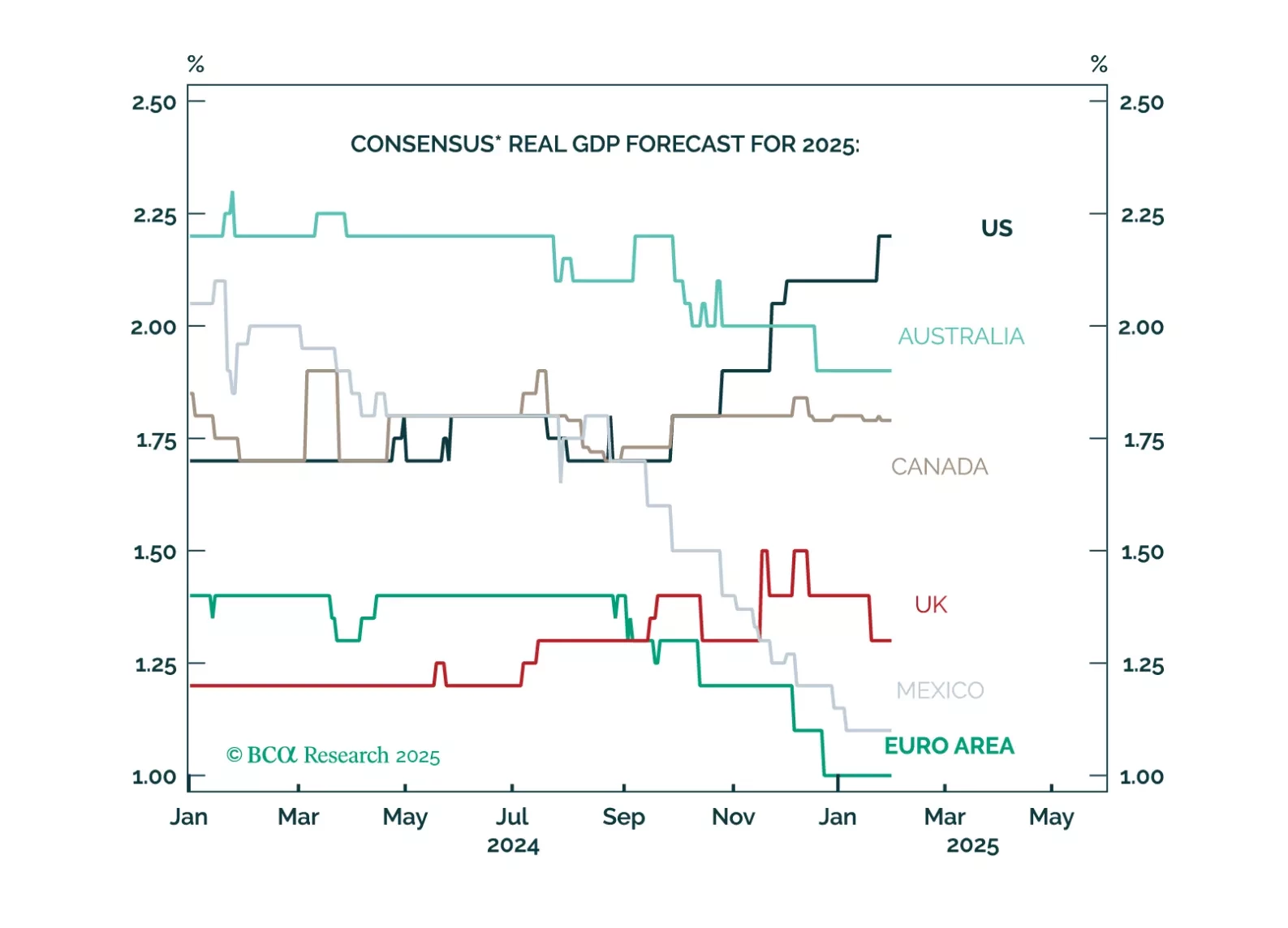

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…

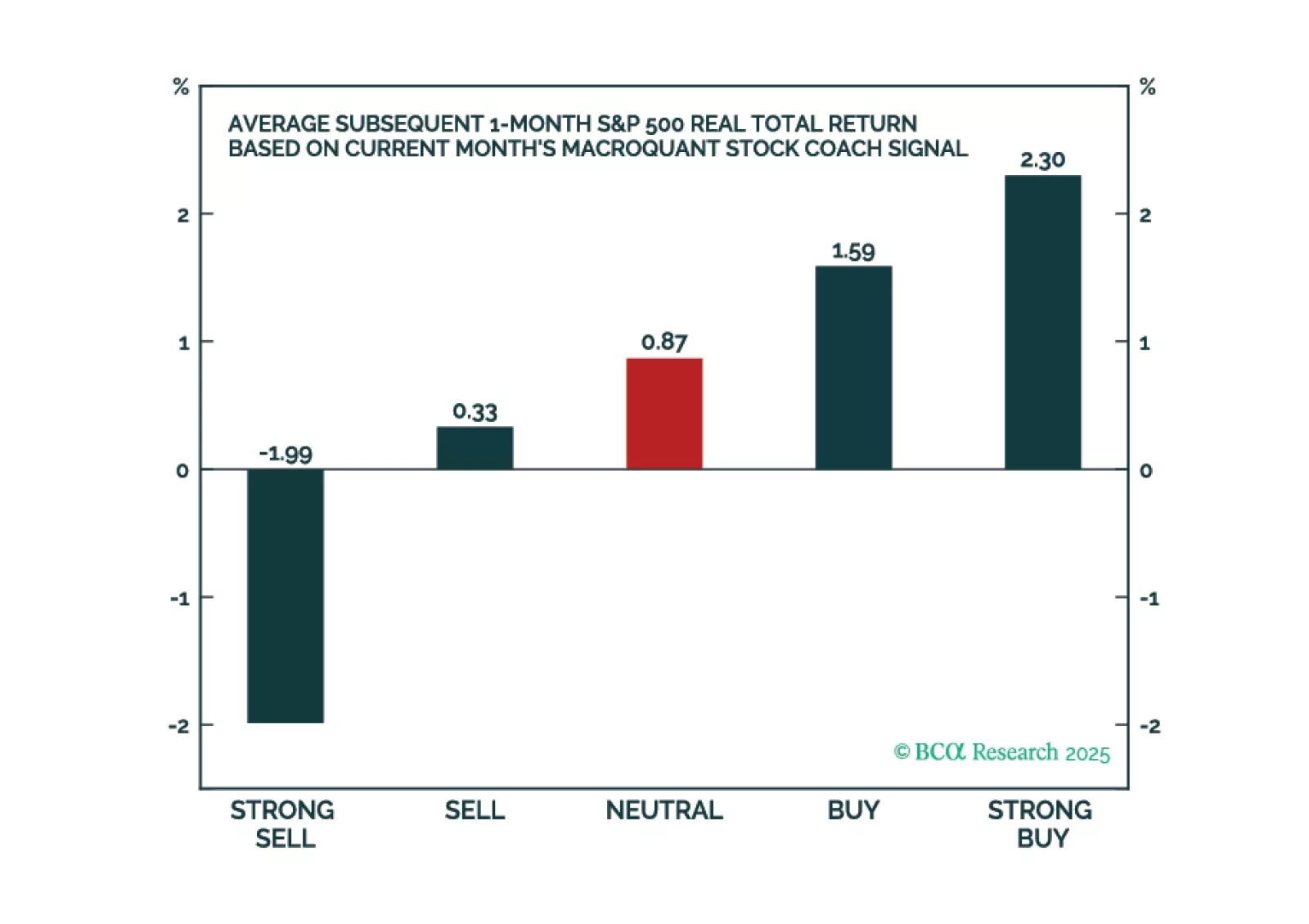

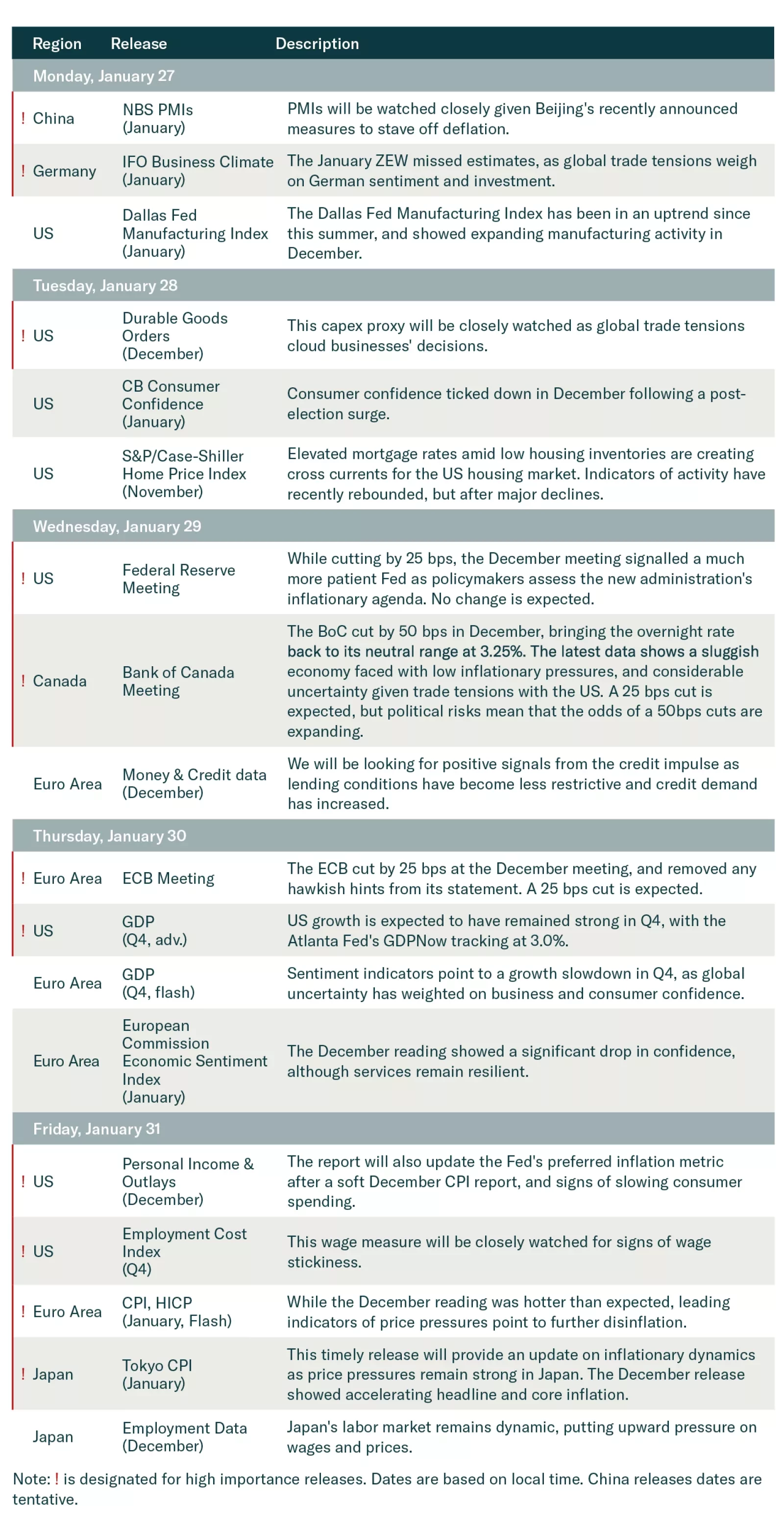

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

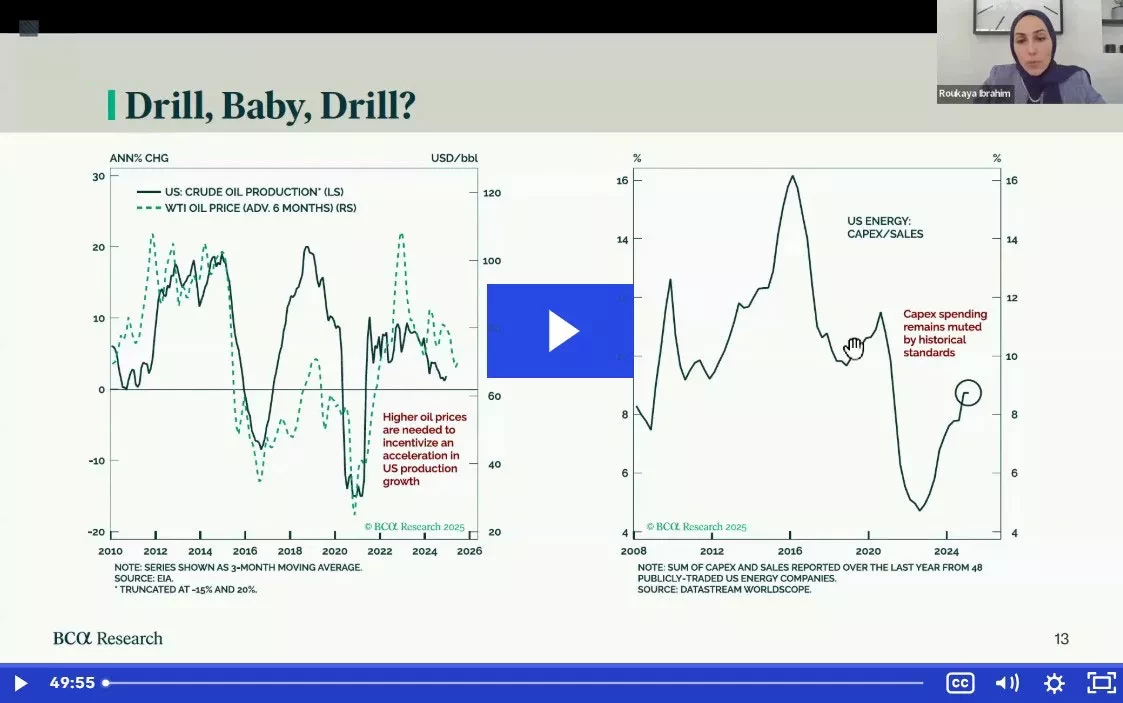

Please join BCA Research's Commodity & Energy Strategist, Roukaya Ibrahim for a Webcast on Thursday, January 30 at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET).

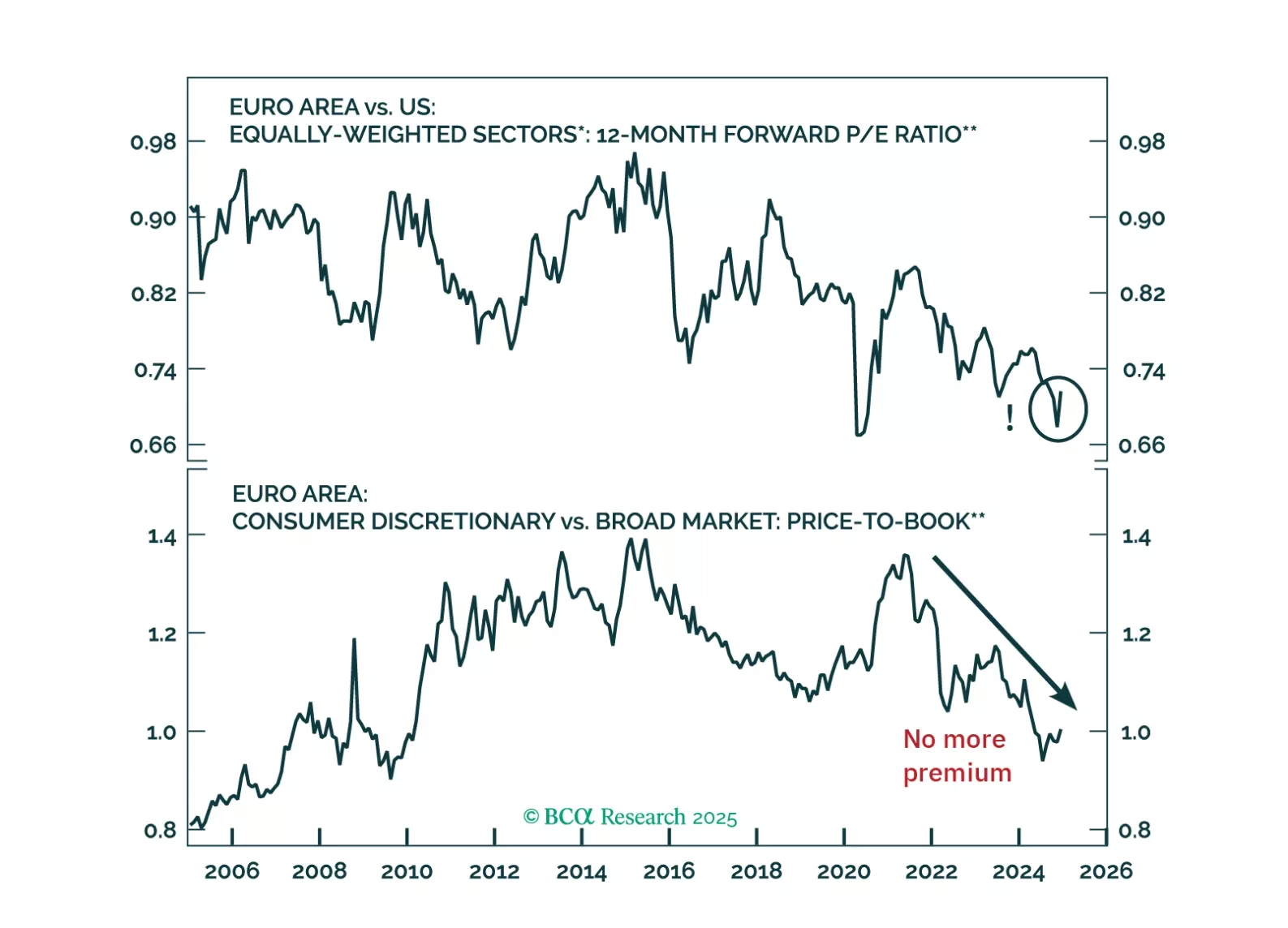

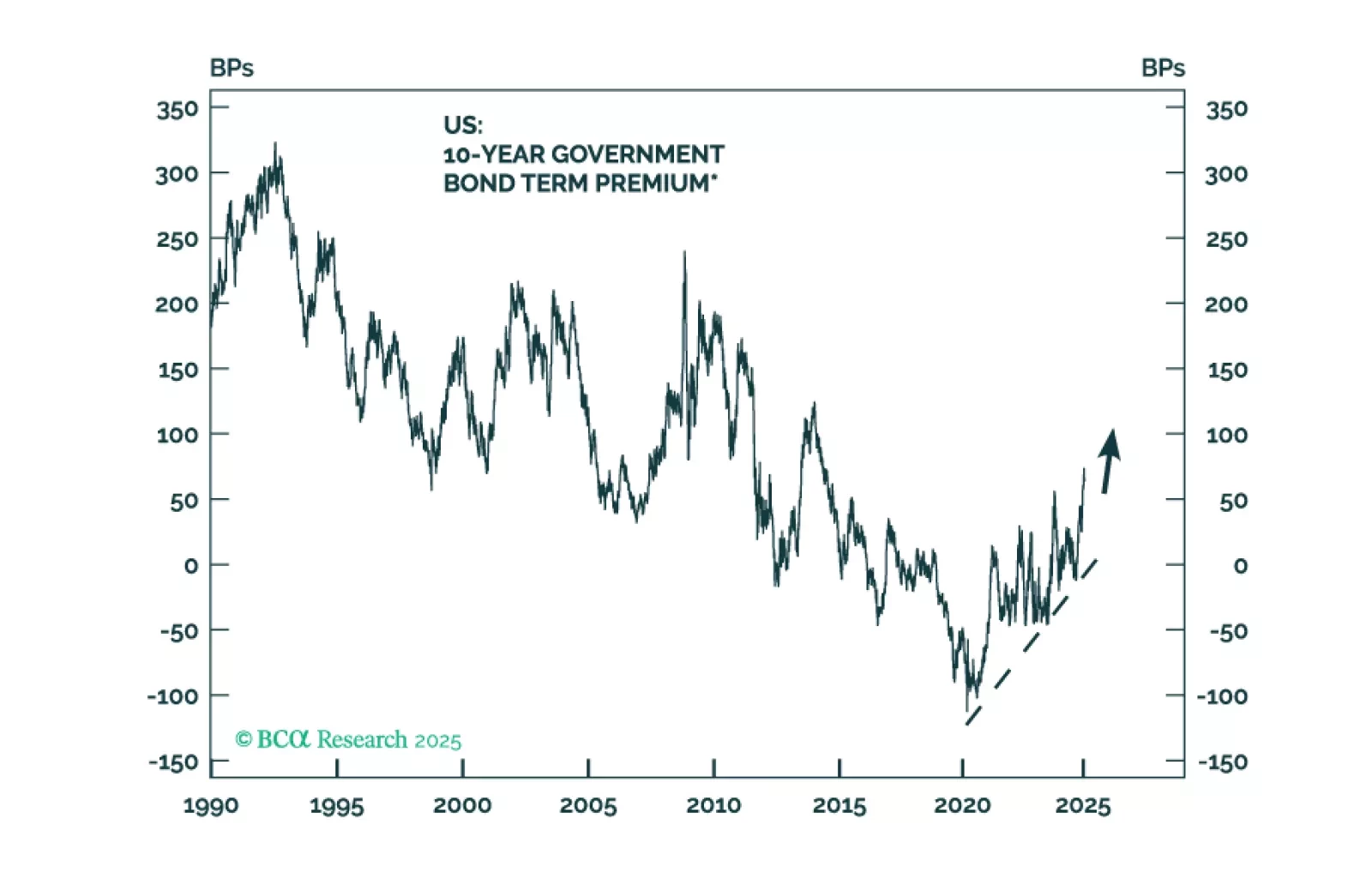

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

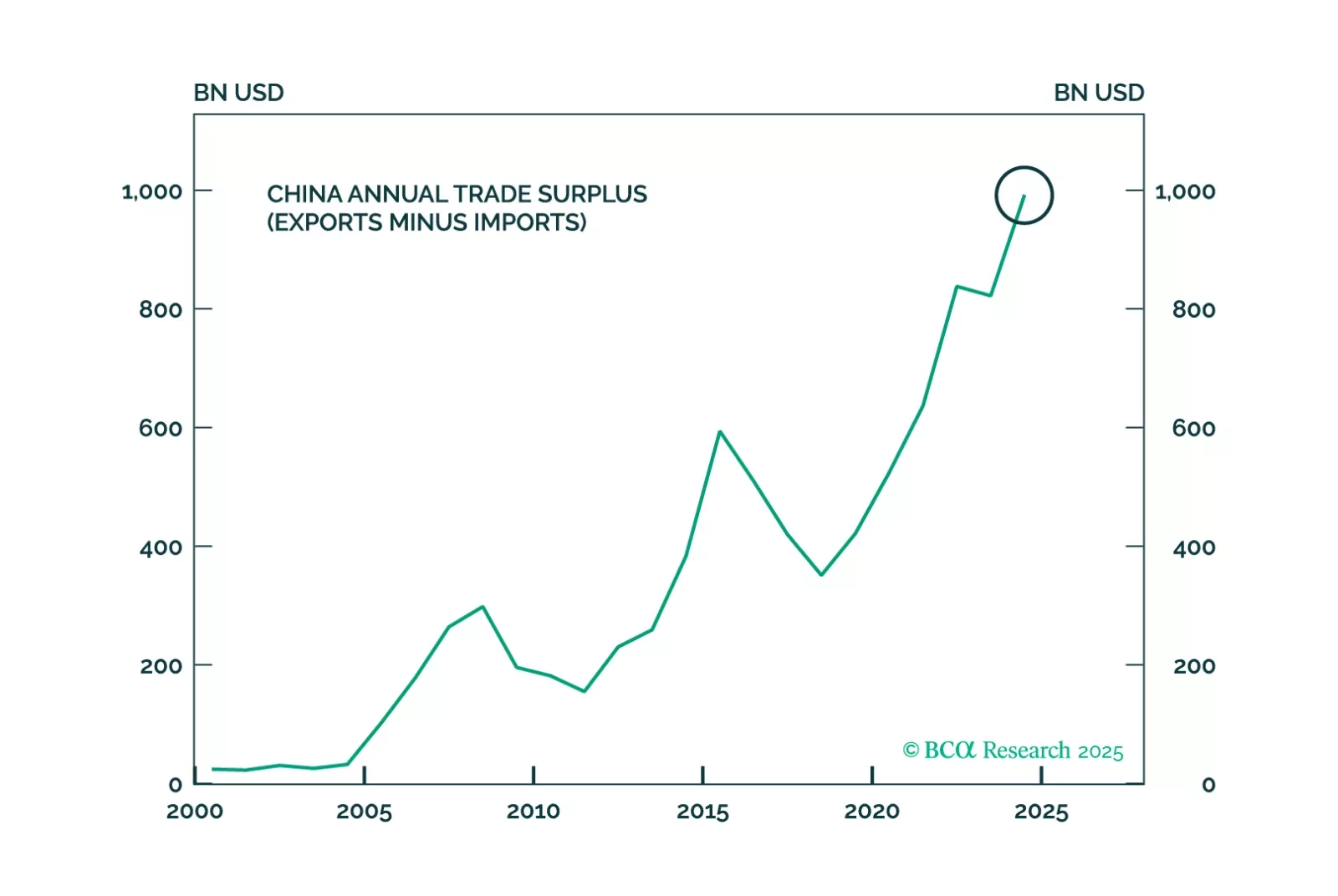

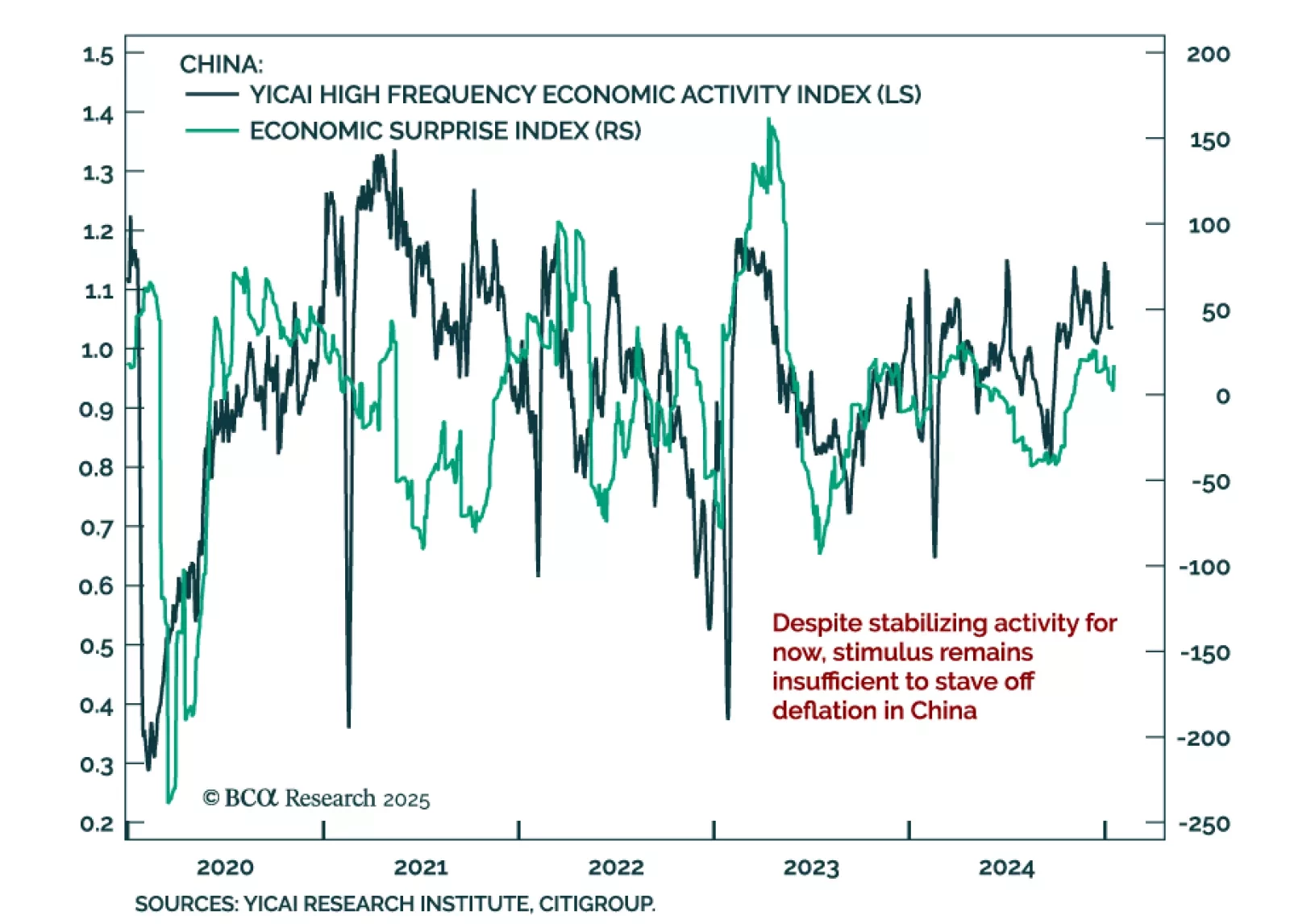

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…