US Dollar

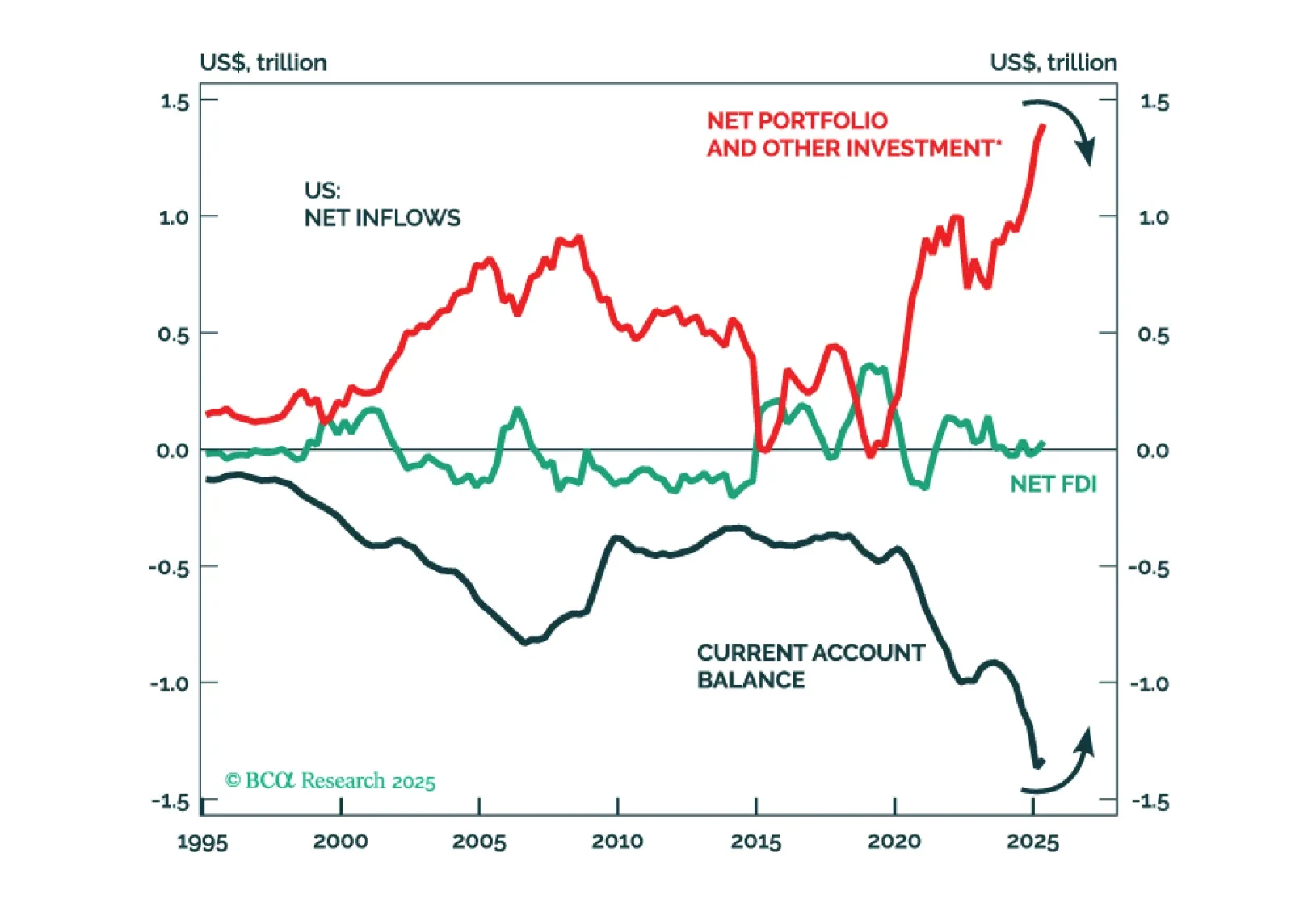

The belief that net portfolio outflows out of the US will fuel EM assets is a common but misguided narrative. If the US starts experiencing net capital outflows, it would need to run a current account surplus. A shift in the US current account from deficit to surplus would be devastating for the global economy in general and EM in particular.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has entered a structural downtrend, our perspective on the yen, gold and other commodities, and much more.

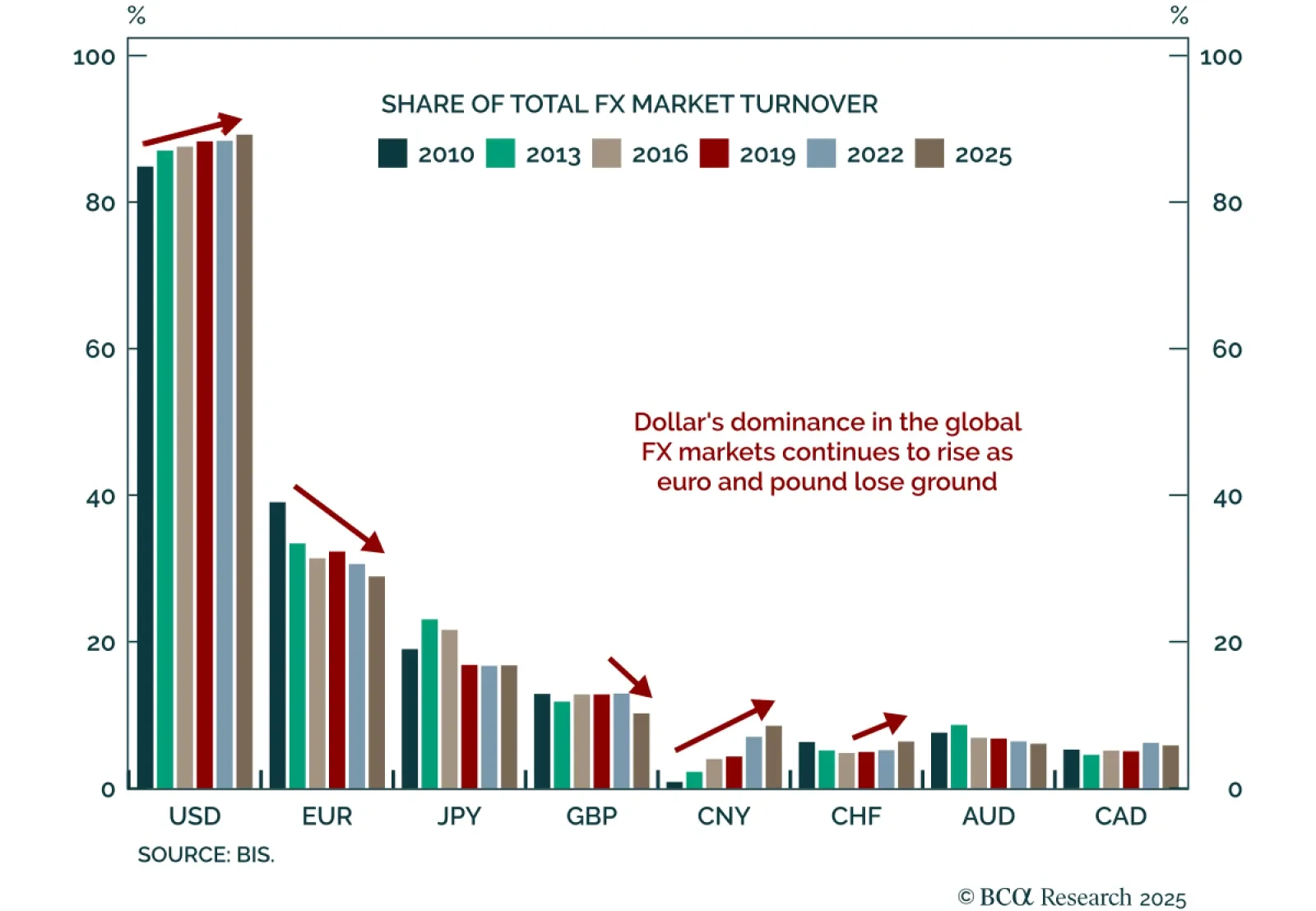

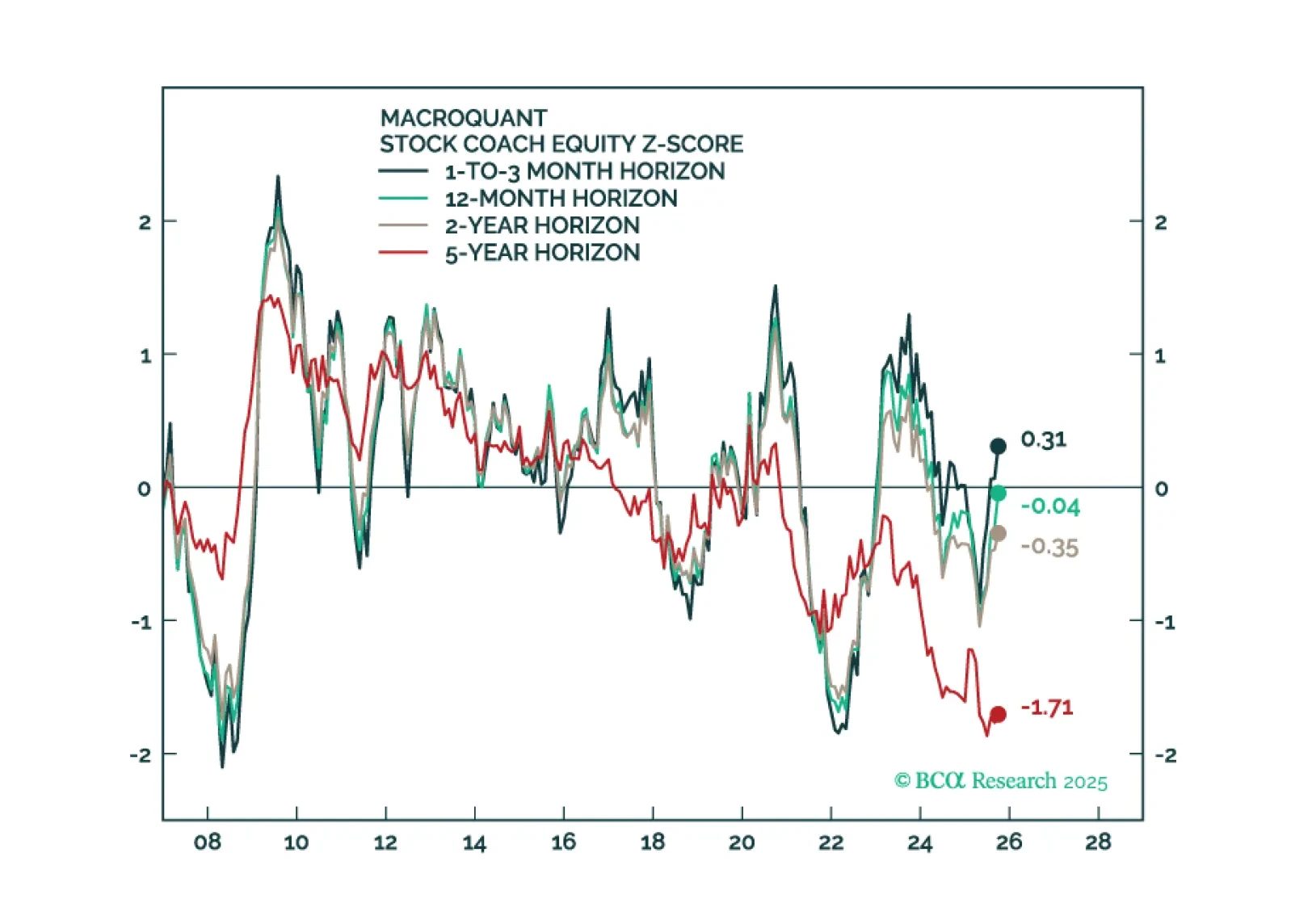

We remain bullish both bonds and equities, but conviction is falling. We are Luddites when it comes to the AI theme, but we have followed it regardless. A bubble is a bubble, not to be shorted. Yet Europe’s weak AI returns reveal 2025’s real story: the fall of King Dollar.

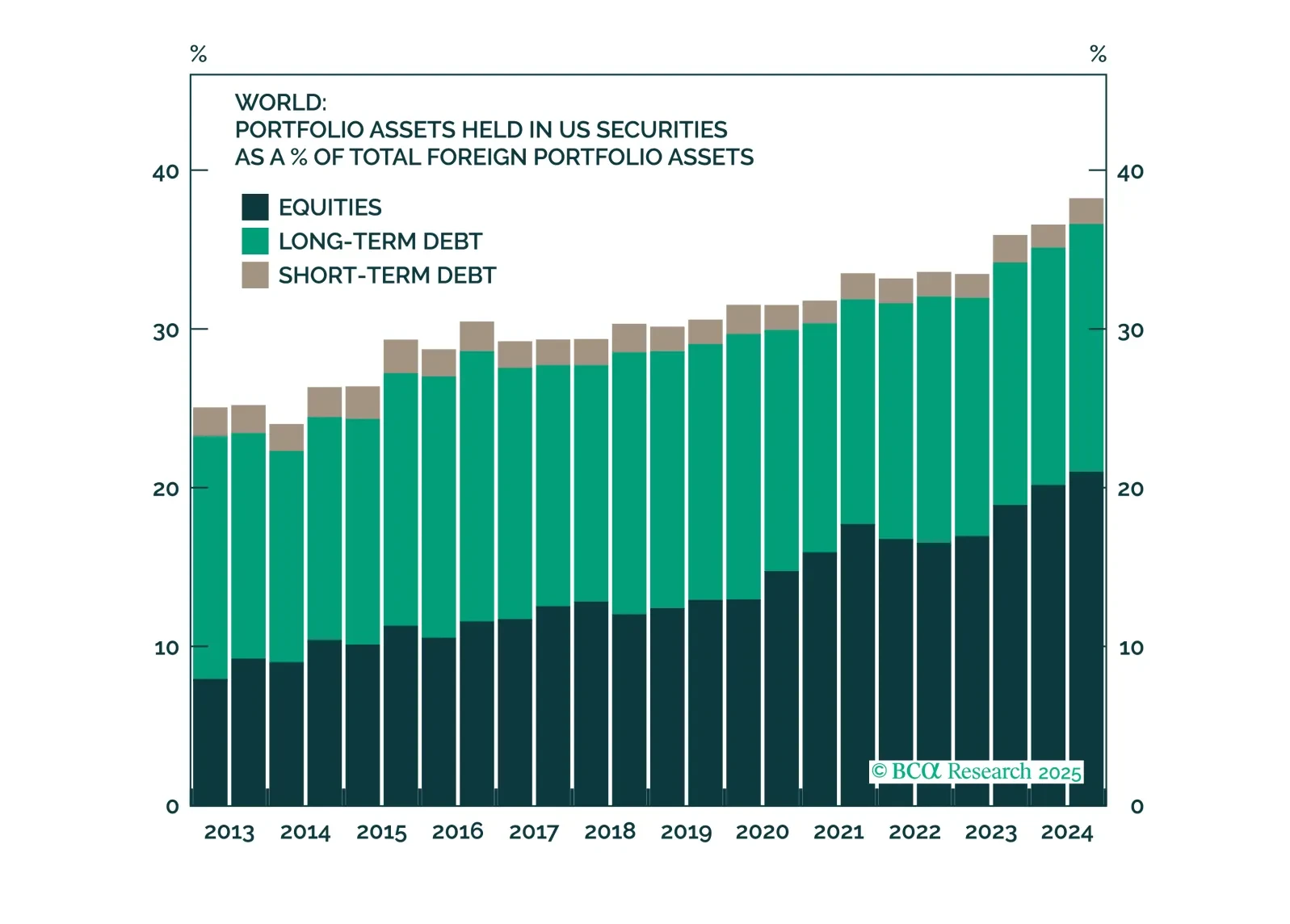

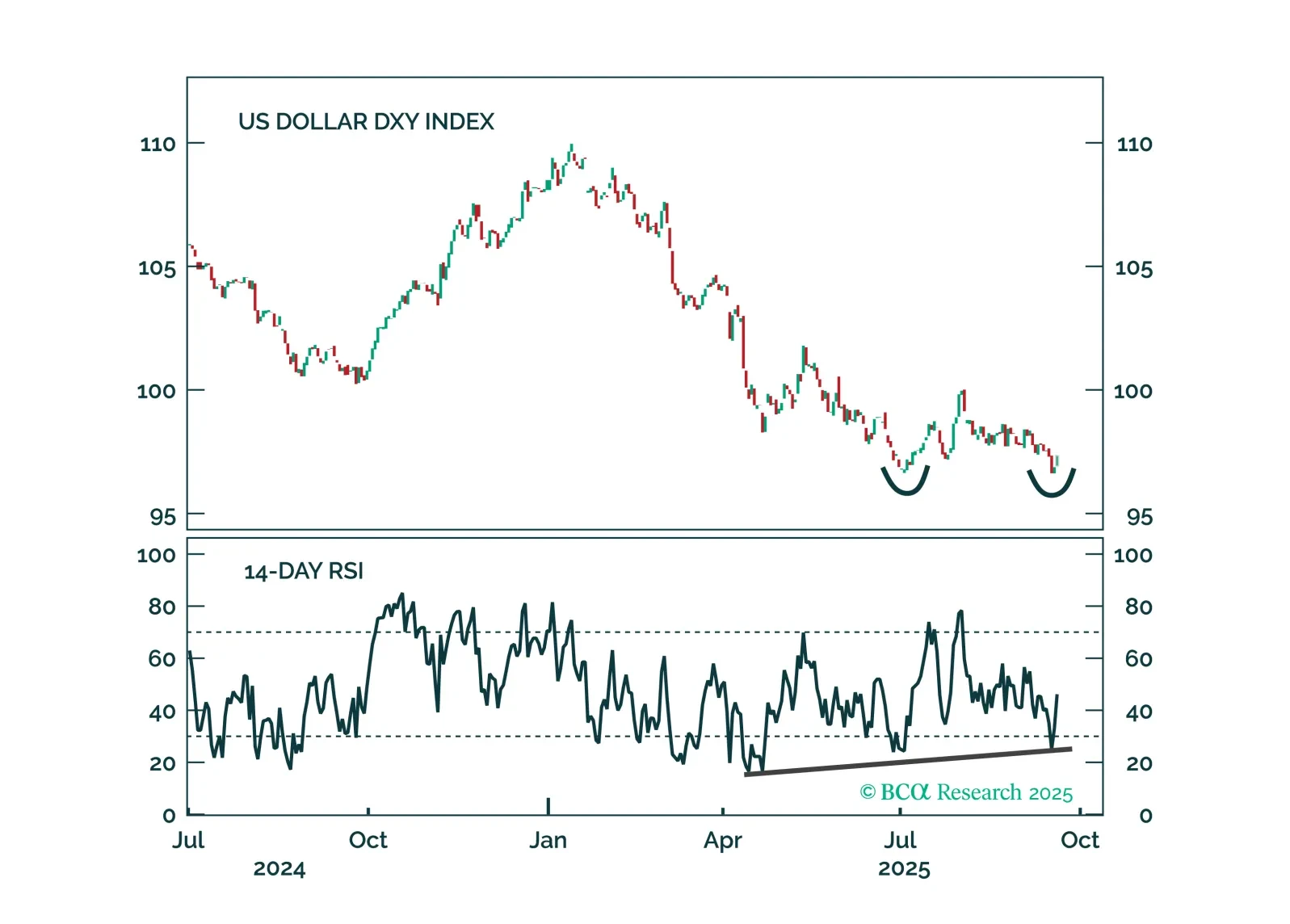

The dollar’s early 2025 decline was a reflection of a global rush to hedge accumulated USD exposure, not a mass exodus from US assets. With most hedging now complete, currency moves should again follow fundamentals, setting the stage for a tactical USD rebound in the months ahead.

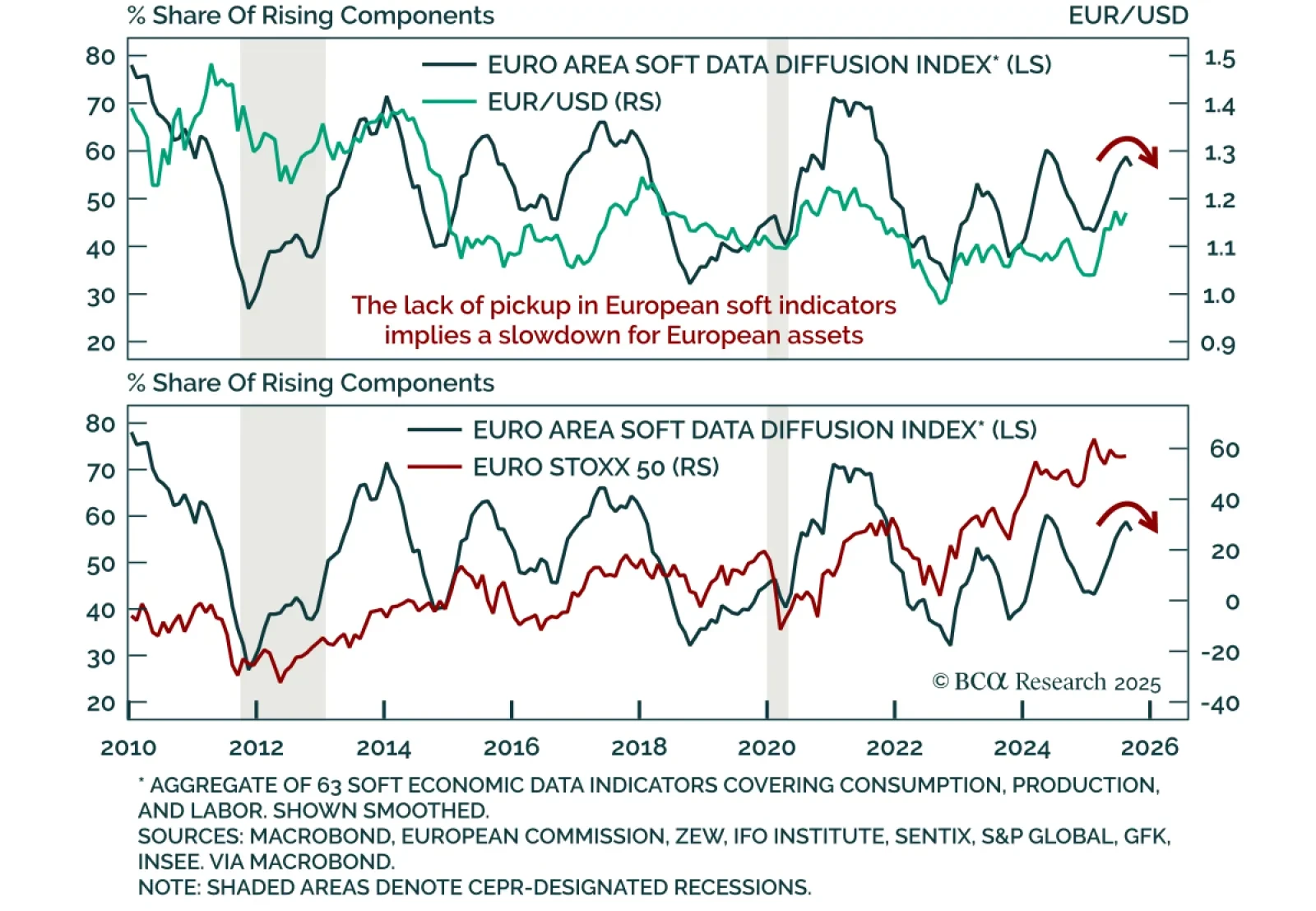

The Fed is mispriced for the rest of 2025. We explain why the dollar is poised to rebound and the trades to position for it.

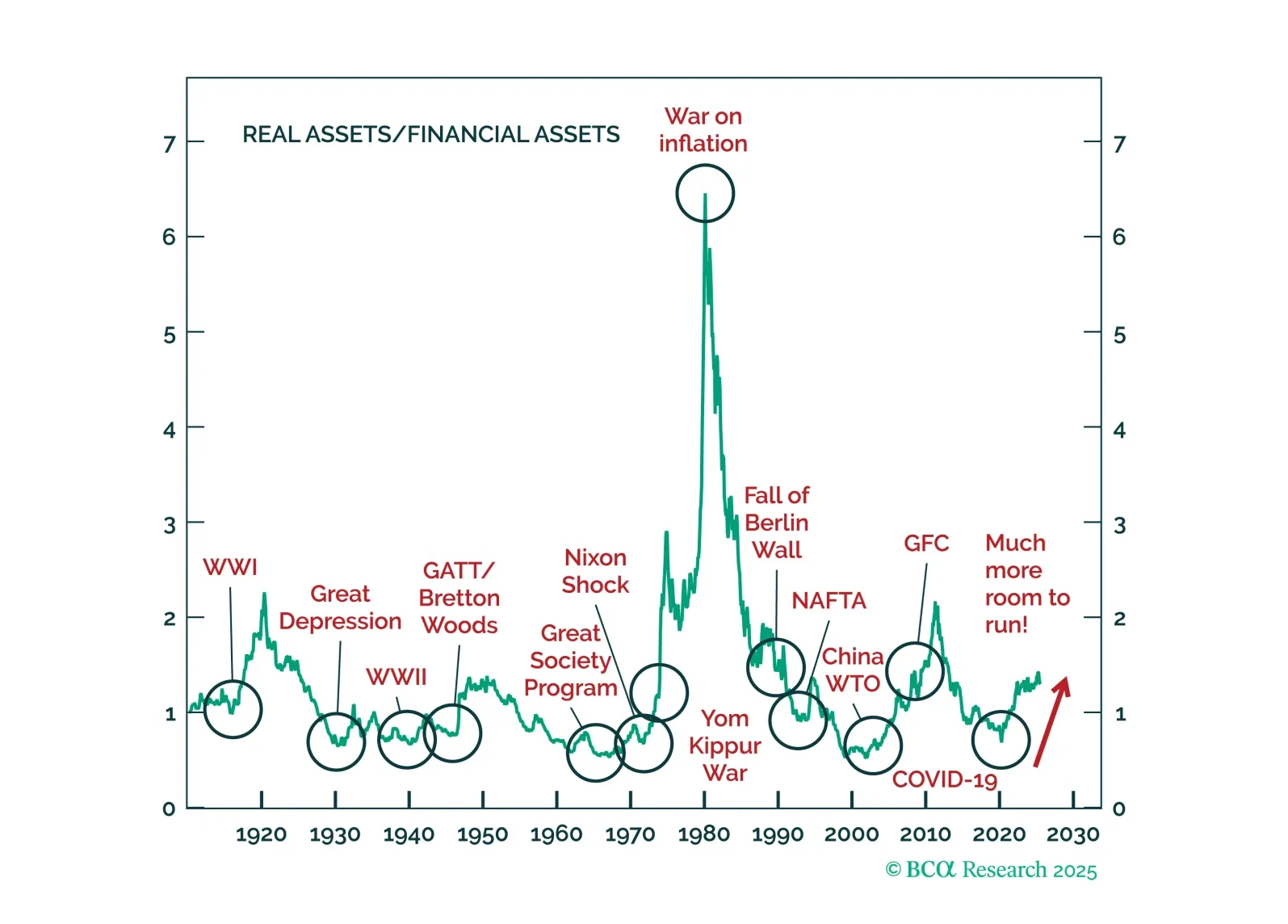

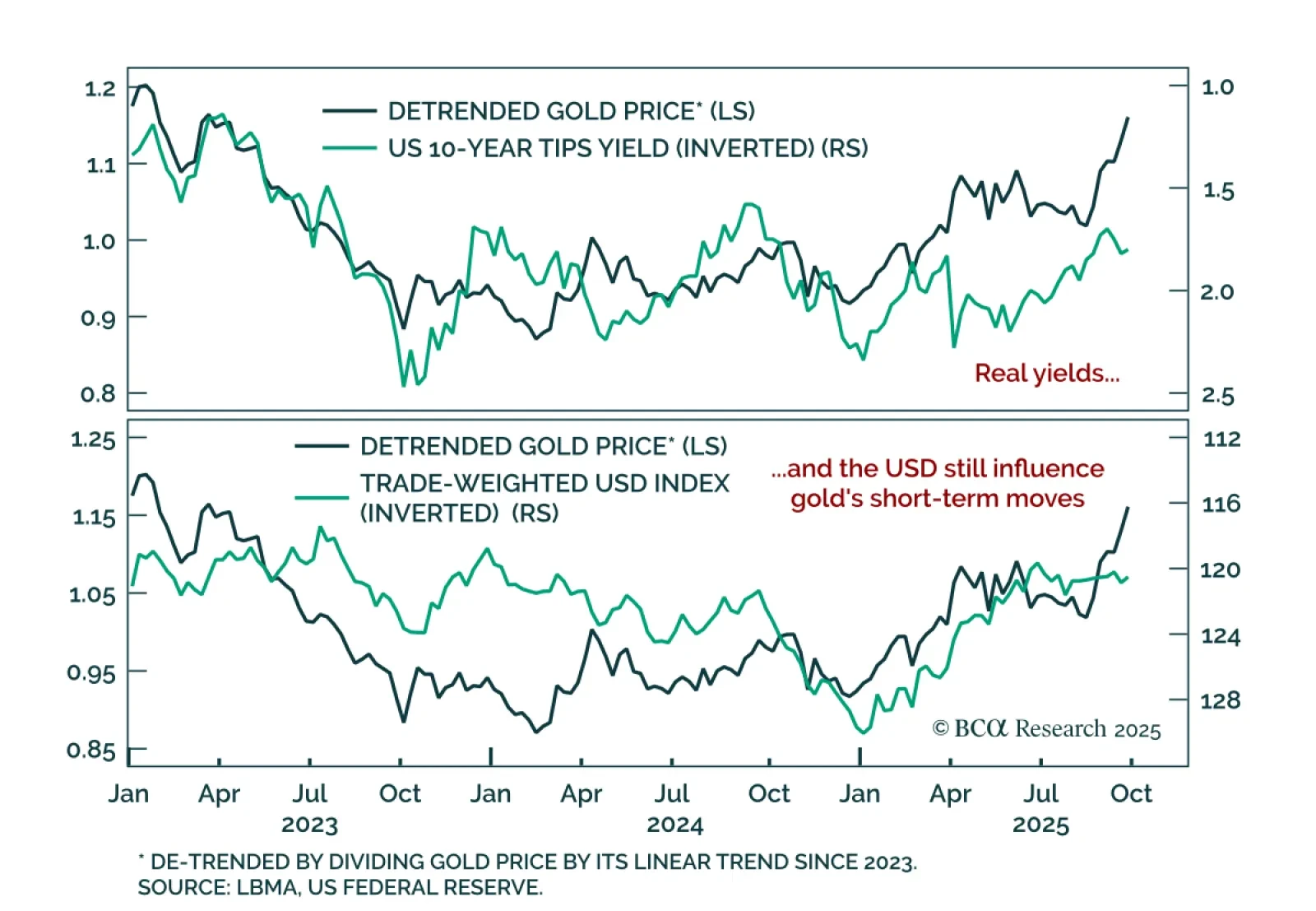

The Fed’s actions tell us that it has chosen to avoid a recession at the cost of moving its inflation goalposts to 3 percent. Thus begins the slippery slope to price instability. Long-term investors should underweight the dollar, own some gold, but better than gold is bitcoin. Plus, a new tactical trade is short GOOGL vs. SPY.

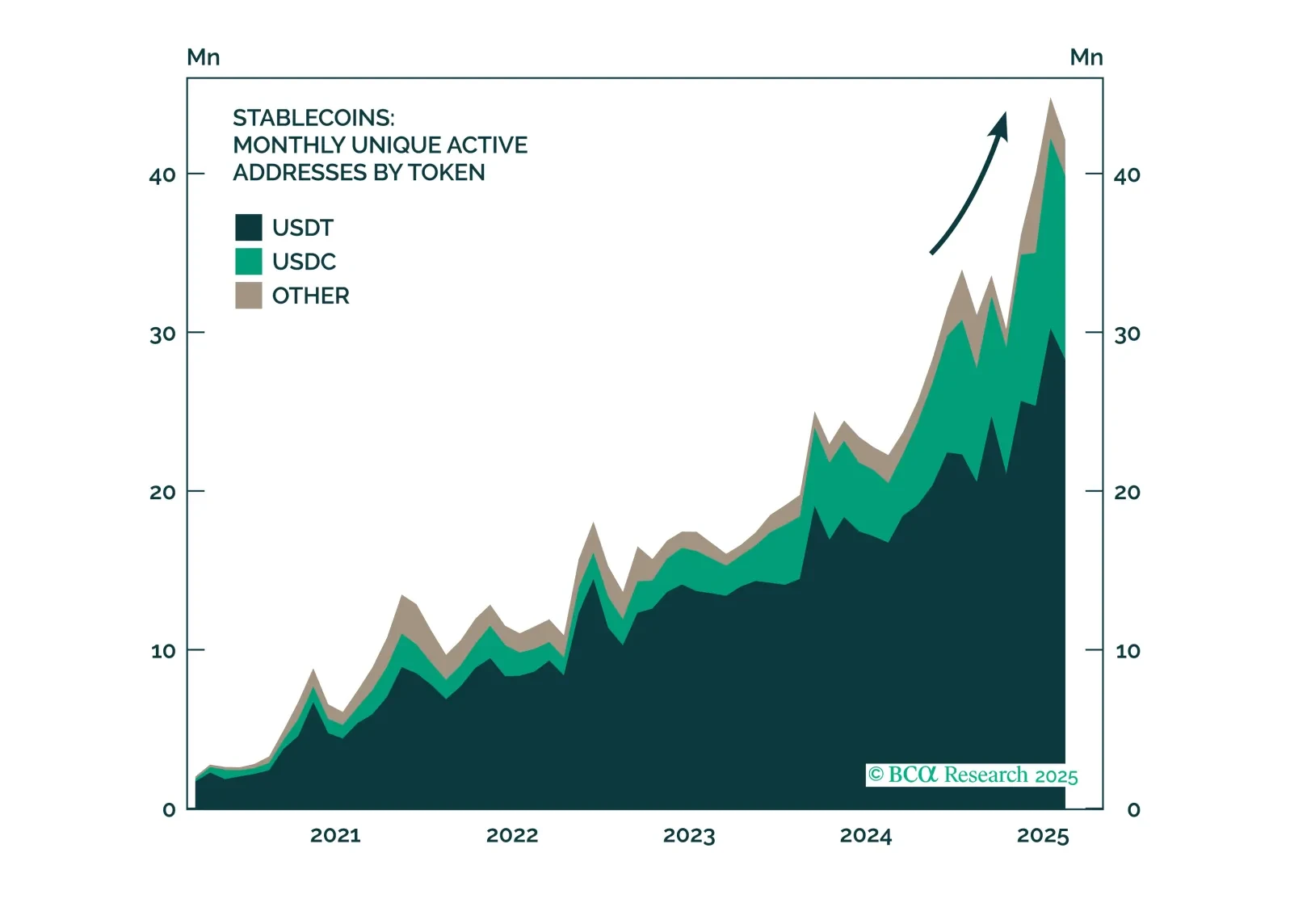

From Treasurys to tokenization, stablecoins are quietly becoming one of the most disruptive forces in global finance, with the power to compress yields, deepen dollar penetration, and shift the balance within crypto markets. Explore BCA’s latest insights on their growing impact.