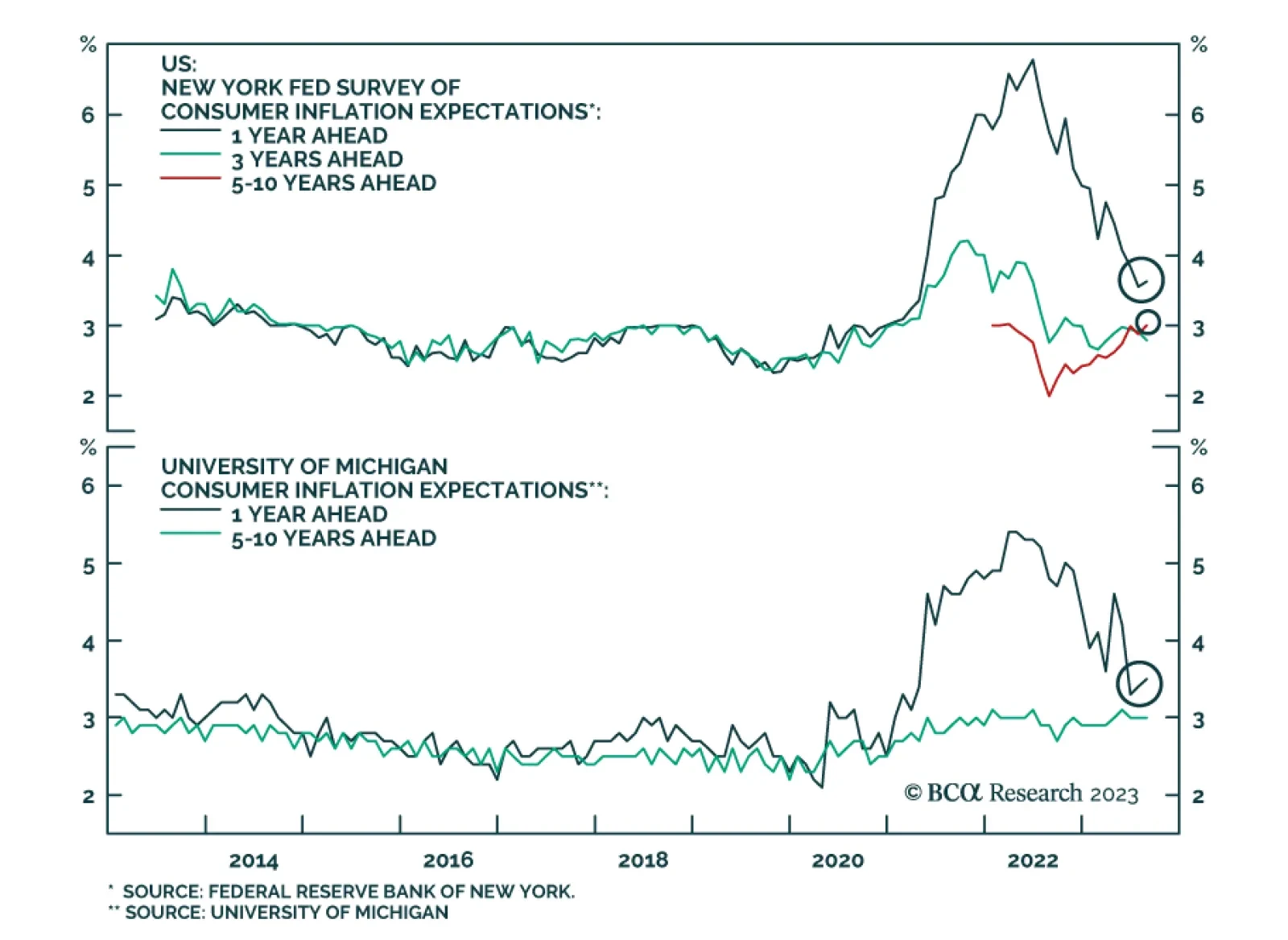

The New York Fed’s latest consumer expectations survey shows household sentiment deteriorated in August. Job loss expectations jumped, with the average perceived likelihood of losing one’s job over the coming year…

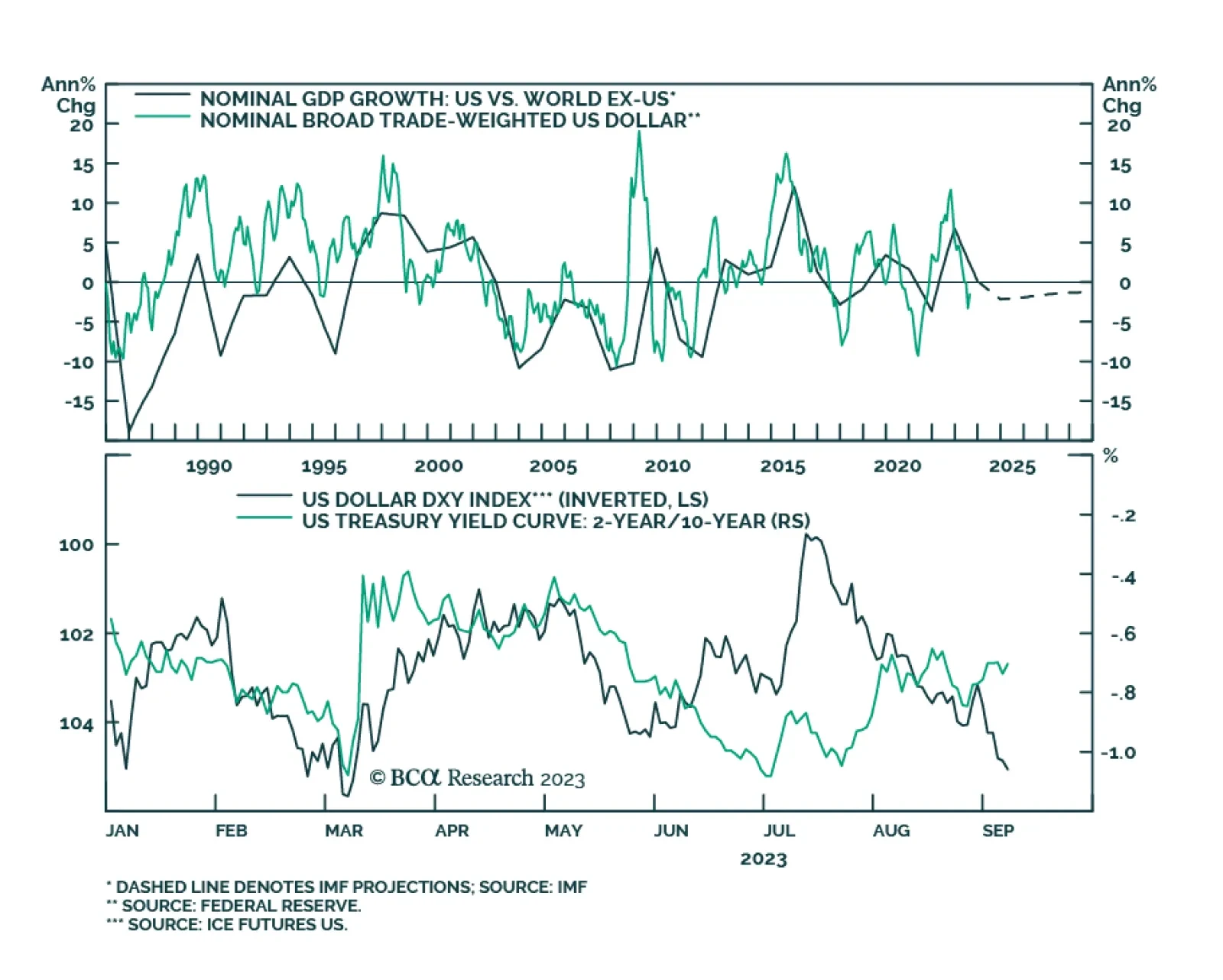

According to BCA Research’s Foreign Exchange Strategy service, the counter-trend bounce in the dollar will continue. Factually, the trend in the dollar has depended on both global growth dynamics and the relative health…

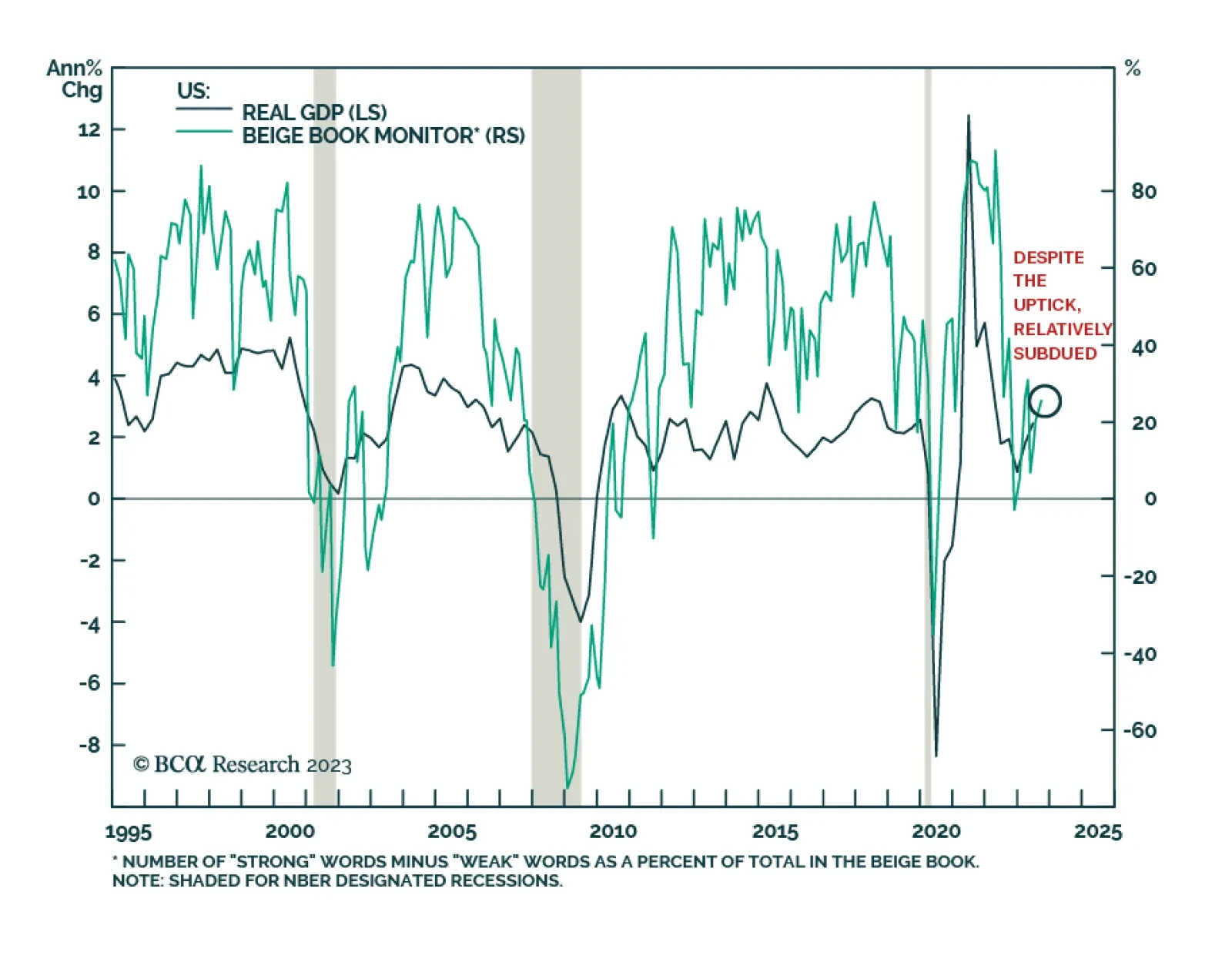

Overall, the Fed’s latest Beige Book provided a pessimistic assessment of the US economy. Although the report characterized tourism spending as “stronger than expected,” it also noted that pent-up demand for…

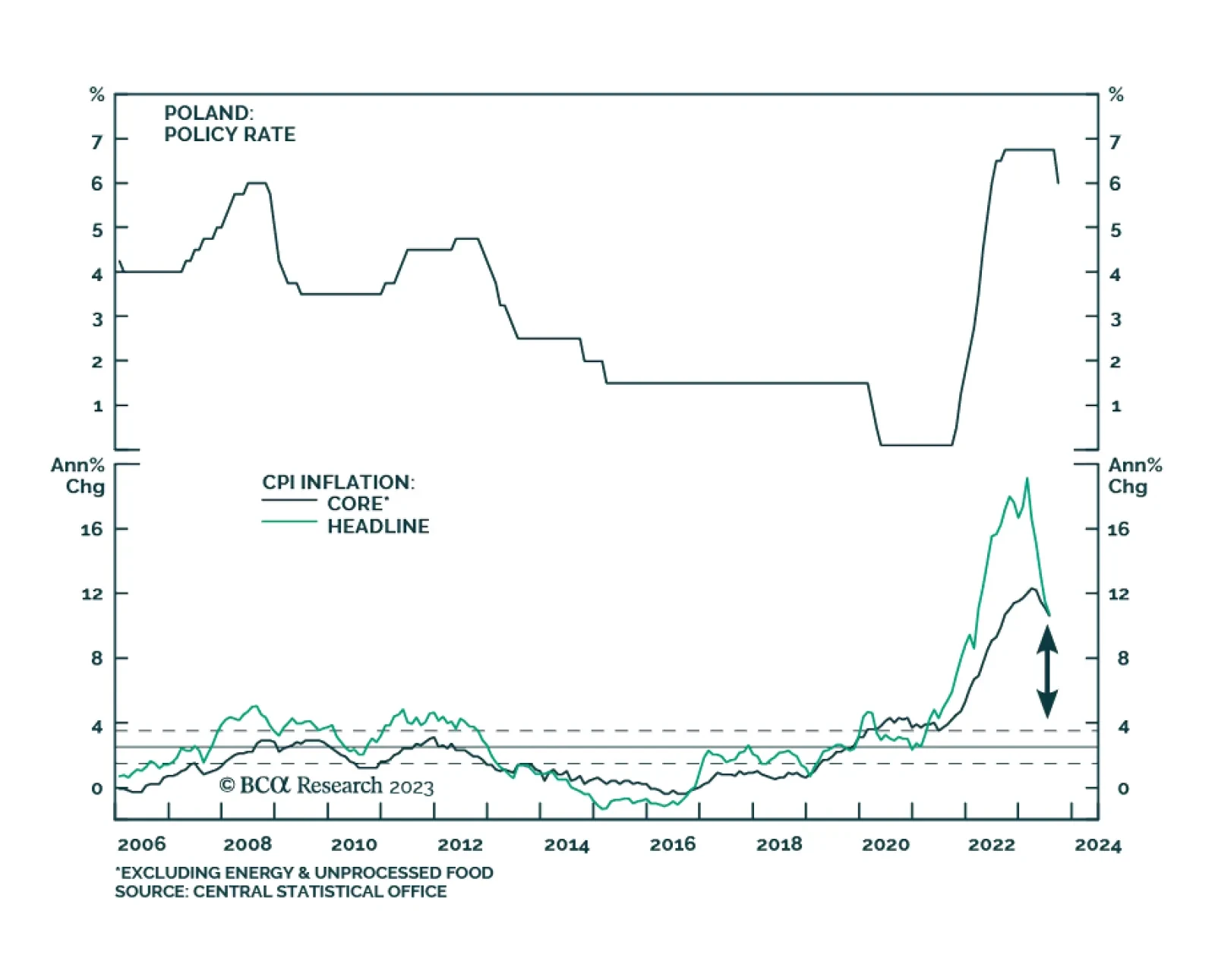

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…

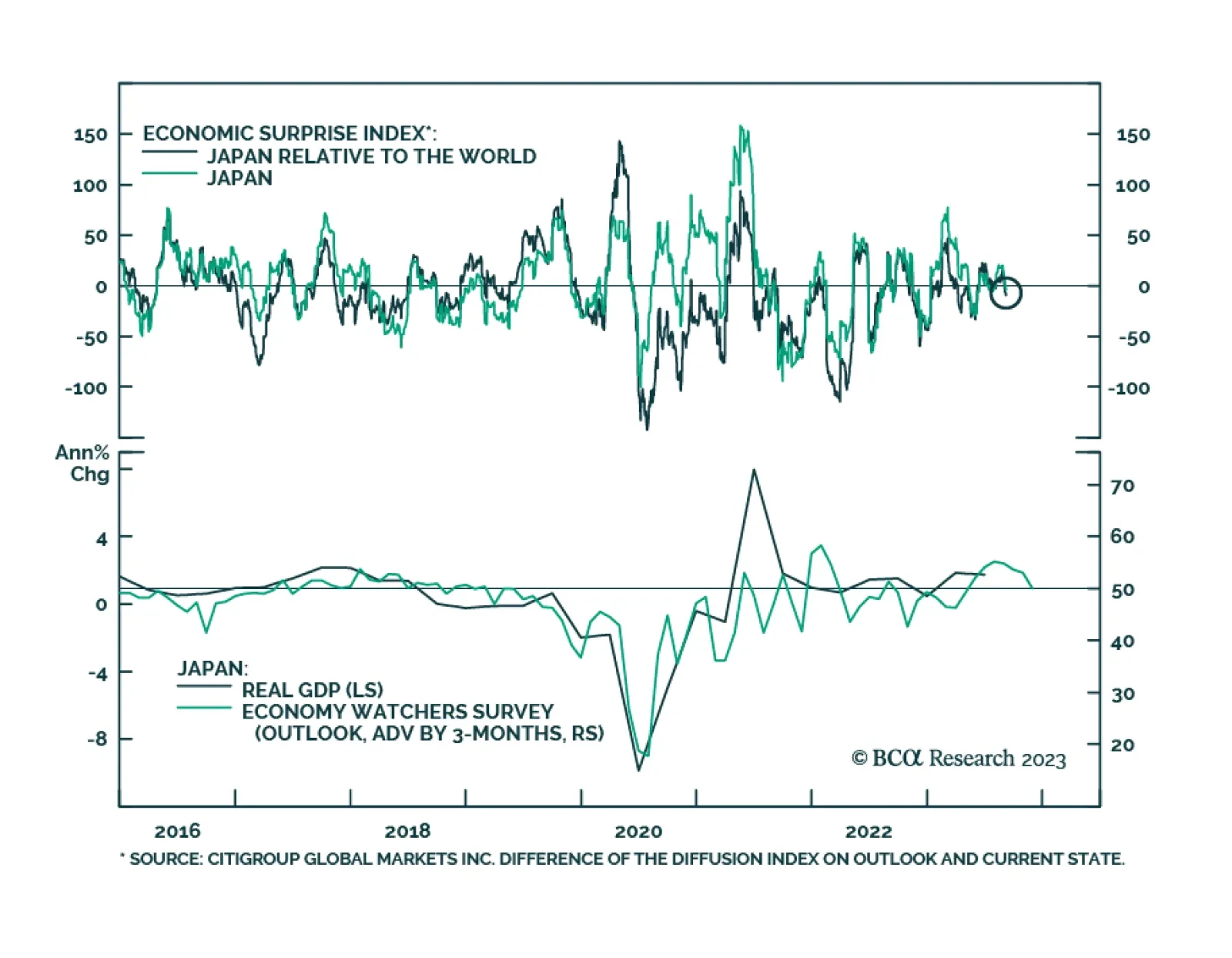

Japanese economic data delivered a negative surprise on Friday. Q2 GDP growth was revised down from 1.5% q/q to 1.2% q/q, below expectations of 1.4% q/q. The downwards revision reflects a 1% q/q decline in business spending (…

In this week’s report, we assess the key reasons why the dollar has risen, and if that is set to continue.

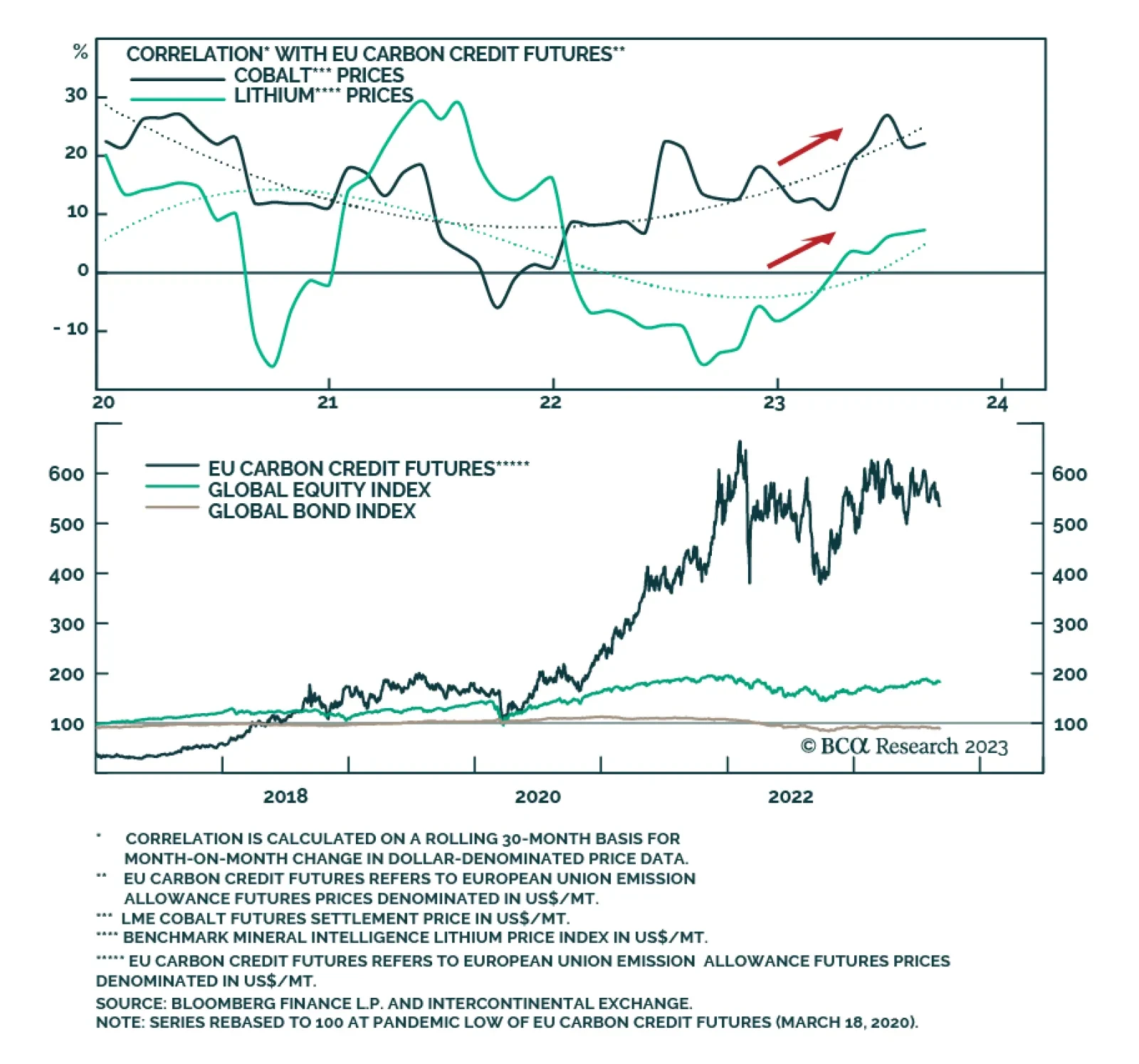

According to BCA Research’s Global Investment Strategy service, the structural bull case for carbon credits remains compelling. However, tactical investors should brace for prices to plateau or even correct over the next 12…

If we look at global growth as an aircraft, the plane is experiencing failing engines and will lose more altitude in the coming months. Yet, neither Chinese authorities, nor the Fed or the ECB will be quick to come to the rescue as…

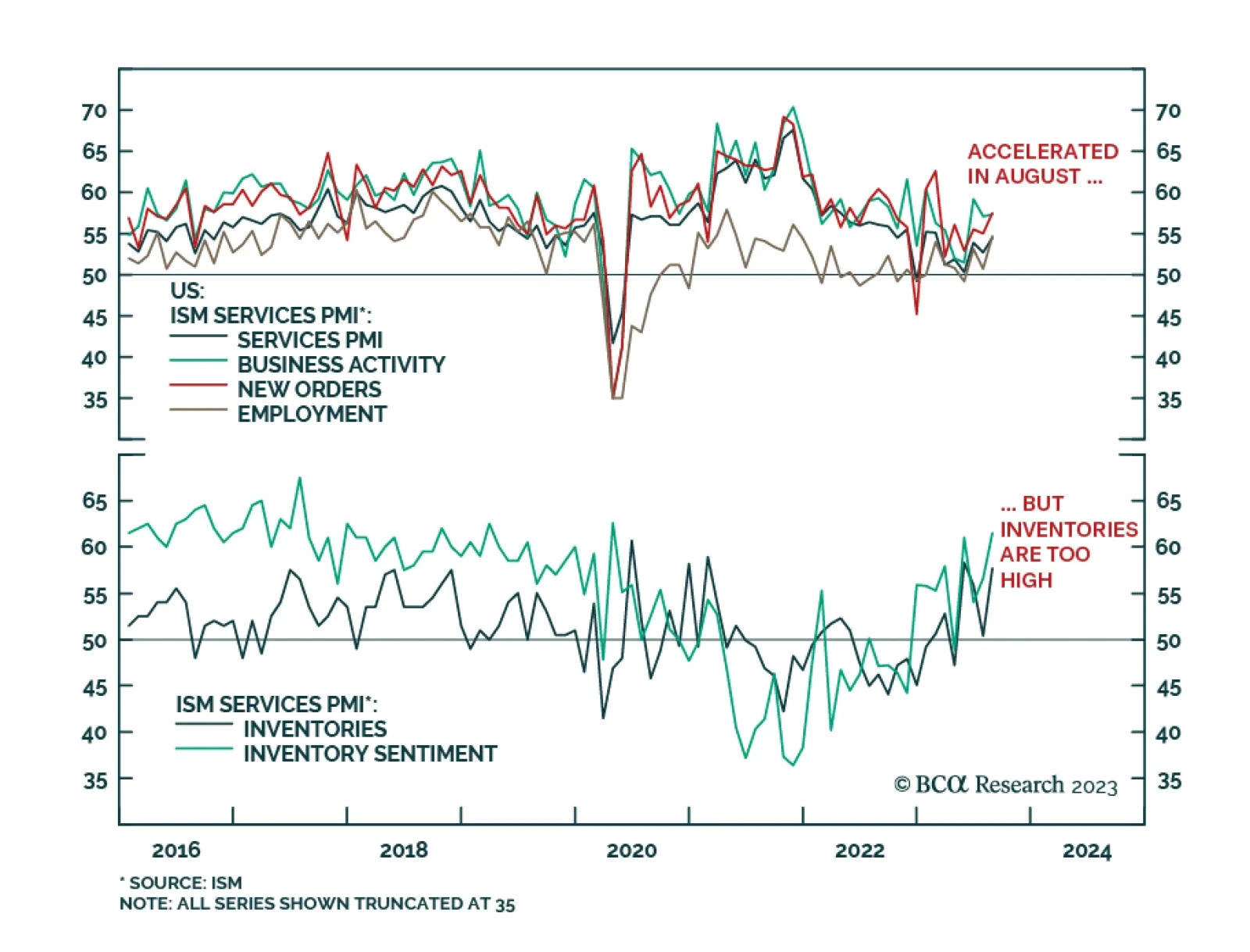

The US ISM delivered a positive signal about service sector activity in August. The headline index unexpectedly jumped by 1.8 points to a six-month high of 54.5, surprising expectations of a 0.2-point decline to 52.5. Importantly…