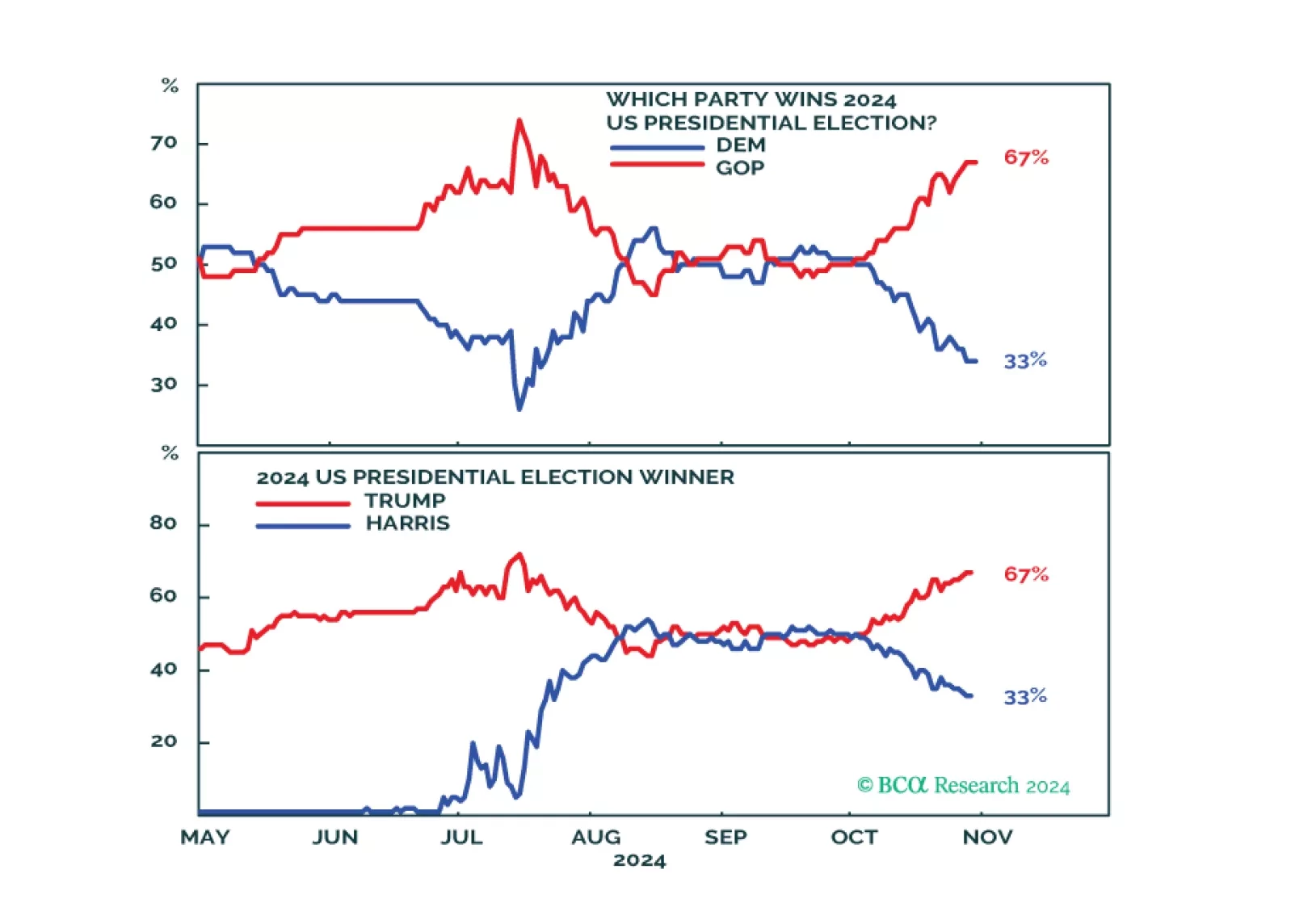

Trump may be favored, but Harris is now underrated. The Senate is highly likely to go Republican – Harris would be gridlocked if she pulled off a victory. If Trump wins it will be a full sweep. Expect volatility in the short term.

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

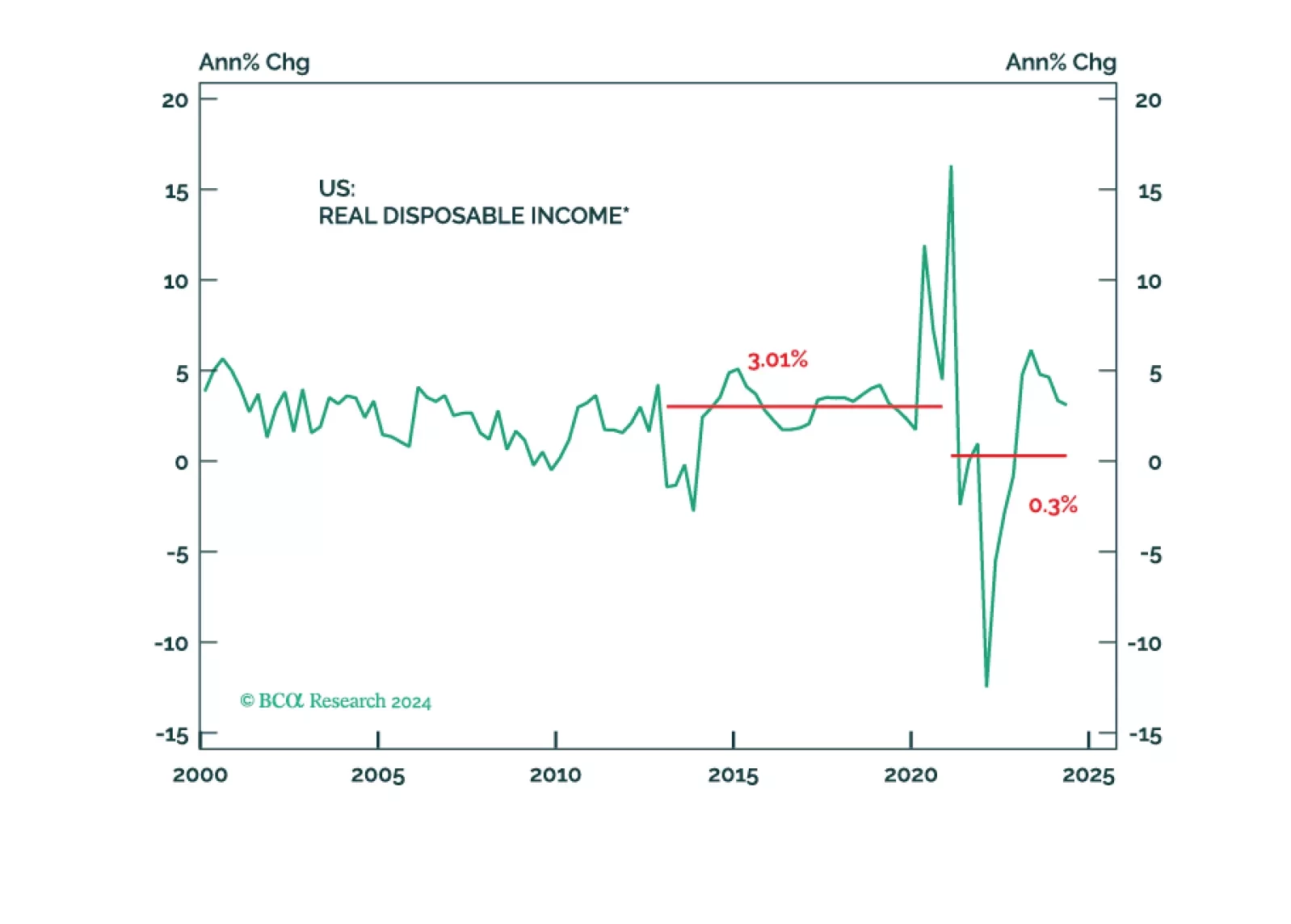

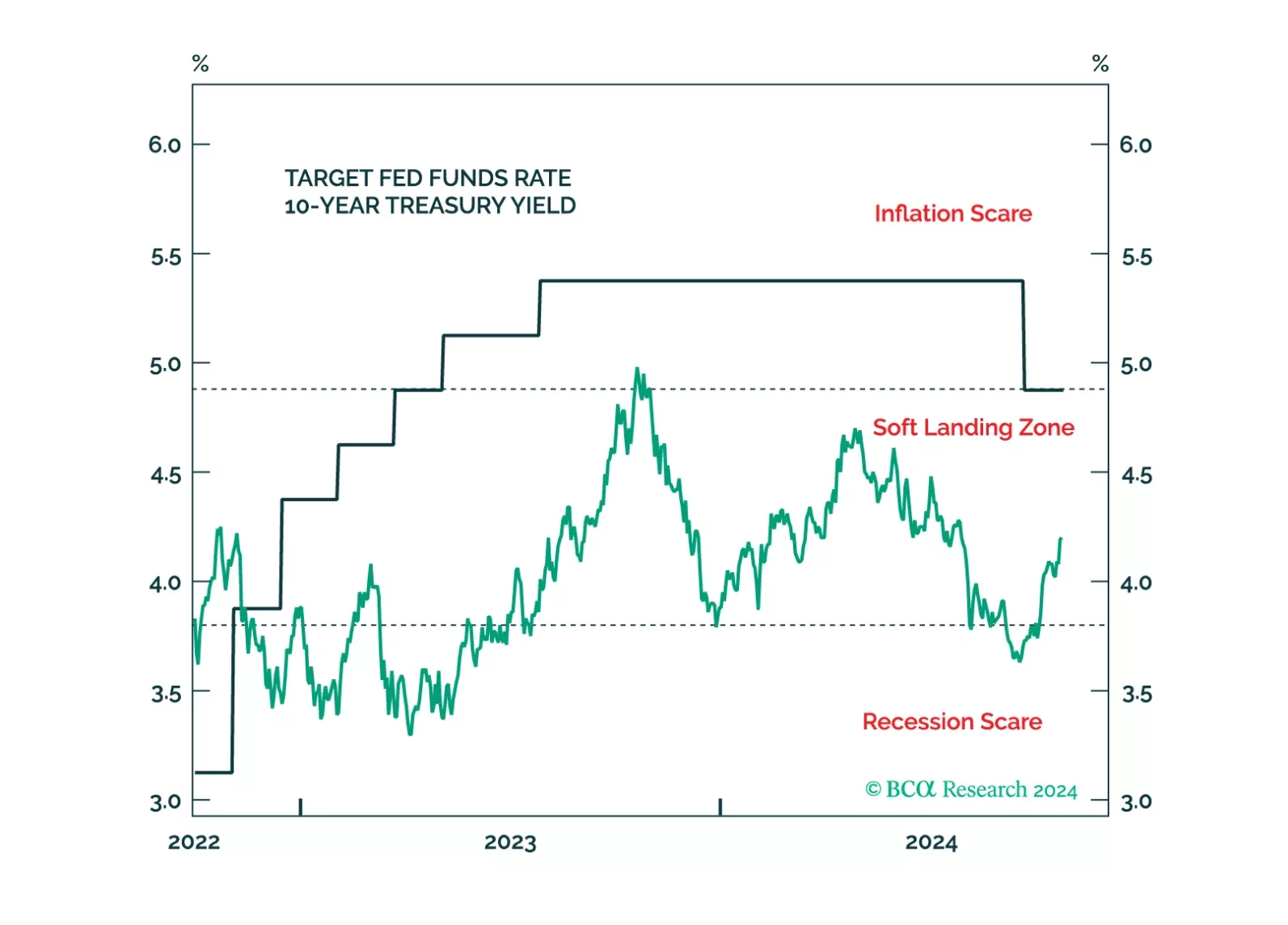

A Donald Trump victory would send bond yields higher during the next few weeks, but yields will fall in 2025 no matter the election outcome.

As the odds of a Trump victory increase, there are indications that the “Trump trade” has commenced in global financial markets, with negative short-term implications for EM. In short, the US dollar will strengthen, and US bond…

The month of October ahead of a US general election tends to be a volatile month with negative outcome for equities. As such, it is prudent to remain on the sidelines until after the election.

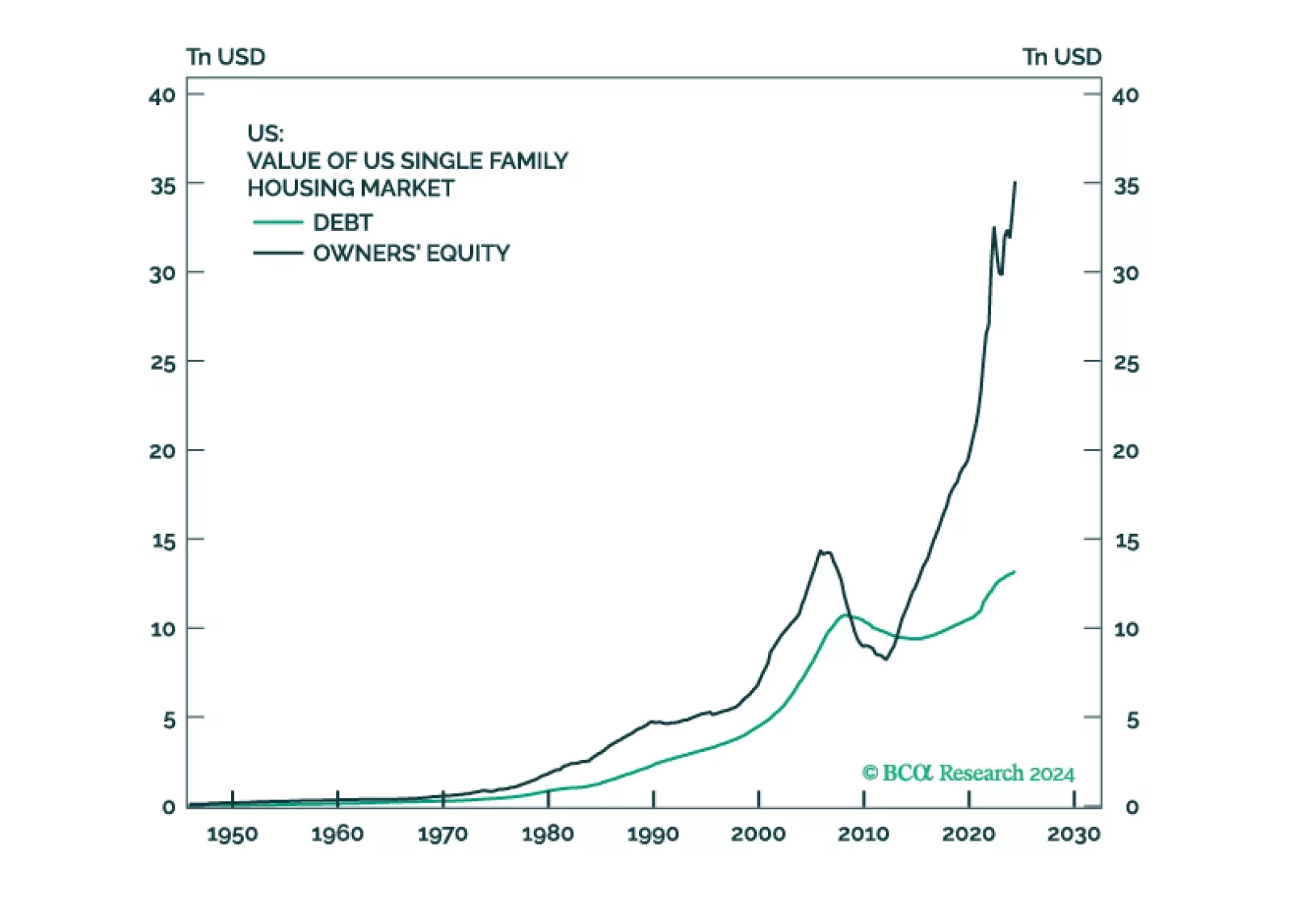

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

But the big macro…

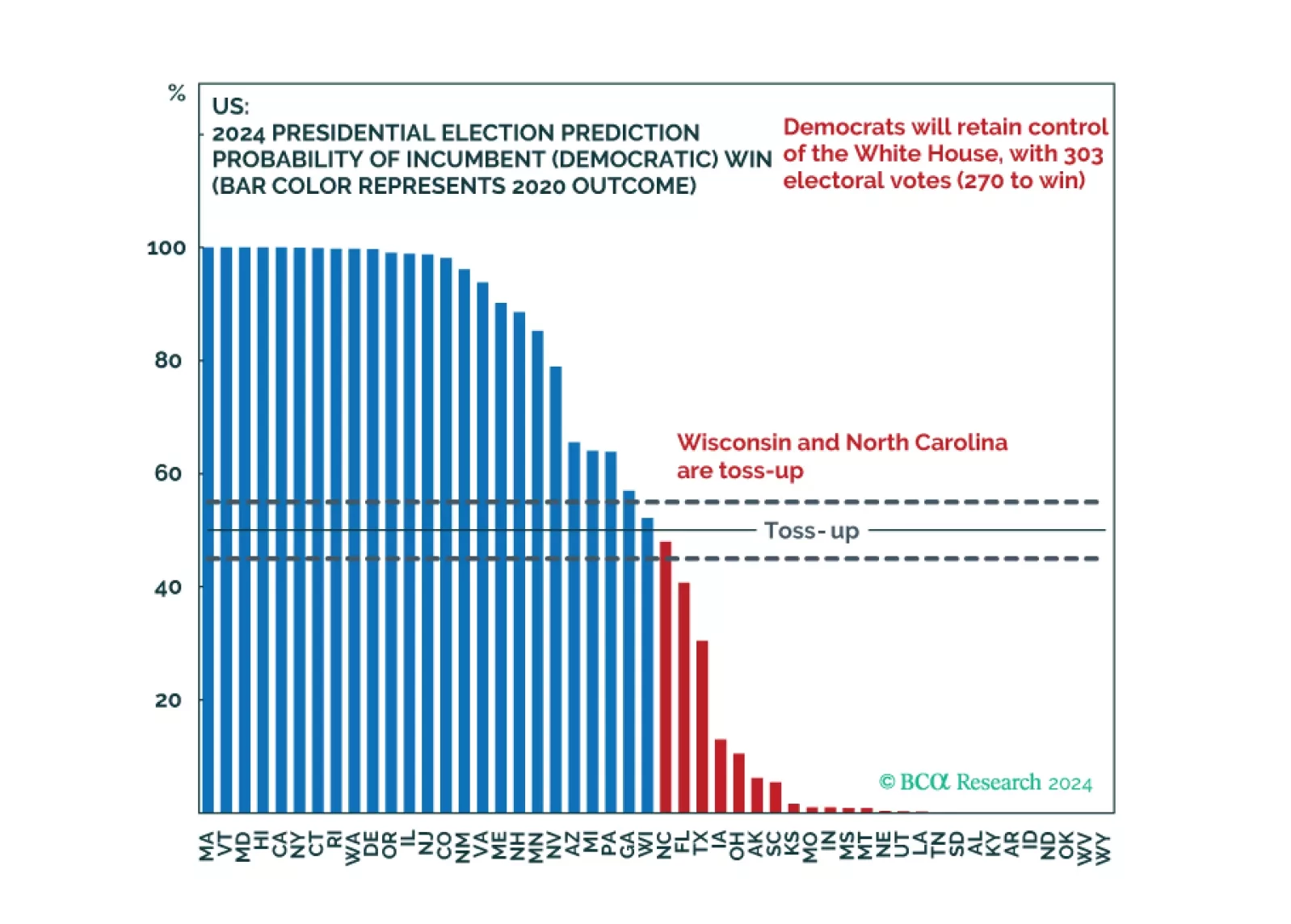

Our quant model shows Democrats winning the election at a 56% probability, with 303 electoral college votes. But swing state economies are slowing and Democrats’ odds in Michigan fell. Trump can win with Georgia, Michigan, plus one…