President Trump’s inaugural speech outlined his second term agenda. The theme was that the US will become “far more exceptional” than it already is. Trump pledged to reverse America’s decline, rebalance the justice system, streamline…

President Trump is only the second president to have won, lost, and won again in US history, so today’s inaugural address was unlike any other since Grover Cleveland in 1893.

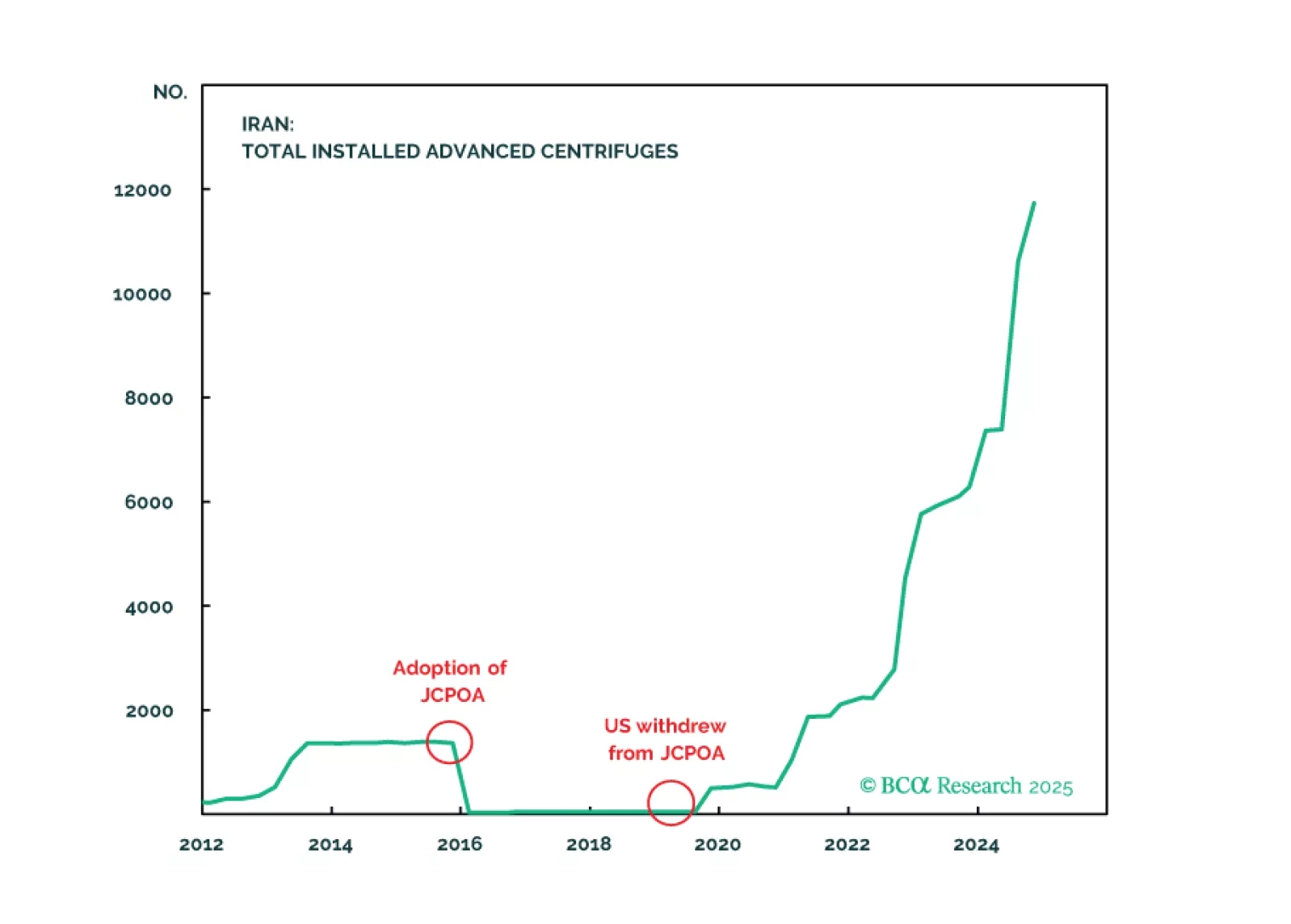

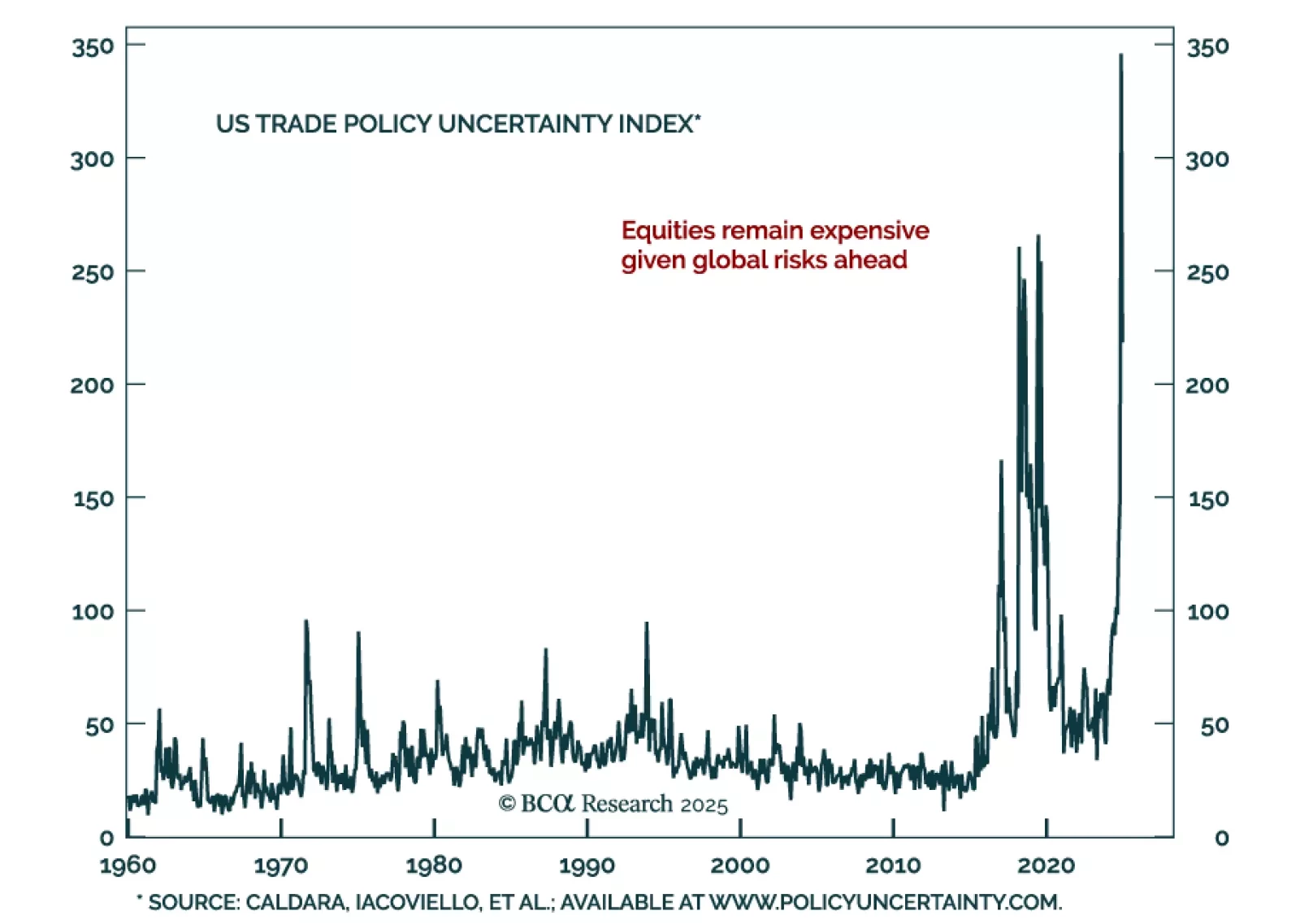

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

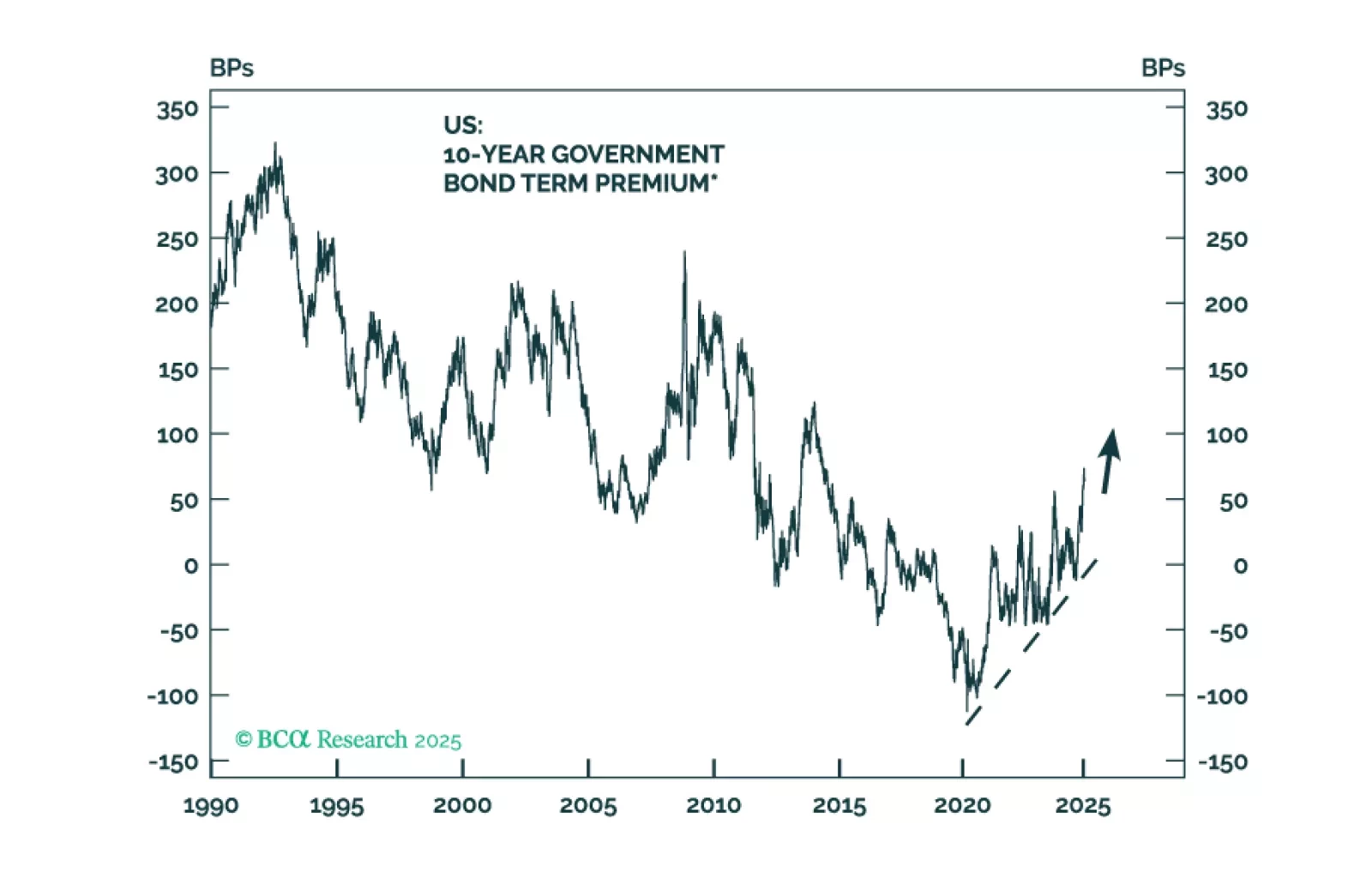

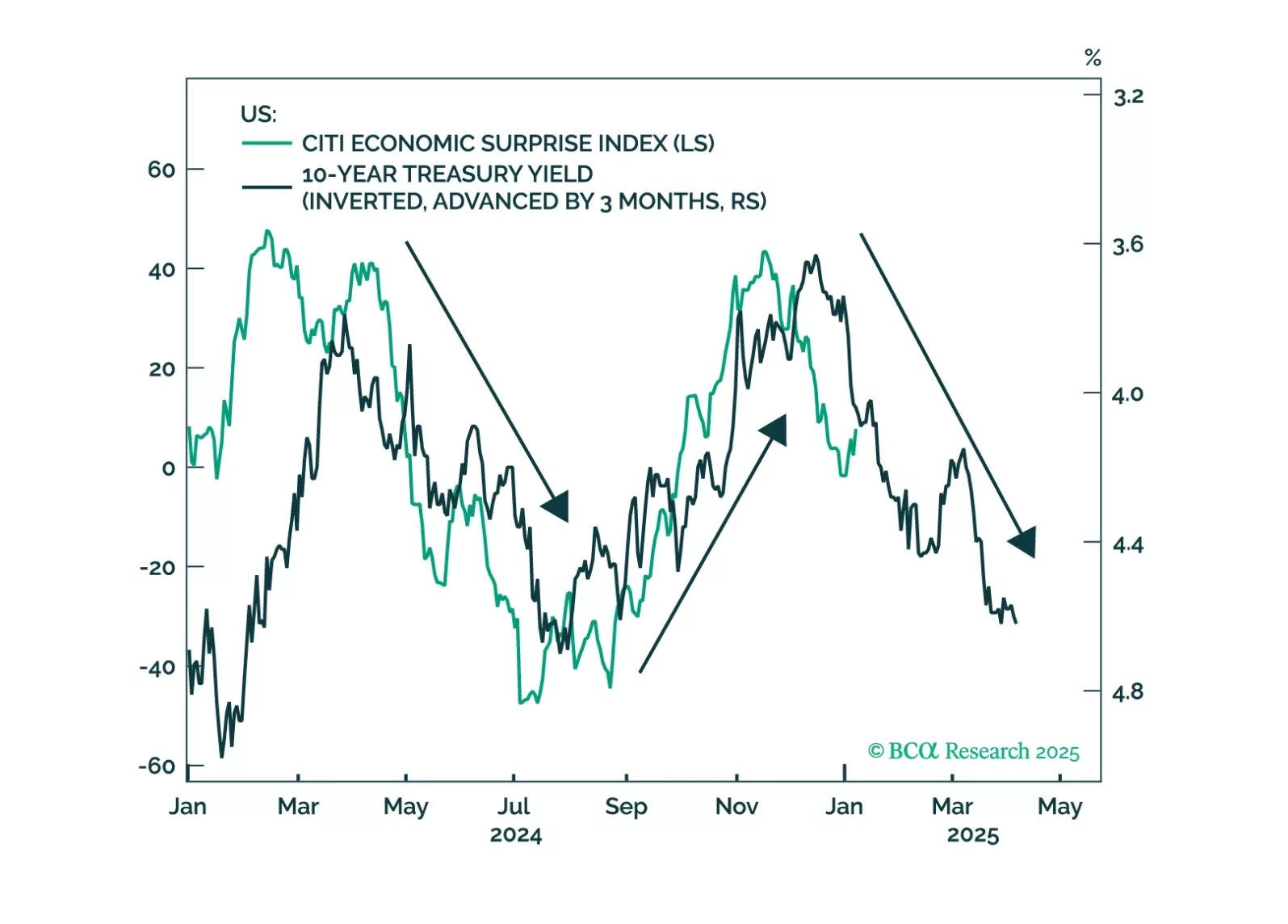

In our Alpha report, we reiterate that we expect President Trump to curb his most enthusiastic plans for tax cuts due to the pressure from the bond market. That will be good for equities in the long run – as it will assuage the…

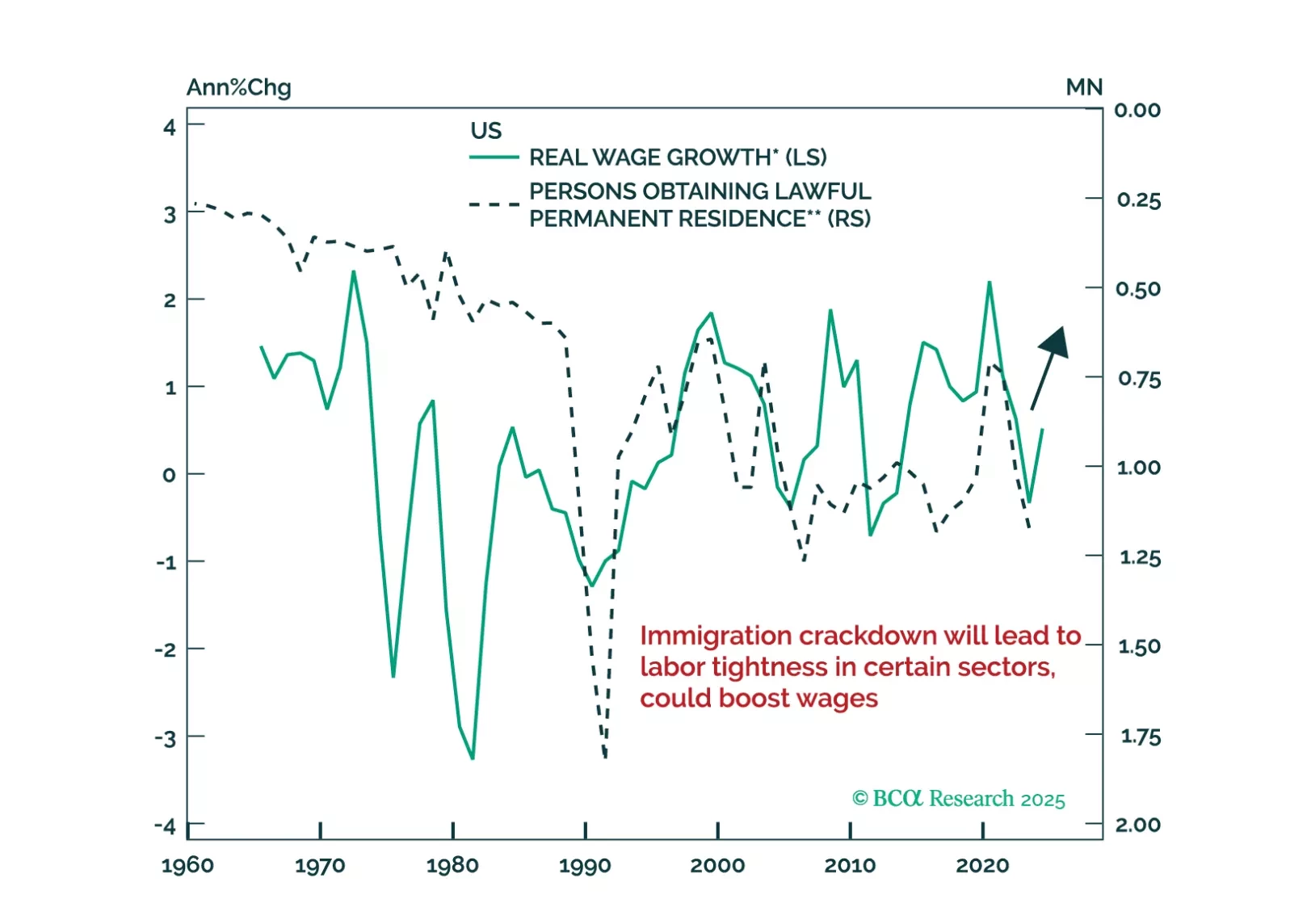

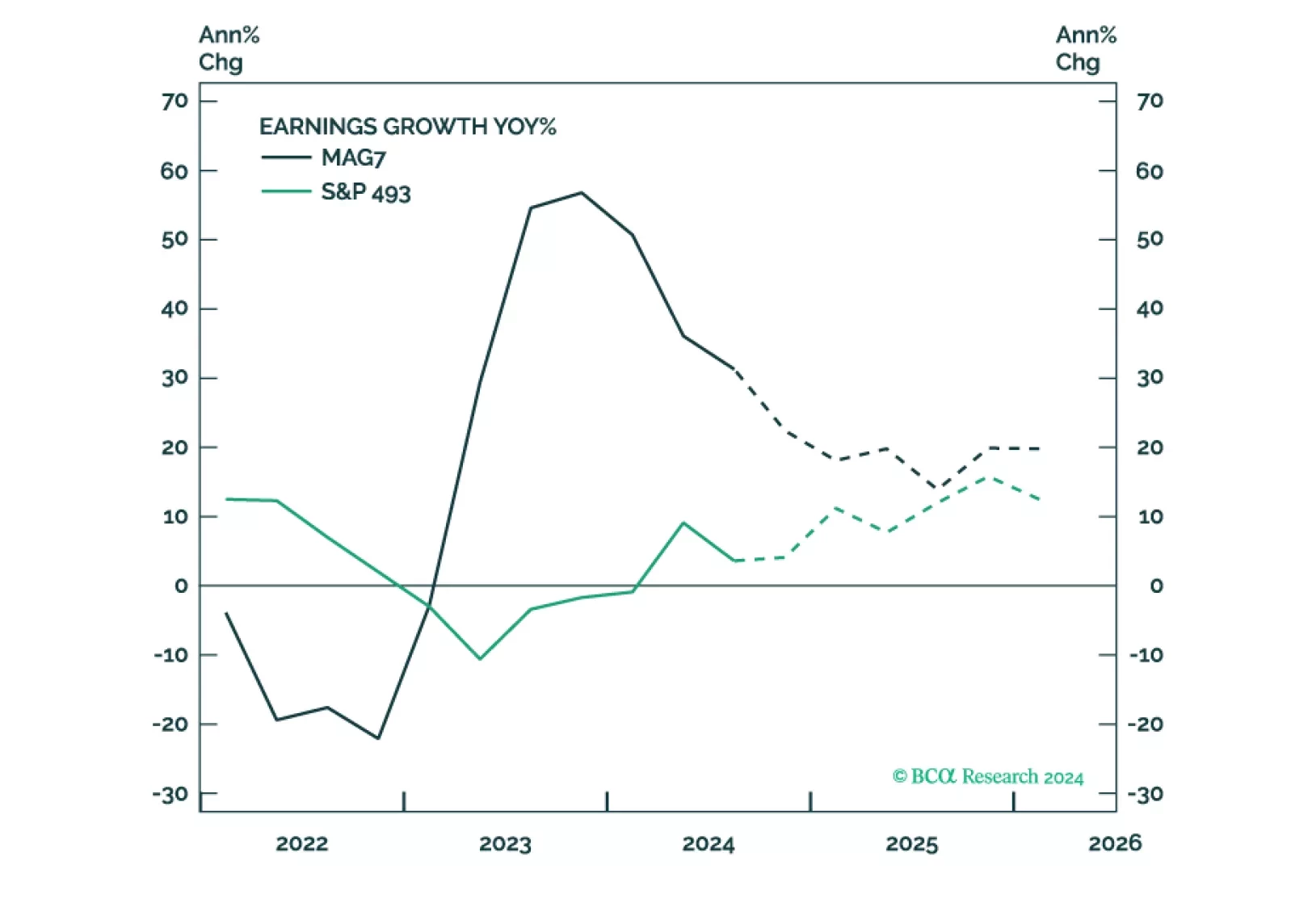

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

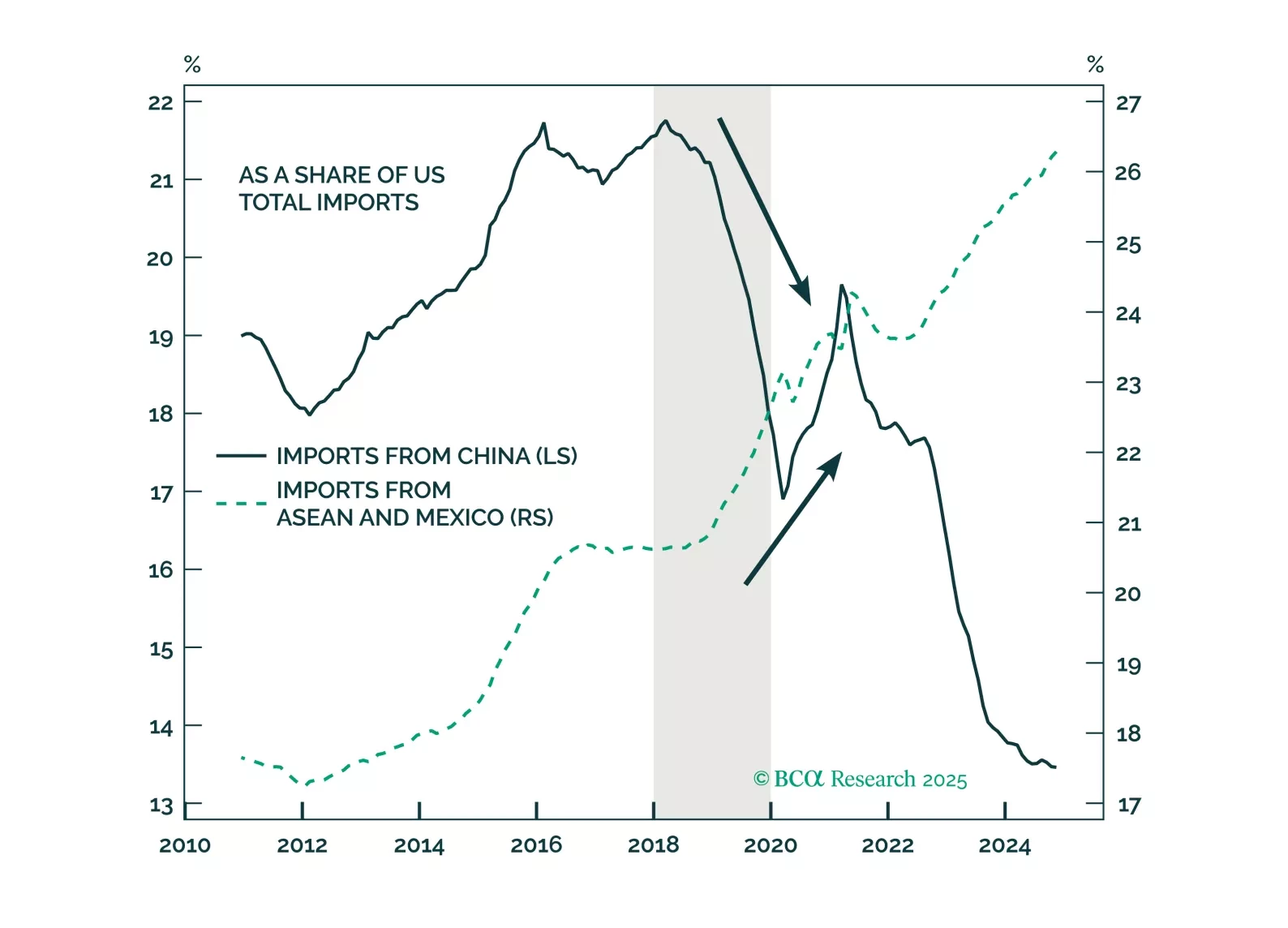

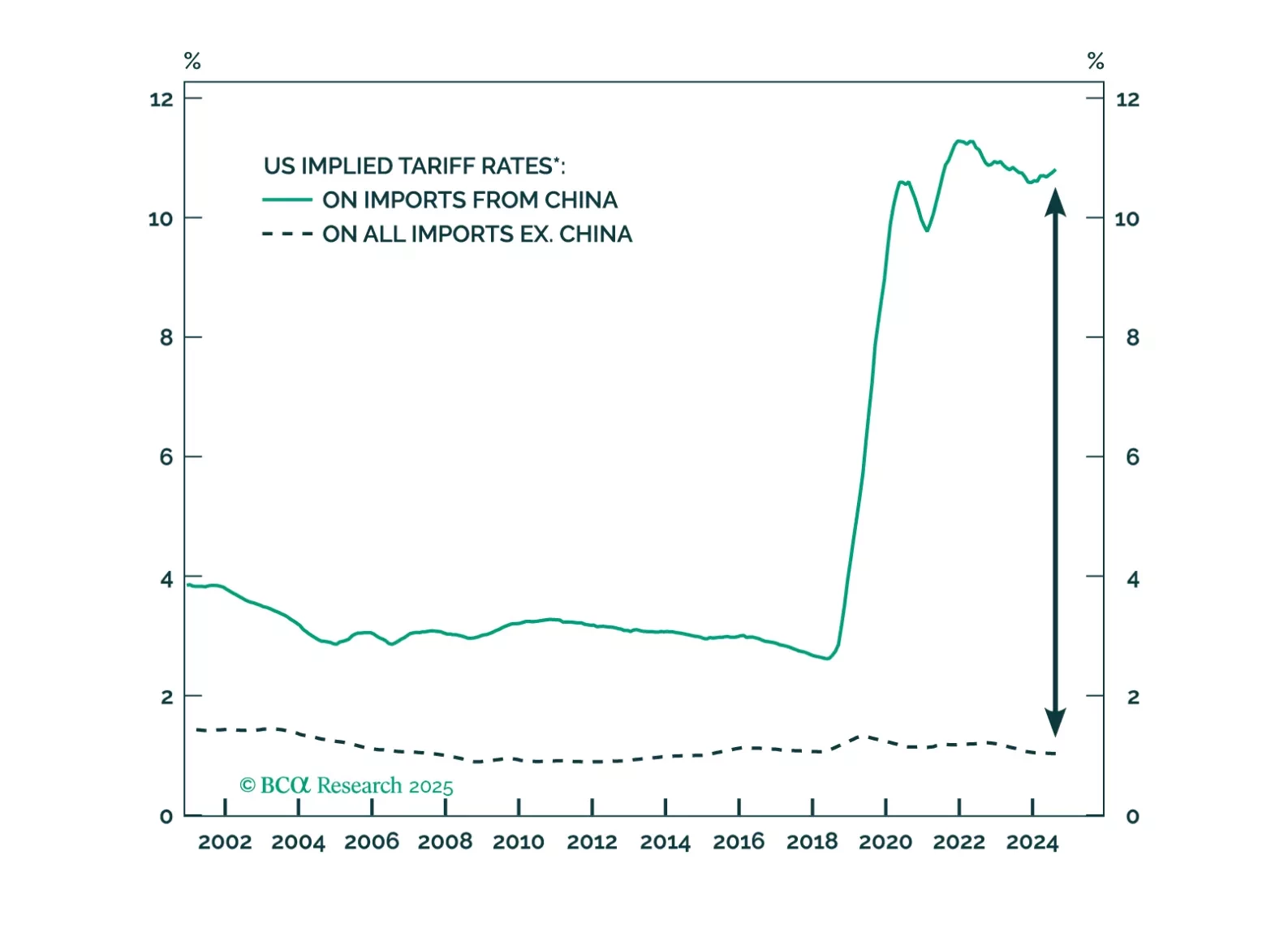

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…