While Chinese stocks have low valuations and are oversold, their attractiveness is dampened by uncertainties in the magnitude of stimulus and the dismal outlook for corporate profits in the next six to nine months.

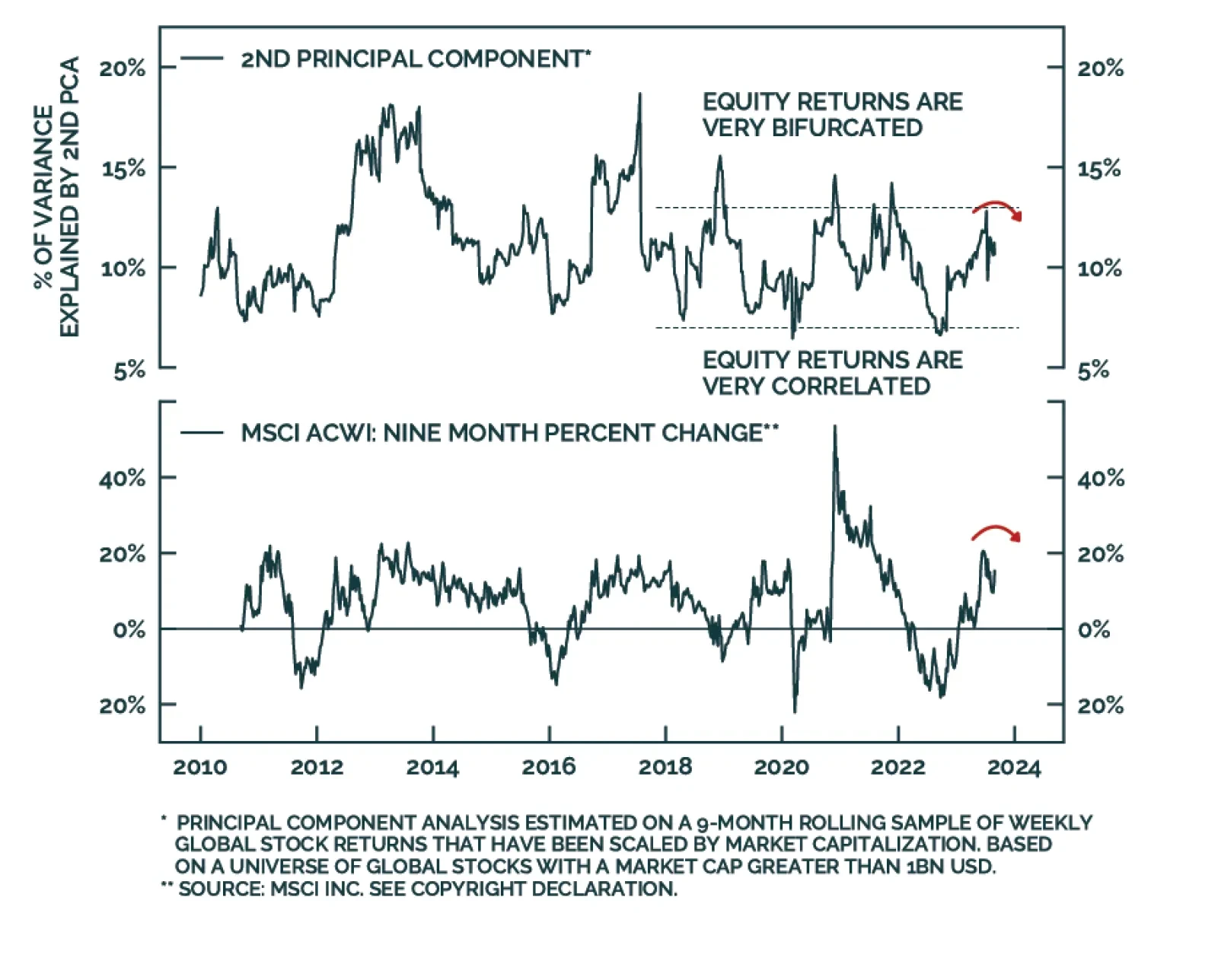

Unsupervised methods, like Principal Component Analysis (PCA), can create powerful indicators that are based purely on the structure of the data and void of researcher bias. Therefore, they can provide agnostic evidence to…

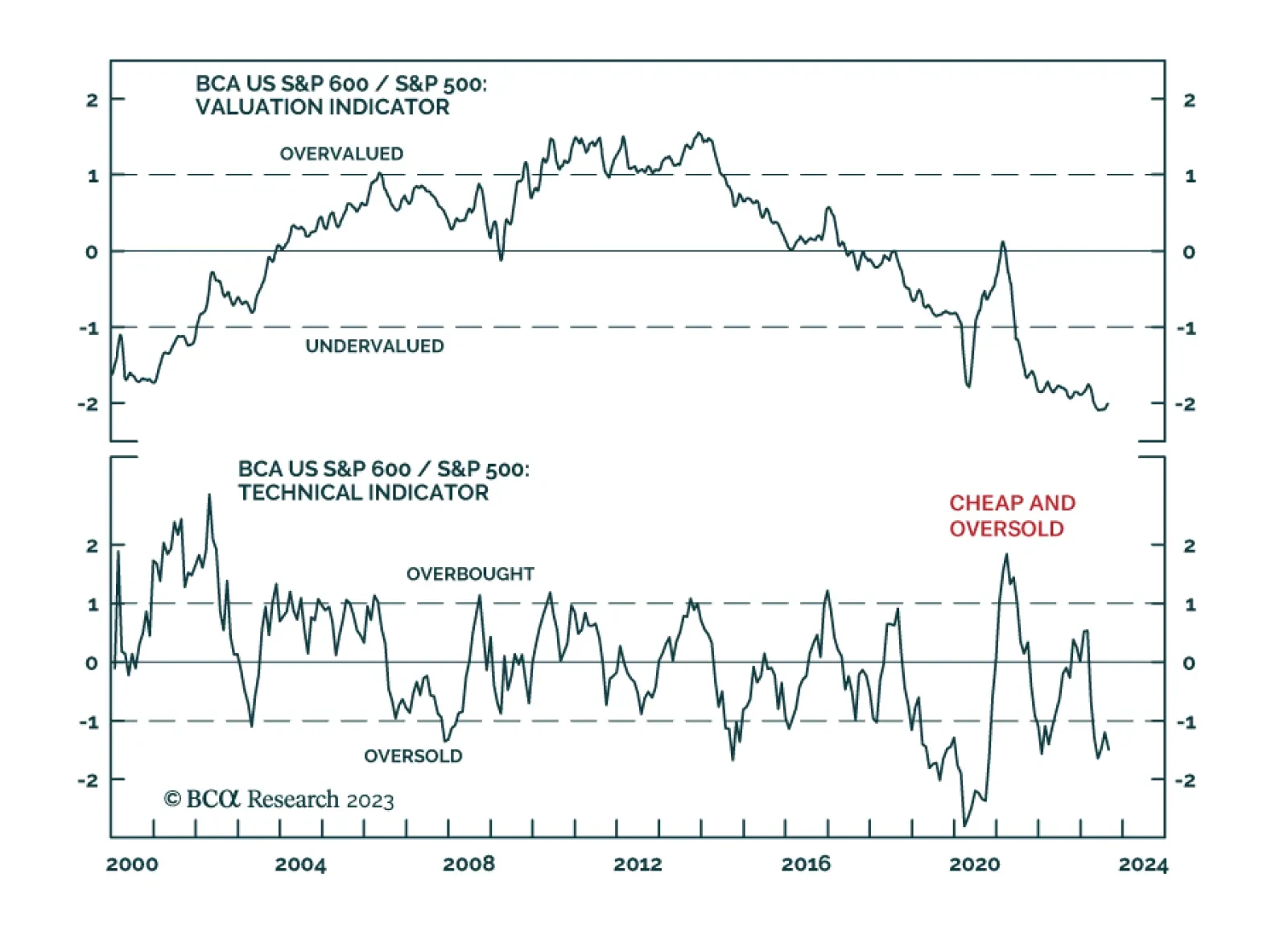

After having sold off in the first five months of the year, the performance of small-cap stocks improved in June and July with the S&P 600 index gaining 13.9% in those two months. A broadening of the US equity rally –…

We comment on Jay Powell’s Jackson Hole speech and recommend shifting to a barbelled allocation along the Treasury curve.

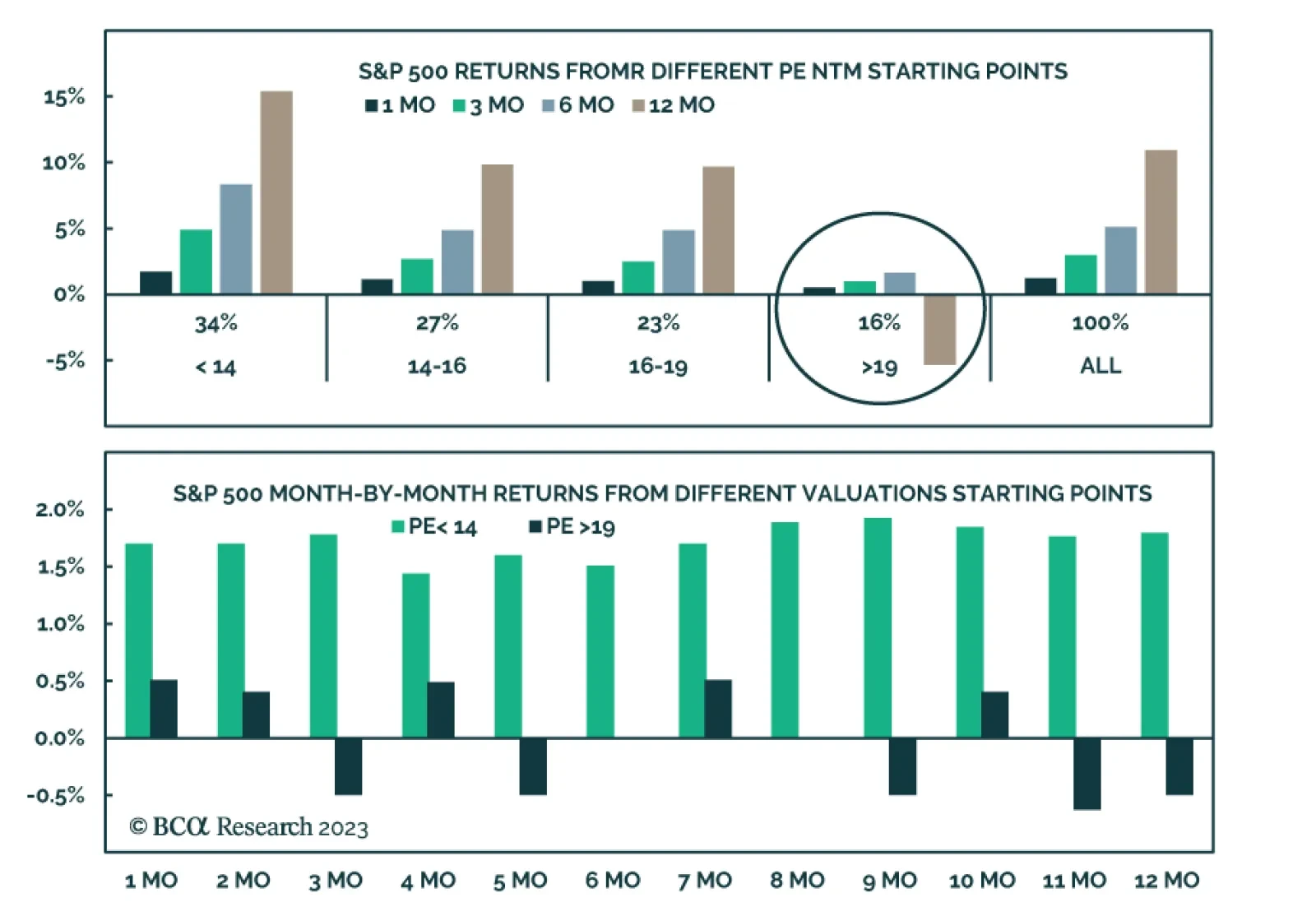

The jubilant summer rally came to a halt in August, with the S&P 500 down 4.4% MTD. A confluence of factors has weighed on the performance of US equities ranging from economic malaise in China to too-hot economic data…

BCA Research's US Equity Strategy service downgraded Semiconductors to underweight for the following reasons: Weakening global growth: Global semiconductor sales move in lockstep with economic growth. Global growth…

High-Yield municipal bonds have performed well in recent years, but valuations are now stretched. We recommend an underweight allocation, though we prefer high-yield munis over high-yield corporate bonds.

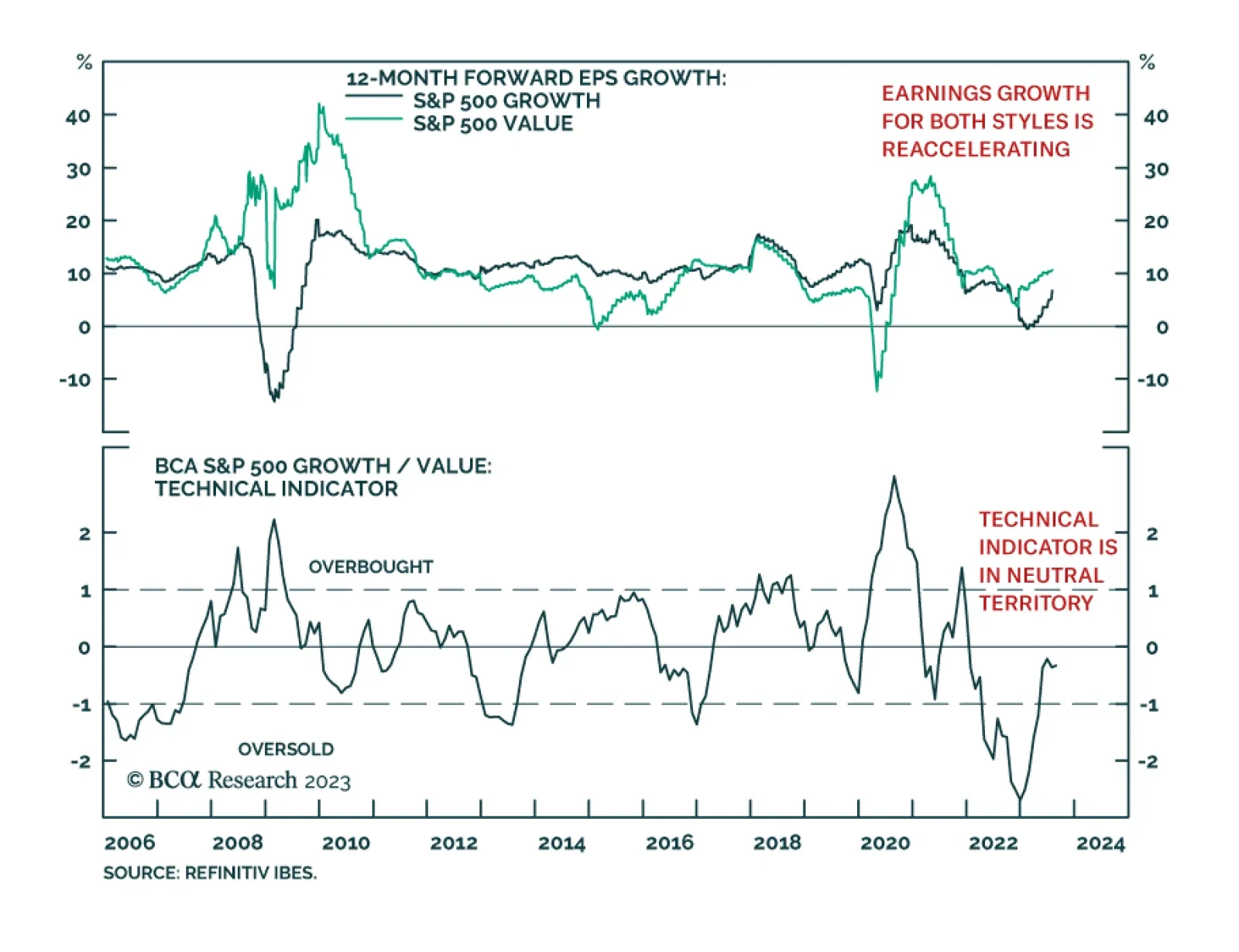

According to BCA Research’s US Equity Strategy service, the outperformance of Growth sectors most likely has run its course. The team has opened an overweight in Growth vs. Value in April. Since then, the trade is…