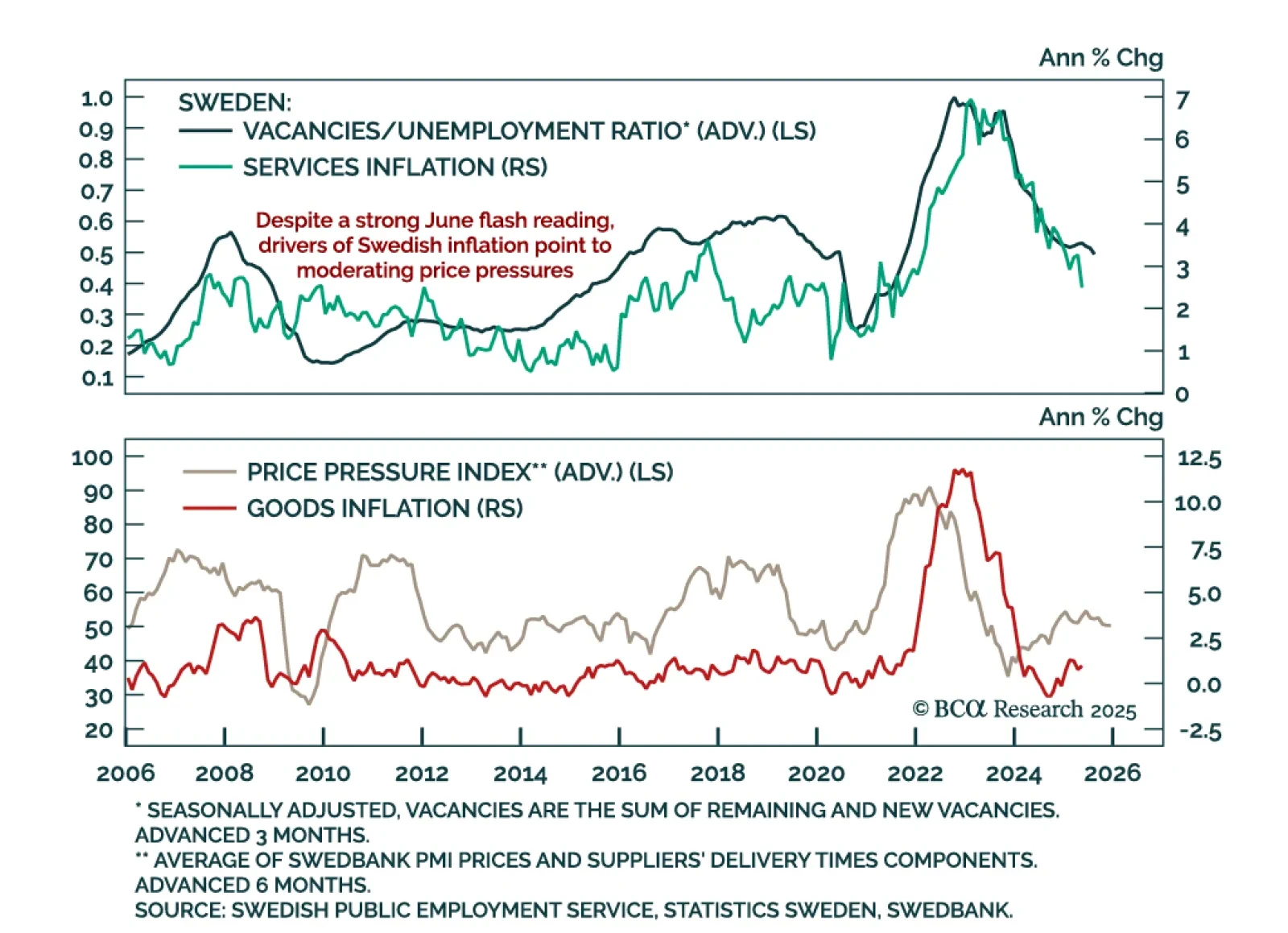

Stronger-than-expected June inflation will likely keep the Riksbank on hold in August, despite soft underlying trends. Headline inflation accelerated more than expected to 0.5% m/m (0.8% y/y), while CPI ex-housing rose to 2.9% y/y…

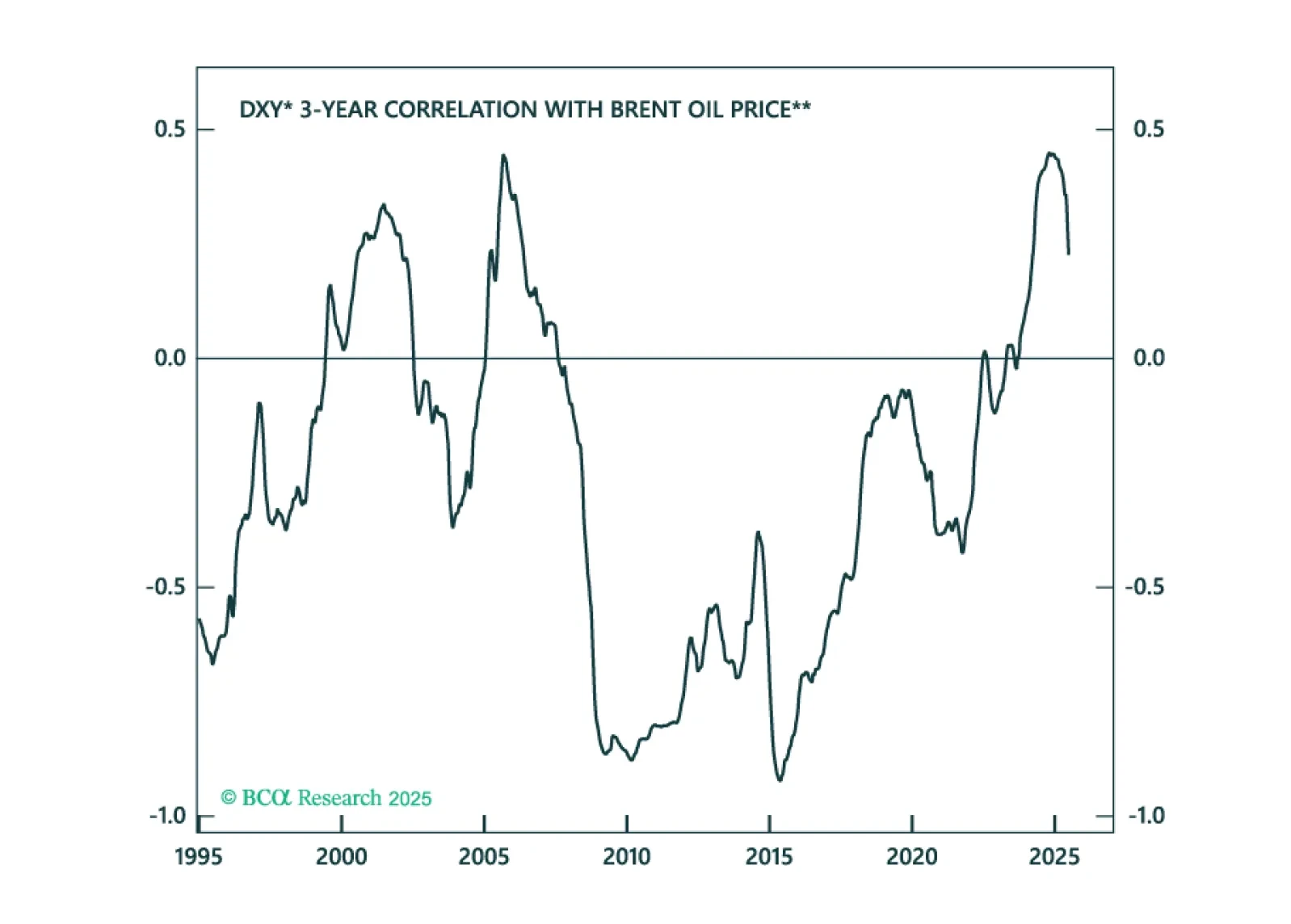

The dollar is breaking down, as capital leaves the US. The important question investors must answer is how much downside is left for the greenback, and whether depreciation will continue in a straight line over the coming months or pause (…

Alligator Bite #1: As US net portfolio inflows decline (the alligator's upper jaw closes), its current account deficit must narrow (the lower jaw will also shut). Alligator Bite #2: As the US current account deficit shrinks (the…

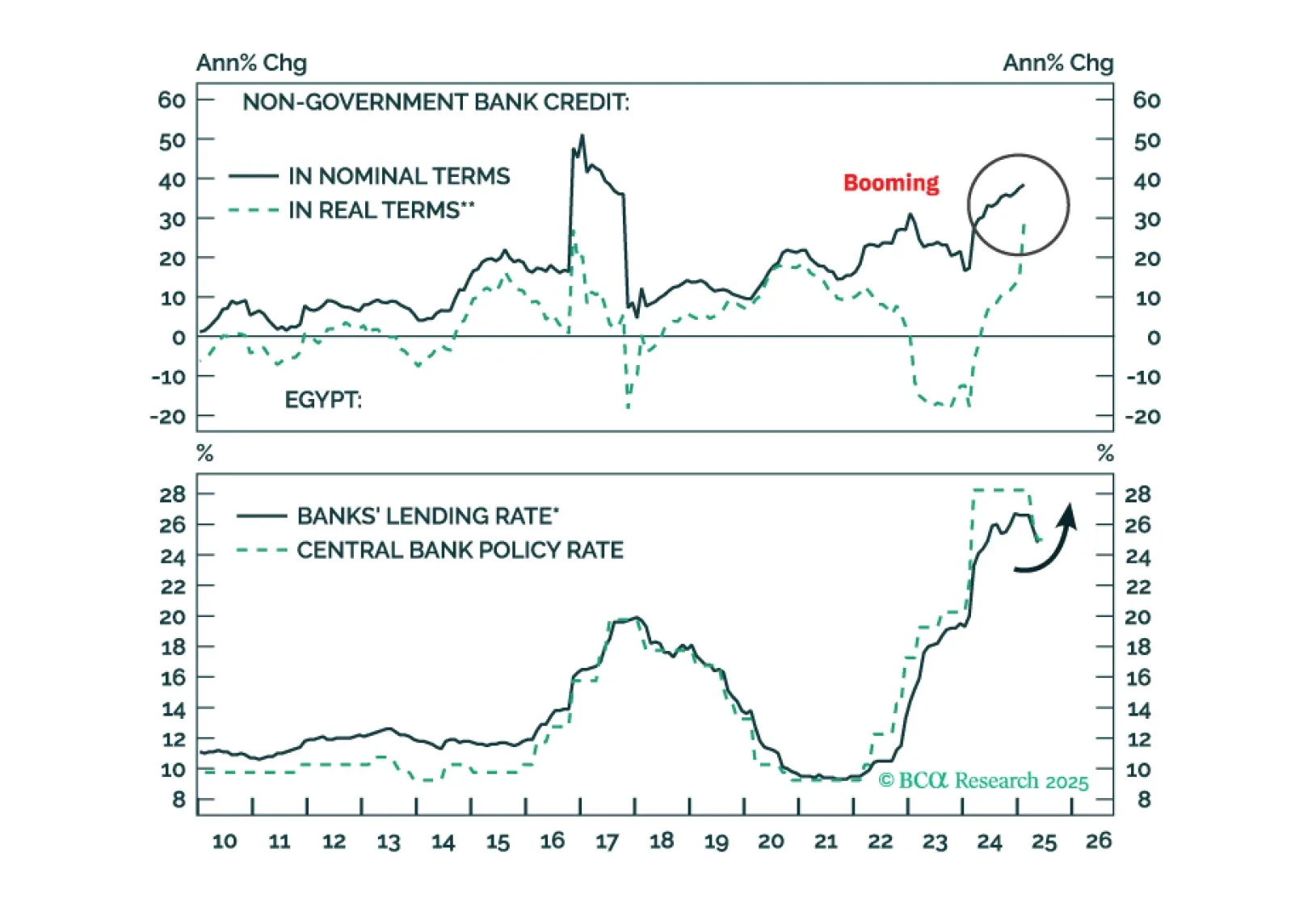

Downward pressure on the pound will rise in the coming months. Inflation will go up, so will bond yields. It’s time to book profits on Egyptian domestic bonds.

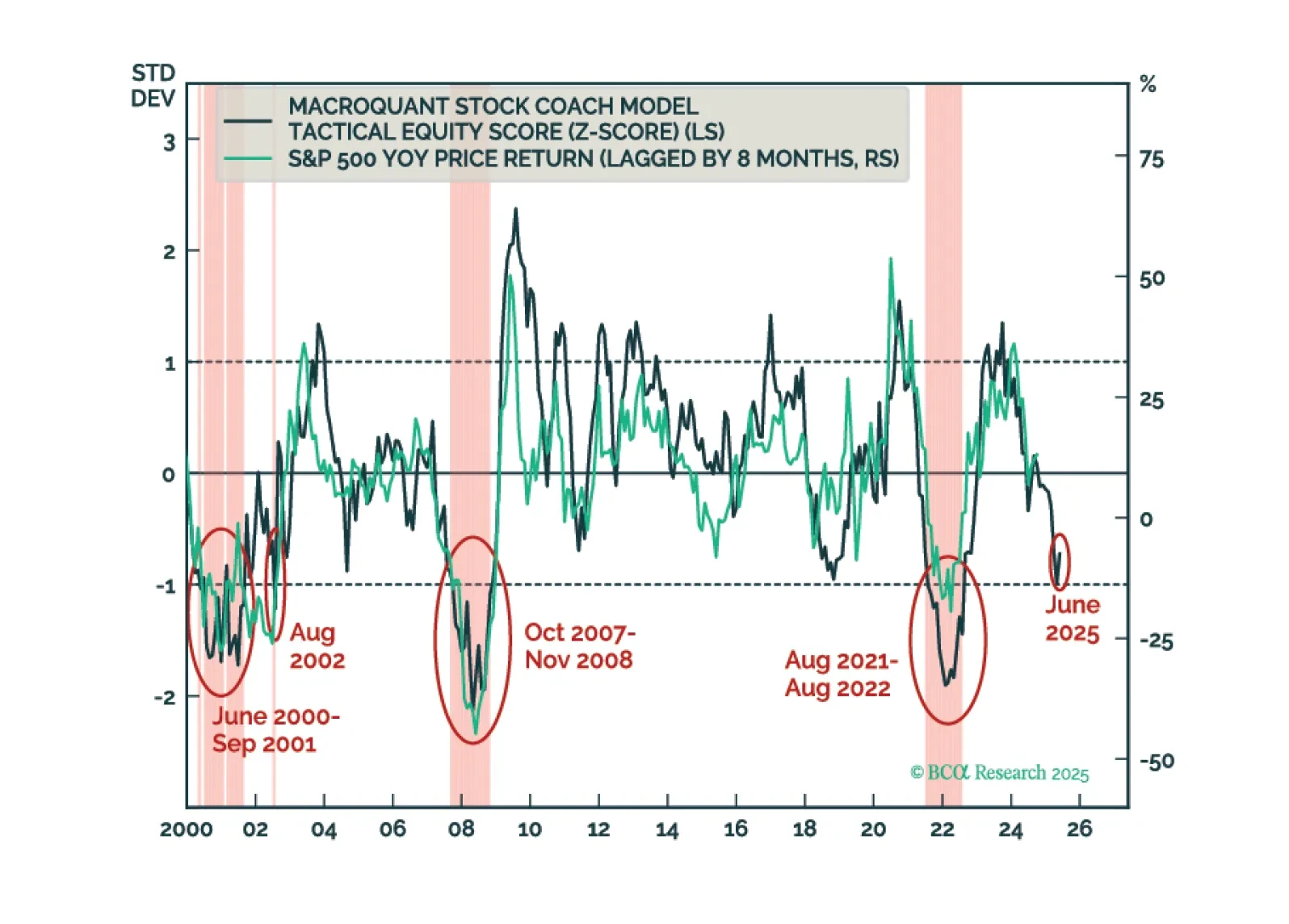

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

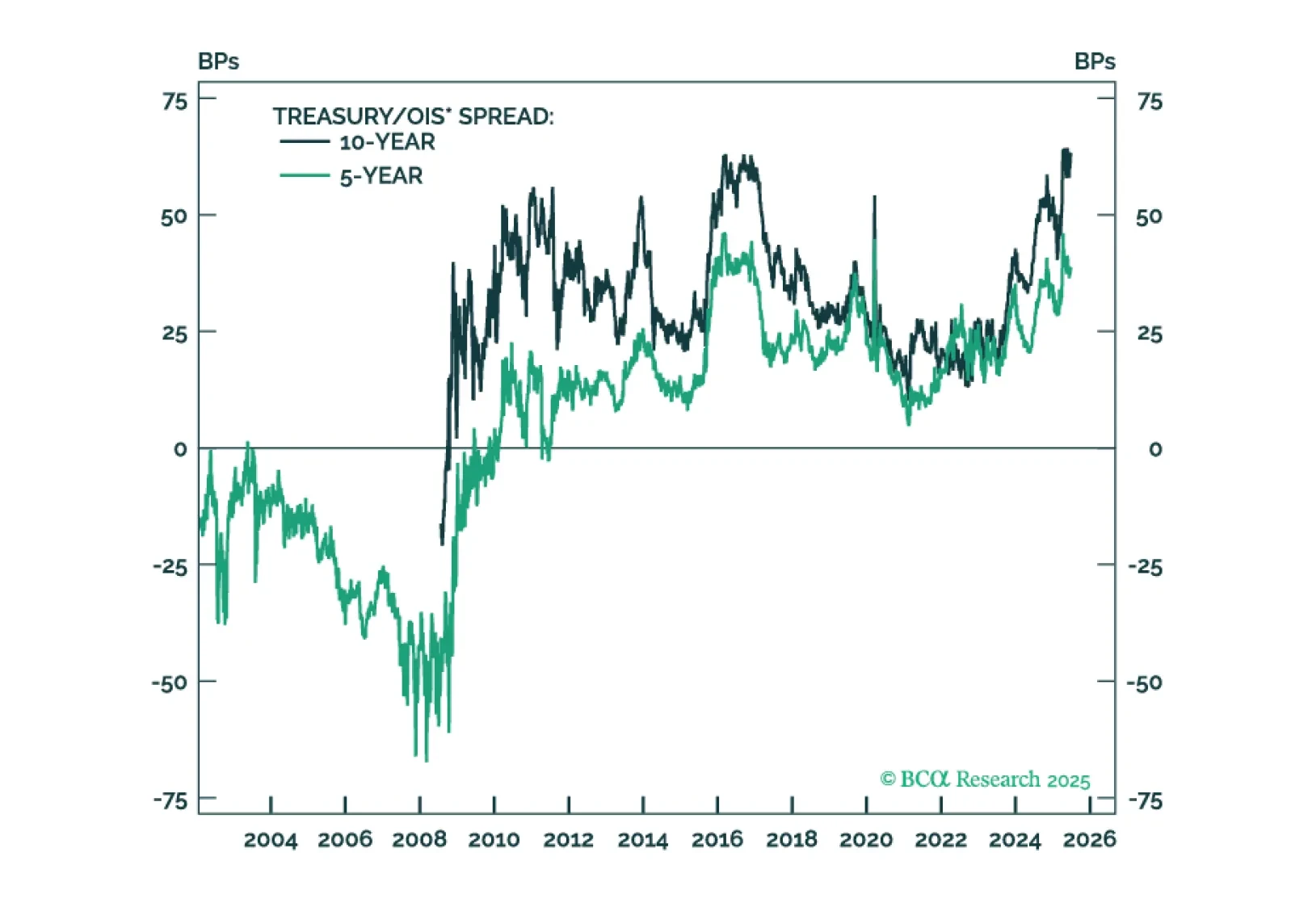

Regional Fed surveys confirm sluggish US manufacturing and tame inflation, supporting long duration positioning outside the US. The June Dallas Fed Manufacturing survey missed expectations, rising to -12.7 from -15.3, still deep in…

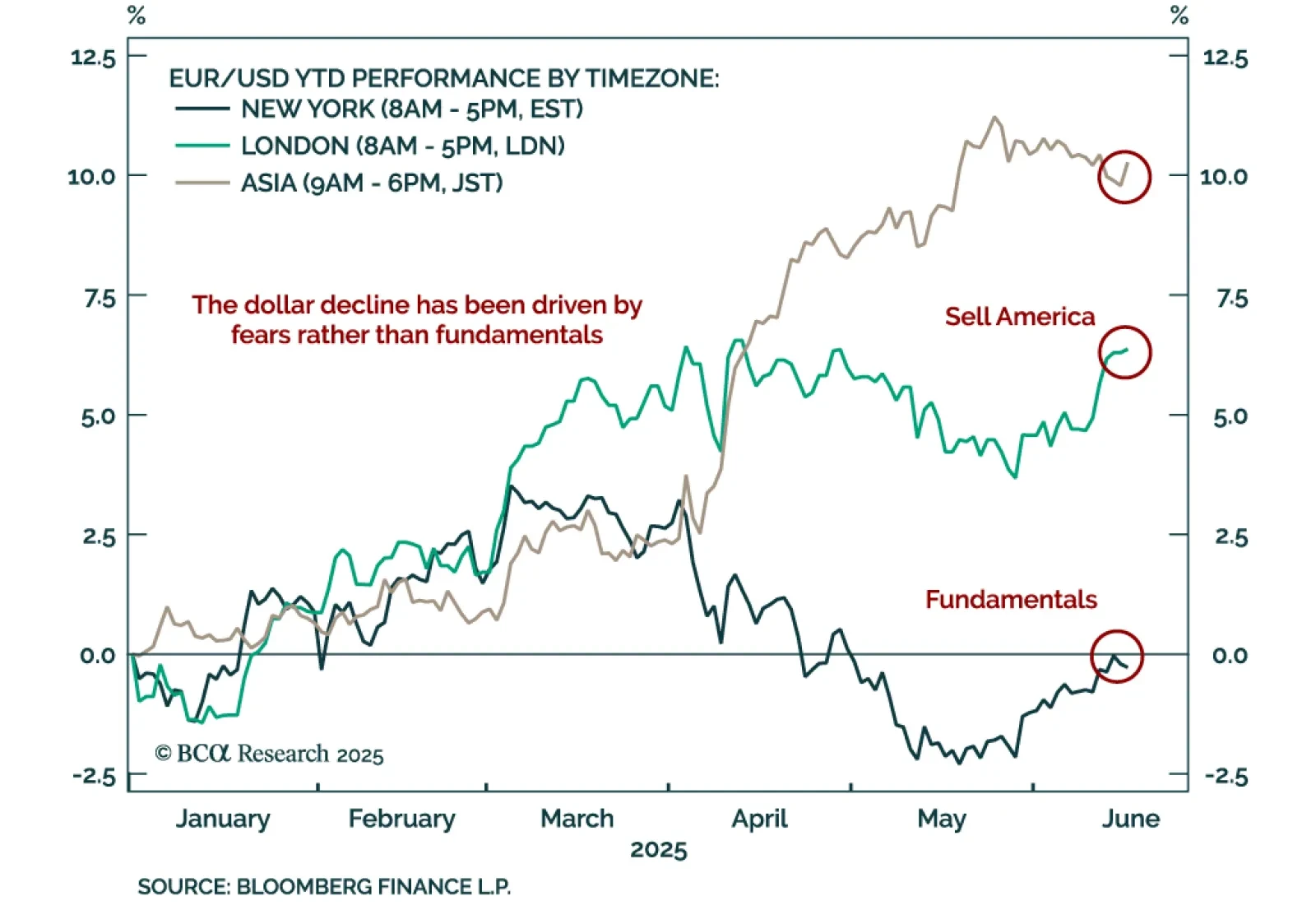

Foreign investors are selling US assets. Our Chart Of The Week comes from Juan Correa, Chief Global Asset Allocation Strategist. Splitting cumulative year-to-date EUR/USD returns by trading session reveals a clear pattern:…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

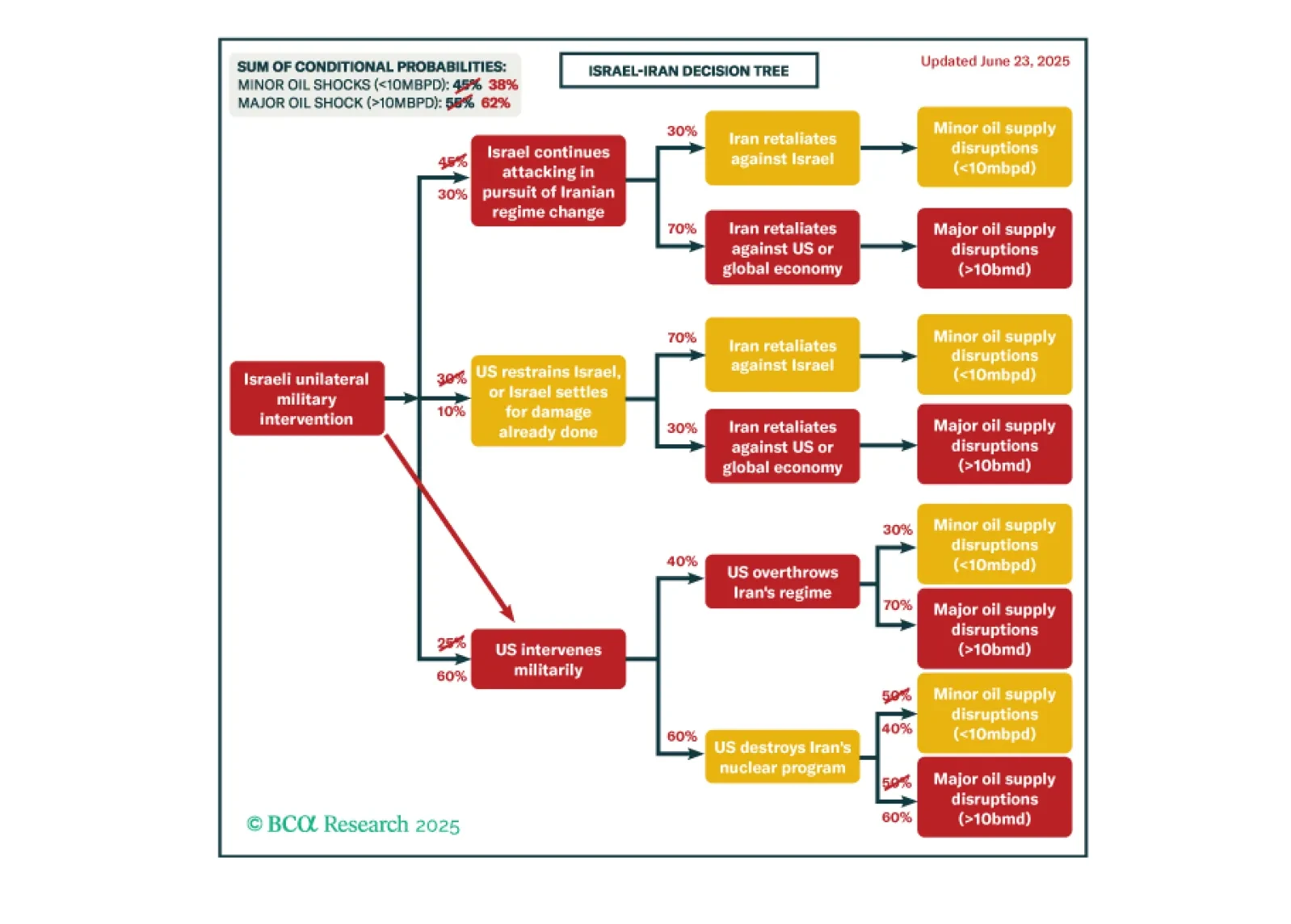

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…