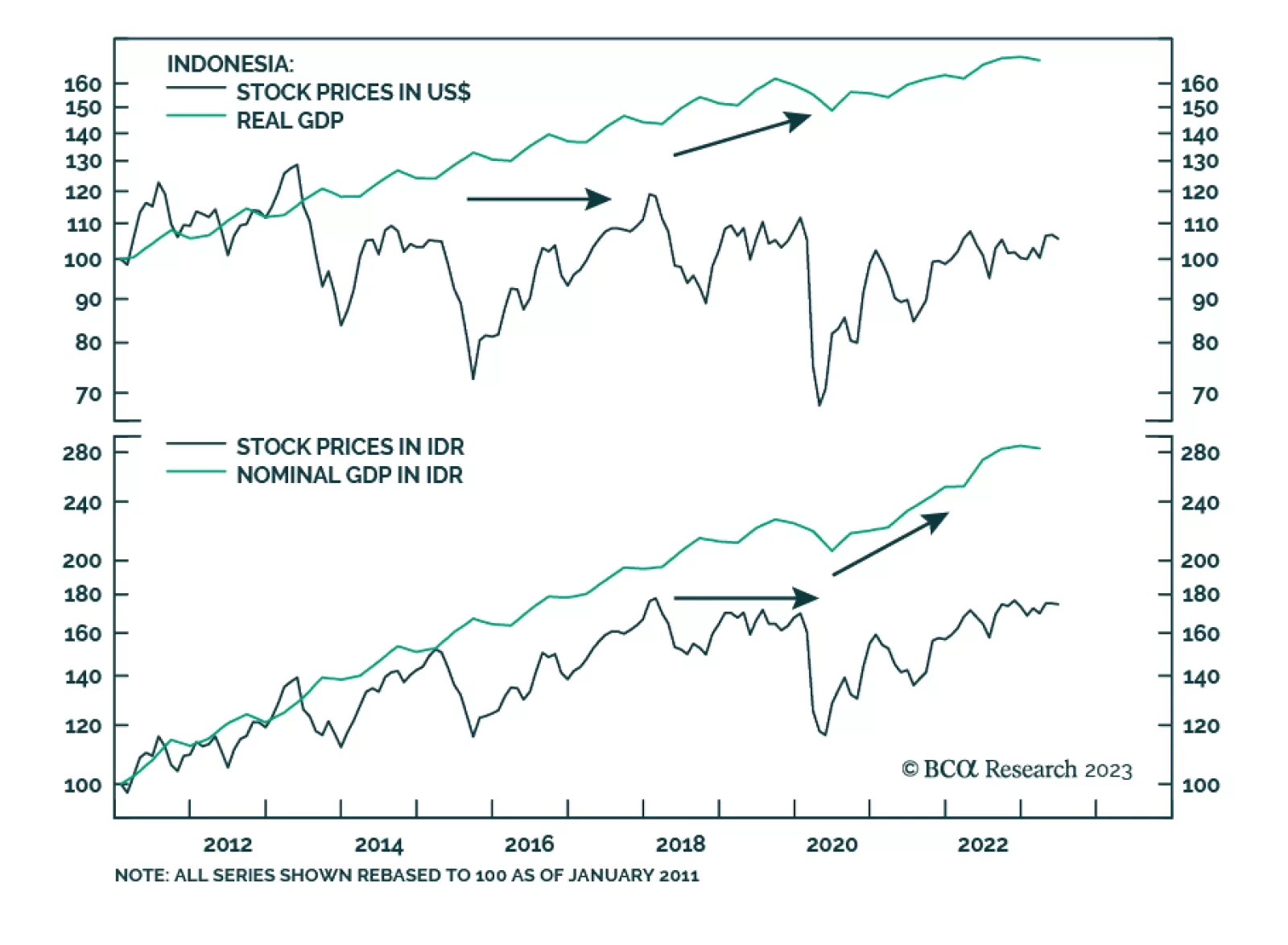

In a recent report, our Emerging Markets Strategy team recommended an underweight stance for Indonesian equities in EM portfolios. The team is also bearish on the rupiah. An unprecedented trade surplus recently gave Indonesia…

Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…

Assuming yesterday’s policy rate hike is a sign that Turkey is finally veering towards orthodox economic policies; should investors rush in?

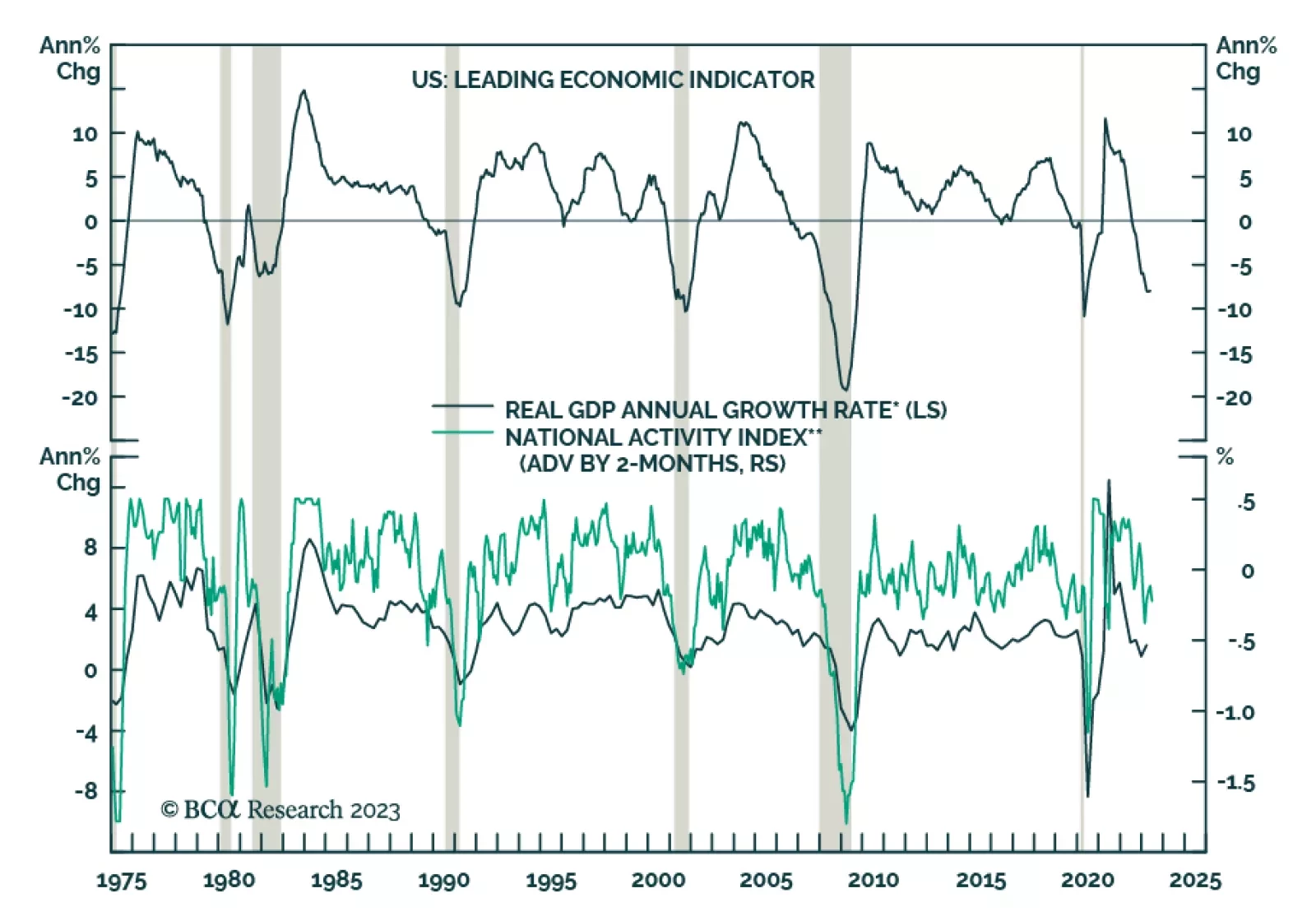

The Conference Board’s US Leading Economic Indicator continues to warn about the economic outlook. The month-on-month rate of change and the six-month rate of change showed the index declining at a faster pace. Weaker…

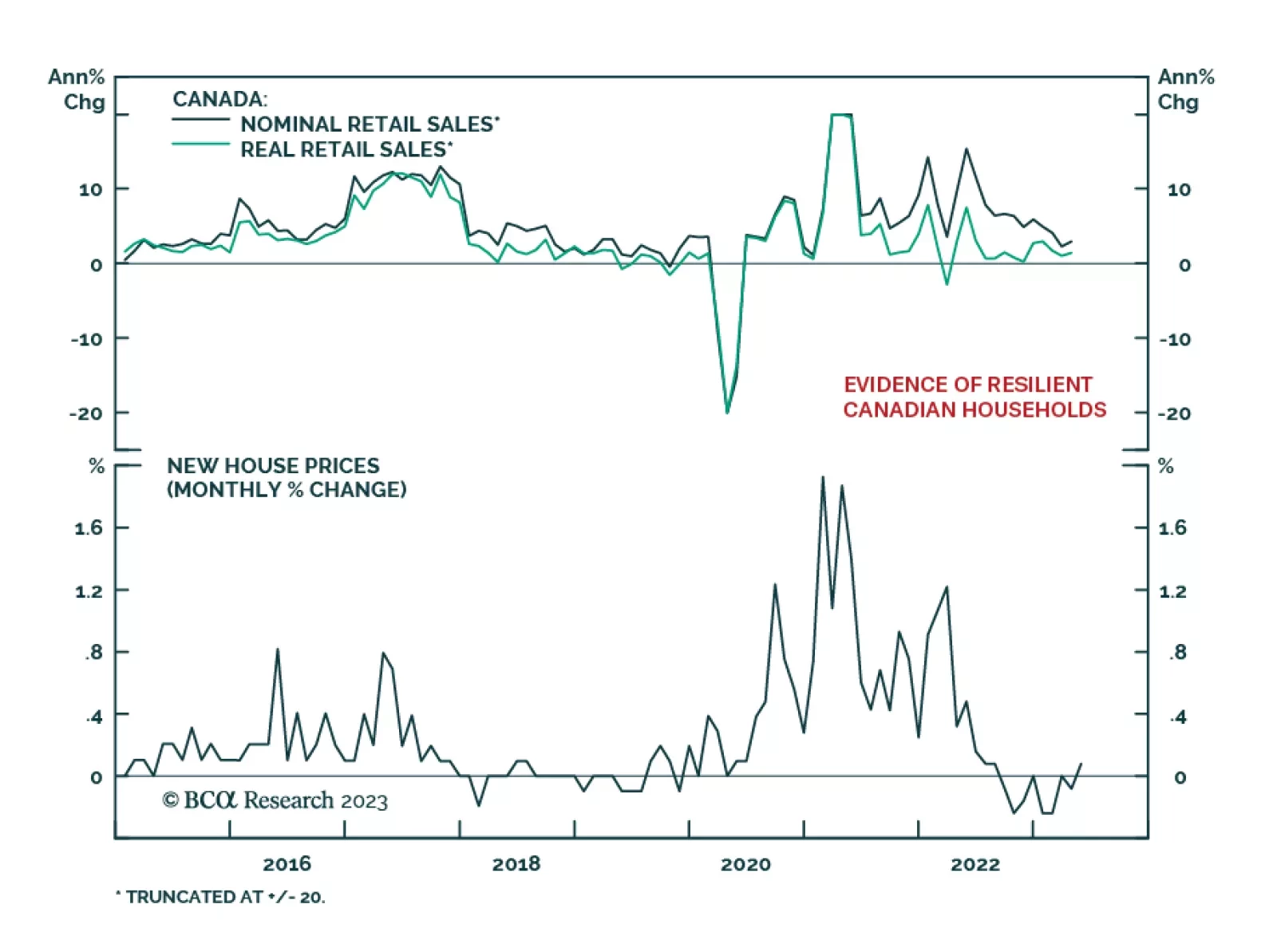

Recent economic data reveal that Canadian household conditions remain resilient. Retail sales surprised to the upside in April. The 1.1% m/m increase follows two consecutive monthly declines and beat expectations of a 0.4% m/m…

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

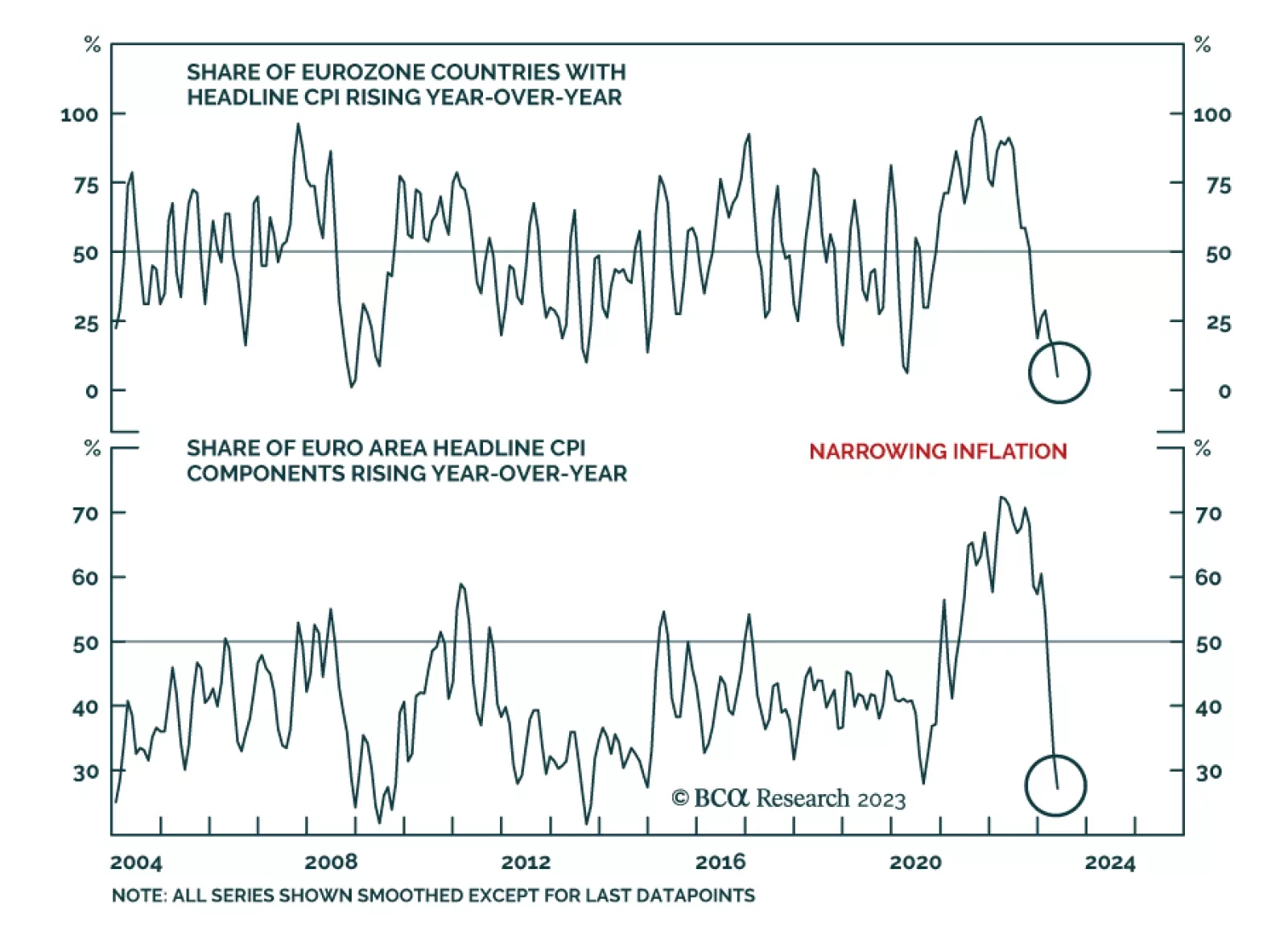

According to BCA Research’s European Investment Strategy service Eurozone inflation likely to diminish further. First, policy is tight. The impact on leading economic variables is already visible, with M1 collapsing,…

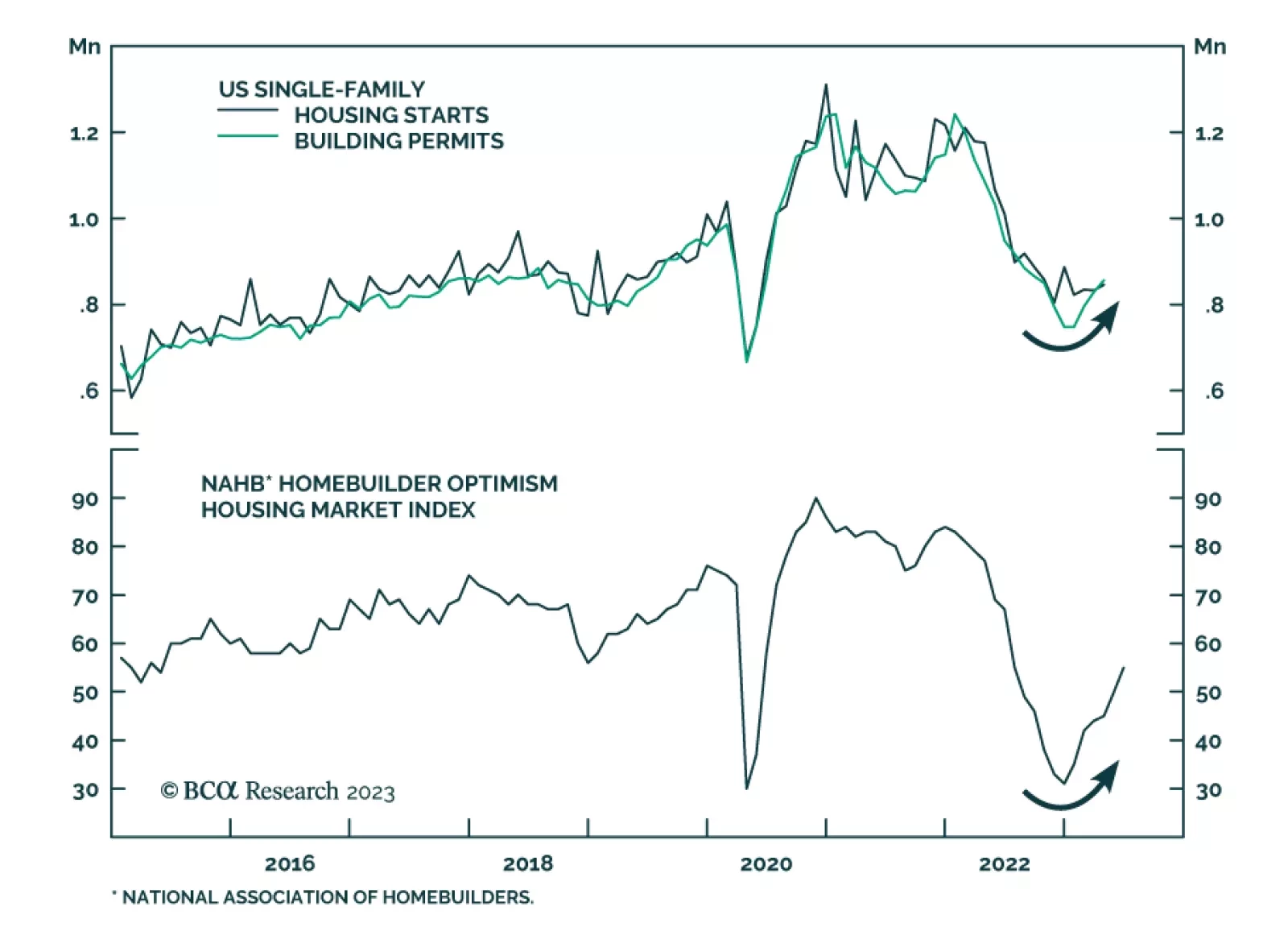

US Homebuilder confidence surprised to the upside on Monday, with the NAHB’s Housing Market Index jumping from 50 to 55 in June – beating expectations of 51. This marks the first time in 11 months that the index rises…

As the S&P 500 nears our 4,500 target, we review the rationale behind the call to assess its merit.