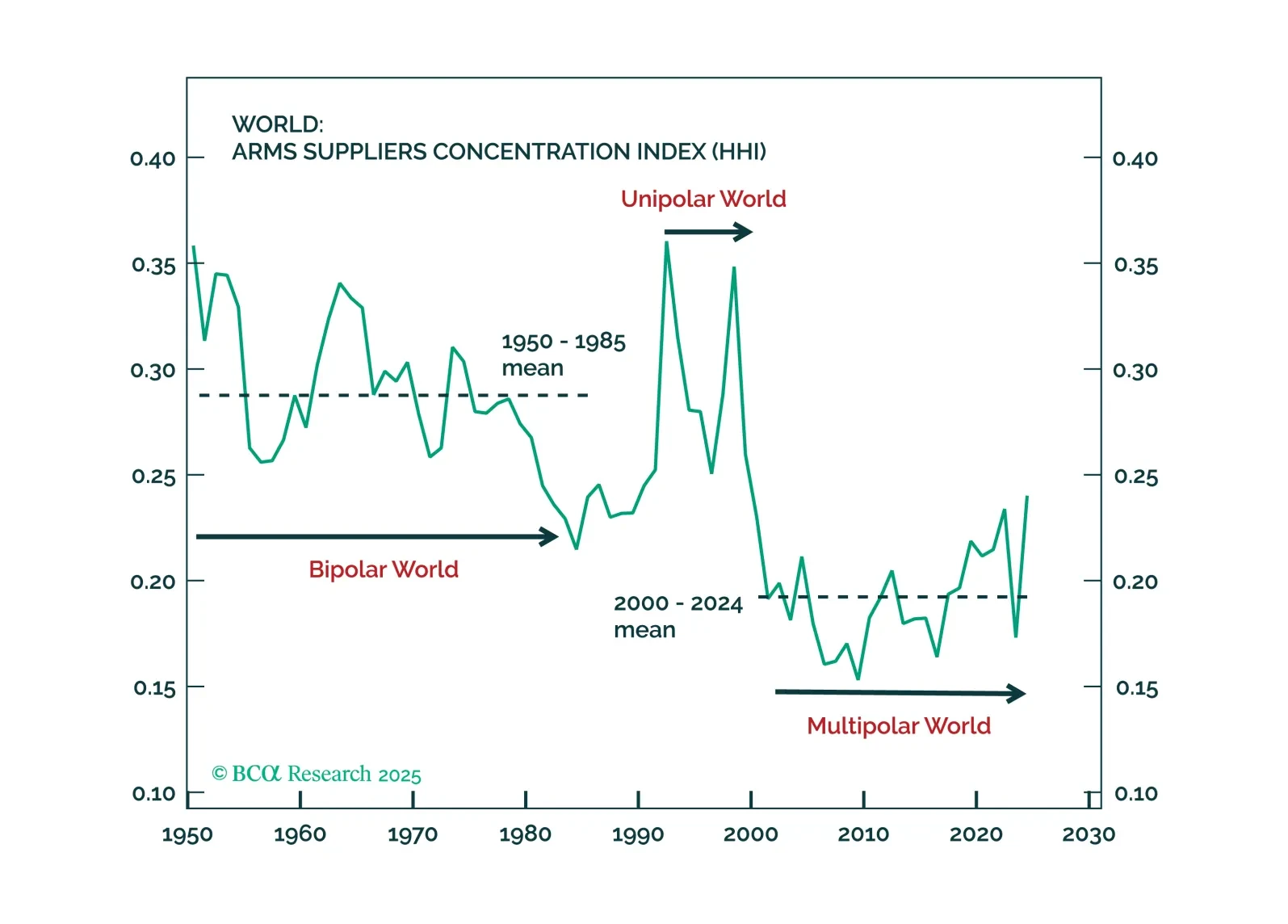

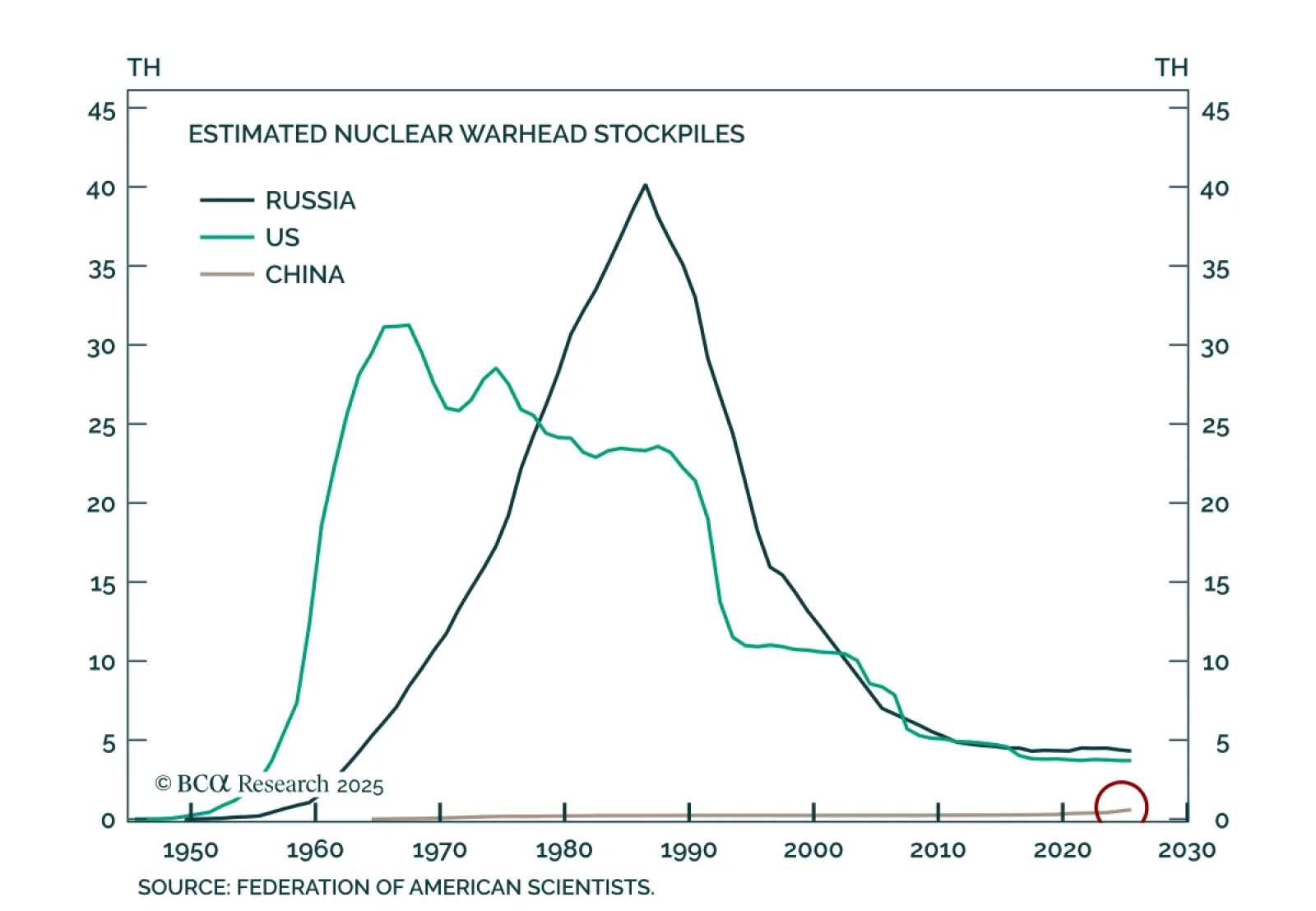

BCA’s Geopolitical strategists advise investors to remain open to the possibility that a new Cold War dynamic is forming in global trade. While the US-China rivalry does not map perfectly onto the original Cold War, the analogy…

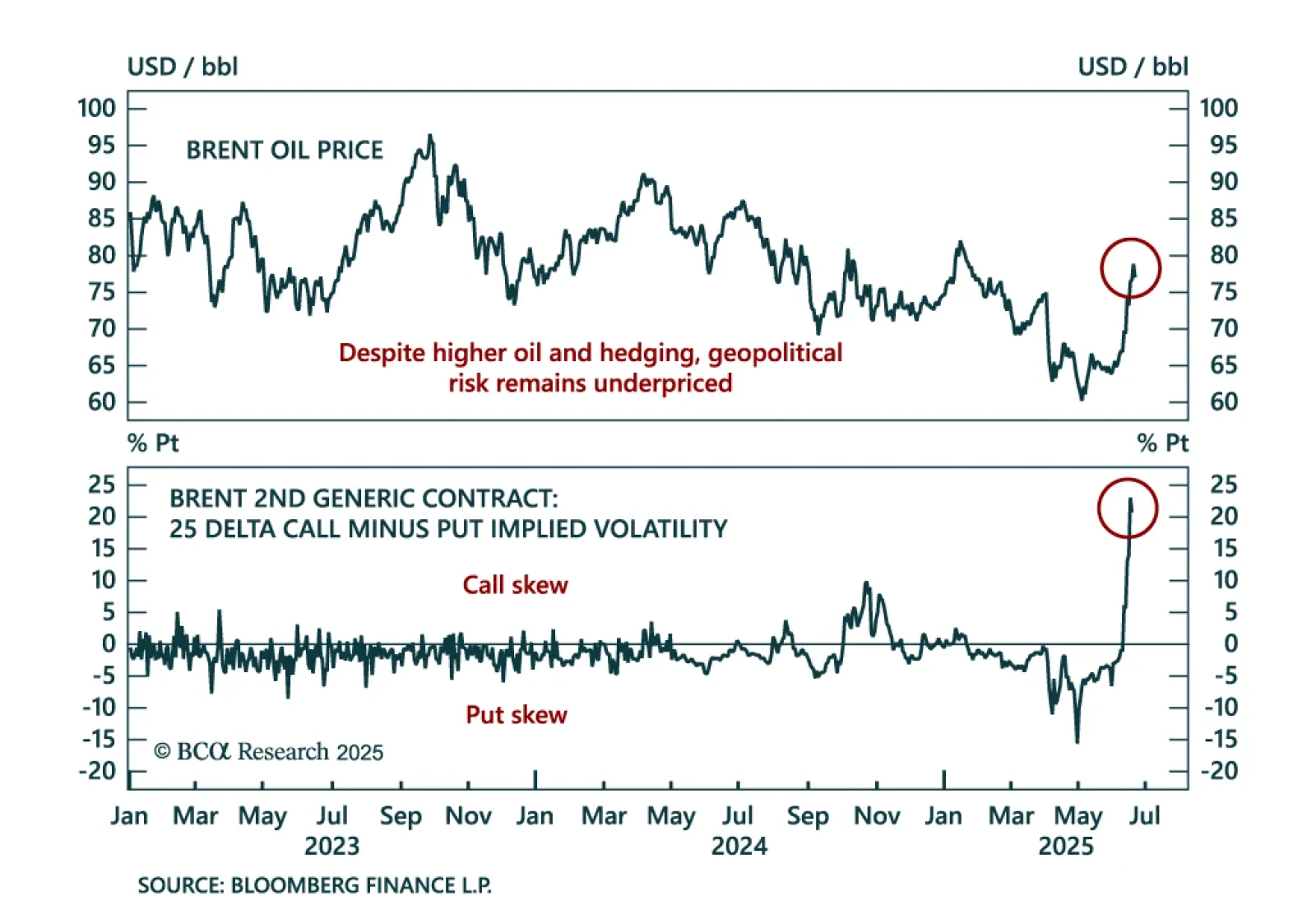

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

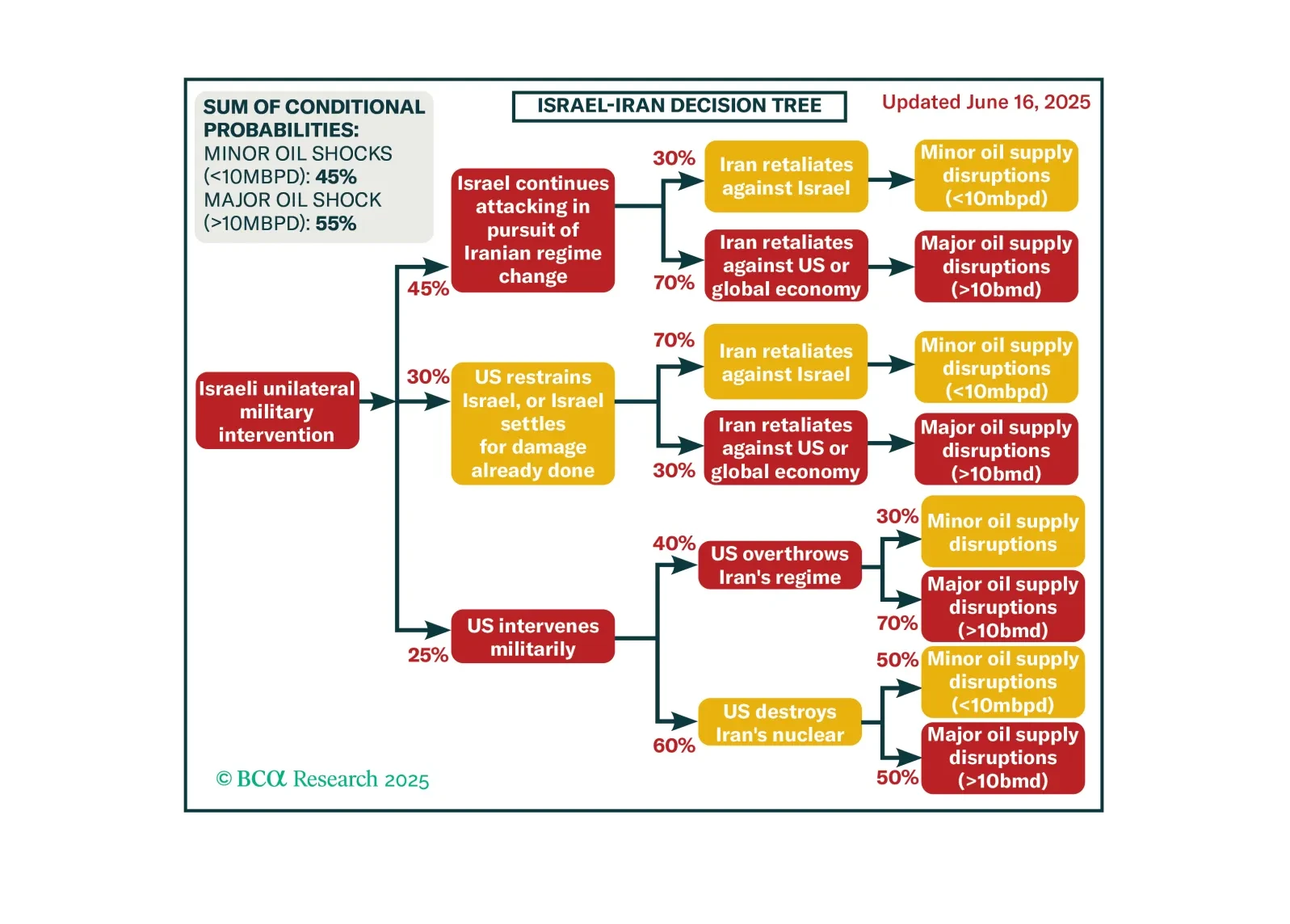

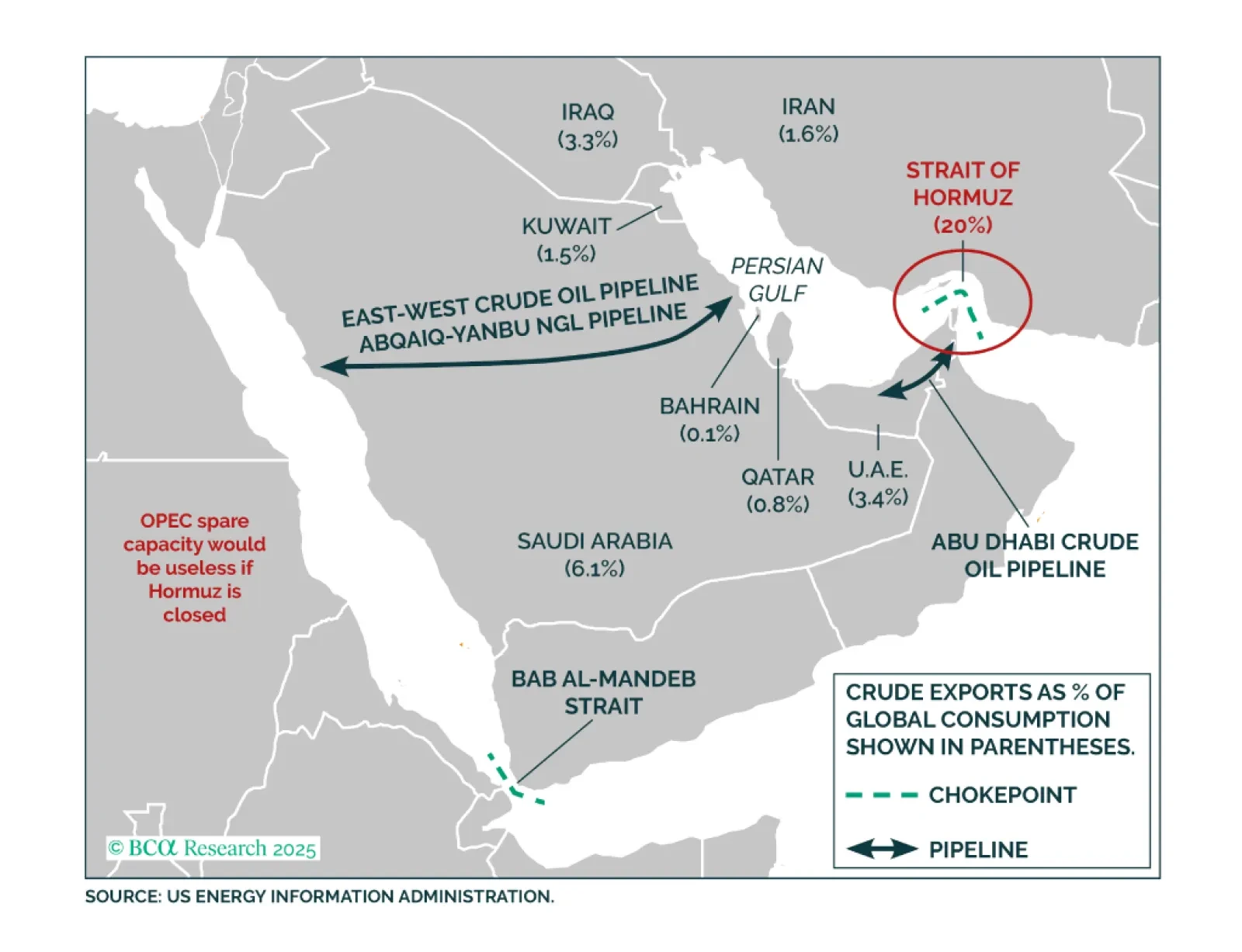

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

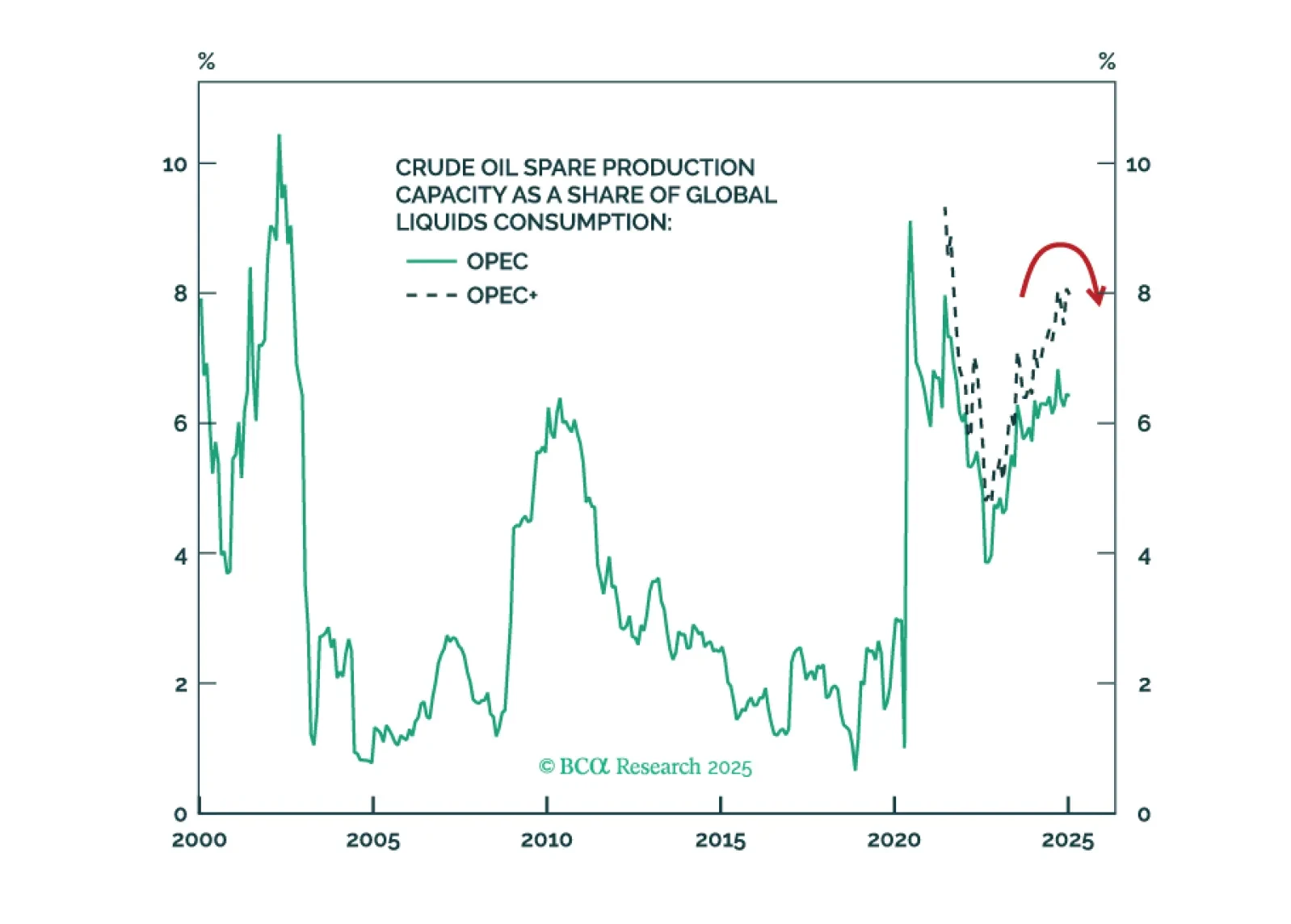

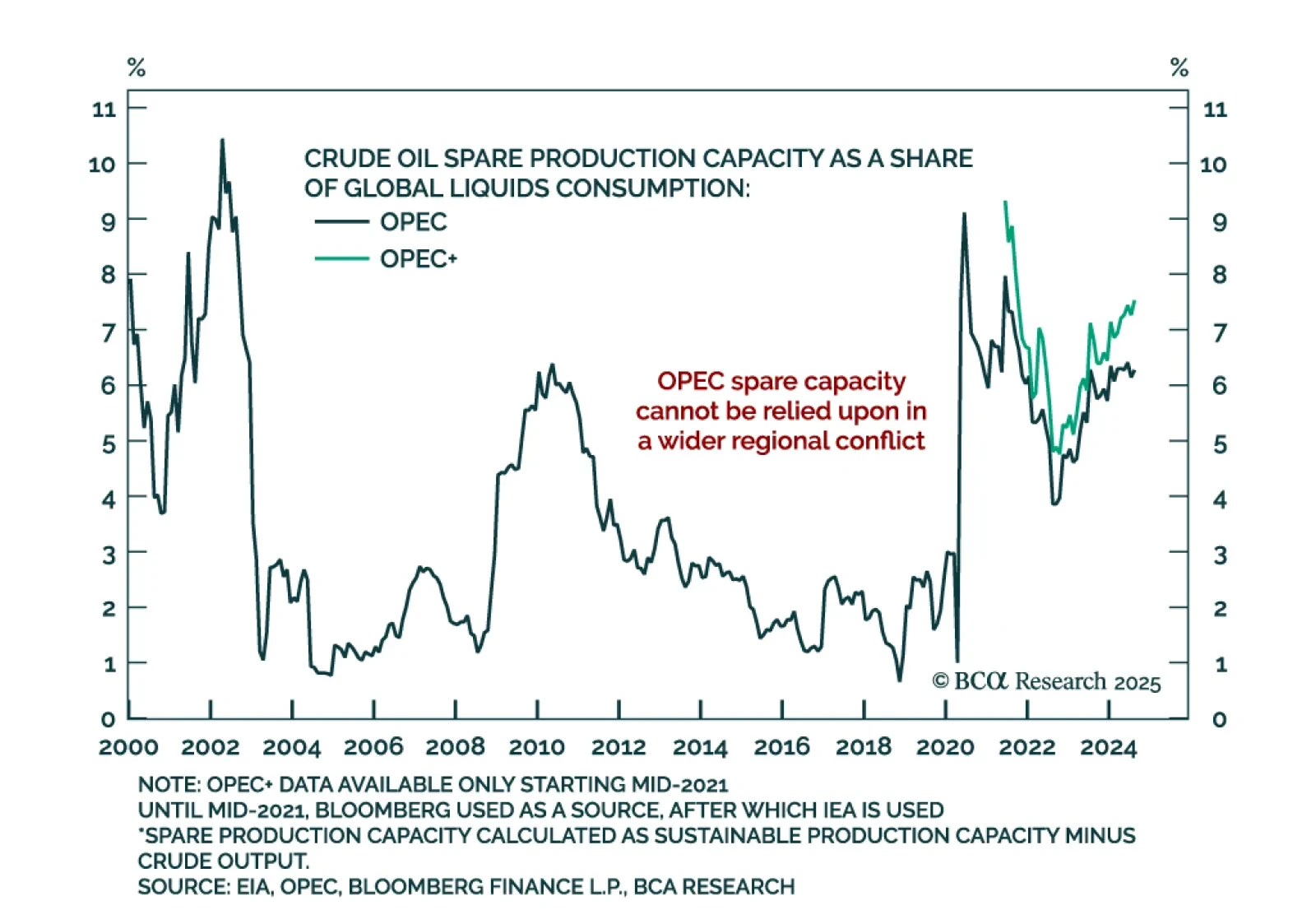

Our Commodity strategists see rising geopolitical risks as a catalyst for gold outperformance and caution that oil markets are underpricing the threat of a supply shock. The intensifying conflict between Israel and Iran has raised…

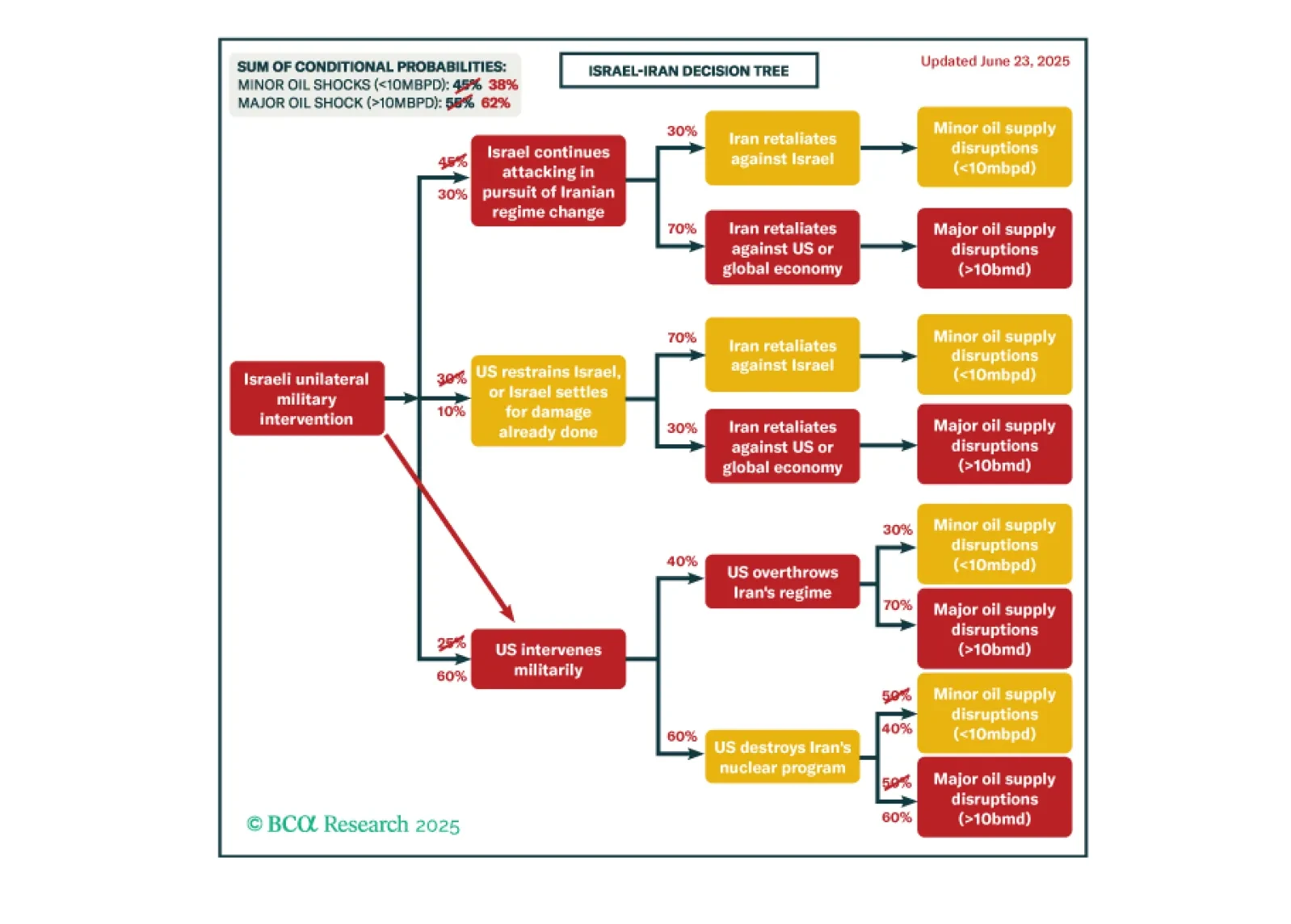

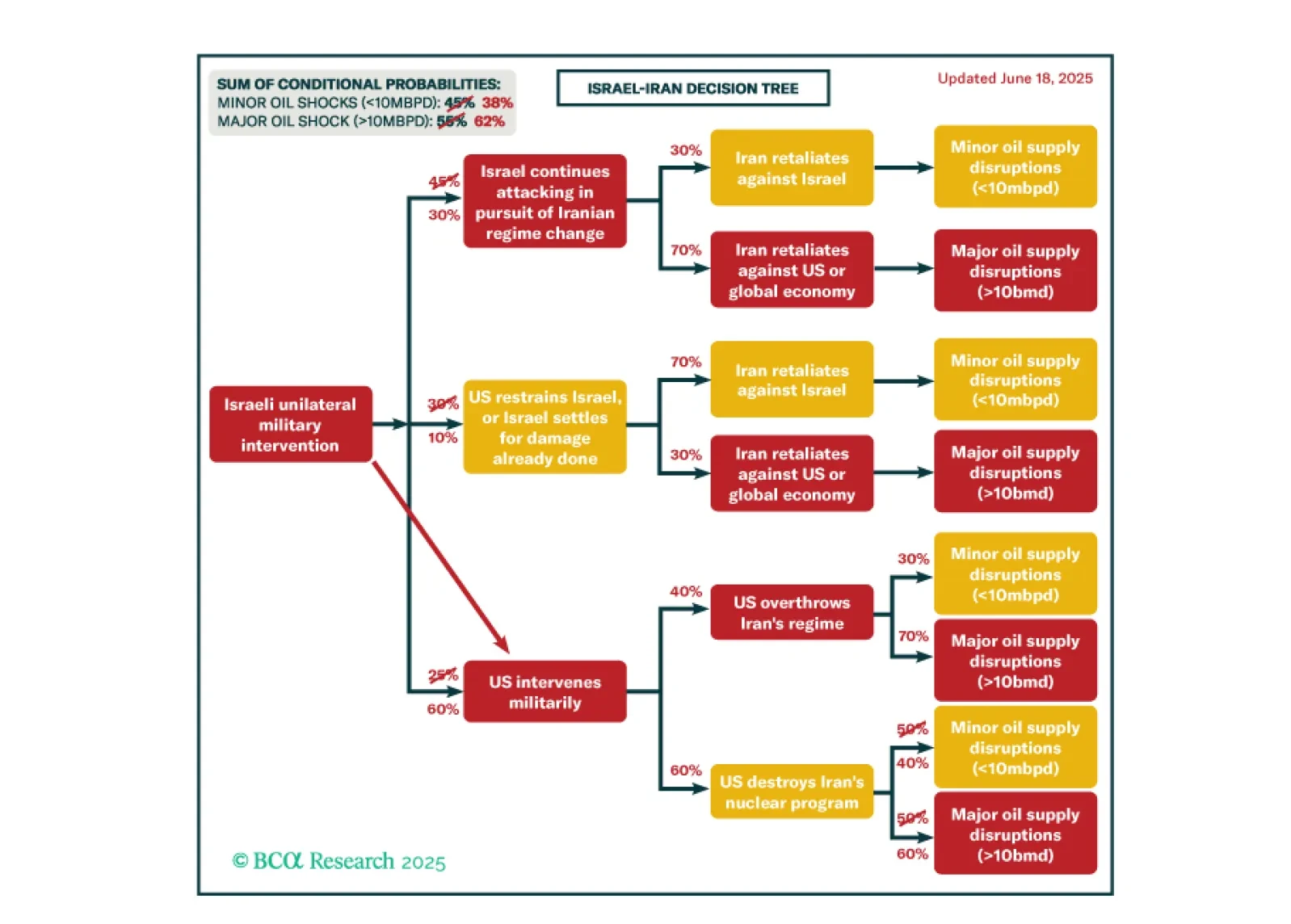

Elevated market complacency contrasts with high geopolitical risk as oil disruption remains a key threat. Middle East tensions escalated over the weekend after the US struck Iran’s nuclear capabilities, yet markets have reacted…

Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…