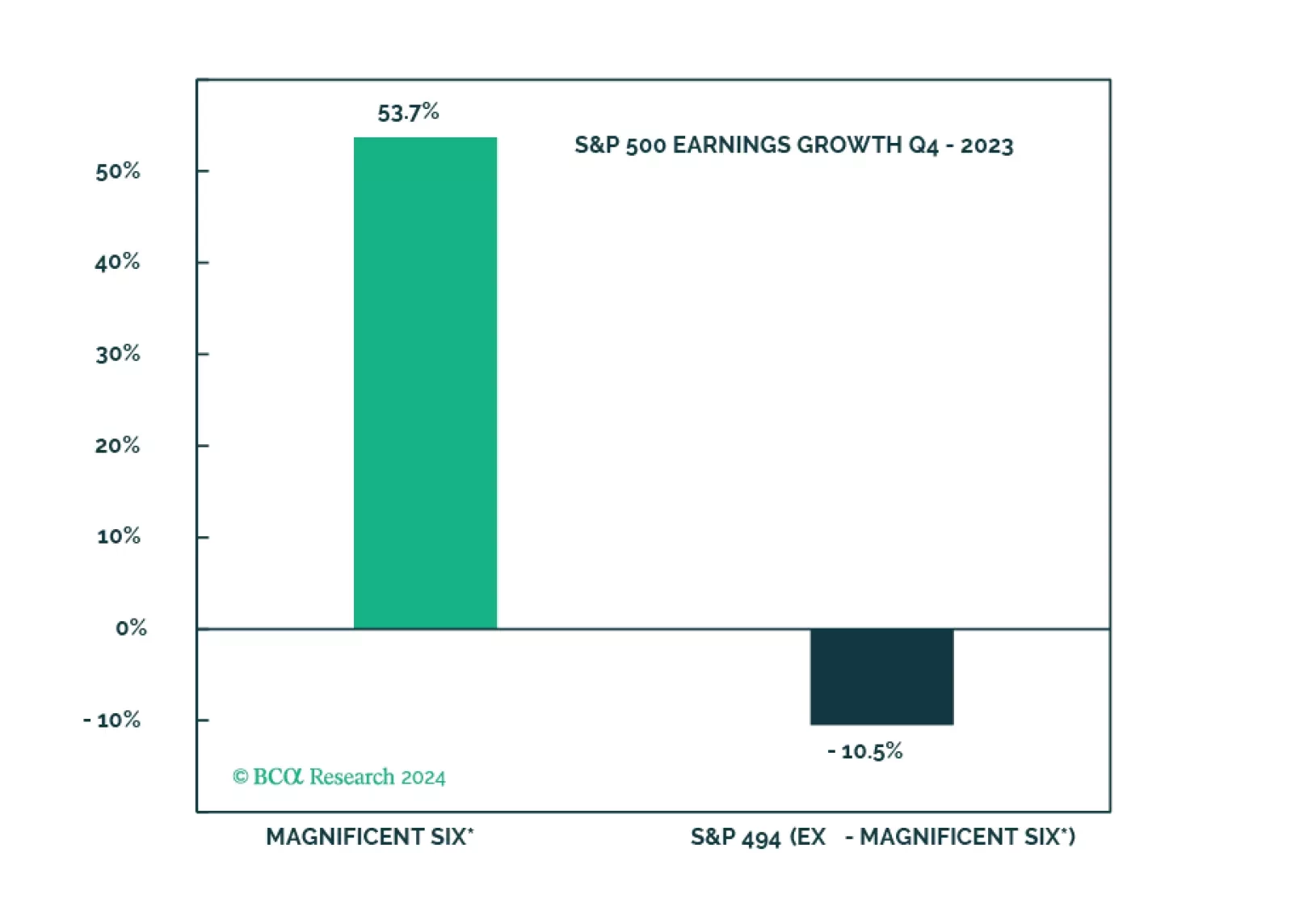

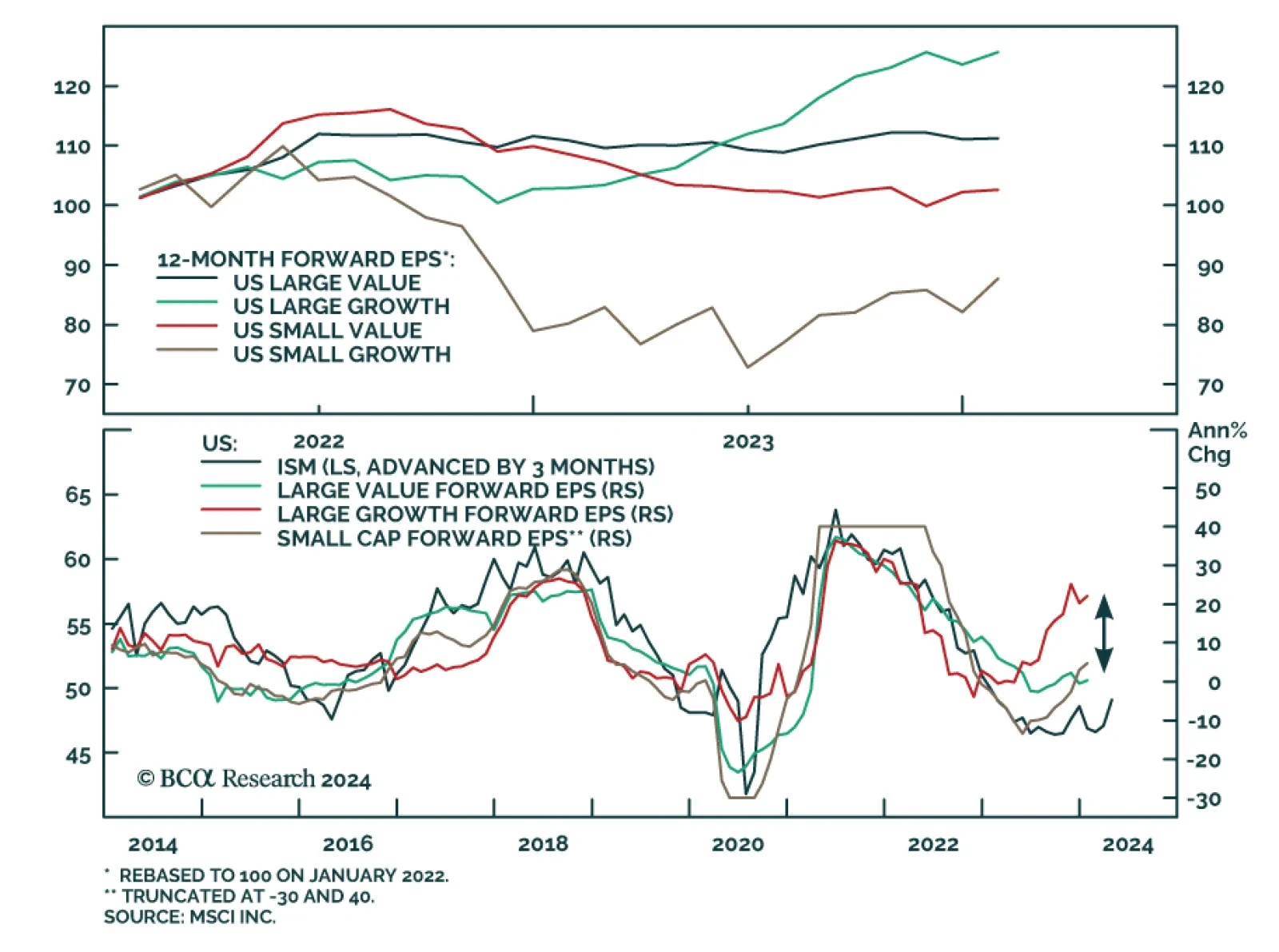

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

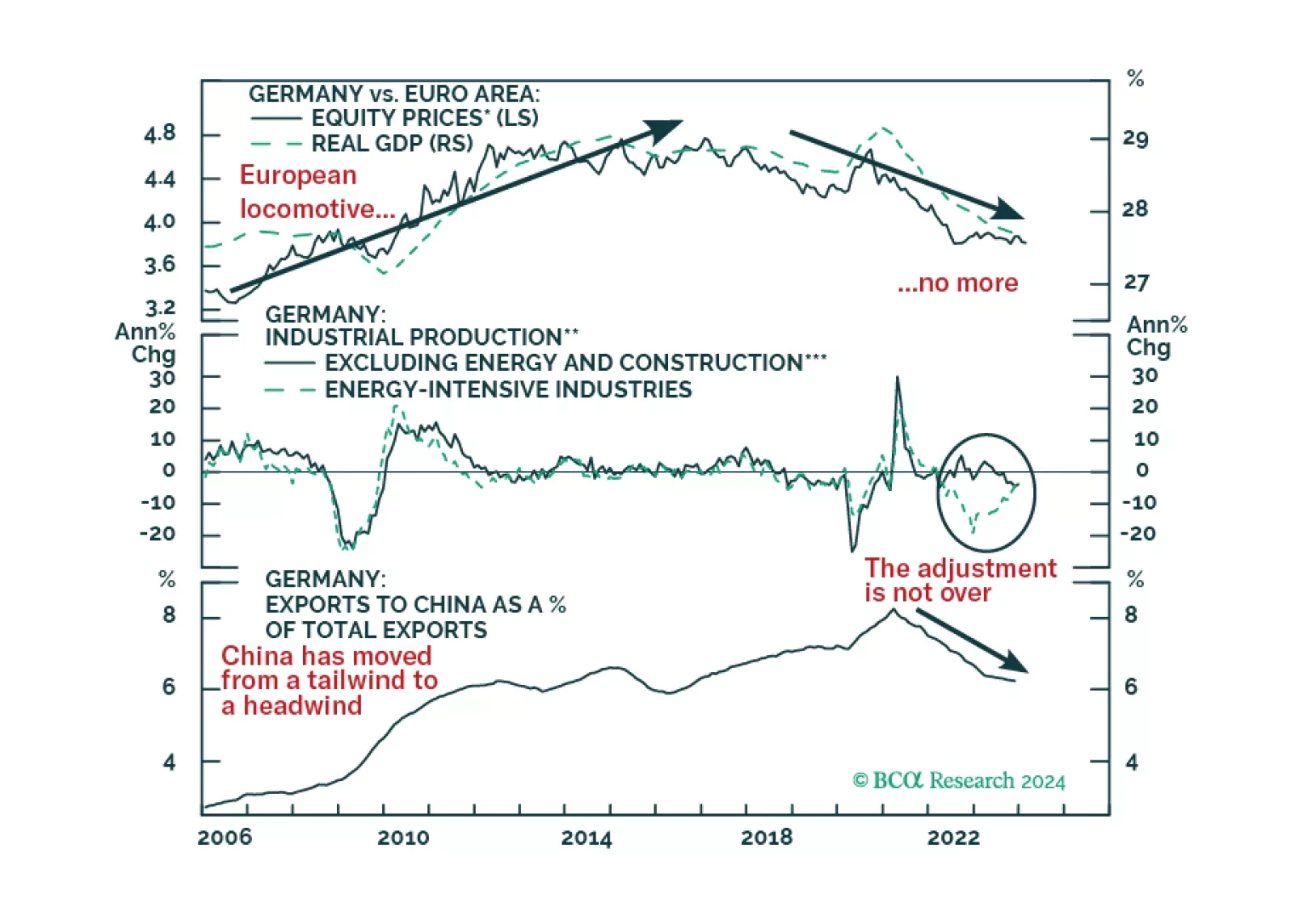

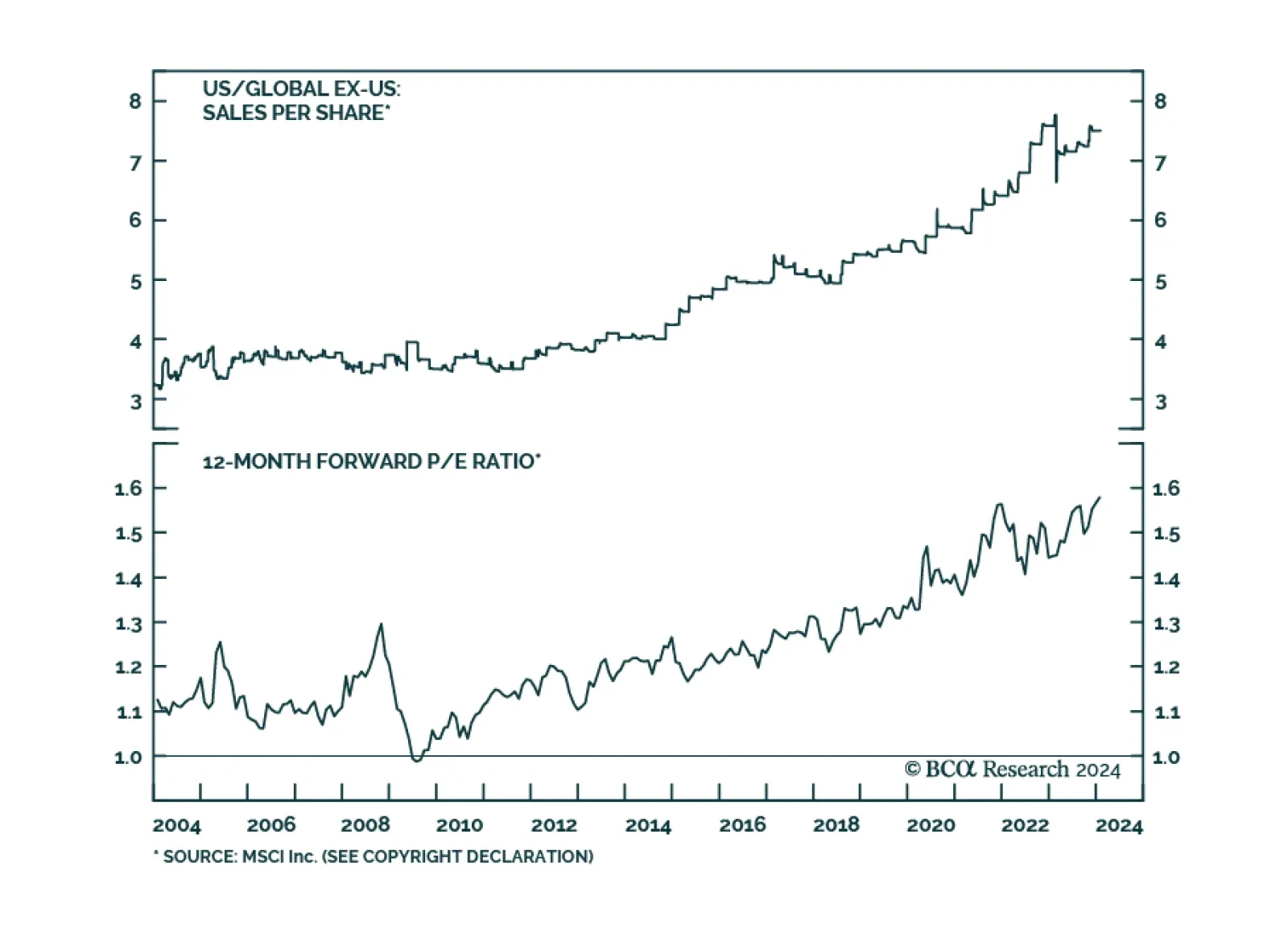

According to BCA Research’s Emerging Markets Strategy service, the diminishing pace of disinflation in the US could pose a threat to US share prices in the near term. In the medium term, the key risk to US share prices is…

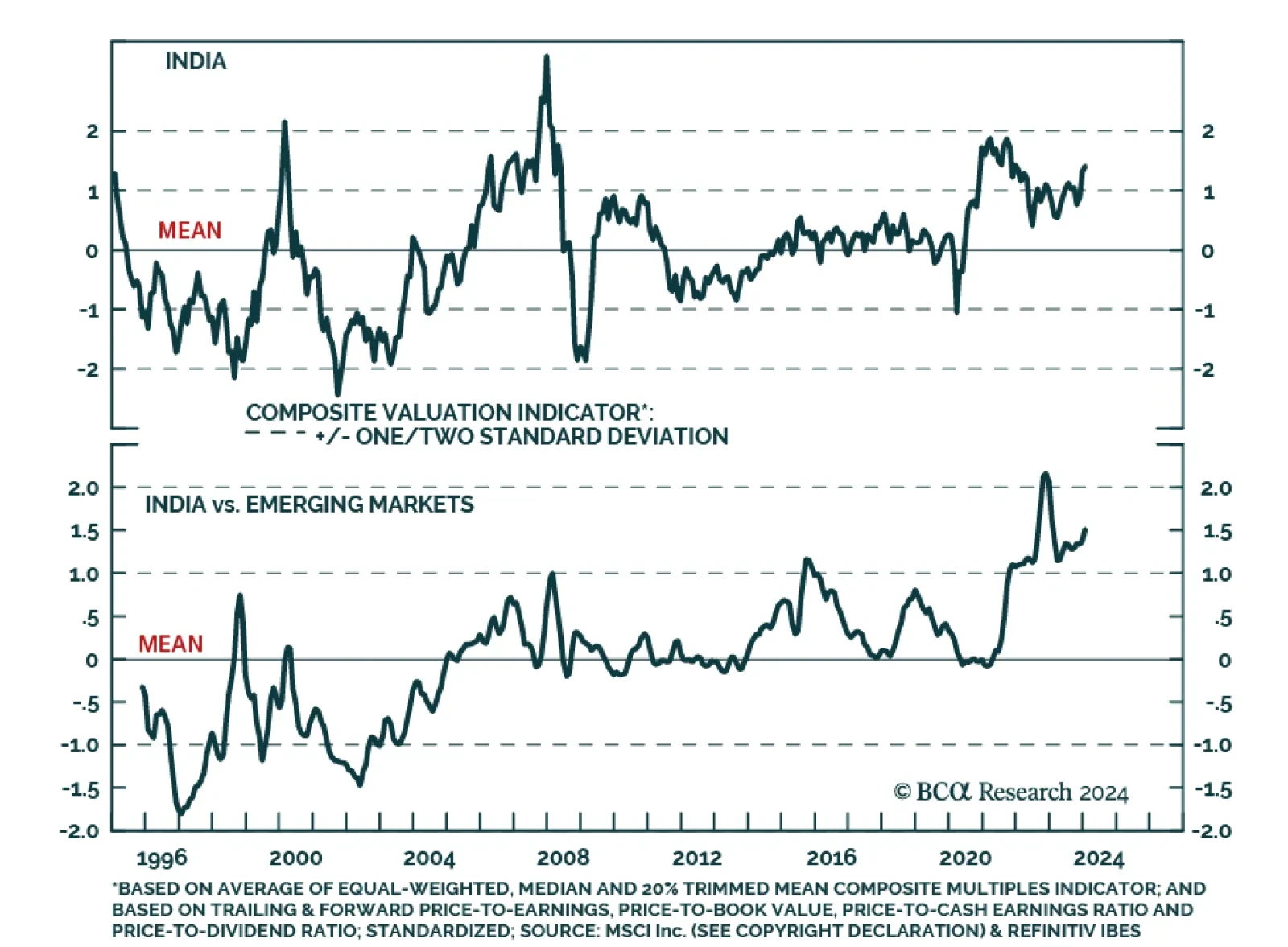

Indian economic data releases delivered a positive signal on Monday. CPI inflation slowed from 5.7% y/y to 5.1% y/y in January – within the Reserve Bank of India’s (RBI) 2-6% target range. Meanwhile, industrial…

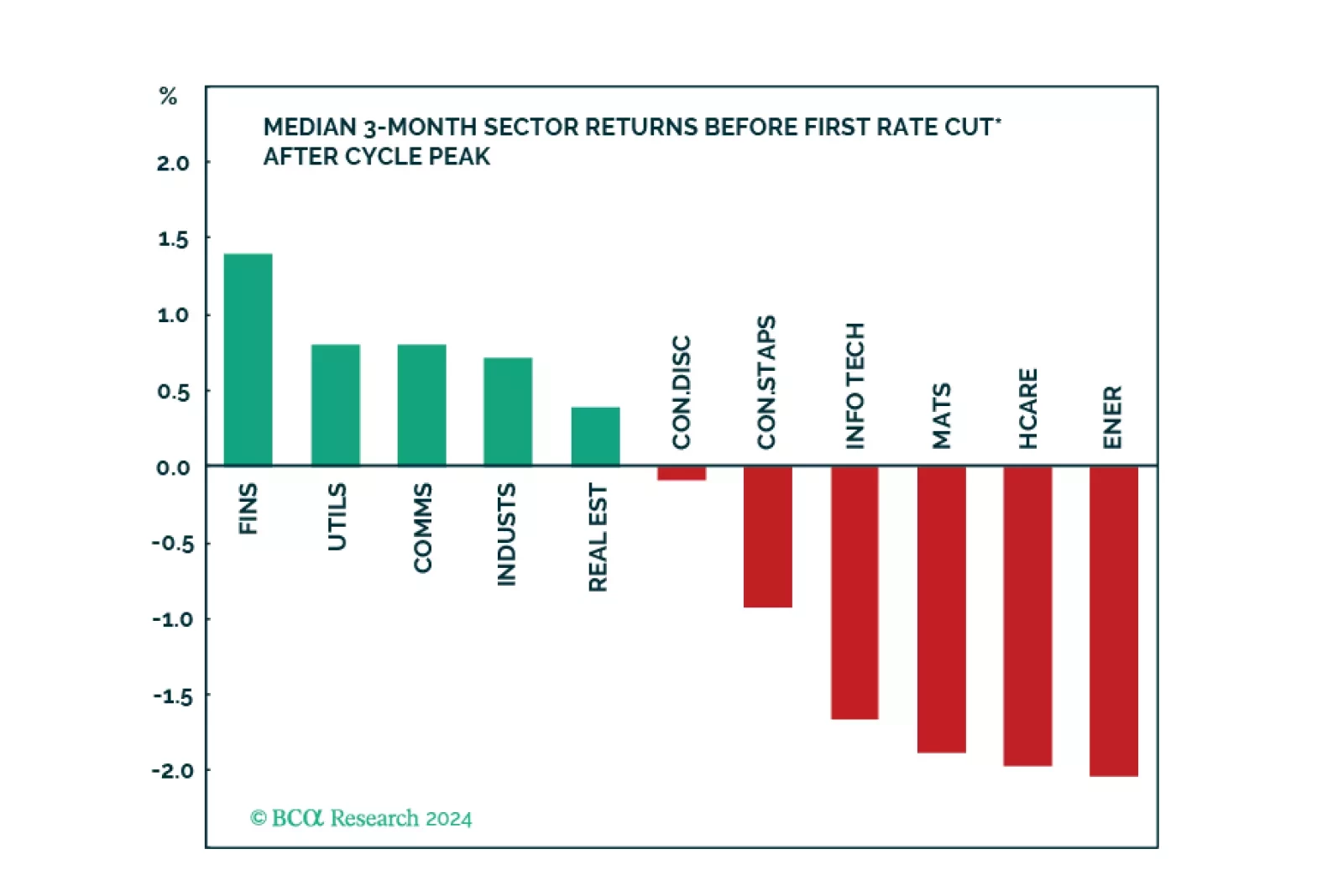

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

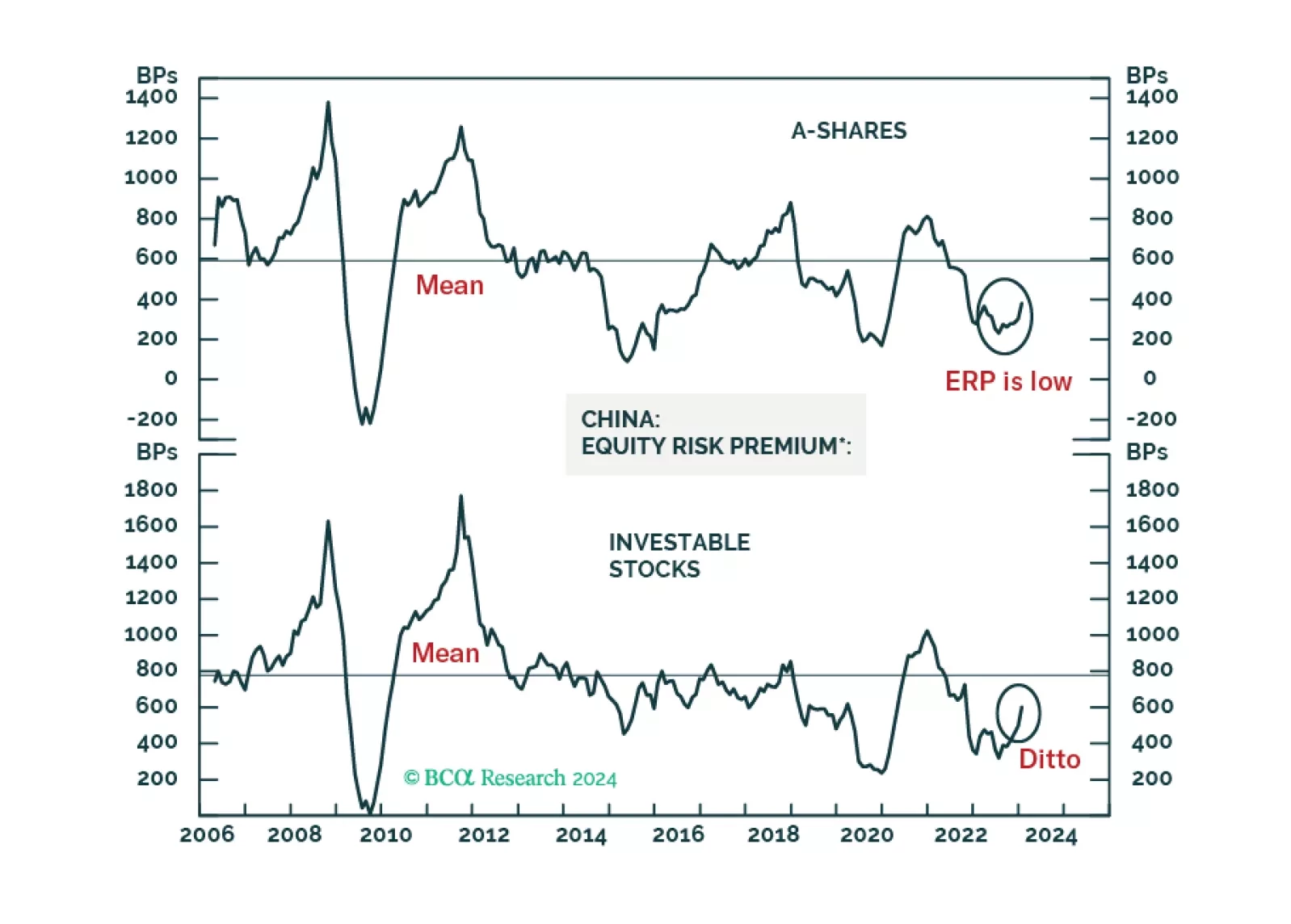

Chinese A-shares will probably begin forming a volatile bottom. The basis is that authorities will likely throw the kitchen sink at the onshore market in an attempt to stabilize share prices. The same is not true for offshore listed…

The dominance of large tech companies in the S&P 500 has caused concern amongst investors. The Magnificent Seven now represent 30% of the index. These companies have more than doubled in value over the past year, in contrast…

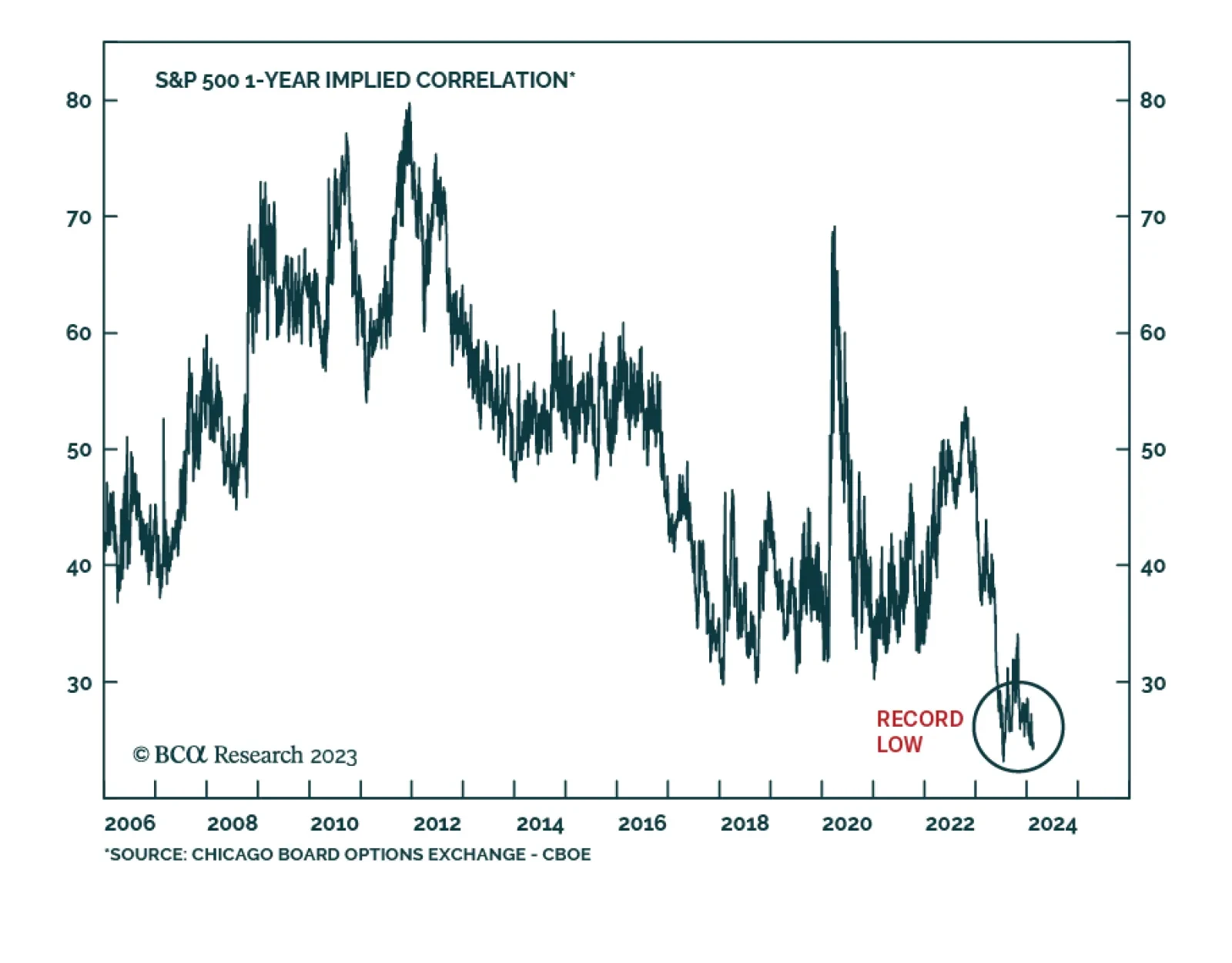

US equities remain on a winning streak. After a sluggish start to the year, US stocks resumed their rally in late-January. Importantly, the rally has recently broadened out, with nine of the 11 S&P 500 sectors rising so far…

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

BCA Research’s Global Investment Strategy service’s MacroQuant 2.0 model continues to recommend that investors maintain a benchmark allocation to equities over a 1-to-3 month horizon. At the end of January,…