The global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. We remain long exposure to the equities of oil and gas producers via the XOP ETF; the COMT ETF to…

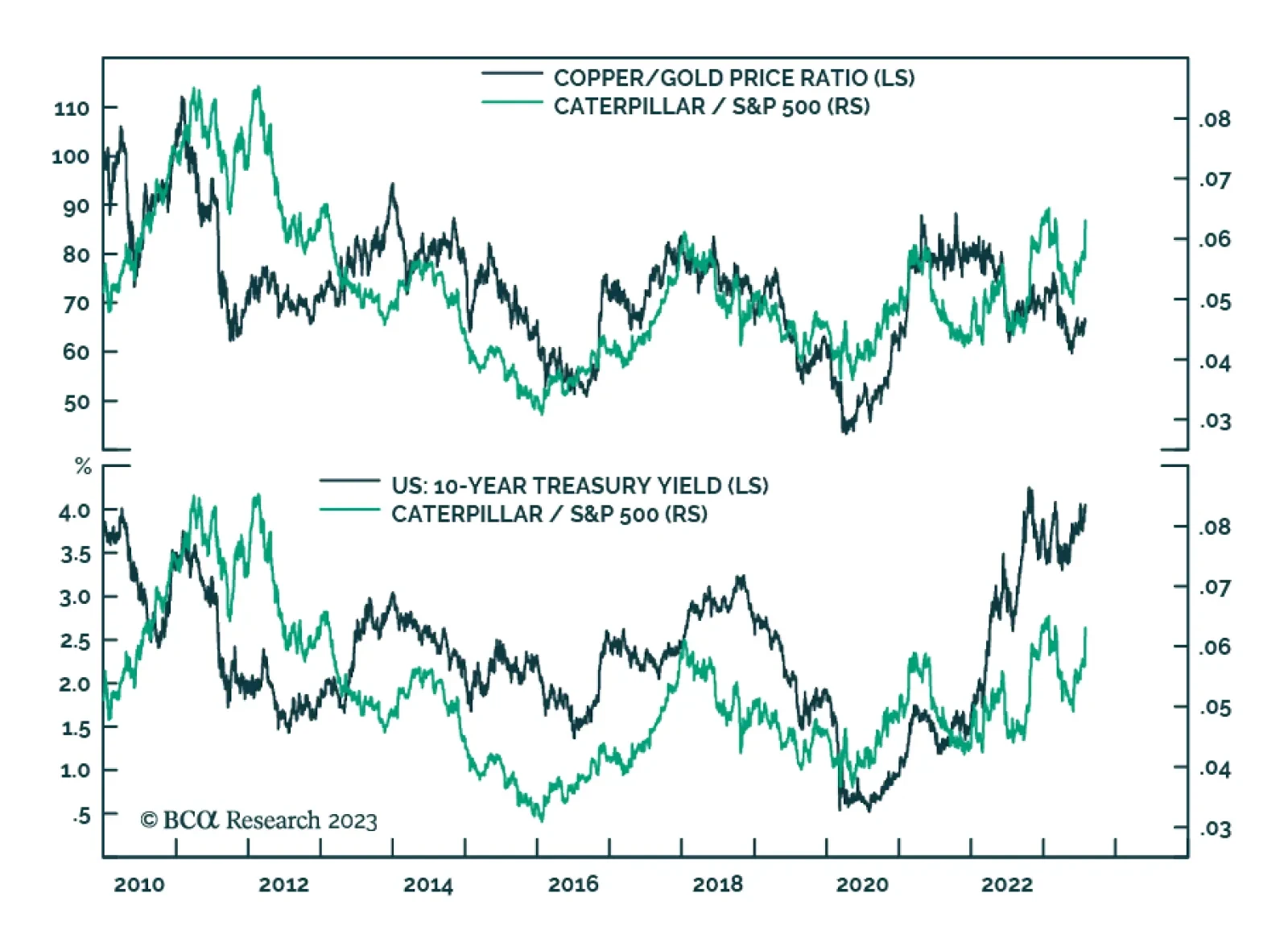

Caterpillar’s Q2 earnings results released on Tuesday beat consensus estimates by a wide margin. Second quarter profit of $2.92 billion ($5.67 per share) came in well above expectations of $2.38 billion ($4.46 per share).…

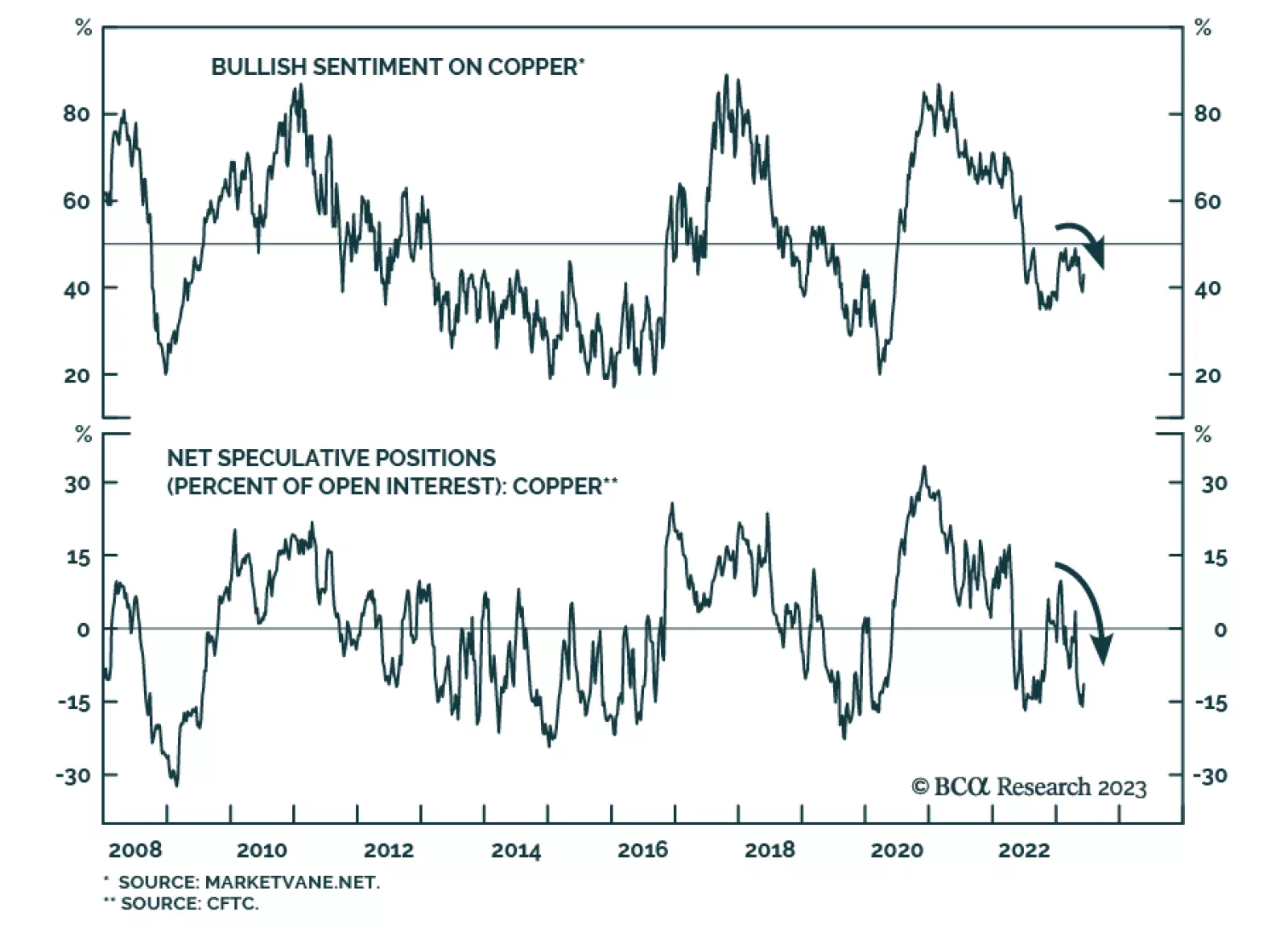

Over the past two months, copper has rallied alongside risk assets and now stands 9% above its late-May trough. Here, the outlook for China’s economy – which accounts for over half of global refined copper usage…

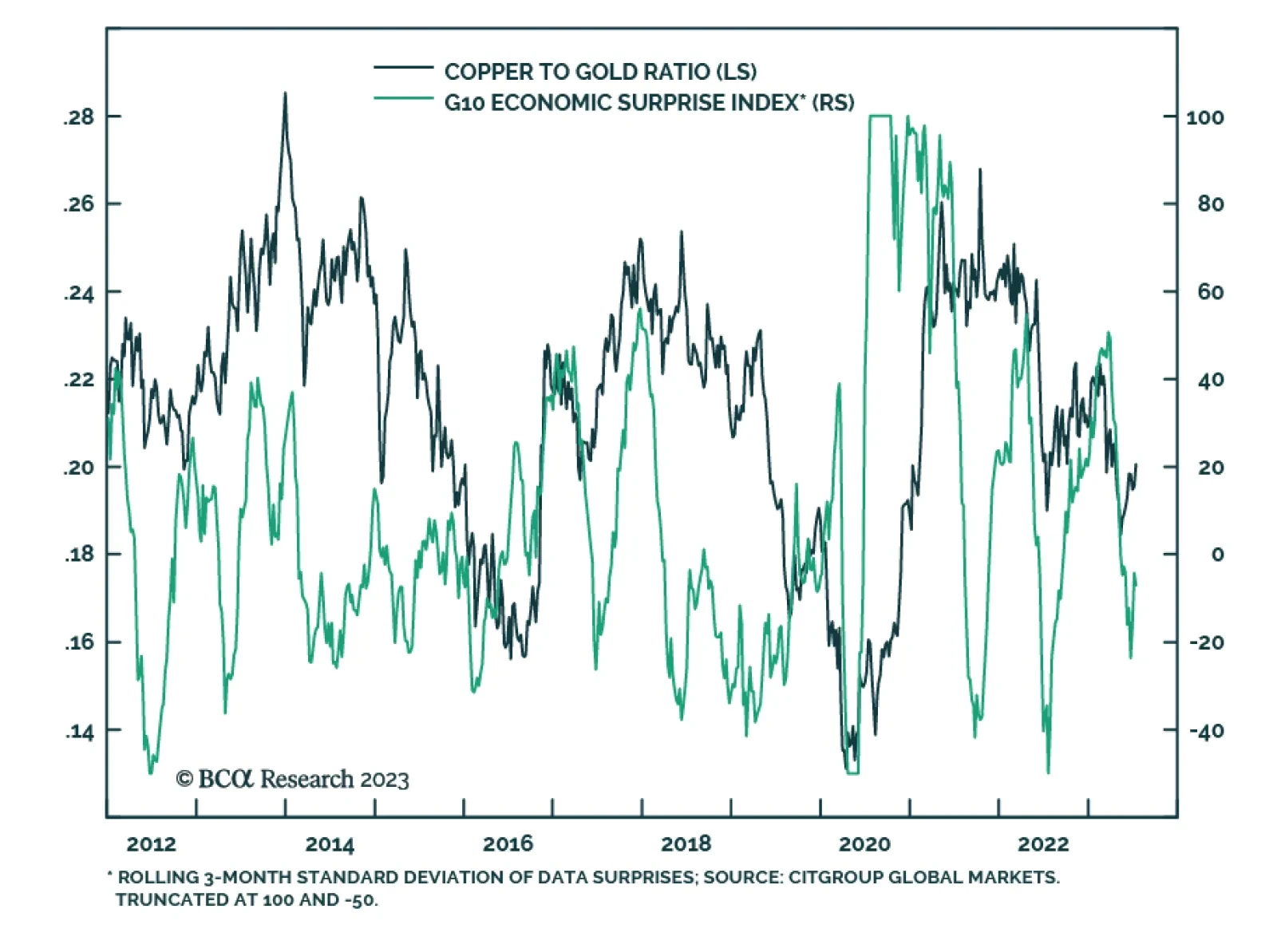

Copper rallied to a two-month high by the end of last week. Importantly, this move did not occur in isolation. It coincides with greater optimism about the prospects of a soft landing. Indeed, the US economic surprise index is…

In our May In Review Insight, we highlighted that last month, industrial metals generated the largest abnormal losses among the major global financial assets we track. This continues a downtrend that started at the beginning of…

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

Tight monetary policy will suppress copper capex. Loose fiscal policy, which is lavishing stimulus on energy and defense firms, will stoke copper demand. Constrained copper supply and turbo-charged demand will feed into headline…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

The development of trading blocs and the rise of economic warfare will lead to the inefficient allocation of resources. Higher fiscal outlays and tight commodity supplies will feed into energy prices driving headline inflation. It…