In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

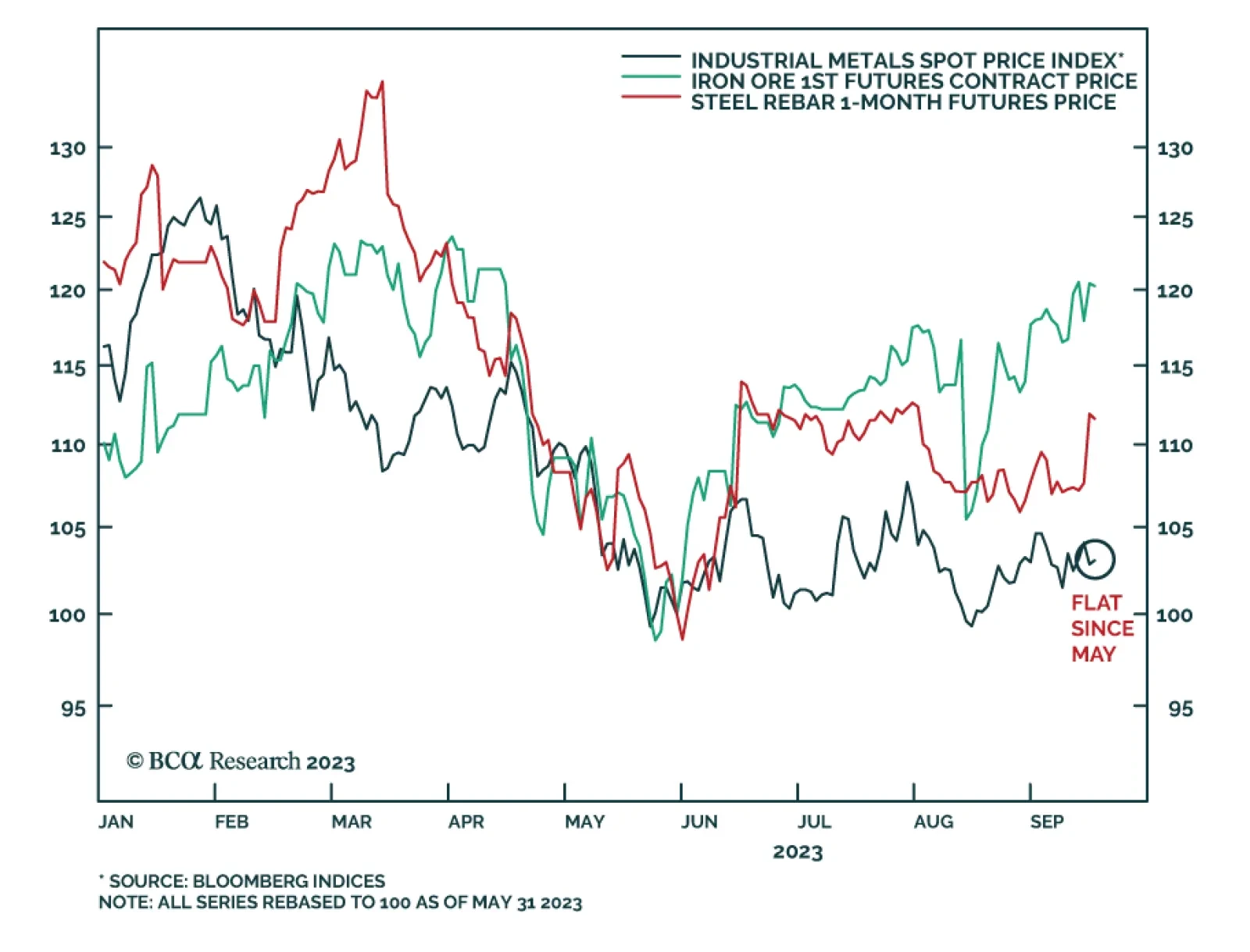

Over the past few months a schism has emerged in the industrial metals complex. On the one hand, the Bloomberg Industrial Metals Index – which is composed of futures contracts on copper, aluminum, zinc, nickel, and lead…

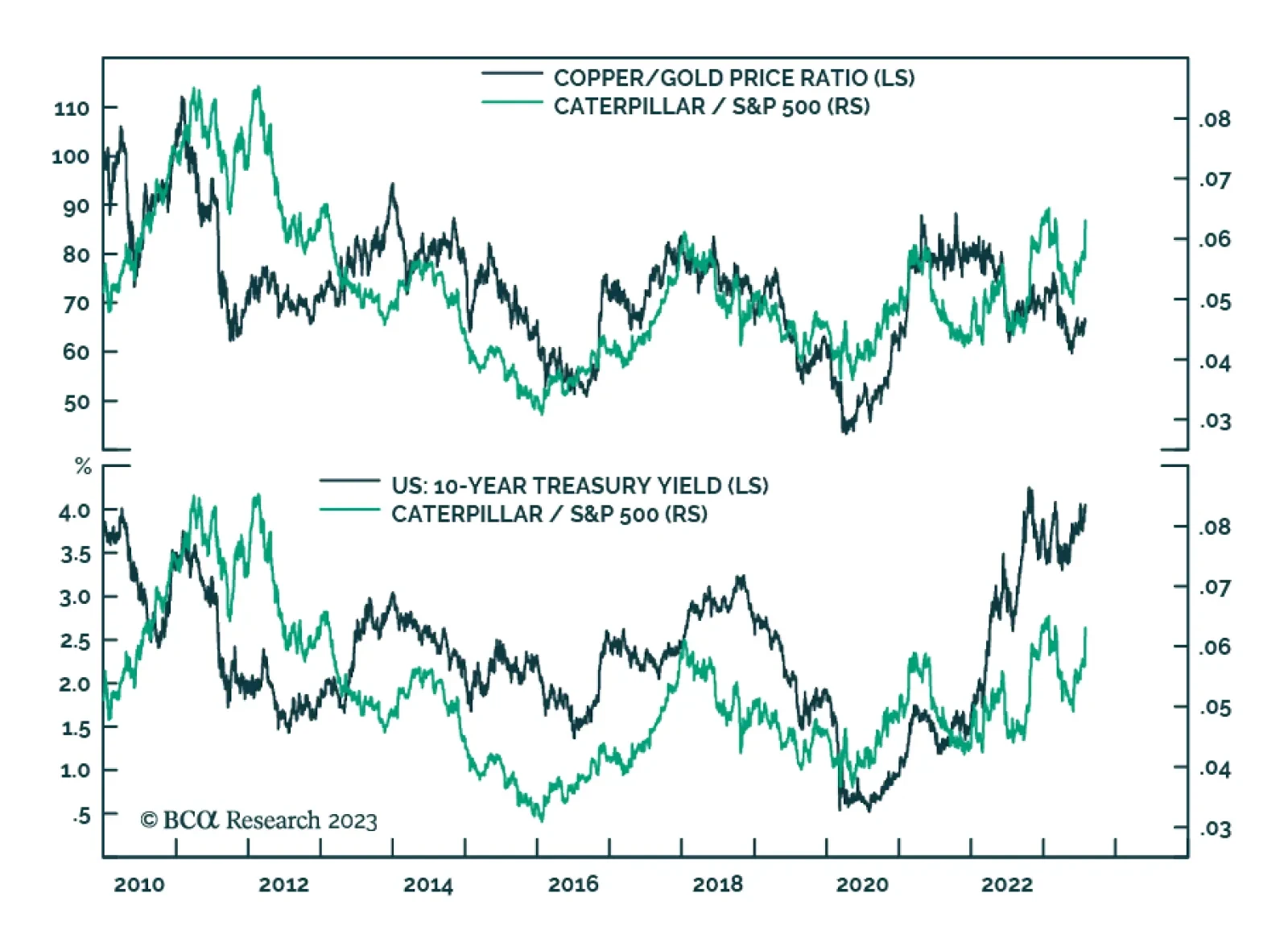

Caterpillar’s Q2 earnings results released on Tuesday beat consensus estimates by a wide margin. Second quarter profit of $2.92 billion ($5.67 per share) came in well above expectations of $2.38 billion ($4.46 per share).…

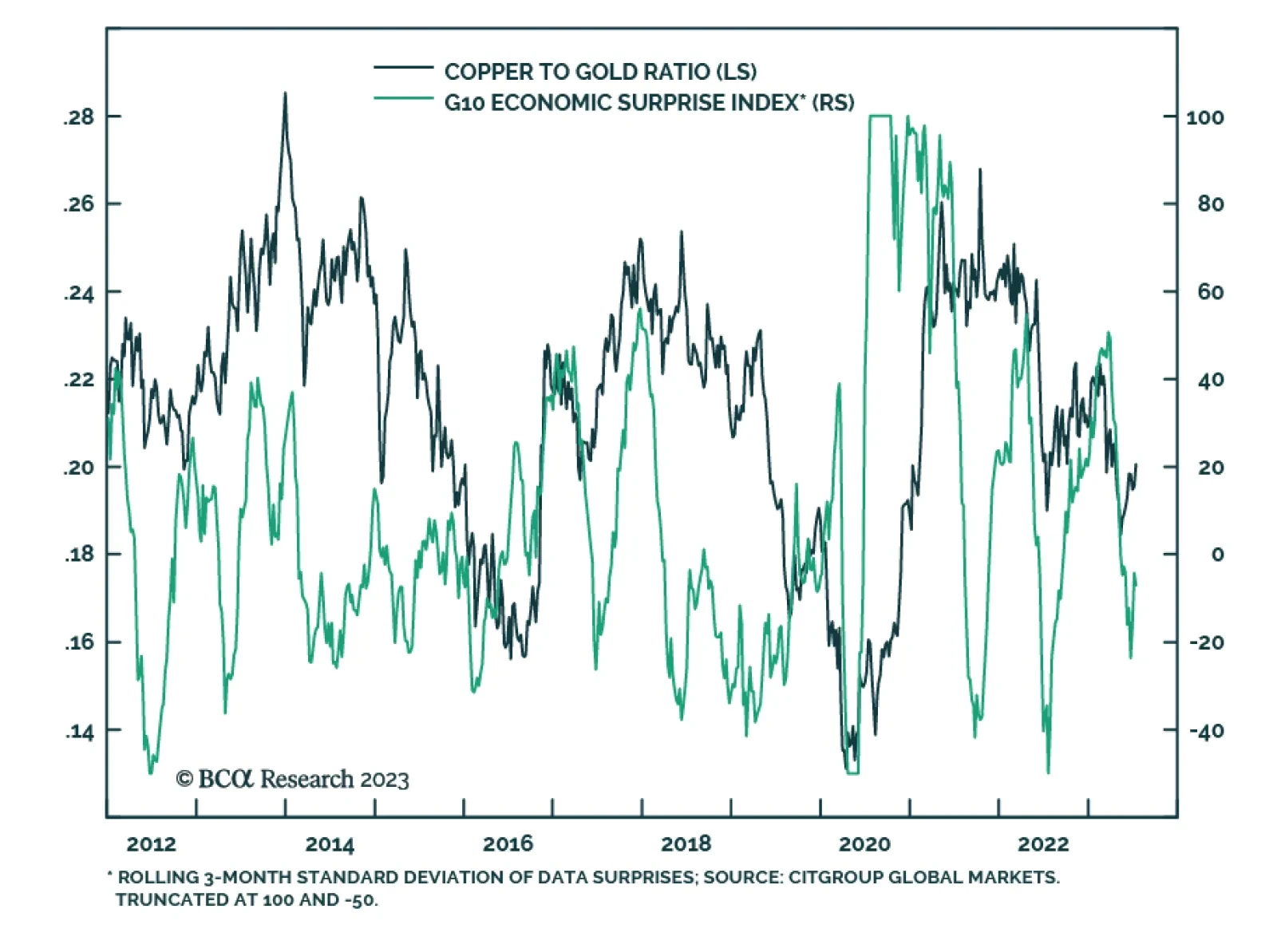

Over the past two months, copper has rallied alongside risk assets and now stands 9% above its late-May trough. Here, the outlook for China’s economy – which accounts for over half of global refined copper usage…

Both EV and Green Energy themes still hold strategic promise for investors, posing large upside, despite prevailing macro headwinds. While both themes have yet to claw back their pandemic peaks, a broadening of the rally supports a…

Copper rallied to a two-month high by the end of last week. Importantly, this move did not occur in isolation. It coincides with greater optimism about the prospects of a soft landing. Indeed, the US economic surprise index is…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.