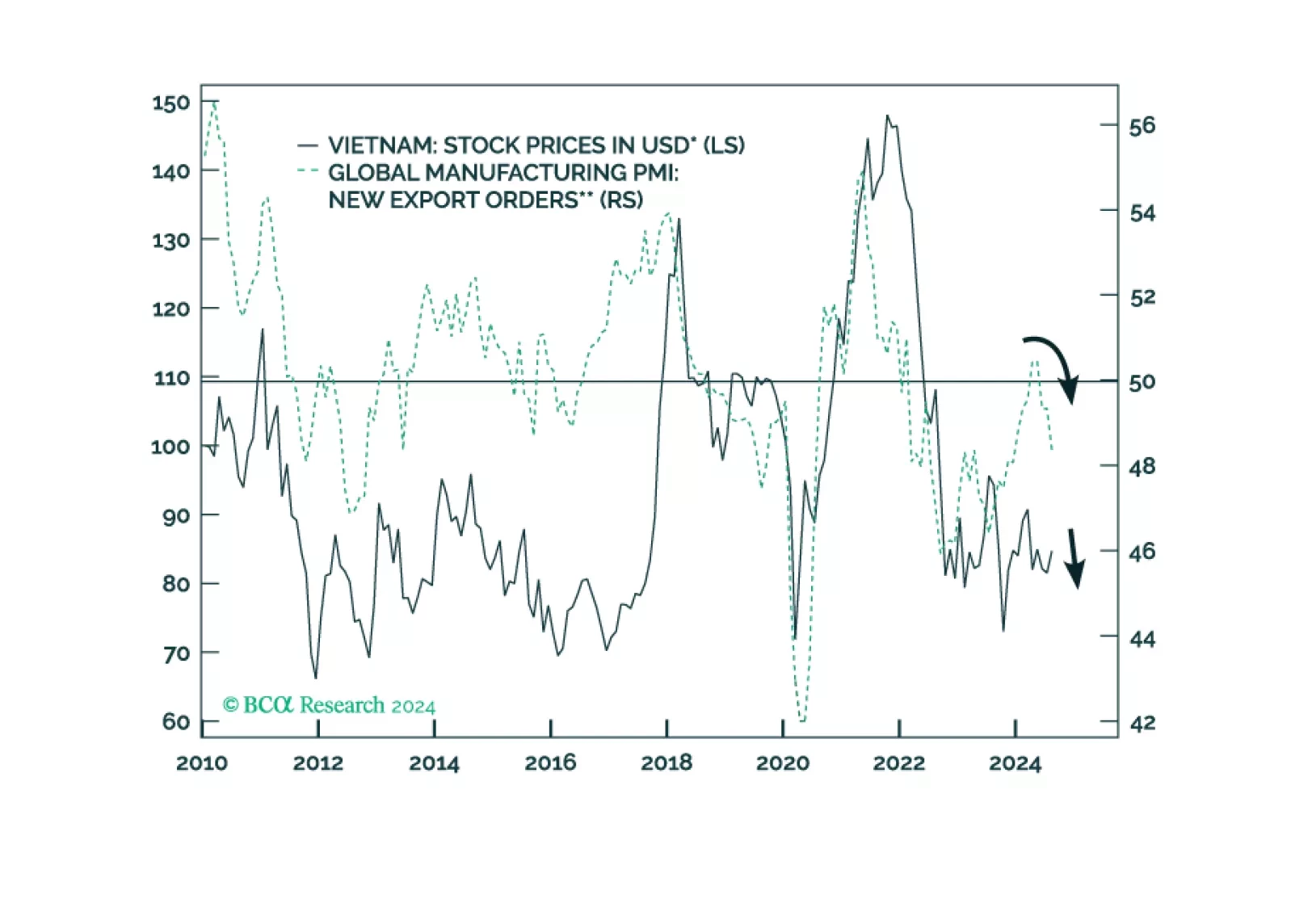

Our Emerging Markets strategists expect Vietnamese stocks to give back recent gains in the near term, while continuing to outperform EM and Asian peers. A divergence between export strength and weak order books suggests that overseas…

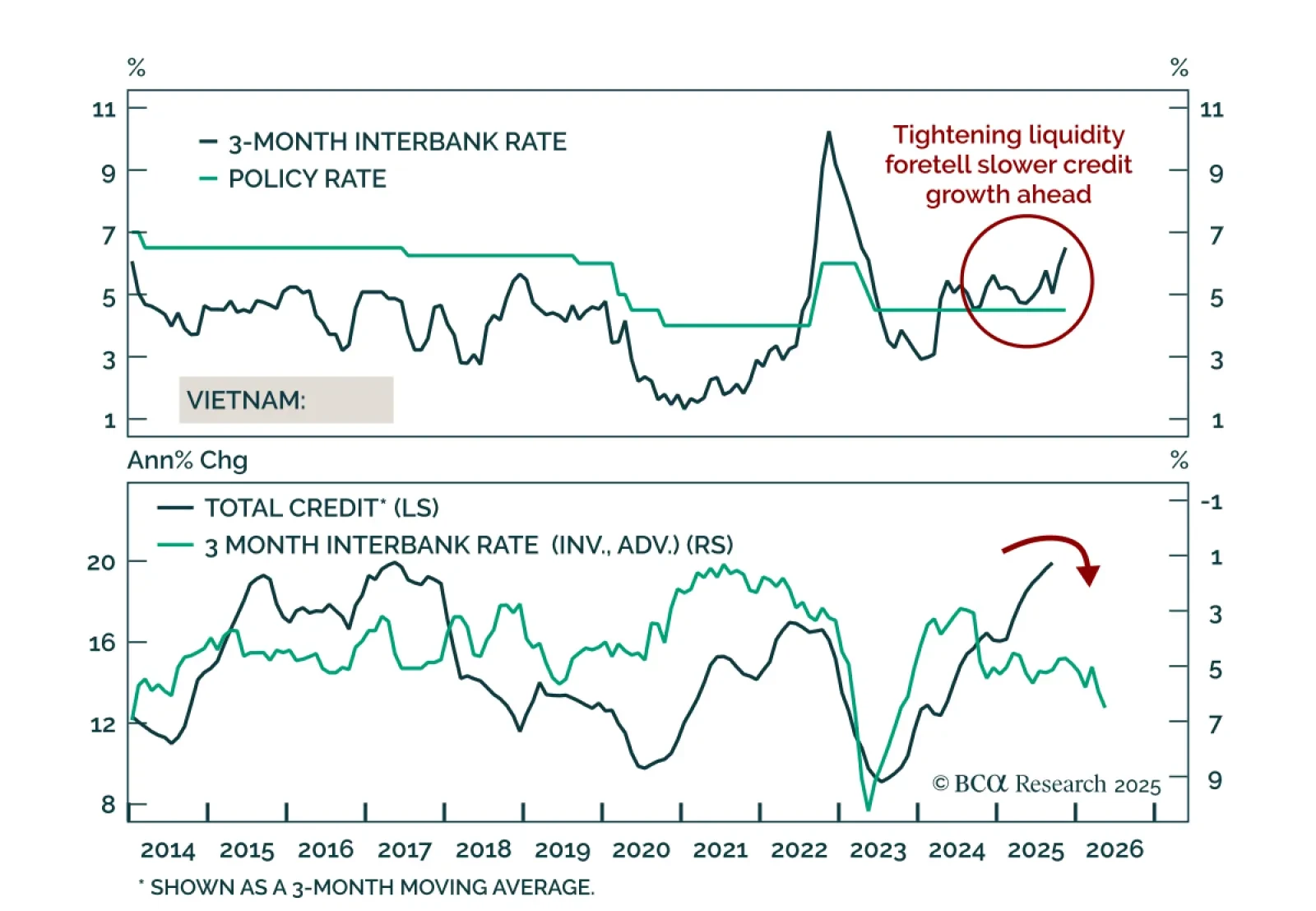

We remain bullish on the alpha-generating potential of Vietnamese stocks over the medium and long term. But our negative outlook on global/EM beta makes us bearish on this bourse in absolute terms over the medium term.

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

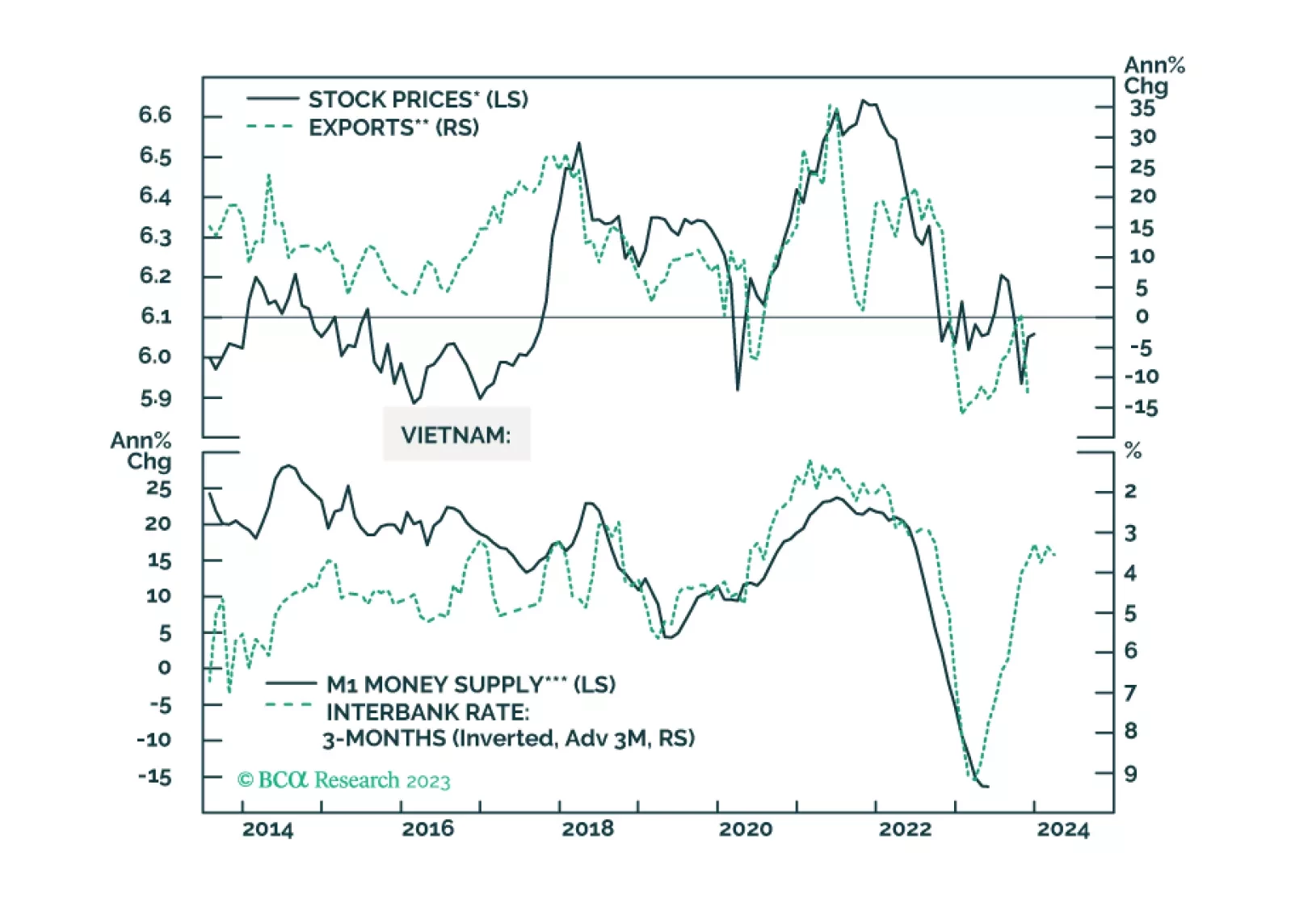

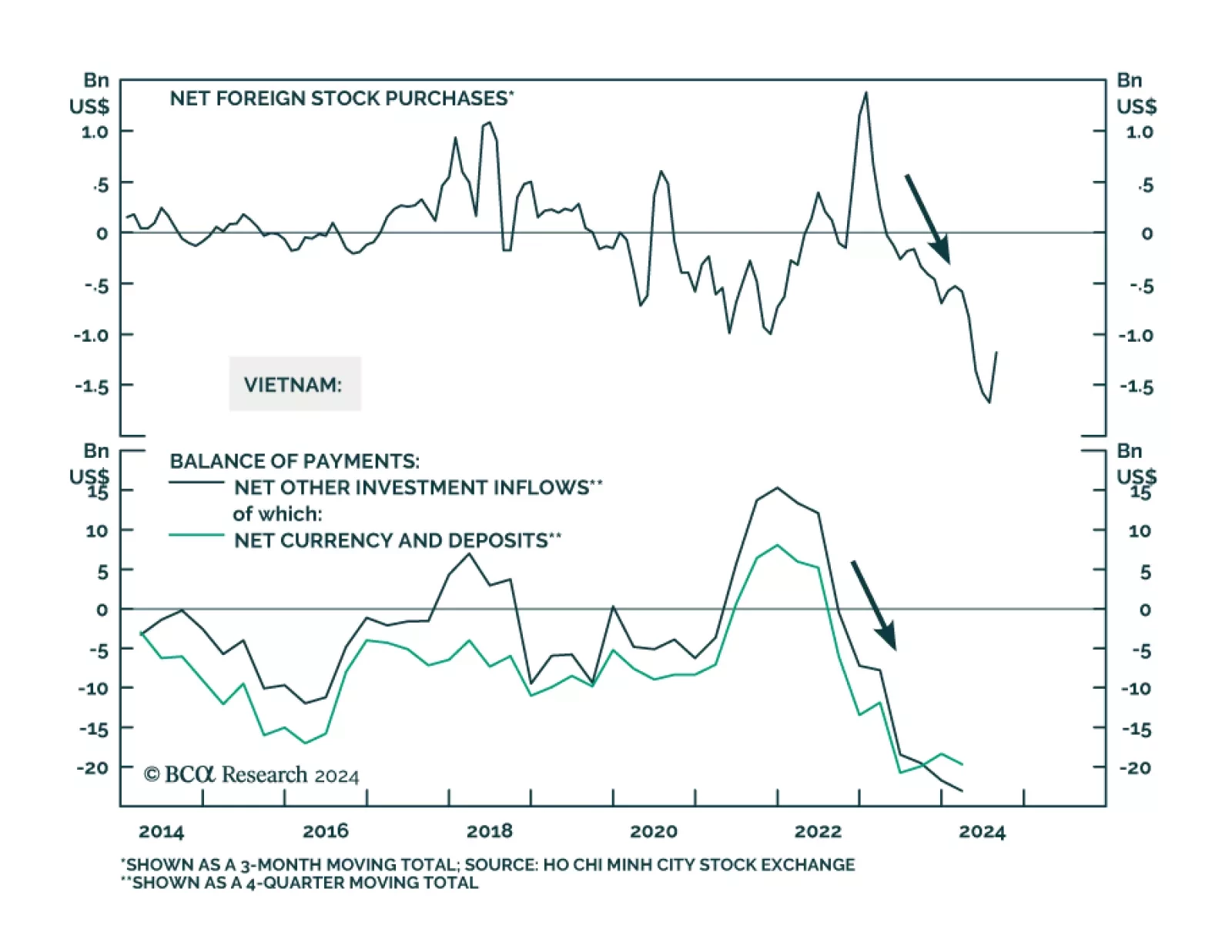

According to BCA Research’s Emerging Markets Strategy service, investor sentiment in Vietnamese markets has soured significantly since 2022, when the authorities' sweeping crackdown on alleged corruption in the real…

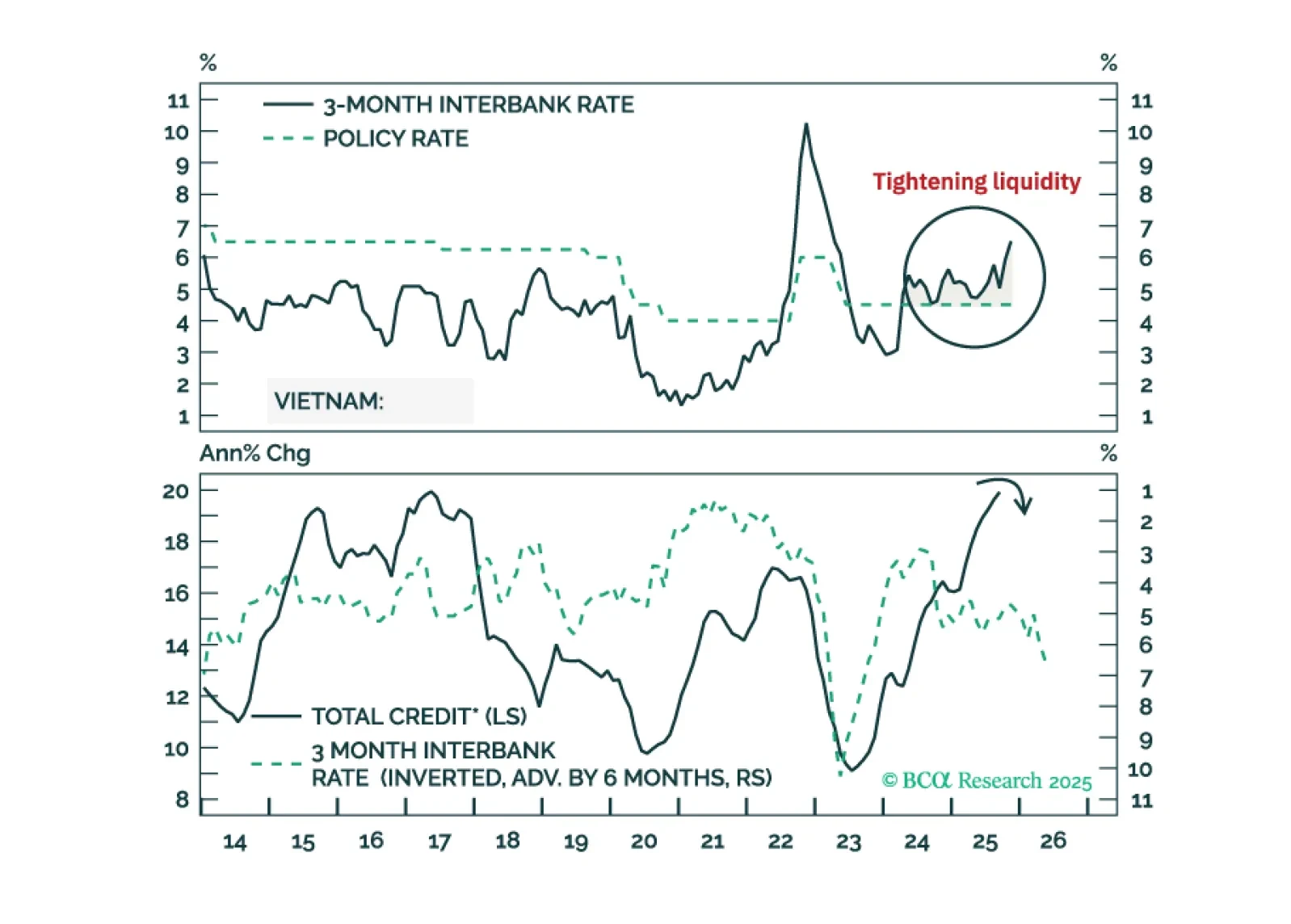

The Vietnamese economy is growing at a strong 7%. Why, then, are Vietnamese stocks struggling? Should investors expect a revival soon?

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…