Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

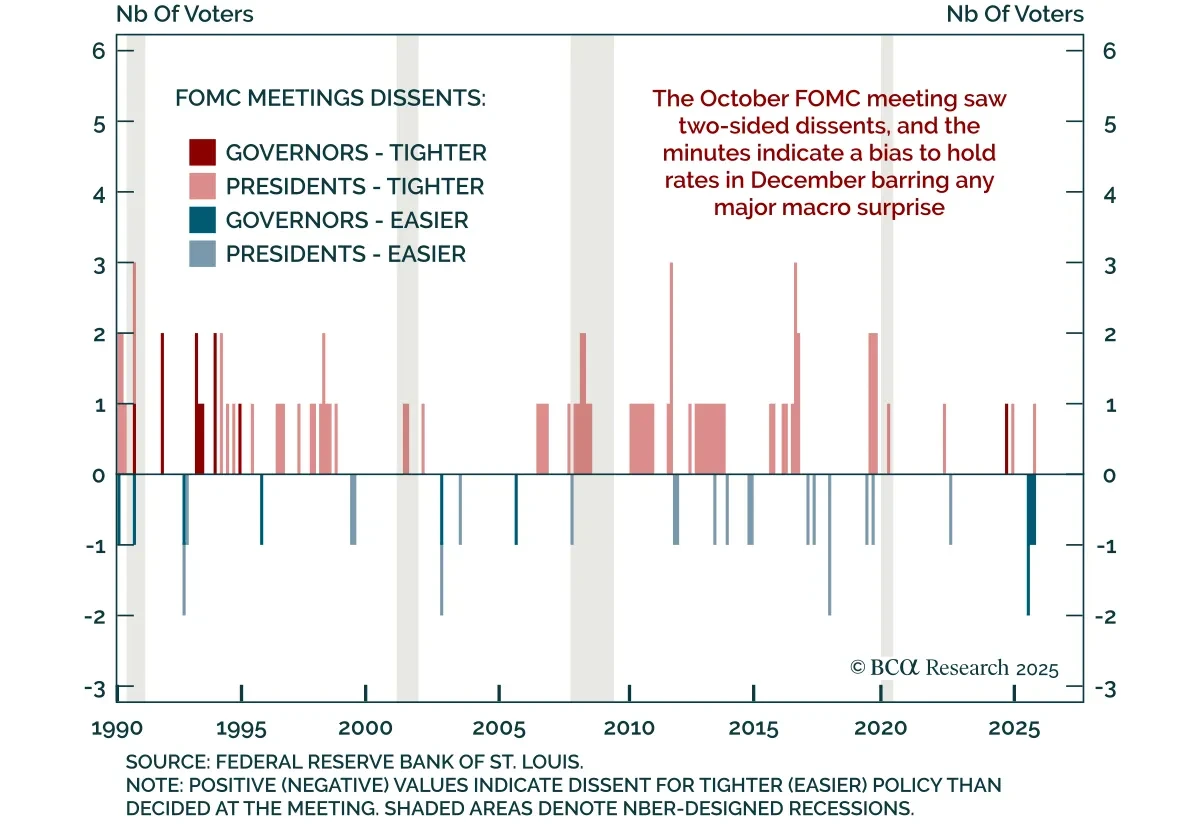

The October FOMC minutes underscored deep divisions over the Fed’s next move, reinforcing expectations for a December hold but keeping the easing bias intact. The 10–2 vote for a 25 bps cut included dissents on both sides (Governor Miran for a 50 bps move and Kansas City Fed President Schmid for no ...

Read more

Insight

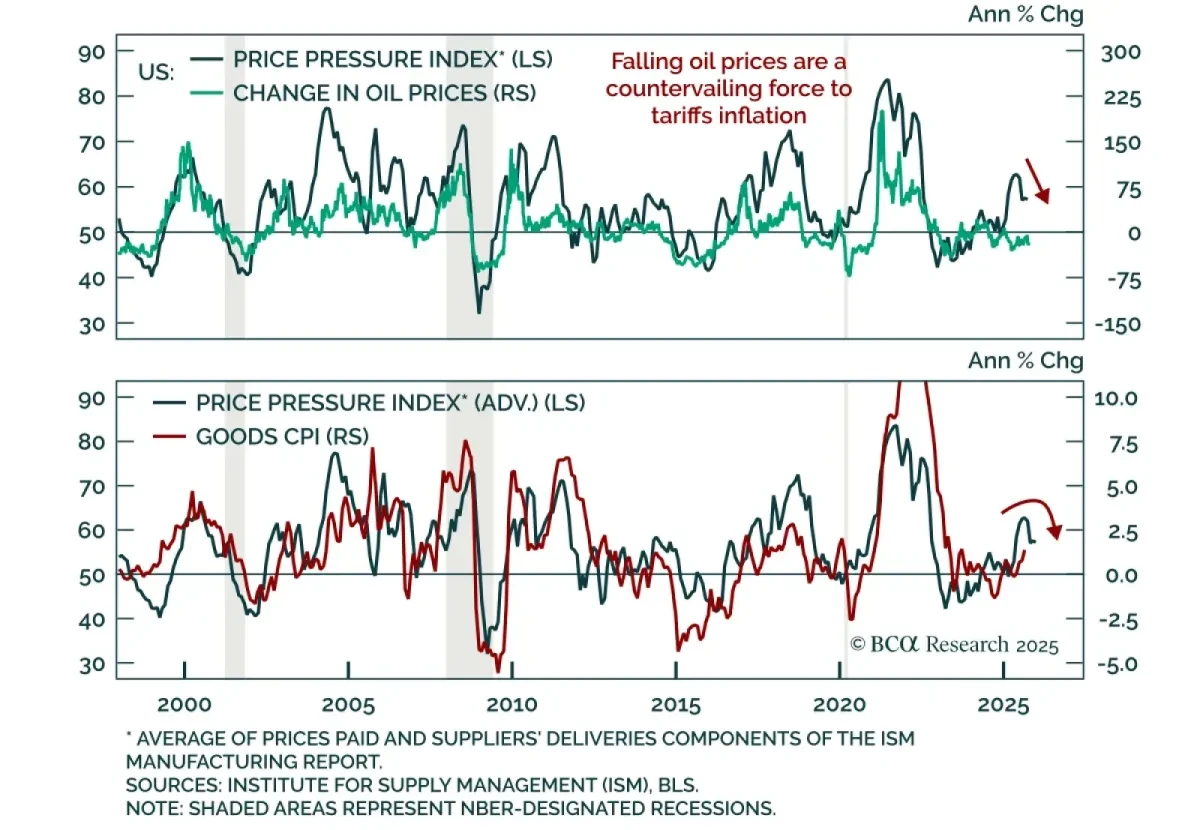

Falling oil prices are countering tariff-driven inflation which, along with a weakening labor market, is reinforcing a long duration stance. Brent crude broke below the $65/bbl support level held since June and WTI is now down 16% from a year ago. Falling oil prices are significant at this stage of ...

Read more

Insight

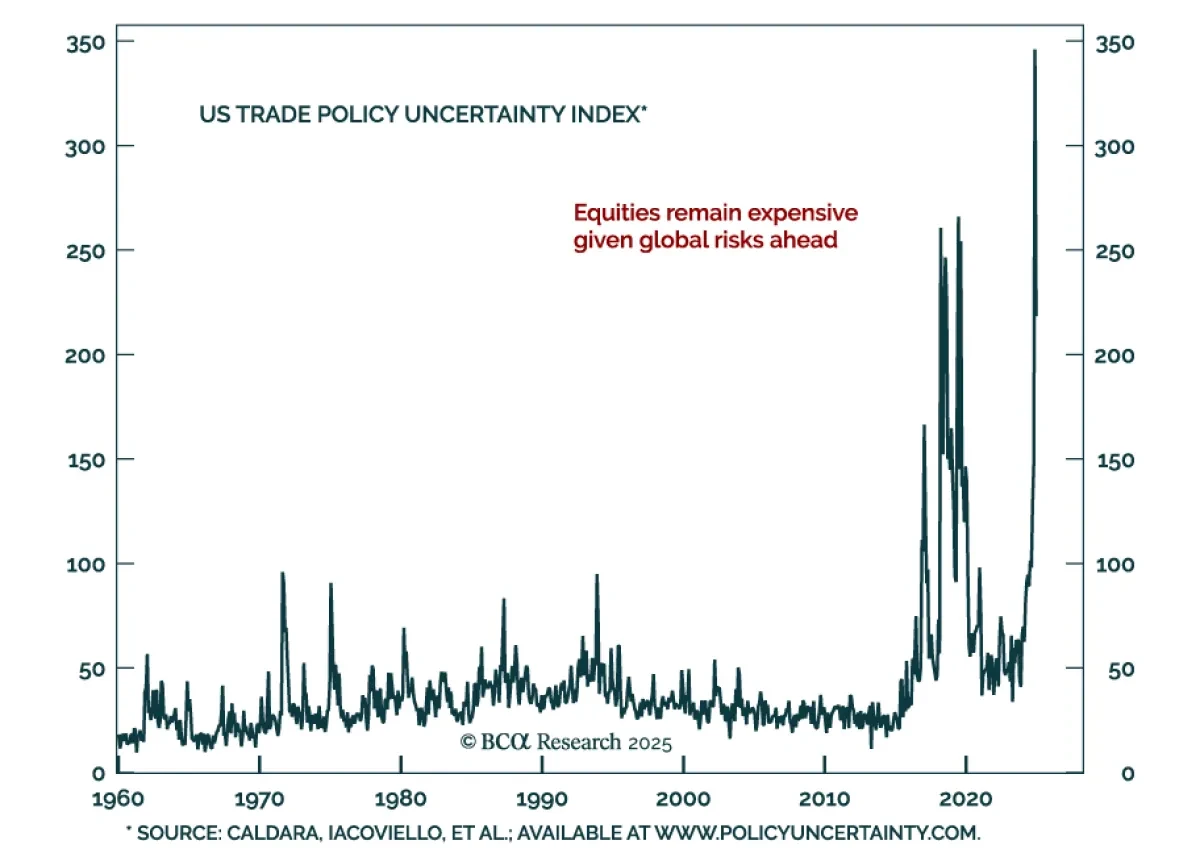

President Trump’s inaugural speech outlined his second term agenda. The theme was that the US will become “far more exceptional” than it already is. Trump pledged to reverse America’s decline, rebalance the justice system, streamline government, protect borders, pare back inflation, restore manufact...

Read more

Insight

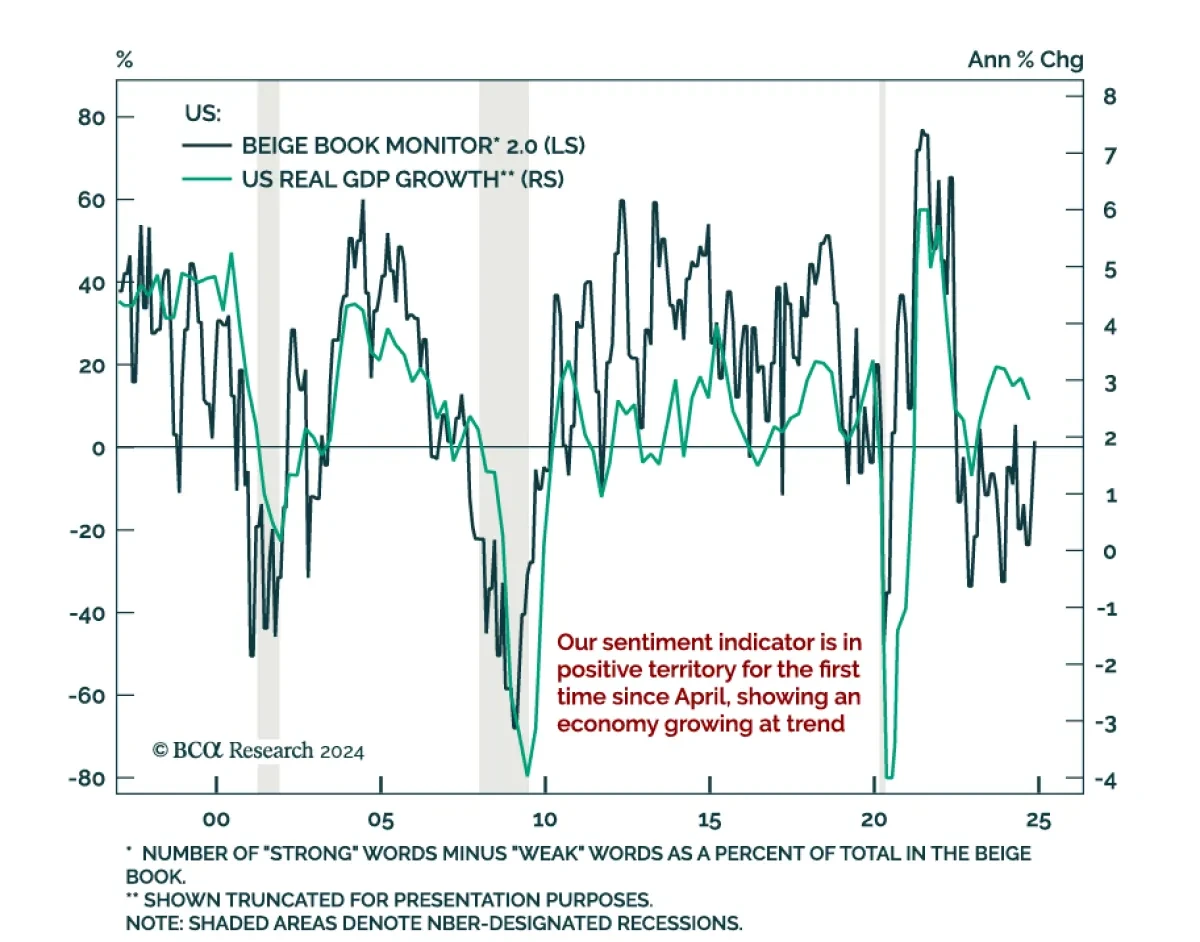

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment. The latest Beige Book is in line with other sentiment indicators showing modest growth but increased post-election expectations. The pict...

Read more

Insight

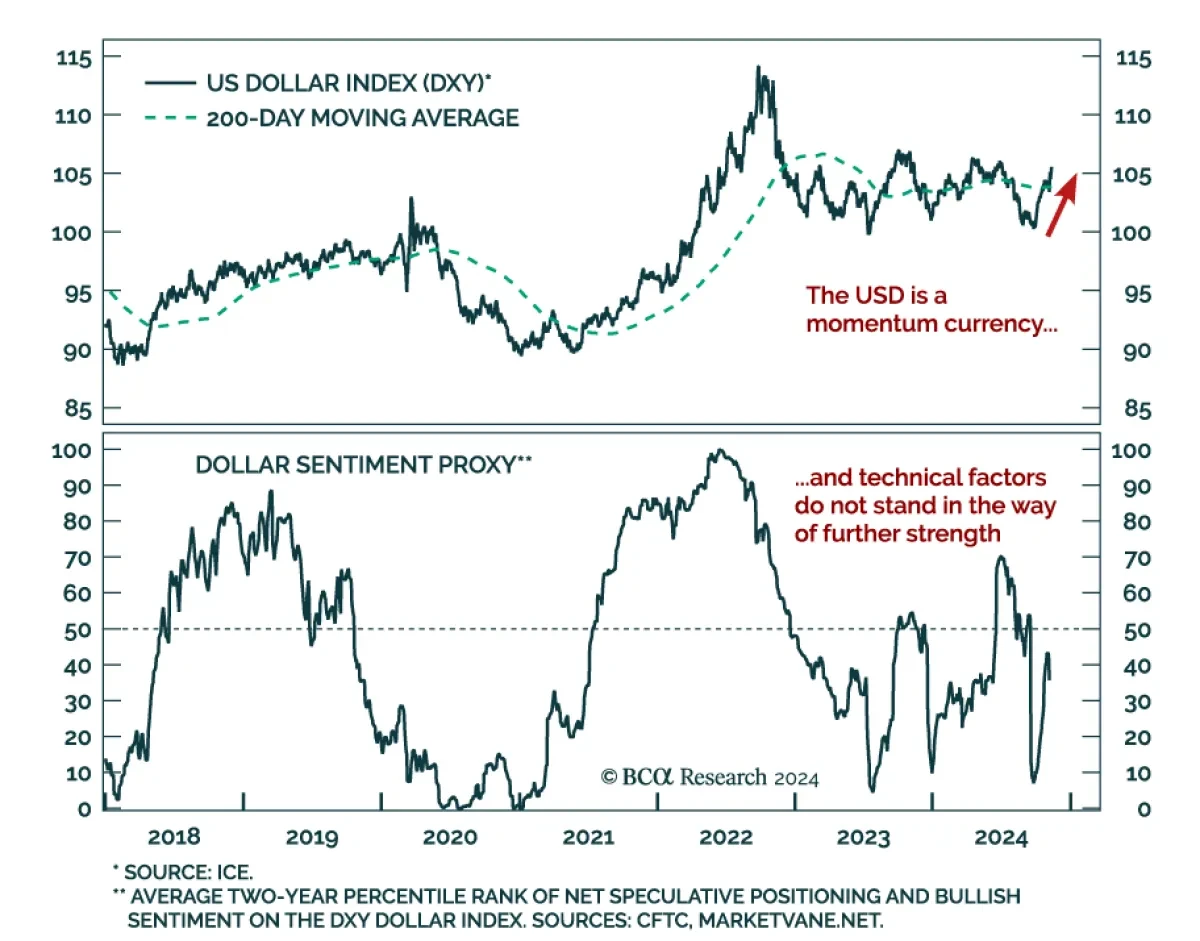

The US dollar steamrolled its peers since early October. After breaking out above its 200-day moving average, it is now fast approaching recent highs. Multiple factors drove this rally, among them are the stronger-than-expected US economic data, weaker data overseas, and Trump’s victory. ...

Read more

Insight

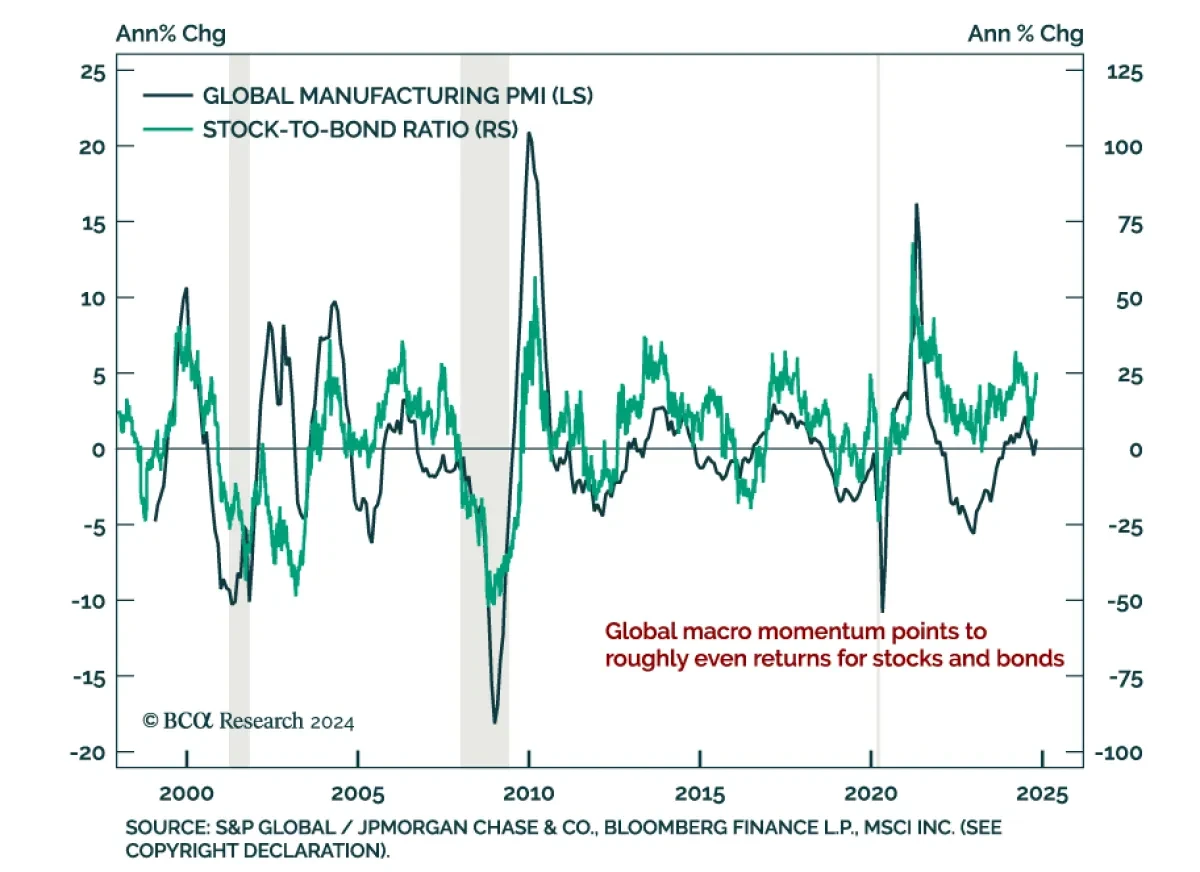

The October global manufacturing PMI printed at 49.4, up from 48.7 in September but still in contractionary territory. While output stabilized at 50.1, new orders (48.8) and new export orders (48.3) remain in contraction, as is the case for the new orders-to-inventories spread. This rebound is ...

Read more

Insight

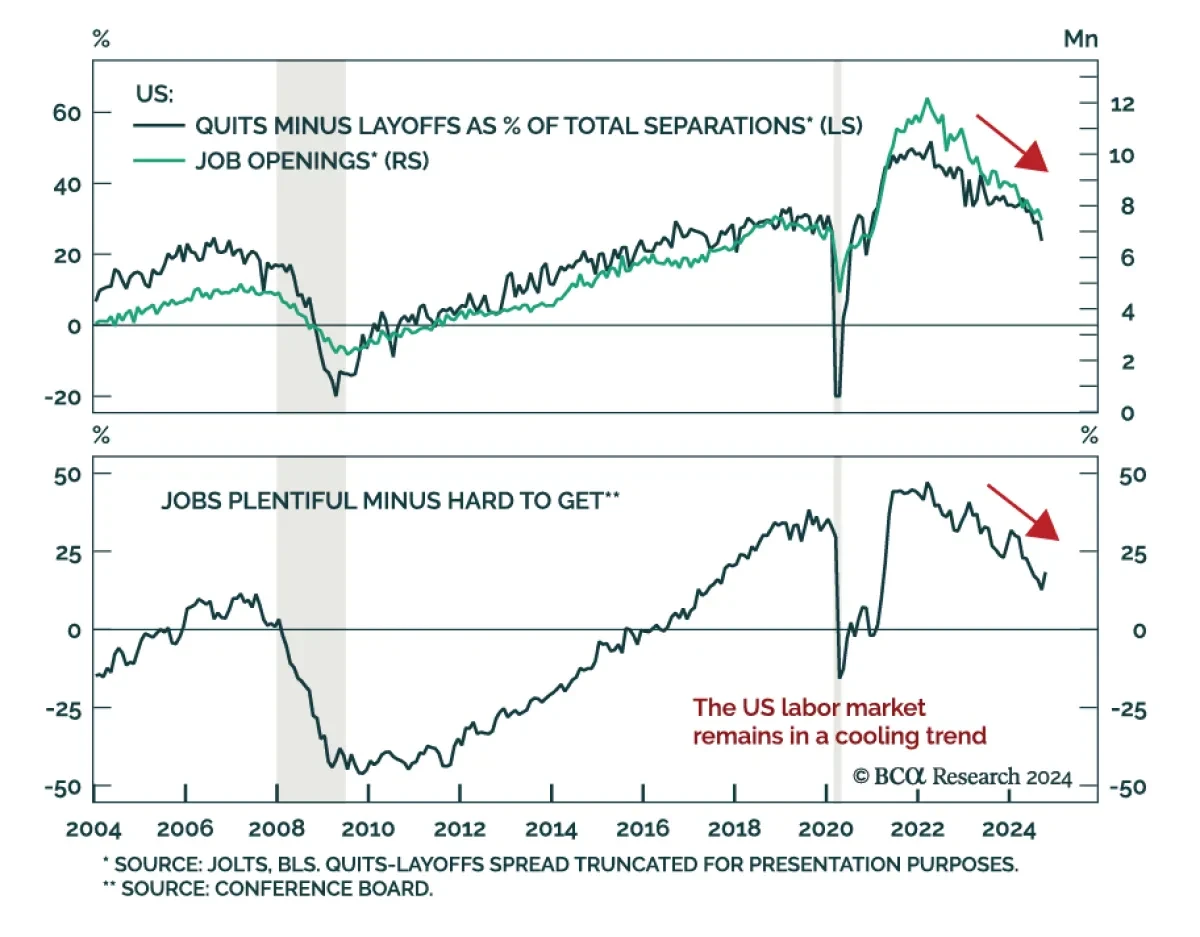

Job openings missed expectations at 7.44 million in September, a mild slowdown from August. The details of the JOLTS report were also negative, except for hirings which continue their June rebound. Meanwhile, consumer confidence for October data beat expectations. The Conference Board’s labor differ...

Read more

Insight

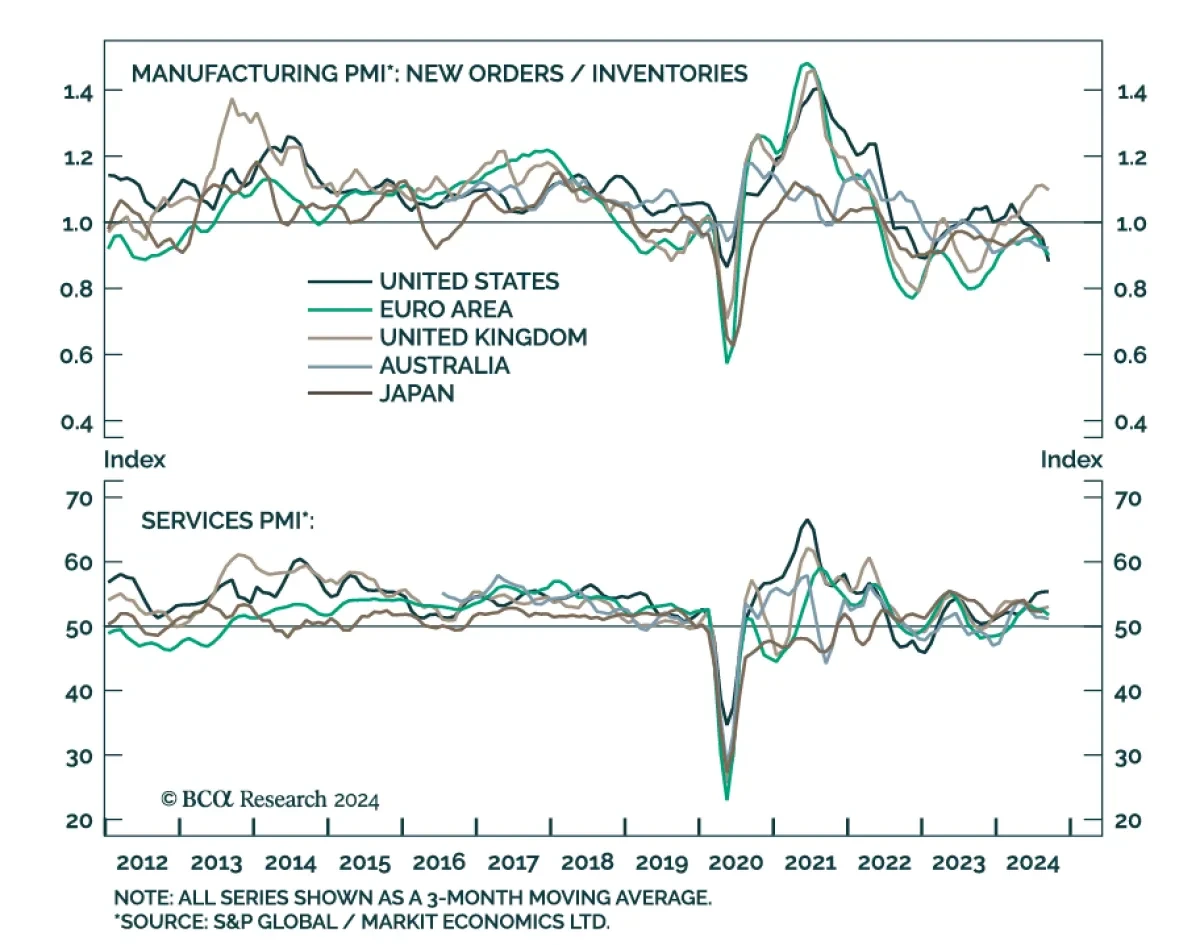

Preliminary estimates suggest that activity continued to slow across DM economies in September.Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in the UK. Services PMIs continued to expand in most regions, though the pace of...

Read more

Insight

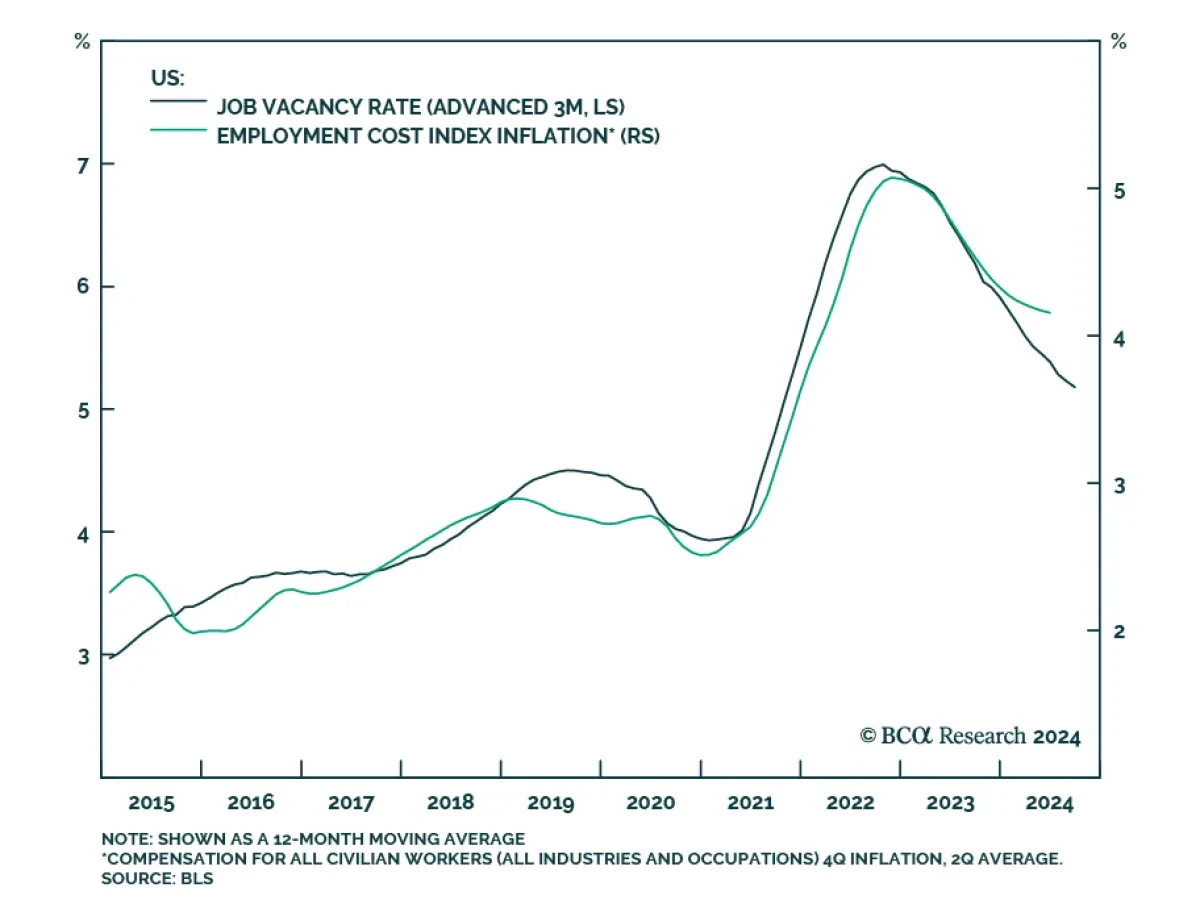

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This inversion is still a ways from normalizing, with labor demand still exceeding supply by 2.2 million jobs...

Read more

Insight

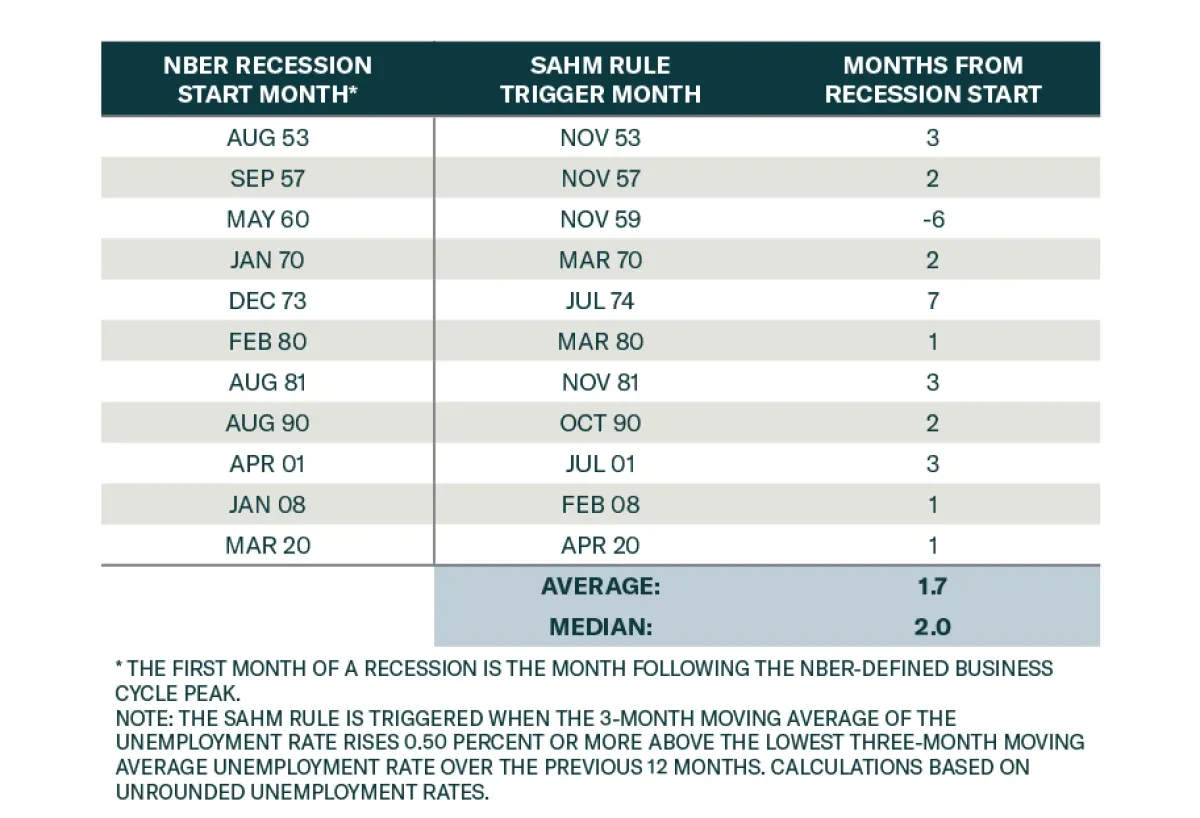

Market and economic observers have devoted a lot of attention to the Sahm Rule following July’s employment report, and whether or not it has been triggered. BCA’s analysis has highlighted that the overall direction of the labor market is far more important than the rounding conventions one applies t...

Read more