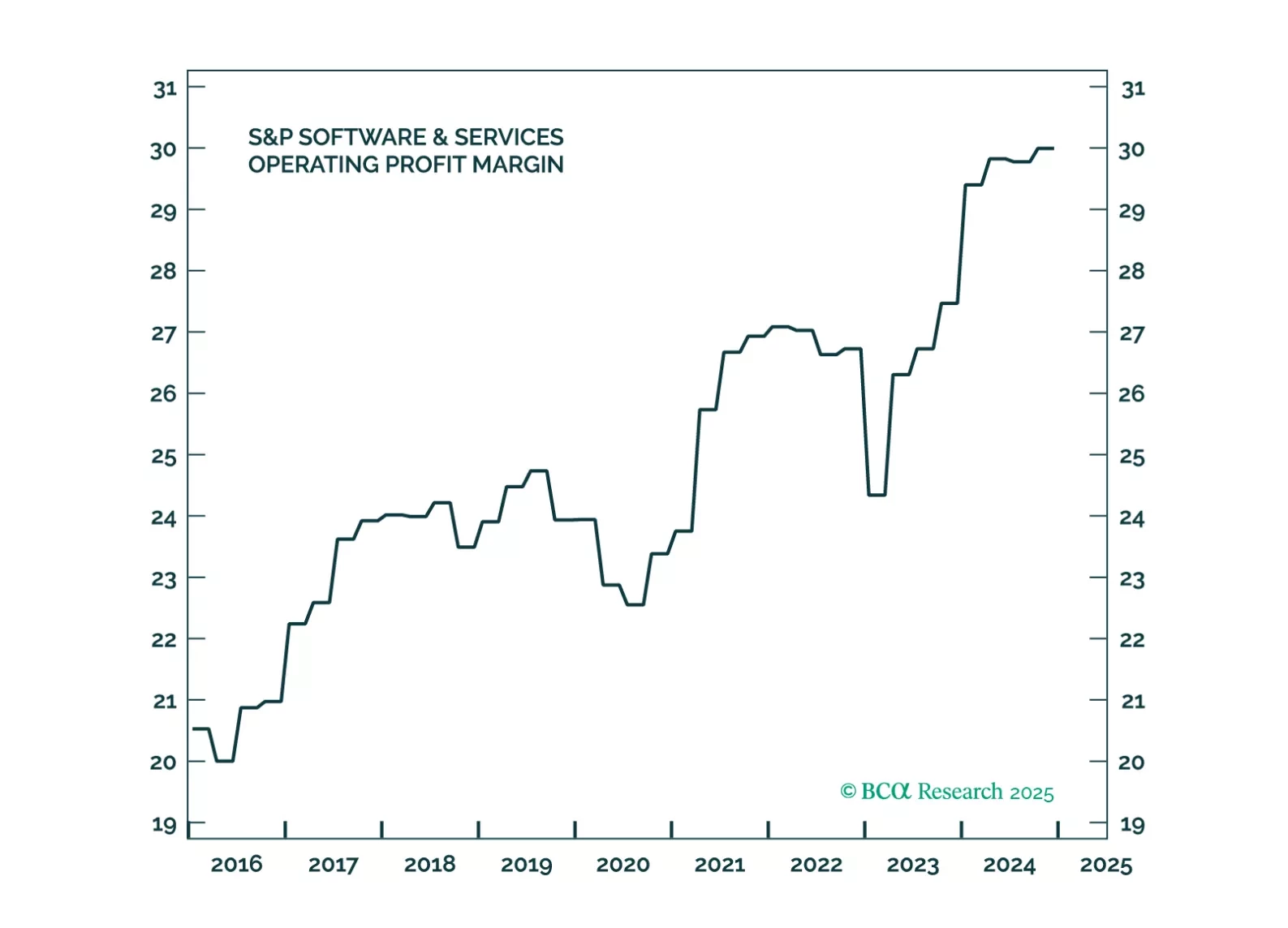

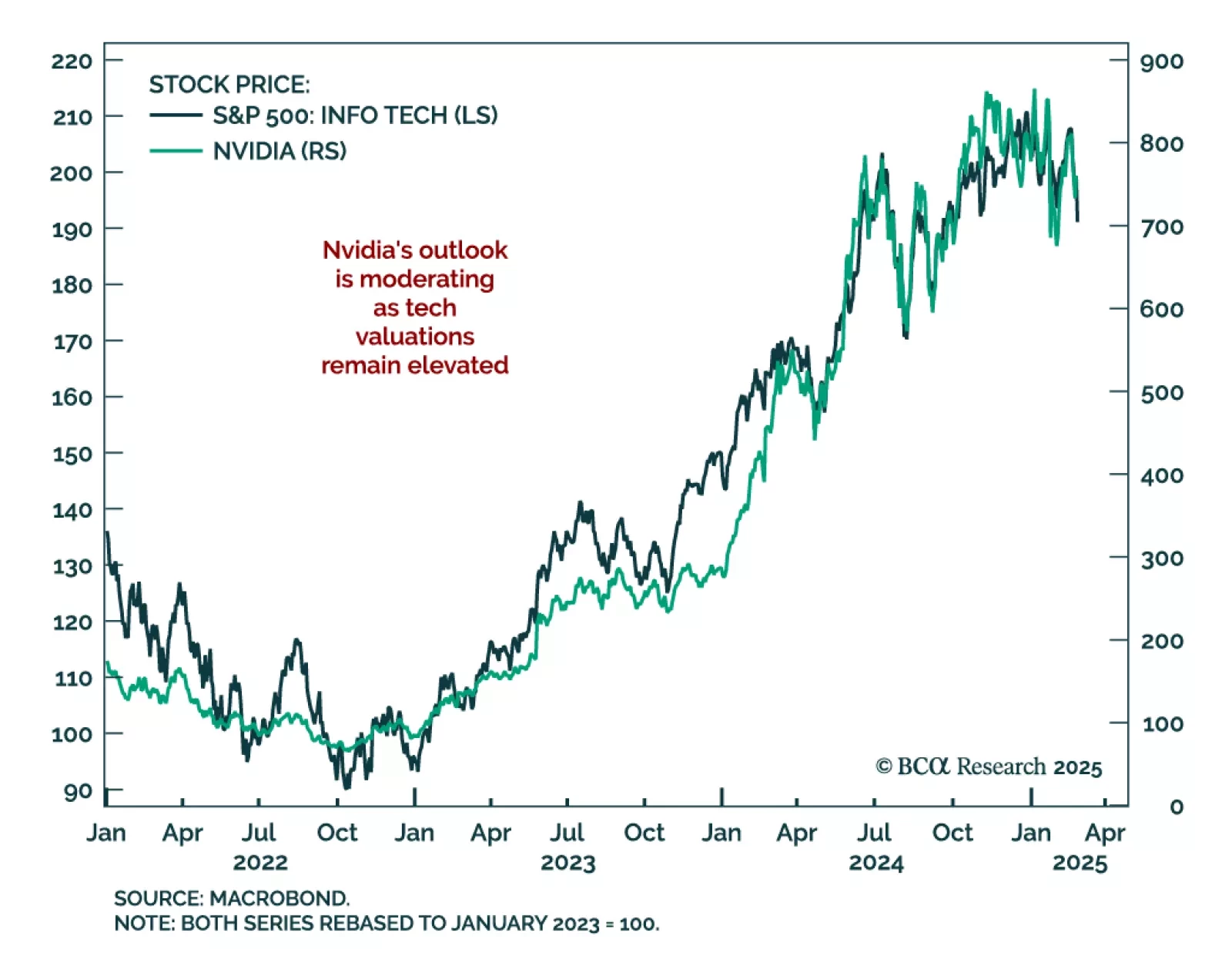

Nvidia announced good results, but Q1 sales guidance fell short of expectations. The numbers point to growth normalization as investors have been accustomed to blowout numbers. Nvidia’s meteoric rise means investors think about…

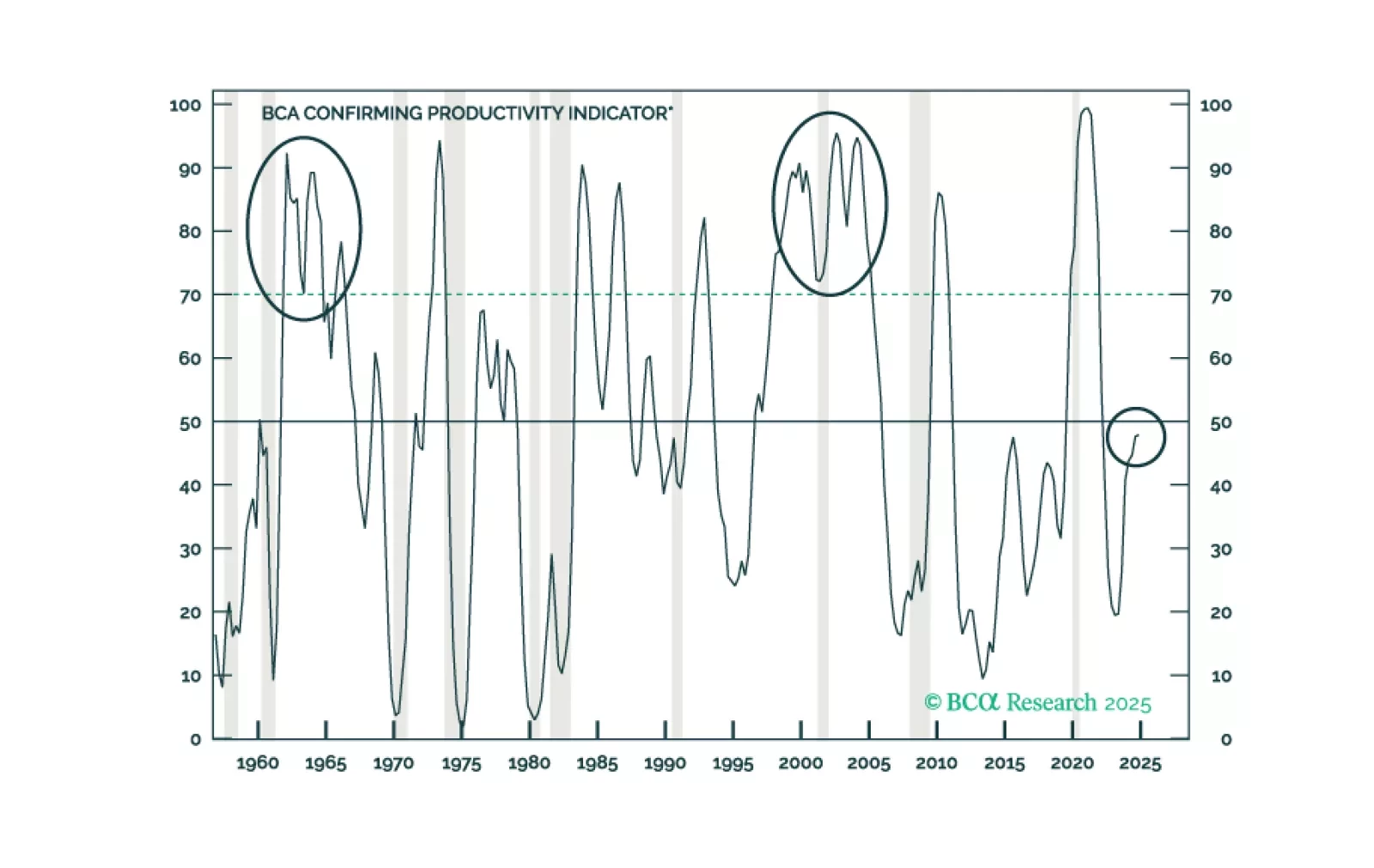

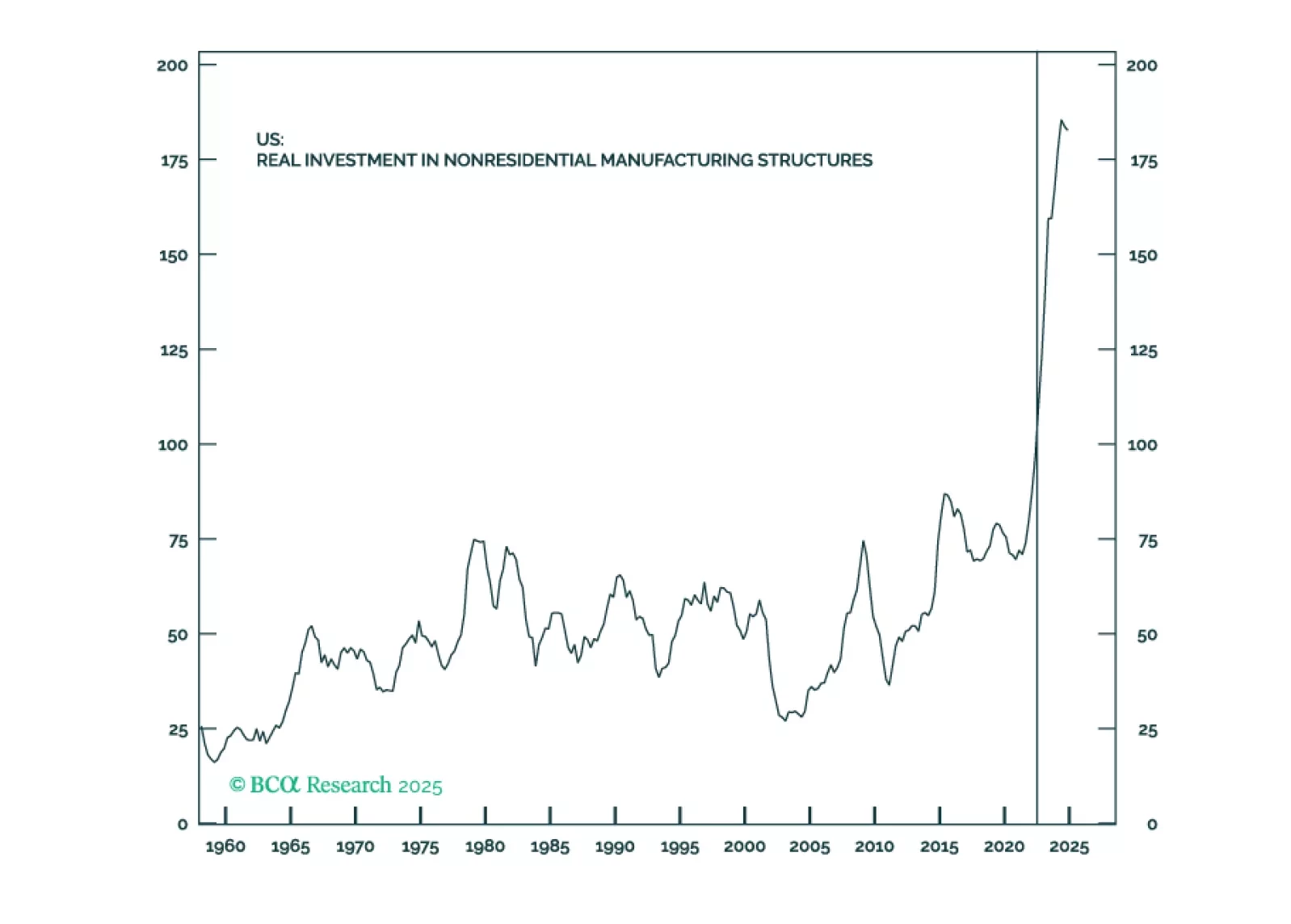

In Section I, Doug notes that the chaos of the new administration, including bellicose tariff threats and DOGE’s abrasive and indiscriminate approach, are sowing uncertainty and fortifying economic headwinds. Lowered guidance of…

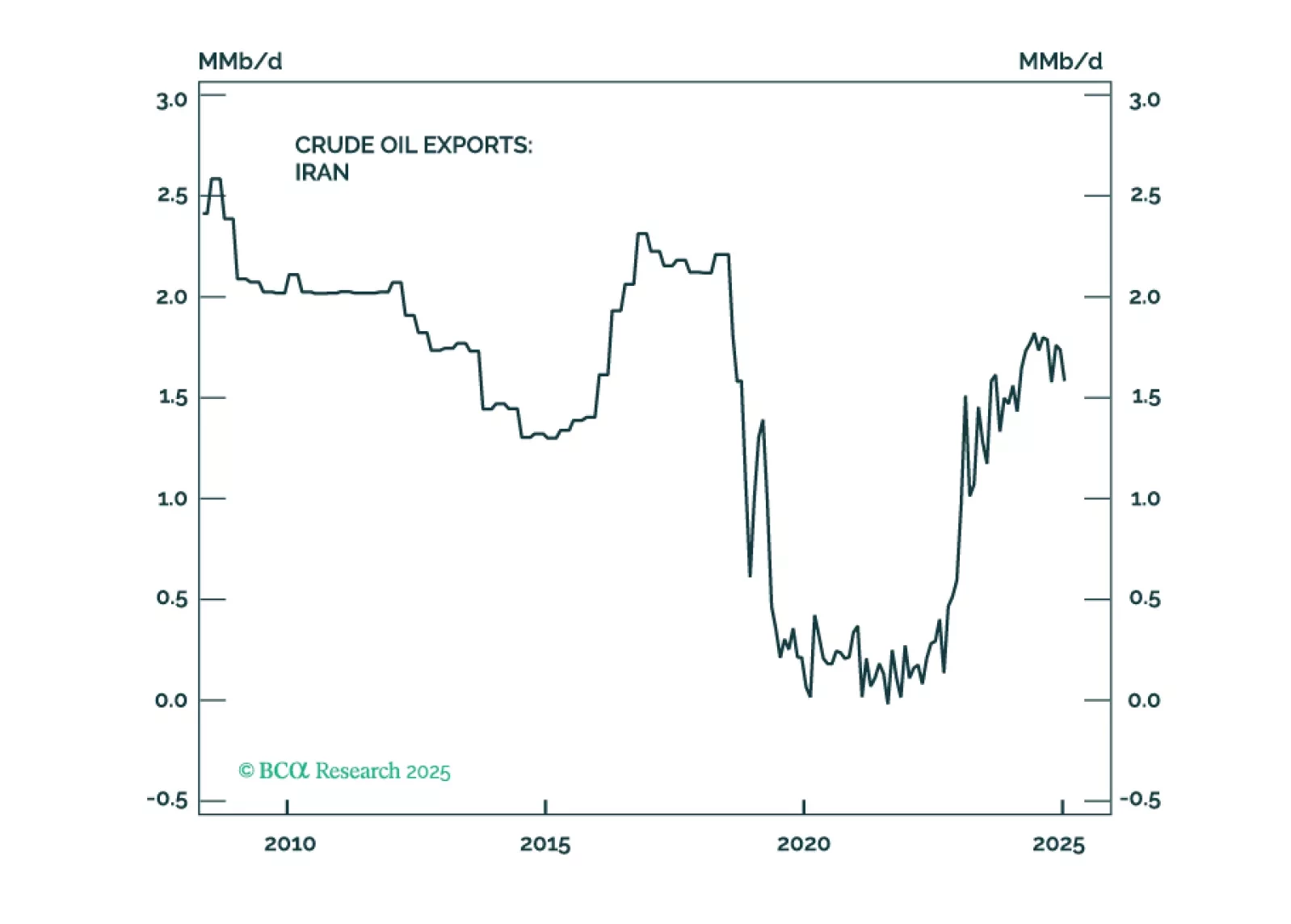

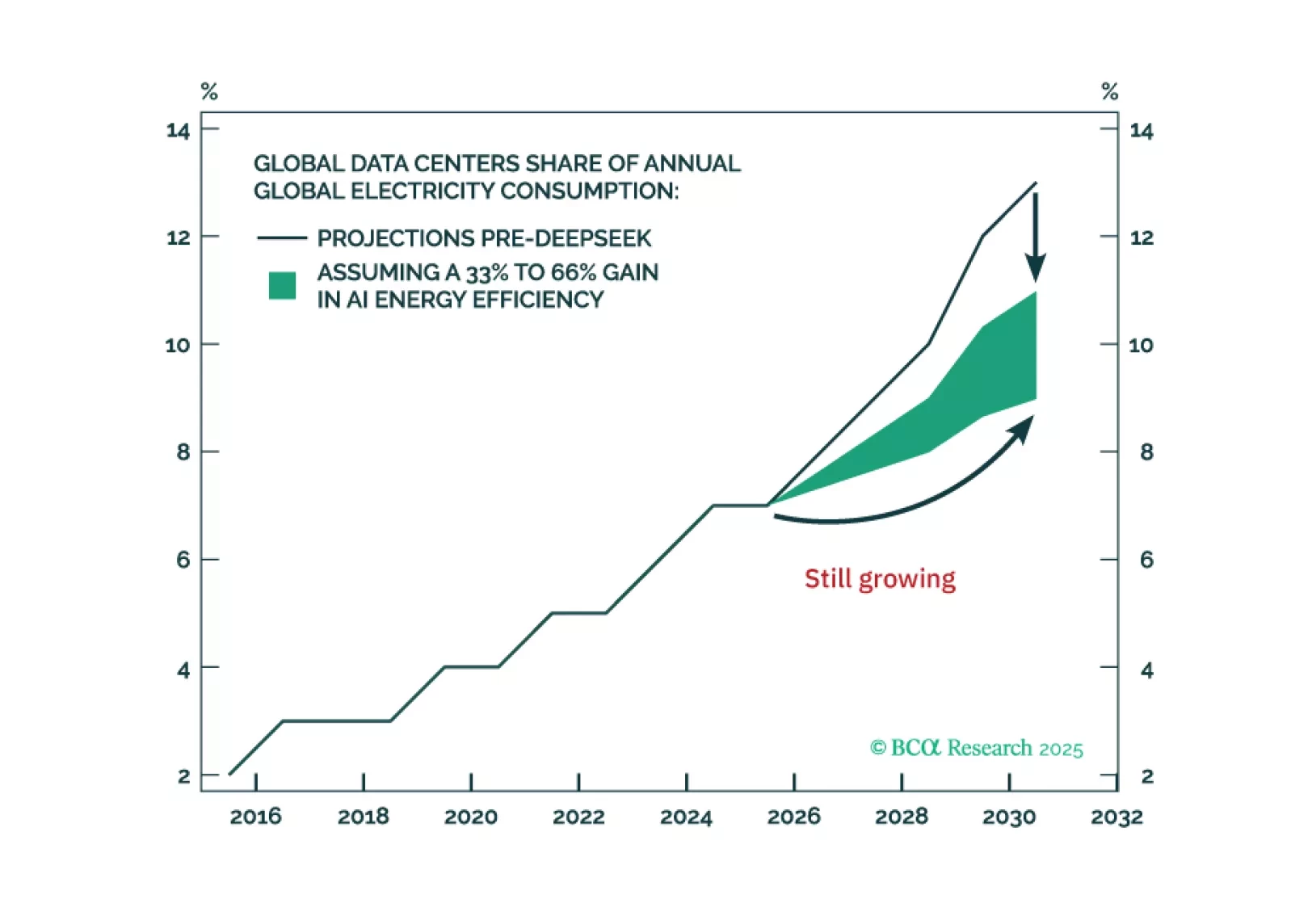

Interest rates will decline if the disinflationary trend continues, deficits are reduced, or economic growth falters. Oil prices are likely to spike over the short term, but the long-term outlook is unfavorable. Not all GenAI…

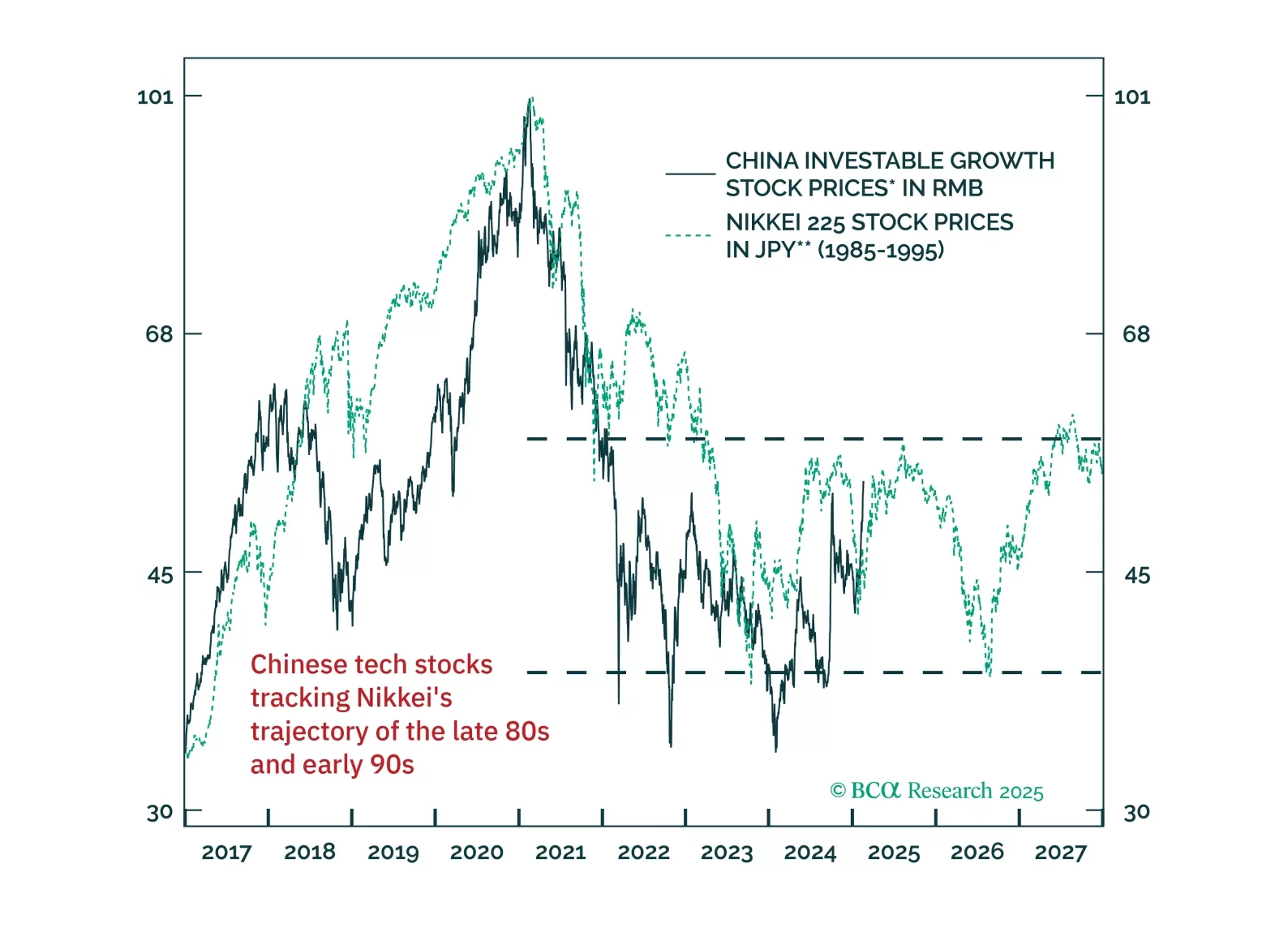

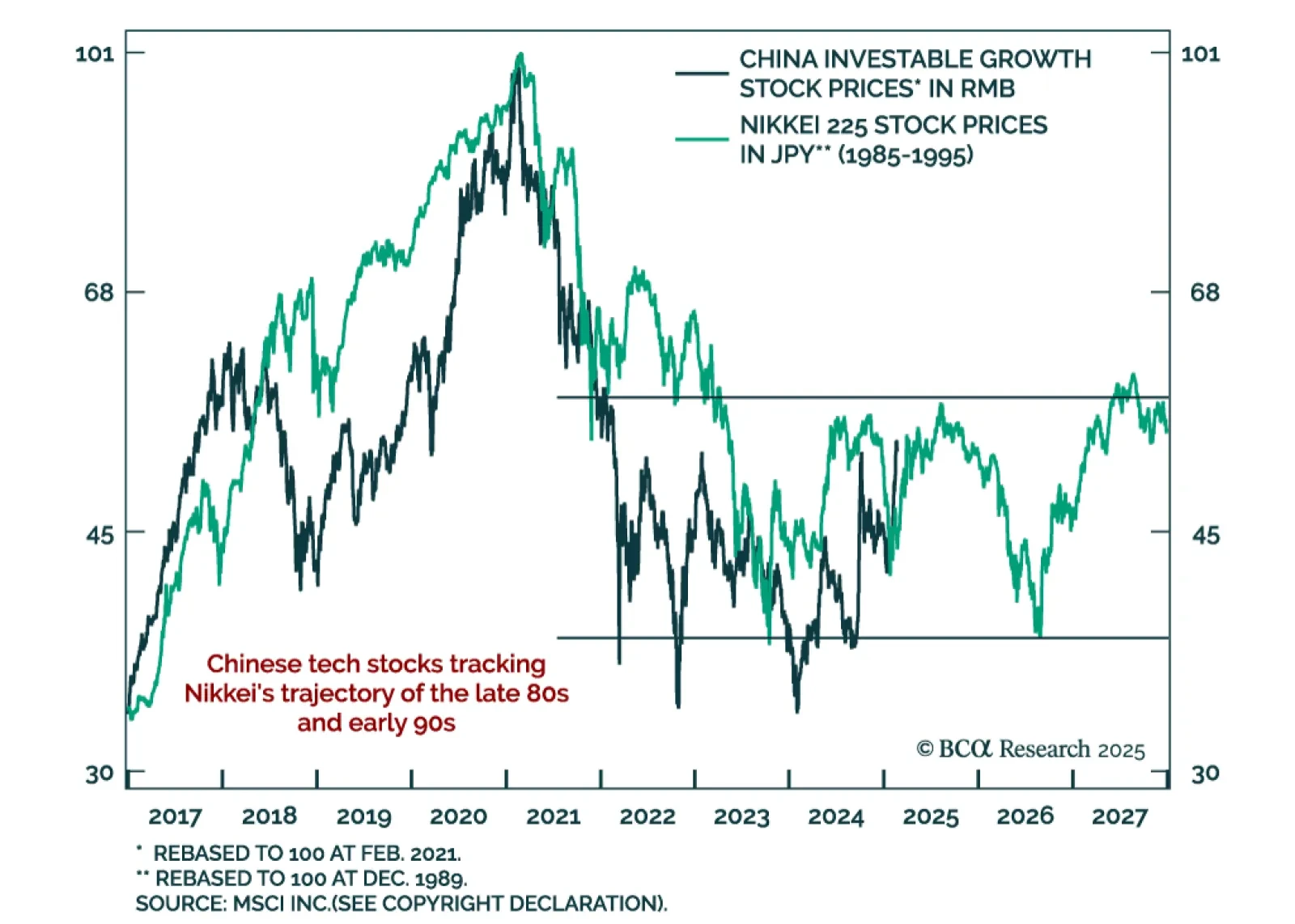

Our China strategists assessed the outlook for Chinese stocks in the aftermath of the DeepSeek hype. DeepSeek’s innovations will boost China’s productivity and technological advancement but are unlikely to create a strong…

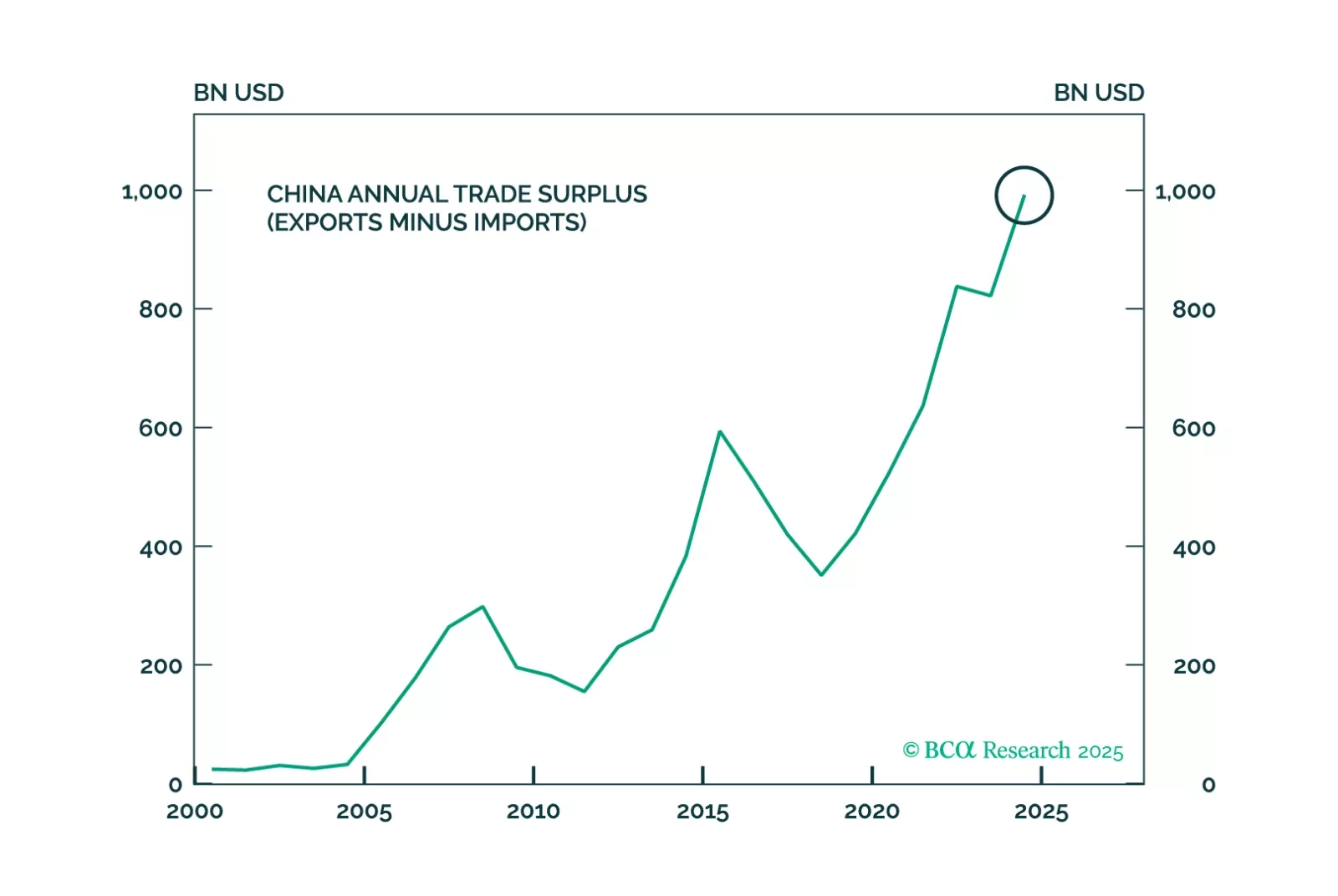

DeepSeek's AI breakthrough will likely enhance China’s productivity gains. But does it justify a re-valuation in Chinese tech stocks? Sustaining the Chinese tech rally will require corporate profits to overcome the pressures of…

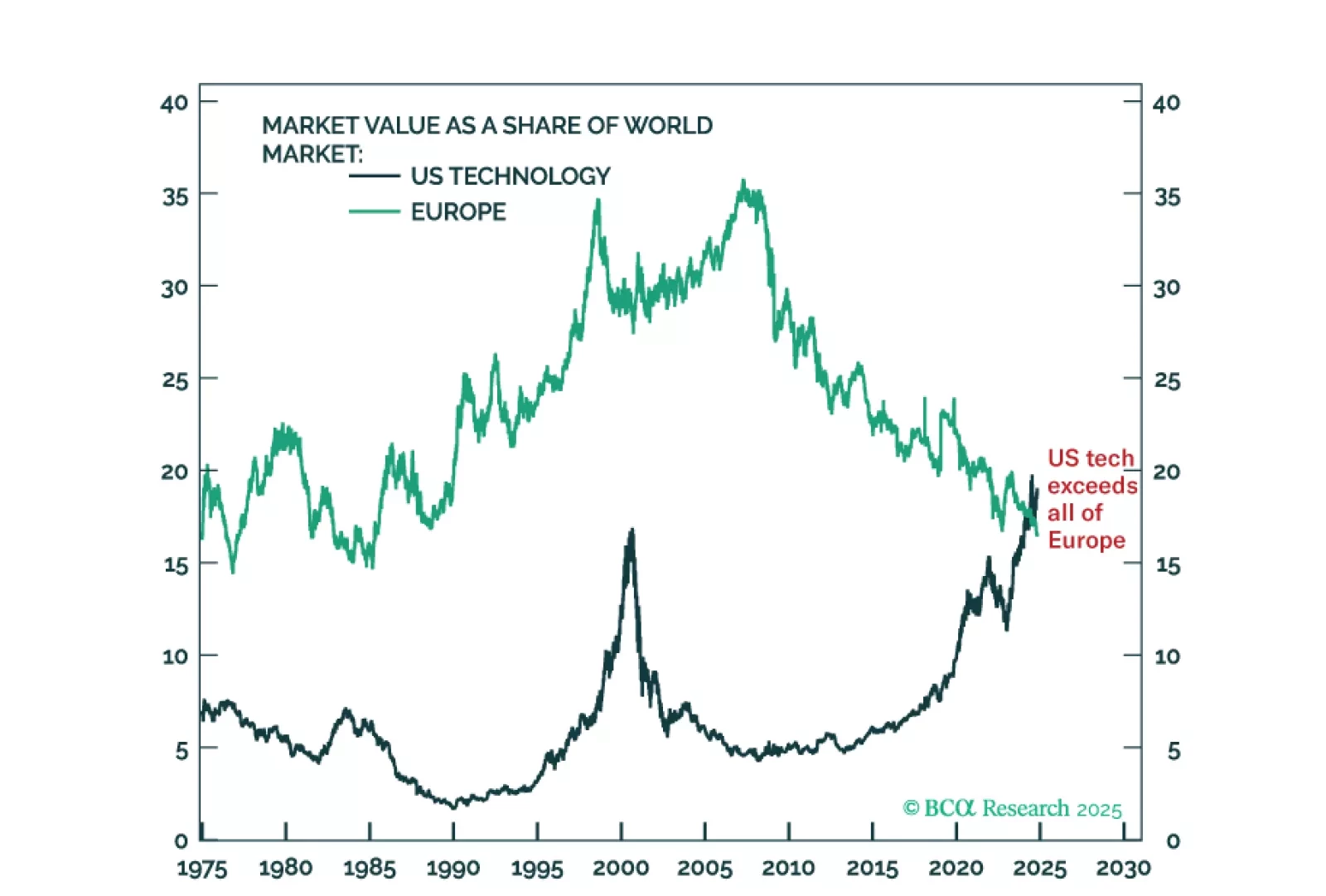

US tech stocks as a share of world stock market capitalisation is at an all-time high that exceeds even the peak of the dot com mania in 2000. At the other extreme, Europe’s share in the world stock market is at a 50-year low. While…

AI will continue to support future nuclear energy demand. Investors should view the recent pullback as a buying opportunity.