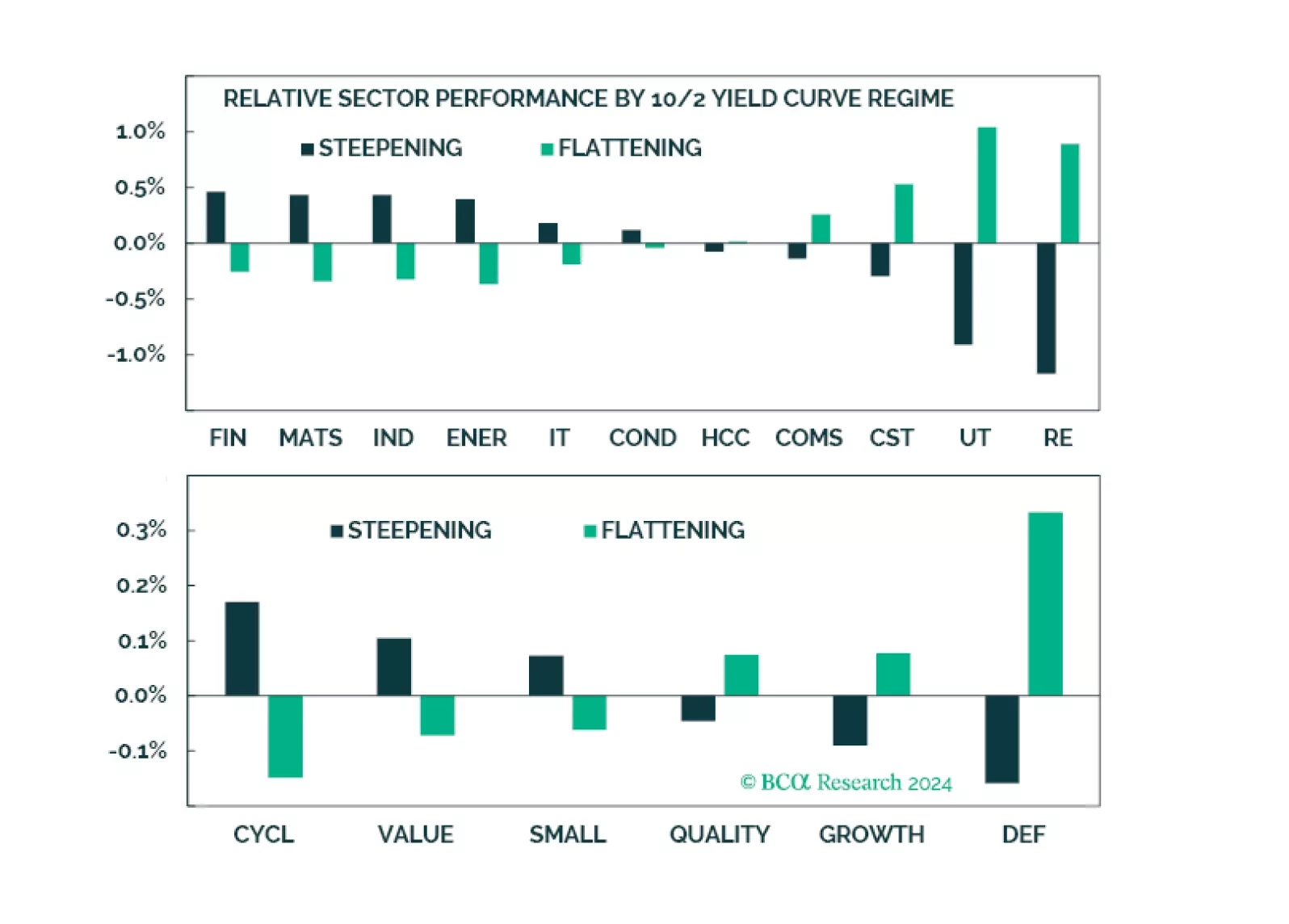

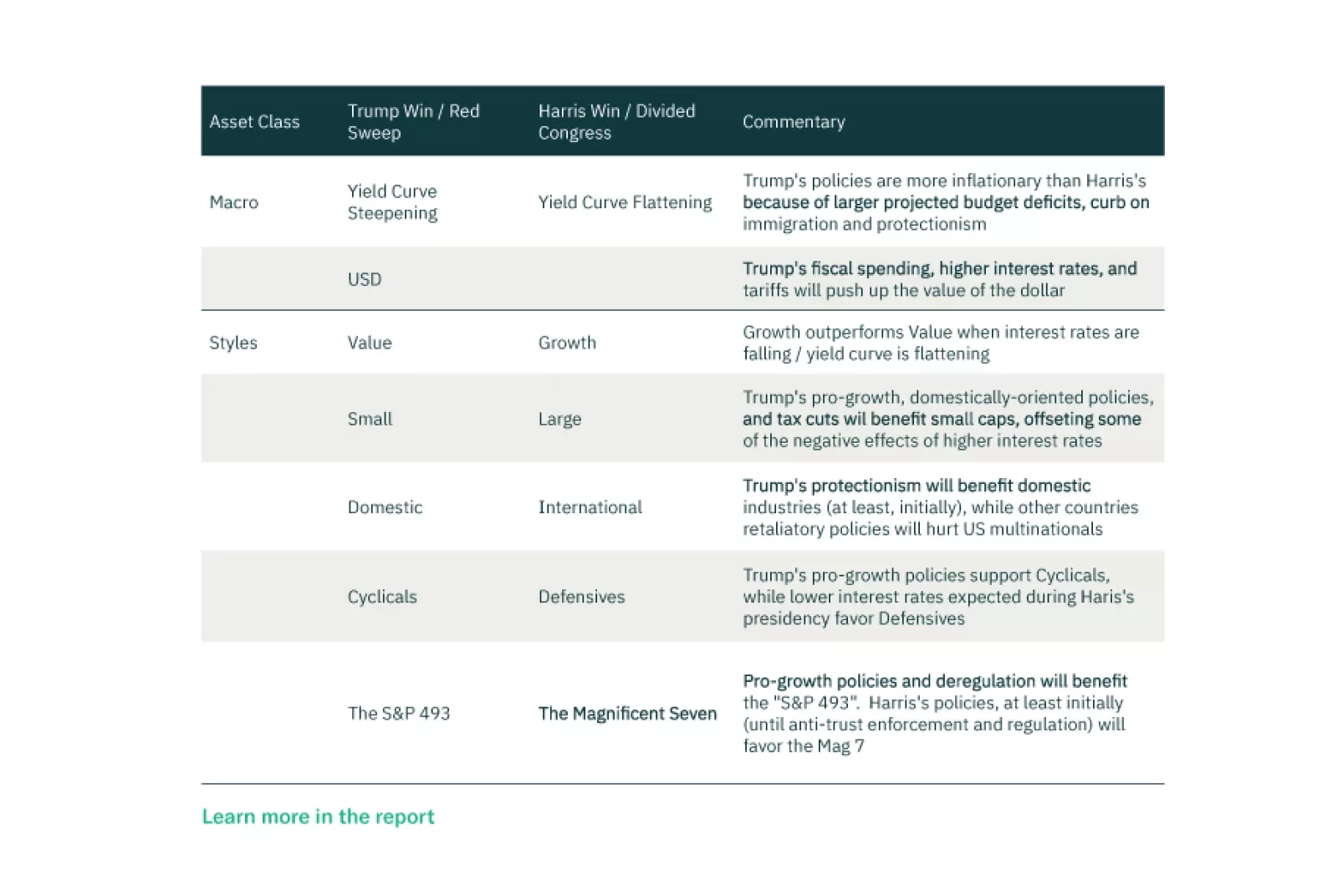

The market is celebrating the prospect of deregulation, lower taxes, and Fed rate cuts, for now ignoring the dangers of wider budget deficits, inflationary pressures, and trade wars. The rally can continue into the year-end and…

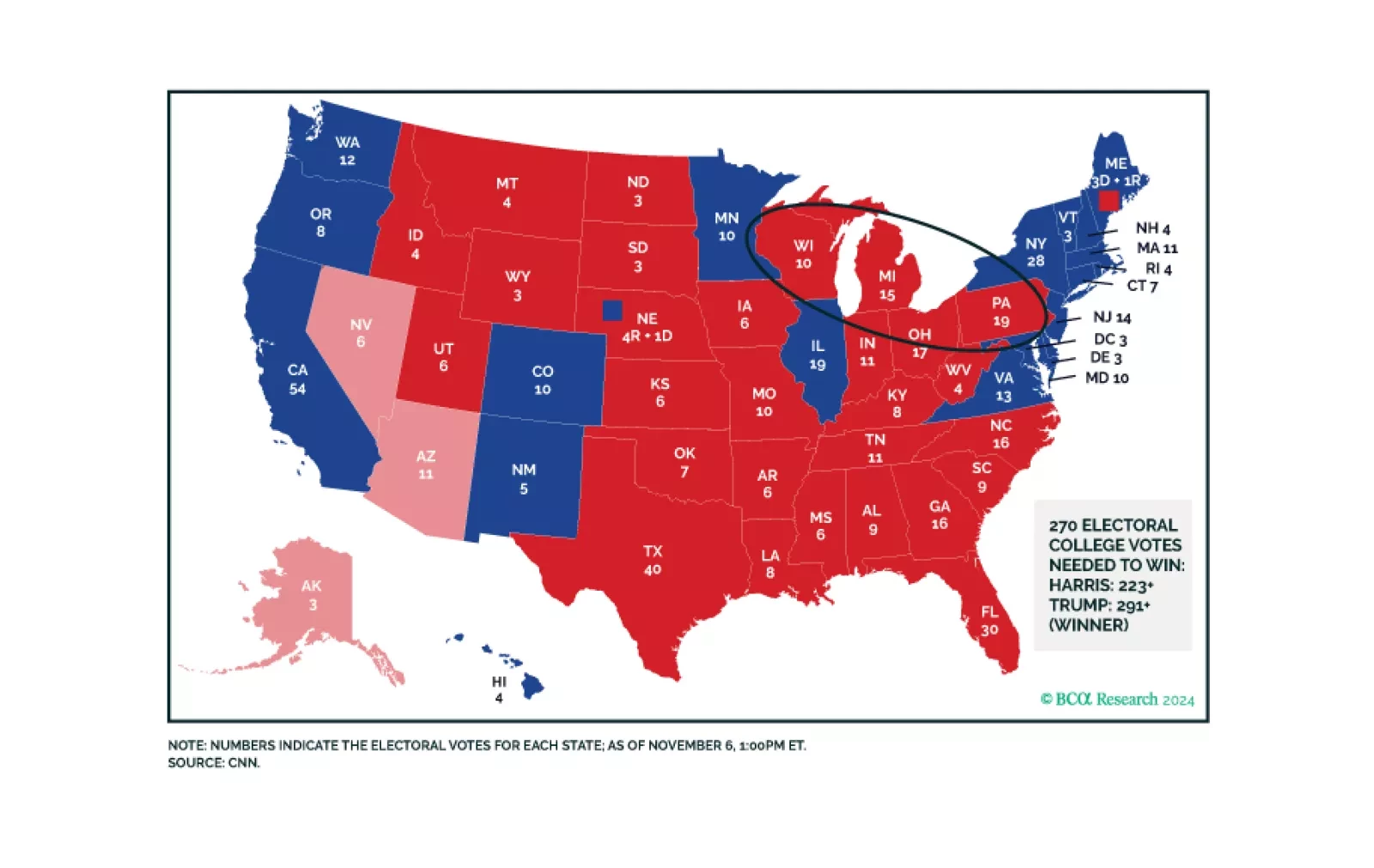

The most likely outcomes for the US elections are a “Red Sweep” and a “Blue Gridlock.” The following is a brief discussion of likely policies associated with each election outcome. We also present a post-election US Equities Cheat…