Despite the steep drop in oil prices, Turkish stocks have failed to outperform the EM equity benchmark (Chart II-1). When a market fails to outperform amid a historically bullish backdrop, it is often a sign of trouble ahead. The basis…

Highlights An analysis on Turkey is available on page 10. In the short term, EM share prices will likely continue searching for a direction as visibility is extremely low. Beyond the near term, an appropriate strategy for EM equity…

Highlights The U.S. and China are moving toward formalizing a trade ceasefire that reduces geopolitical risk in the near term. The risk of a no-deal Brexit is finished – removing a major downside to European assets. Spanish…

Highlights There is a tentative decline in geopolitical risk: An orderly Brexit or no Brexit is the likely final outcome and the U.S.-China talks are coming together. The outstanding geopolitical risks still warrant caution on global…

Turkish financial markets have rebounded to their respective falling trend lines (Chart II-1). Are they set to break out or is a setback looming? Chart II-1Back To Falling Trend Chart II-2TRY Is Cheap Pros The…

Analysis on Turkey is available below. Highlights A dovish Fed or robust U.S. growth does not constitute sufficient conditions for a bull market in EM. China’s business and credit cycles are much more important factors for EM…

Highlights President Trump’s support among Republicans and lack of smoking gun evidence will prevent his removal from office. Trade risk will increase if Trump’s approval benefits from impeachment proceedings and the U.S.…

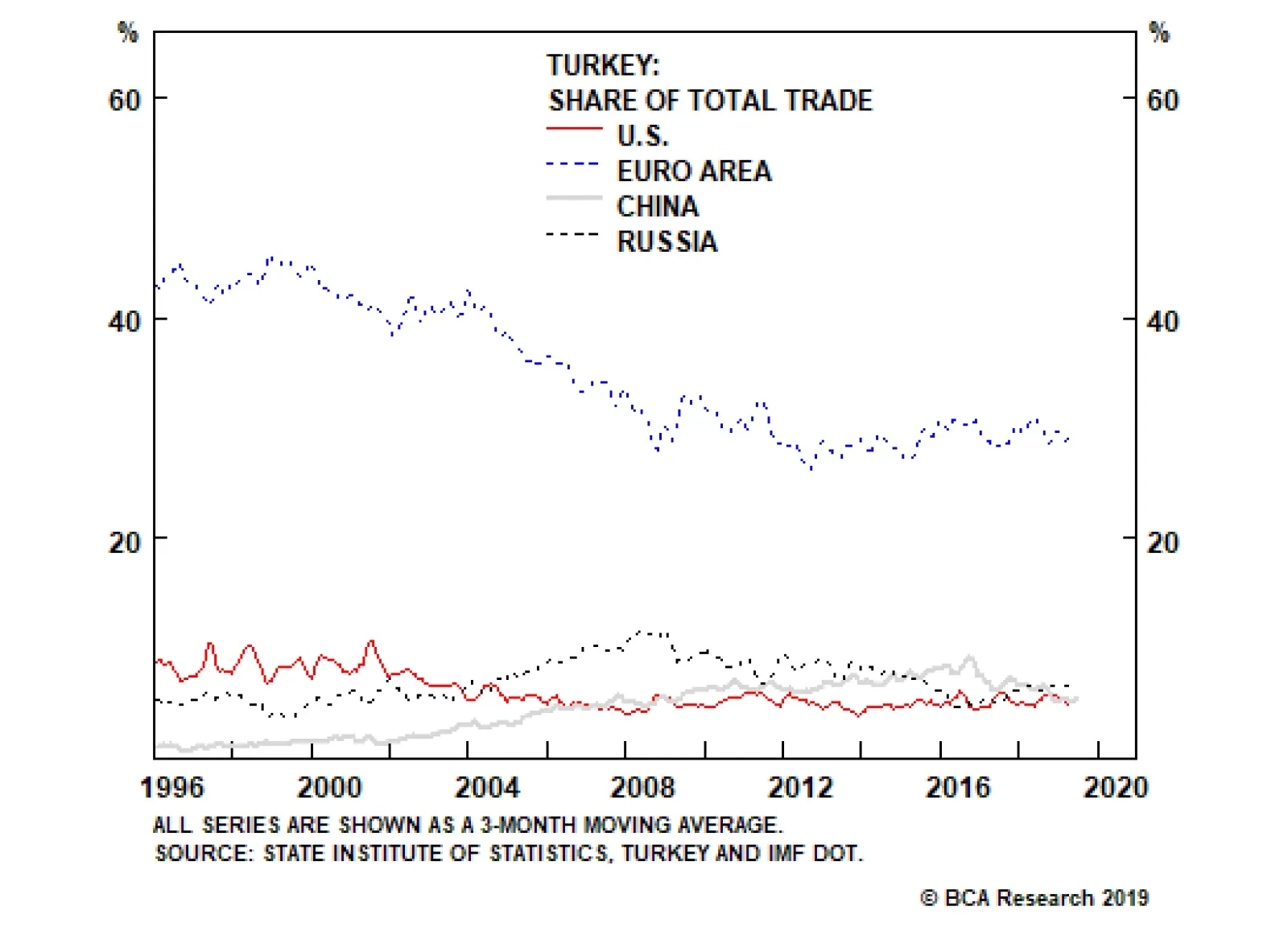

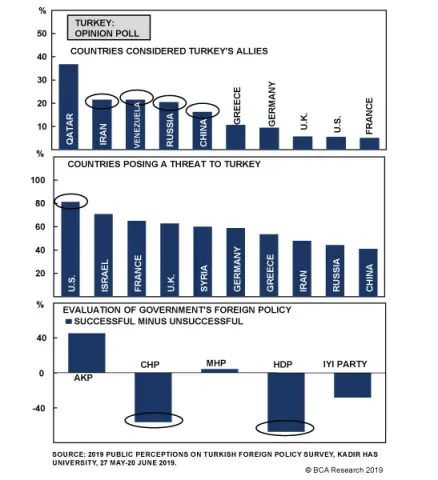

Various forces are creating a tug-of-war on the U.S.-Turkey relationship. First, the U.S. Congress is ready to impose sanctions over the S400s and Trump is under pressure to punish Turkey for undermining NATO and dealing with the…

For several years Erdogan has attempted to distract the populace from the country’s economic slide by adopting an aggressive foreign policy, particularly toward the West. The immediate cause is Syria, where Turkey has…