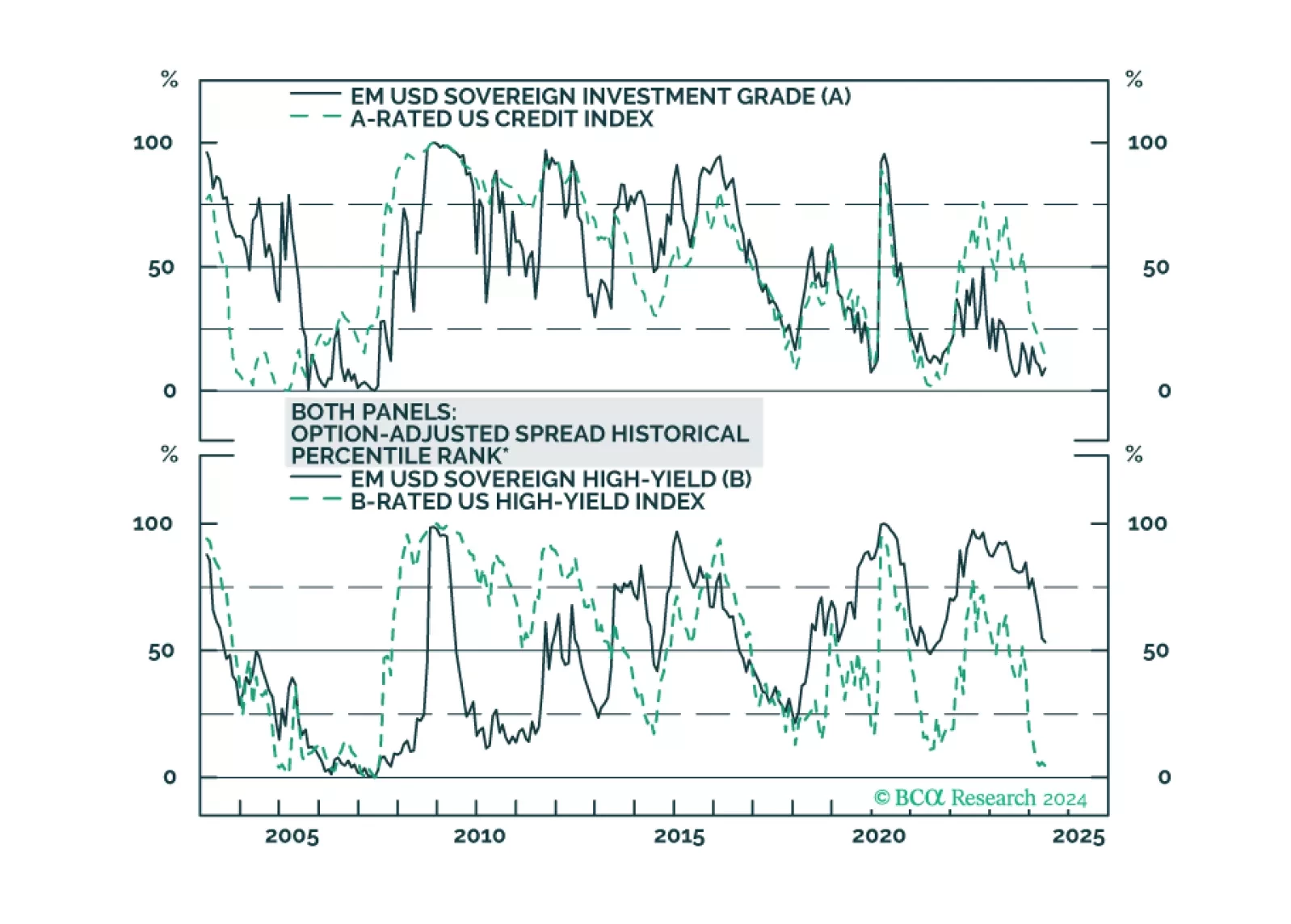

We dig into the USD-denominated Emerging Market Sovereign Index to see which credit tiers and countries offer value relative to US Credit.

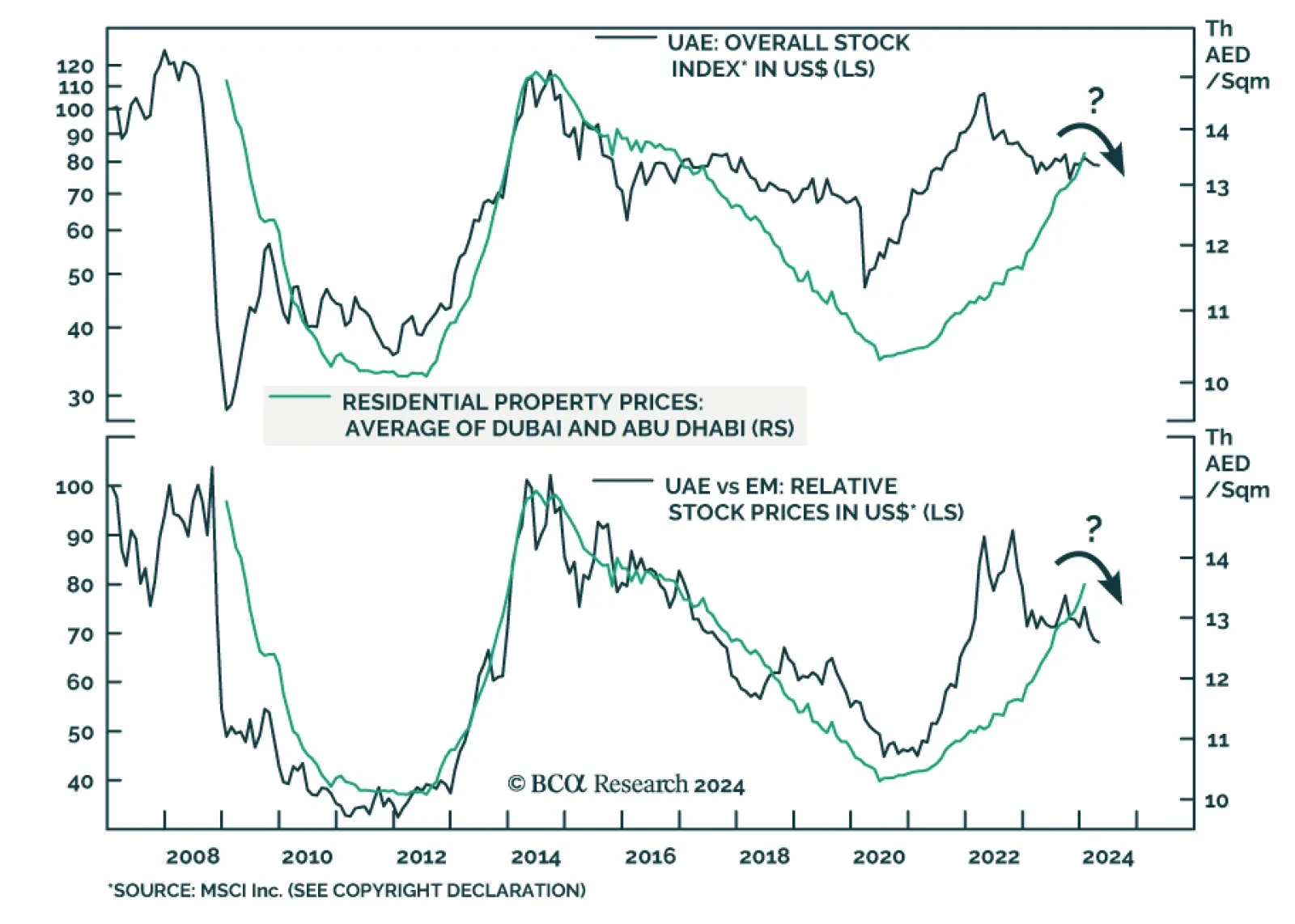

According to BCA Research’s Emerging Markets Strategy service, peaking property prices will remove the sole tailwind behind the Emirati Stock Market. Over the past couple of years, the Emirati stock market has been…

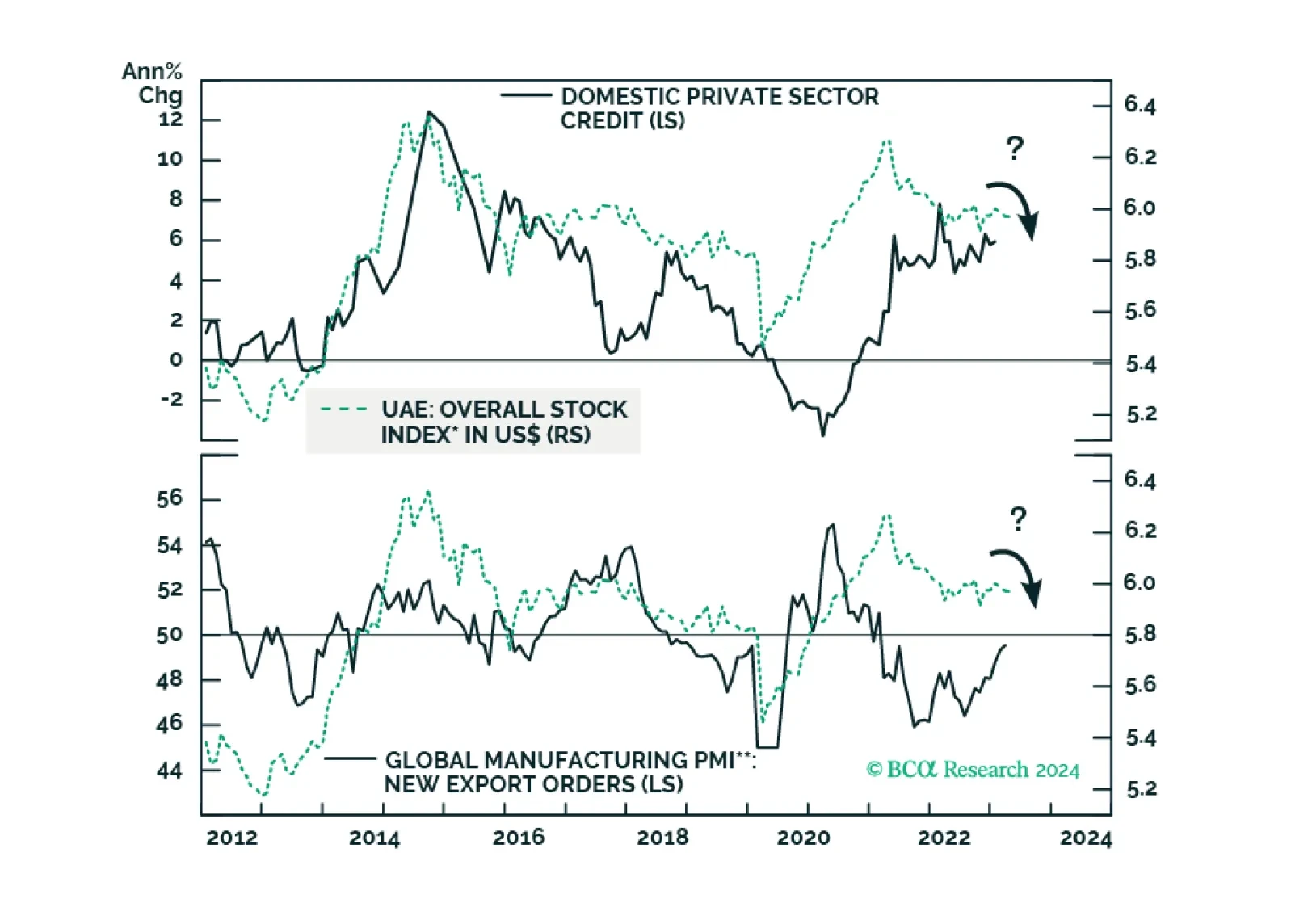

Subdued credit growth and weak global trade will remain headwinds for Emirati stocks. Surging property prices, which have led to a boom in real estate stocks, will also peak soon. Stay neutral on this bourse. Sovereign credit…

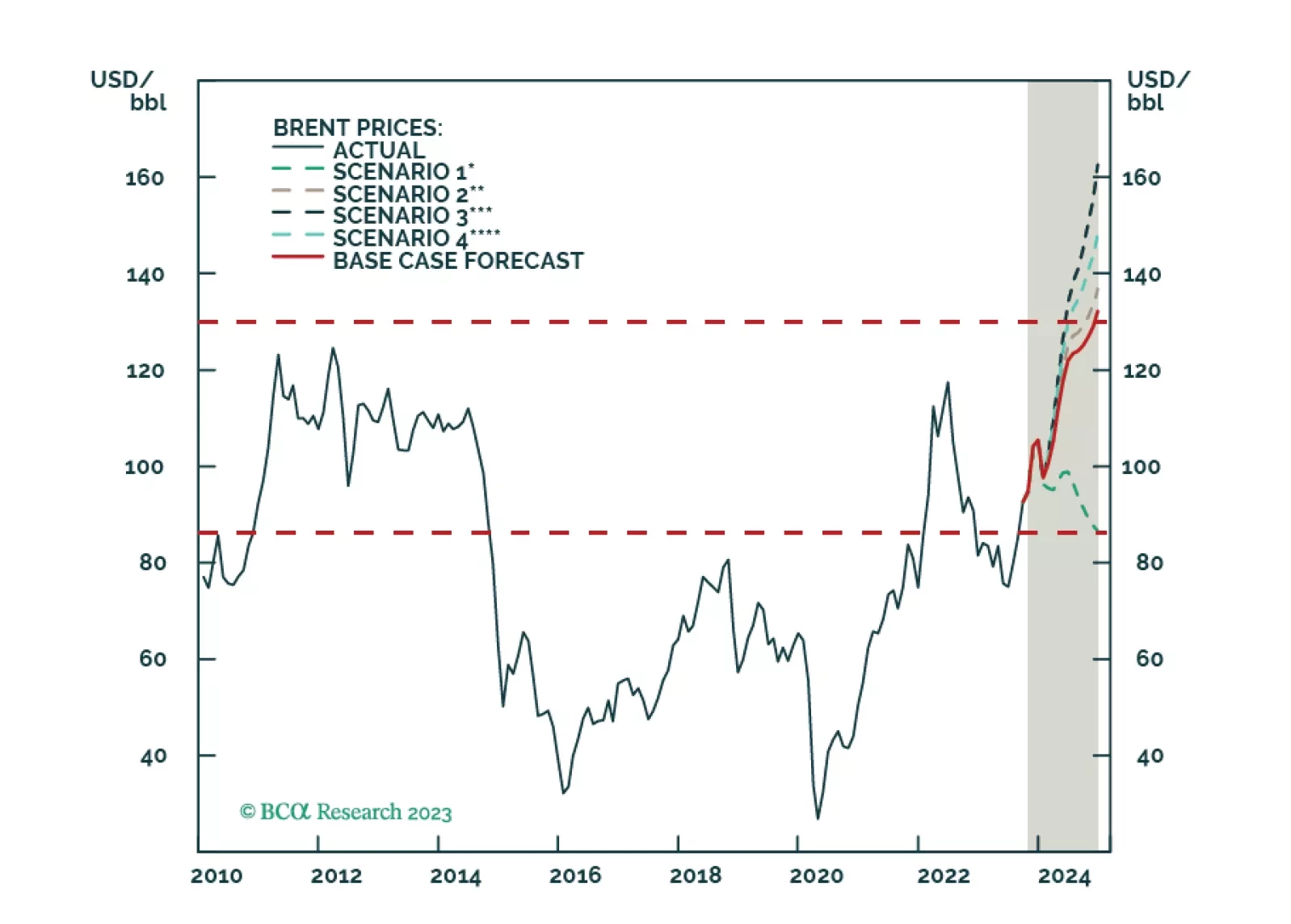

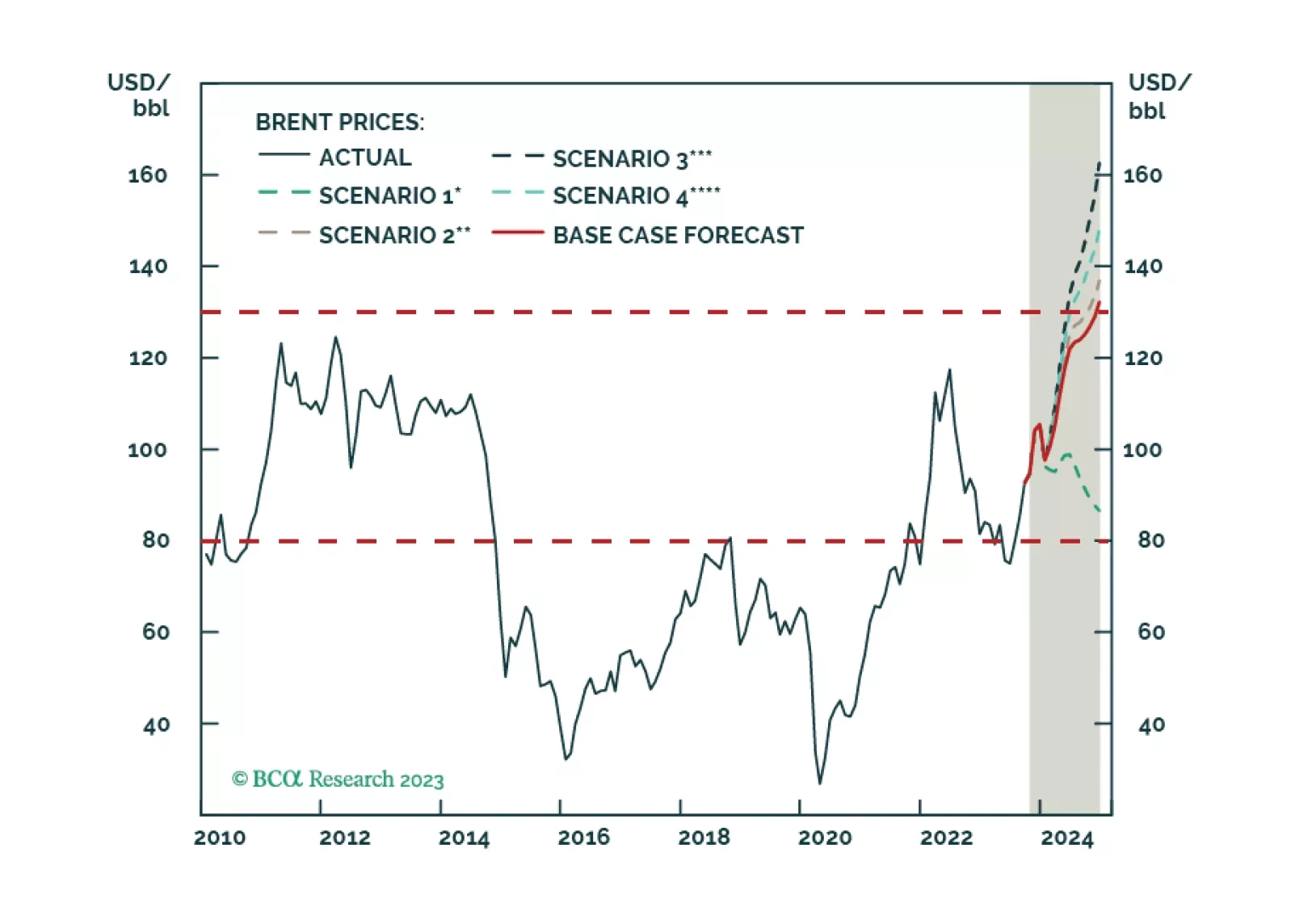

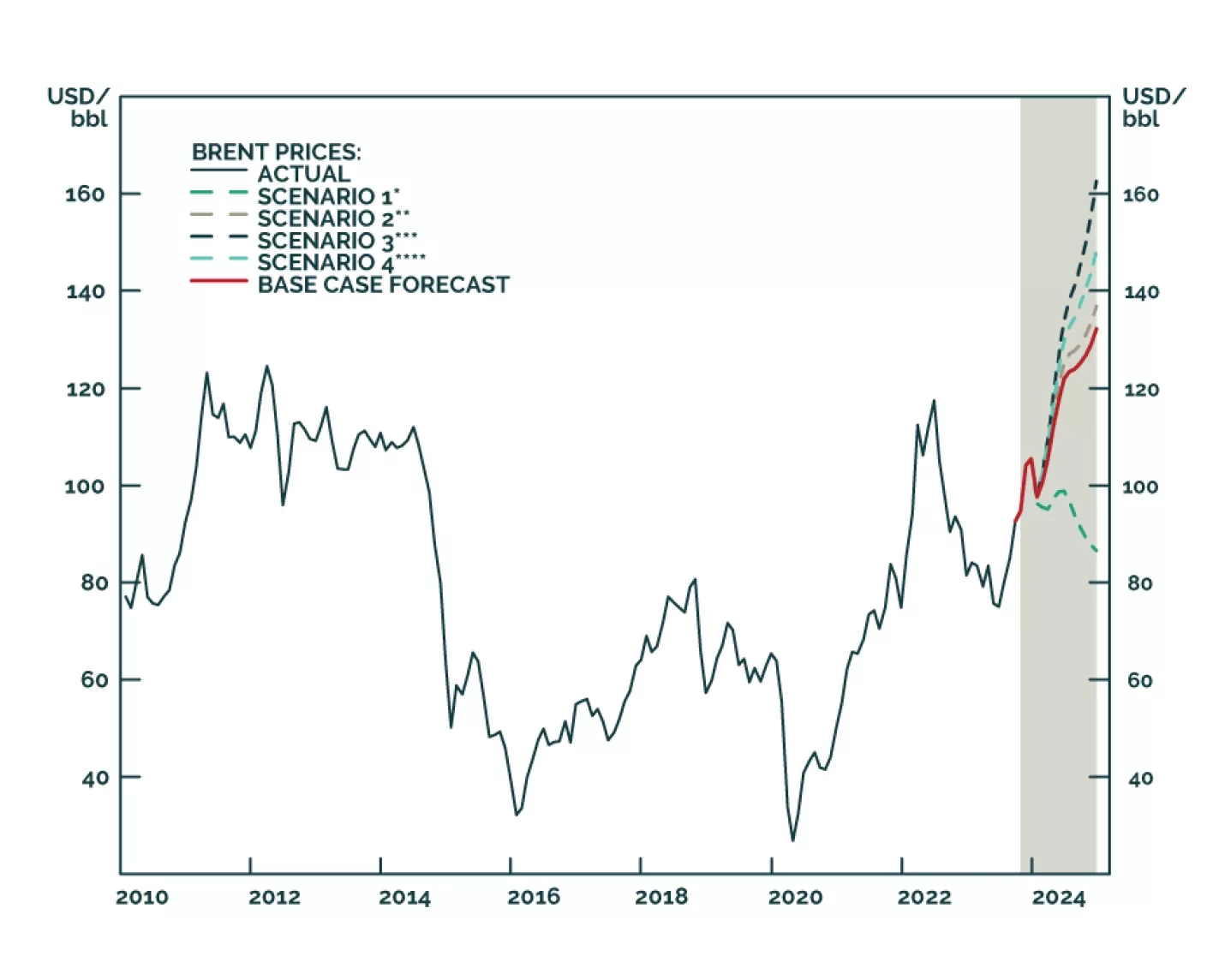

The US and core OPEC 2.0 are – wittingly or not – laying the groundwork for a price band with a floor and cap on oil prices – at $79/bbl and $130/bbl, respectively – “at least” to May 2024. This accommodates multiple goals for both…

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

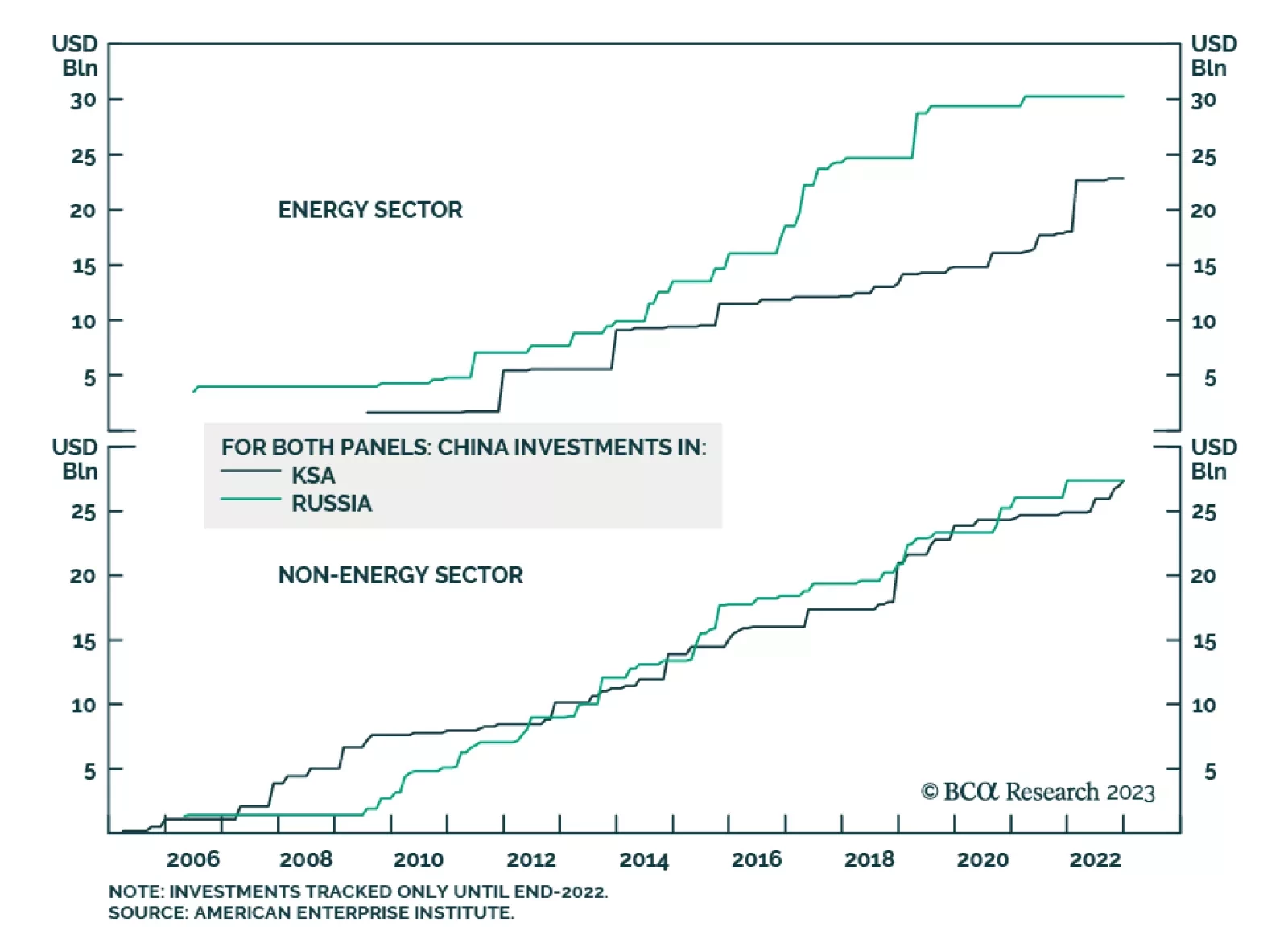

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

Following this weekend’s OPEC 2.0 meeting, KSA announced a 1mm b/d crude output cut, slated for this July or August, as it attempts to support weak oil prices. The new output quotas, reduced to reflect members’ weak crude oil…

UAE markets are a simultaneous play on interest rates, crude prices, and global trade. None of them is presently favorable, with rising interest rates being the main threat to the UAE economy and stock market.

OPEC 2.0’s decision to cut 2mm b/d of output beginning in December telescopes the loss of Russian volumes we expect over the course of the coming year. OPEC 2.0 clearly is not playing by the G7’s or the US’s rules. This will keep…