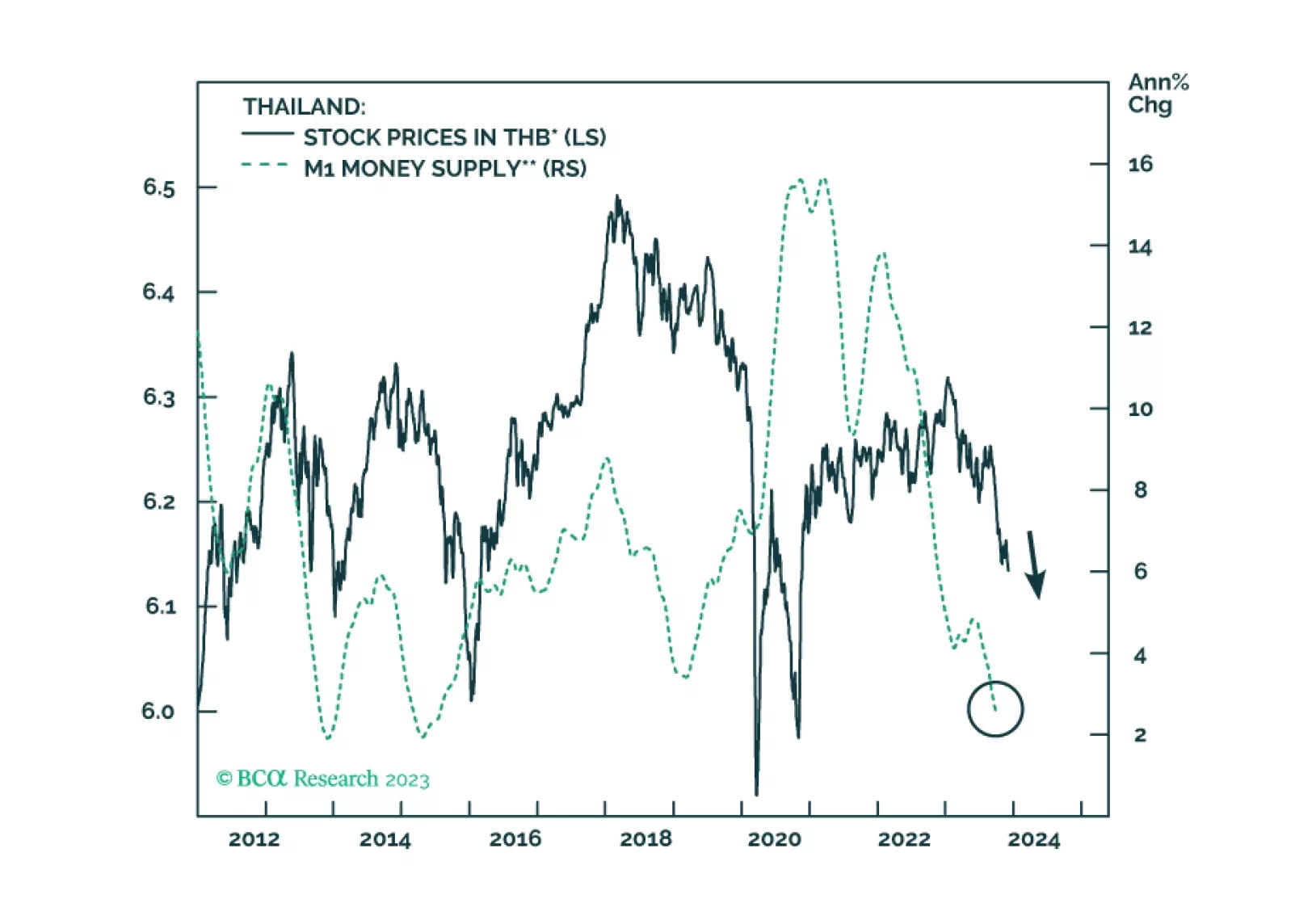

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

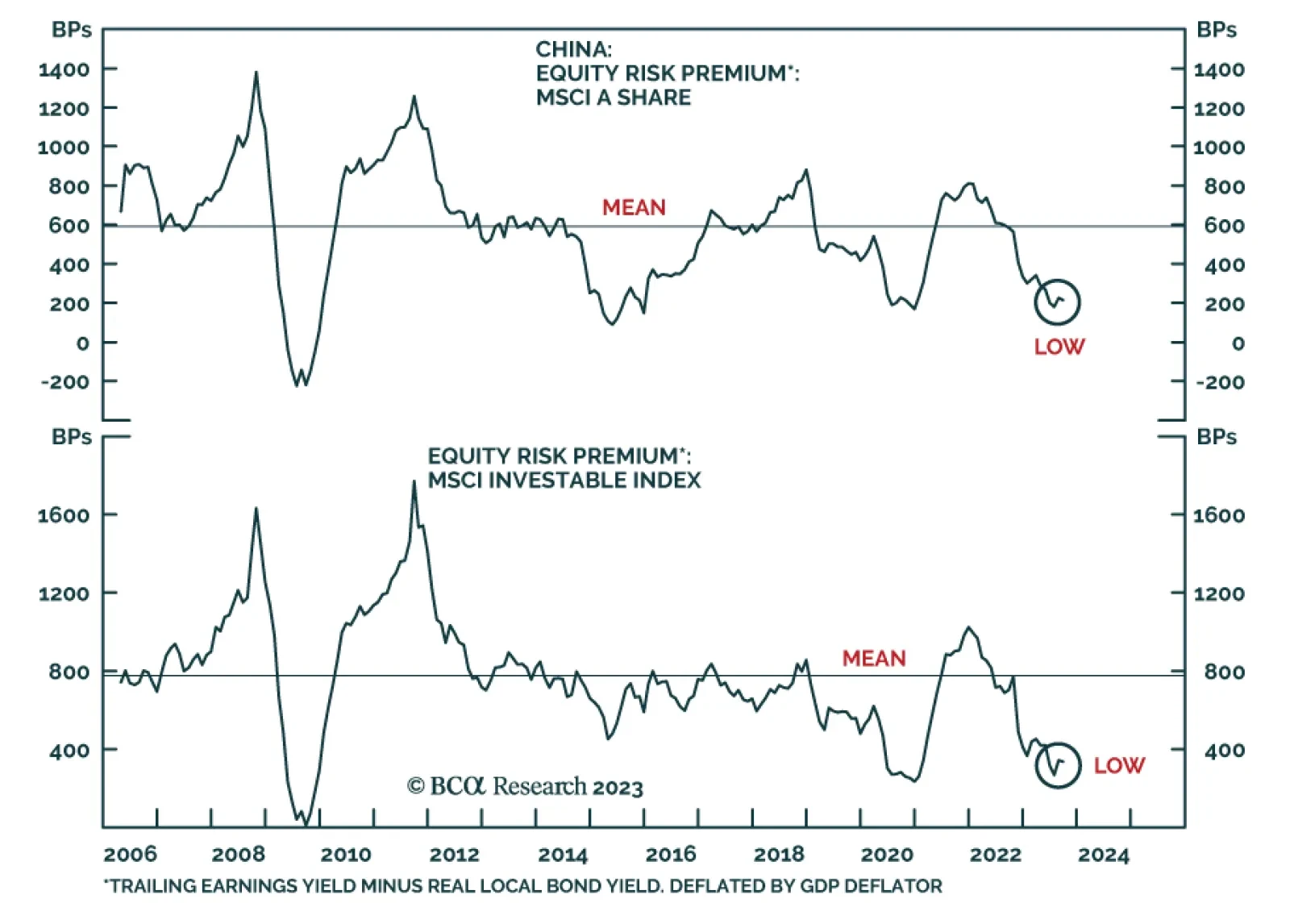

China’s CSI 300 equity index closed at its lowest level since early 2019 on Tuesday following news that Moody’s downgraded its outlook for China’s credit rating from stable to negative. The report cited the…

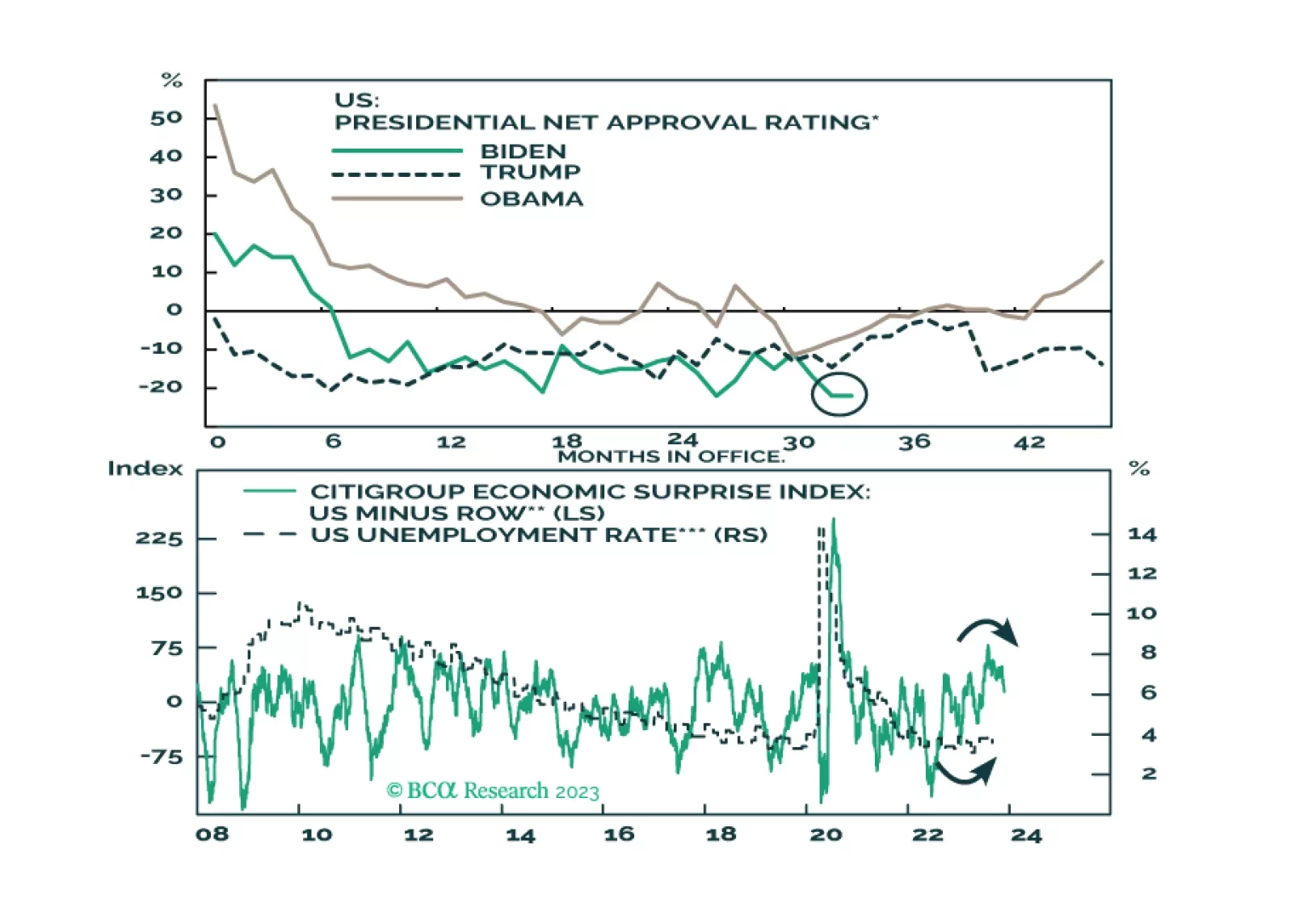

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

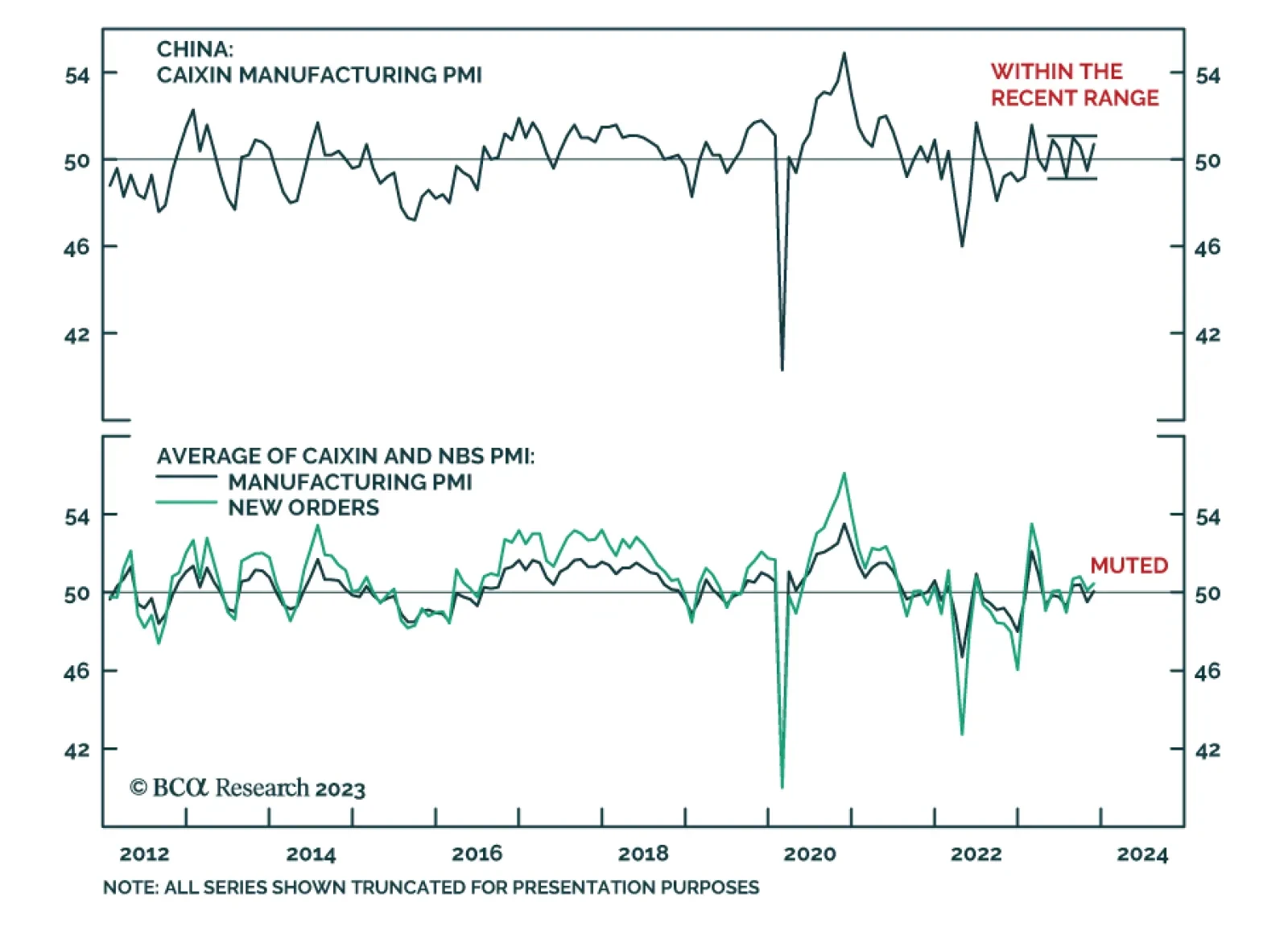

The Caixin manufacturing PMI delivered a positive surprise about the Chinese economy in November. The PMI unexpectedly showed manufacturing activity expanded last month, breaking above the 50 boom-bust line to a three-month high…

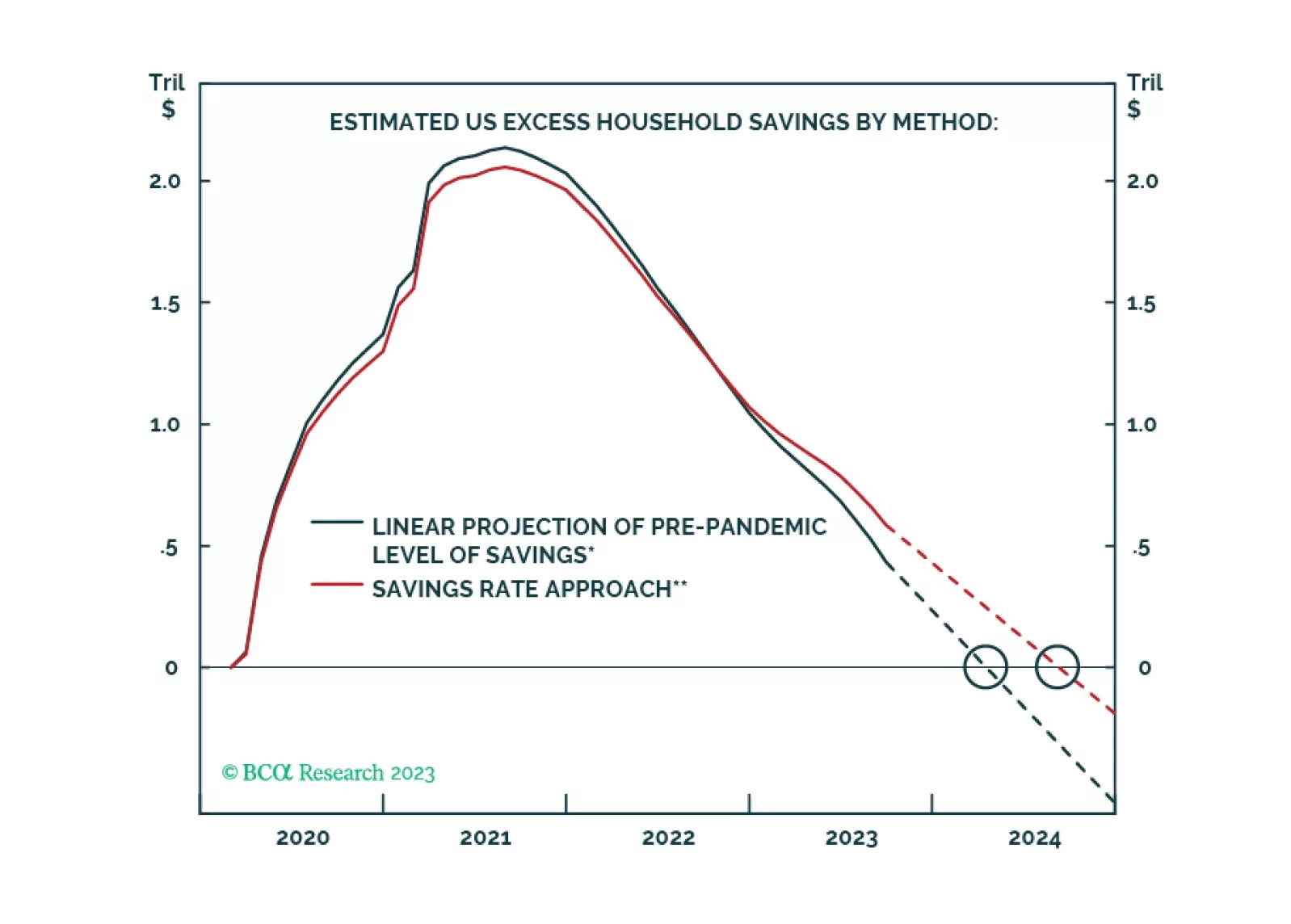

Inflation won’t fall fast enough for the Fed to cut rates preemptively before recession arrives. The risk/rewards balance is unfavorable for risk assets. Stay overweight bonds versus equities.

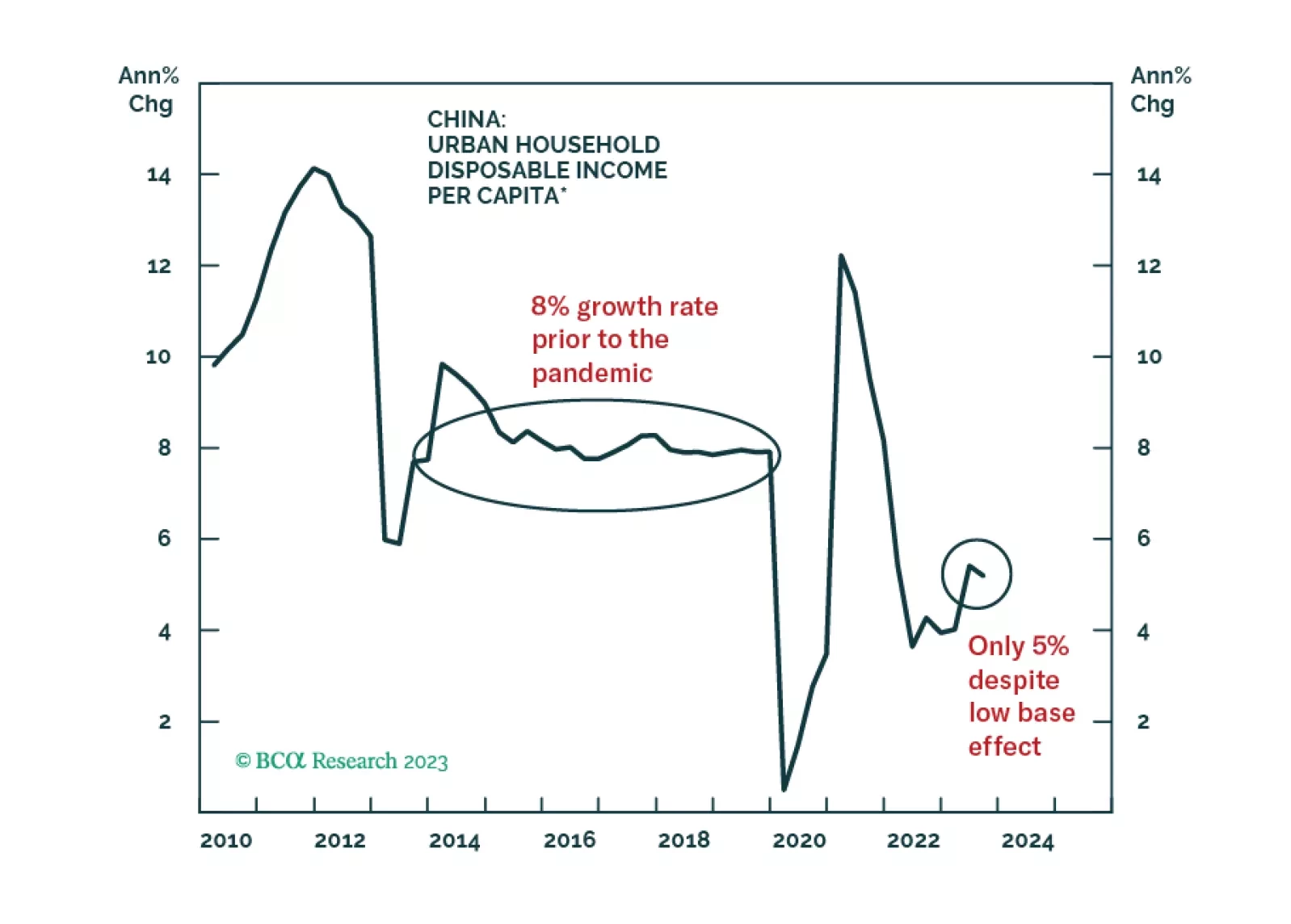

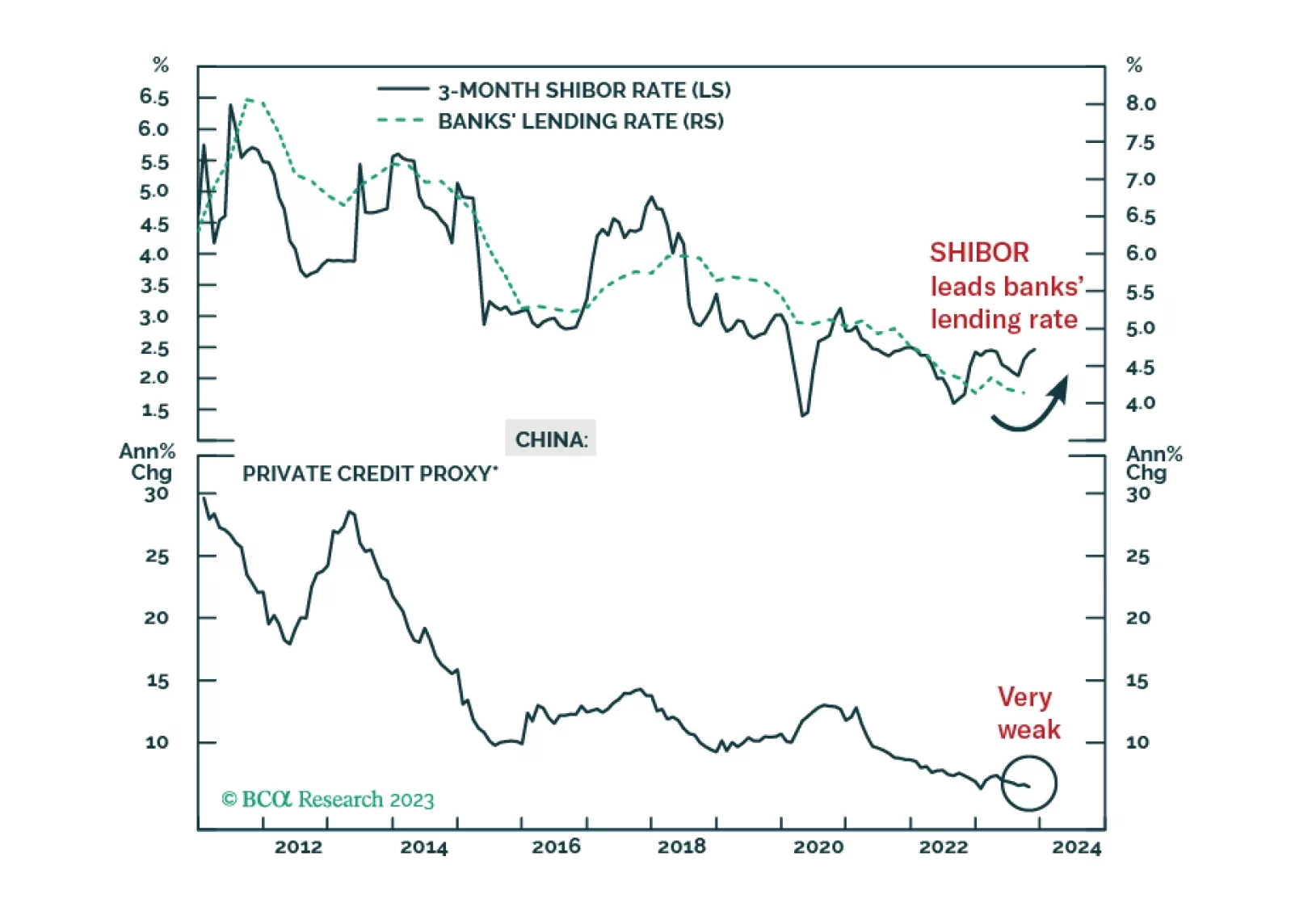

A cyclical recovery in China’s economy is still not imminent. The PBoC has tightened interbank liquidity to stabilize the exchange rate since late August. This does not bode well for the real economy. The uptick in onshore bond…

Chinese industrial profits for October delivered a pessimistic signal on Monday as the annual growth rate eased to 2.7% y/y. While the latest update marks the third consecutive month of profit growth, it is a sharp slowdown from…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

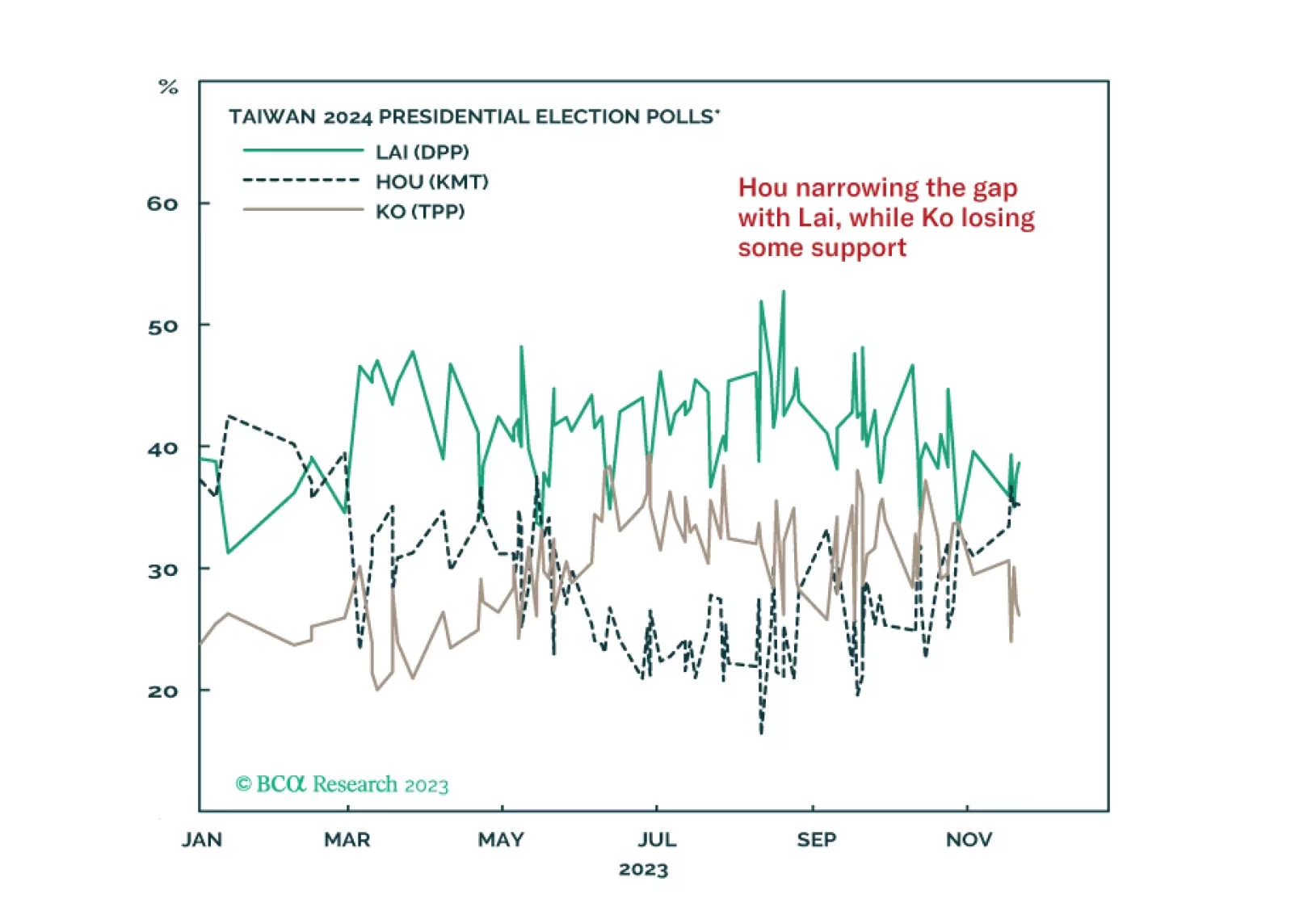

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…