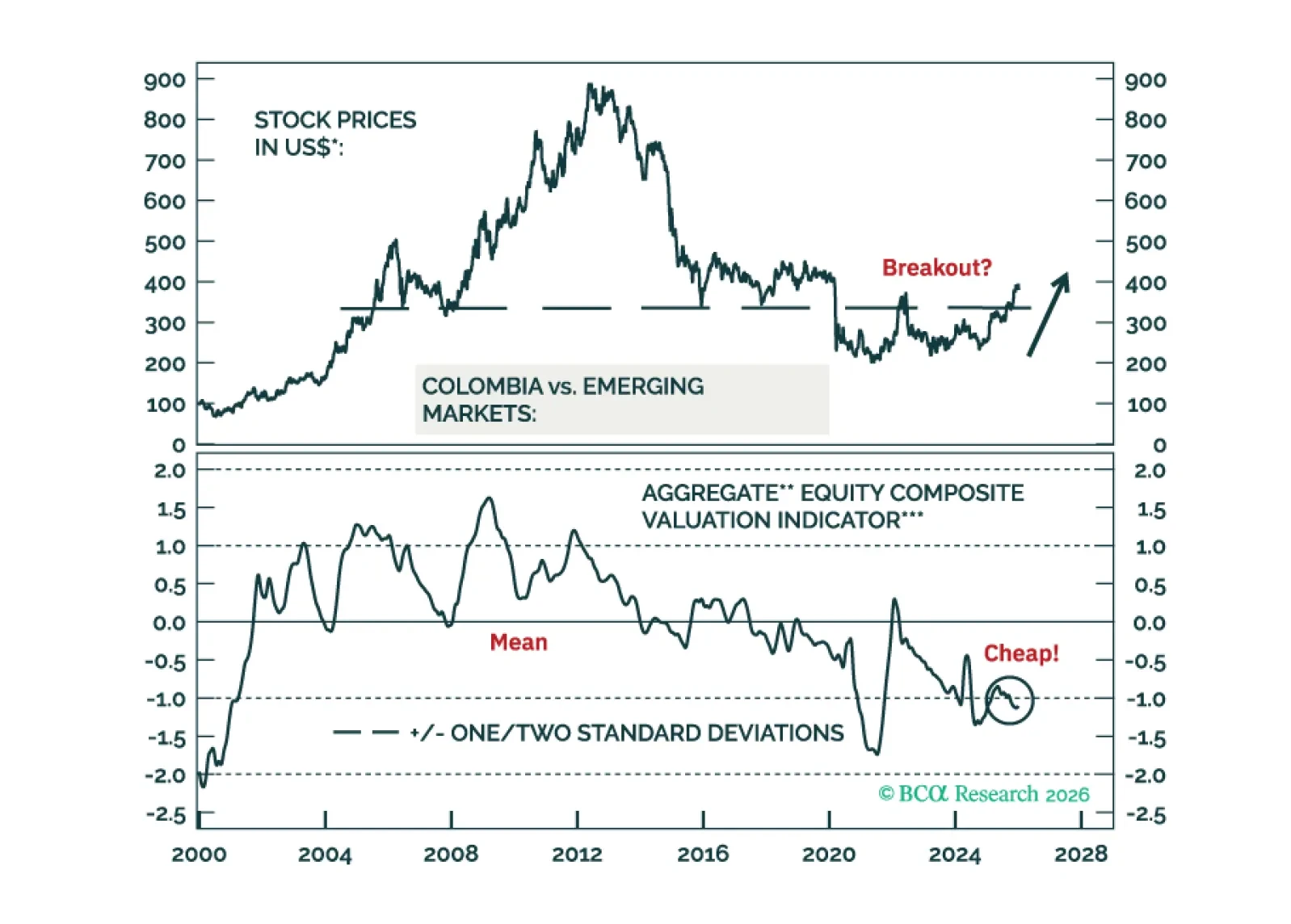

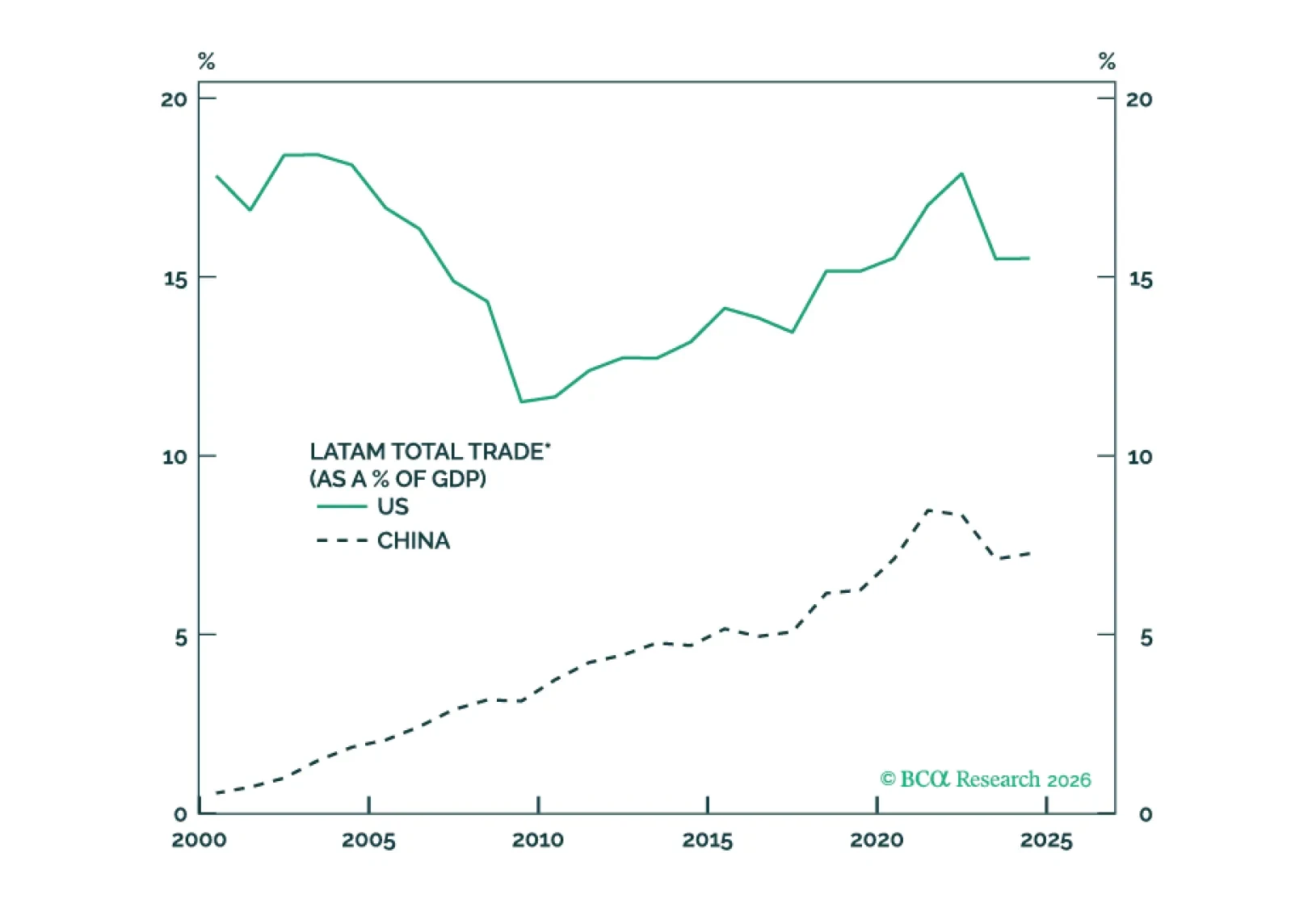

There will be little market and macro implications from the US intervention in Venezuela. Fade away any near-term moves in global oil markets. However, Colombian and Peruvian assets will benefit from lower political risk premiums.…

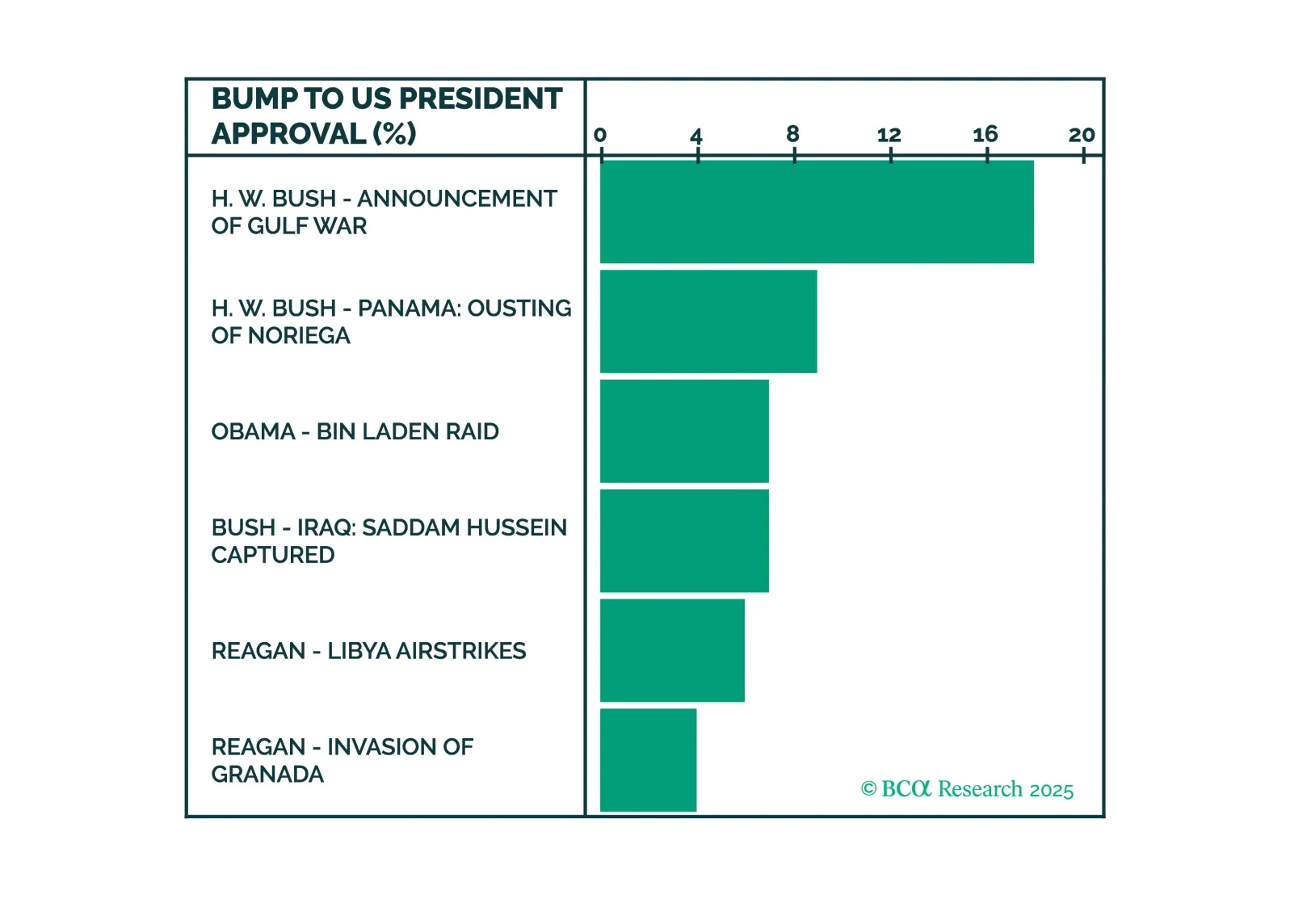

The US removal of Venezuela's Maduro does not presage an invasion of Greenland. But it does justify a lingering risk of conflict with Iran.

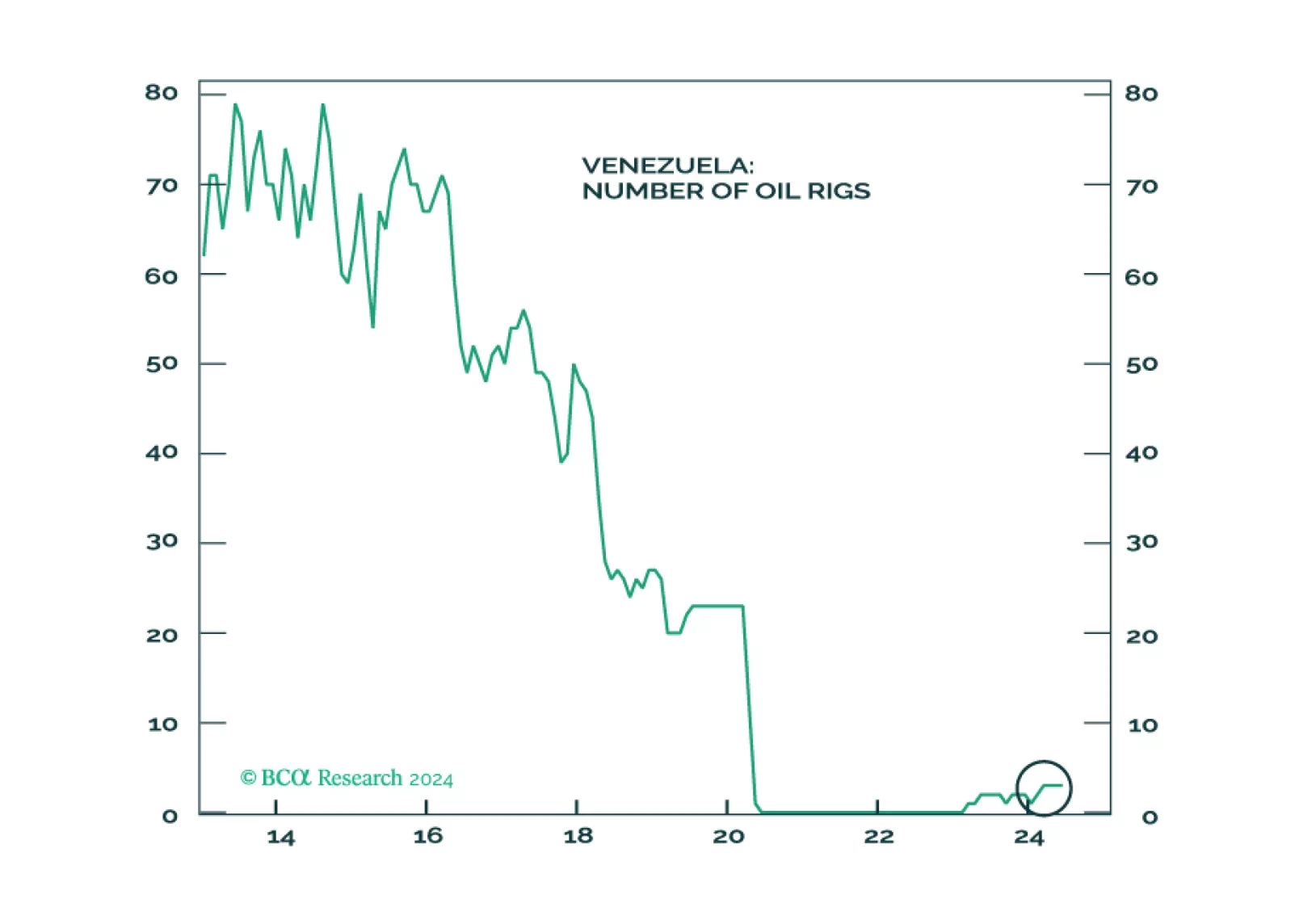

Fade oil-related narratives and equity rallies tied to Venezuela, as the near-term supply impact is negligible despite geopolitical upheaval. The US orchestrated the ouster of Venezuela’s Maduro. Our Geopolitical strategists view…

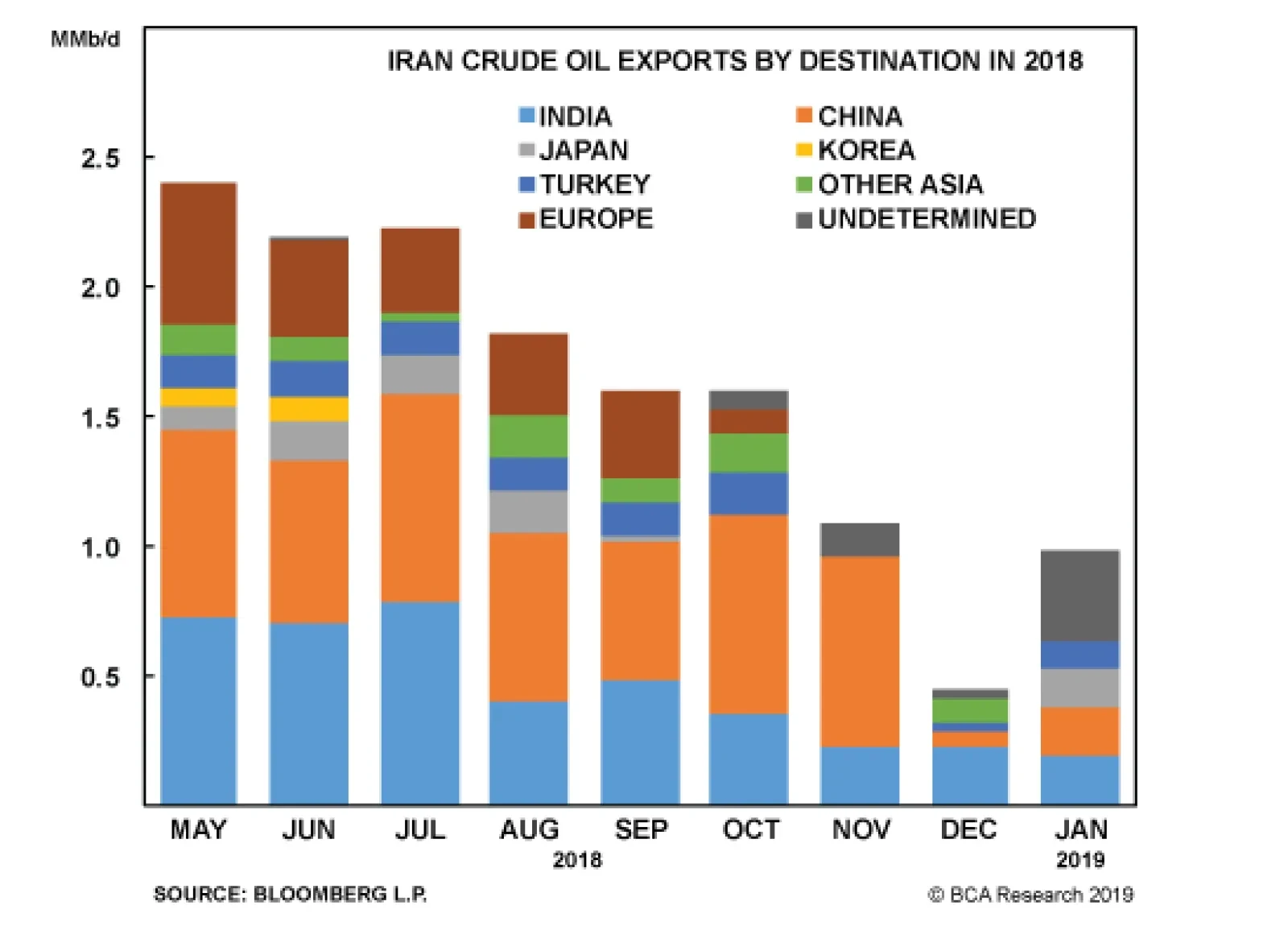

Highlights The collapse in oil prices supercharges the geopolitical risks stemming from the global pandemic and recession. Low oil prices should discourage petro-states from waging war, but Iran may be an important exception. Russian…

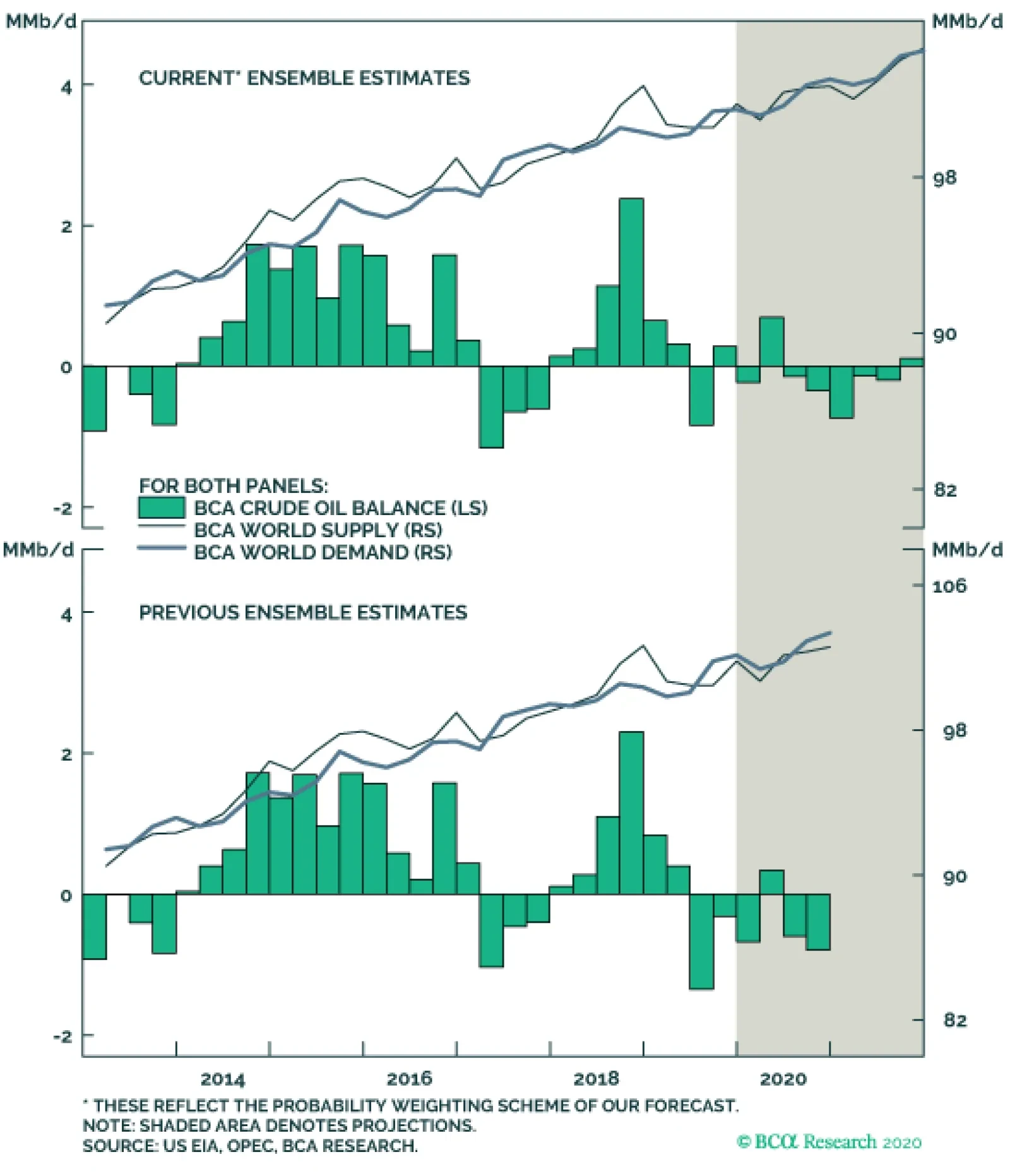

Crude oil fundamentals continue to favor higher prices. We continue to expect demand to grow 1.4mm b/d this year. For 2021, we expect growth of just under 1.5mm b/d, reaching 103.65mm b/d globally. For its part, the EIA is…

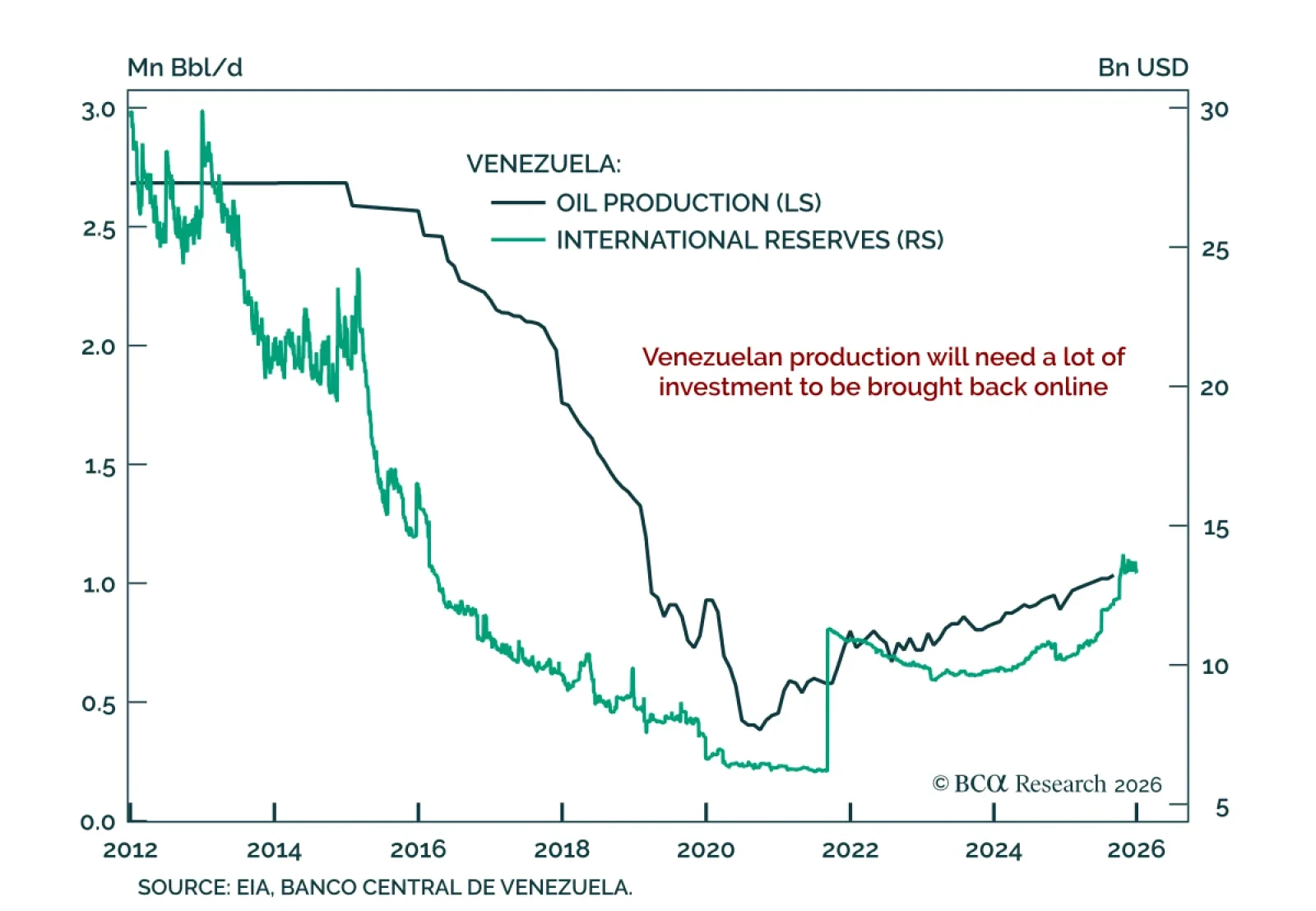

Highlights Venezuela’s oil production likely fell ~ 500k b/d last week in the wake of nationwide power outages, reducing total output to ~ 500k b/d. However, neither OPEC 2.0 nor U.S. President Donald Trump drew much attention to…

The manner in which U.S. sanctions against PDVSA and the Maduro regime evolve – in particular, whether a regime change materializes – will determine whether waivers on the oil-export sanctions the U.S. re-imposed on…

Political economy – i.e., the interplay between critical nation states’ policies and markets – often trumps straightforward supply-demand analysis in oil. This is because policy decisions affect production and…