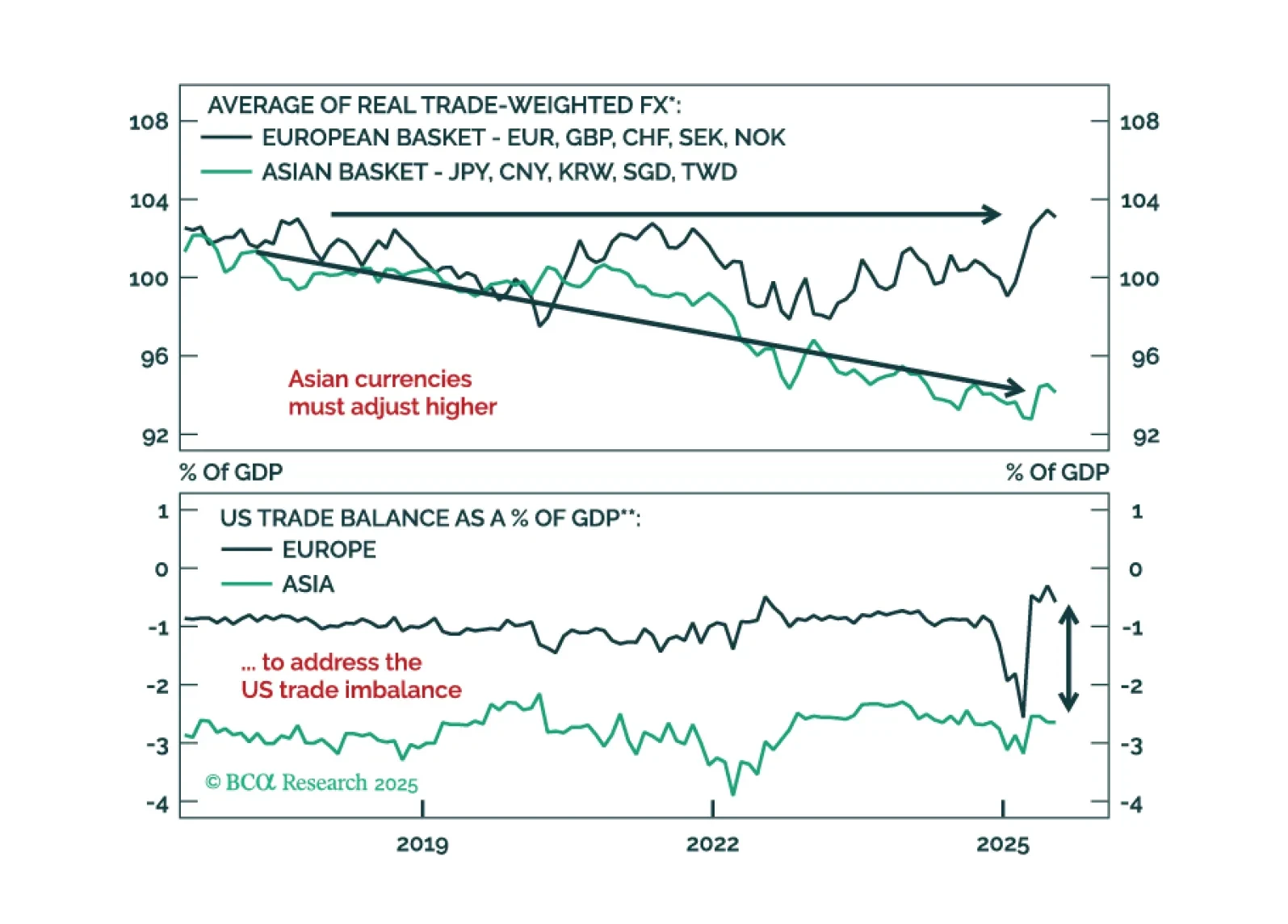

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

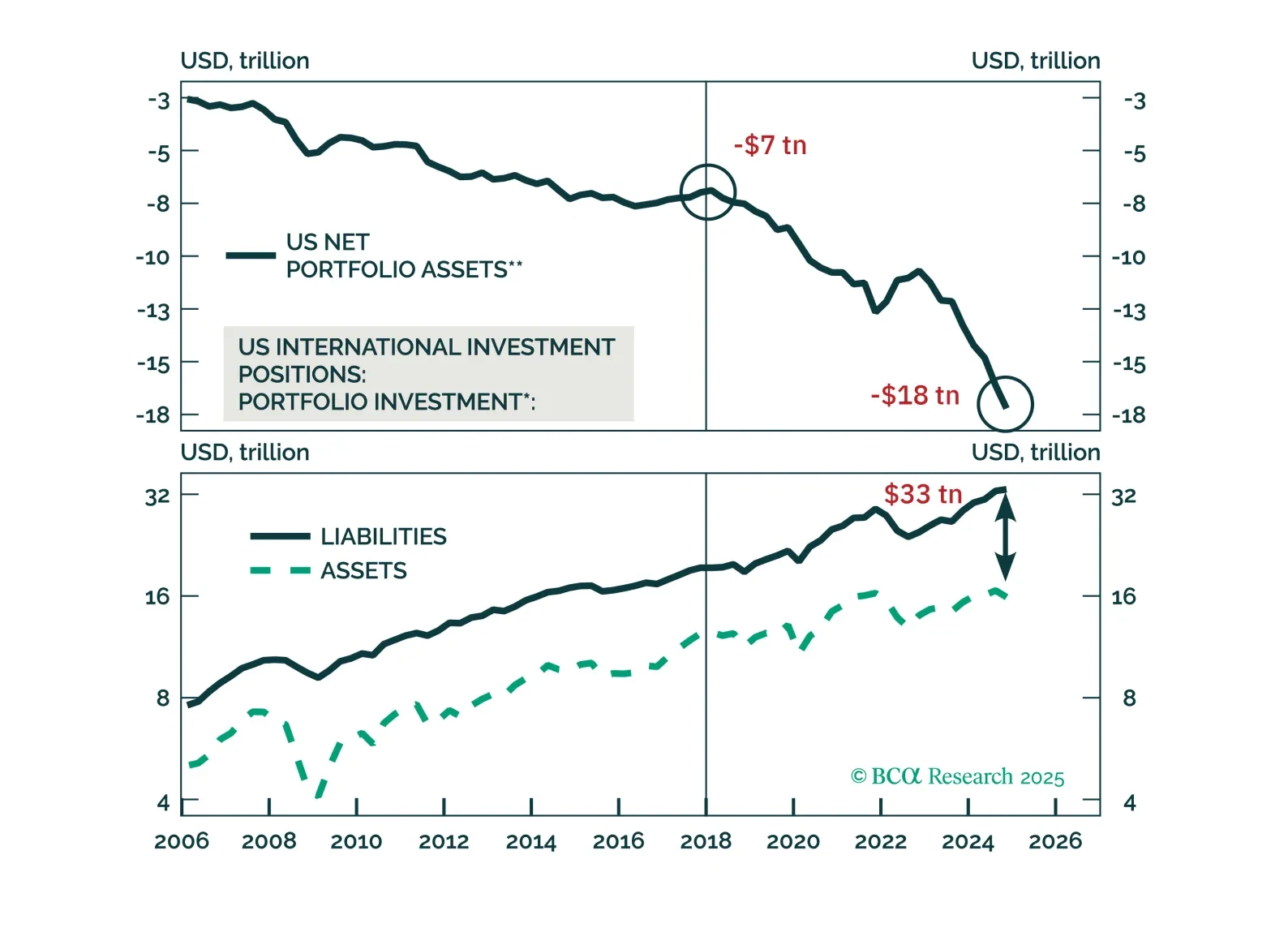

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Alligator Bite #1: As US net portfolio inflows decline (the alligator's upper jaw closes), its current account deficit must narrow (the lower jaw will also shut). Alligator Bite #2: As the US current account deficit shrinks (the…

Global currency markets have entered a new era. This implies that the framework for analyzing exchange rates must also change. We introduce a new framework for analyzing EM currencies and classify them into…

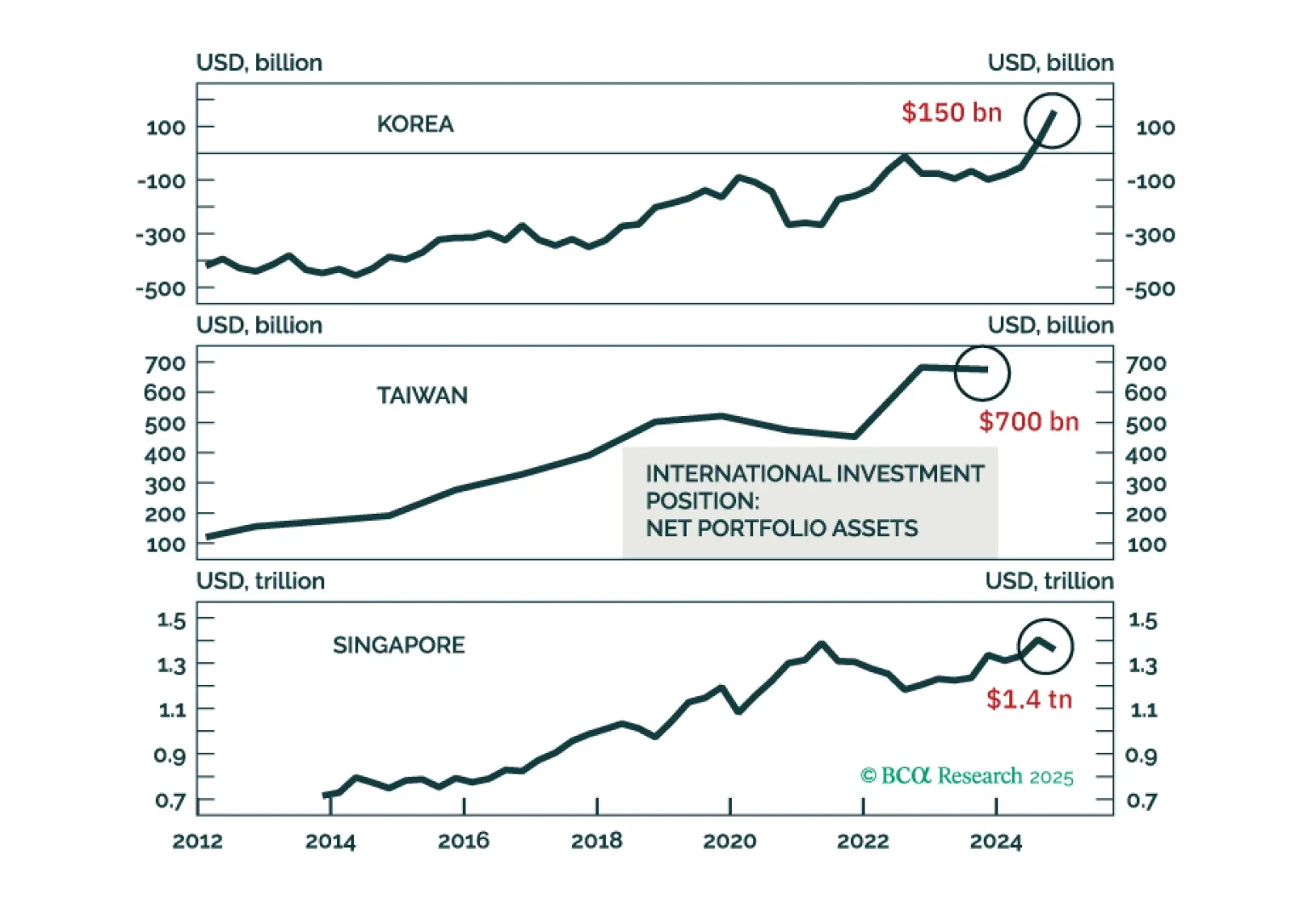

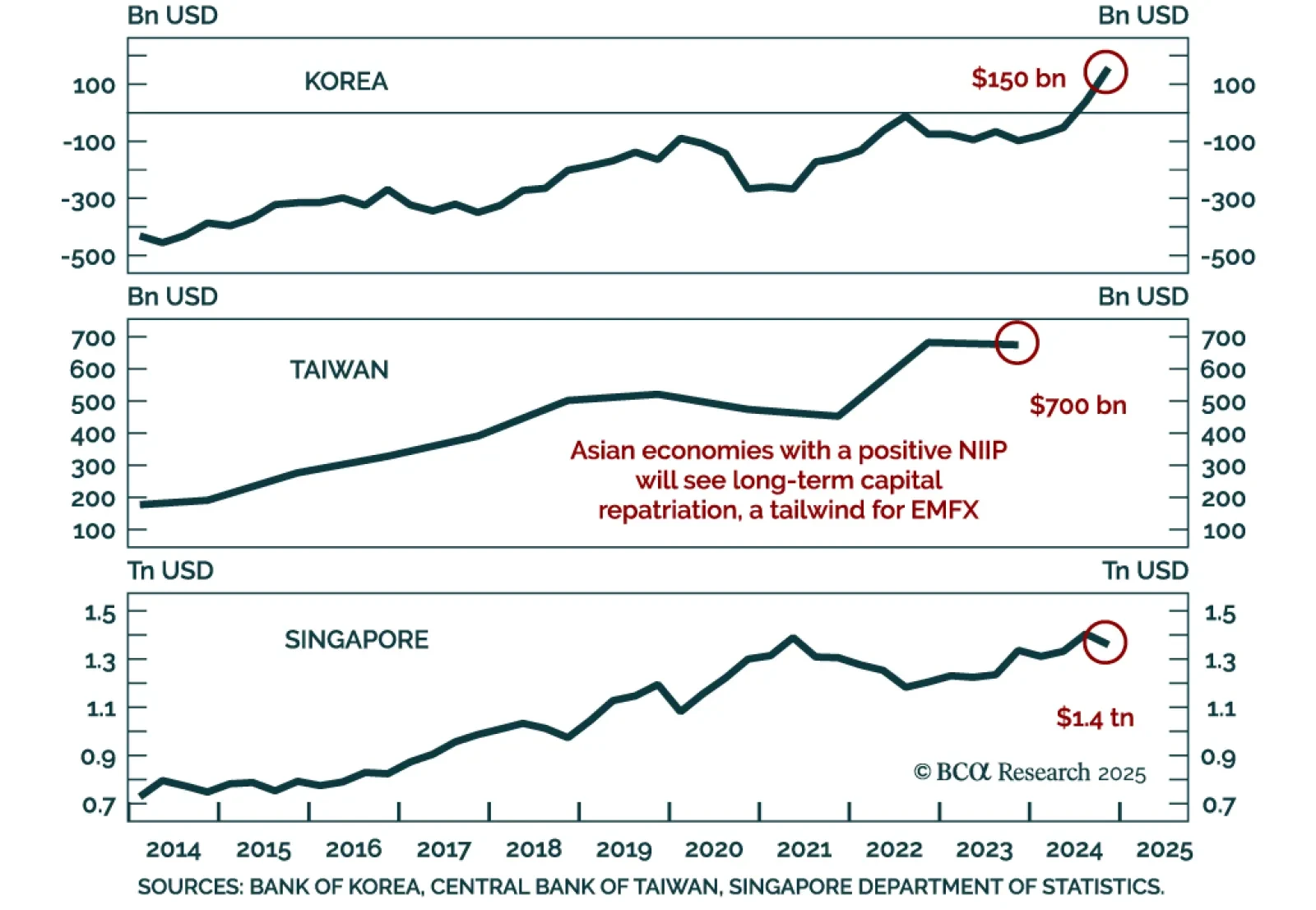

Our EM strategists see rising odds of a structural regime shift in Emerging Asian currencies. However, they expect a USD rebound and are looking to close short positions in IDR, PHP, and TWD. Severe deflationary shocks will drive…

Taiwan, Singapore, and Korea's currencies might appreciate versus the USD, driven by capital repatriation from domestic private investors away from the US. This thesis is less pertinent to India, Indonesia, and the Philippines…

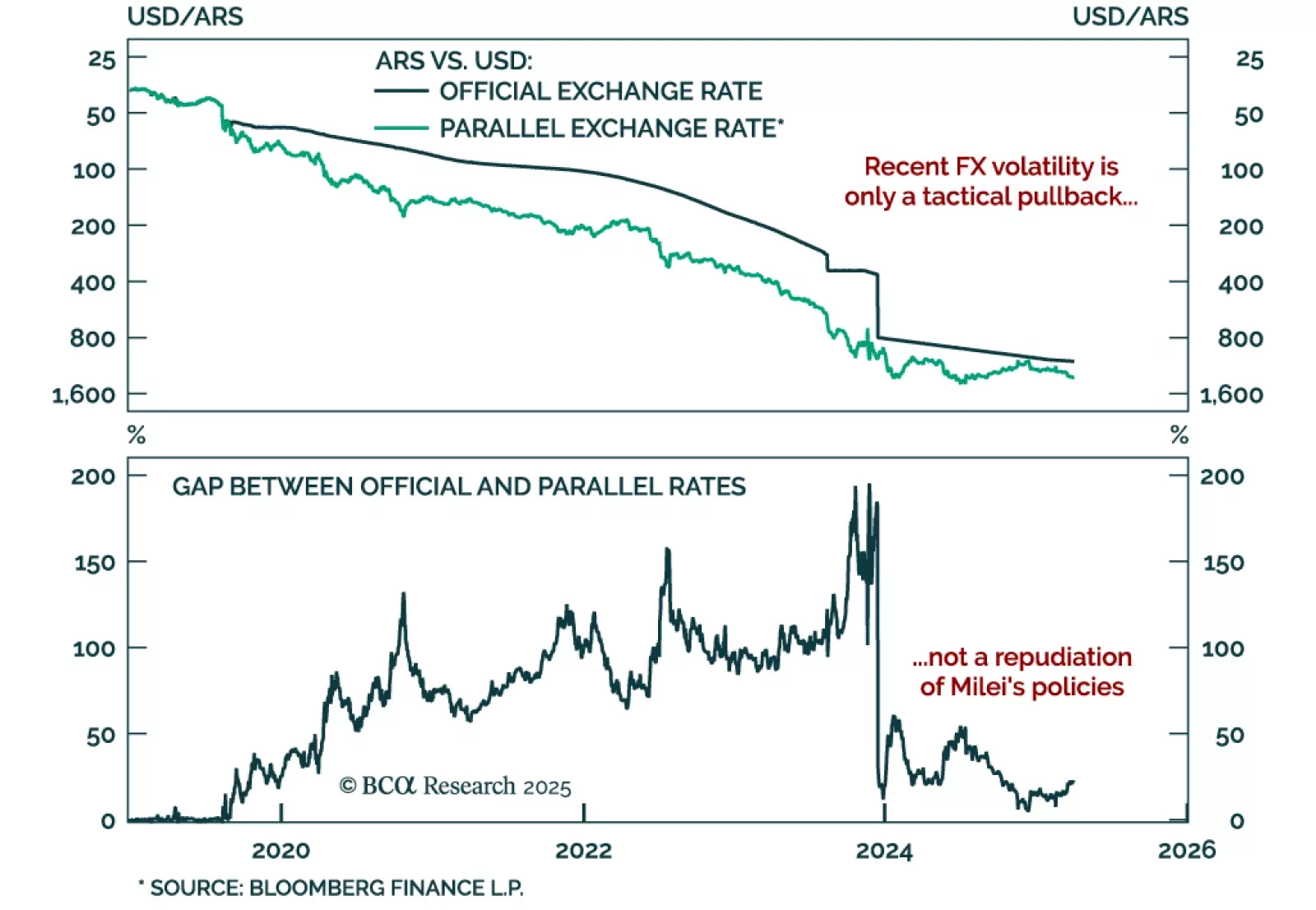

Remain constructive on Argentine assets as recent market moves are a tactical pullback, not a loss of confidence. The gap between official and parallel exchange rates has widened, prompting concerns that markets are questioning…

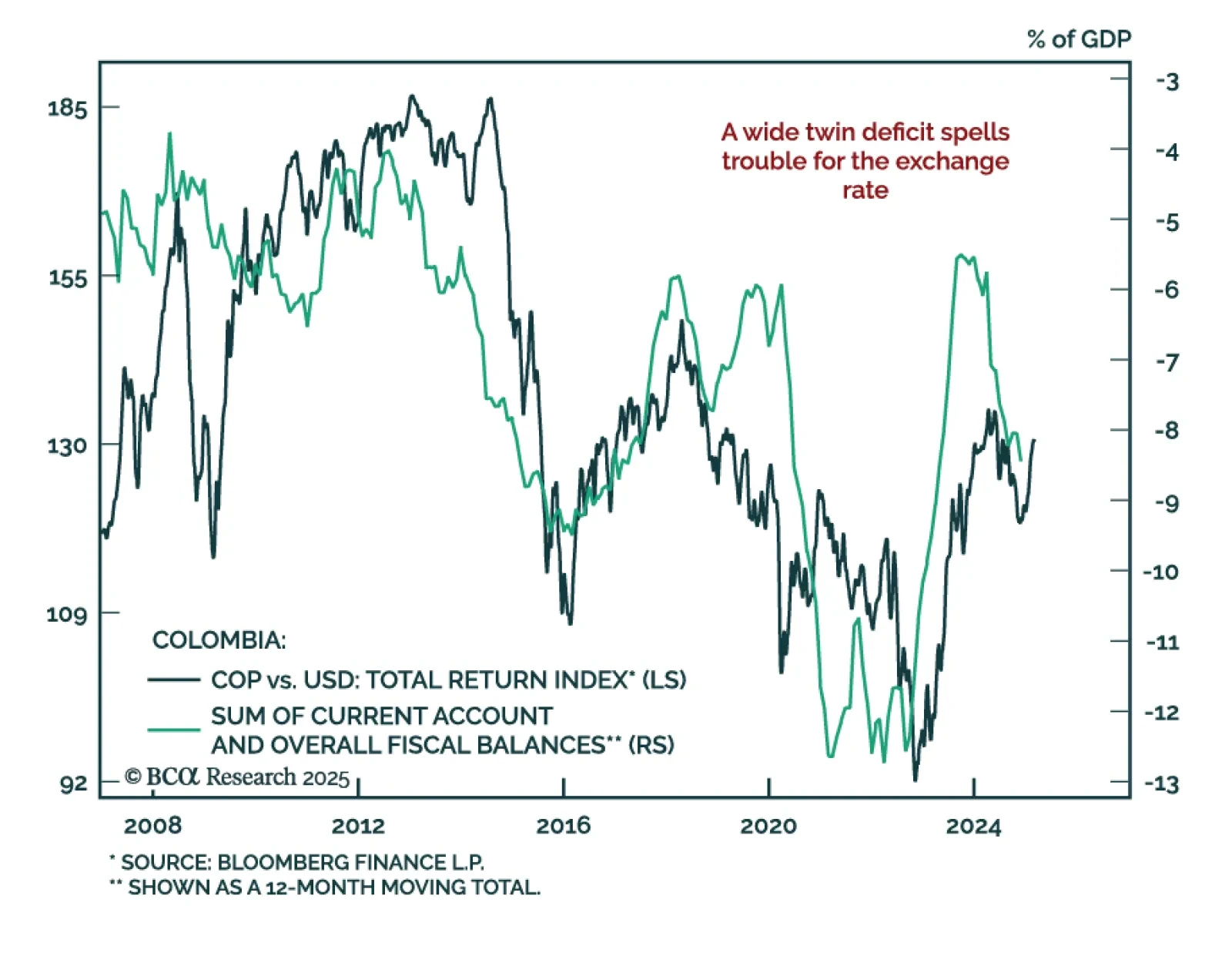

Our Emerging Markets strategists assessed Colombian assets after a significant rally. Colombia faces deep-rooted macroeconomic challenges that will not be easily reversed by a right-wing government in 2026. Public debt is on an…