Our US Political Strategists give a one-third probability of a federal government shutdown before November. The odds could increase after that. But the market impacts are limited. The source of the disagreement is the enhanced…

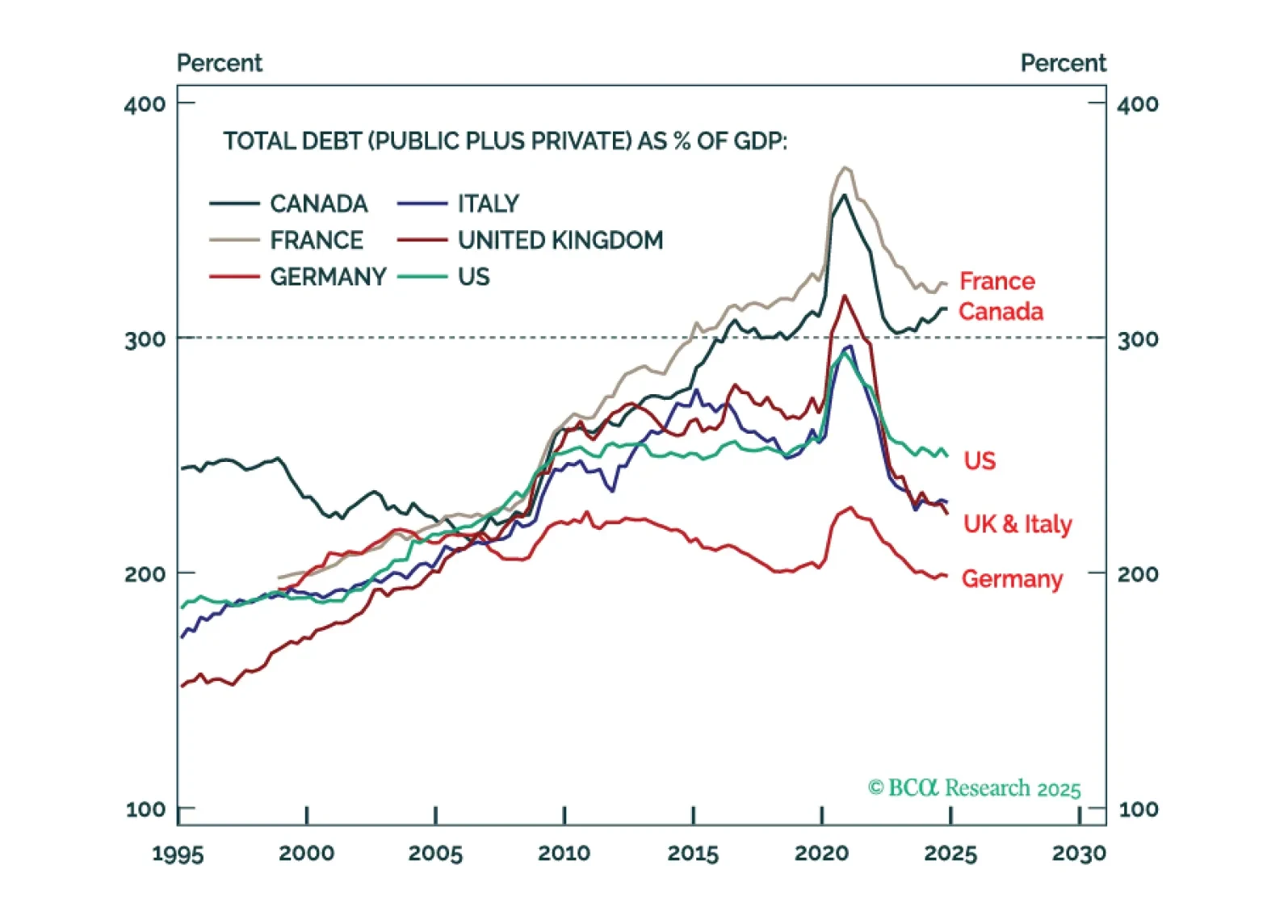

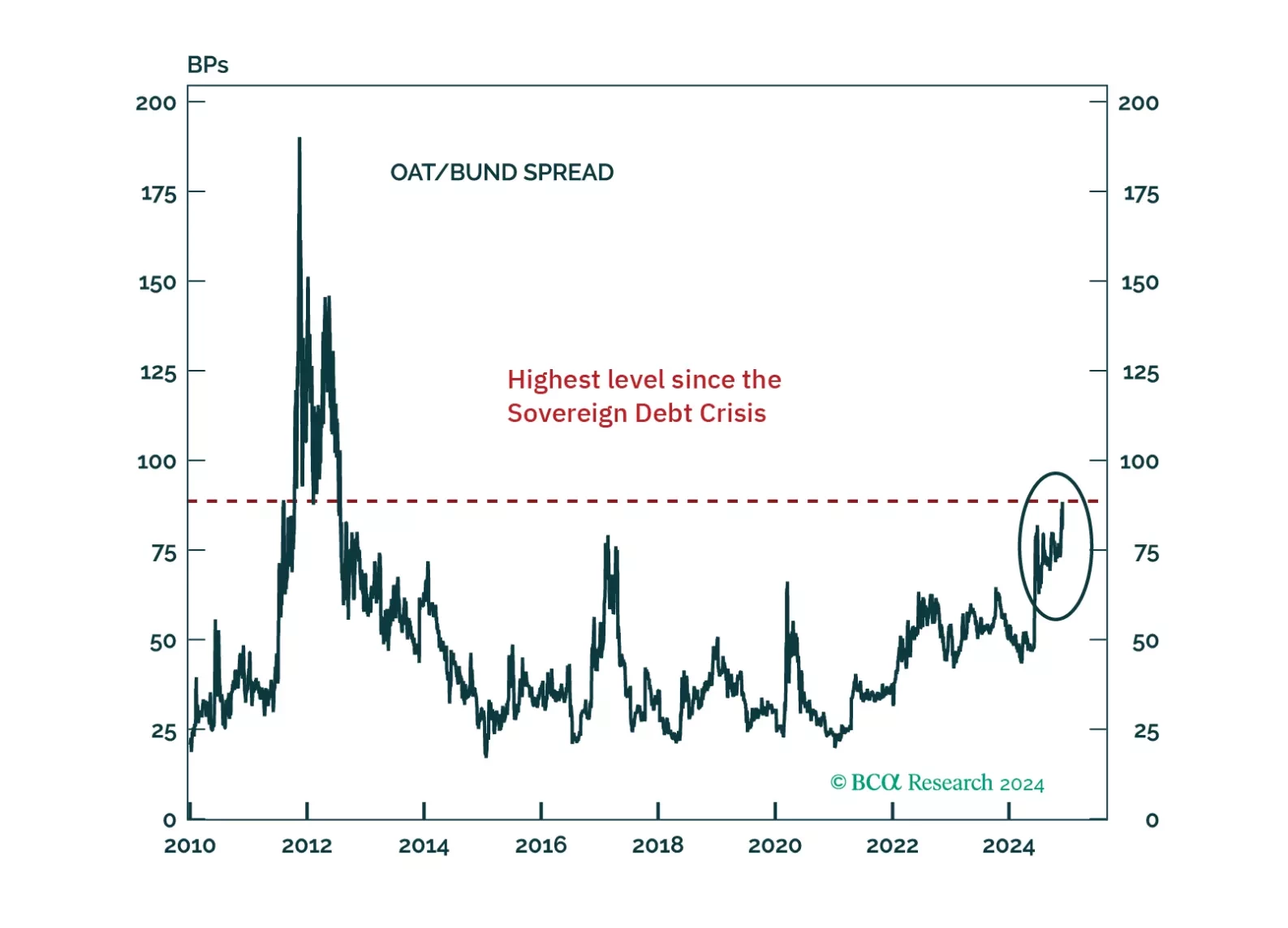

The bond vigilantes are circling over several targets right now: France, the UK, and Japan. But France is the most vulnerable because of a toxic combination: a total debt ratio well above 300 percent plus the worst primary deficit in…

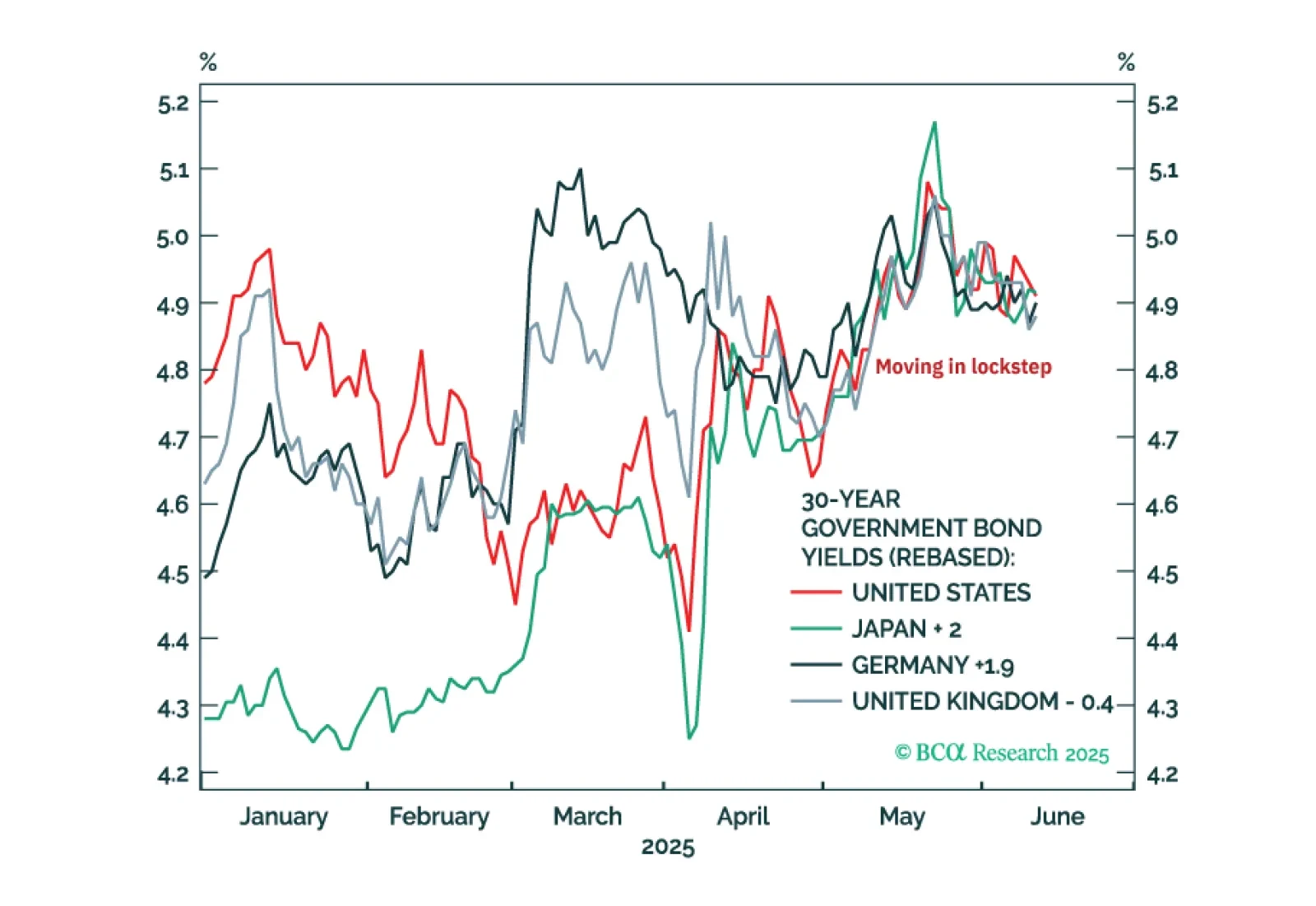

The perfectly synchronised moves in US, Japanese, German, and UK 30-year bond yields through the past two months are odd… and irrational. These irrational moves present compelling investment opportunities.

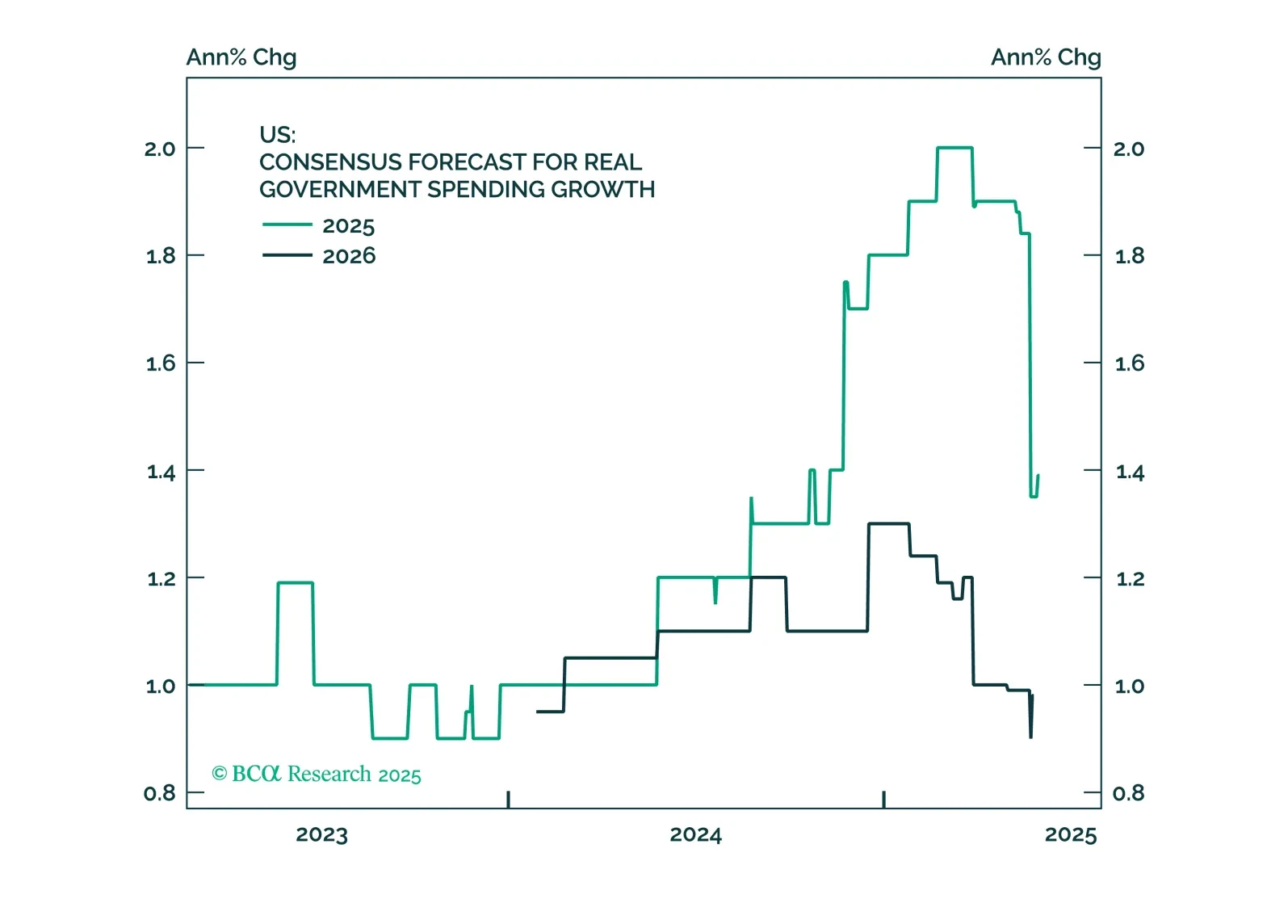

This month, we focus on the One Big Beautiful Bill Act (OBBBA). Our assessment in the Alpha report is that there won’t be any remaining alpha to harvest by shorting duration. The team that coined the “Human Steepener” moniker for…

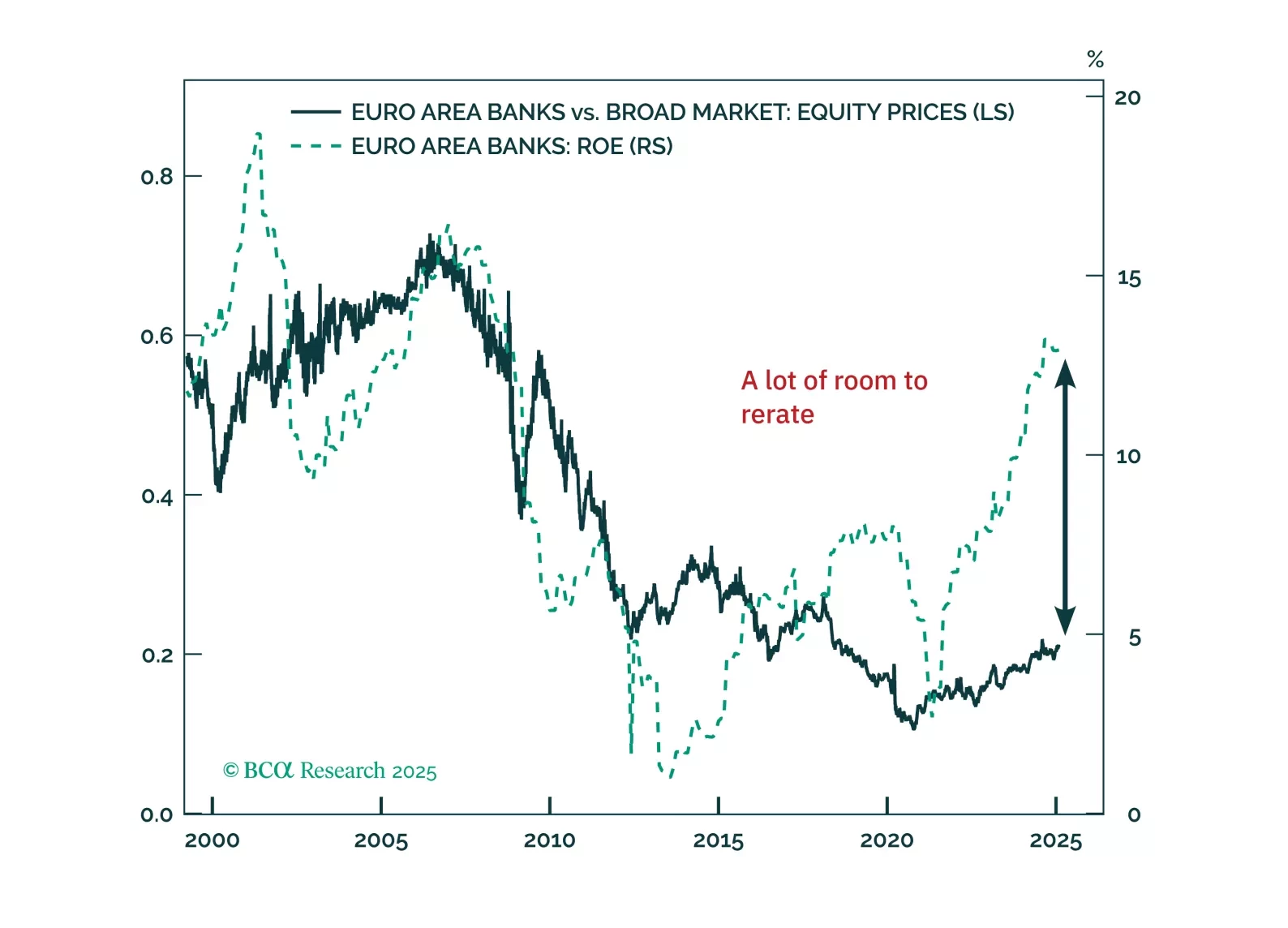

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

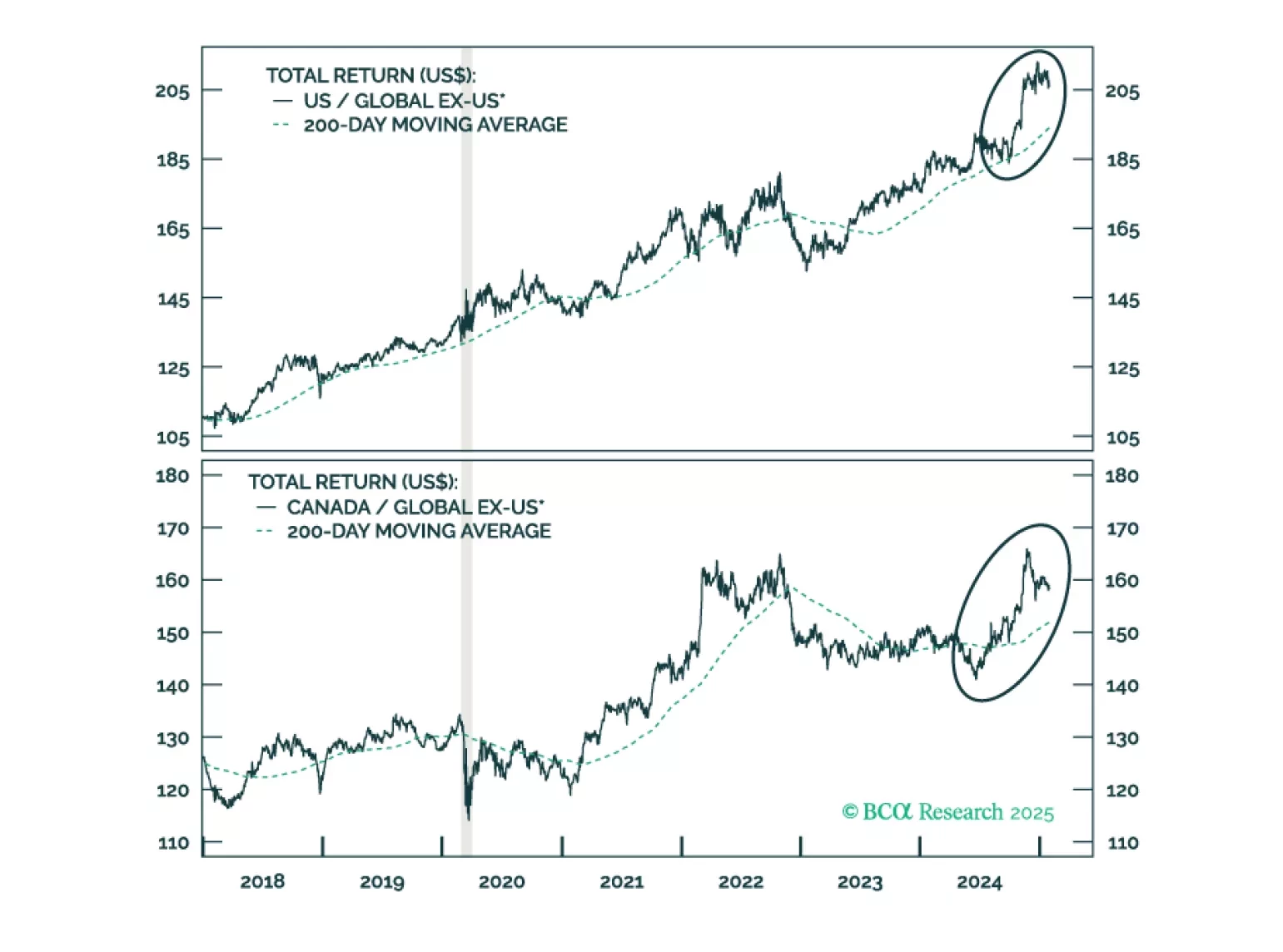

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…