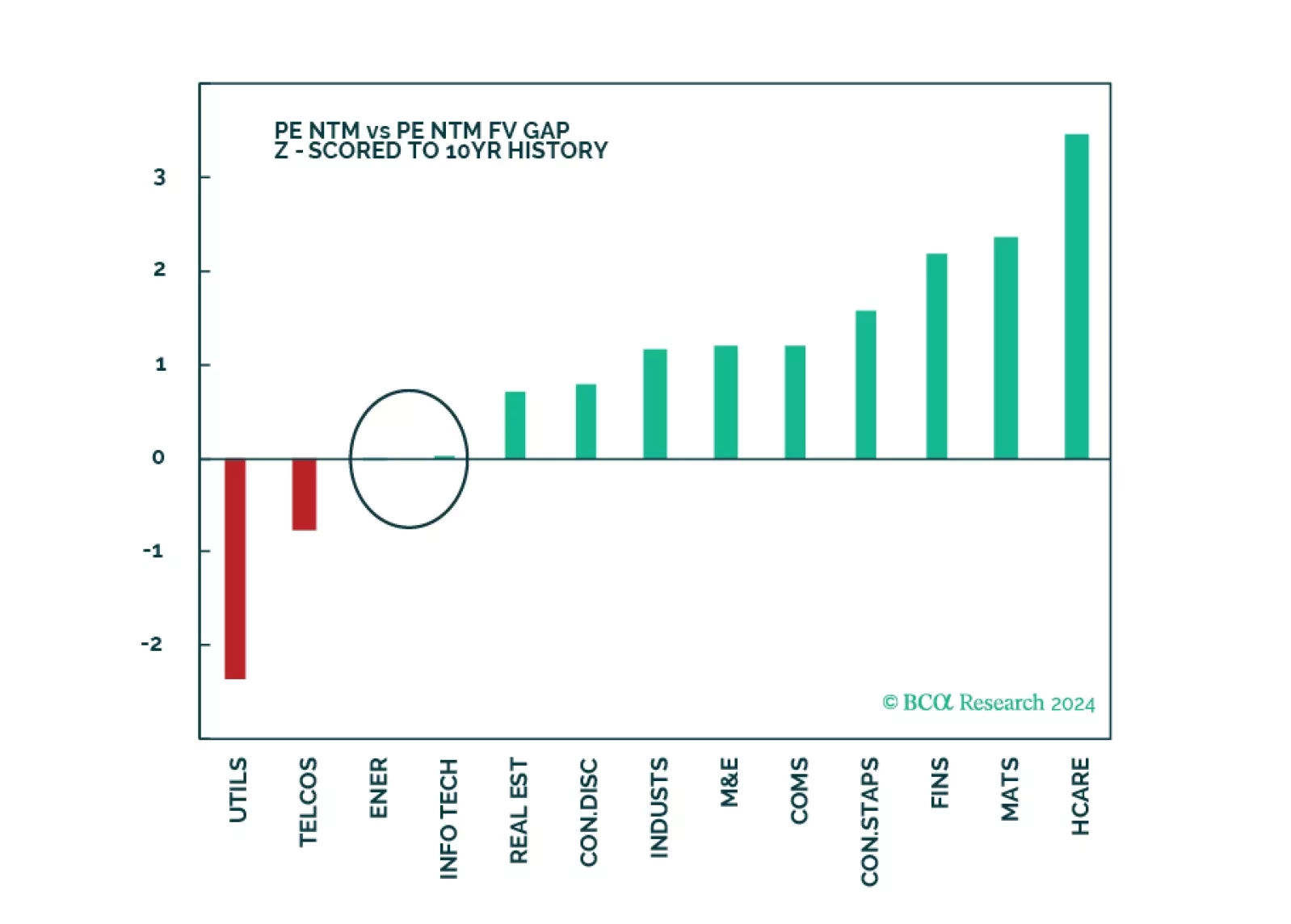

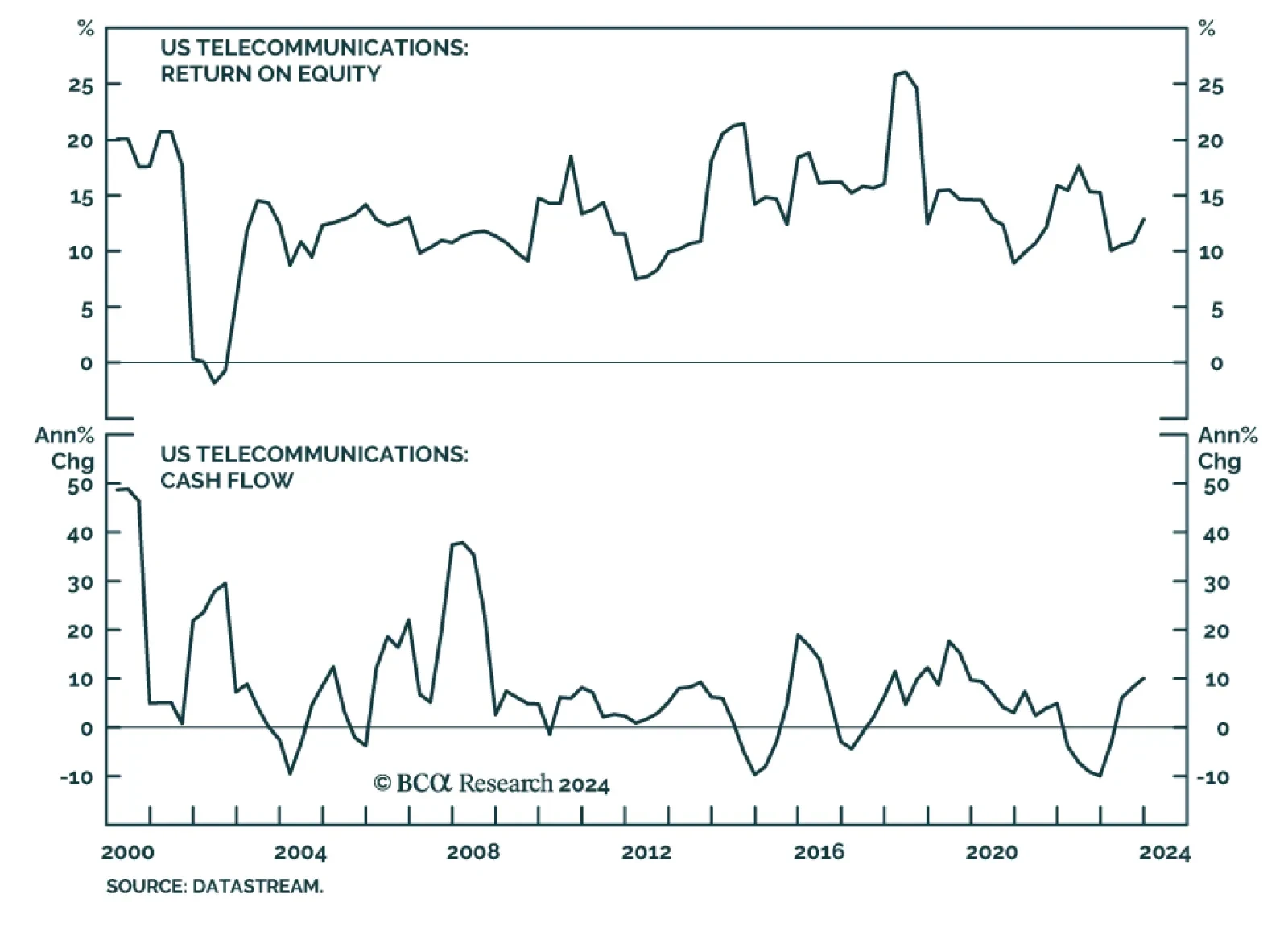

According to BCA Research’s US Equity Strategy service while Telecoms are not attractive on a strategic investment horizon, as a low-beta defensive sector they offer excellent downside protection for a portfolio. The…

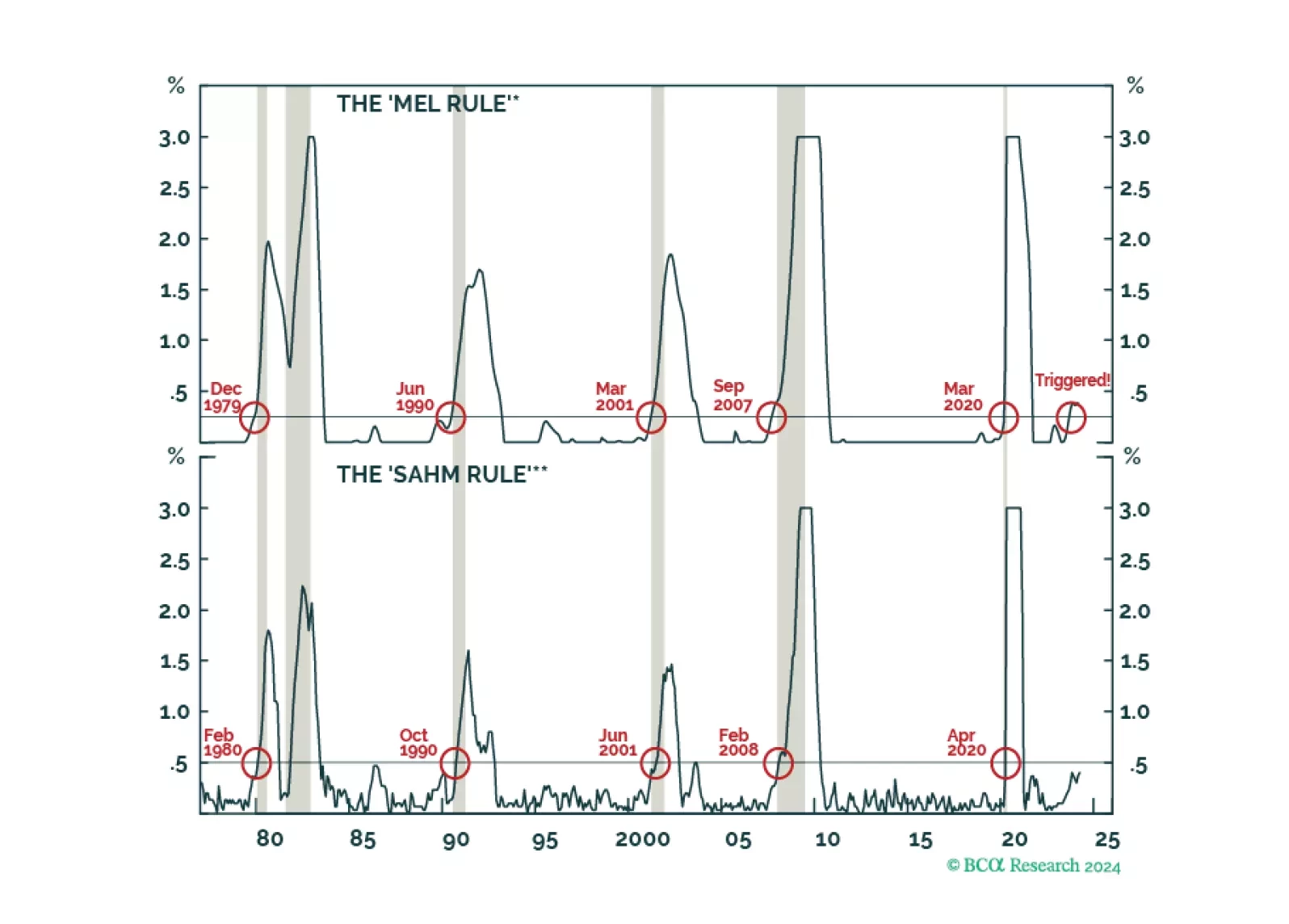

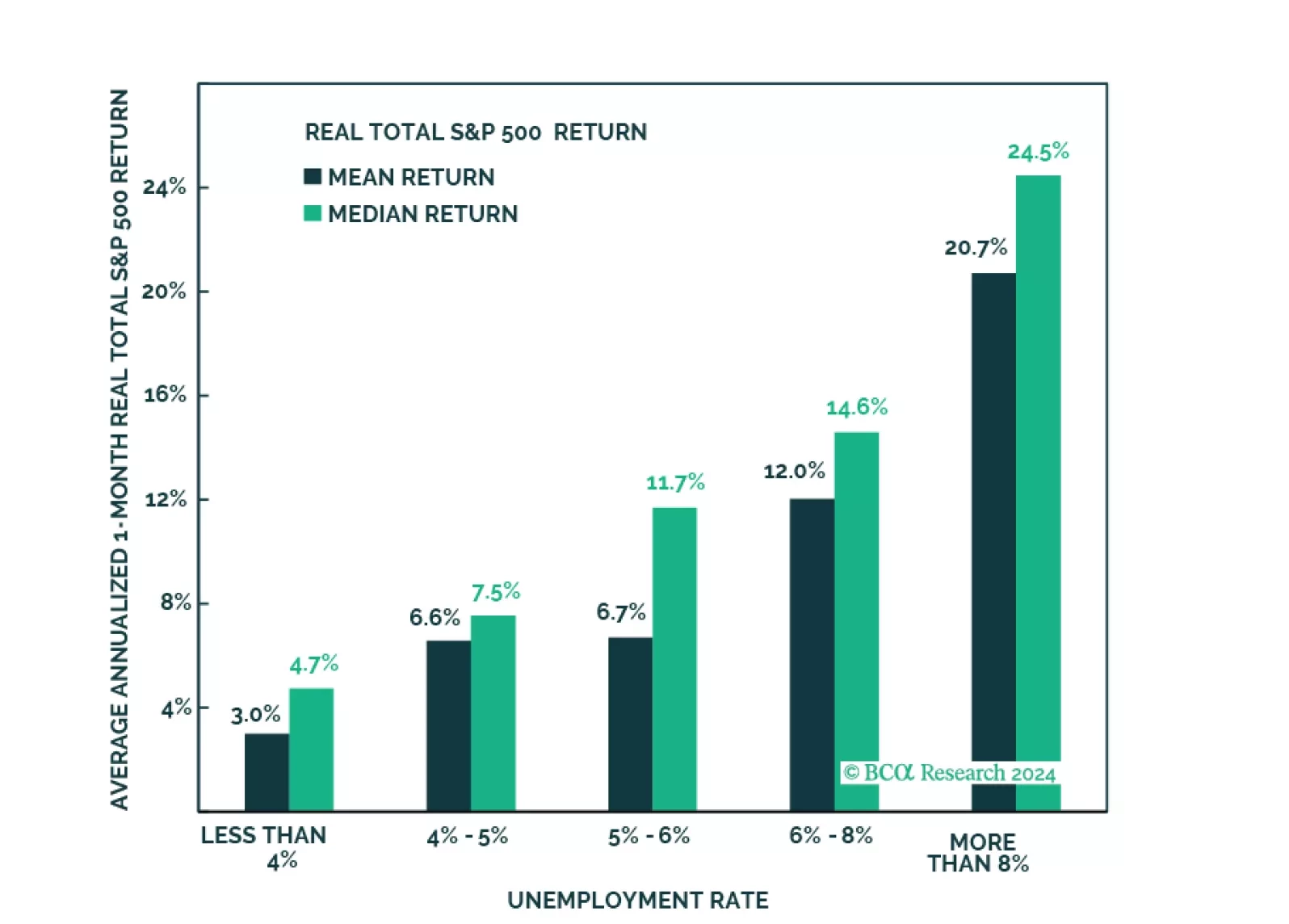

Contrary to conventional wisdom, most leading indicators suggest that the US labor market is weakening, including our very own “Mel rule.” After being overweight stocks last year, we moved to neutral at the start of 2024, and are now…

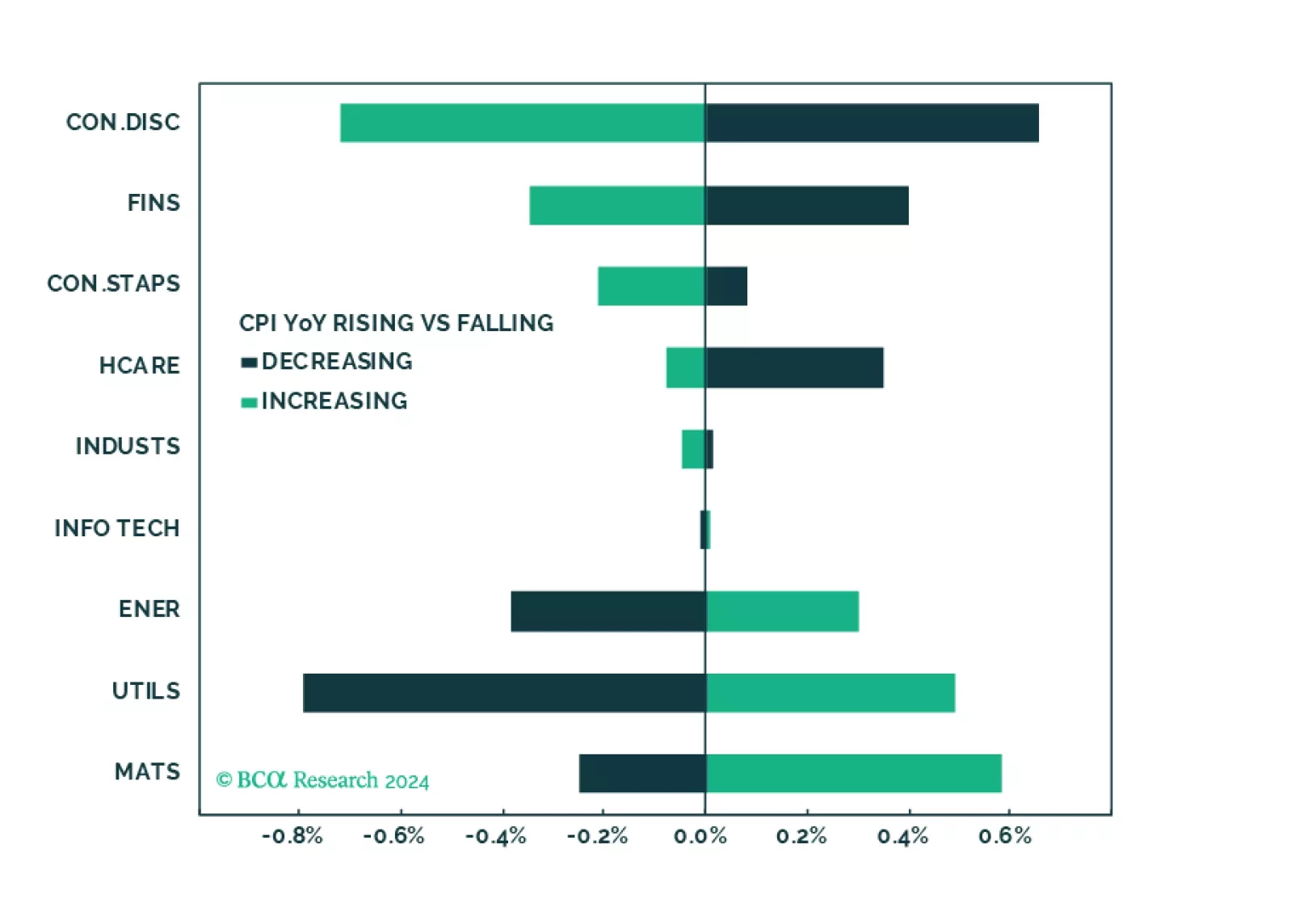

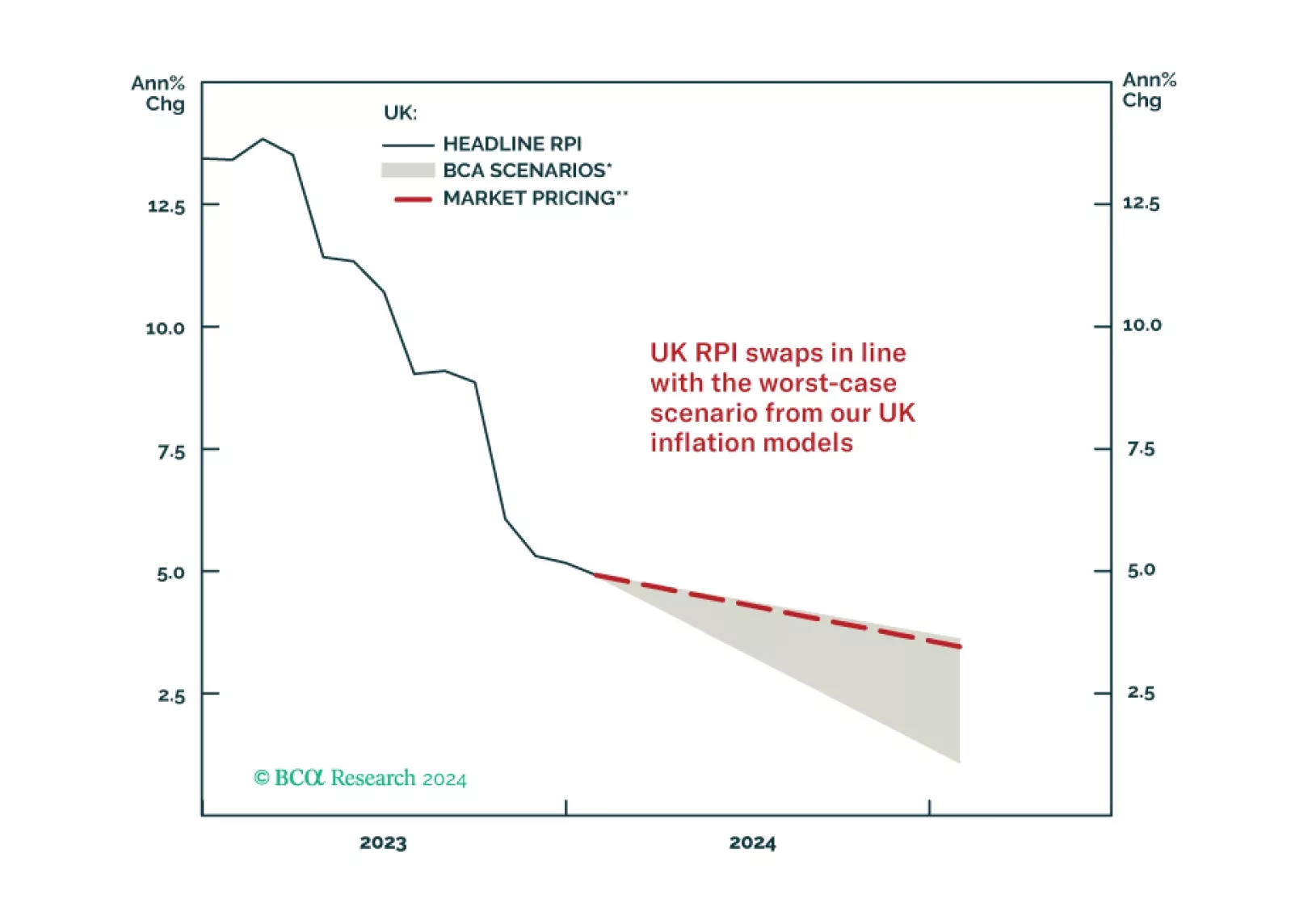

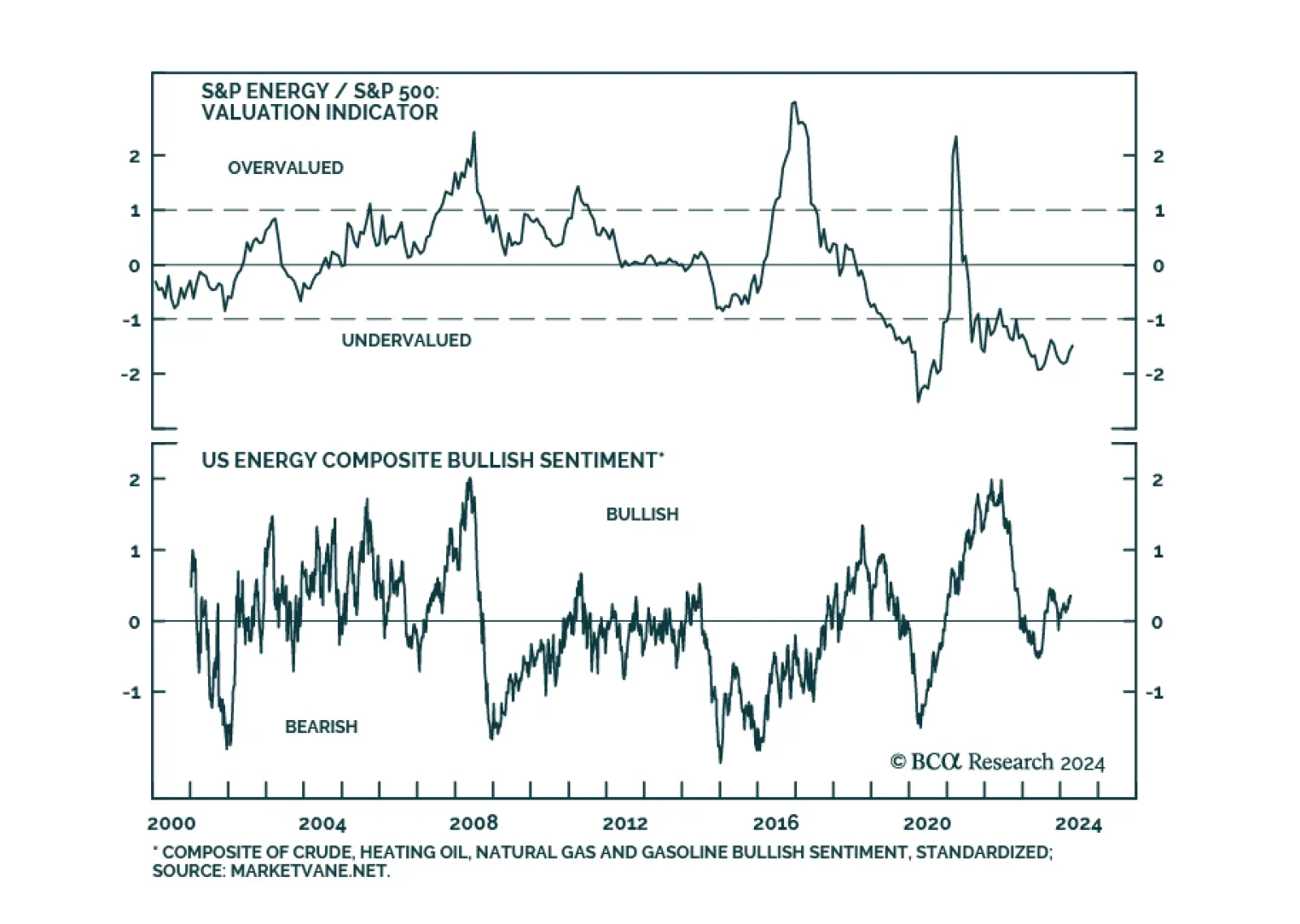

According to BCA Research’s US Equity Strategy service, rising inflation benefits Utilities, Energy, and Materials, and is a headwind for the Consumer Discretionary sector. After a protracted bout of underperformance,…

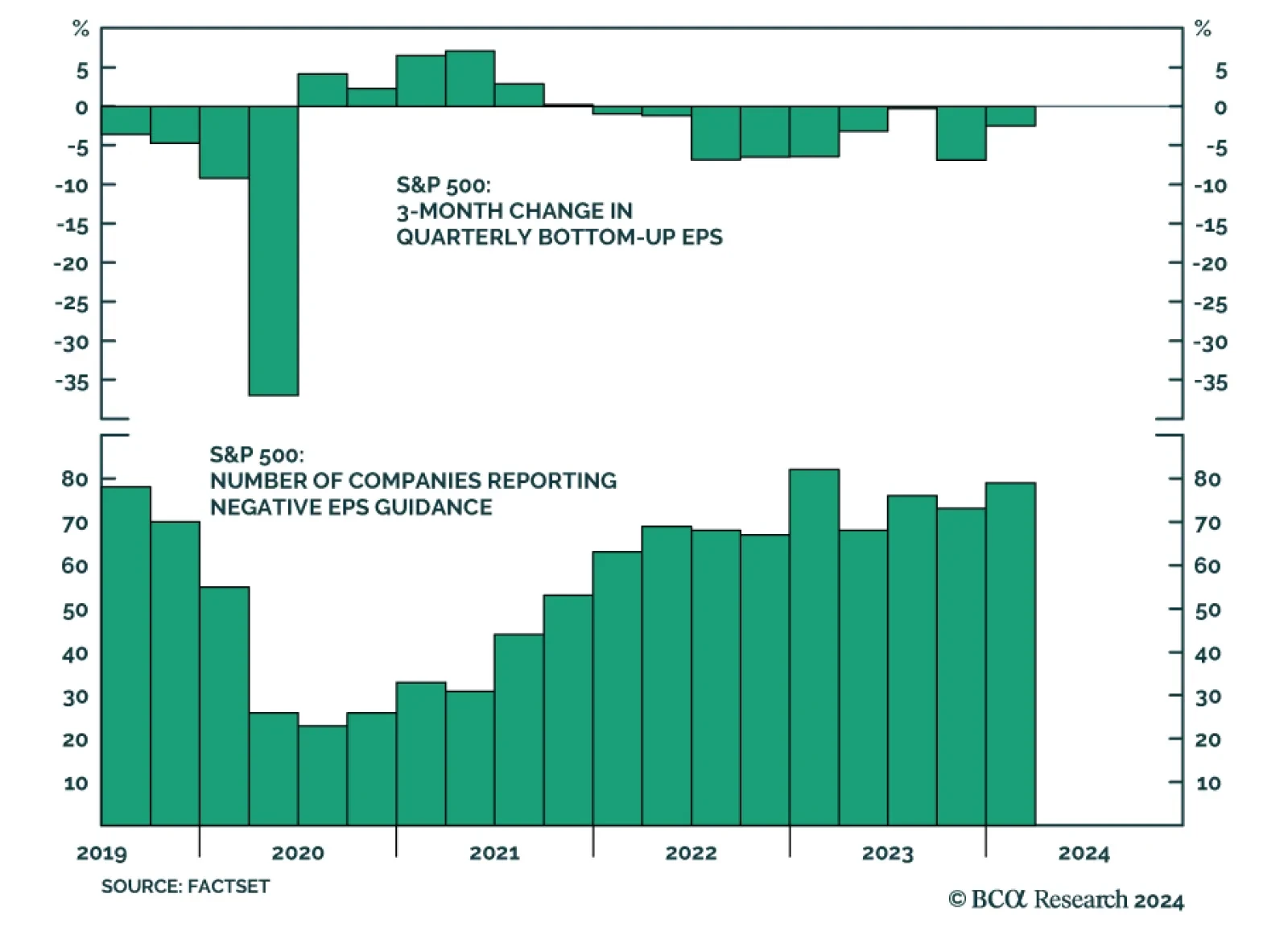

Some of the biggest US banks will kick off the reporting season in earnest this Friday, leading increased market focus on Q1 2024 earnings. According to Factset, analysts expect S&P 500 year-over-year earnings growth to…

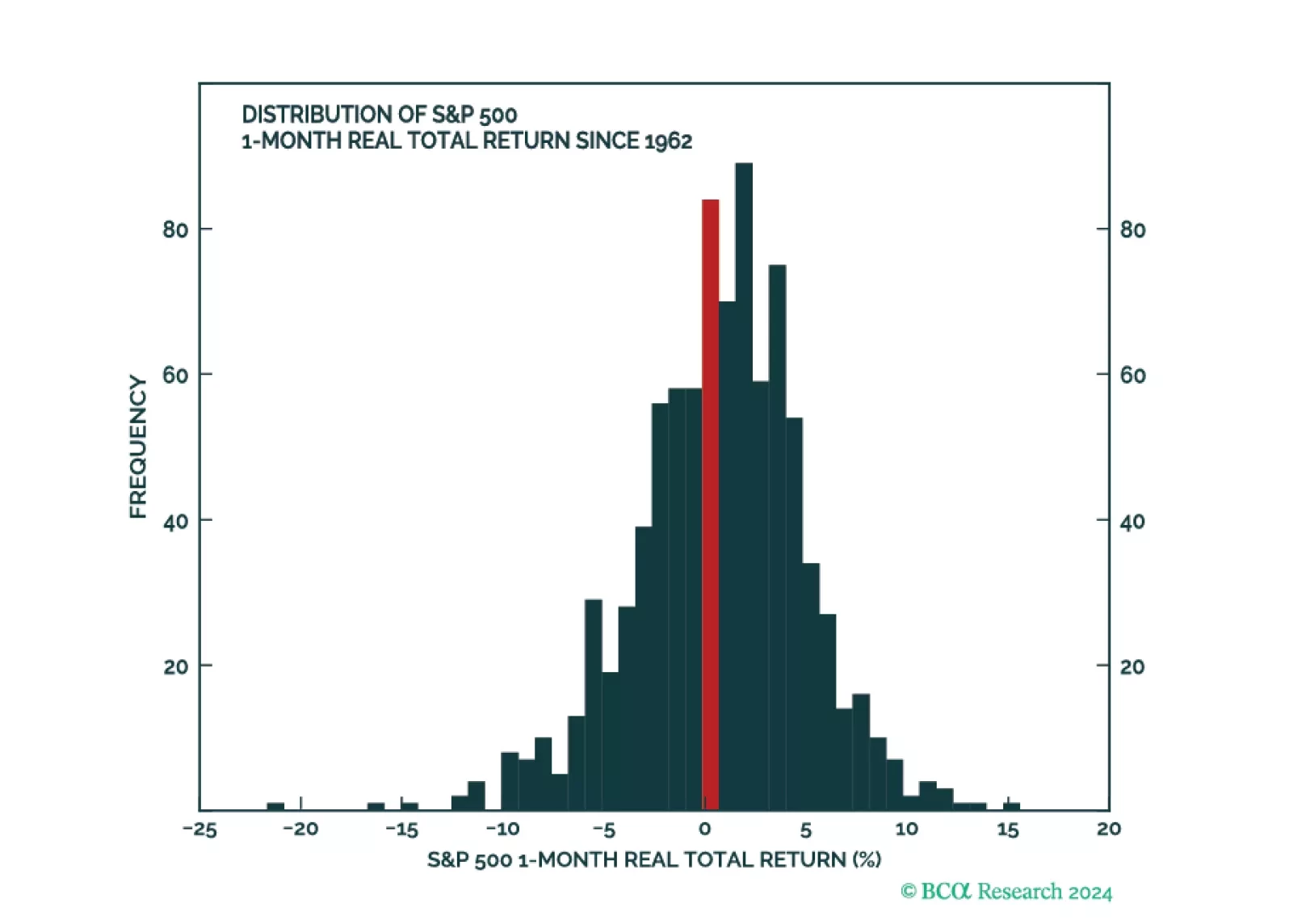

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

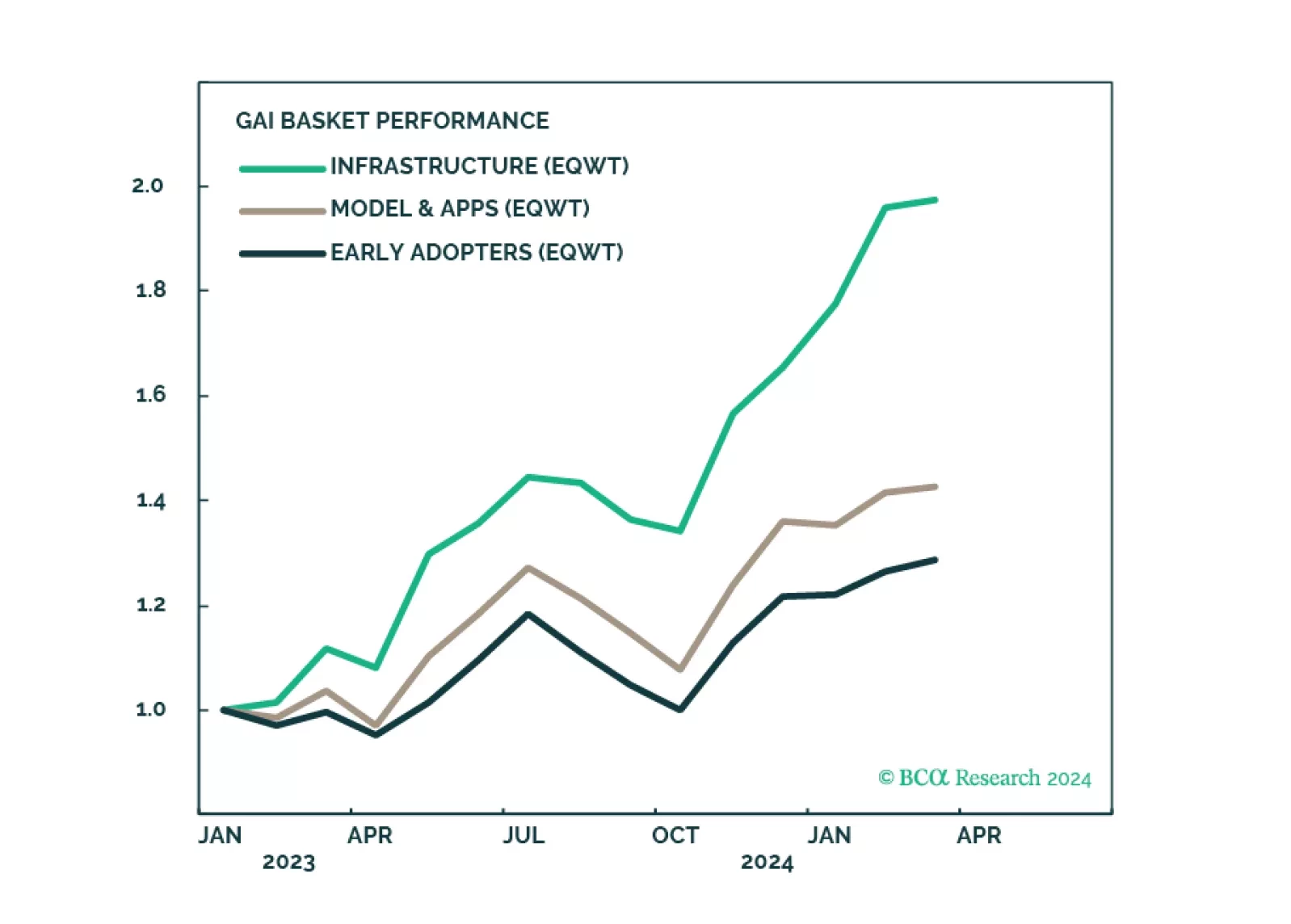

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

MacroQuant downgraded equities from overweight to neutral on a 1-to-3 month horizon. The model maintains a negative view on stocks over a 12-month horizon.

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.