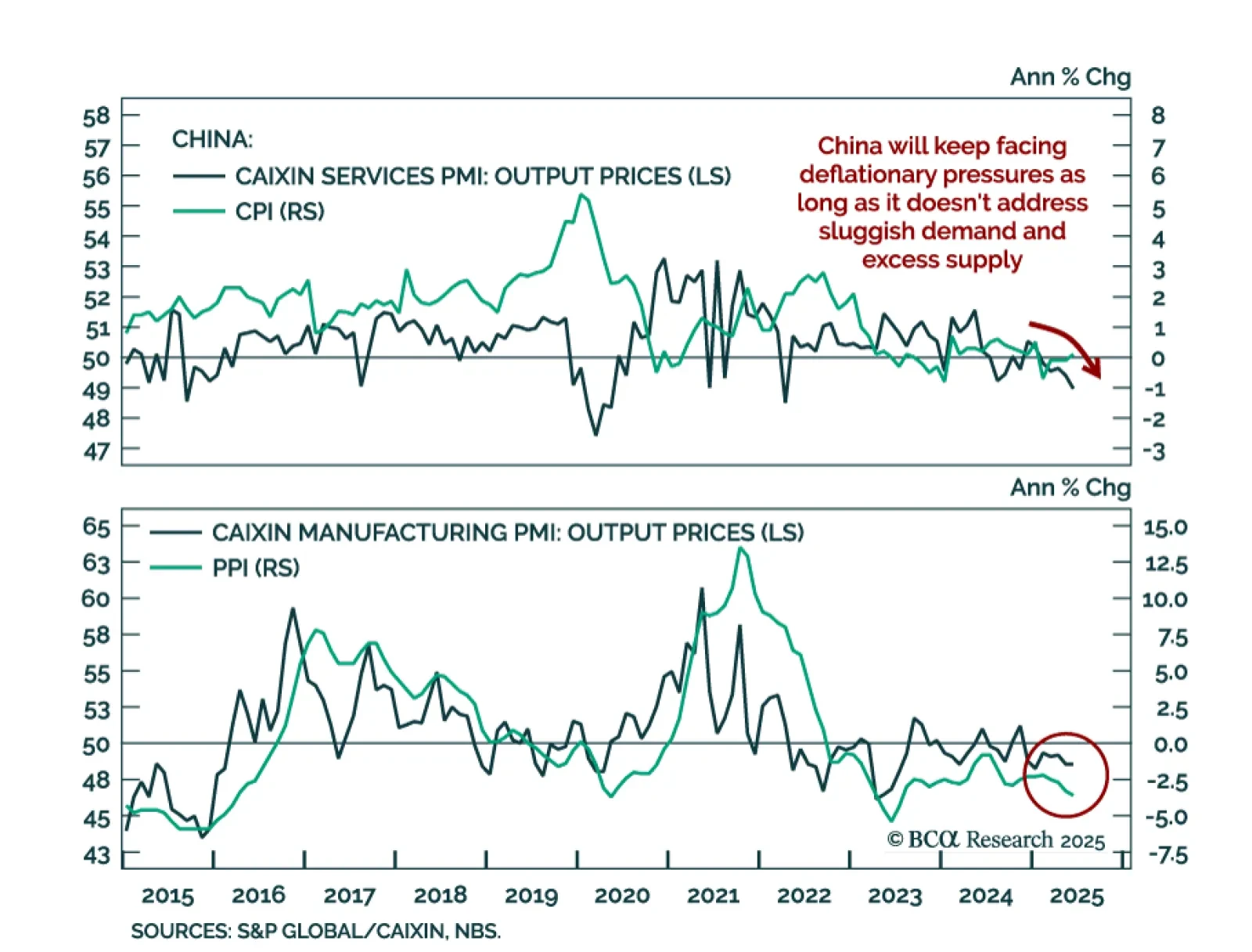

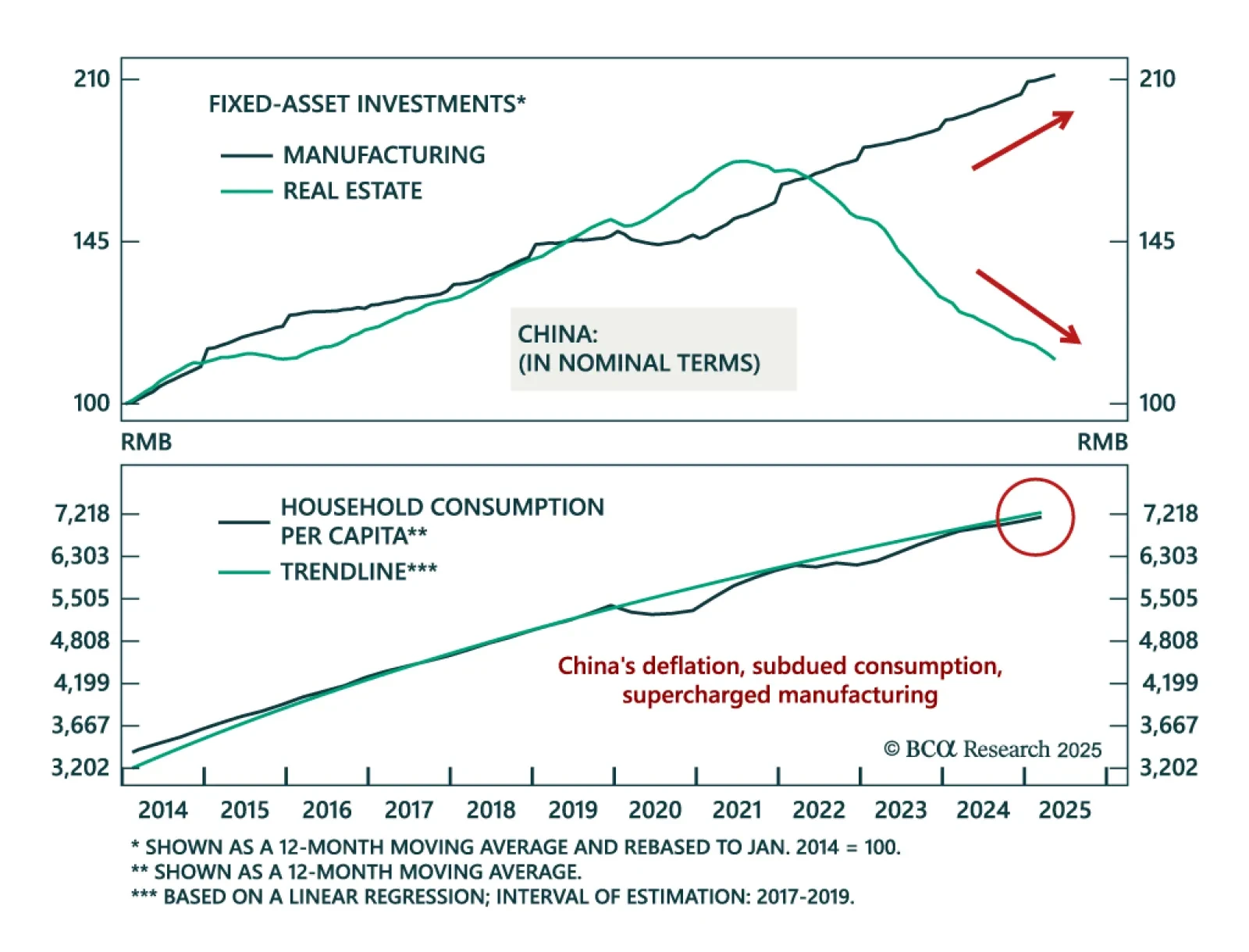

Persistent deflation and constrained policy options support a defensive stance on China, favoring bonds and high-dividend equities. Consumer prices were roughly flat in June, rising just 0.1% y/y after a 0.1% decline in May. Producer…

Our China strategists maintain a defensive stance on equities, favoring government bonds and high-dividend sectors as deflation persists. China’s deflationary pressures are supply-driven, with manufacturing capacity expanding faster…

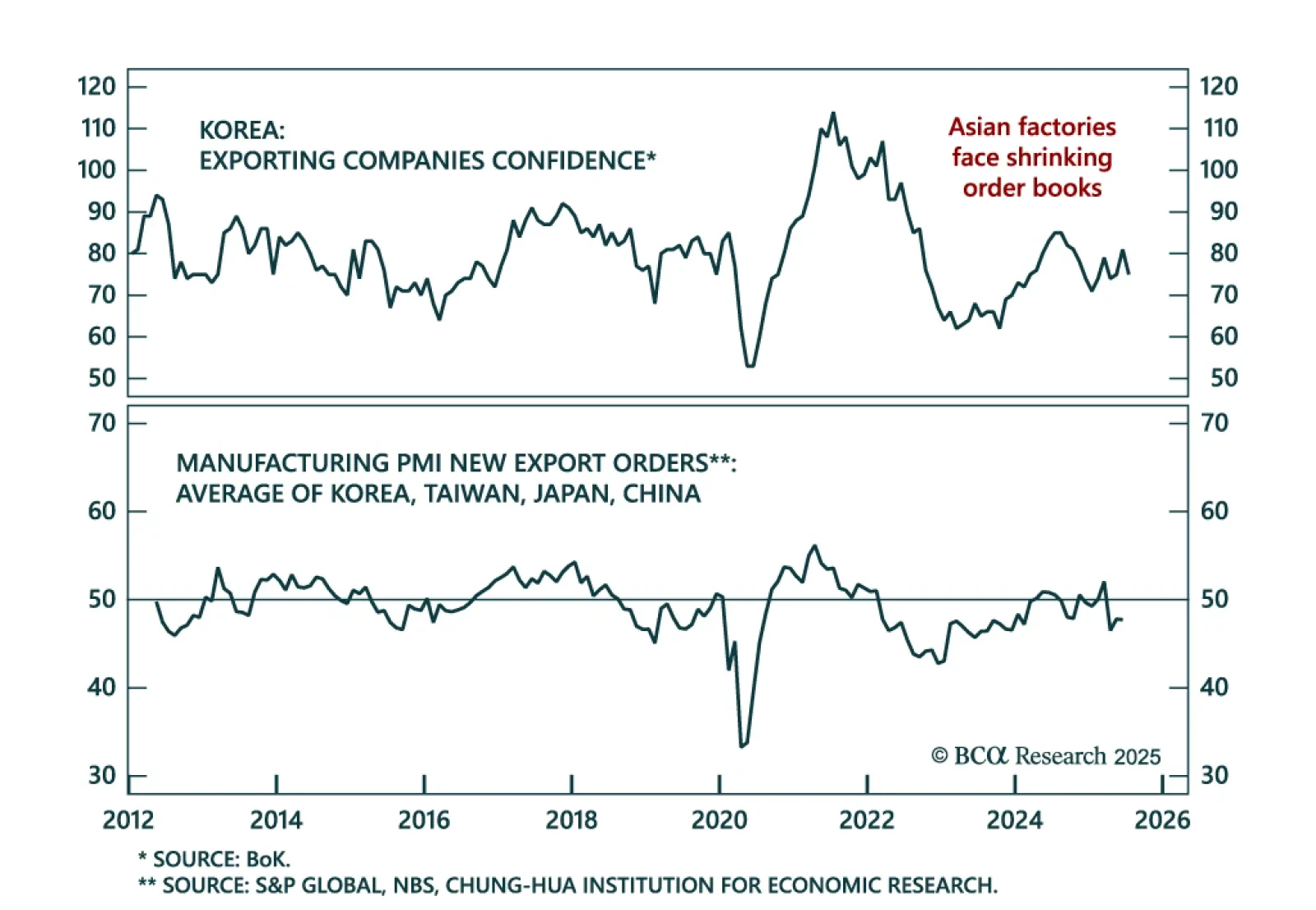

The latest data on Asian exports and manufacturing suggest that the global trade outlook remains downbeat. Korean exports in USD terms grew in June by 4.3% y/y. The three-month moving average is 2.2%. Assuming Q2 export shipments…

Alligator Bite #1: As US net portfolio inflows decline (the alligator's upper jaw closes), its current account deficit must narrow (the lower jaw will also shut). Alligator Bite #2: As the US current account deficit shrinks (the…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

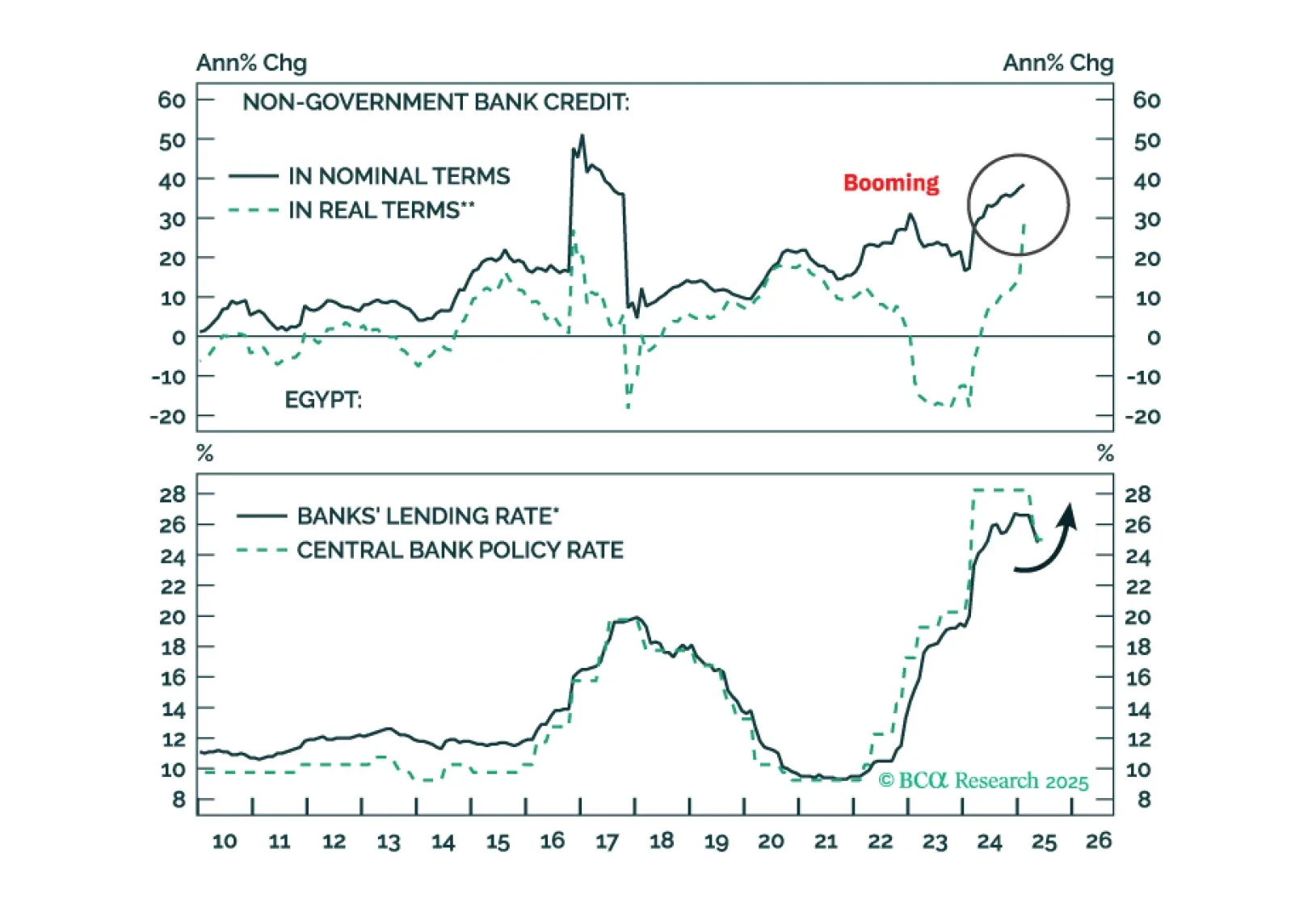

Downward pressure on the pound will rise in the coming months. Inflation will go up, so will bond yields. It’s time to book profits on Egyptian domestic bonds.

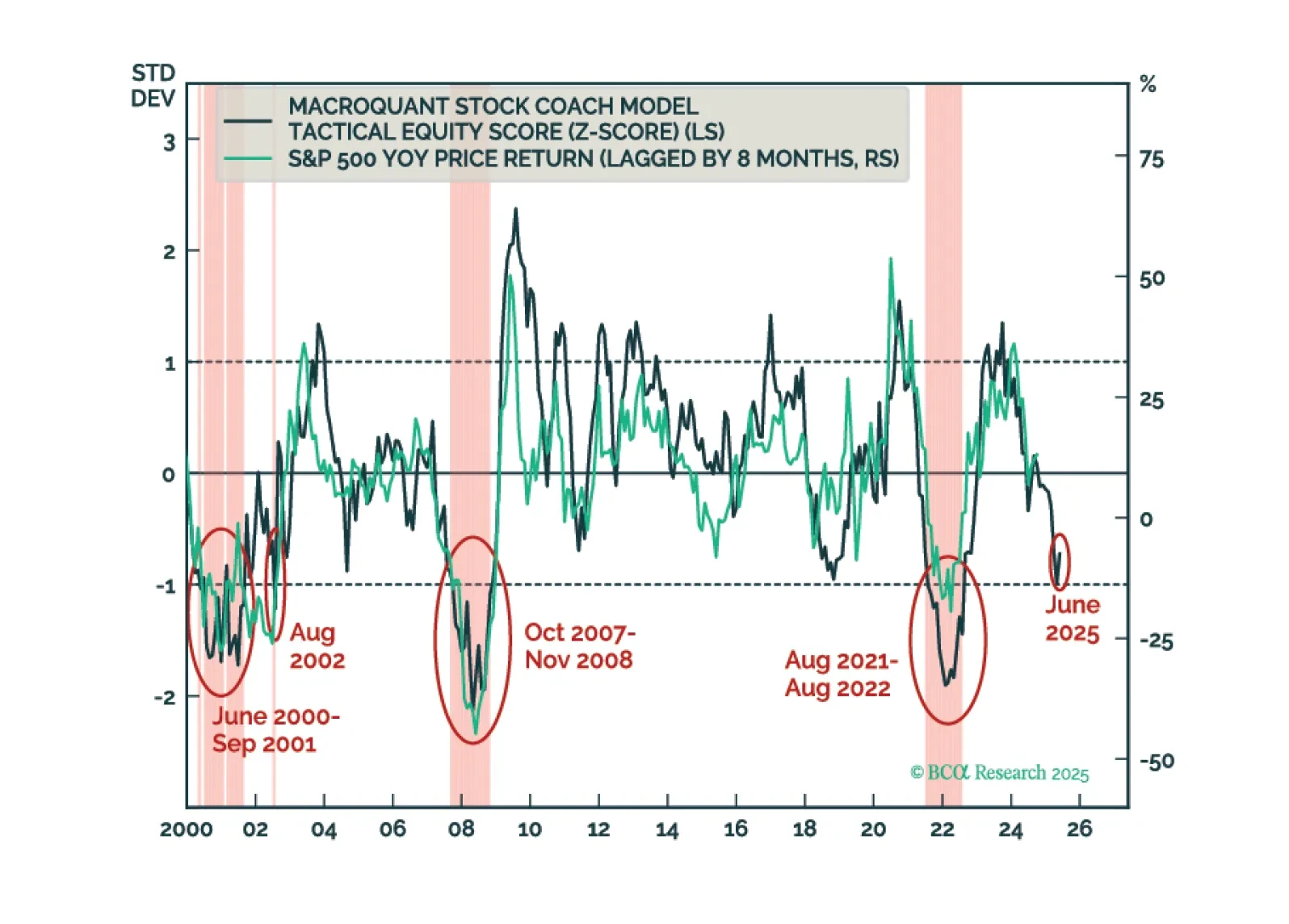

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

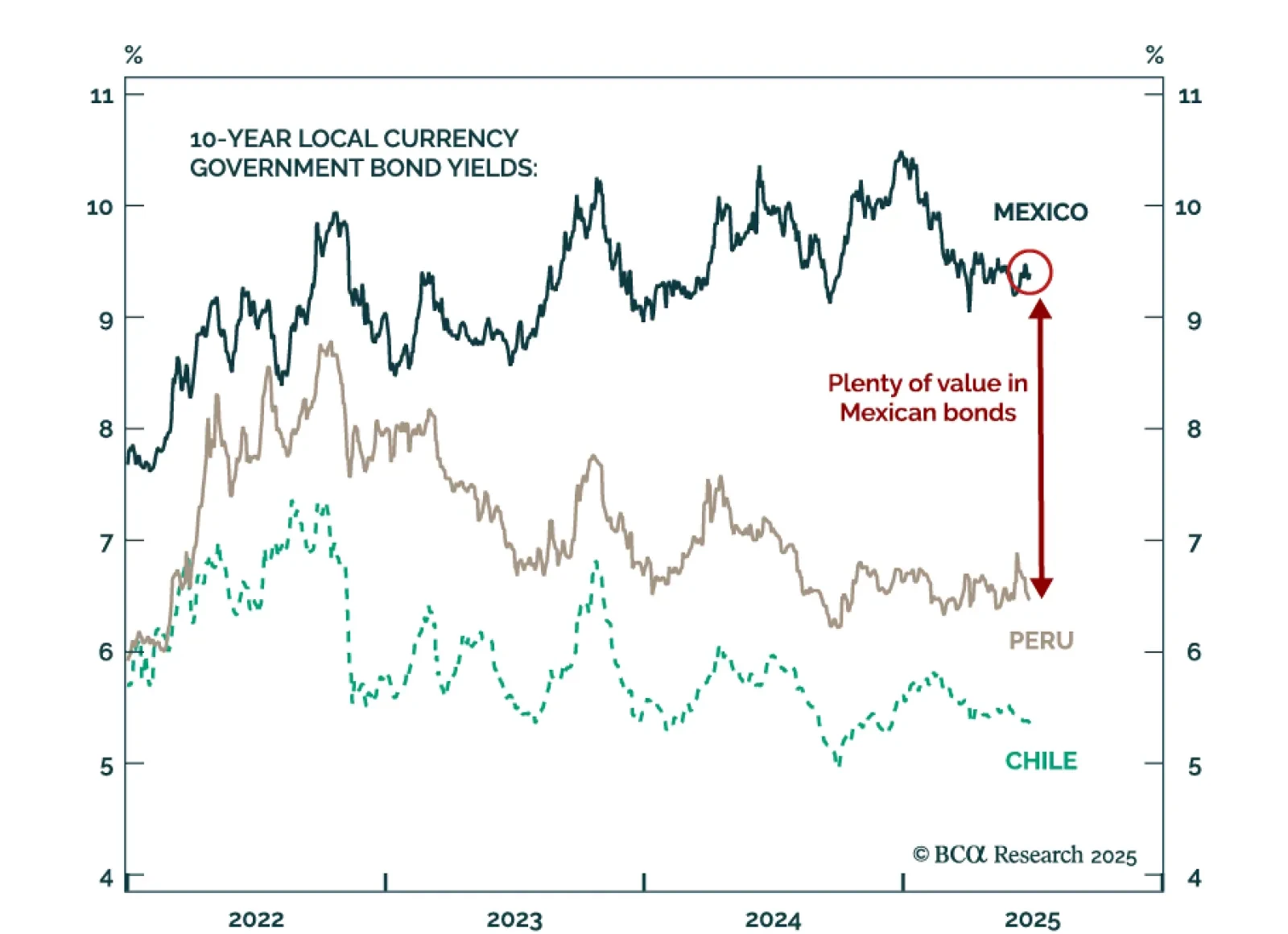

Banxico’s dovish stance reinforces our bullish view on Mexican local currency debt. The Mexican central bank cut interest rates by another 50 basis points to 8%. The central bank will continue easing monetary policy well…

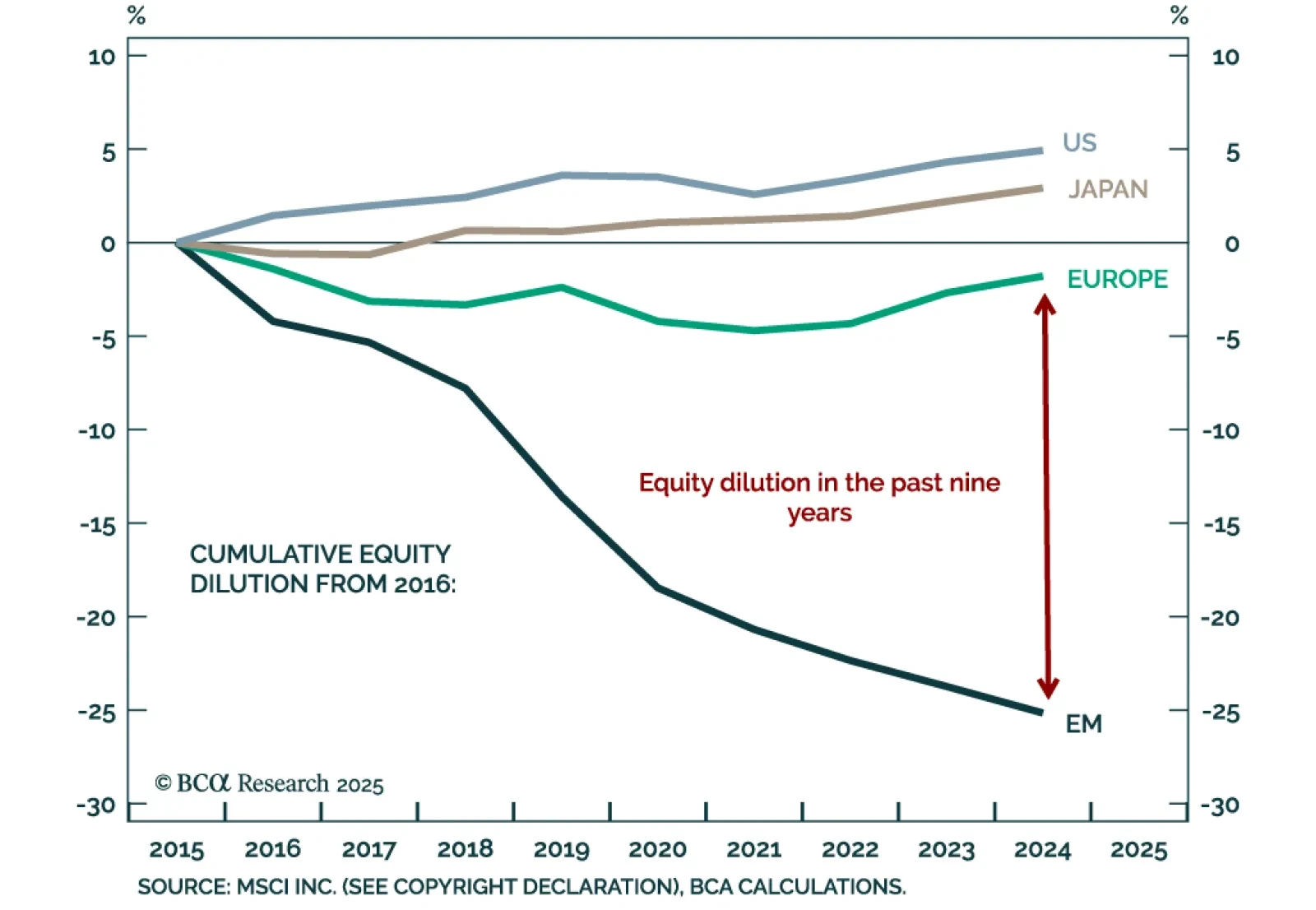

Our Emerging Markets strategists highlight that systematic equity dilution has meaningfully eroded EM shareholder returns, explaining the long-term disconnect between profit growth and EPS. Over the past 18 years, EM companies have…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.