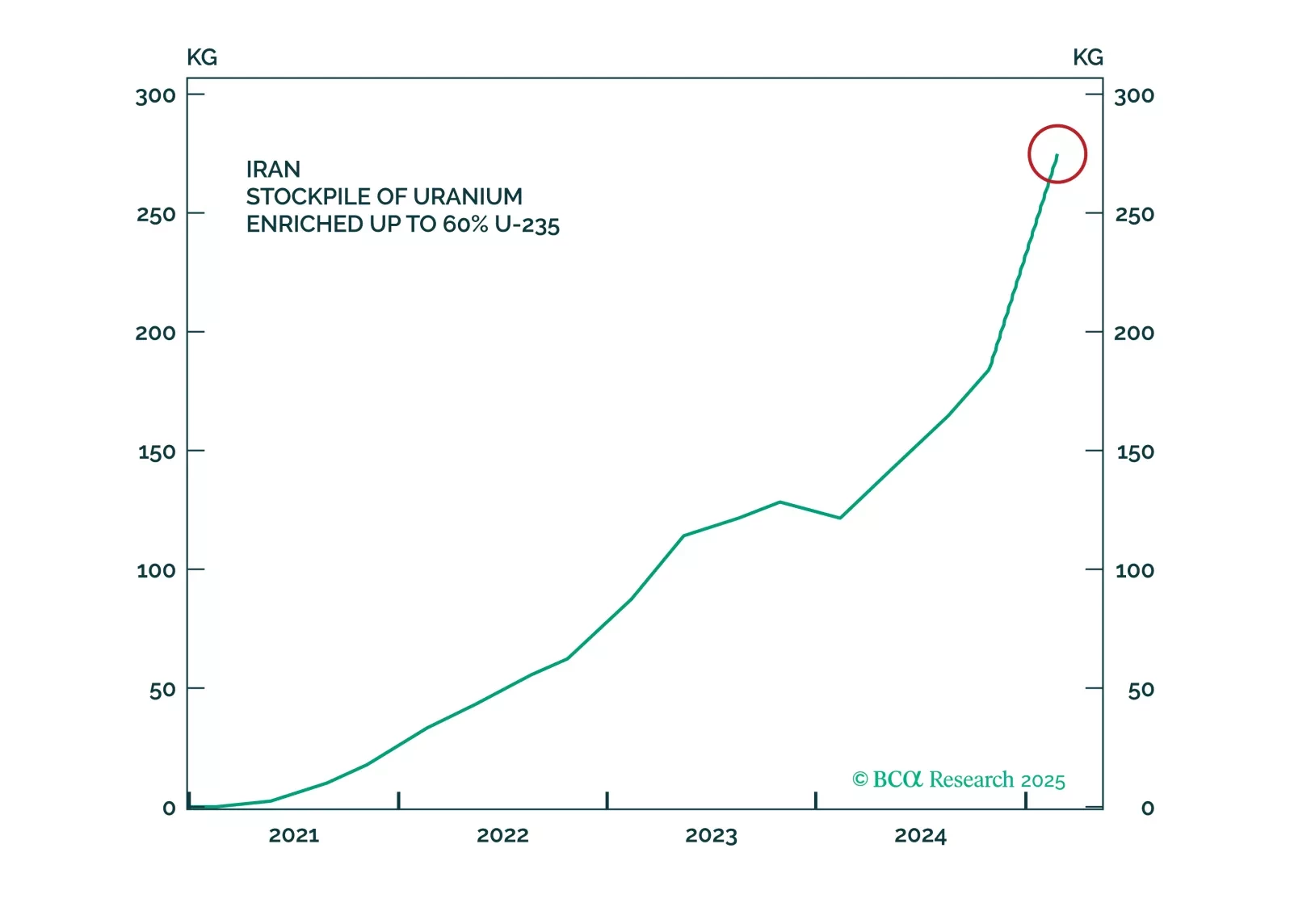

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

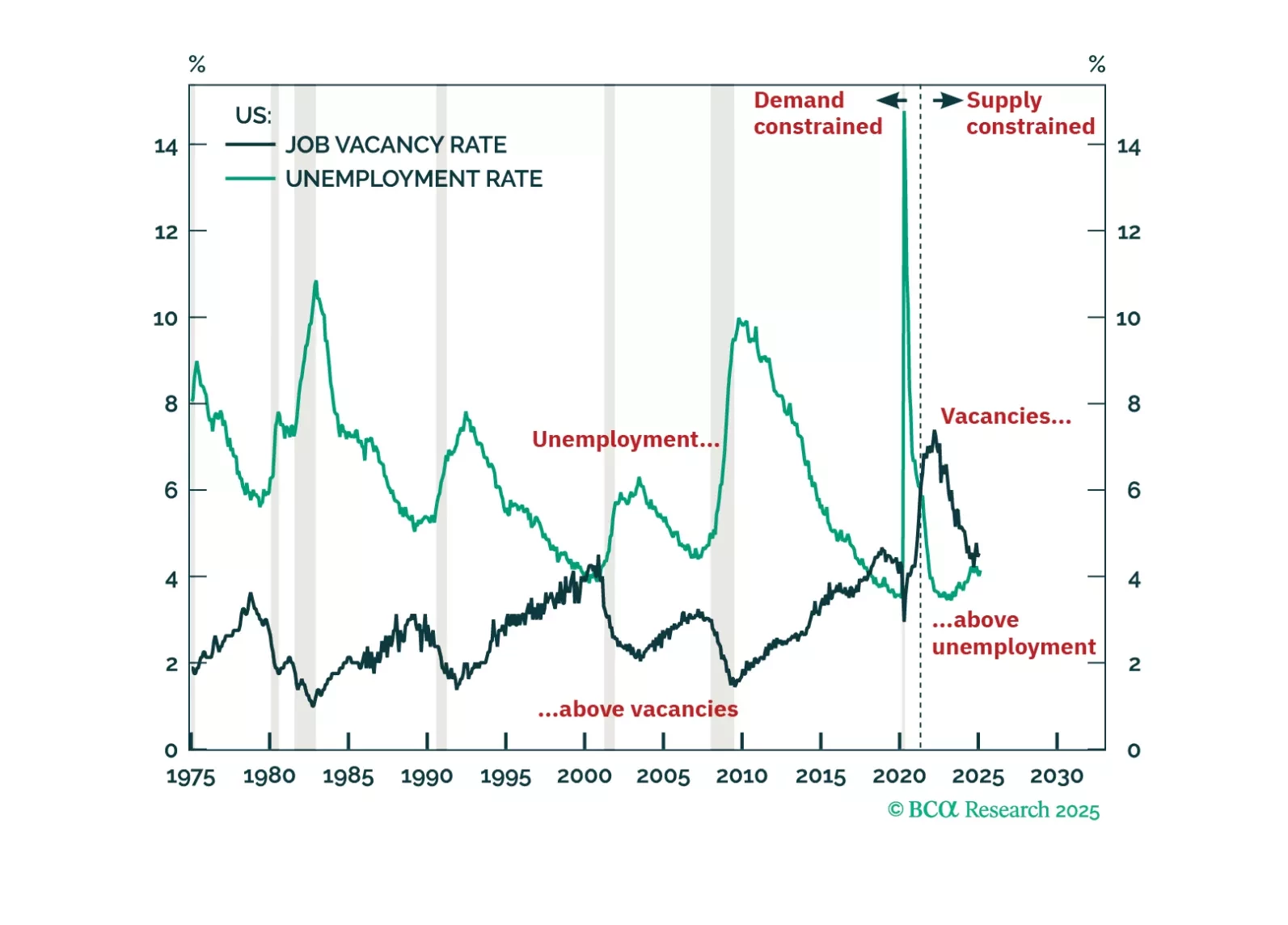

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

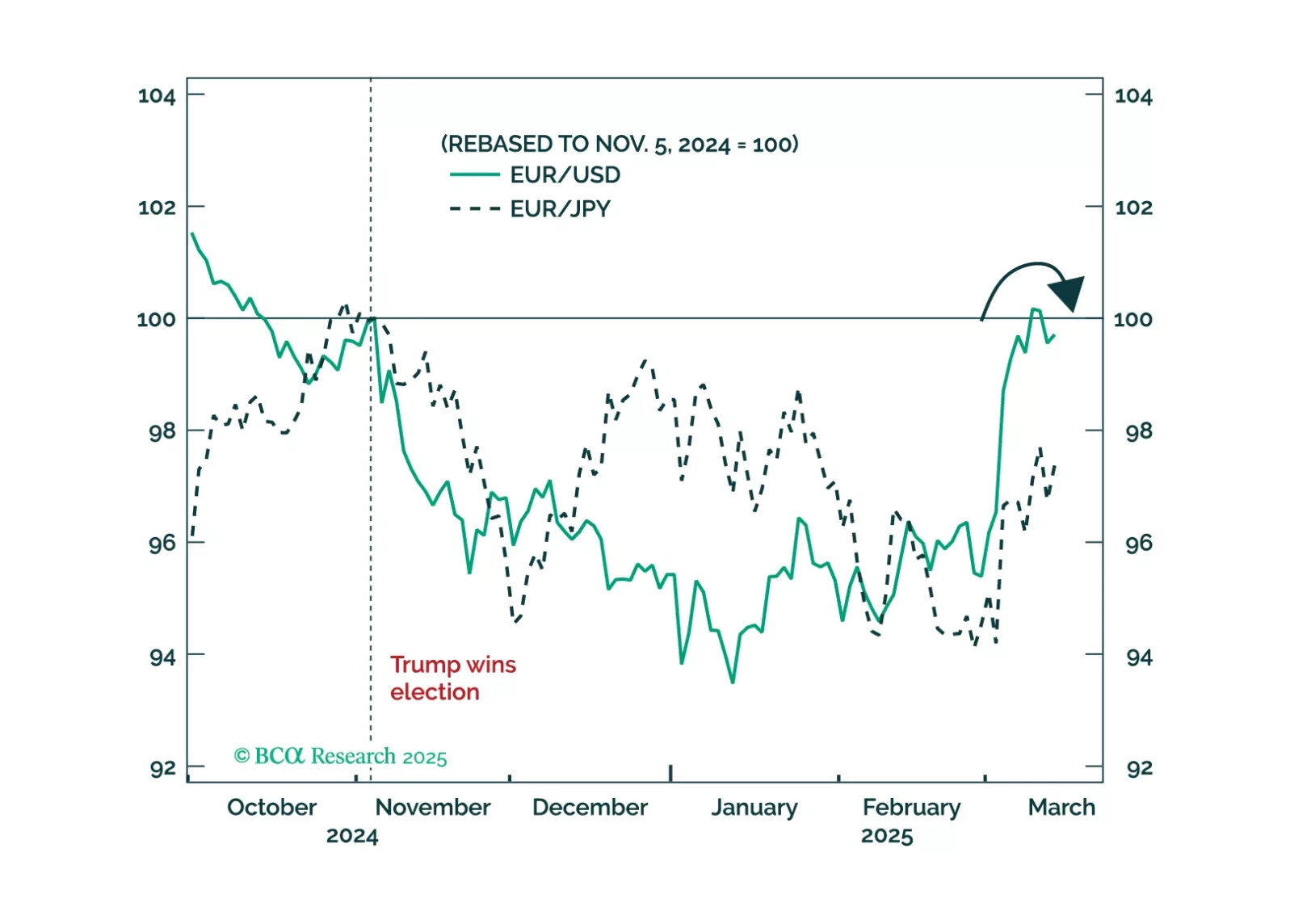

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

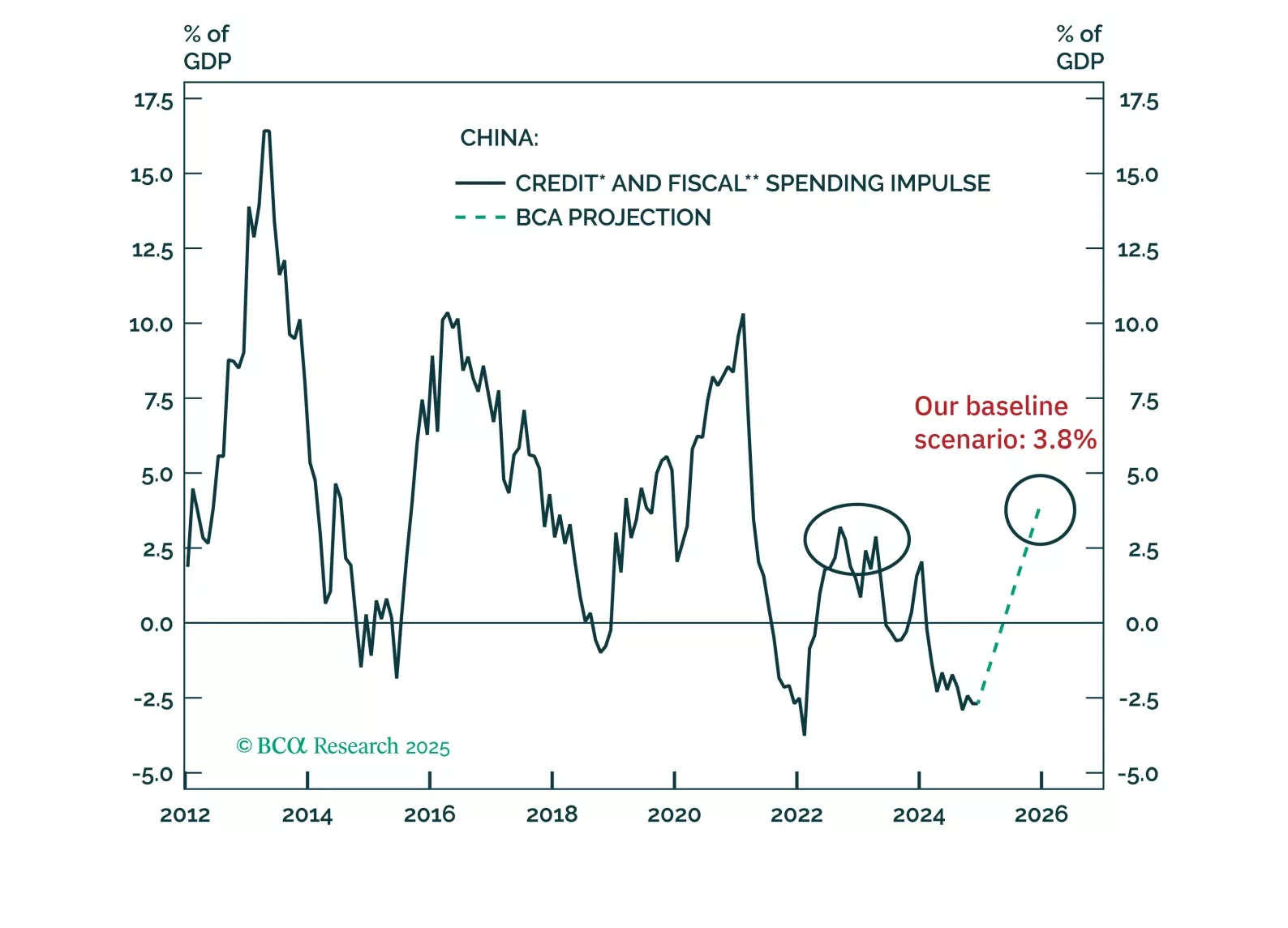

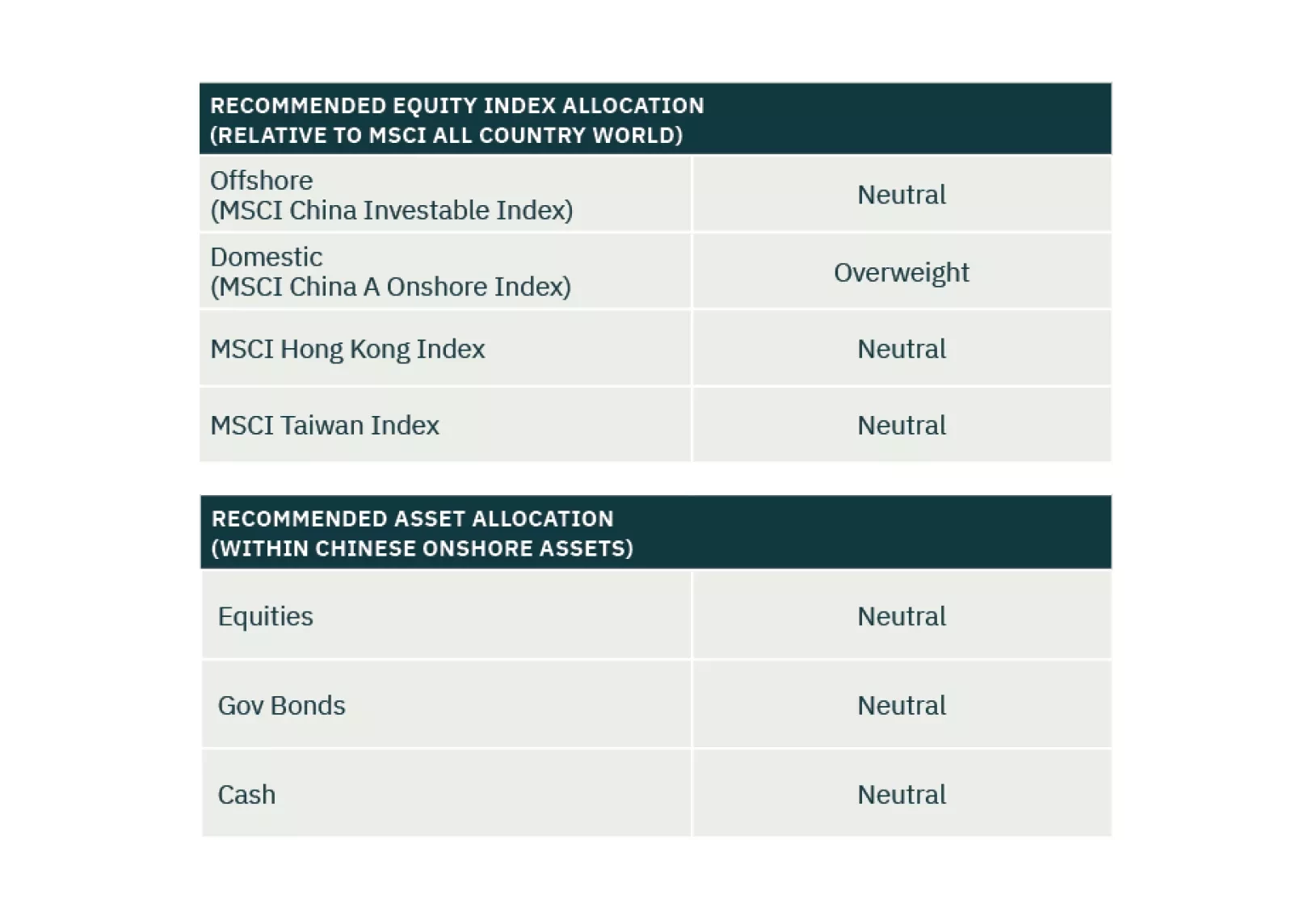

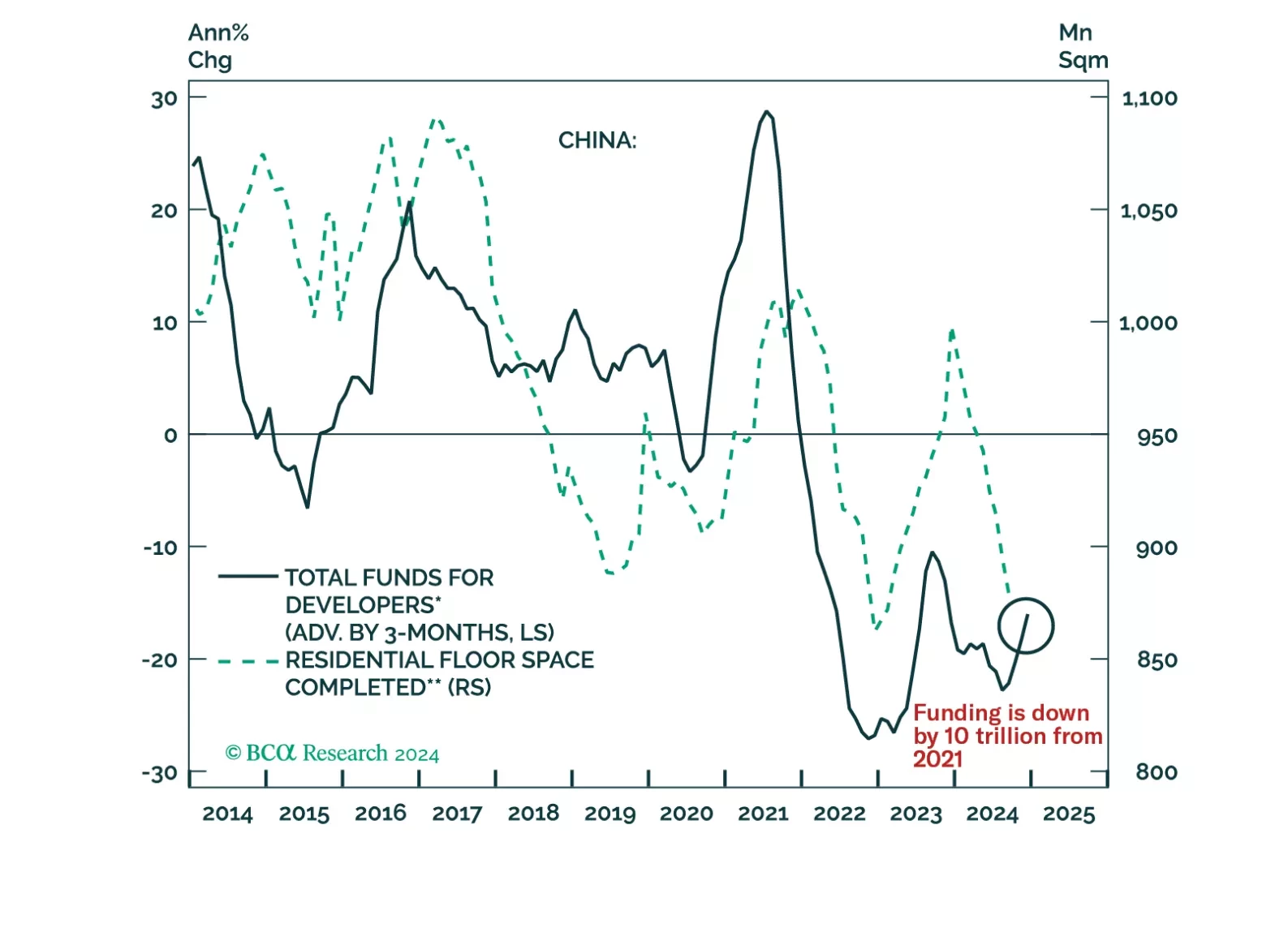

The fiscal stimulus announced at this year’s National People’s Congress is only slightly larger than last year’s. Notably, the details of the measures suggest that it will be challenging for fiscal stimulus to effectively…

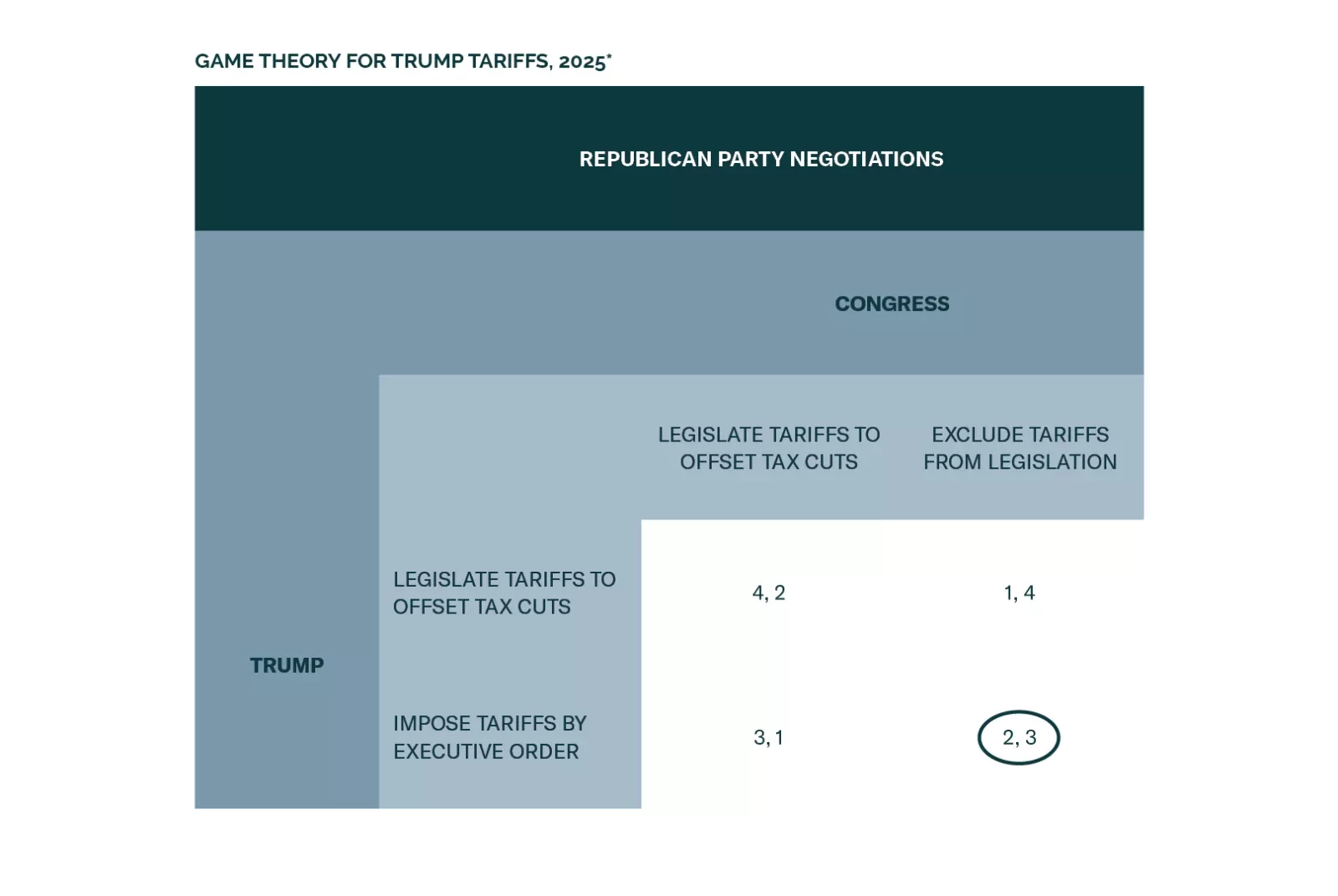

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

This week we conduct a thorough audit of our open positions by revisiting the original basis and subsequent performance of all 13 cyclical recommendations. Following the review, we recommend closing 6 of the 13 positions.

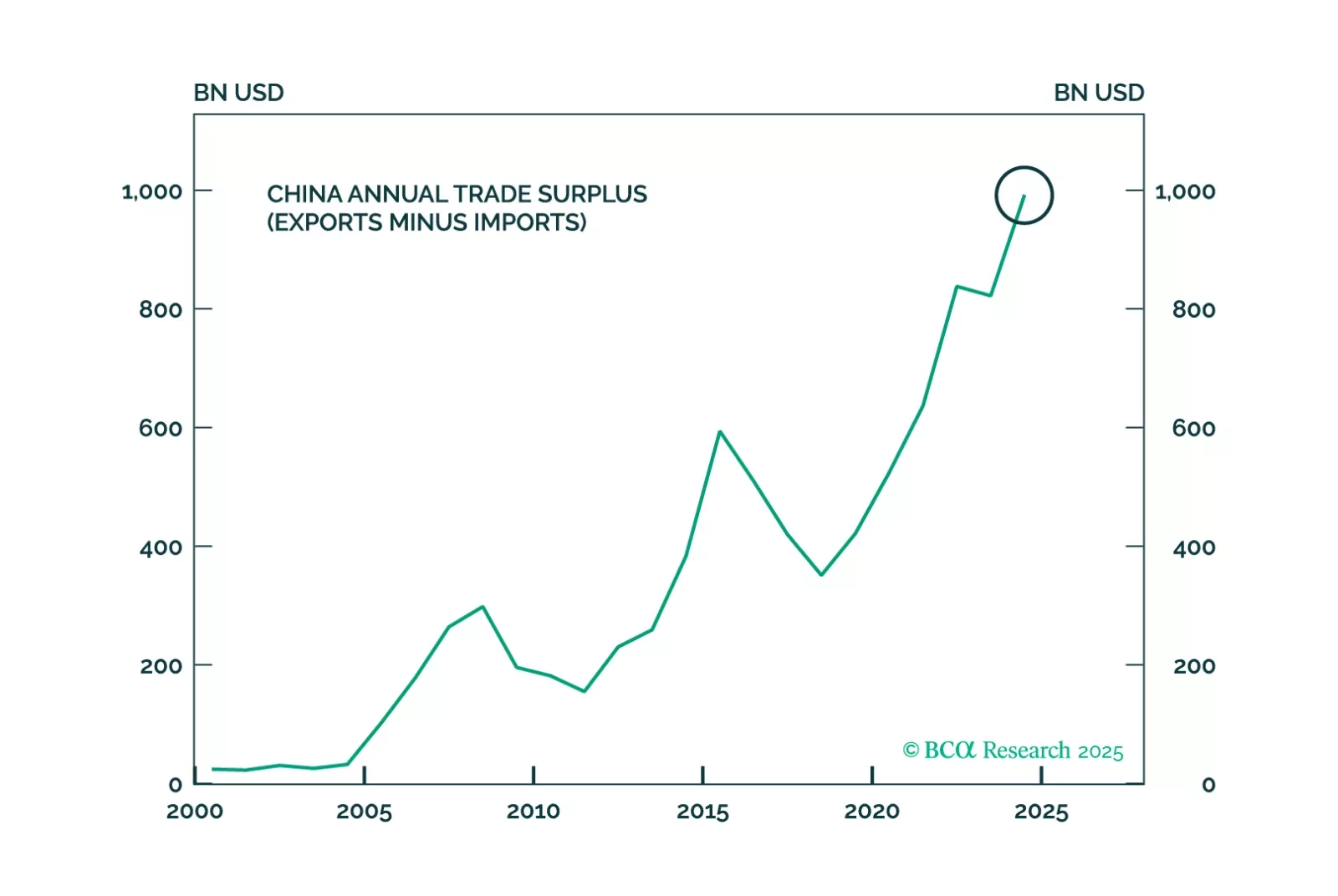

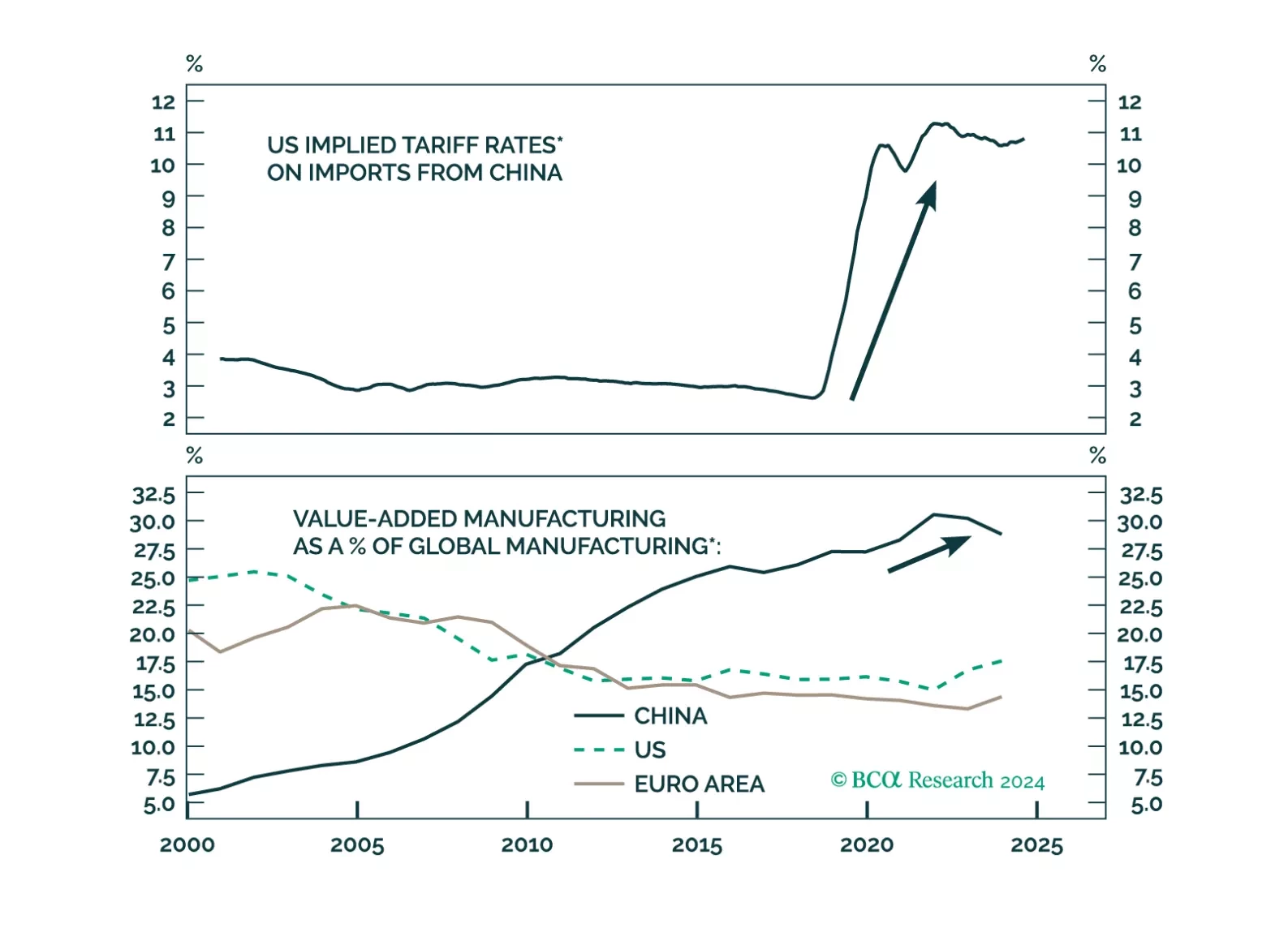

Trump's presidential re-election makes US tariff rate hikes on Chinese exports an imminent threat. Beijing has made extensive efforts to derisk the domestic economy and diversify trade away from the US. However, China is no better…

We spent last week visiting our clients in China. In this report, we share some of the key questions from the client meetings as well as our responses.