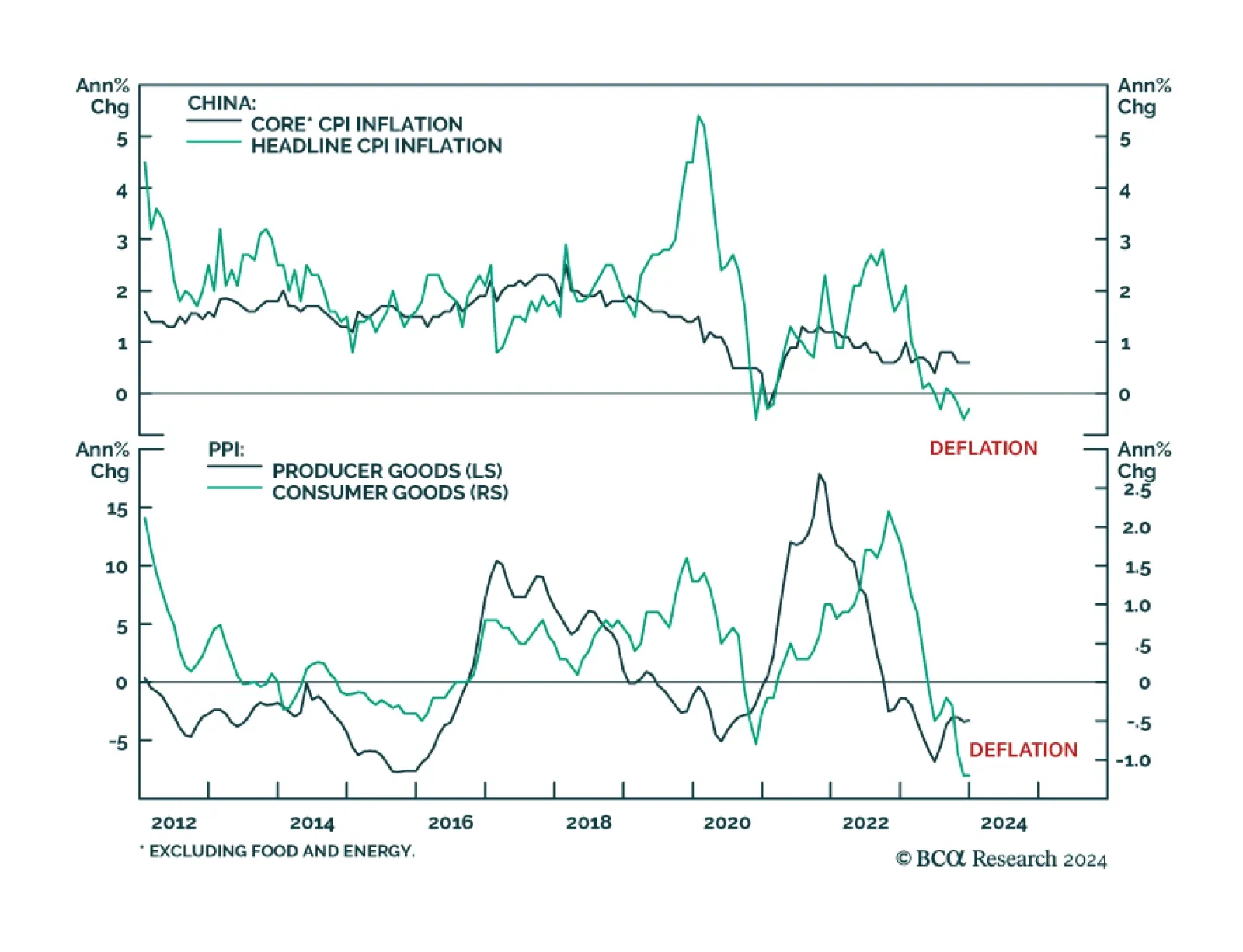

On the surface, domestic economic data painted a mixed picture of conditions in China at the end of 2023. On the positive side, the December trade data beat expectations. The dollar value of Chinese imports expanded by 0.2% y/…

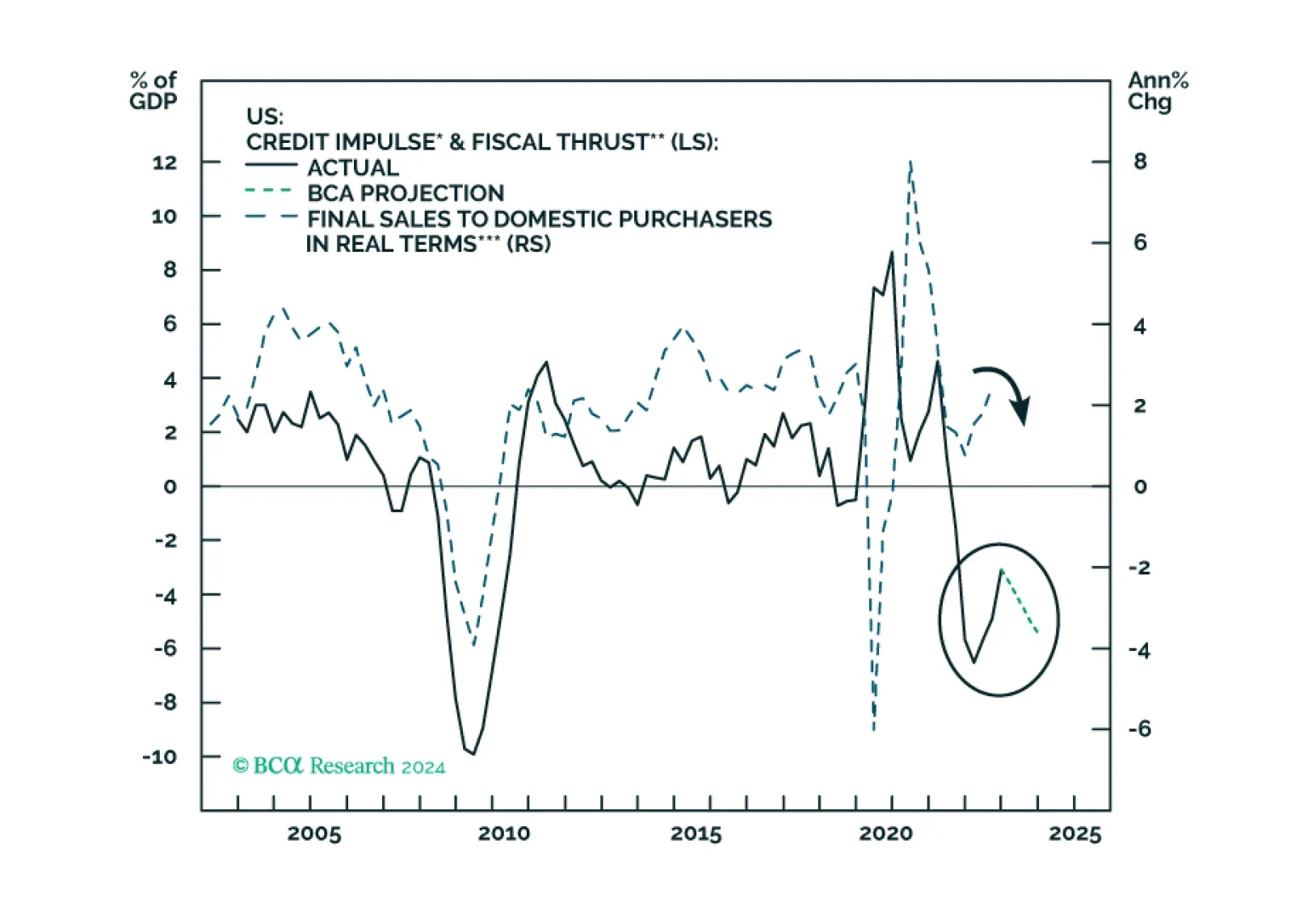

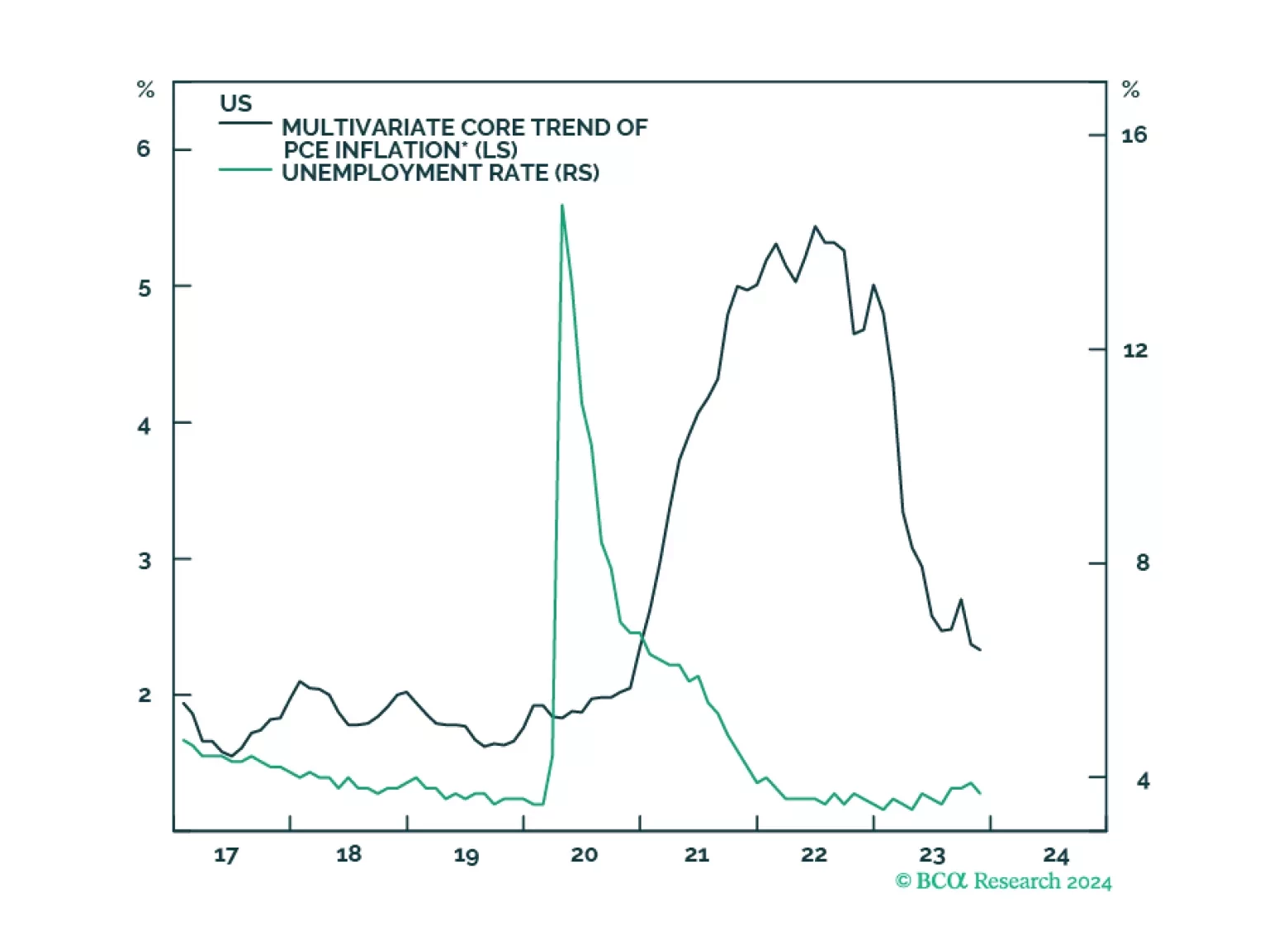

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

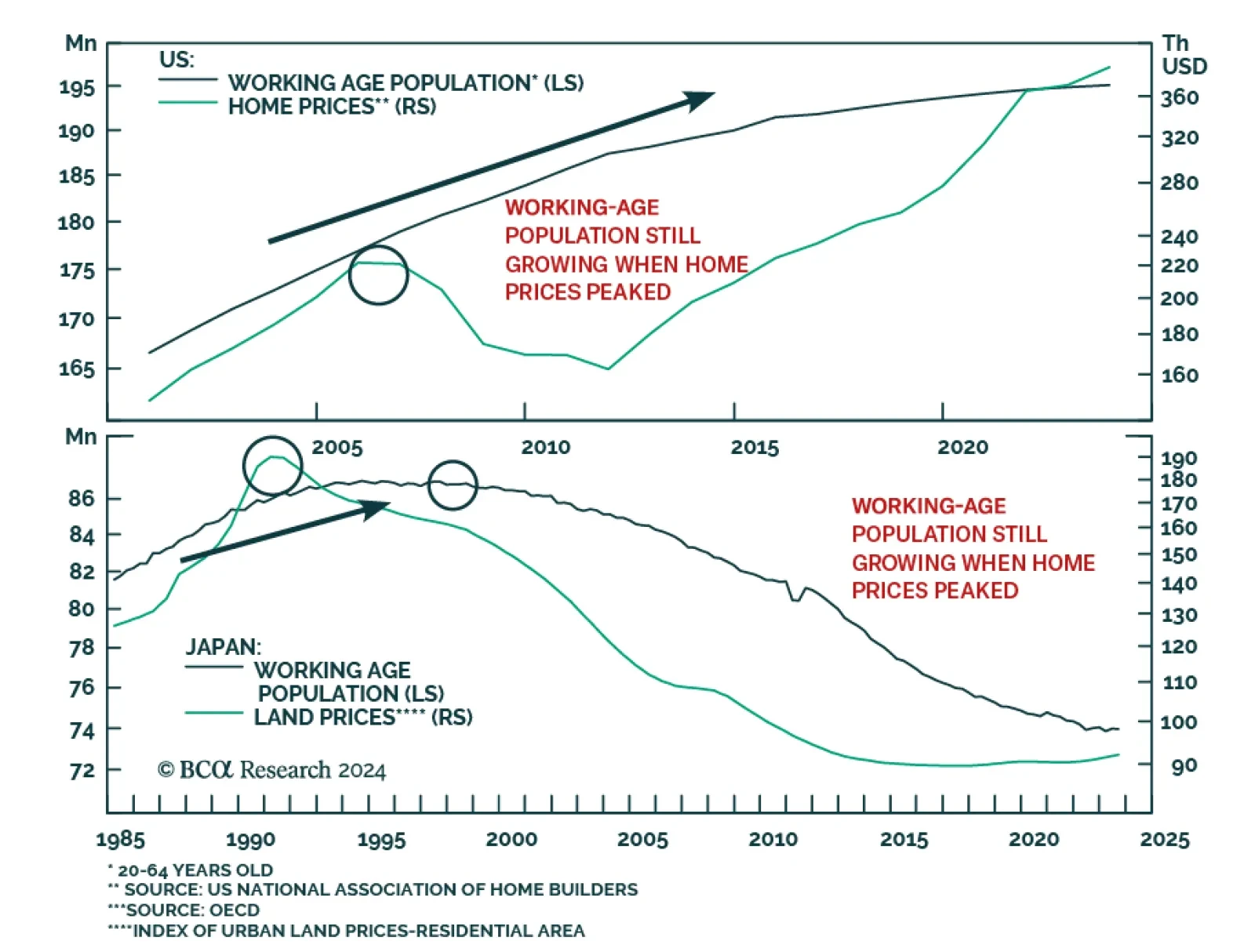

According to BCA Research’s China Investment Strategy service, the structural landscape of China's property market today is, in many aspects, more challenging than the real estate markets in Japan and the US at the peak…

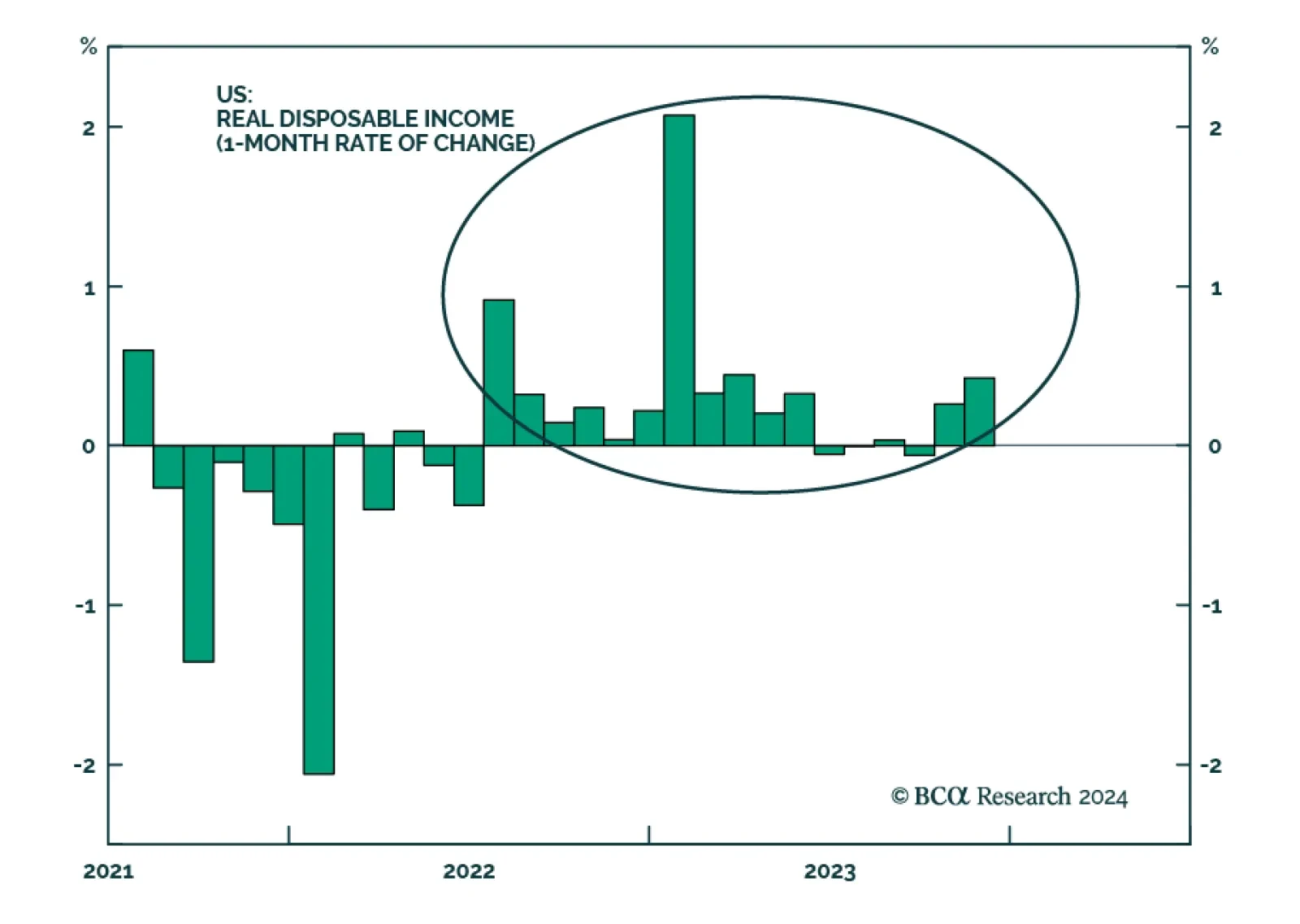

Growth in US disposable income has outpaced inflation nearly every month since mid-2022. Consumption is principally driven by income, but in the US it has gotten a meaningful assist the last two years from the drawdown of excess…

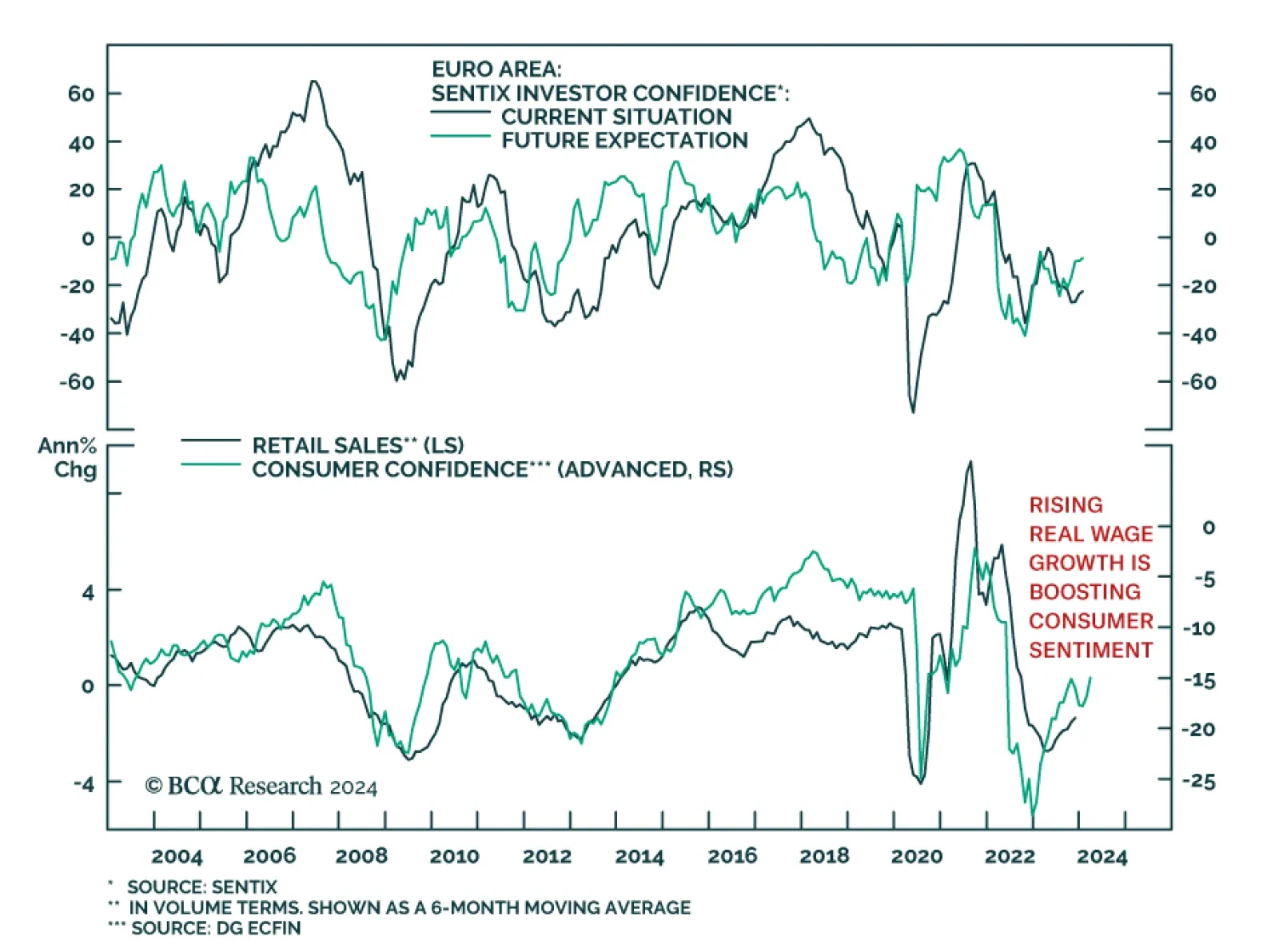

Optimism among investors and economic agents continues to improve in the Eurozone. The Sentix Economic Index for the Eurozone rose from -16.8 to -15.8 in January – in line with consensus expectations and marking the third…

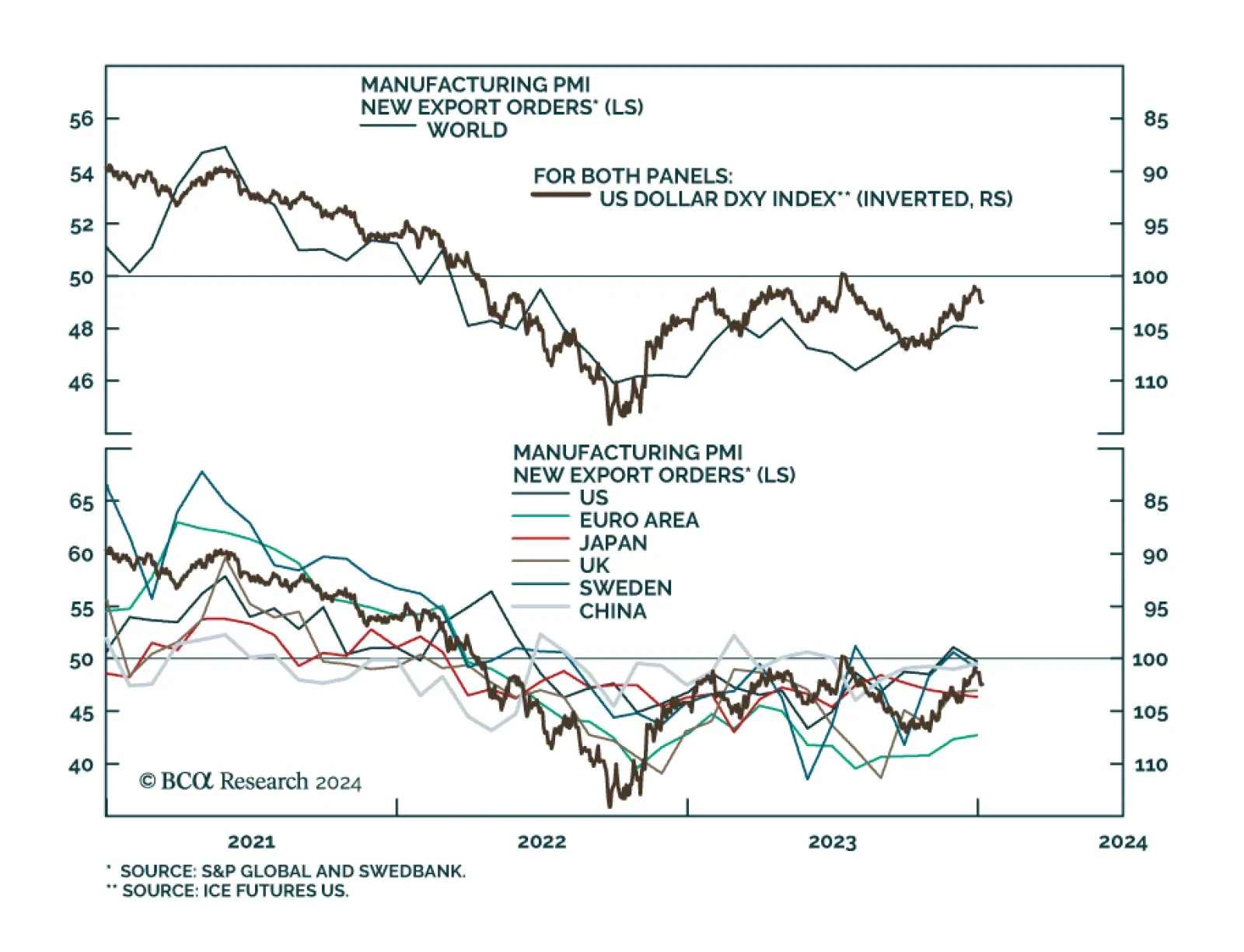

The dollar has kicked off 2024 on a tear. The closely followed DXY index bottomed on Thursday December 28th, and has since risen almost 2%. Year-to-date, the only major currency that has held up against the dollar is the Mexican…

After rallying by 11.2% between October 5 and December 27, the price of copper has since been on a losing streak, falling in each of the subsequent six trading sessions. Notably, this decline has coincided with weakness among…

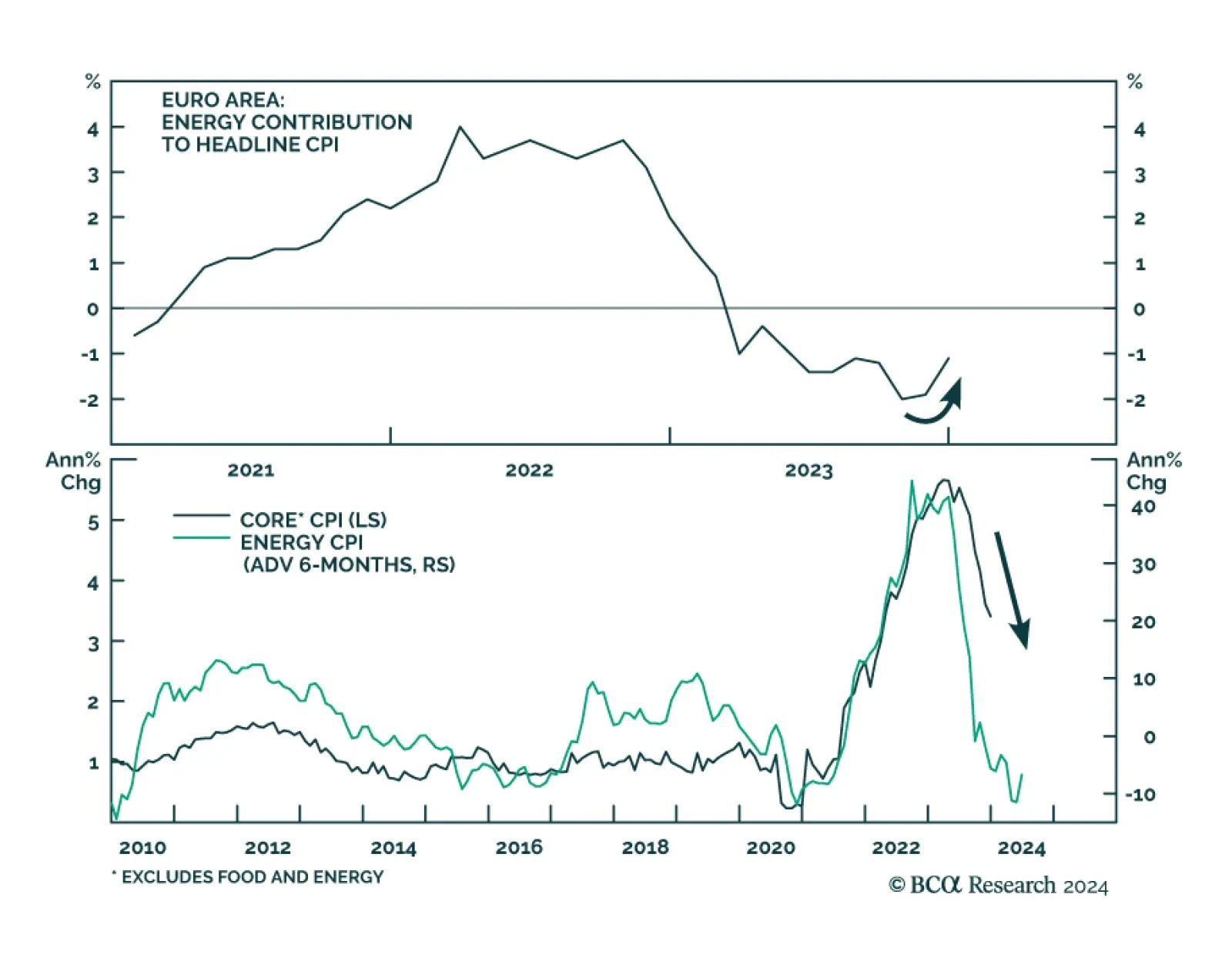

Friday’s Eurozone CPI inflation report was in line with consensus estimates. Headline inflation reaccelerated from 2.4%y/y to 2.9%y/y in December, in part reflecting the impact of the end of energy subsidies in Germany and…

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.