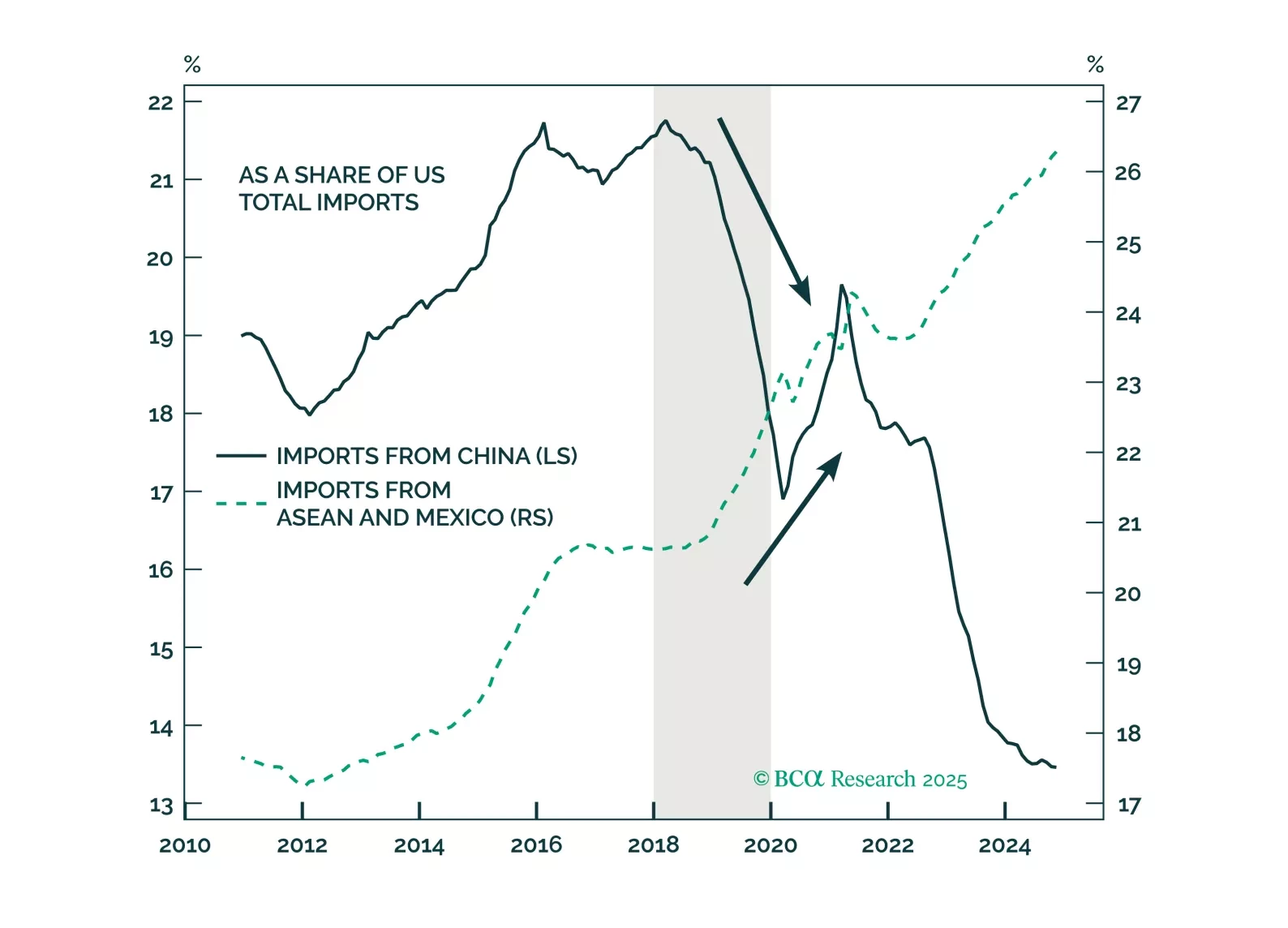

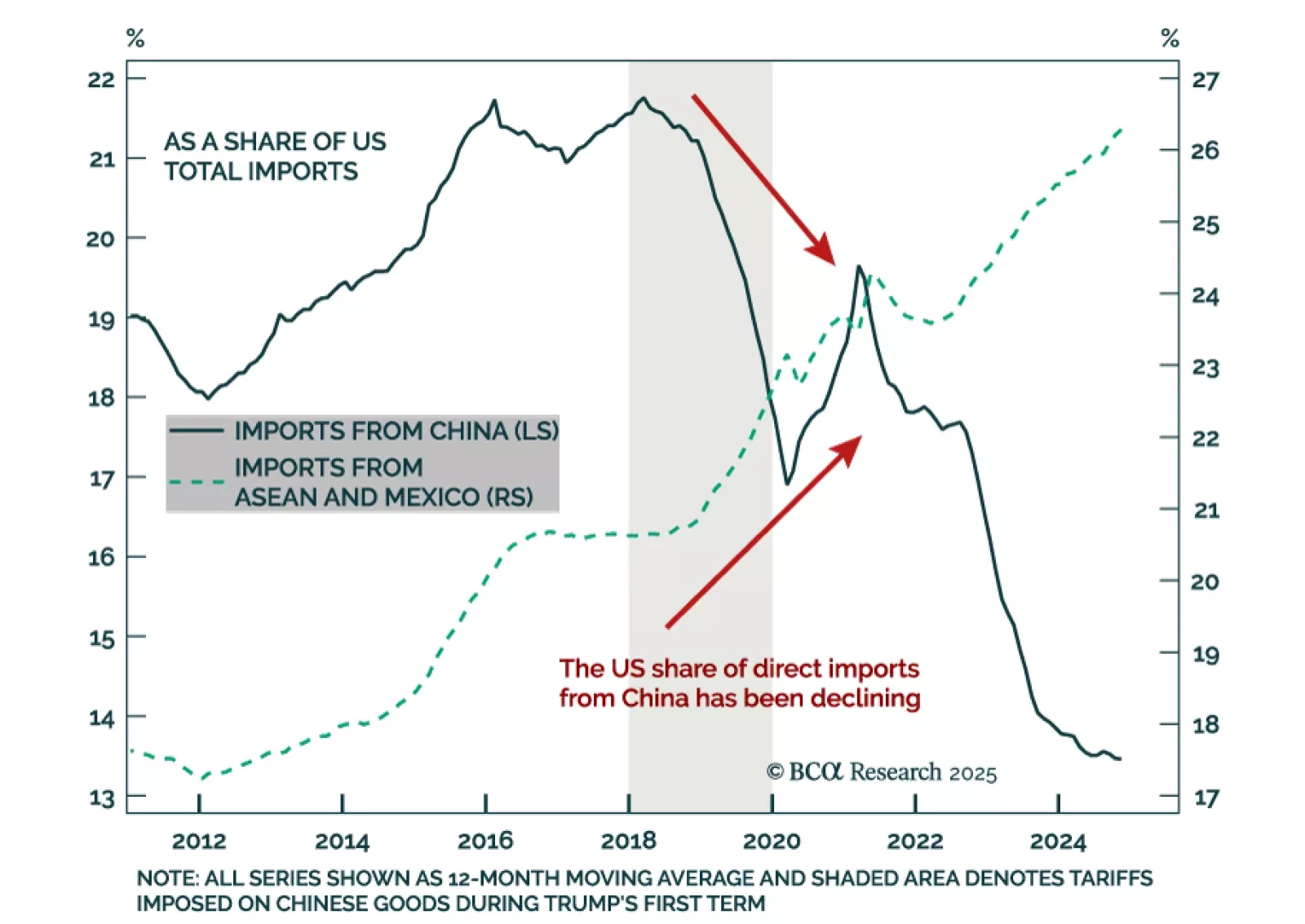

Our China Investment Strategy team explored how the costs of higher tariffs might be distributed among foreign suppliers, US importers, and consumers. The inflationary impact of new US tariffs is likely to remain modest unless…

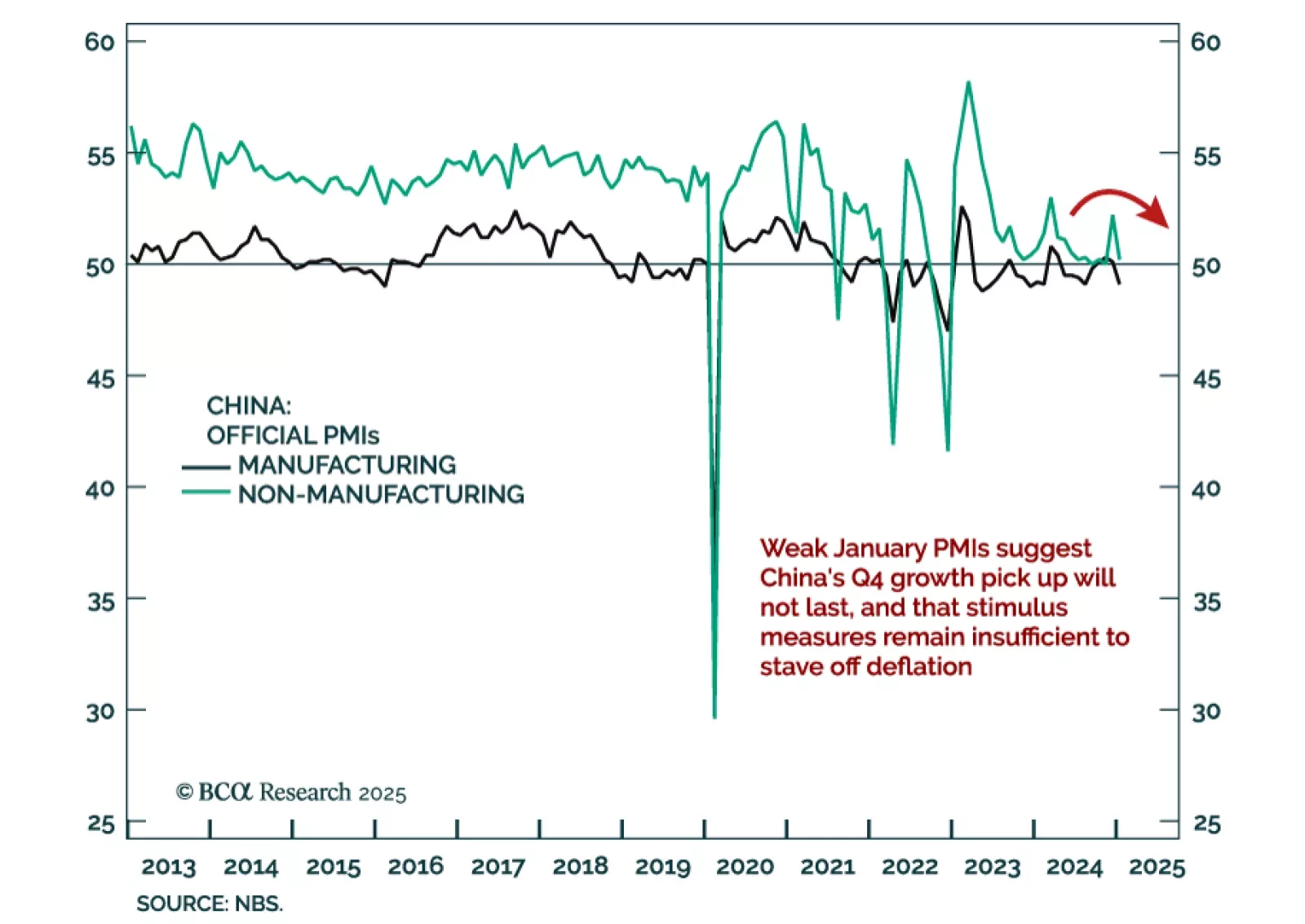

China’s official January PMIs disappointed, with the composite ticking down to 50.1 from 52.2. The decrease was driven by both the manufacturing and non-manufacturing components, with the former indicating contraction, and the latter…

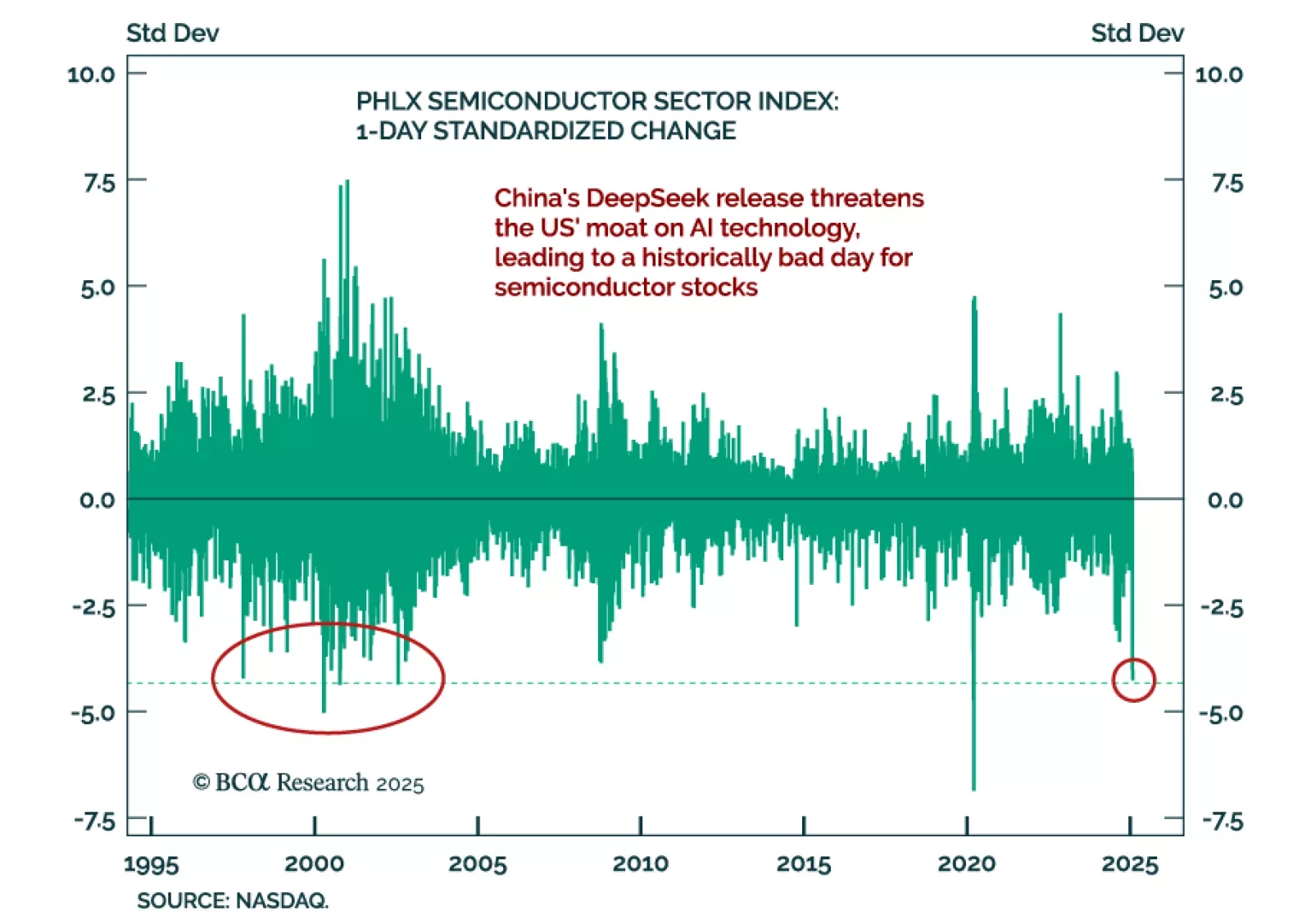

News of a cheaper Chinese-developed AI model sent a tremor through markets, with a selloff in the S&P 500, NASDAQ, and leading tech names associated with AI. The narrative on Monday was that the eye-watering sums spent on AI…

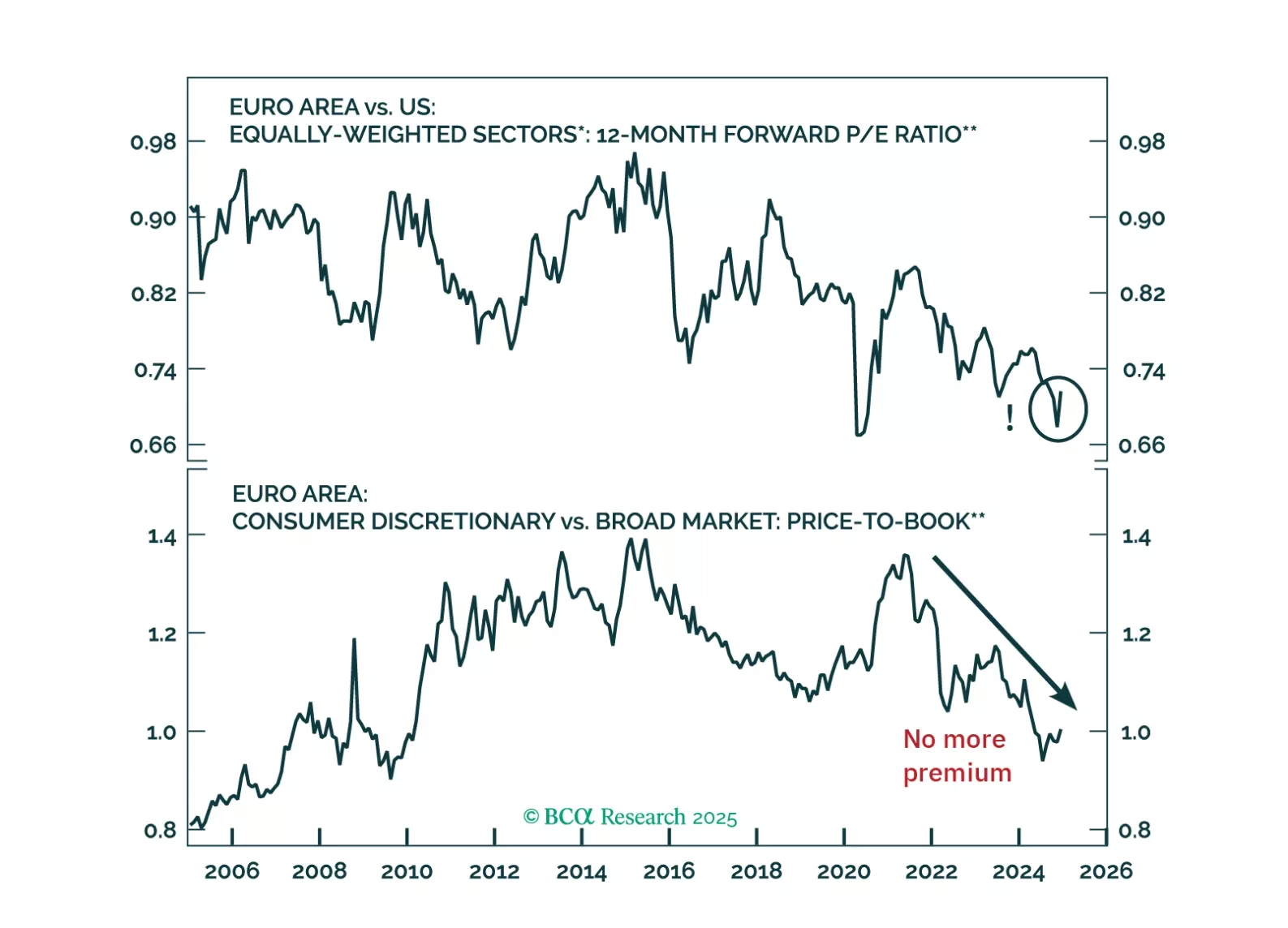

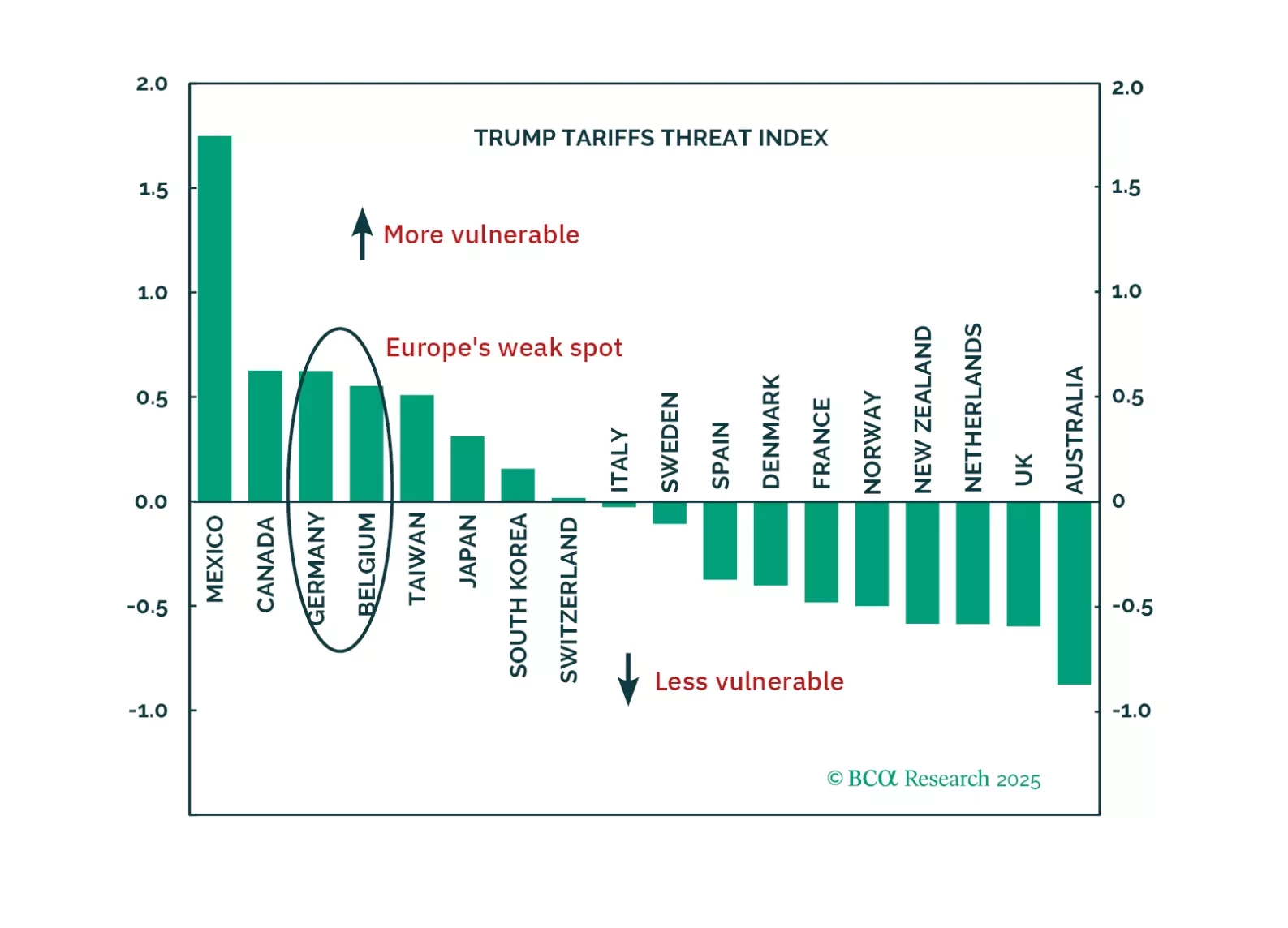

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

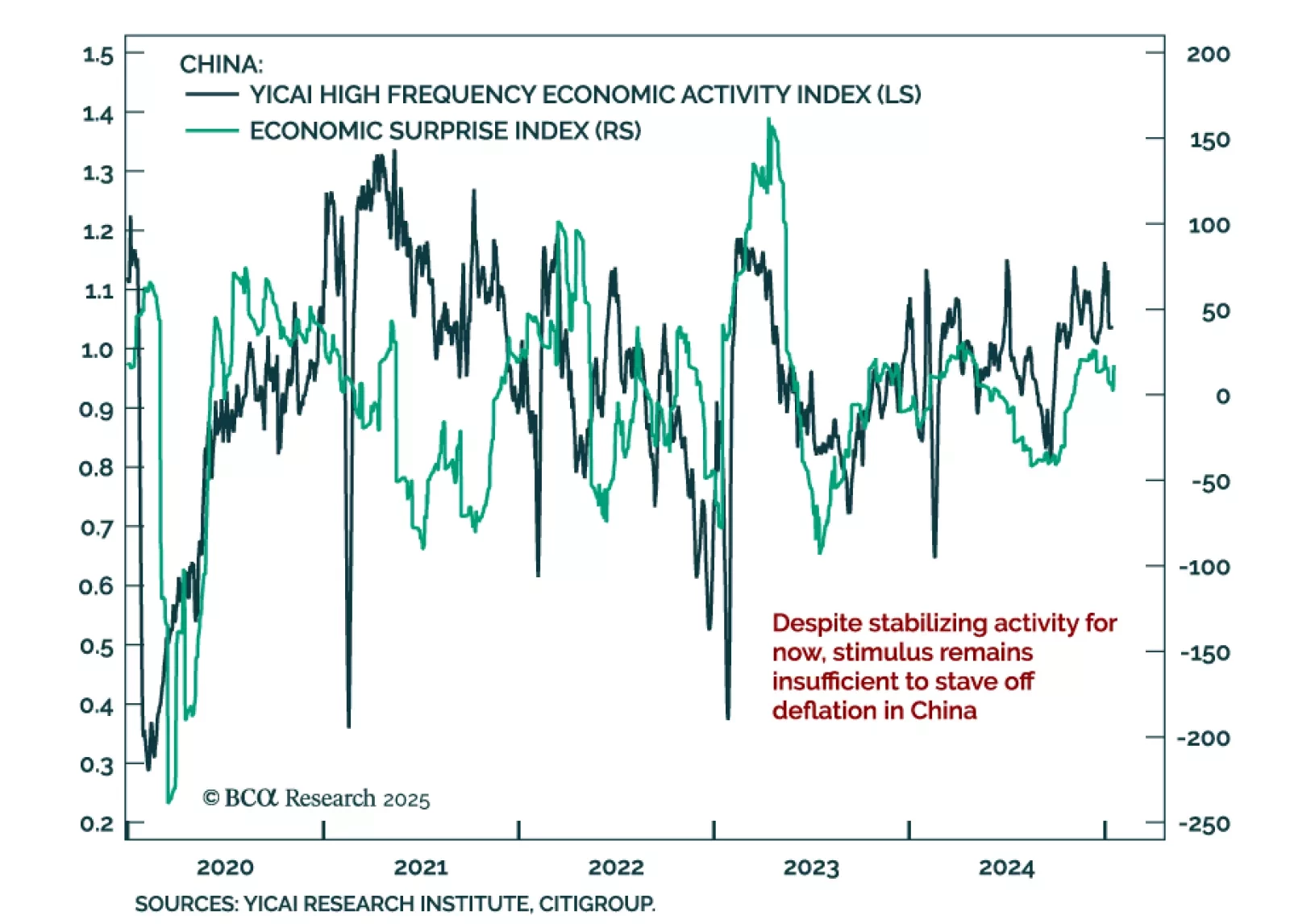

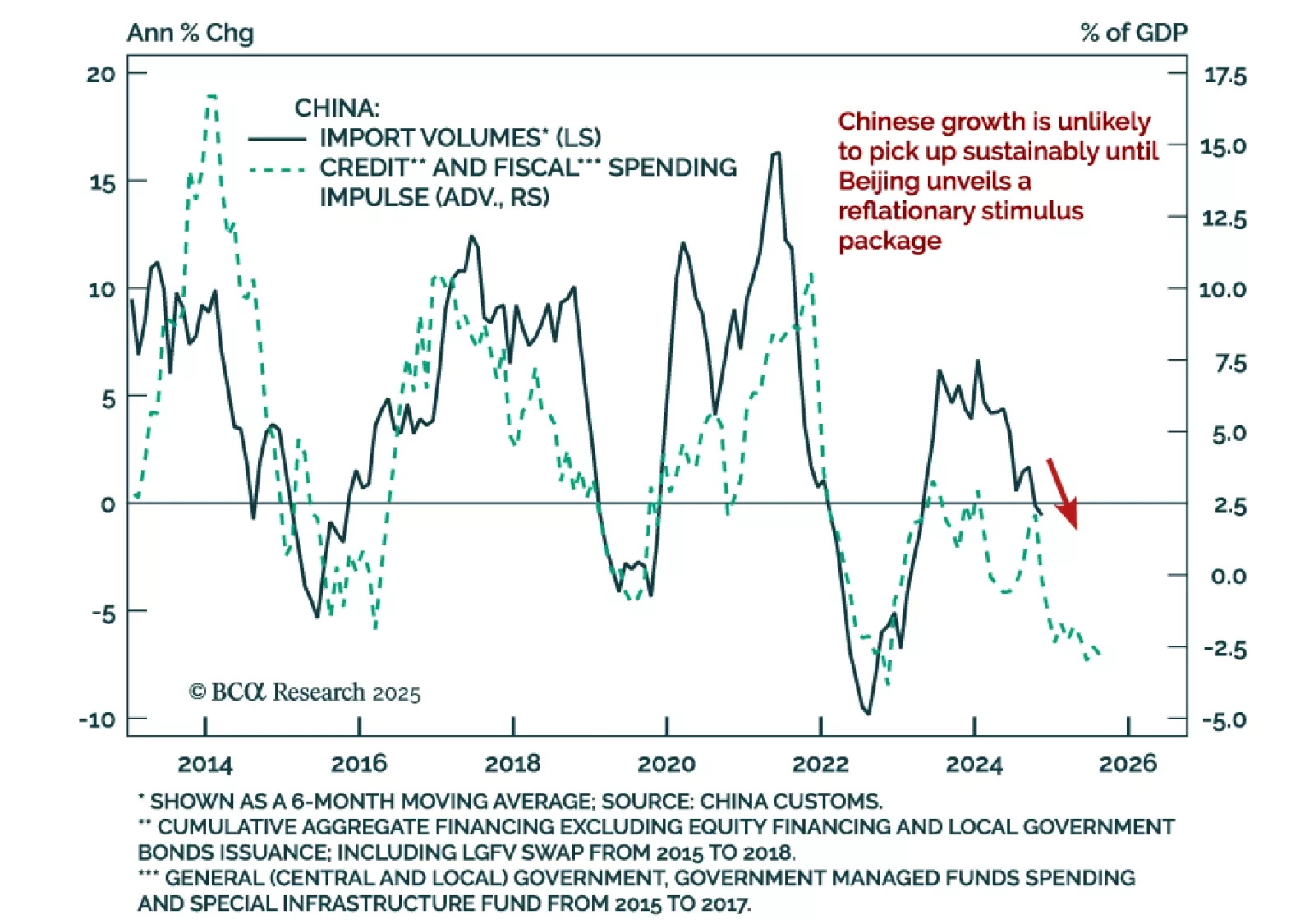

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…

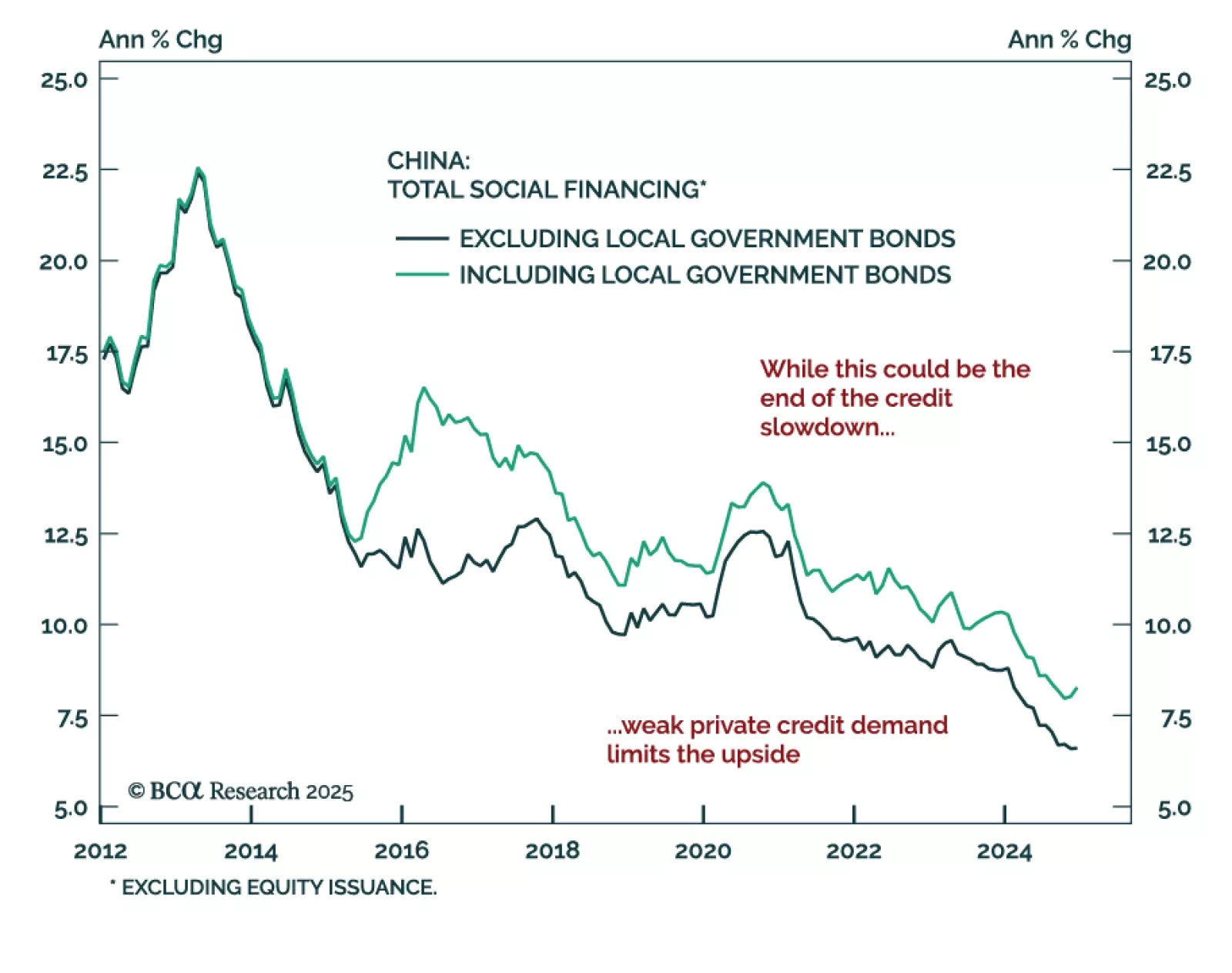

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

China’s December trade data was positive, with exports in USD terms rebounding to 10.7% y/y from 6.7% in November, and imports rebounding to 1.0% from -3.9%. Taken at face value, the numbers are positive for both the Chinese and…