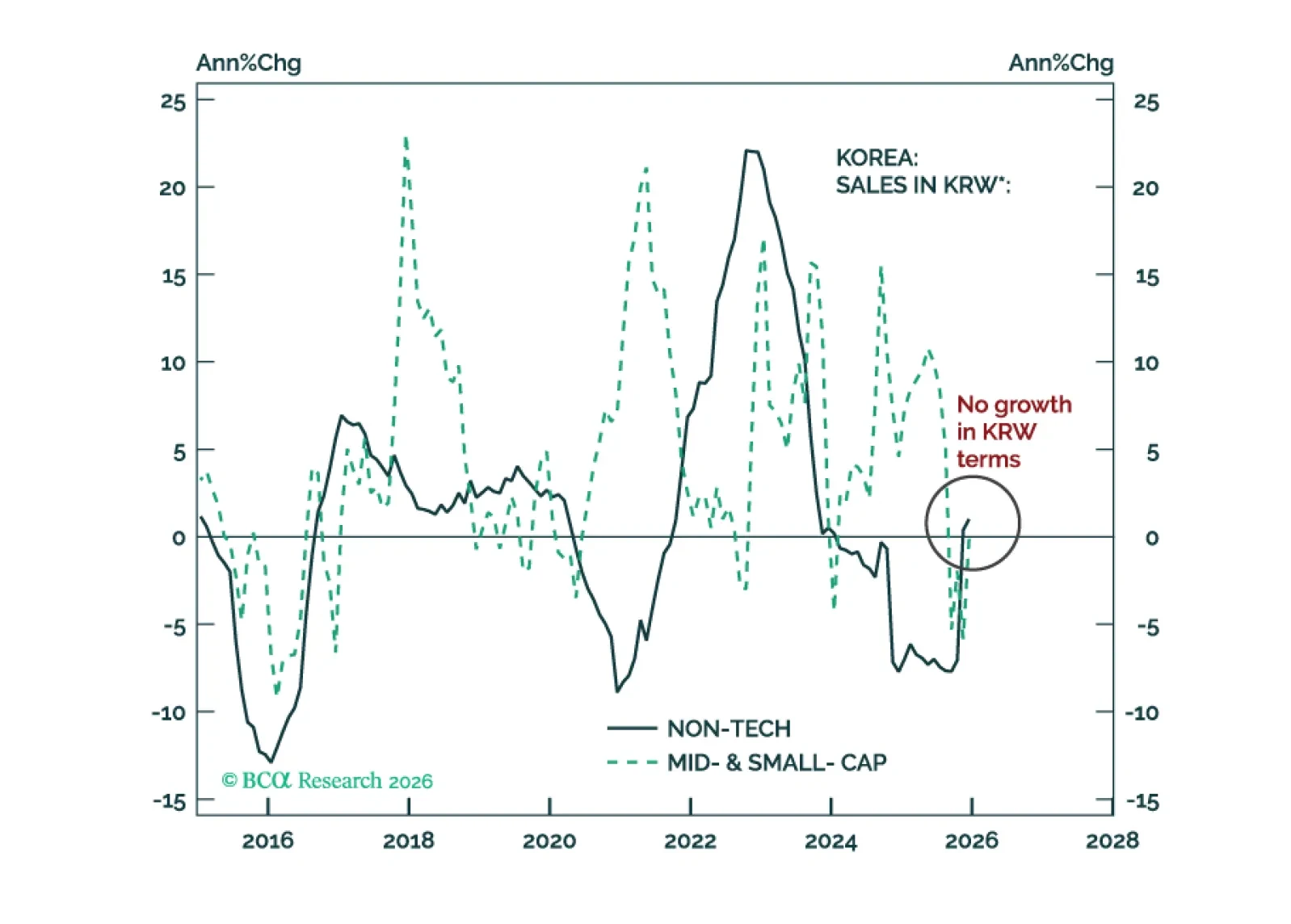

Go long KRW versus USD. Within an EM equity portfolio, overweight Korean tech and stay neutral on Korean non-tech. However, we are not bullish on the Korean bourse's absolute performance.

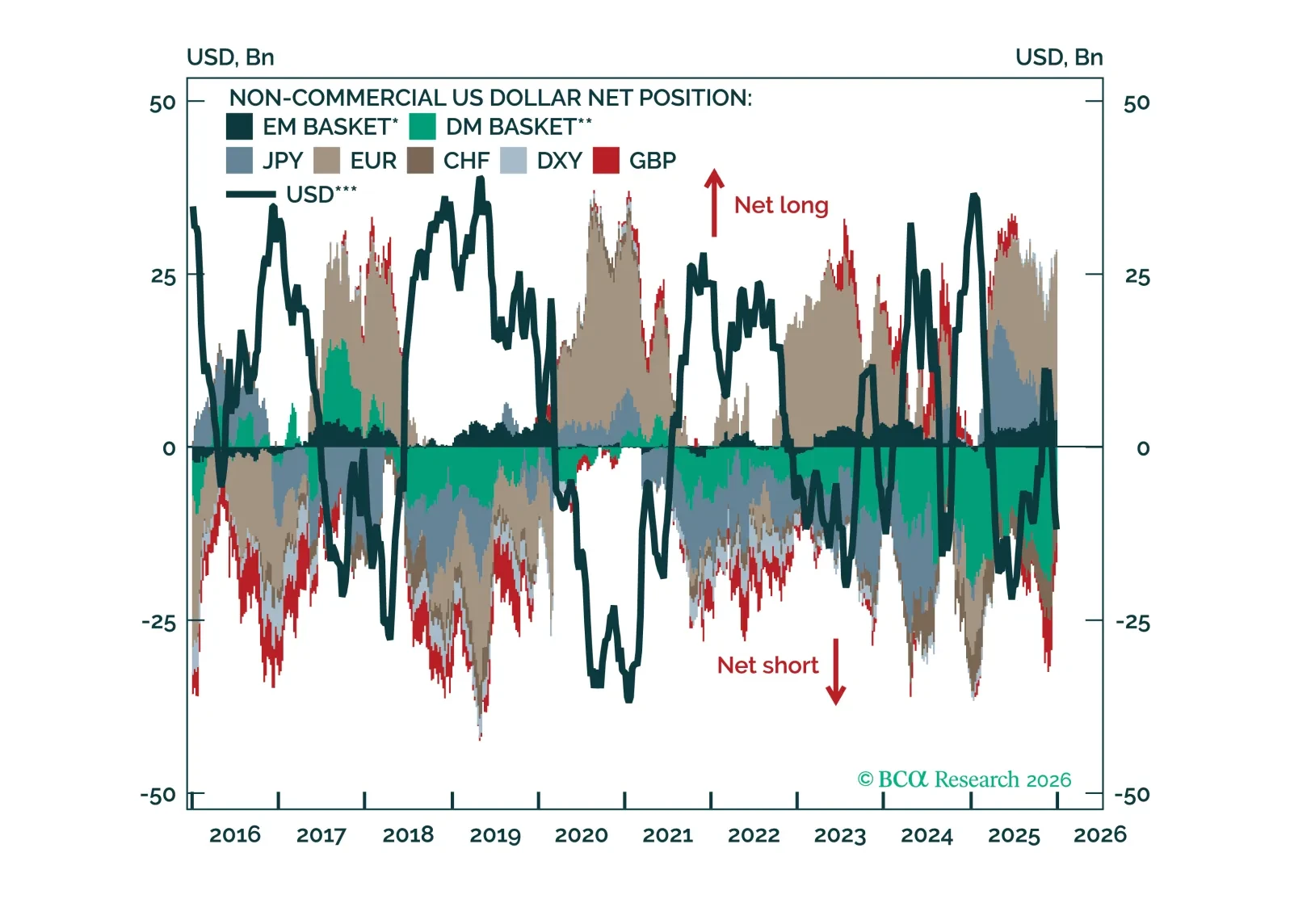

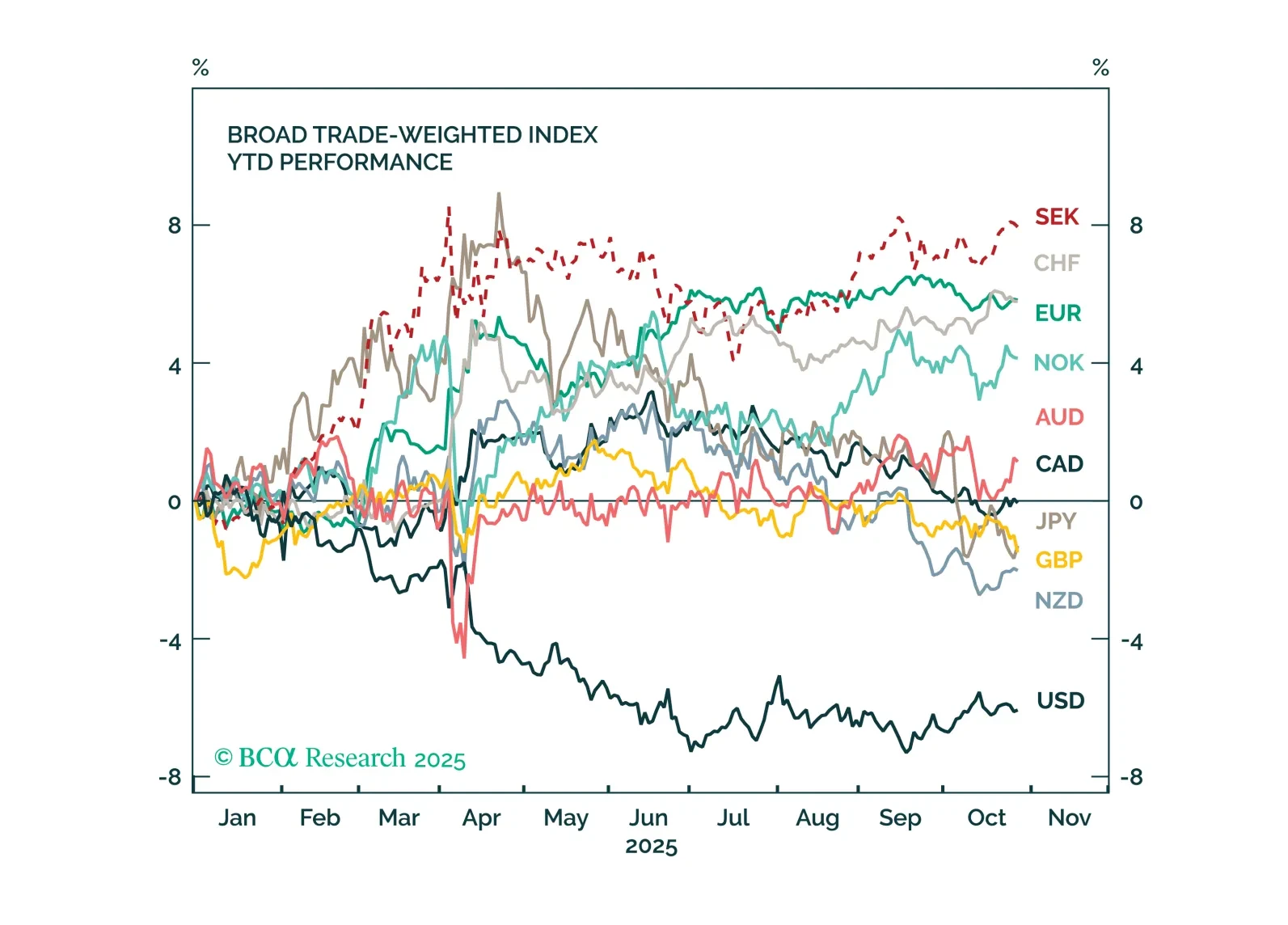

With FX volatility near cycle lows, this Insight examines where positioning has become most stretched across G10, EM FX, and precious metals – and what that implies for near-term moves and reversal risks.

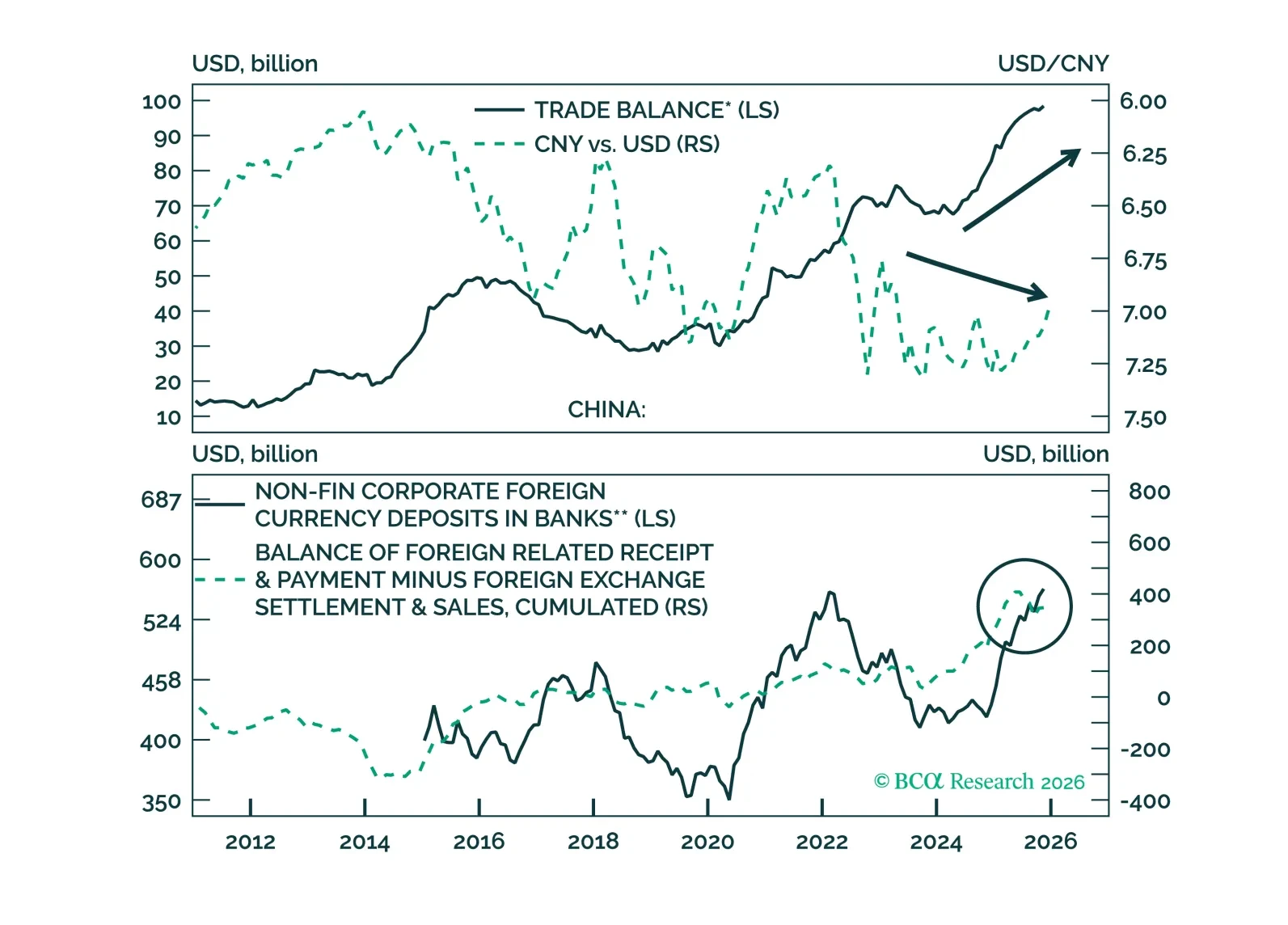

We explain the underlying catalysts for the RMB’s seasonal appreciation, and assess the upside potential for the currency in 2026.

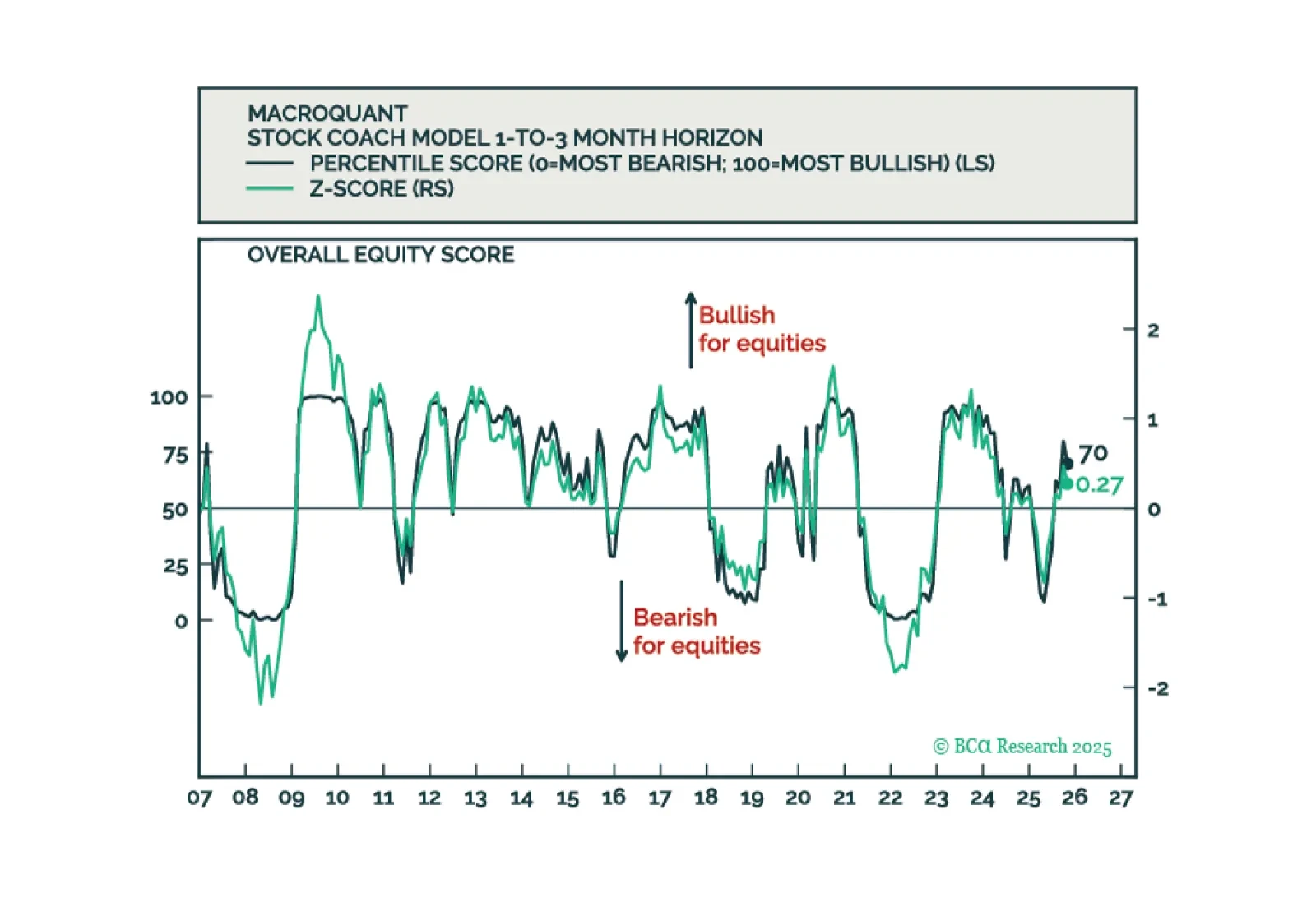

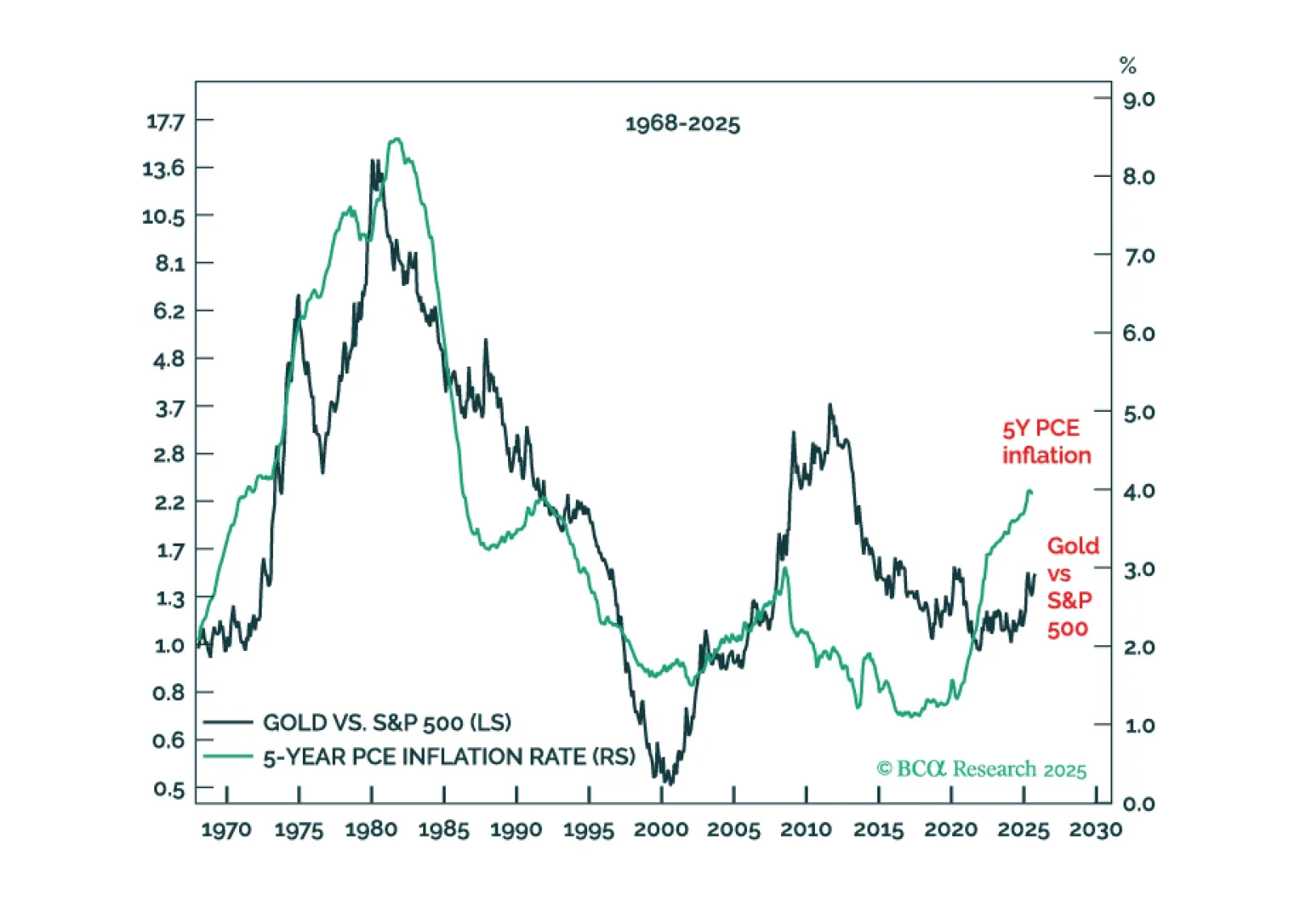

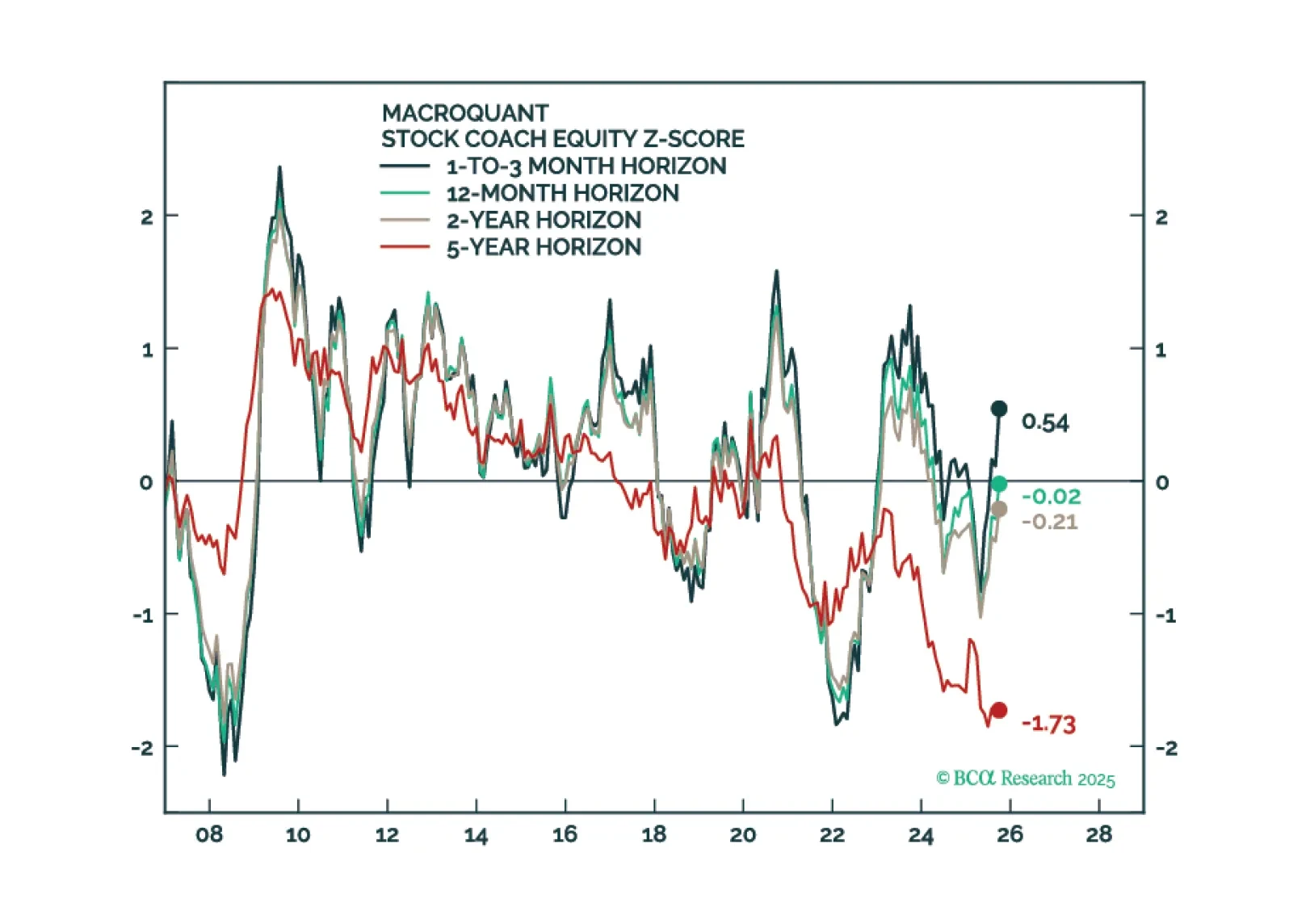

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

Long-term investors should own gold. The network effect that makes gold the physical ‘insurance asset’ of choice will generate long-term outperformance. But long-term investors should also own bitcoin. The network effect that makes…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…