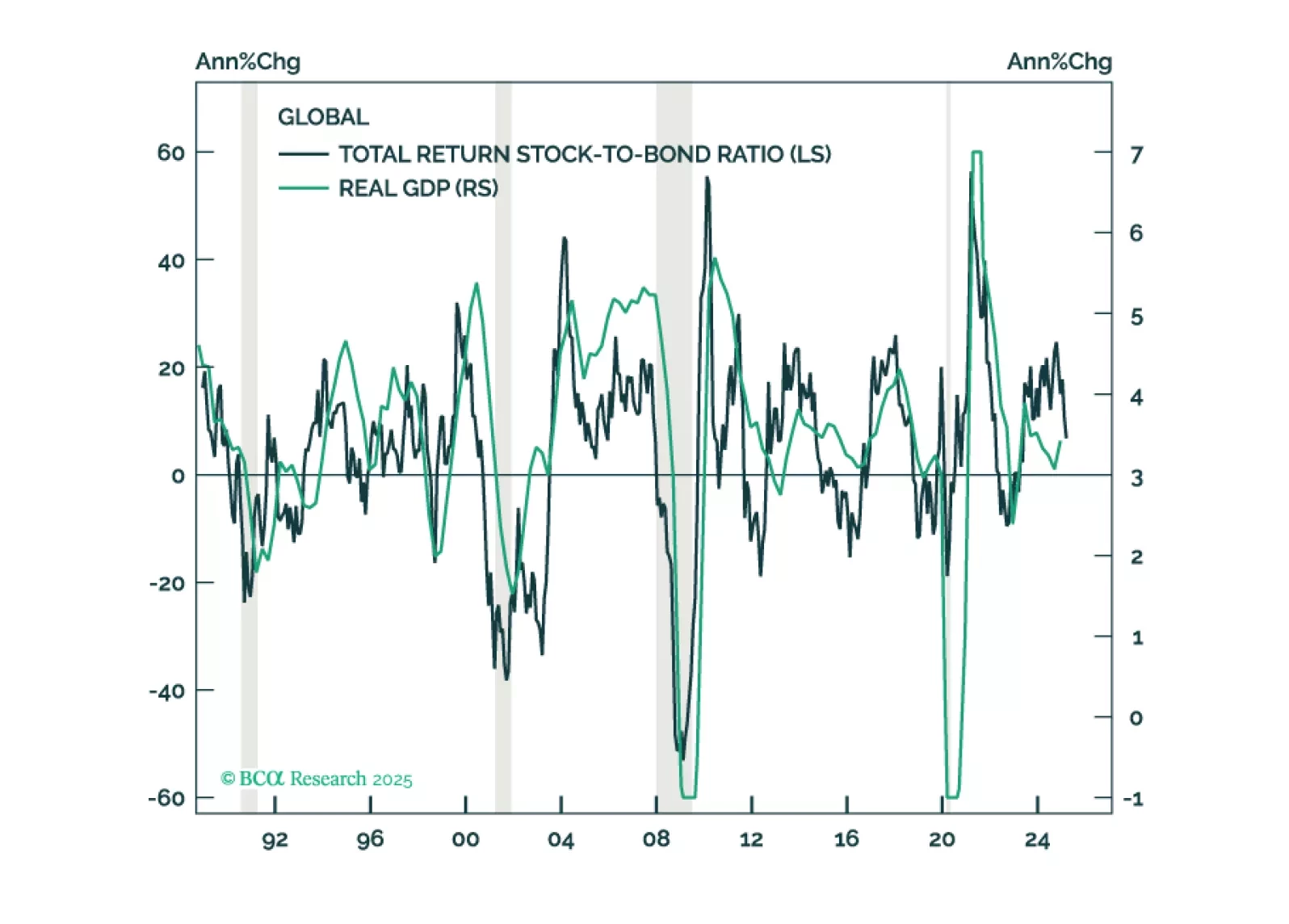

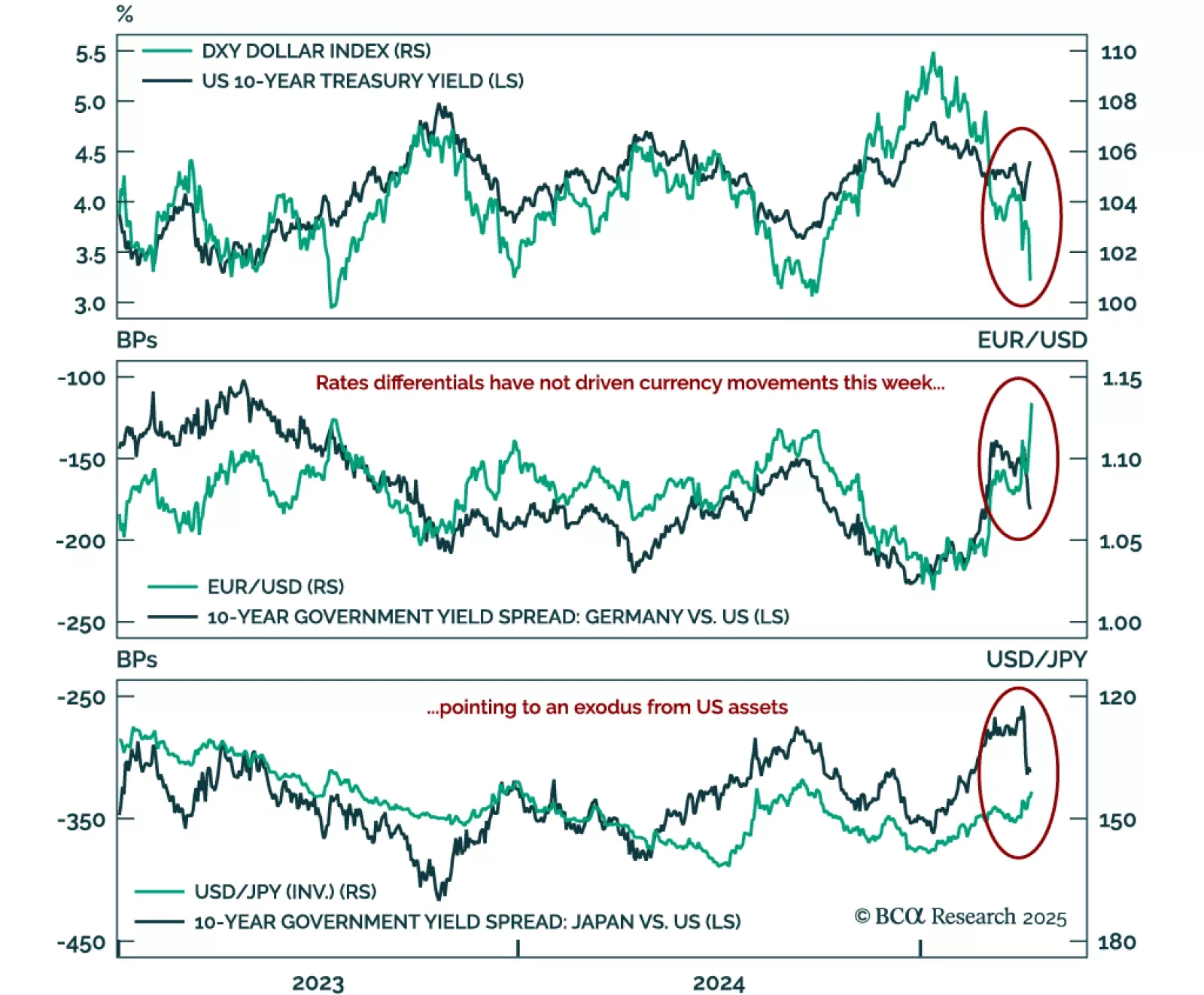

The recent breakdown in cross-asset correlations highlights mounting risk premia on US assets. Last week, the long-standing correlations underpinning our understanding of global markets violently broke down. The Treasury market…

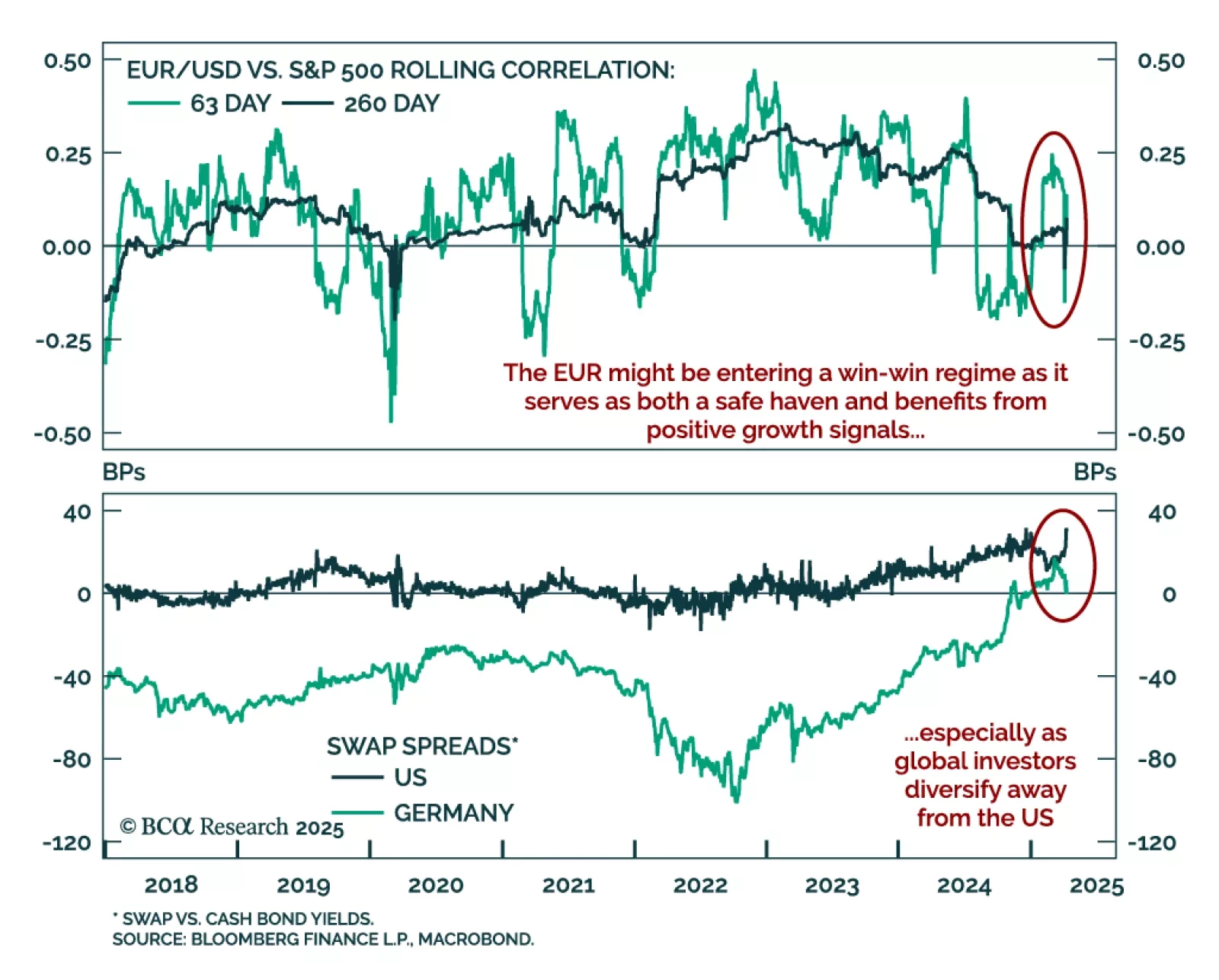

Dips in European assets remain long-term buying opportunities, even though short-term risks abound. A notable feature of the recent selloff is that US safe havens failed to rally. In a global growth scare, both the US dollar and…

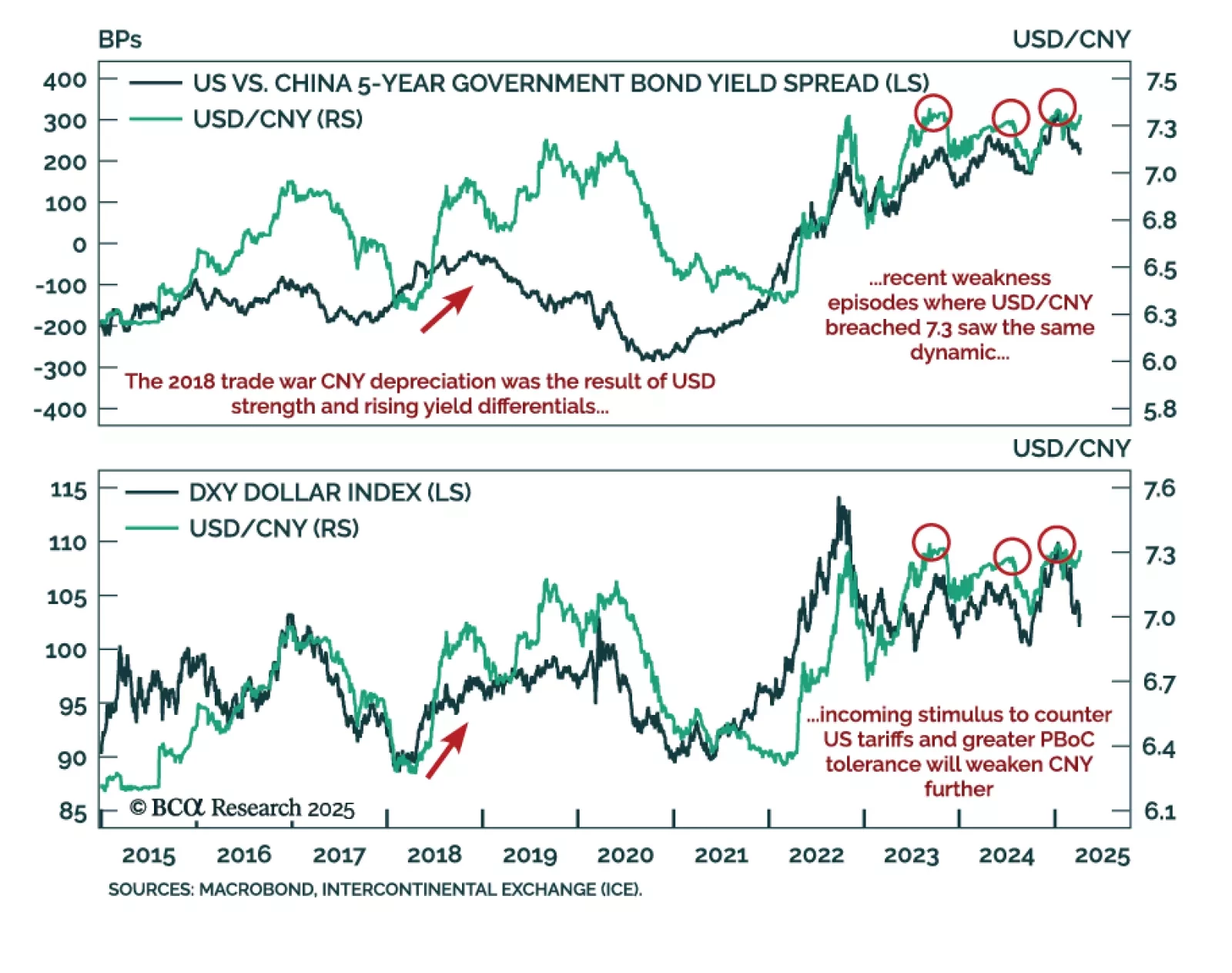

USD/CNY’s break above 7.3 signals more downside is in store for the yuan, supporting short high-beta FX and long CHF and JPY positions. The CNY has weakened in 2025 even as the US dollar has depreciated against most major currencies…

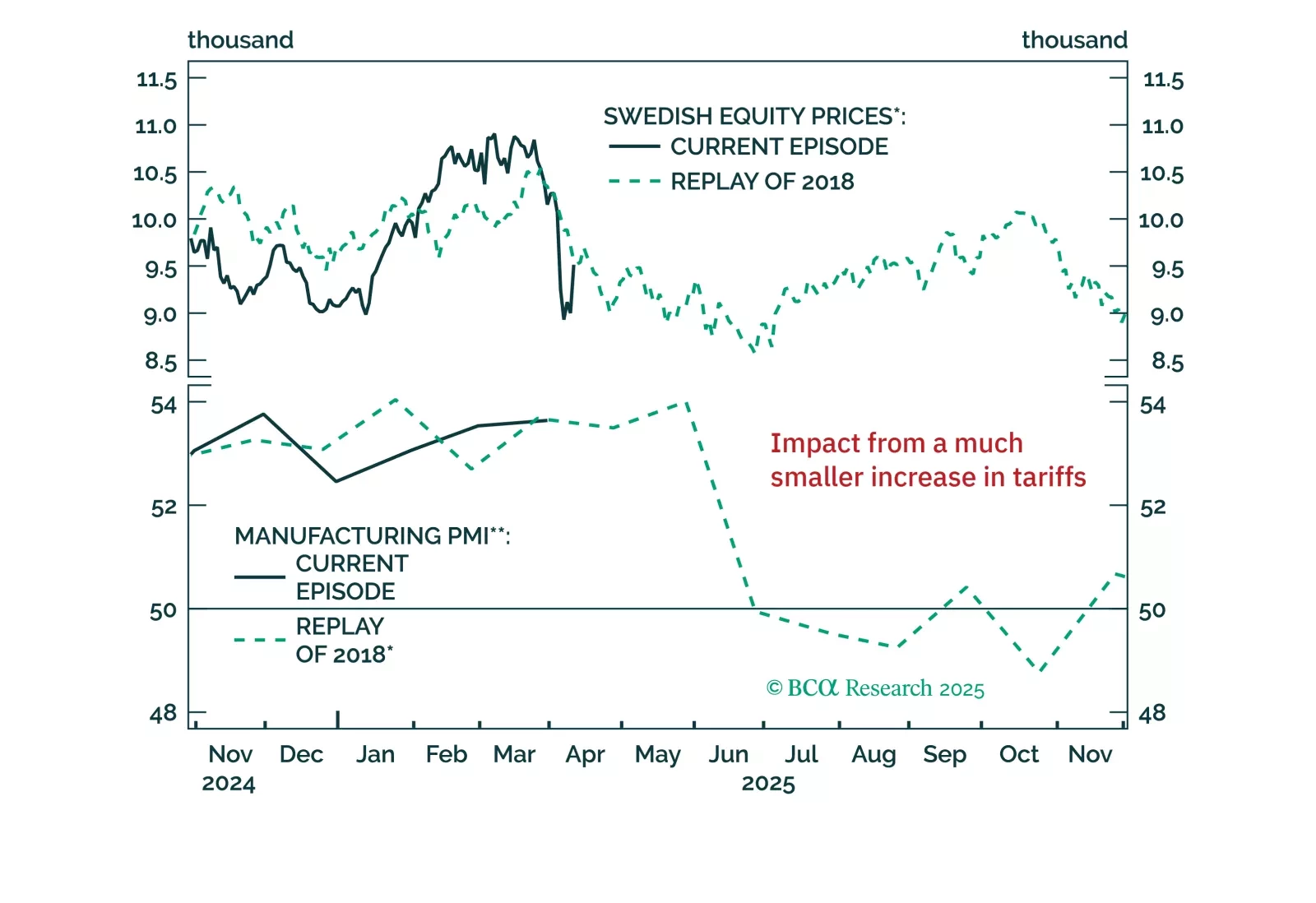

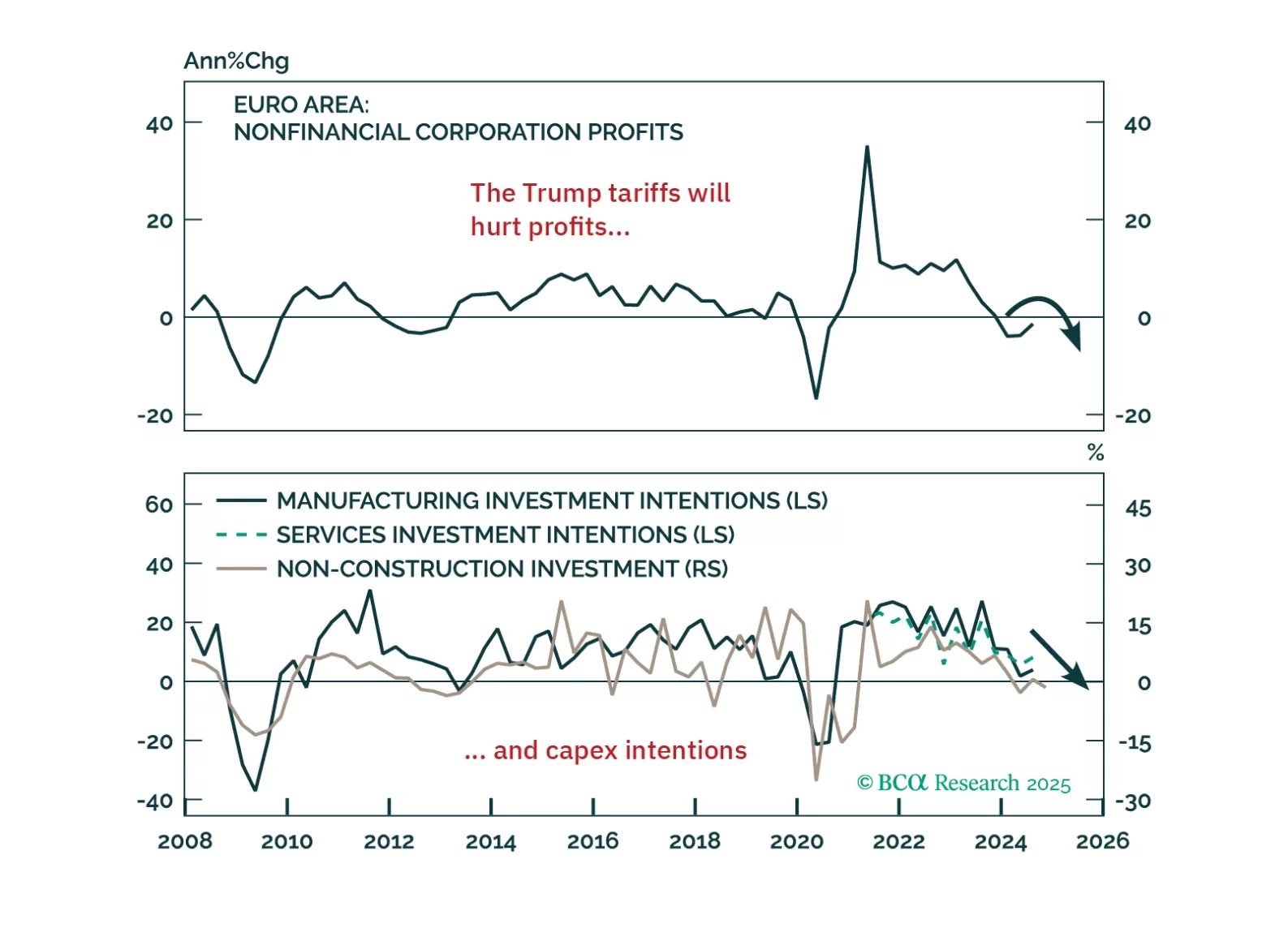

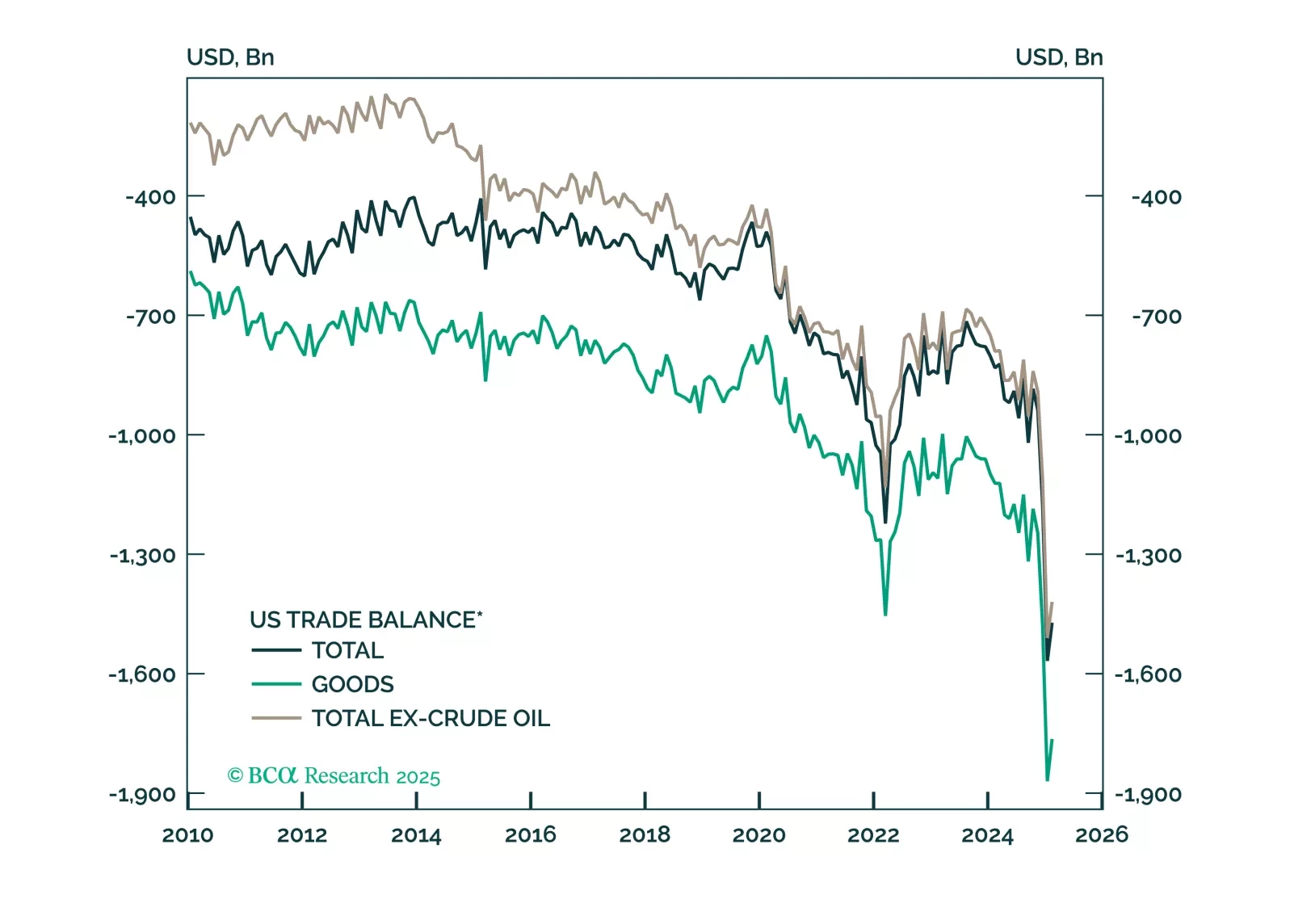

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

On the one hand, US tariffs are much more deflationary for the rest of the world than for the US, so interest rate differentials might move in favor of the US dollar in the near term. On the other hand, portfolio outflows from the US…

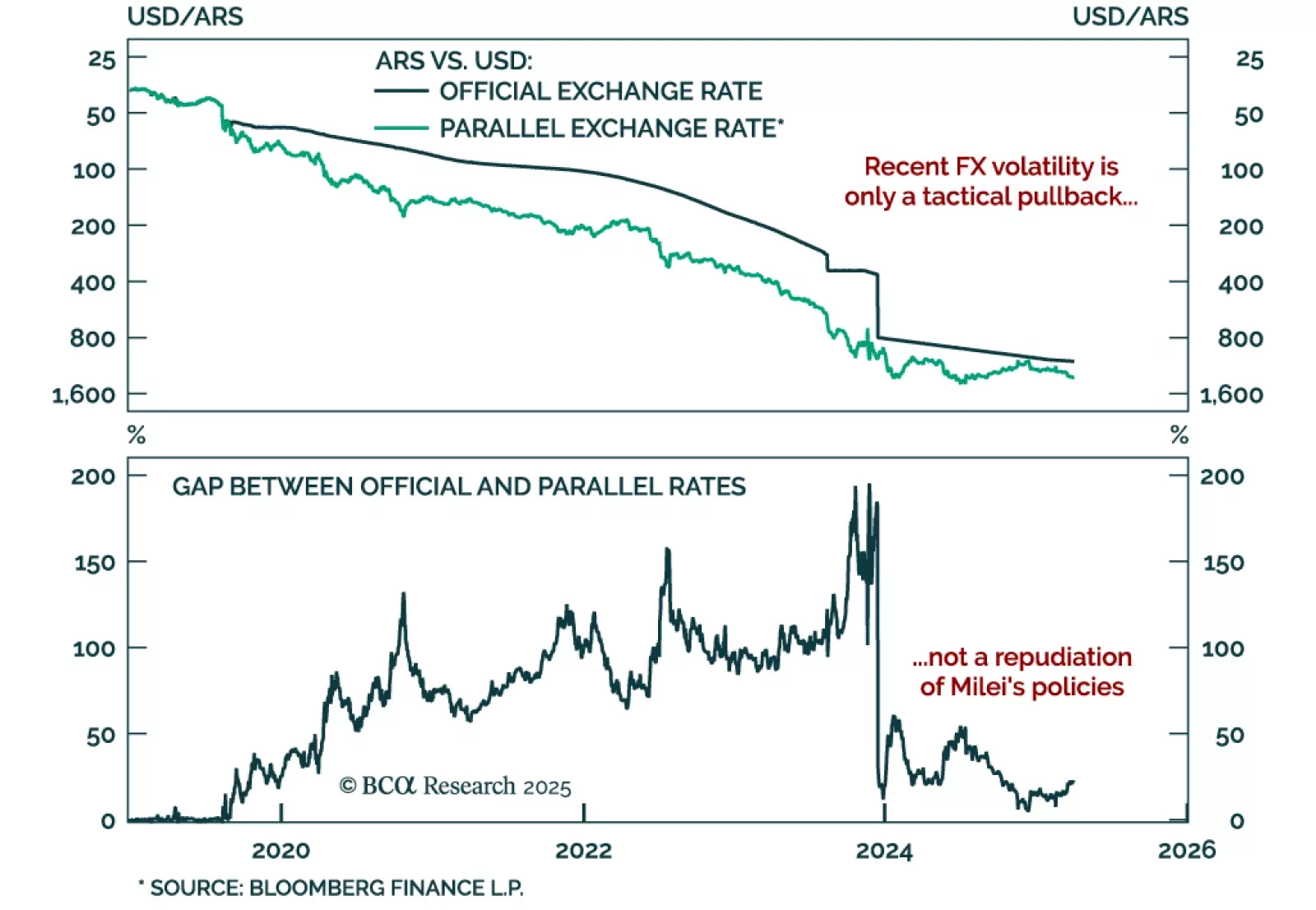

Remain constructive on Argentine assets as recent market moves are a tactical pullback, not a loss of confidence. The gap between official and parallel exchange rates has widened, prompting concerns that markets are questioning…

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.