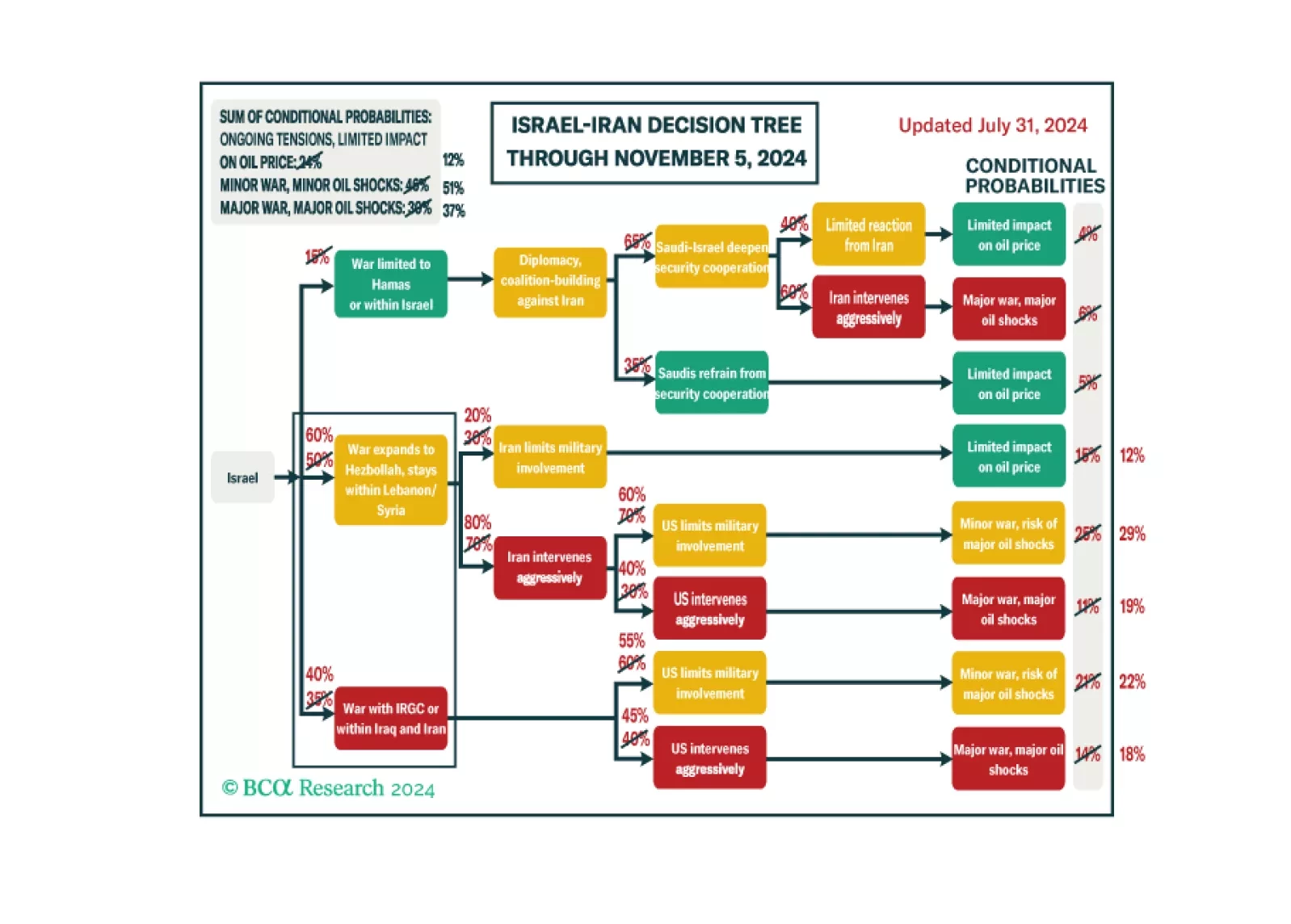

Following the recent escalation in the Middle East conflict, BCA Research’s Geopolitical Strategy service upgrades its subjective odds of a major oil supply shock to 37%. Volatility should spike again as investors…

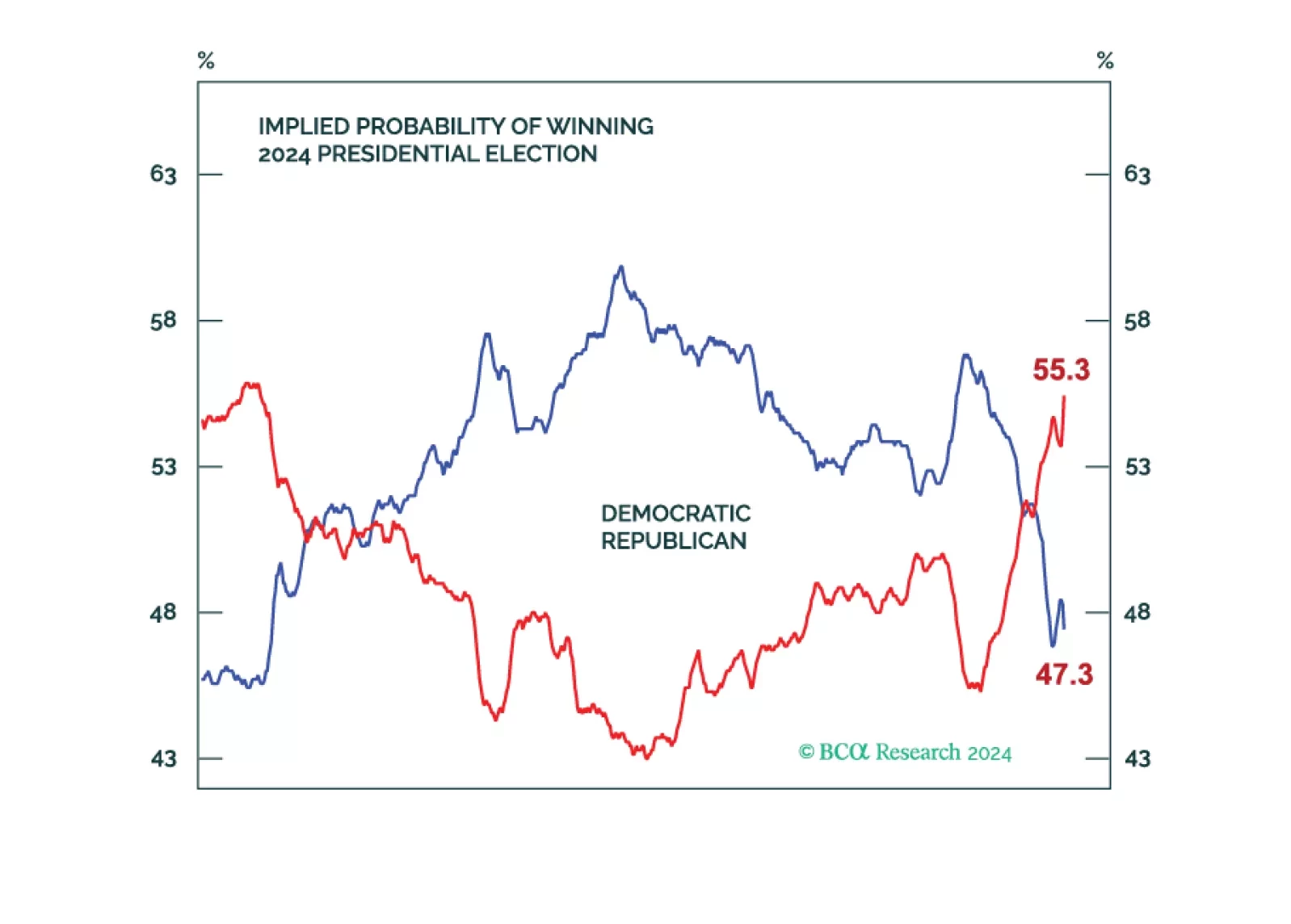

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…

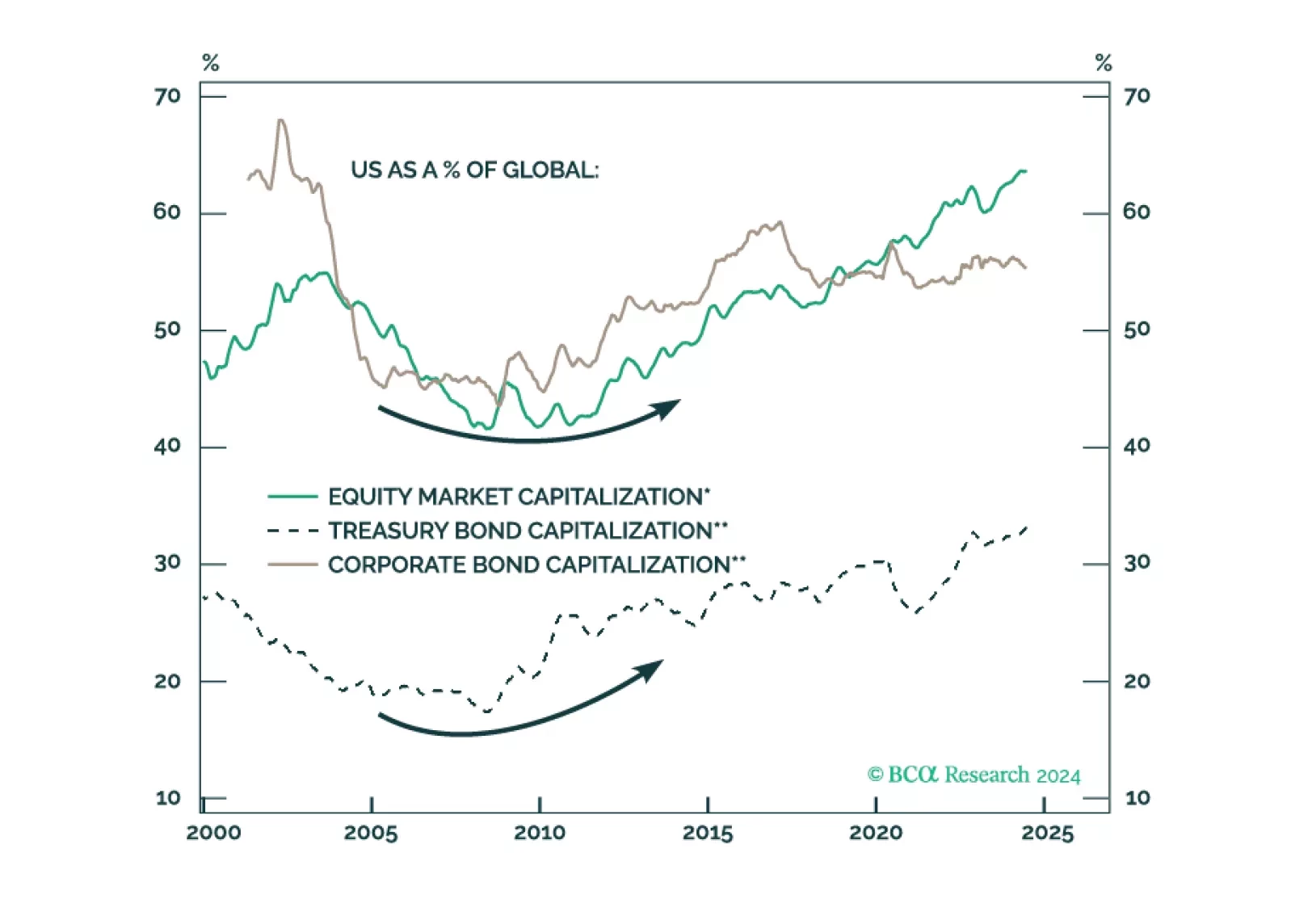

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

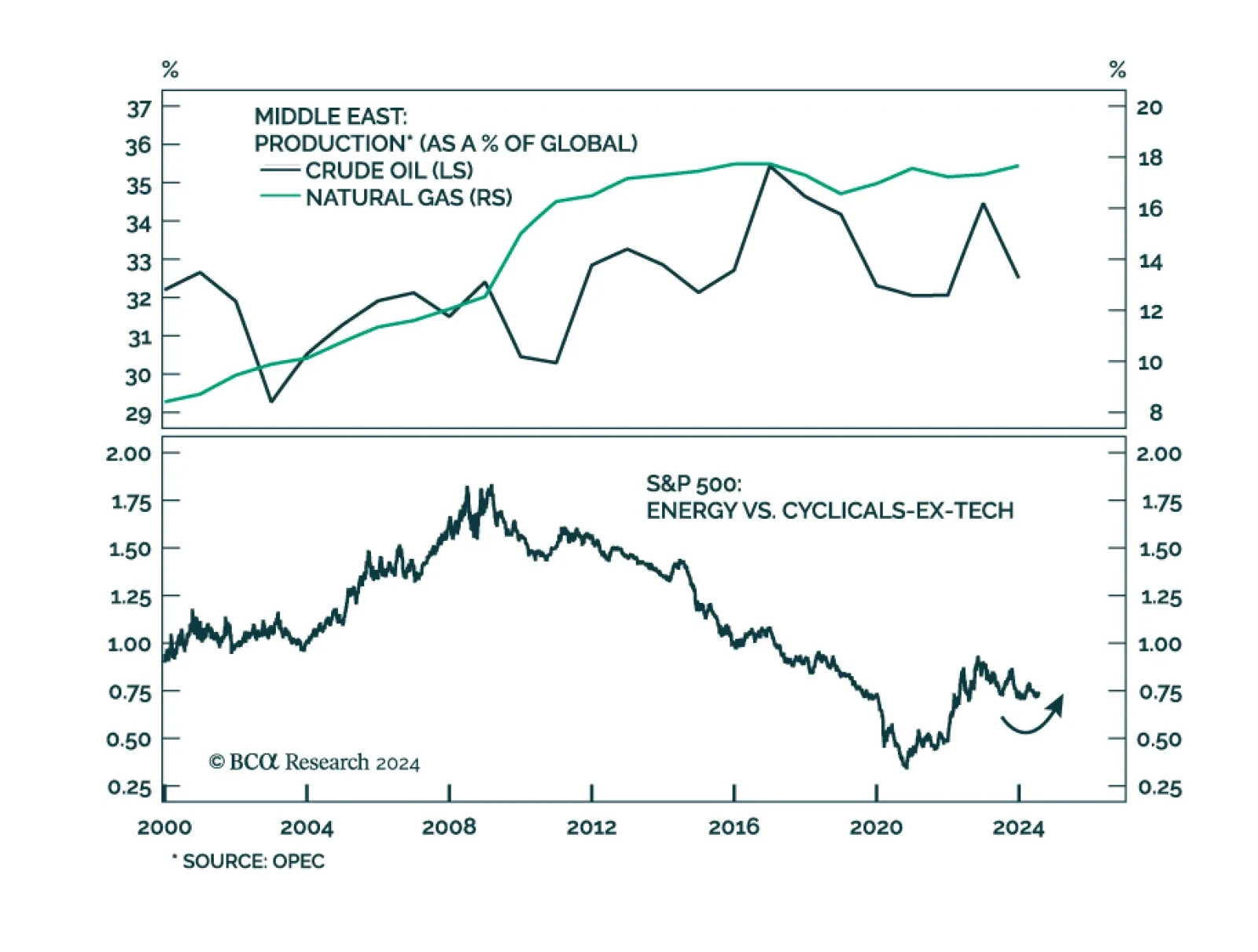

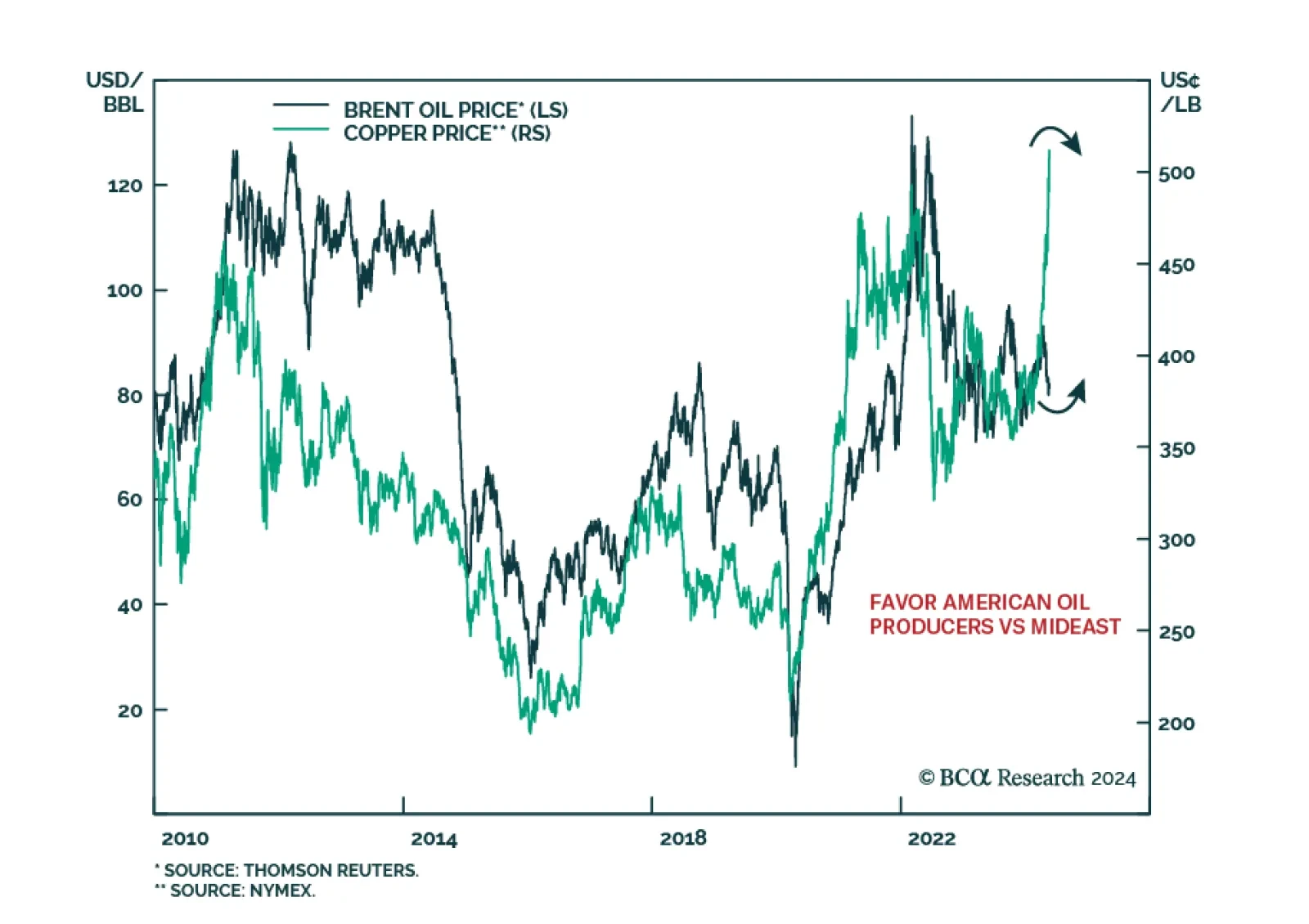

According to BCA Research’s Geopolitical Strategy service, the death of Iran’s President Ebrahim Raisi in a helicopter crash underscores the instability of Iran and the Middle East, which is getting worse, not better…

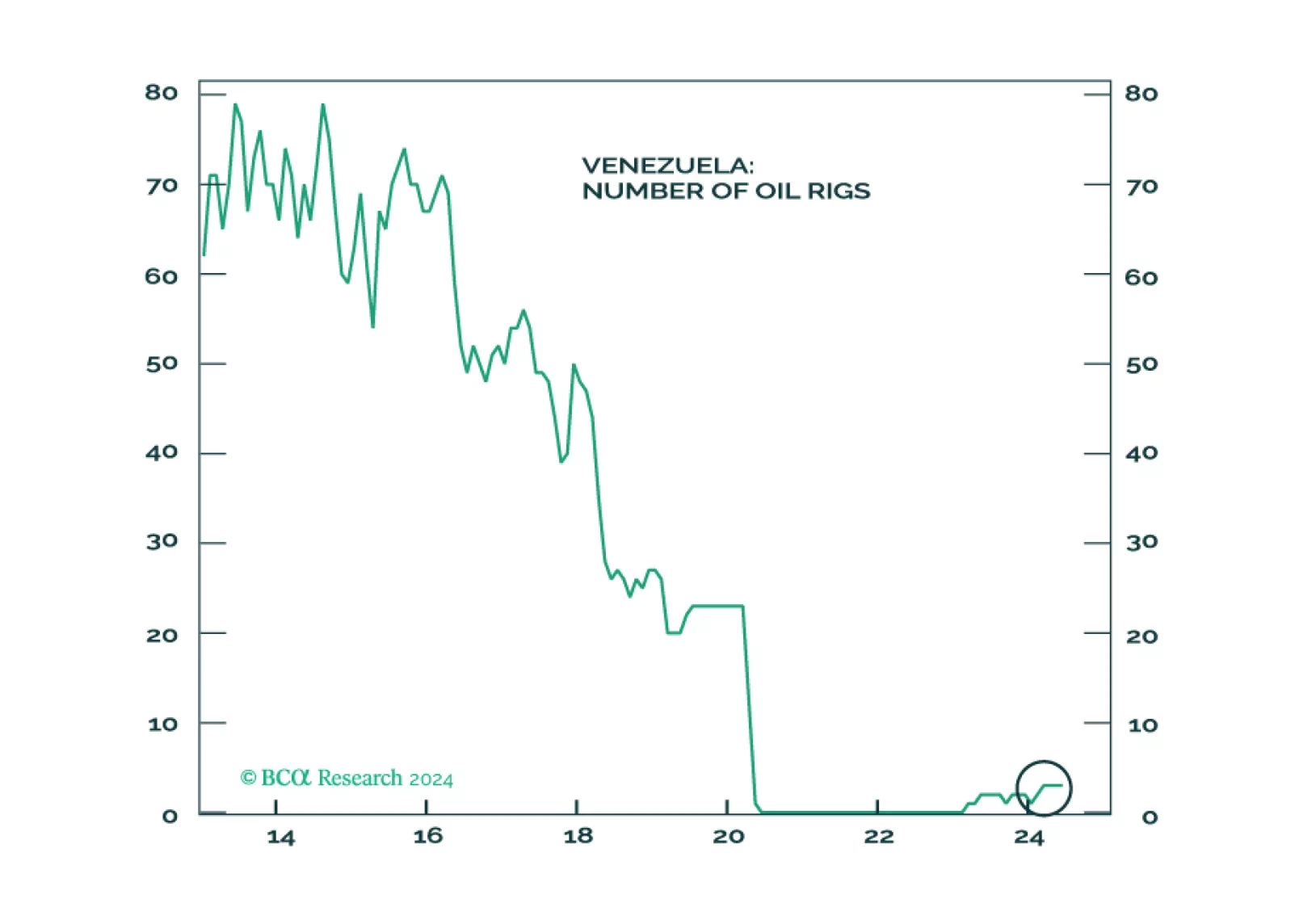

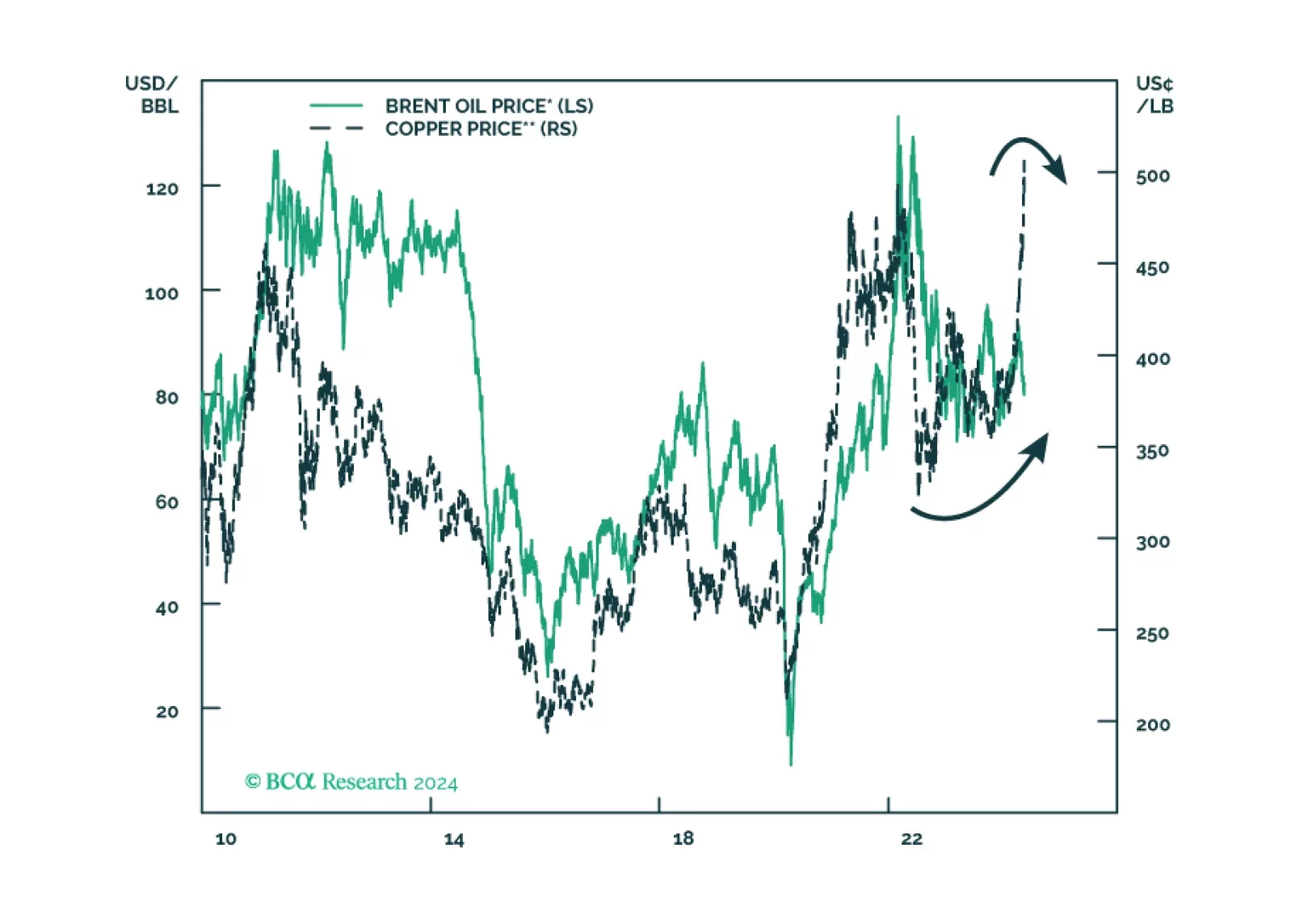

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

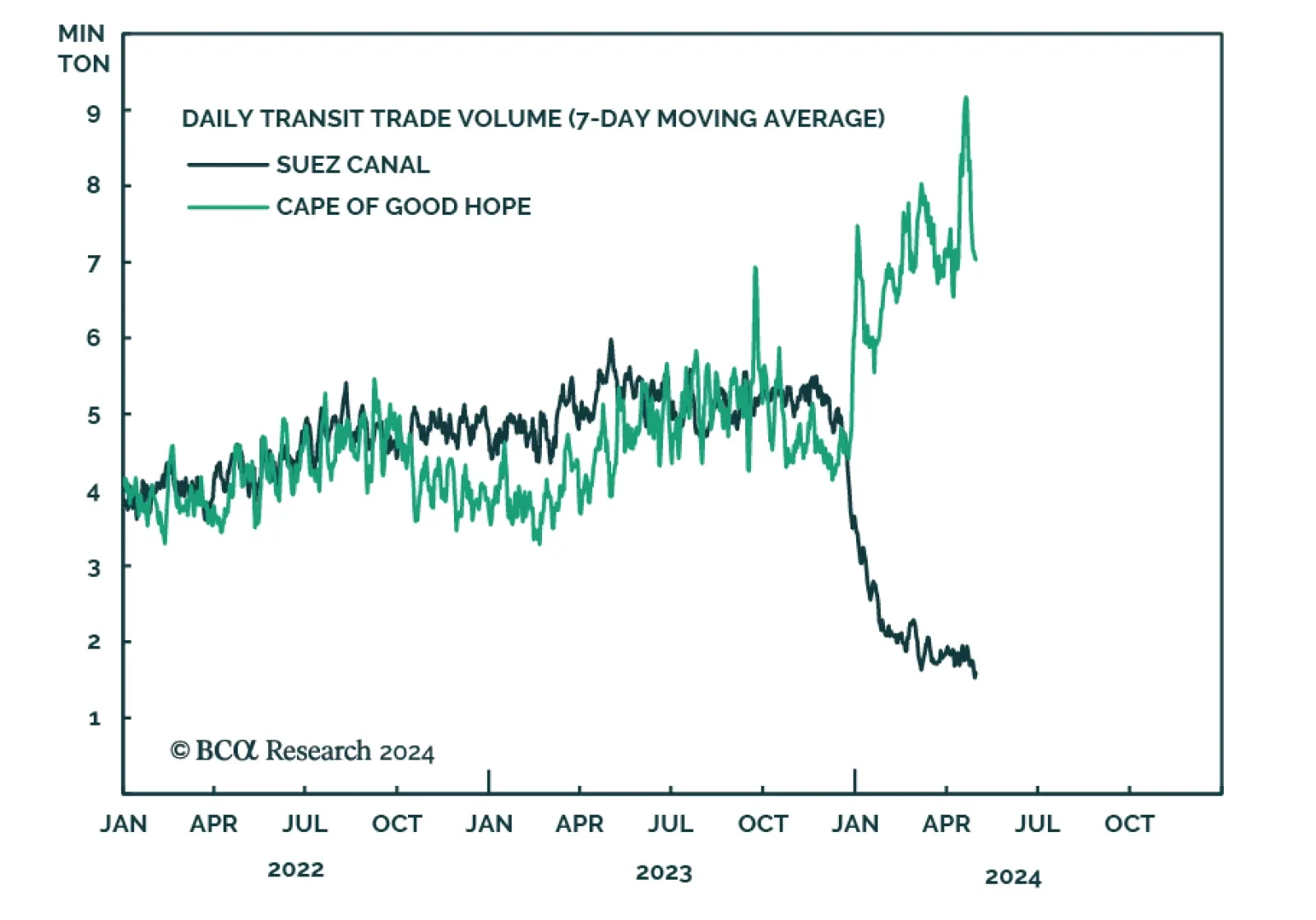

Transit through the Suez Canal has hit a new low. The 7-day moving average of daily ship transit calls is currently at 30, less than half of what it was at the end of 2023. The decline in volume has been even more severe, with…