Vietnamese stocks can remain shaky for a few more months. But they have cheapened considerably, and equity portfolios with longer terms investment horizon should overweight them in EM, Emerging Asia and Frontier Market portfolios.

Highlights The bull run in Vietnamese stocks is due for a pause as the weakness in overall EM markets spreads to this bourse. Household consumption will stay constrained as new COVID-19 cases remain high and fiscal and monetary…

Like many EM bourses, Vietnamese stocks have plunged 35% over the past two months in US dollar terms. How should investors now position themselves with regard to Vietnamese equities, in both absolute and relative terms? In absolute terms…

Highlights Please note that we are publishing an analysis on Vietnam below. The unprecedented depth of this recession entails that many businesses will likely be operating below their break-evens for a while, even after the…

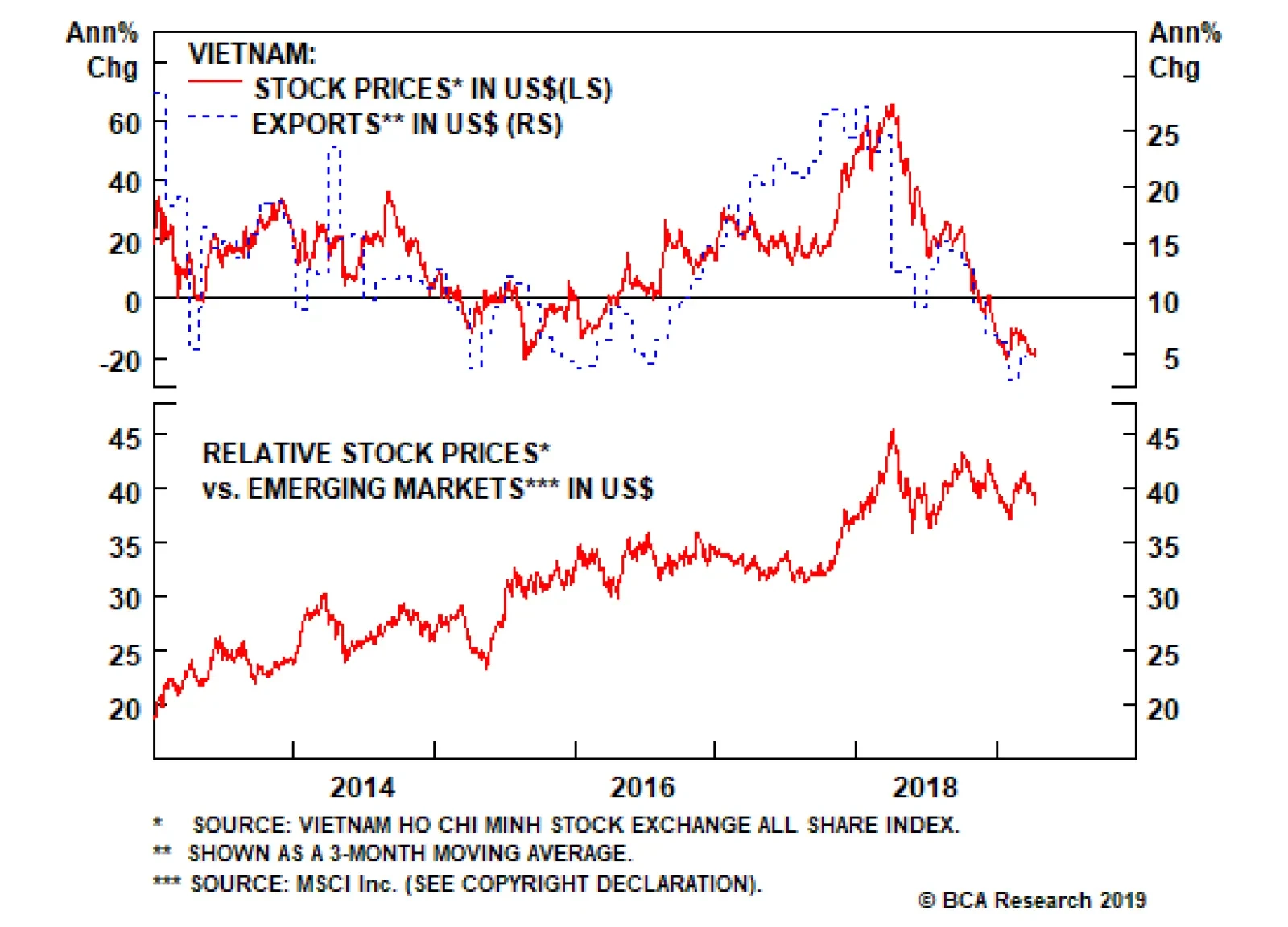

The significant deceleration in export growth alongside the selloff in broader emerging markets has generated a double-digit drop in Vietnamese stock prices over the past 12 months. Looking forward, a new upturn in Vietnamese…

Highlights Foreign investors have been rushing into Indian equities in anticipation of a Modi win. While Modi’s chances are reasonable, he may not win an outright majority. Keep tactically underweighting Indian stocks for now.…

Our negative call on Vietnamese stocks since last May has turned out well.1 The significant deceleration in export growth alongside the selloff in broader emerging markets has generated a double-digit drop in Vietnamese stock prices over…