Is China completely abandoning its dynamic zero-COVID policy? When will the economy start recovering? What are the implications for Chinese stocks and China-related assets?

Have authorities provided enough financing to property…

Recession is not yet fully priced in, so markets have further to fall next year. But watch for a buying opportunity in the second half.

The Chinese government will repress social unrest, then relax Covid-19 social restrictions to try to stabilize the economy. Russia will be aggressive in the short term but will pursue a ceasefire before March 2024. European and…

Chinese social unrest will be suppressed first, then the government will relax policies to stabilize the economy. We are reducing our 4Q22 Brent forecast to $85/bbl as a result of the short-term negative news, but maintaining our $…

European asset prices have rebounded sharply since September. Can this trend survive in the face of a weak Chinese economy where deflation prevails?

Today, we are sending you the BCA annual outlook for 2023. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

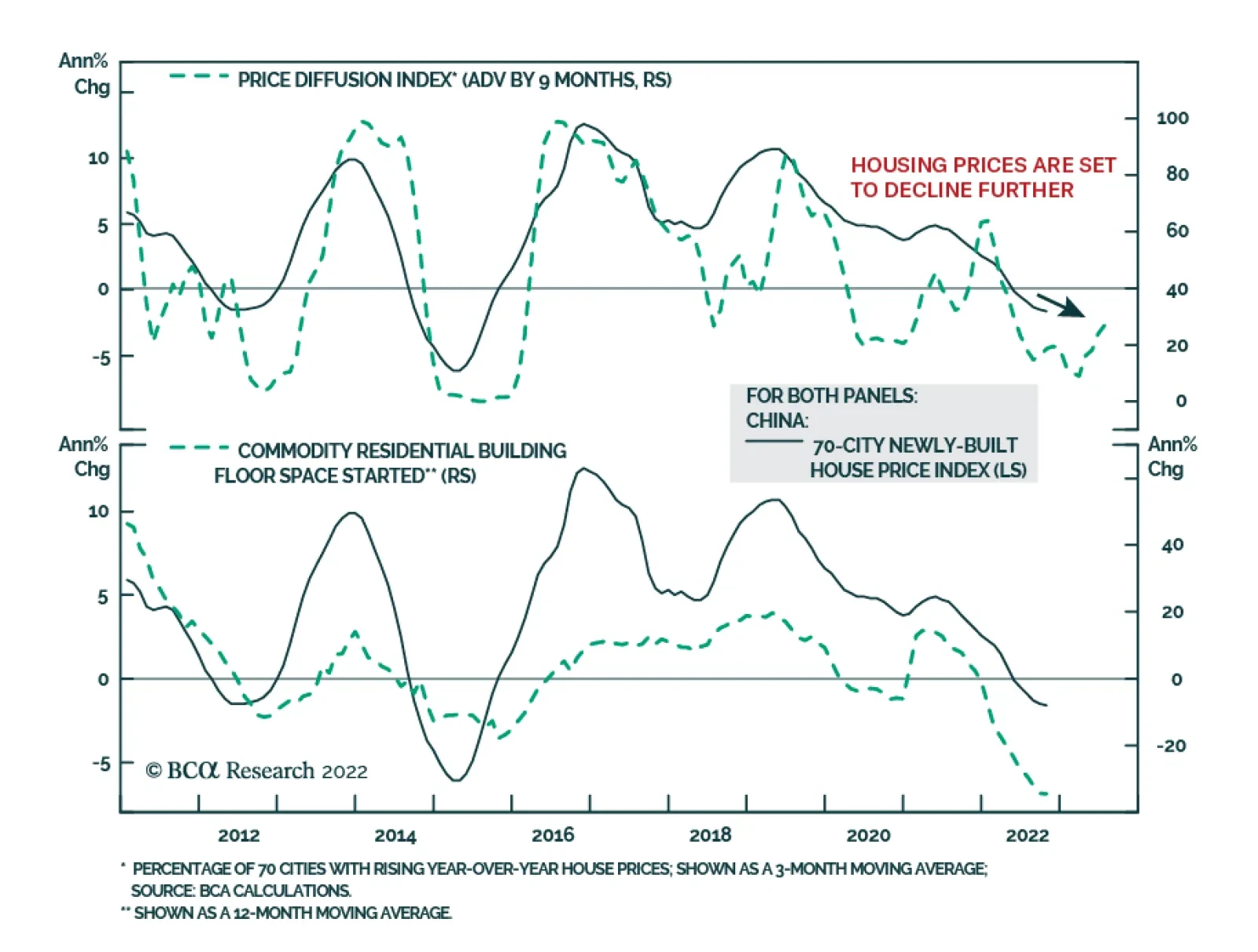

China’s property price declines are accelerating. The contraction in new home prices in Chinese 70 large and medium-sized cities widened to 1.6% y/y in October, compared with 1.5% y/y in September. Meanwhile, 70-city…

China is on the verge of experiencing a full range of deflation. Poor domestic demand will likely continue into 1H 2023 amid the ailing housing market, subdued private-sector sentiment and the zero-Covid policy, warranting a cautious…

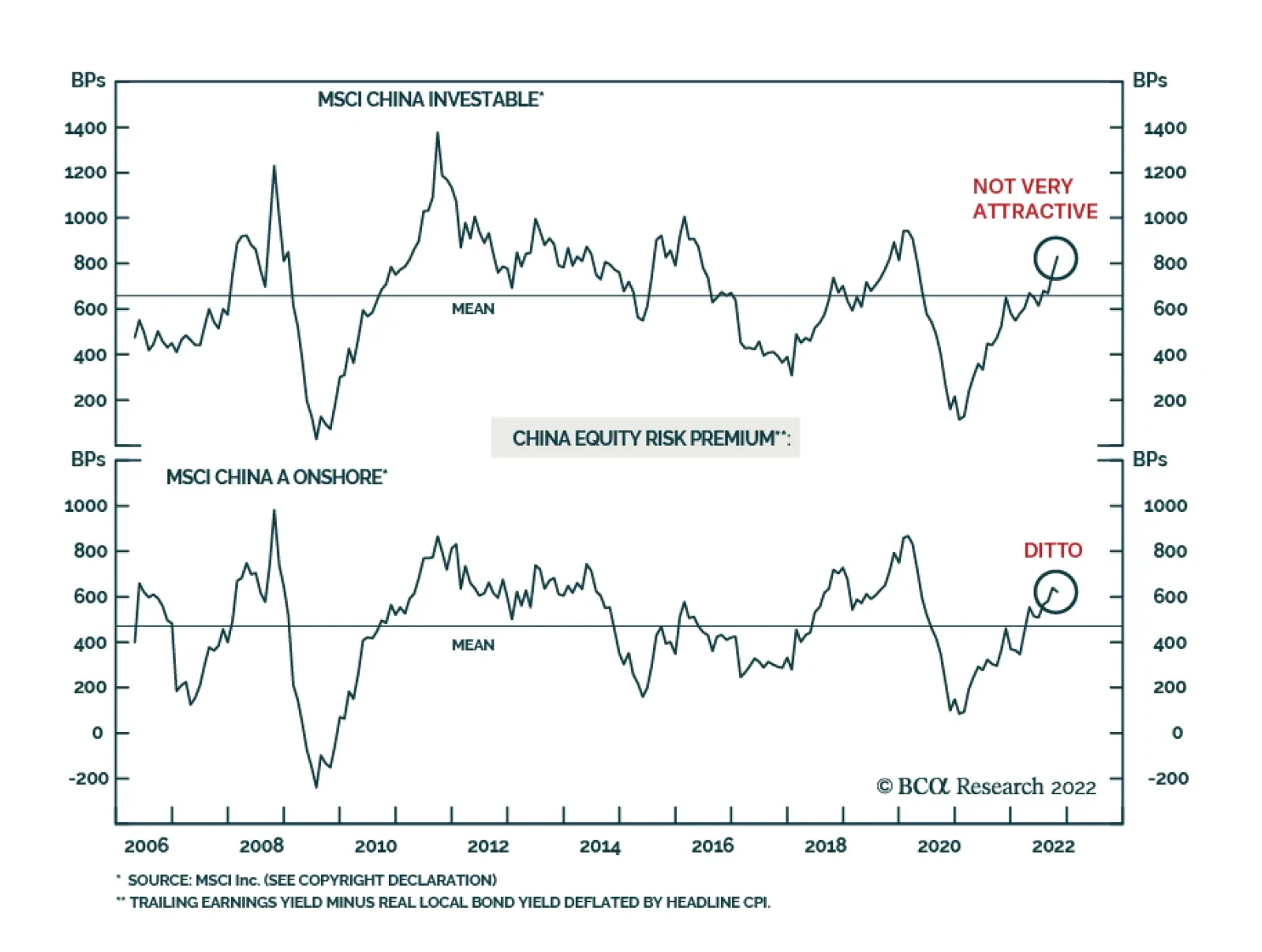

BCA Research’s China Investment Strategy service concludes that although Chinese equity valuations are cheap, the breakdown in share prices below their long-term technical supports merits a vigilant stance. One of the…