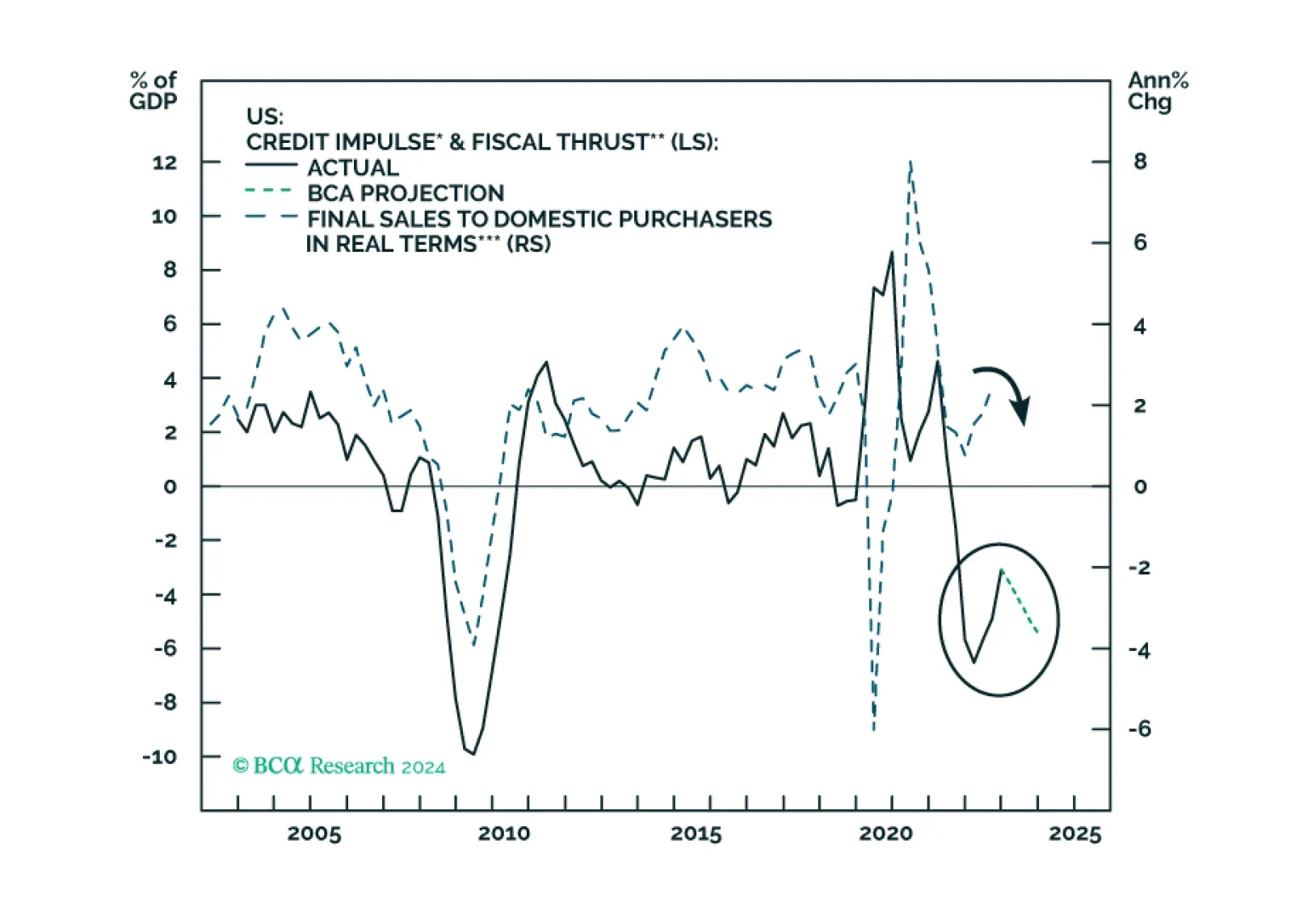

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…

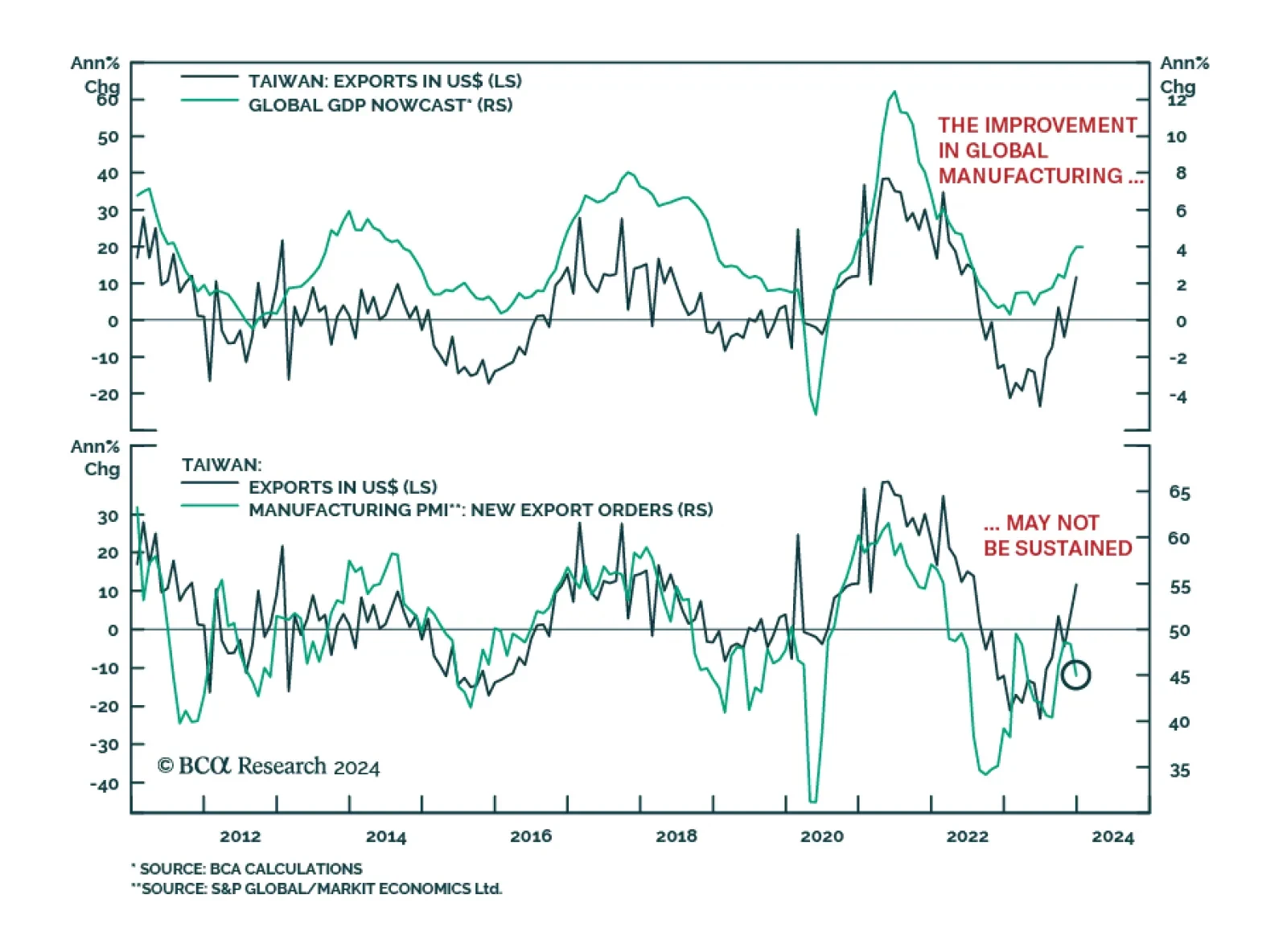

Taiwan’s December trade data corroborates the signal from other Asian exporters (such as South Korea) that global manufacturing activity is experiencing a mini revival. Taiwanese exports surged by 11.8% y/y last month,…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

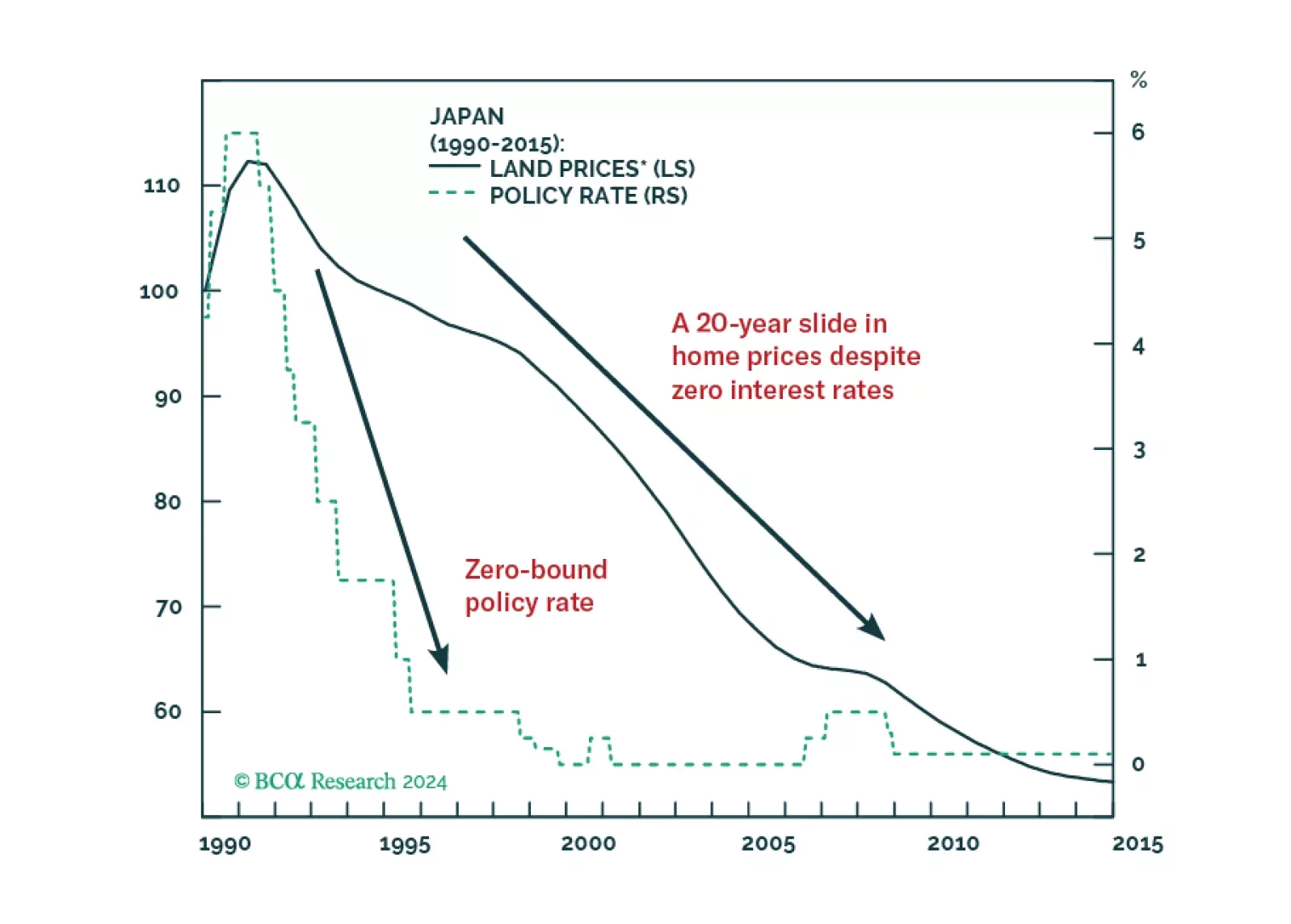

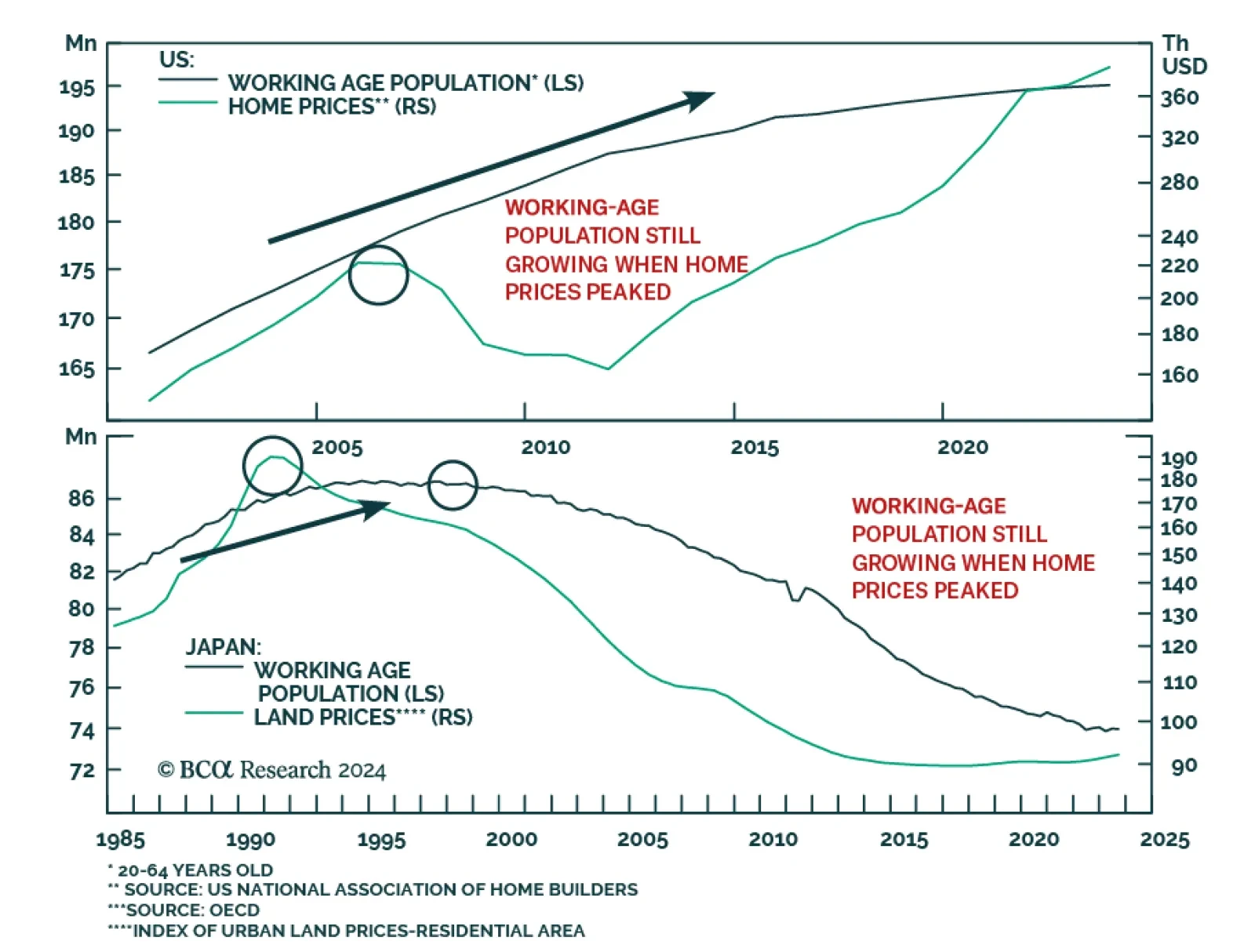

According to BCA Research’s China Investment Strategy service, the structural landscape of China's property market today is, in many aspects, more challenging than the real estate markets in Japan and the US at the peak…

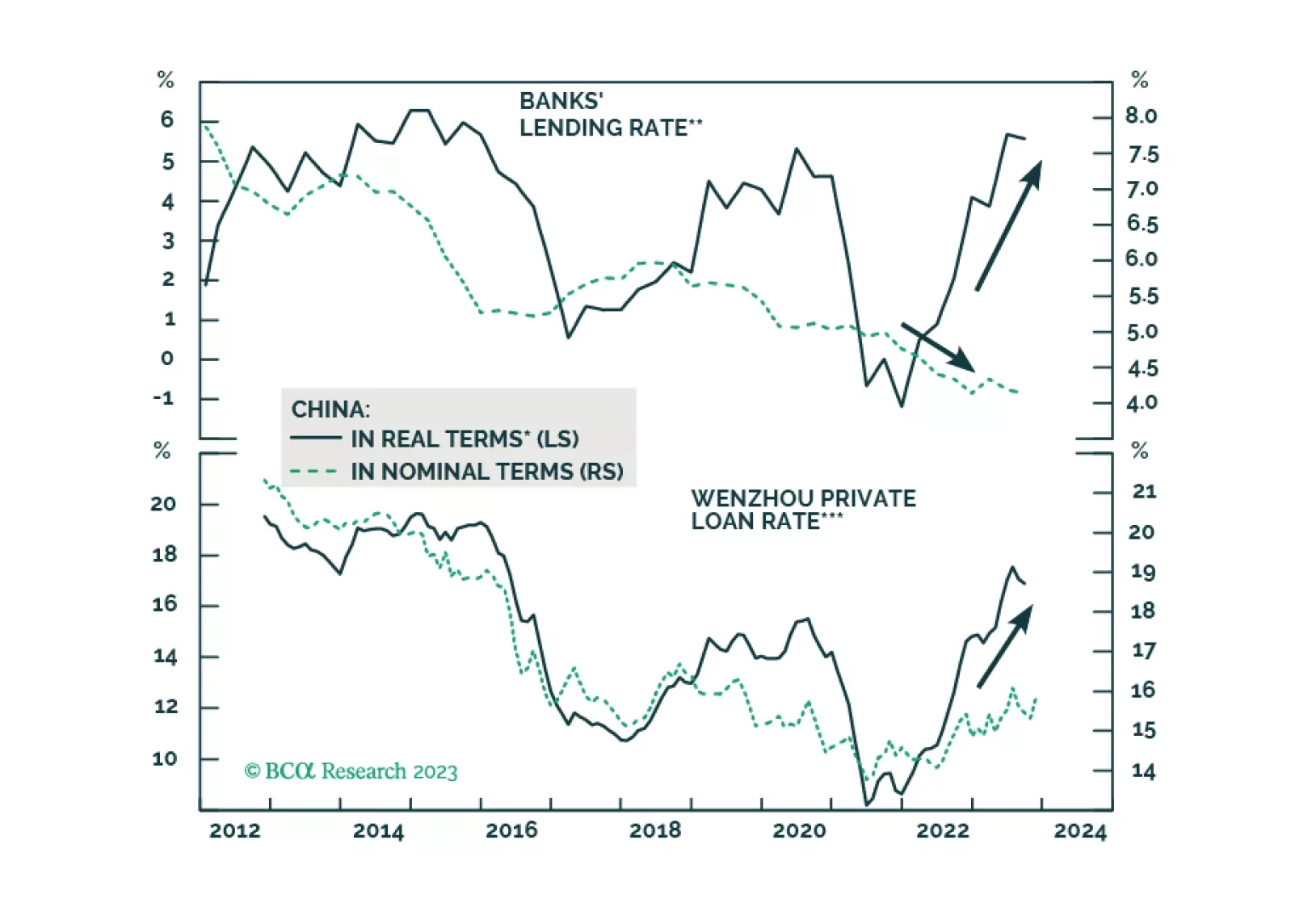

A low multiplier effect of stimulus will reduce the magnitude of the rebound in China's business activities in 2024. The housing market downturn will likely persist, and the ongoing household deleveraging also poses a significant…

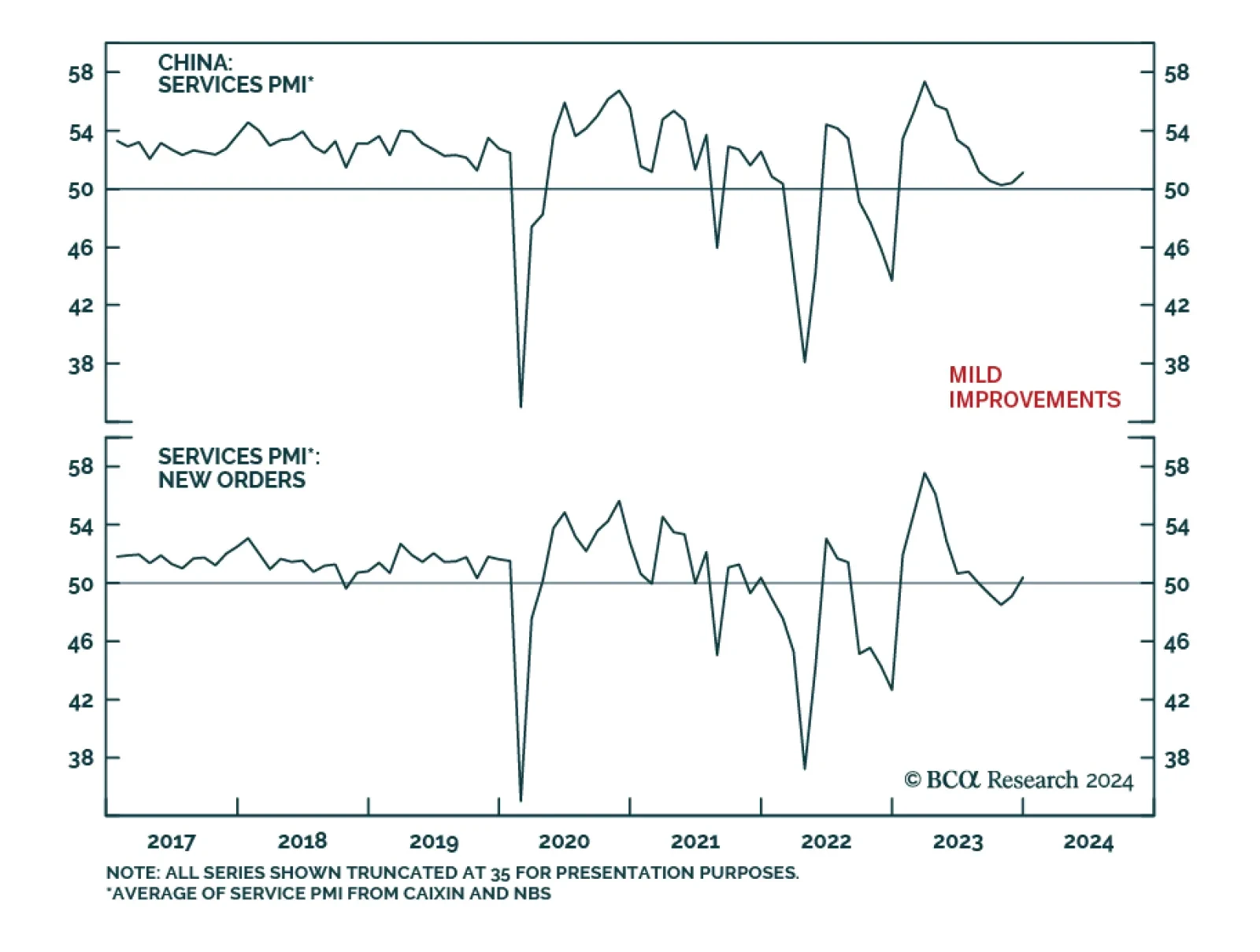

China’s Caixin PMI delivered a positive signal on Thursday. The Services index climbed from 51.5 to 52.9 in December, beating expectations it would remain more or less unchanged. The improvement in the Services PMI lifted…

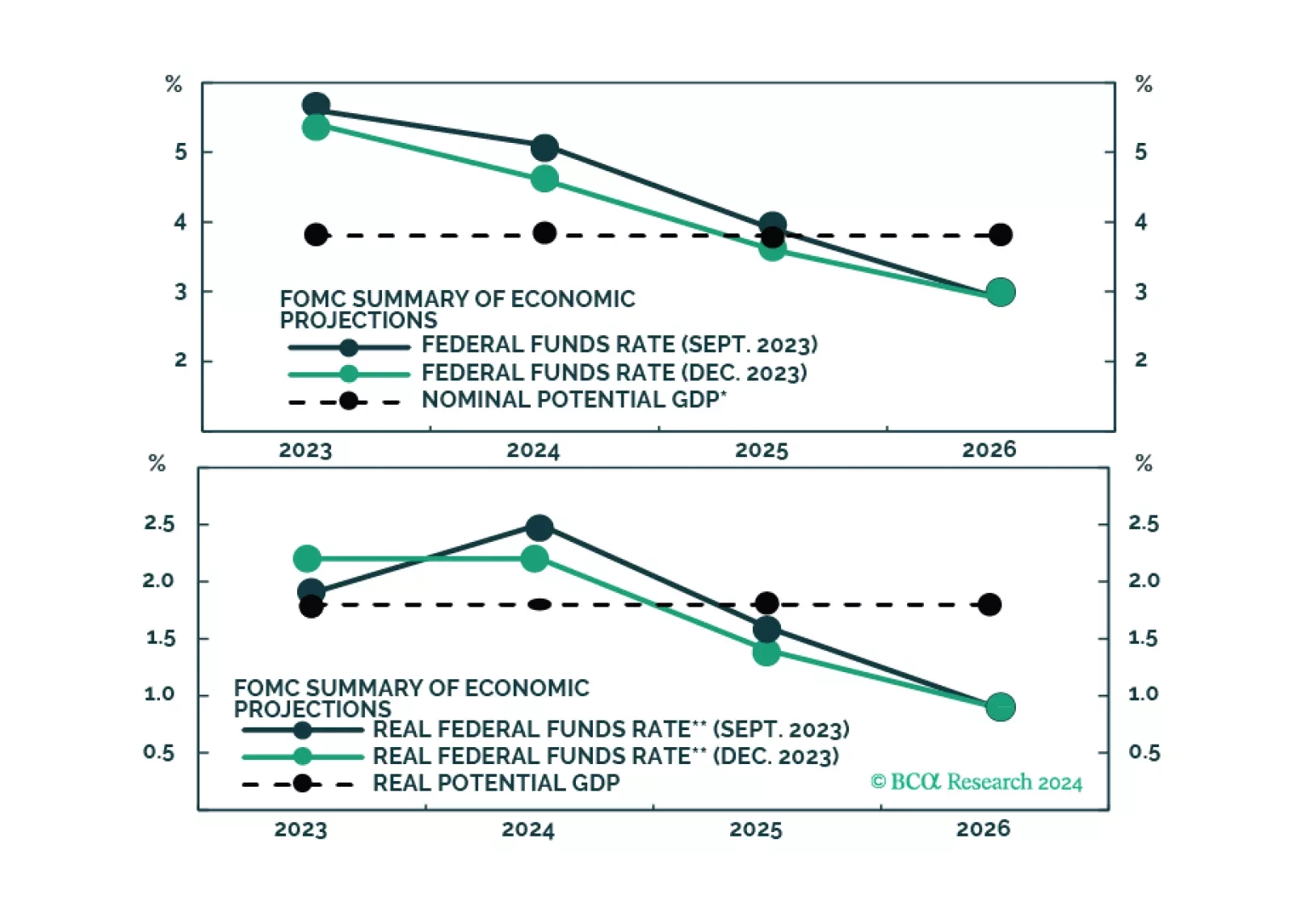

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…