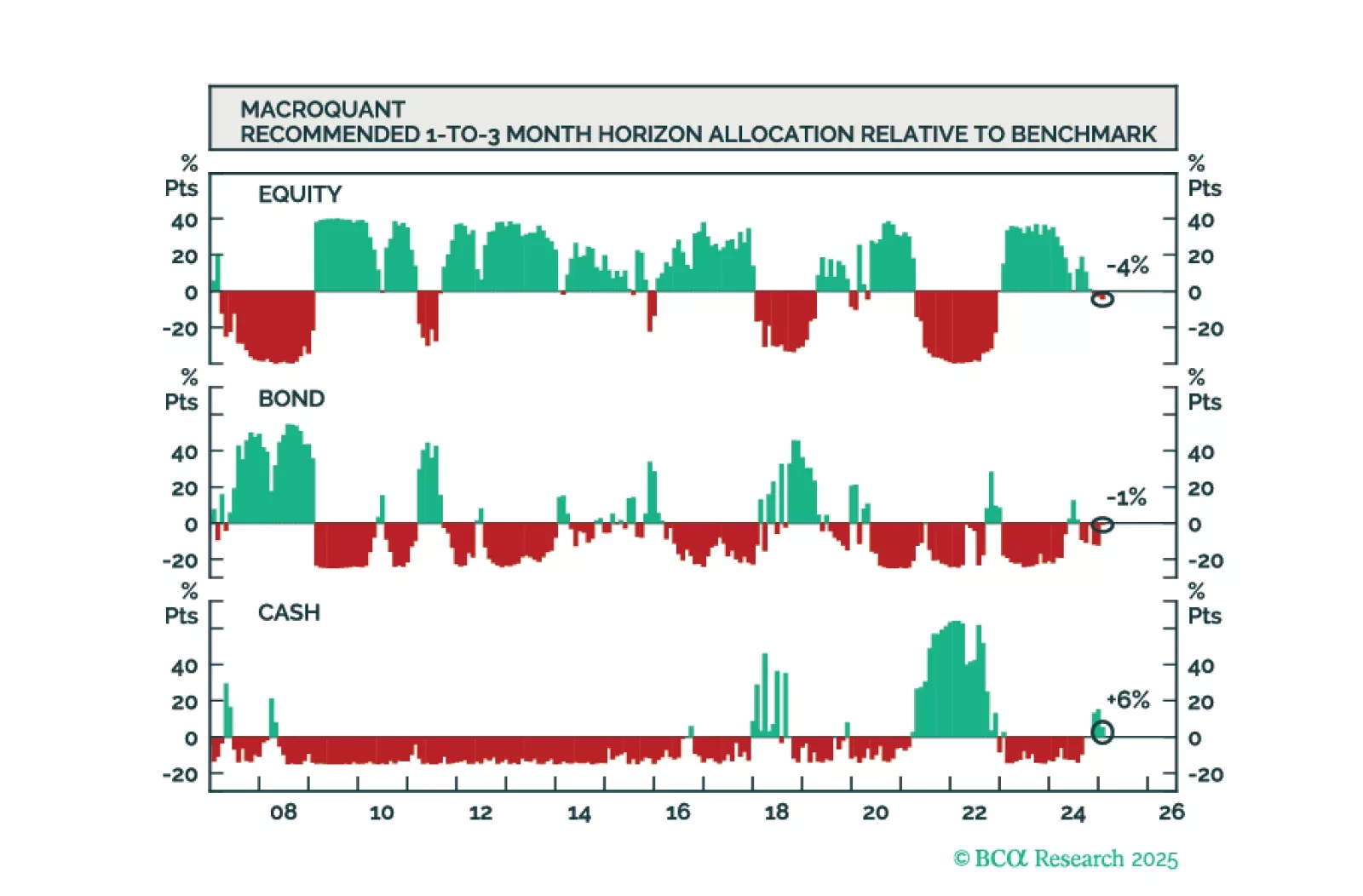

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

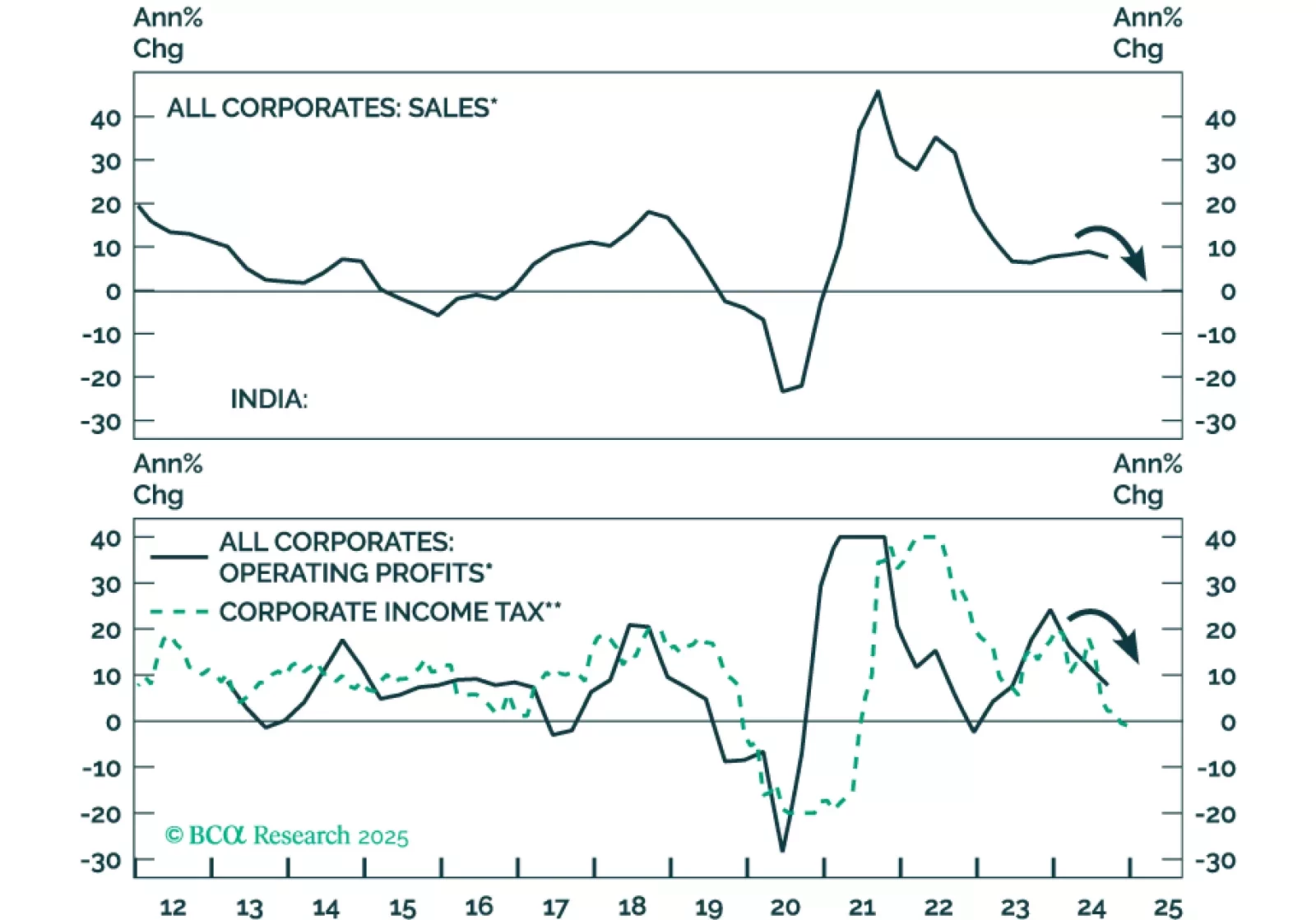

In its budget plans last week, the Indian fiscal authorities announced major tax cuts for households – the equivalent of about US$12 billion, 0.3% of GDP – to boost consumer spending. Soon thereafter, the central bank cut its policy rates…

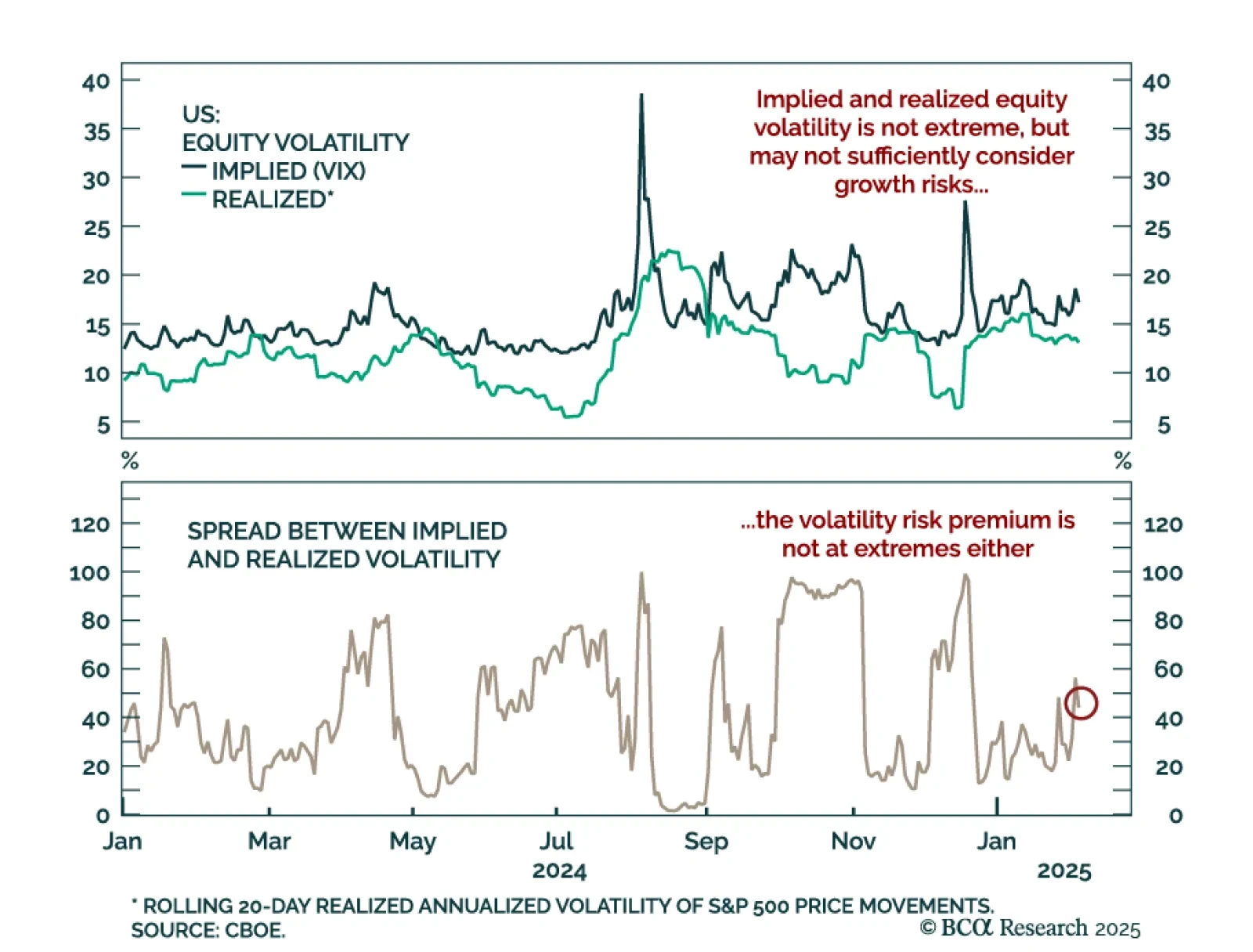

Despite disruptive headlines, equity market volatility remains contained. The S&P 500 has been in a tight range since the last VIX spike, and news of a disruptive, cheaper AI technology has not sustainably brought down US tech…

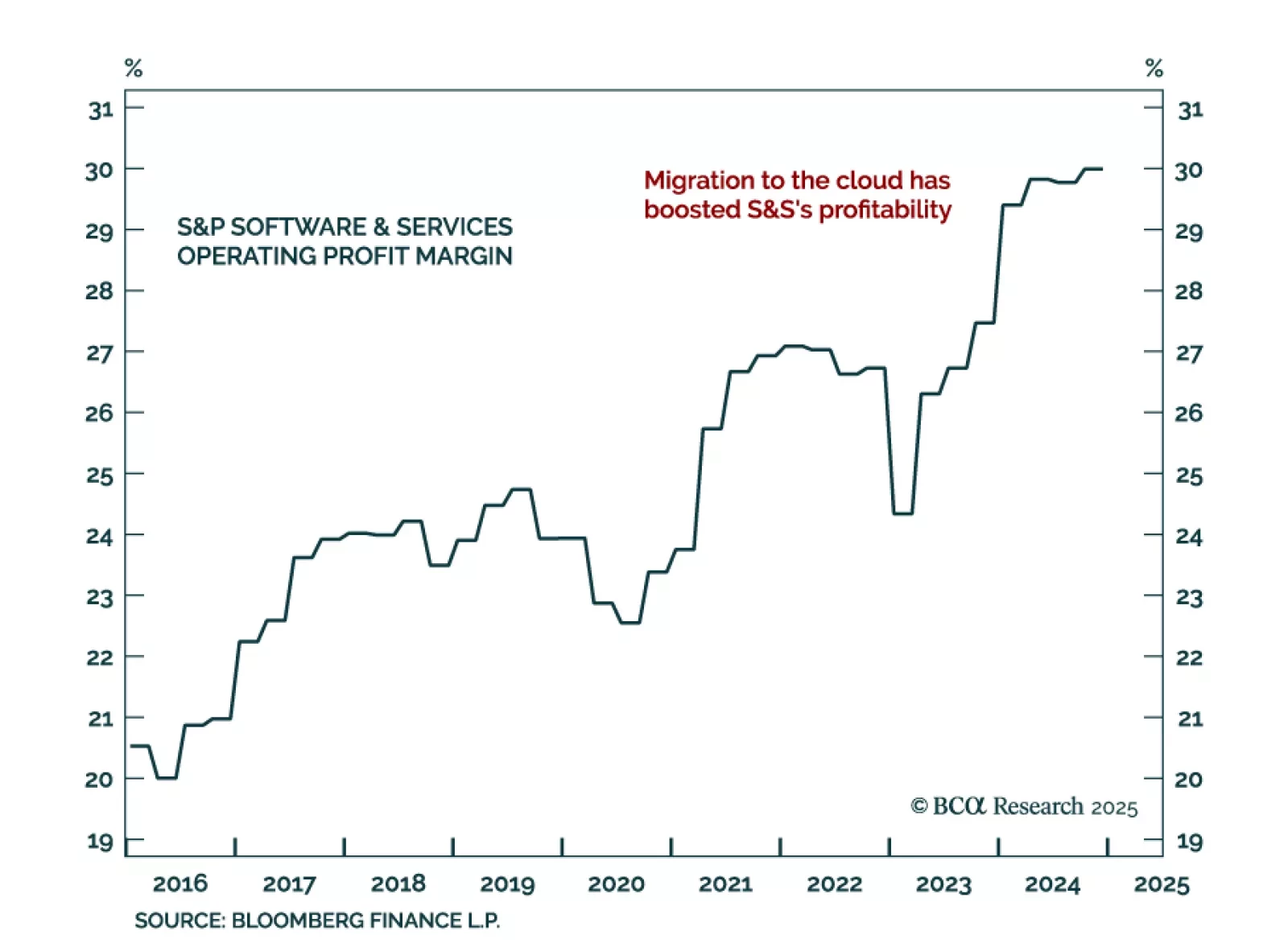

In the aftermath of Monday’s tech selloff, our US Equity strategists took a deep dive into the Software and Service (S&S) industry group. The S&S industry underperformed in 2024 as post-pandemic spending slowed, but…

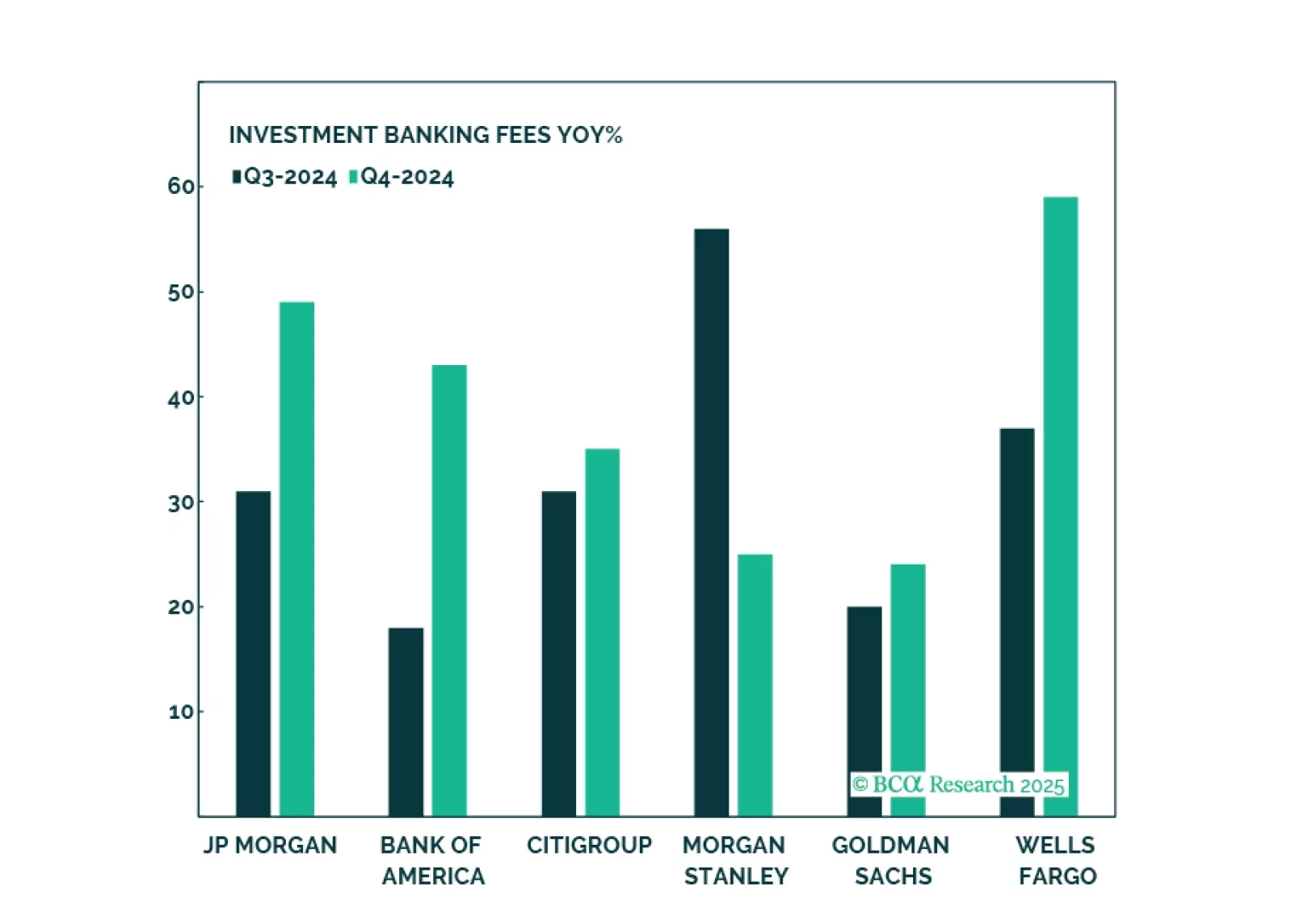

Our US Equity strategists preview the 2024 Q4 earnings season, and look at the results from banks. Q4 earnings growth is set to impress, with small and mid-cap earnings surging and S&P 493 growth turning positive, though…

Banks have had an amazing run, and while such strong performance is unlikely to repeat, there is still oomph left in the trade thanks to a more favorable regulatory environment, stronger demand for loans, a steeper yield curve, and a…

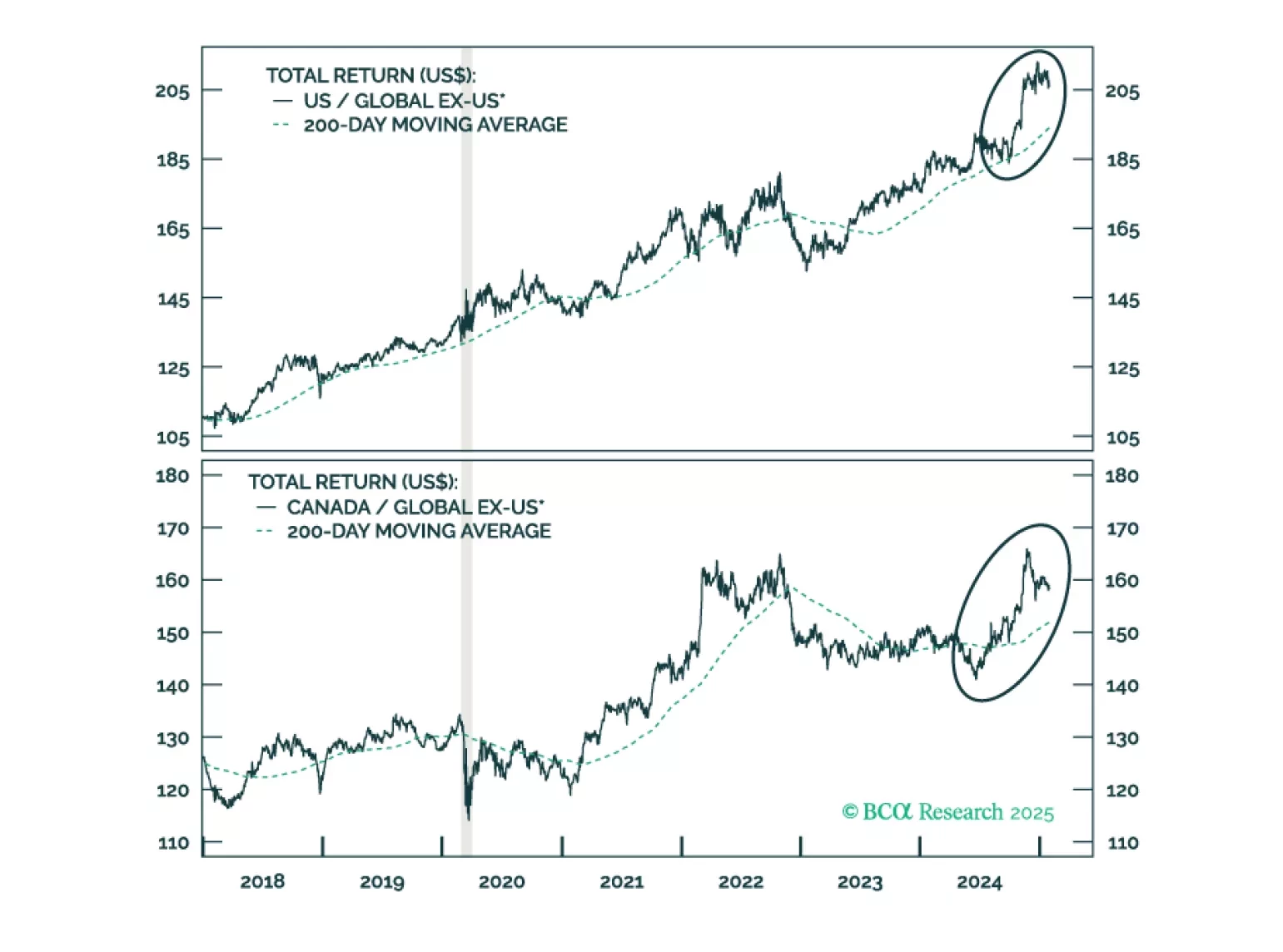

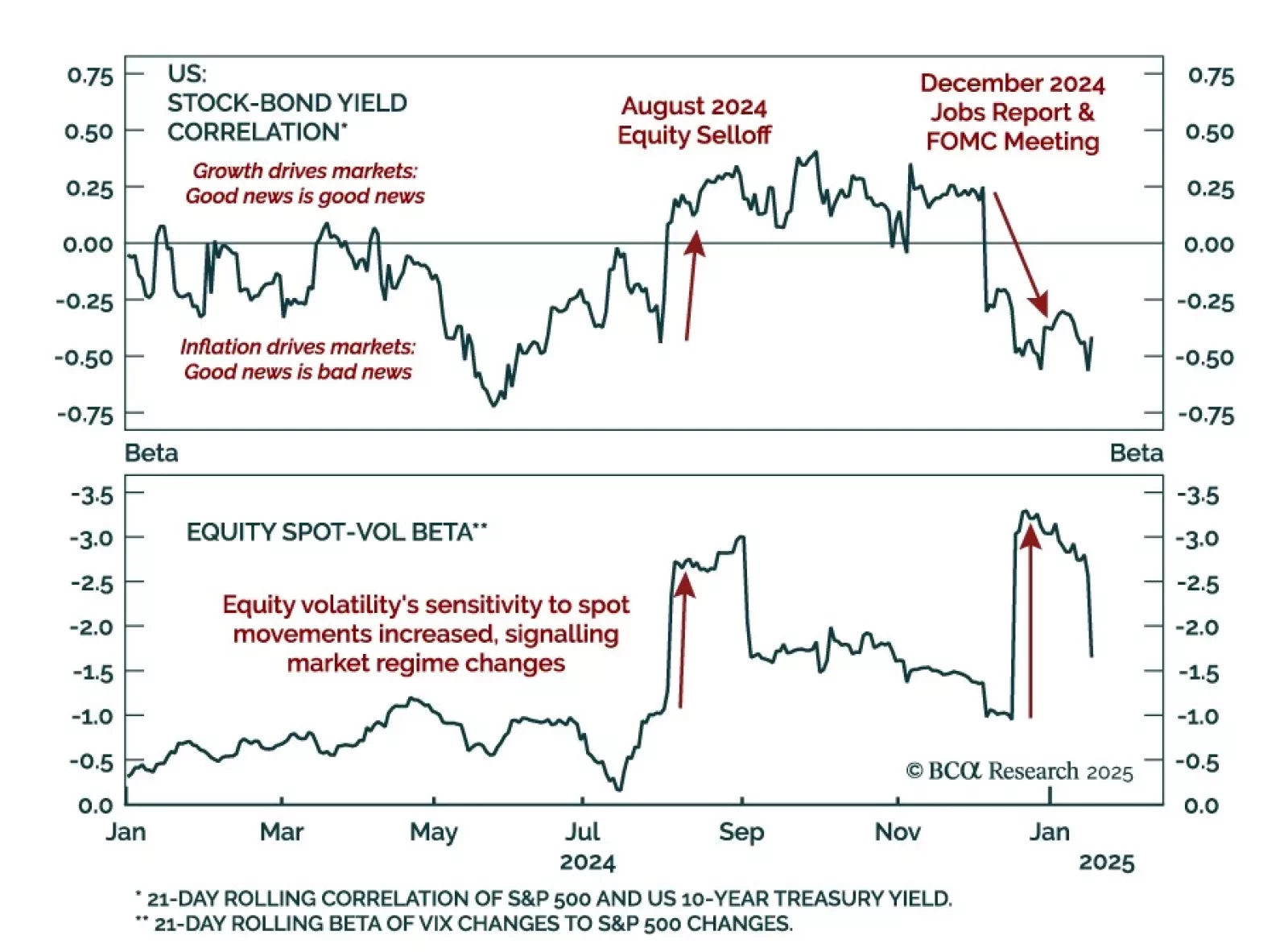

Two main market events defined 2024, highlighting how assets will react to economic data on the tactical horizon. The August 2024 selloff marked a positive shift in the stock-bond yield correlation, as higher odds of a “hard landing…

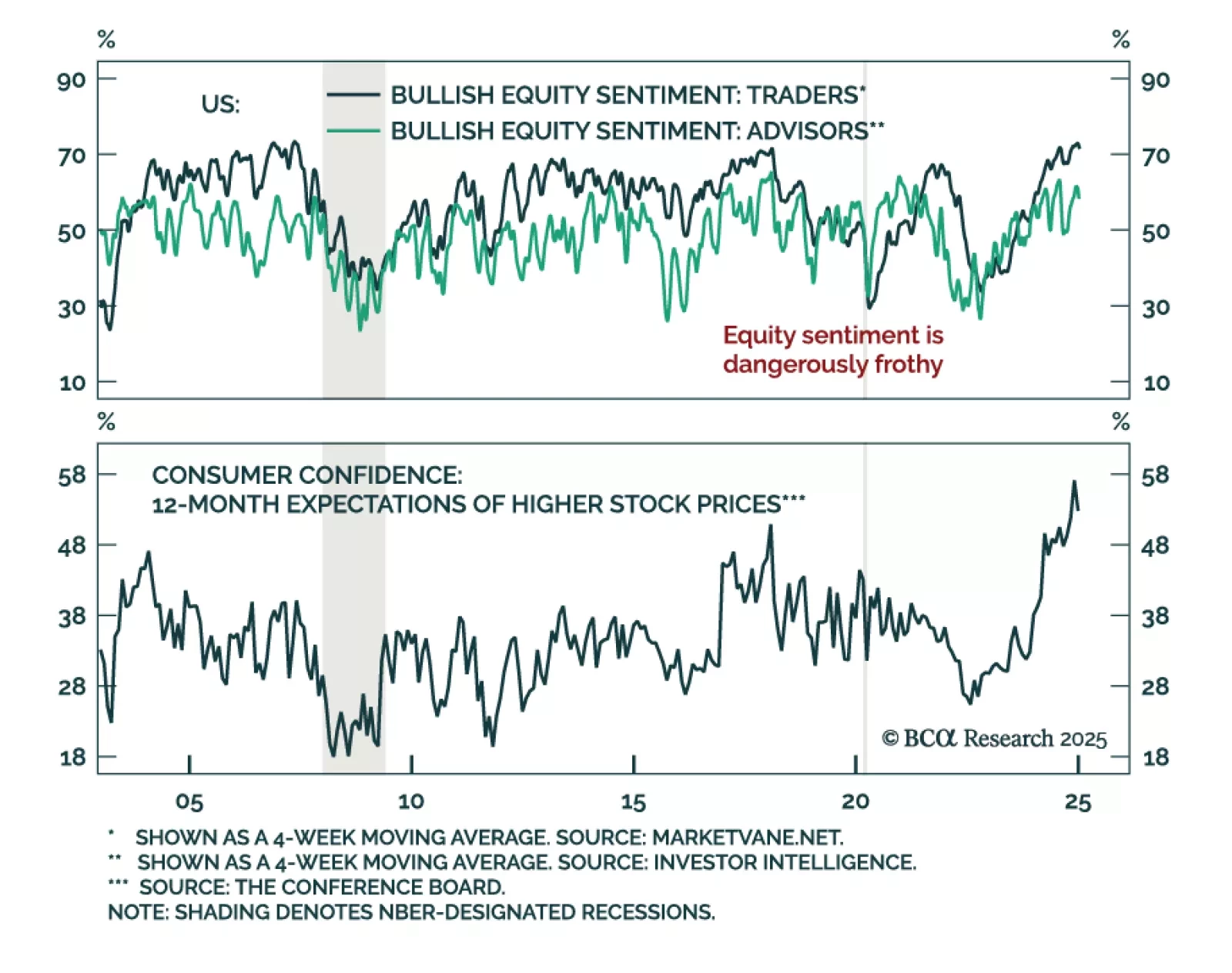

Our Global Investment Strategy (GIS) team believes the US economy is not as strong as commonly believed, and that equity valuations offer little buffer given the risk of incoming macro shocks. The US economy is more fragile than…