President Trump’s inaugural speech outlined his second term agenda. The theme was that the US will become “far more exceptional” than it already is. Trump pledged to reverse America’s decline, rebalance the justice system, streamline…

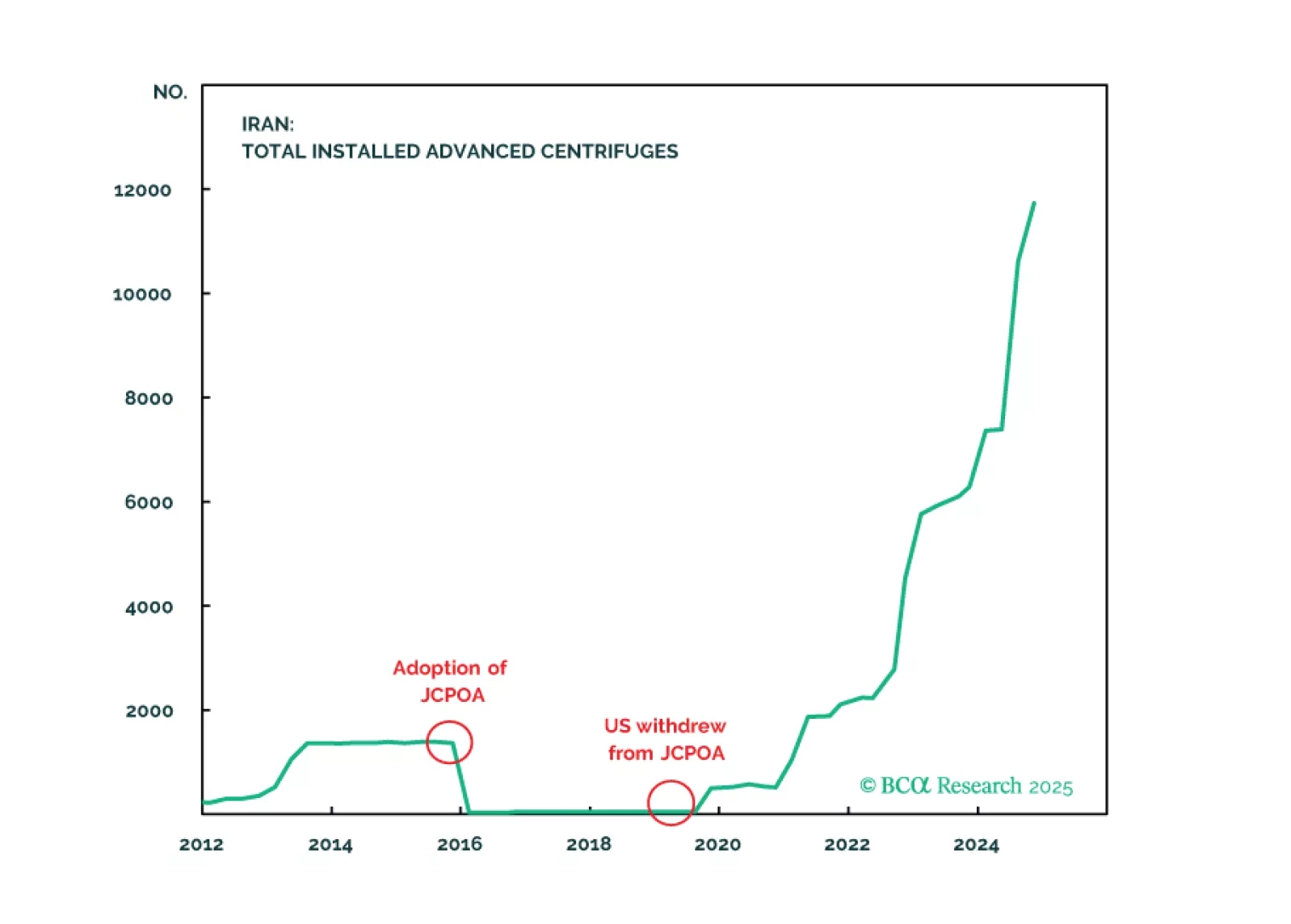

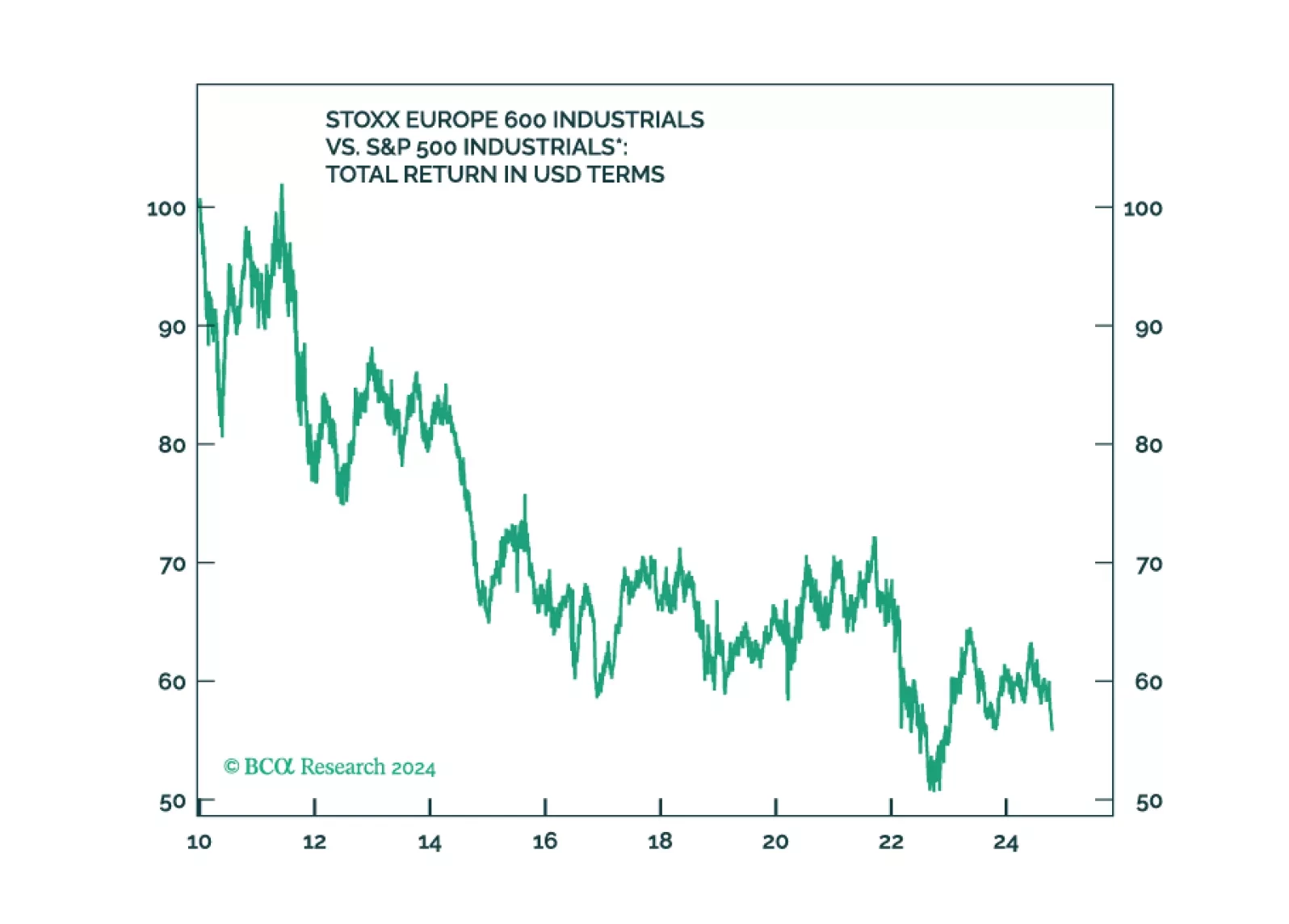

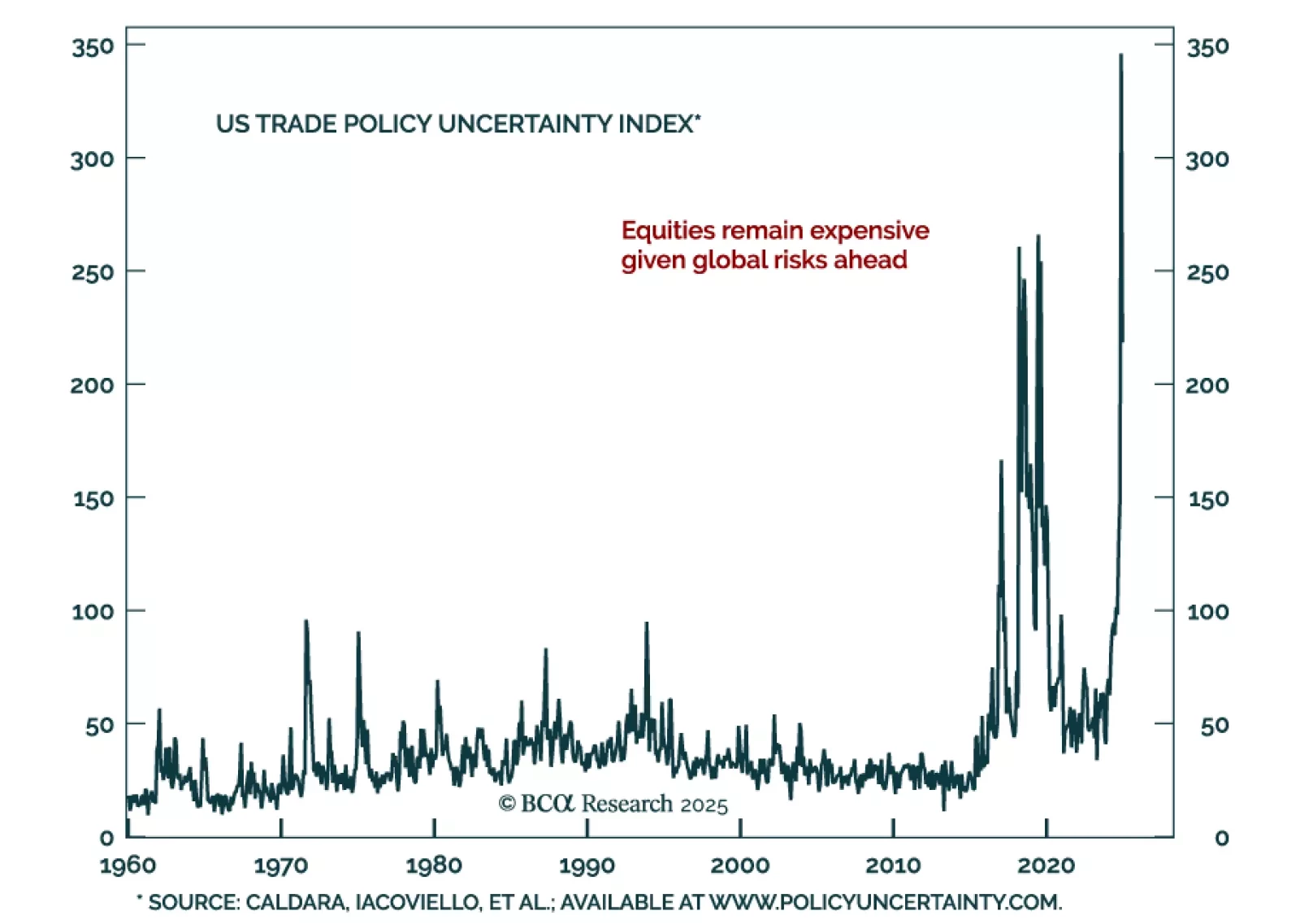

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

After more than 10 years of civil war, Bashar Al-Assad’s rule came to an abrupt end when rebels captured Damascus. Syria might not be a significant country in economic or financial terms, but it is part of the Middle…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

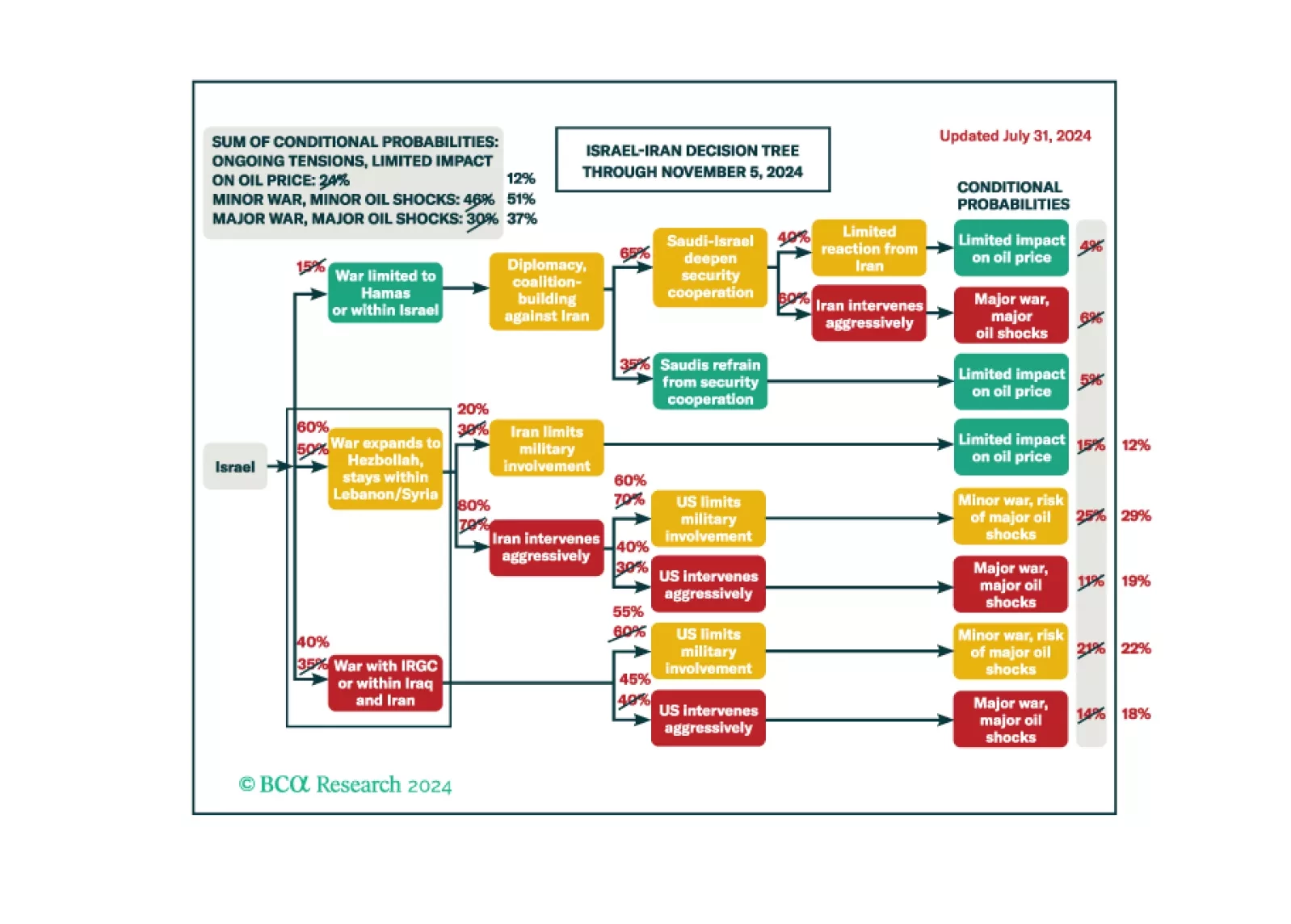

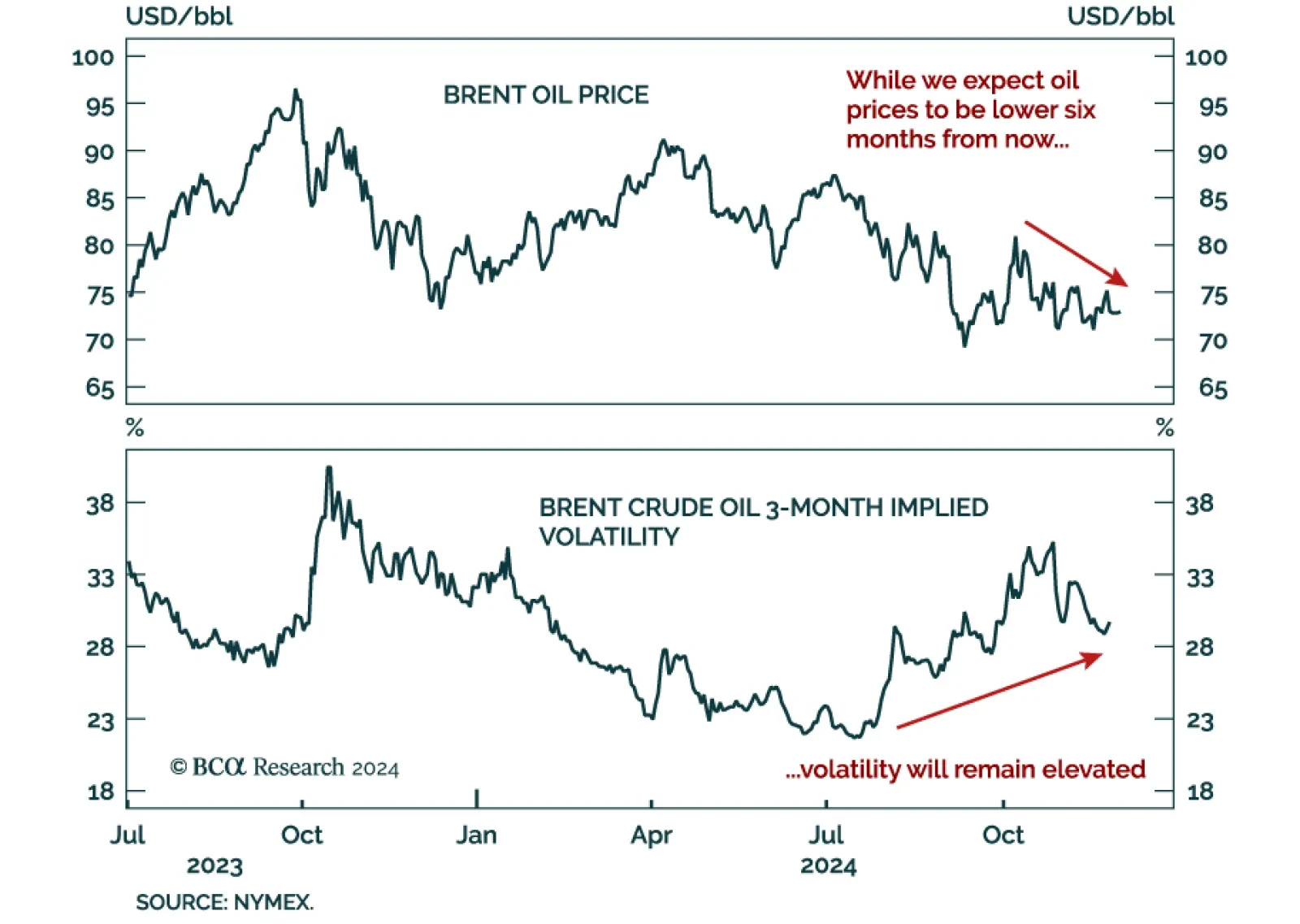

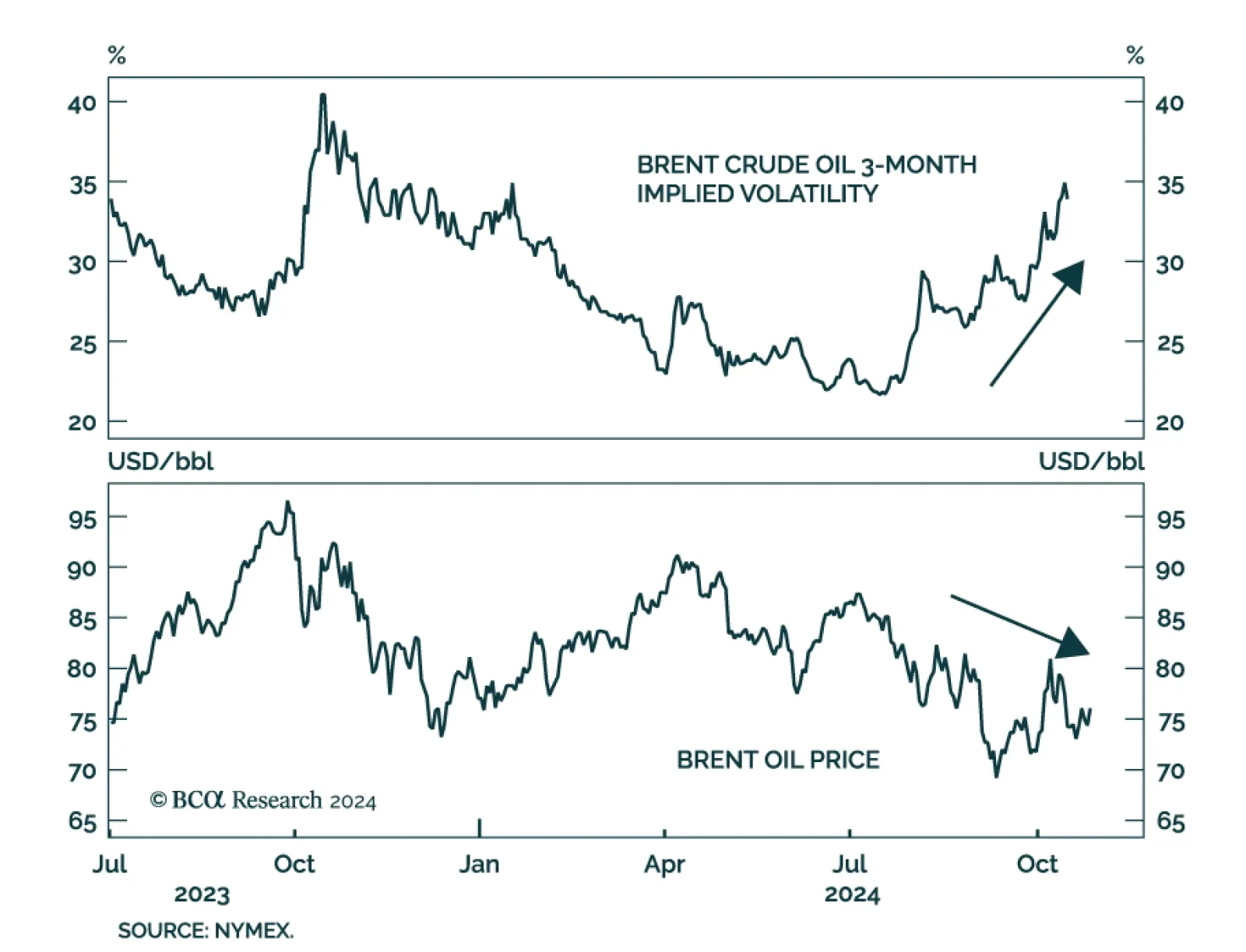

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…

The war in Ukraine has ended in late 2022… for markets at least. This is the conclusion from our GeoMacro team’s latest report, which aims to dispel five crucial myths surrounding the conflict. The myths are the…

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.