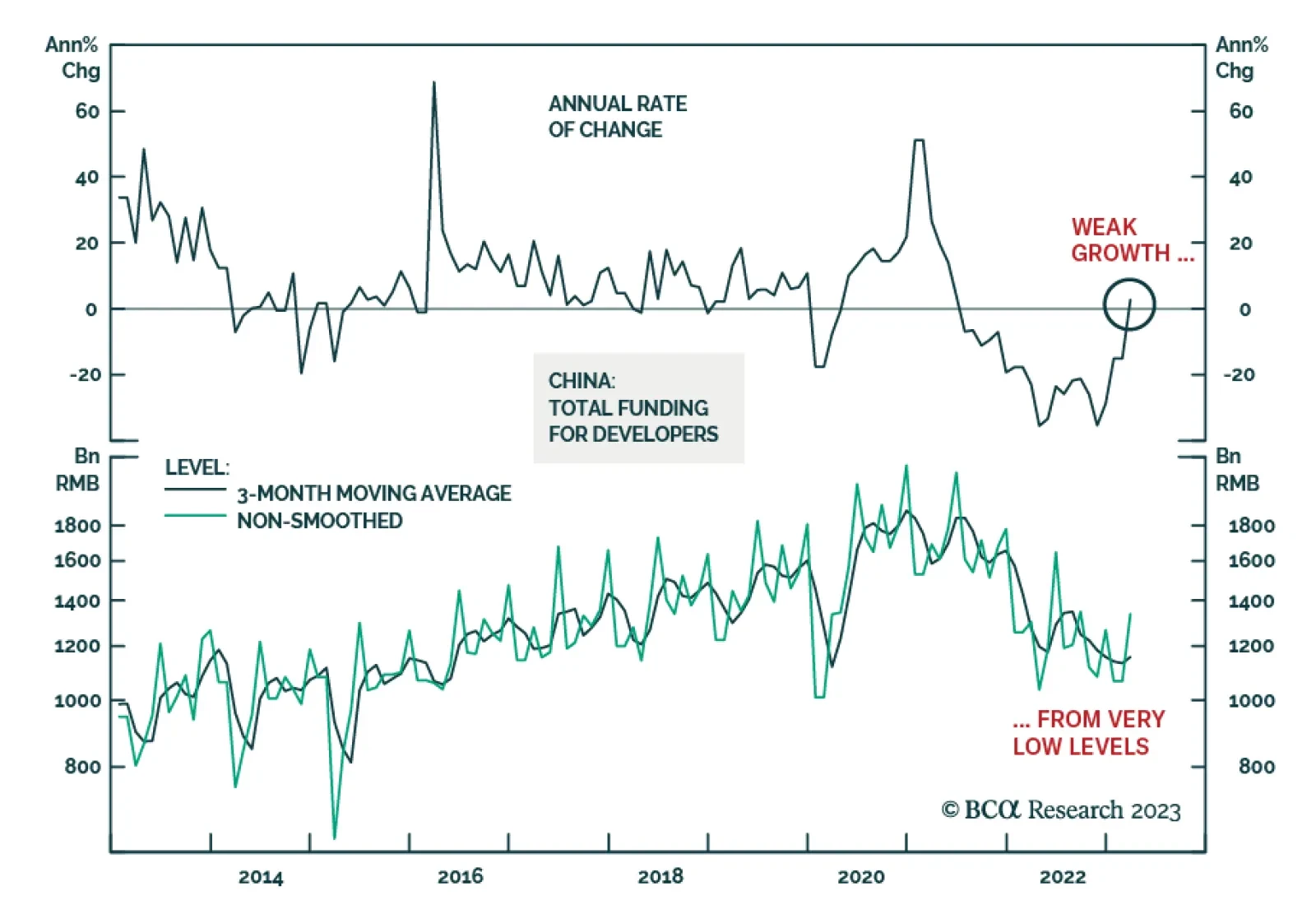

According to BCA Research’s China Investment Strategy service, China’s property market indicators show signs of stabilization, and further mild improvement in the coming months is likely. However, a strong recovery is…

We are increasing our gold price target to $2,200/oz, given the increasing risk of fiscal dominance in the US, rising geopolitical risk, the return of trading blocs and currency debasement risk. These risks also will increase…

The dollar has entered a structural bear market. Although the greenback could get a temporary reprieve during the next recession, investors should position for a weaker dollar over the long haul.

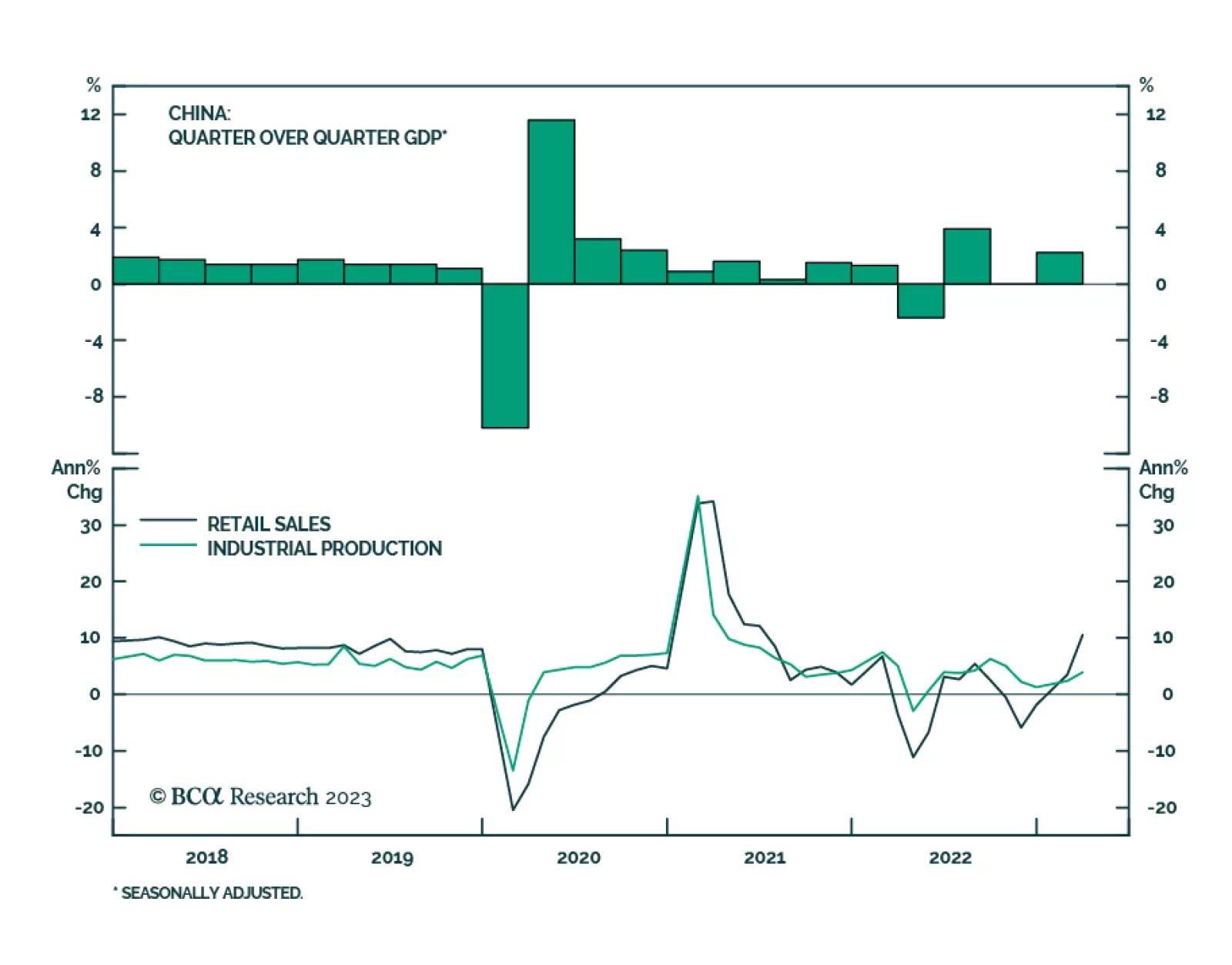

China's recovery will be driven by consumer spending in general and on services in particular, while industrial sectors will disappoint.

China’s economic data sent a positive signal about the domestic recovery following the dismantling of pandemic restrictions. GDP growth accelerated from 2.9% y/y in Q4 2022 to 4.5% y/y in Q1 2023, marking the fastest…

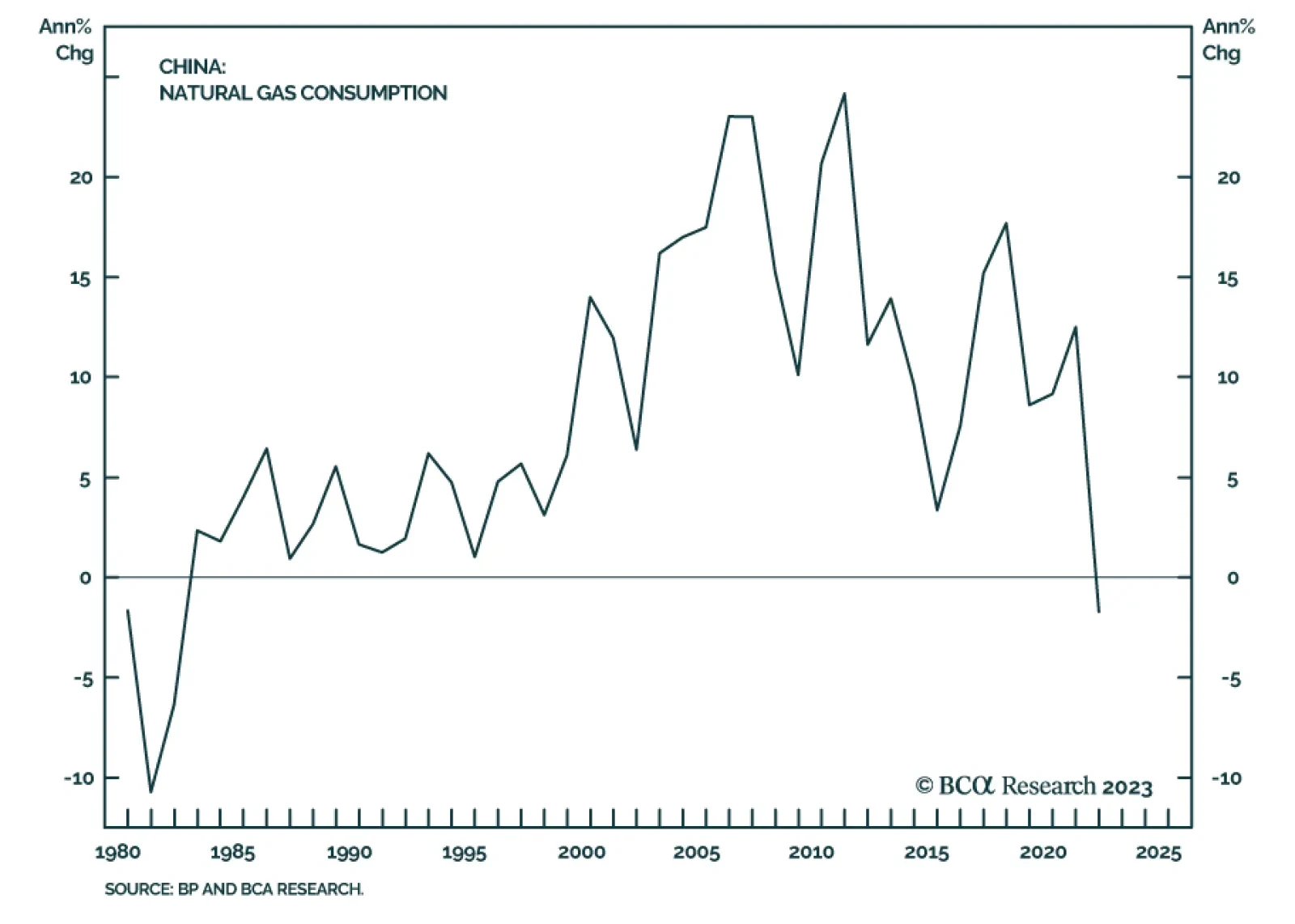

Global natural gas prices have collapsed over the past few months. Prices at the Dutch Title Transfer Facility dropped by 88% since August. According to our China Investment strategists, lower prices will attract Chinese demand…

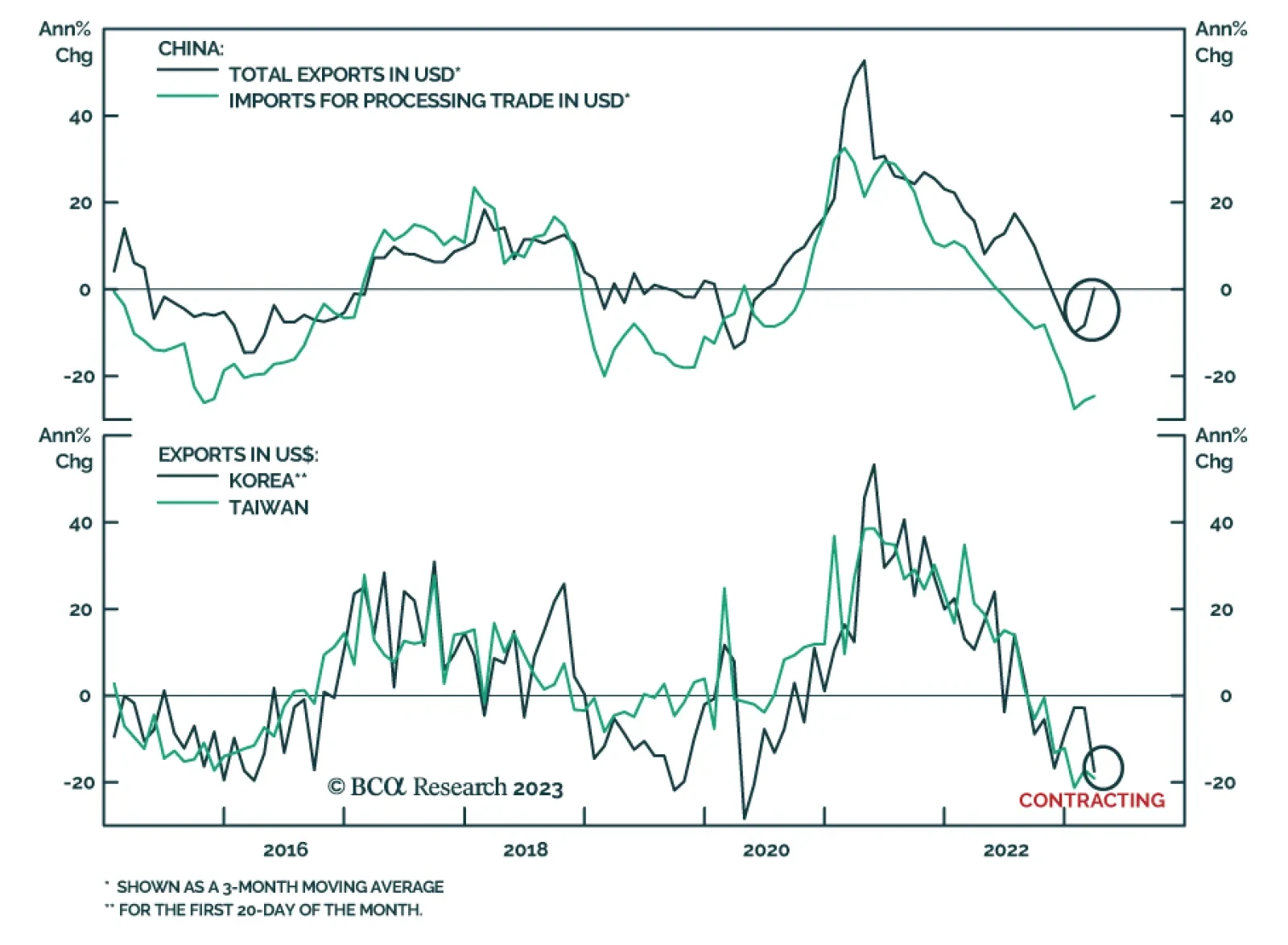

Chinese trade data delivered a strong positive surprise on Thursday. Exports jumped by 14.8% y/y in USD terms in March following five consecutive months of contraction and beating expectations of a 7.1% y/y decline. In particular…

There are several widespread market narratives regarding US inflation, the Fed’s policy, global manufacturing/trade and China’s recovery that we disagree with. In this report, we explain our reasoning and where it puts us in terms of…

No, the secular rise in geopolitical risk has not peaked. EU-China trade ties underscore the multipolar context, but this multipolarity is unbalanced, as the US has not reached a new equilibrium with its rivals. While the second…