Turkey is facing another currency turmoil. At the core of significant currency depreciation pressures is an overflow of money. Chart III-1 demonstrates that narrow money (M1) and broad money (M3) are booming at 90% and 50%, respectively,…

China: The Recovery And Equity Dichotomy China’s economic recovery has been gathering steam, and policymakers have become reasonably confident about the growth outlook. In fact, transaction activity in the property market has…

Highlights In the short run, extreme policy uncertainty is problematic for risk assets. In the long run, gargantuan fiscal and monetary stimulus continues to support cyclical trades. Equity volatility always increases in the…

BCA Research's Emerging Markets Strategy service recommends that investors short the Turkish lira versus the US dollar and equity investors underweight Turkish equities and credit relative to their respective benchmarks.…

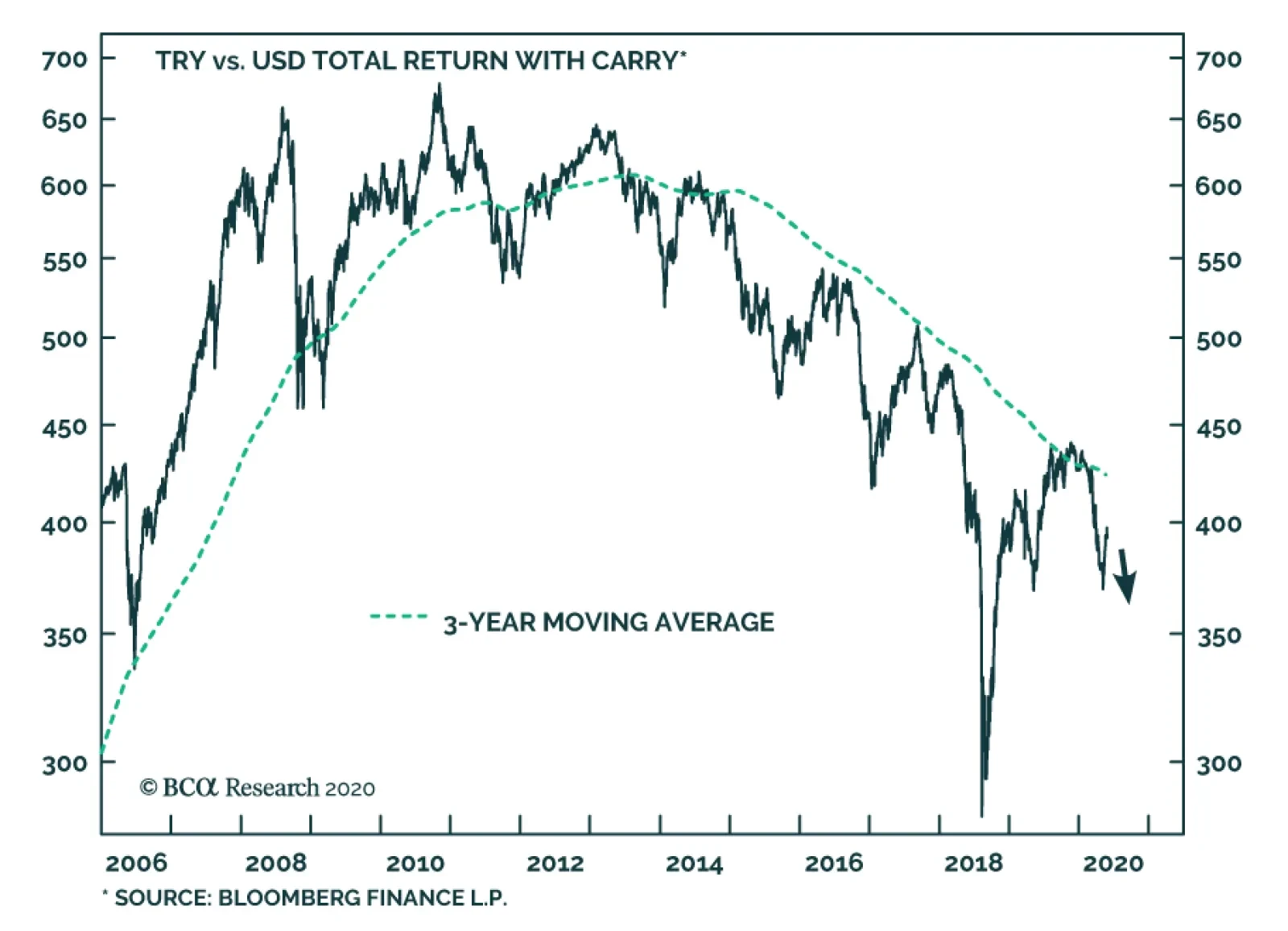

The Turkish lira has rolled over at its resistance level on a total return (including carry) basis (Chart II-1). The spot rate versus the US dollar is at its 2018 low. In short, the exchange rate is facing a litmus test. The culprit of a…

An analysis on Turkey is available below. Highlights Due to the sizable stimulus announced by the NPC, we are upgrading our outlook for Chinese growth for this year. Nevertheless, in terms of investment strategy, we are…

Highlights The pandemic has a negative impact on households and has not peaked in the US. But a depression is likely to be averted. Our market-based geopolitical risk indicators point toward a period of rising political turbulence…