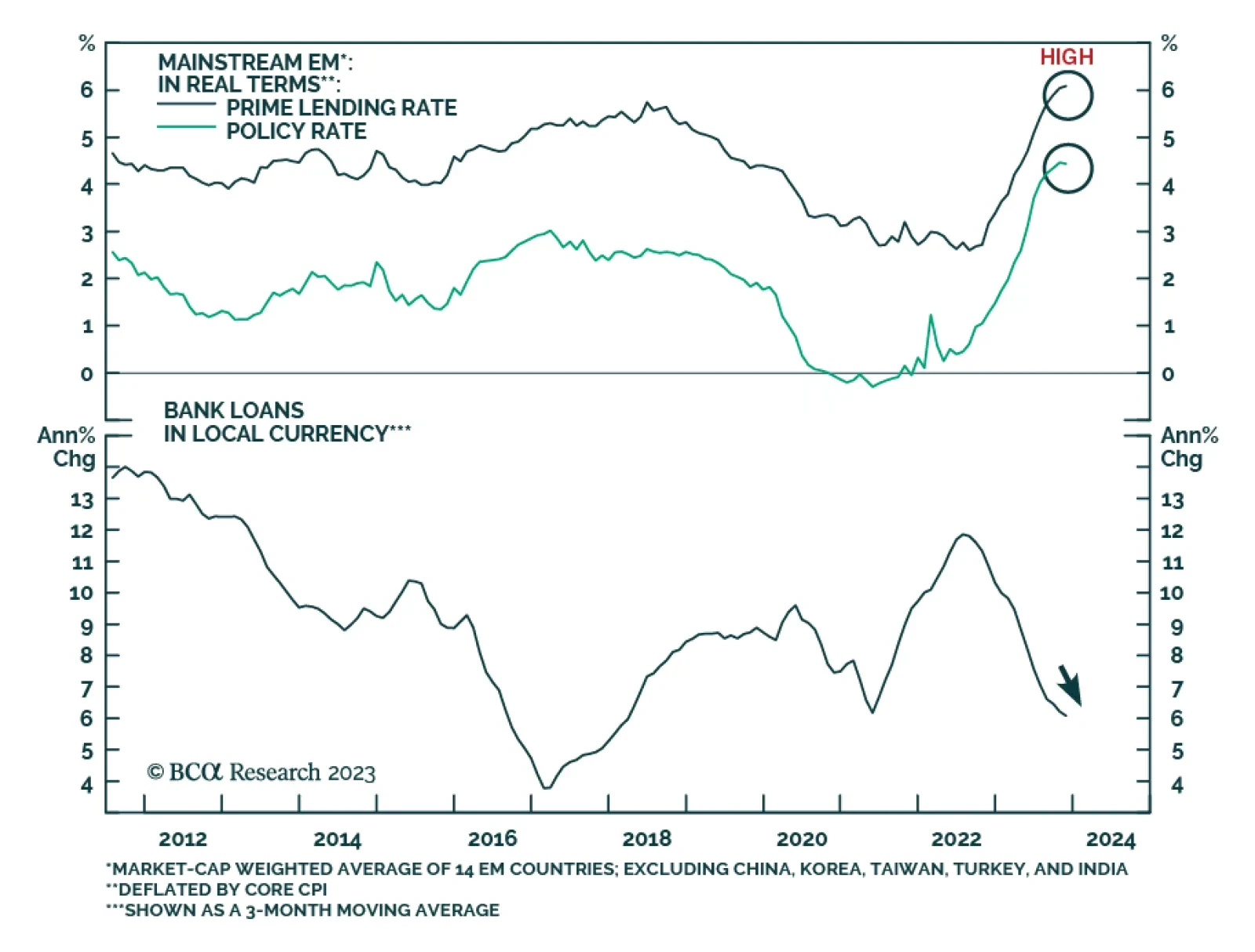

According to BCA Research’s Emerging Markets Strategy service, domestic demand and corporate profits will disappoint across mainstream Emerging Market economies (excluding China, India, Korea, and Taiwan) in H1 2024.…