According to BCA Research’s Geopolitical Strategy service, Israel’s retaliation against Hamas has a 70% chance of expanding beyond Gaza in some form over the coming 12 months. The team’s scenarios and…

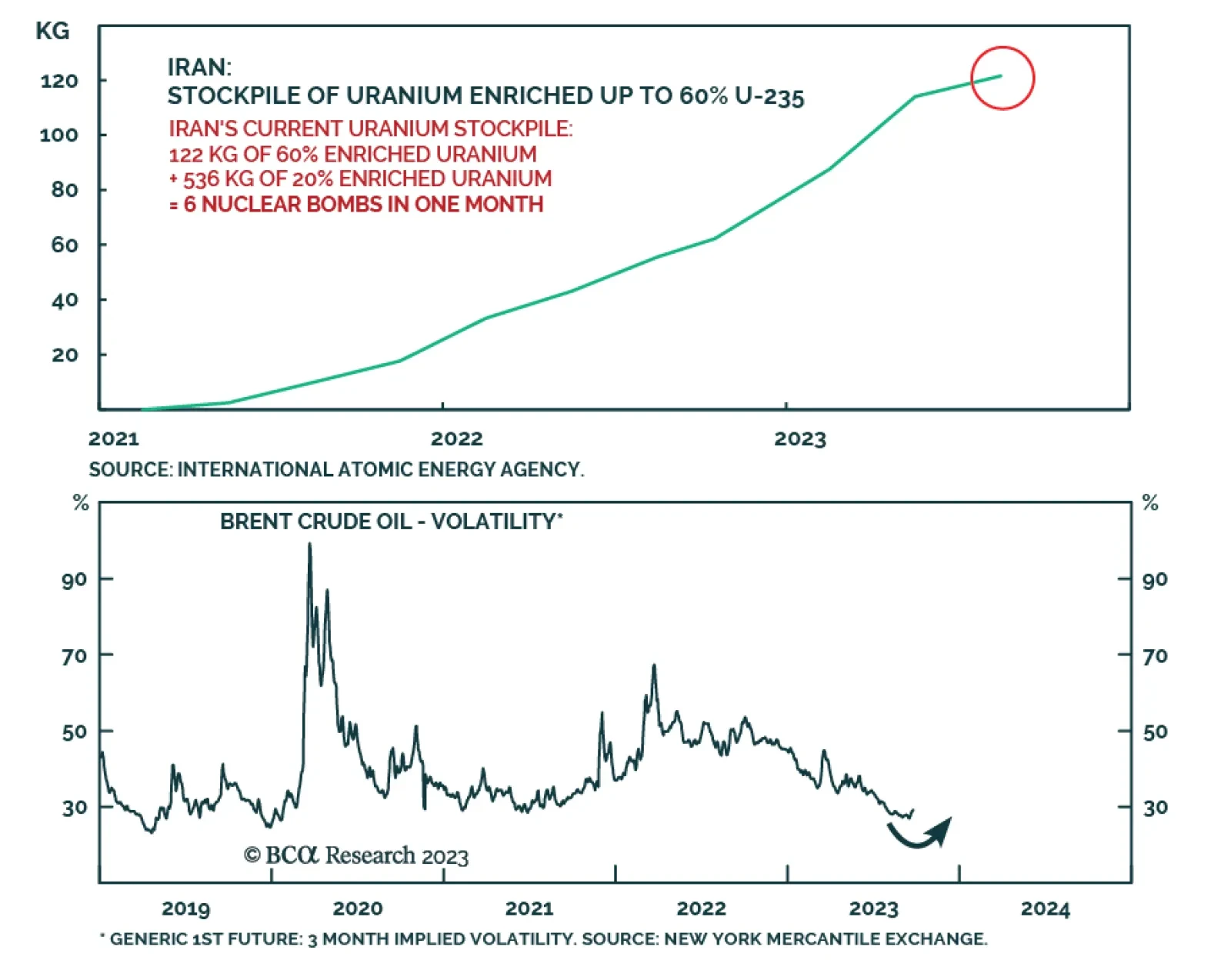

According to BCA Research’s Geopolitical Strategy service, volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. Everything depends on whether…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

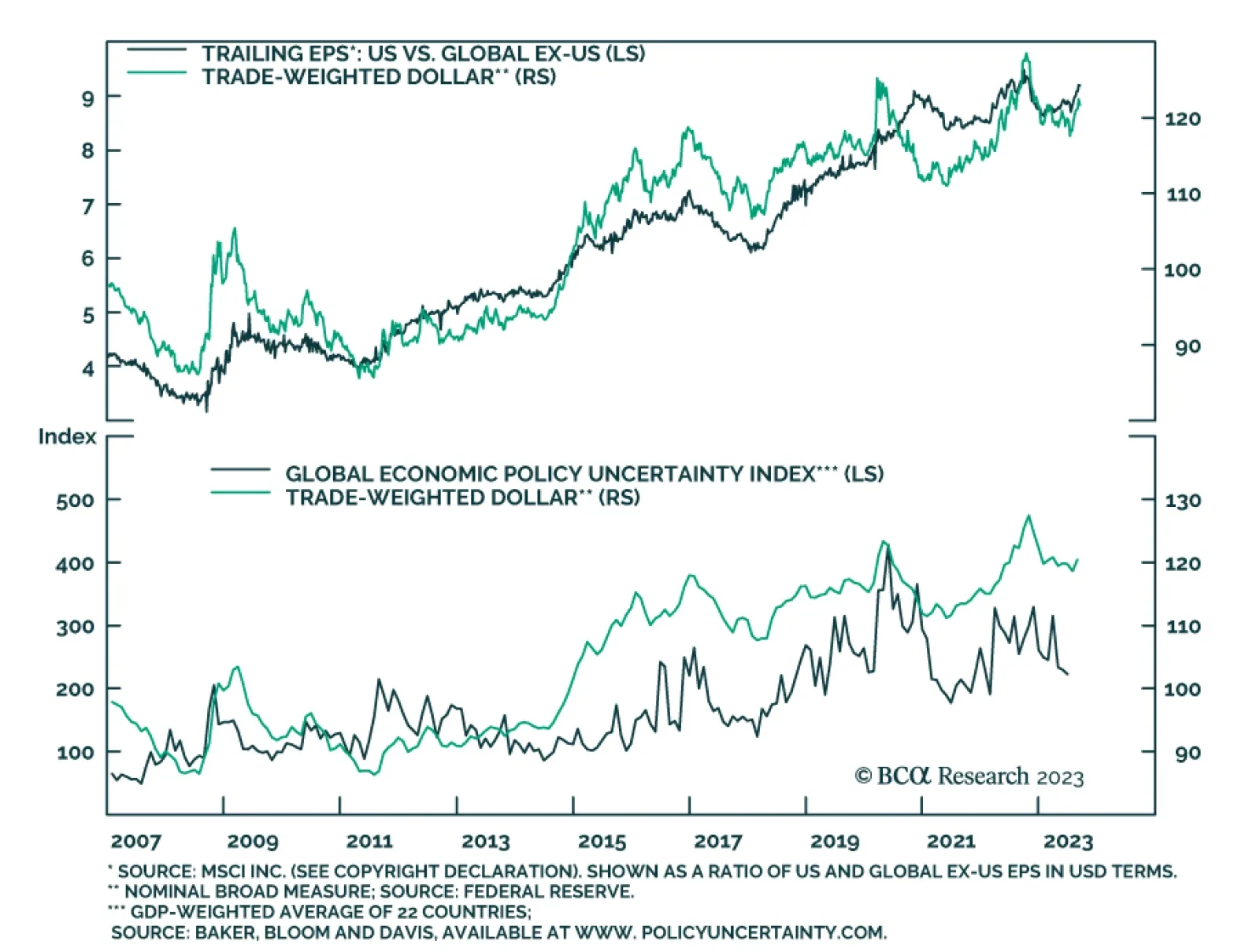

Last week, the Federal Reserve signaled that it expects to deliver one last rate hike this year. Similarly, some of its European counterparts signaled that they are at or close to the end of their hiking cycles. Where does this…

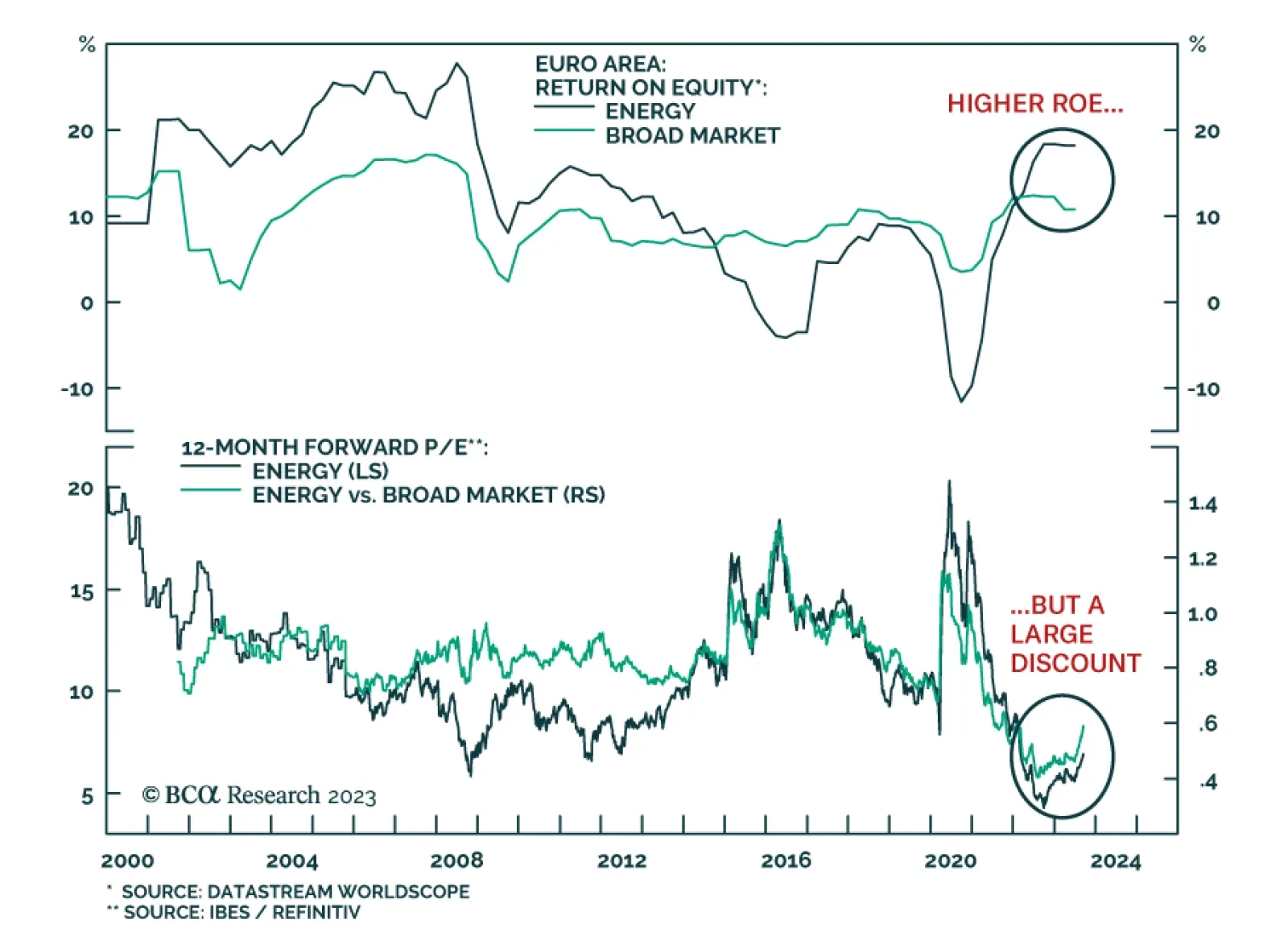

According to BCA Research’s European Investment Strategy service, energy stocks are an appealing overweight as a hedge against oil supply cuts. For now, the earnings of the energy sector continue to lag that of the broad…

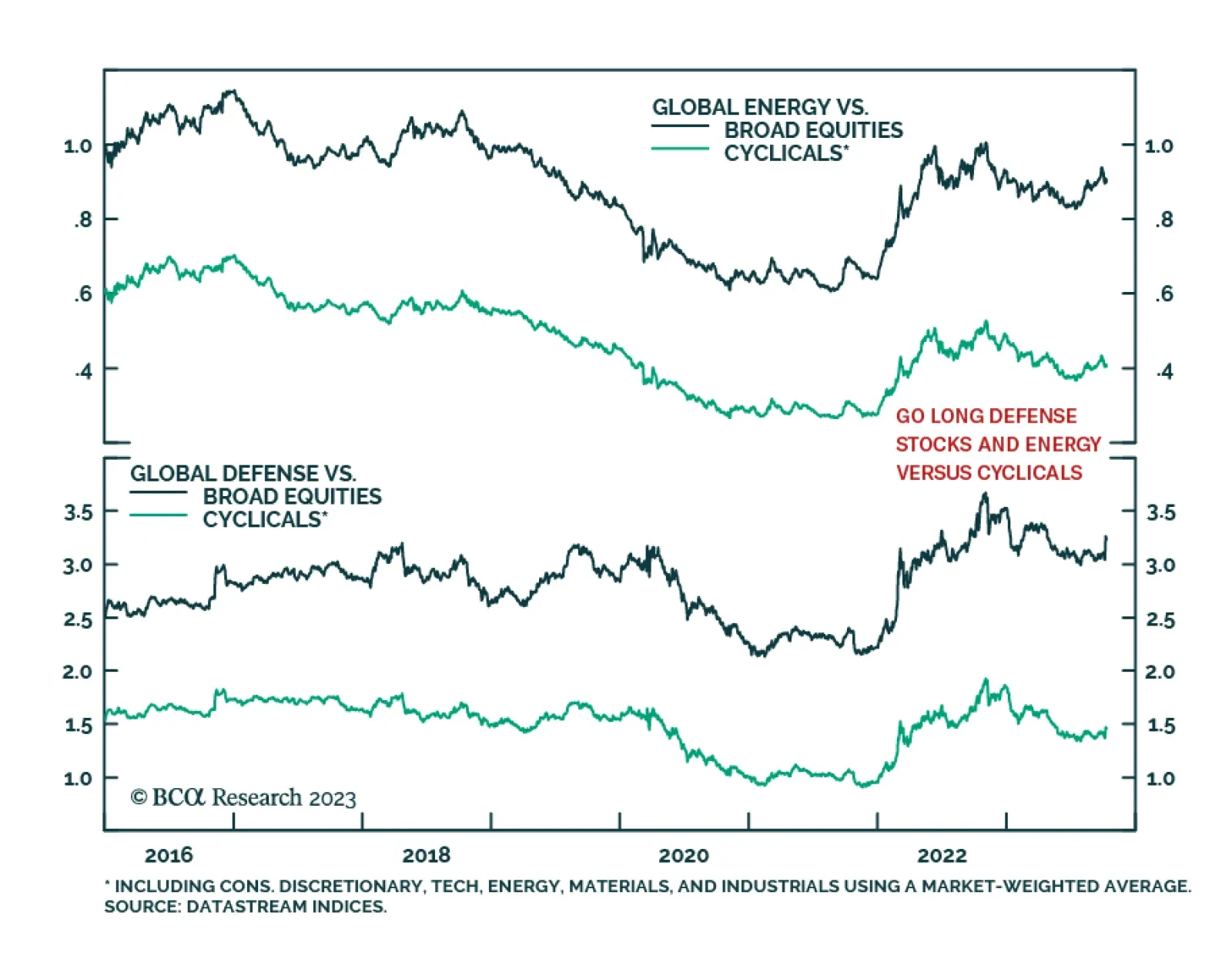

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.