Erdogan will most likely lose the Turkish election but it could go onto a second round. A strong opposition majority in the assembly would justify a tactical overweight in Turkish equities on a relative basis. For now, go long…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

Investors should bet against the global rally in risk assets and maintain a defensive positioning until recession risks verifiably abate.

Executive Summary Our negative view on the summer rally is coming to fruition, with equities falling back on the negative geopolitical, macro, and monetary environment. China is easing policy ahead of its full return to autocratic…

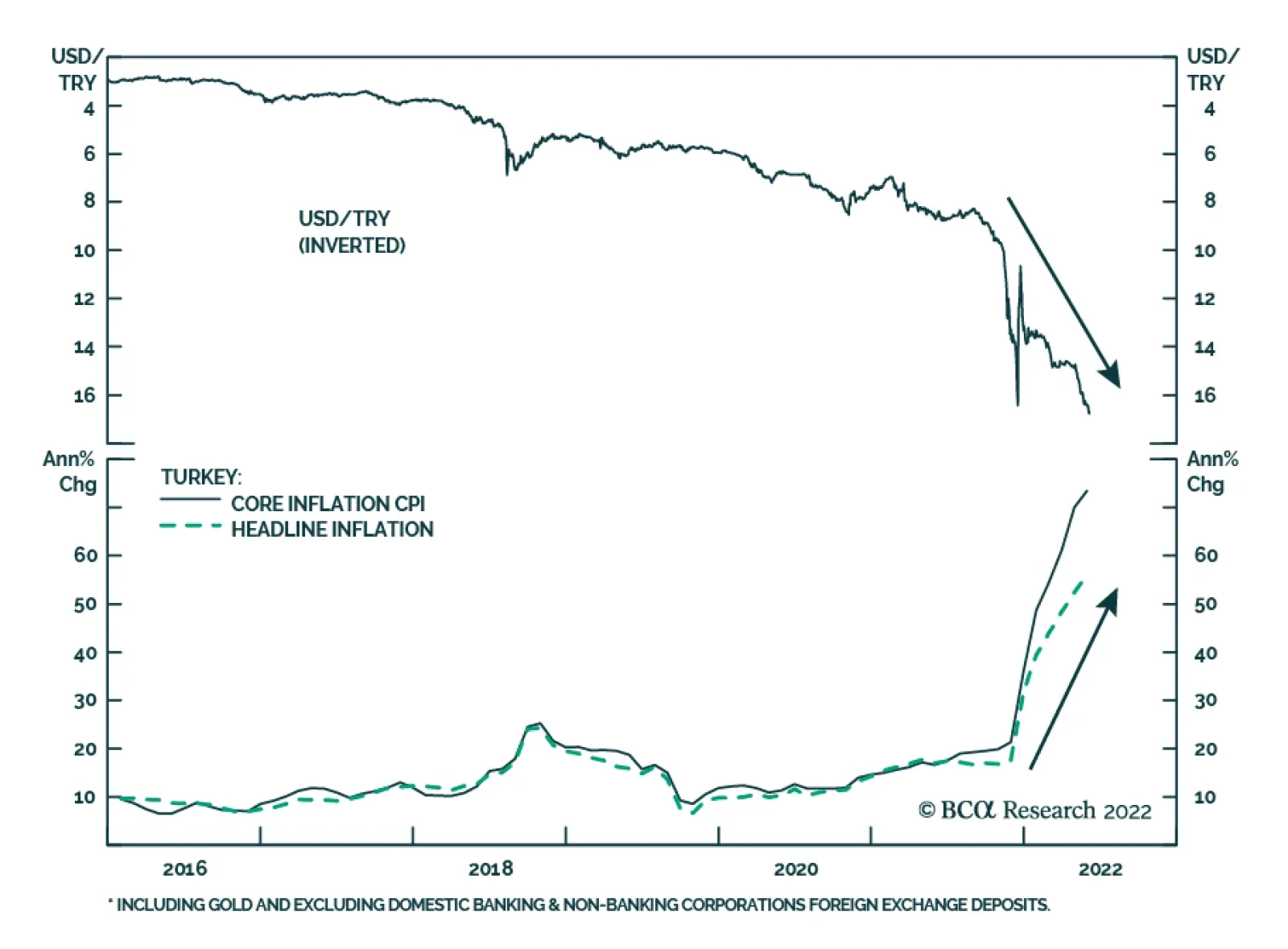

After a brief period of stability earlier this year, the Turkish lira has resumed its downtrend. The culprit behind this weakness is dovish monetary policy amid extreme inflationary pressures. Headline CPI inflation accelerated…

Executive Summary Macron Still Favored, But Le Pen Cannot Be Ruled Out Macron is still favored to win the French election but Le Pen’s odds are 45%. Le Pen would halt France’s neoliberal structural reforms,…