Falling core inflation in the US over the short run will boost real disposable household income, which will keep consumption – ~ 70% of US GDP – strong. Over the medium- to-longer term – 3 to 5 years out – inflation risks rise as…

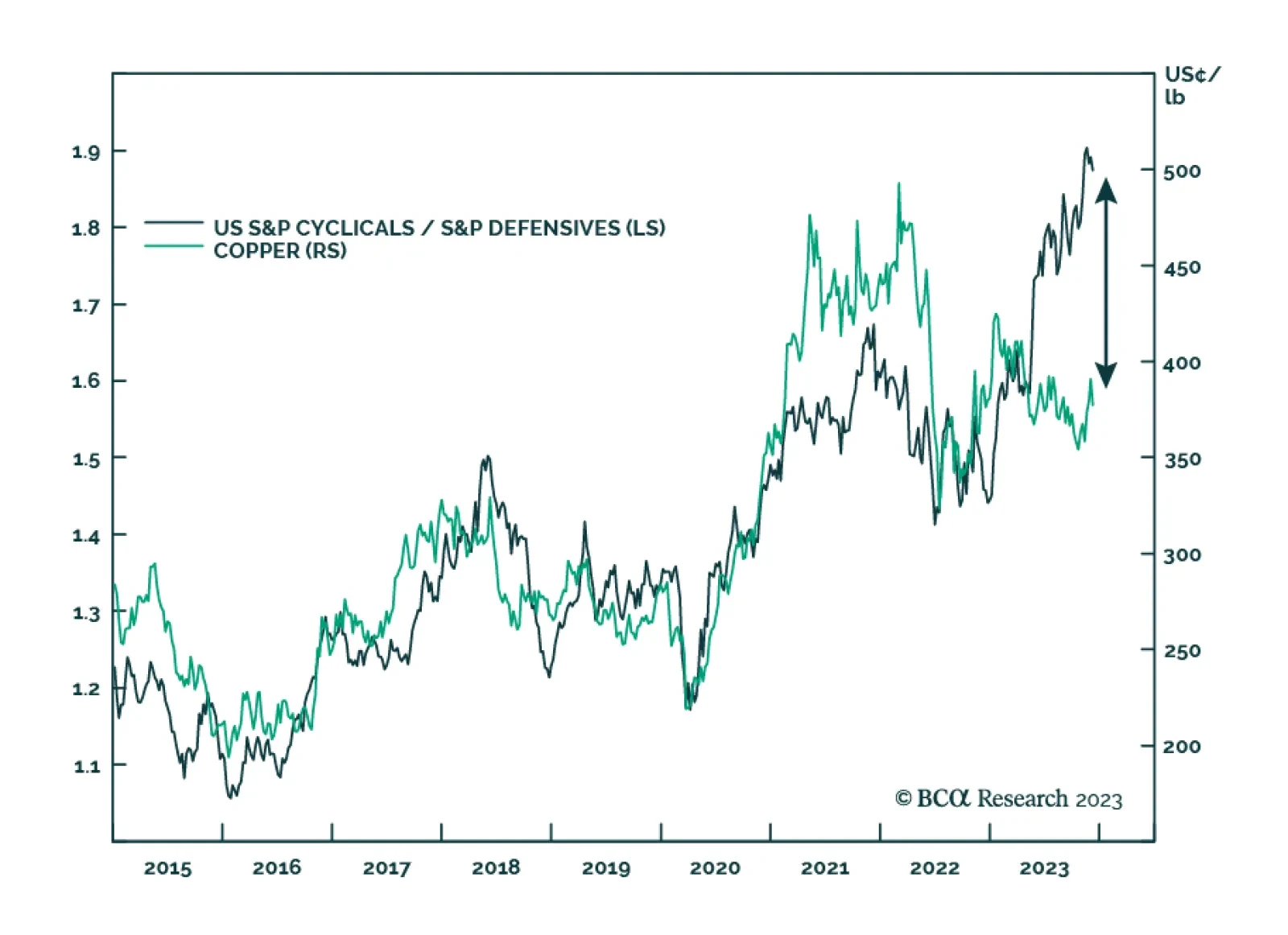

Copper benefited from the recent improvement in global risk sentiment, participating in the broad-based rally in November. To the extent that the red metal has vast applications across many economic sectors, it is…

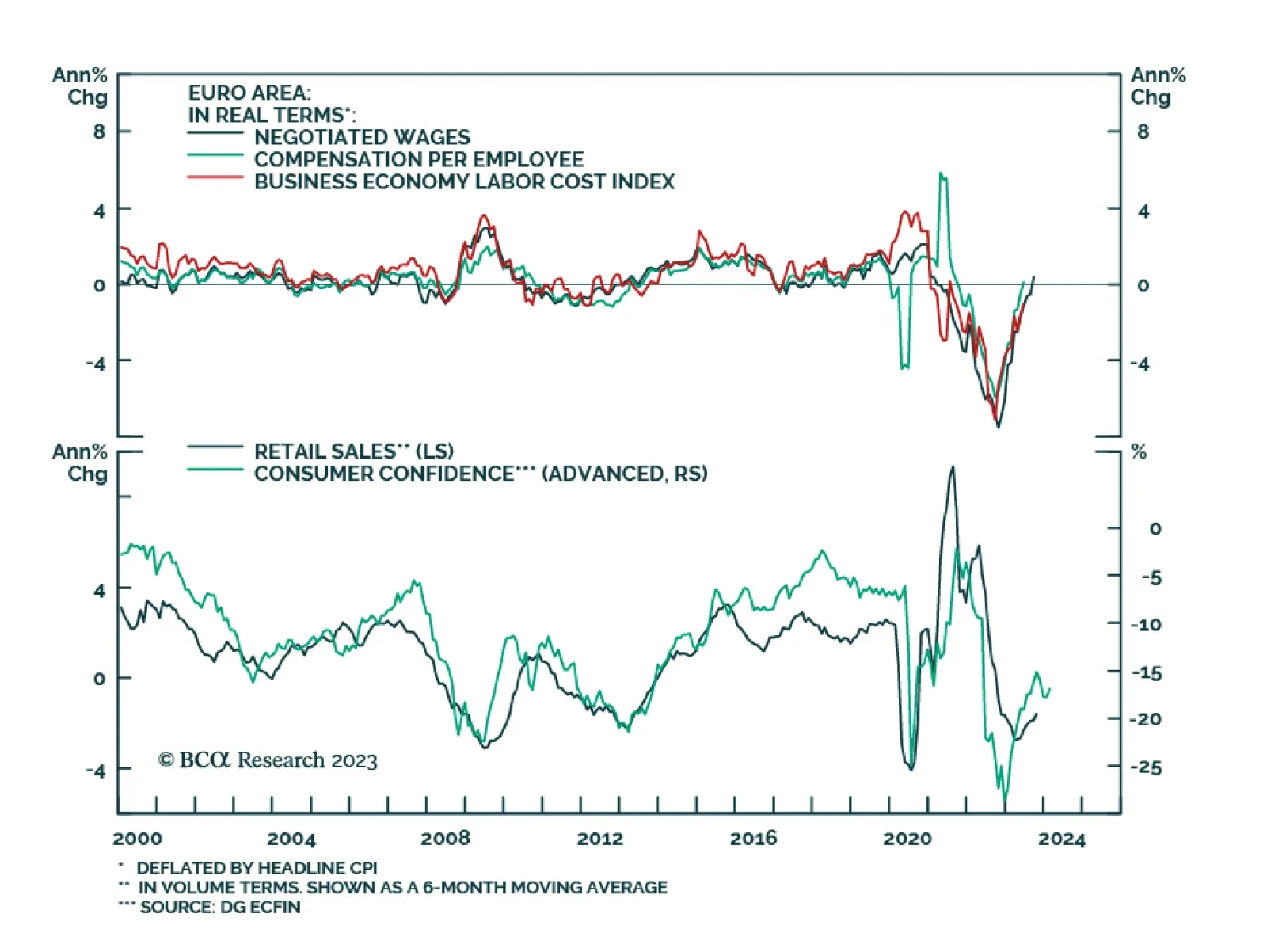

Retail sales volumes grew on a sequential basis for the first time in three months in October, rising by 0.1% m/m following an upwardly revised 0.1% m/m decline. On an annual basis, the pace of decline slowed from -2.9% y/y to -1…

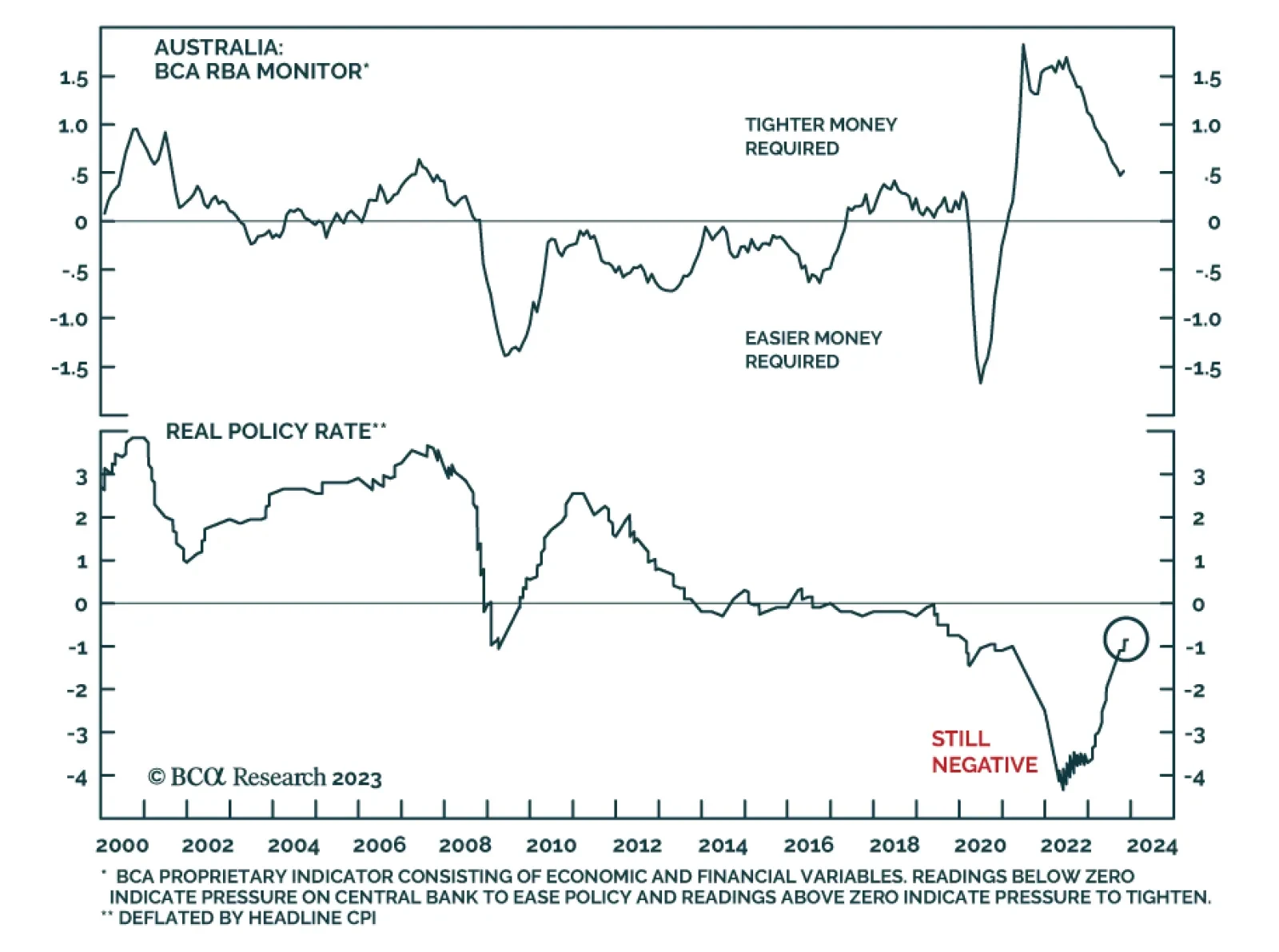

The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 4.35% on Tuesday, in line with expectations. In her post-meeting statement, Governor Michele Bullock revealed that economic developments since the RBA’s…

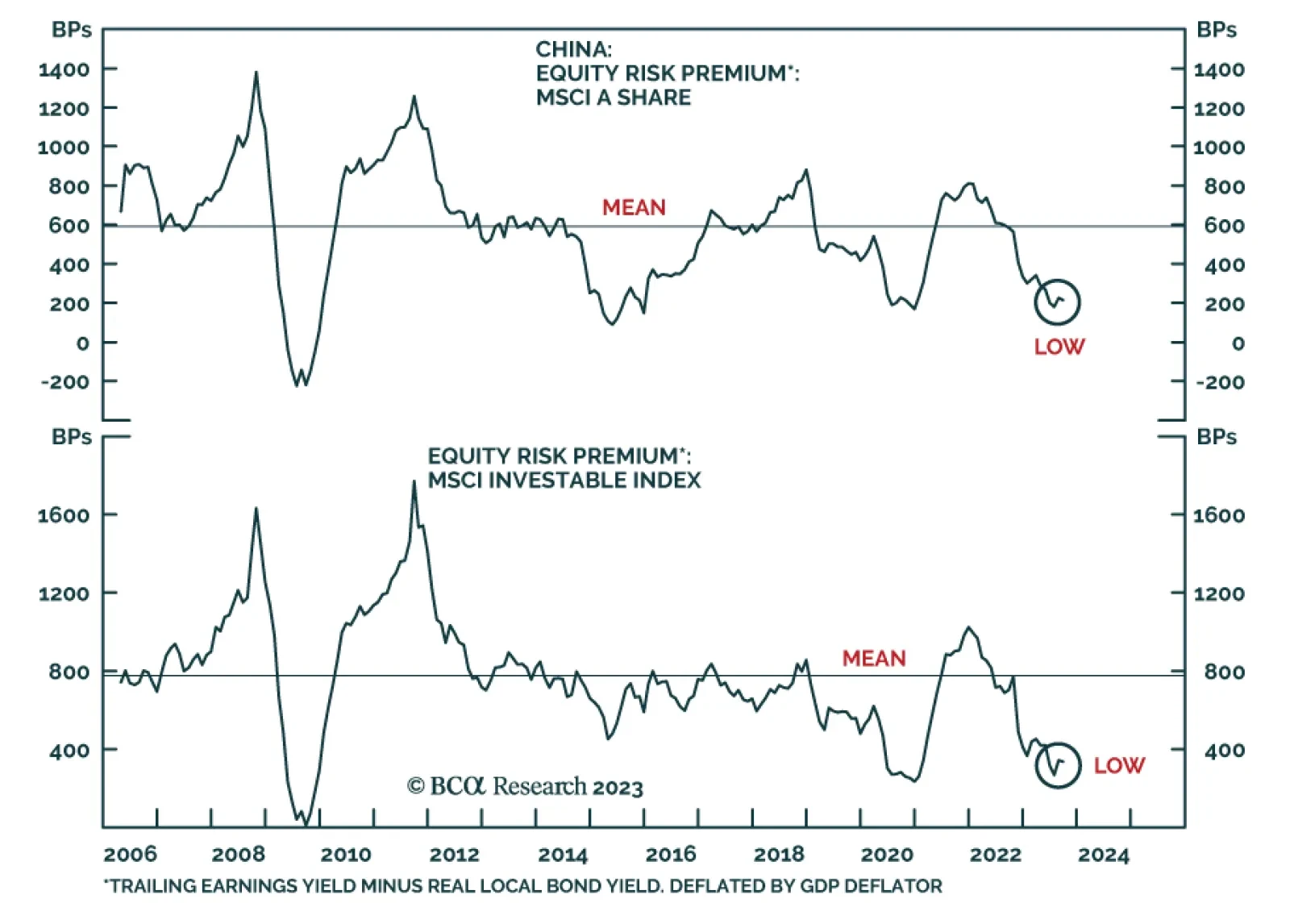

China’s CSI 300 equity index closed at its lowest level since early 2019 on Tuesday following news that Moody’s downgraded its outlook for China’s credit rating from stable to negative. The report cited the…

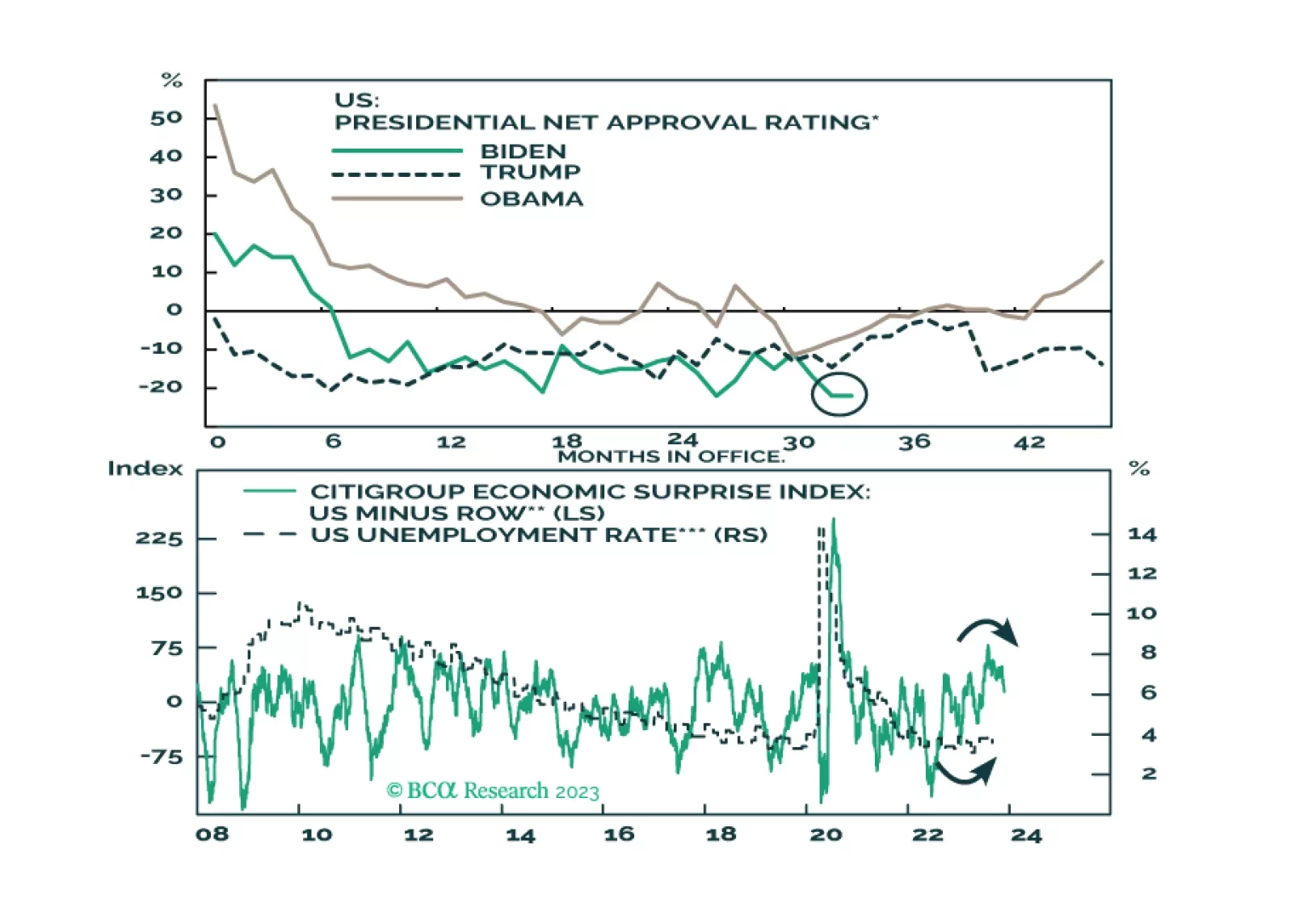

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

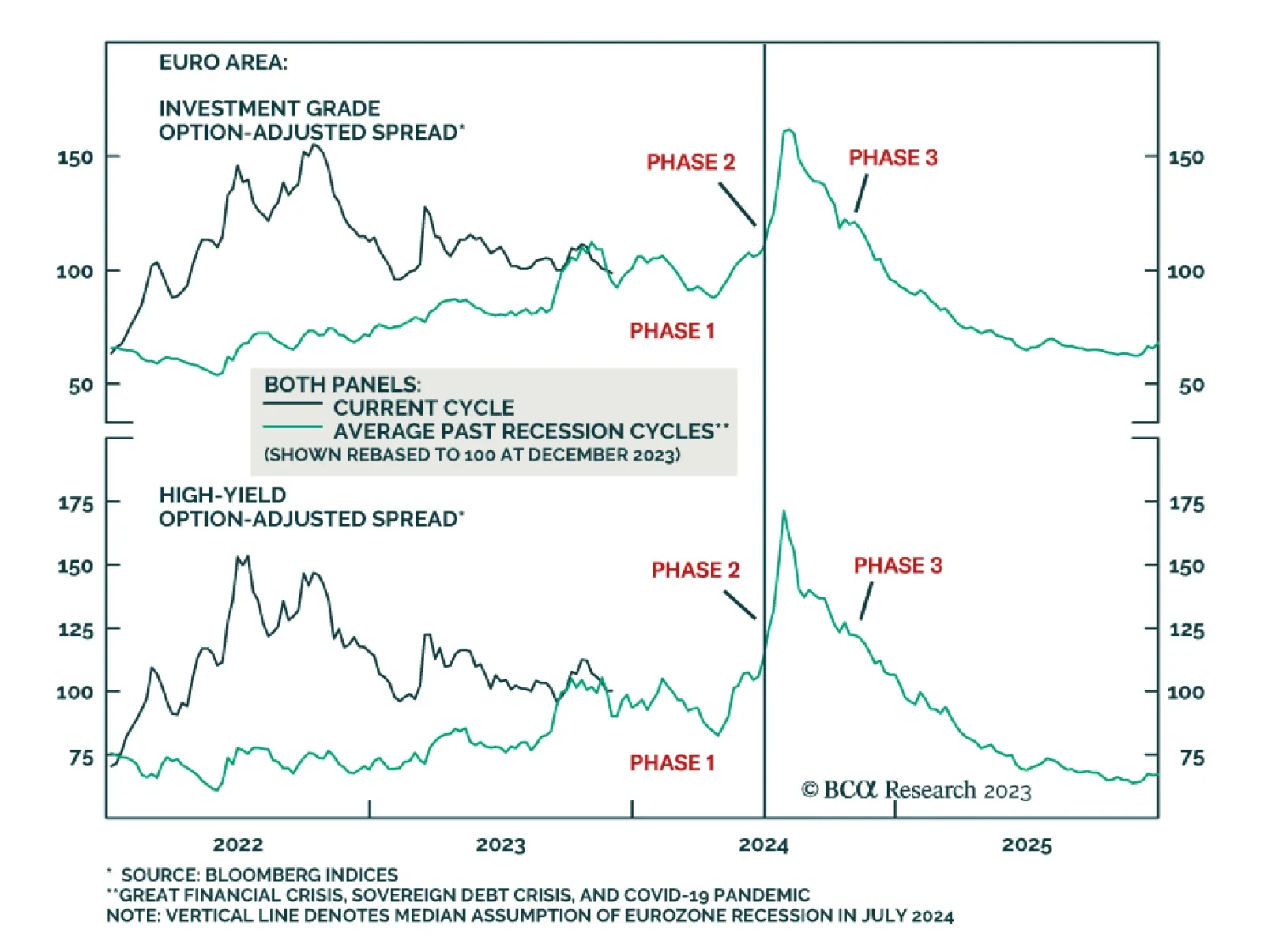

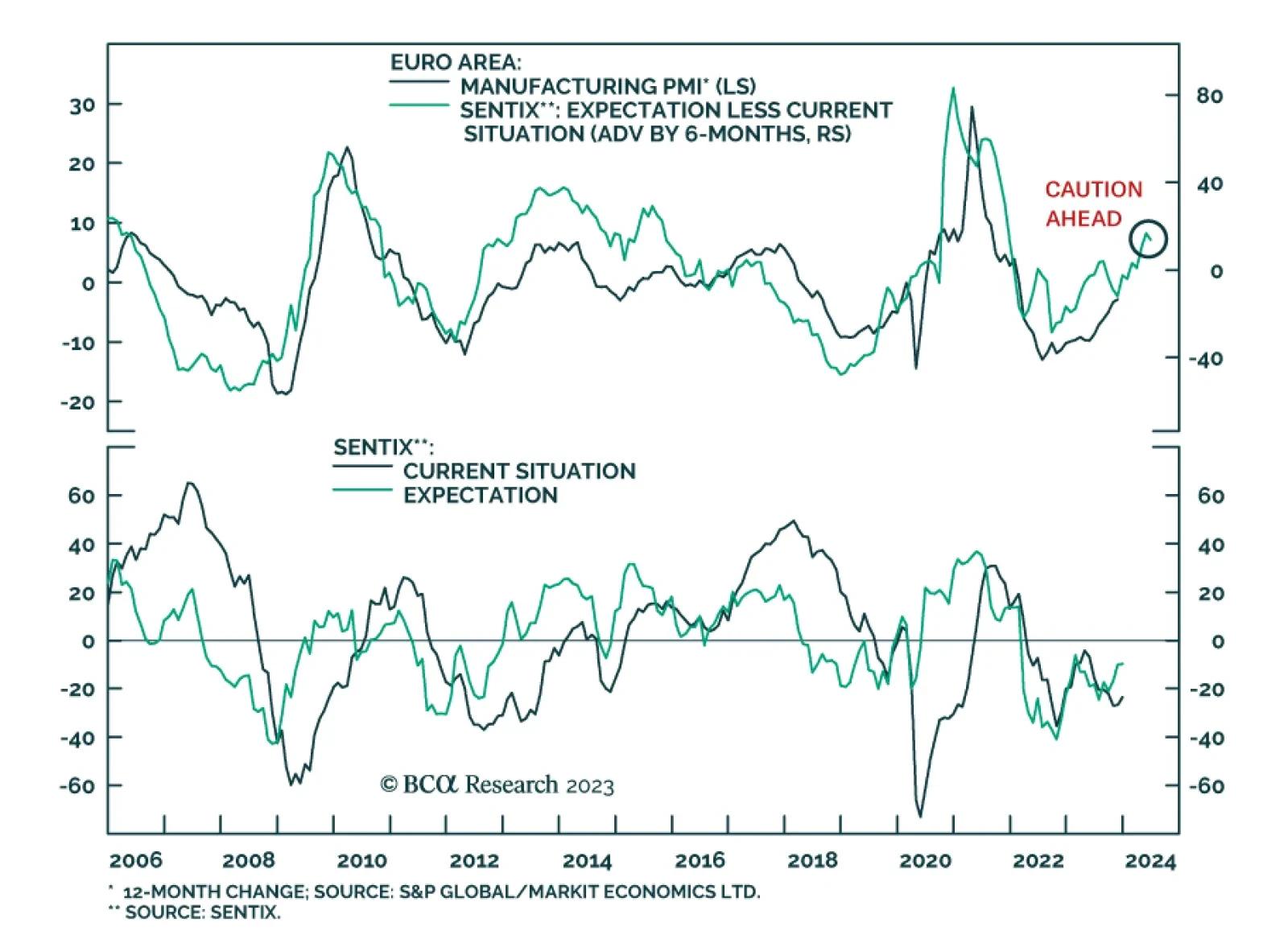

According to BCA Research’s European Investment Strategy service, European corporate spreads will widen over the coming six months before an attractive buying opportunity emerges in the second half of 2024. 2024 will…

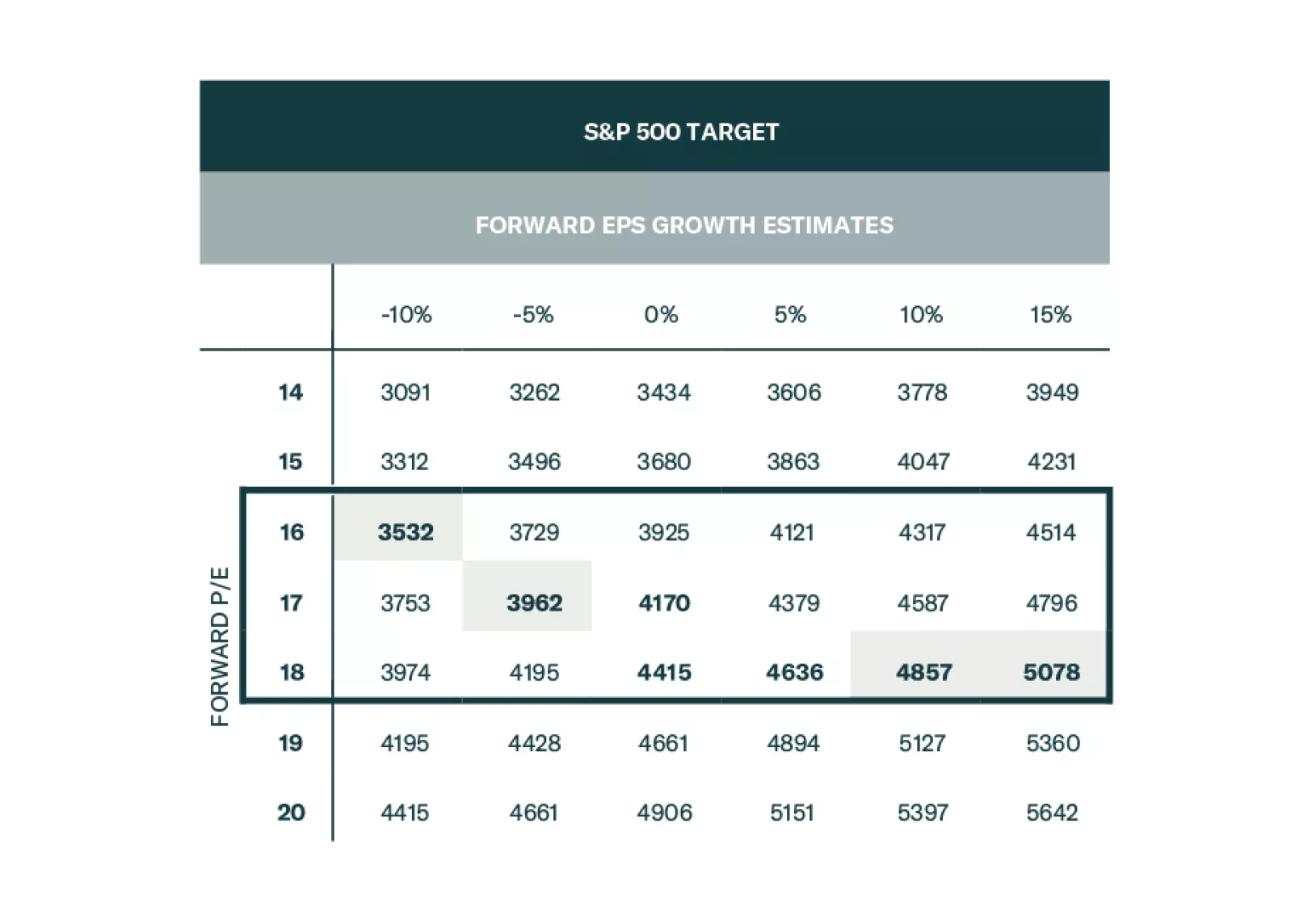

The S&P 500 closed at a fresh year-to-date high on Friday, breaking slightly above its late-July top. The brisk rally since late-October erased all the losses of the prior three months. However, the sector performance has…

The Sentix Economic Index for the Eurozone continues to send a marginally positive signal. Its 1.8-point increase to -16.8 in December brings it to its highest level since May, albeit below expectations of a slightly more…