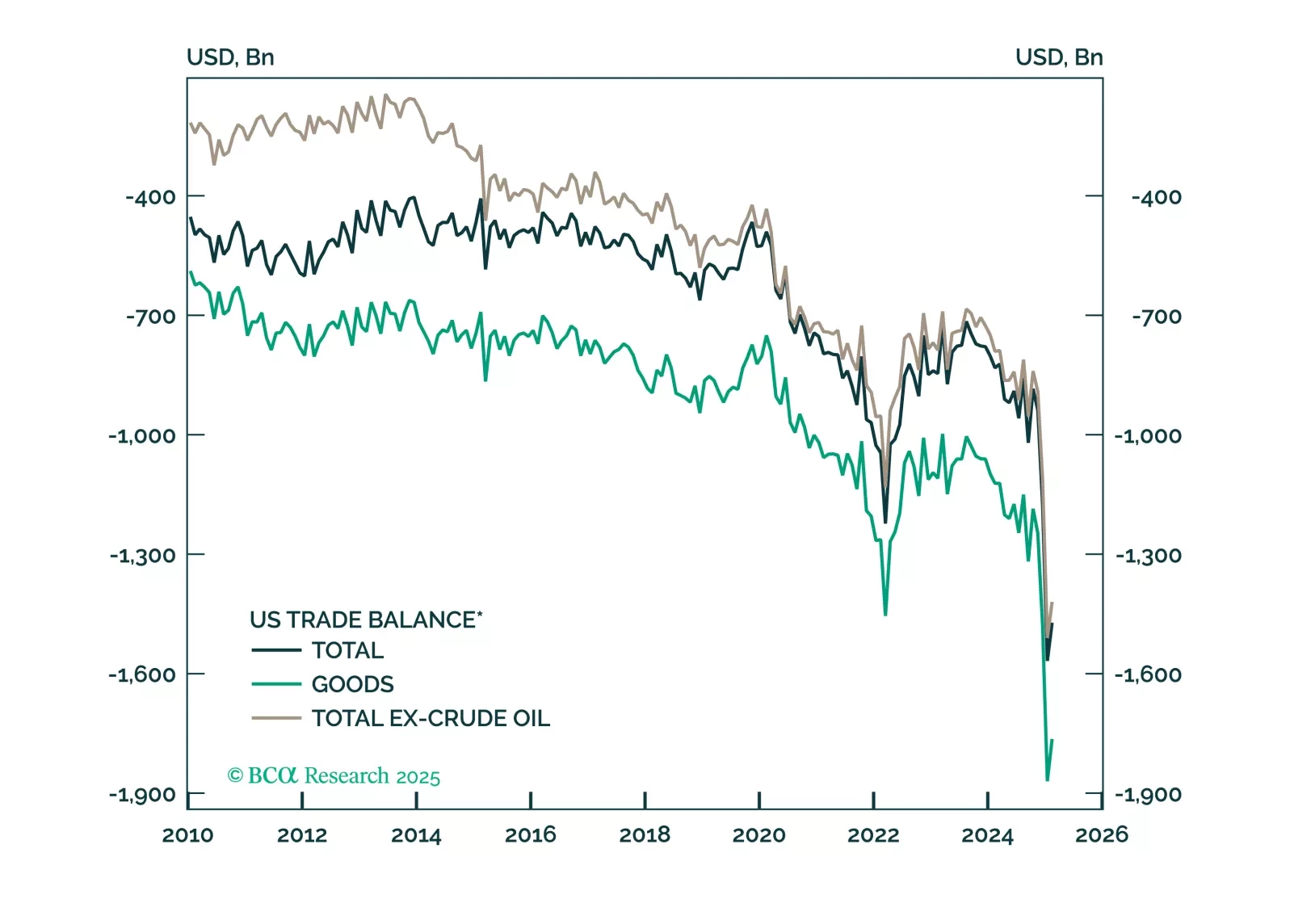

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

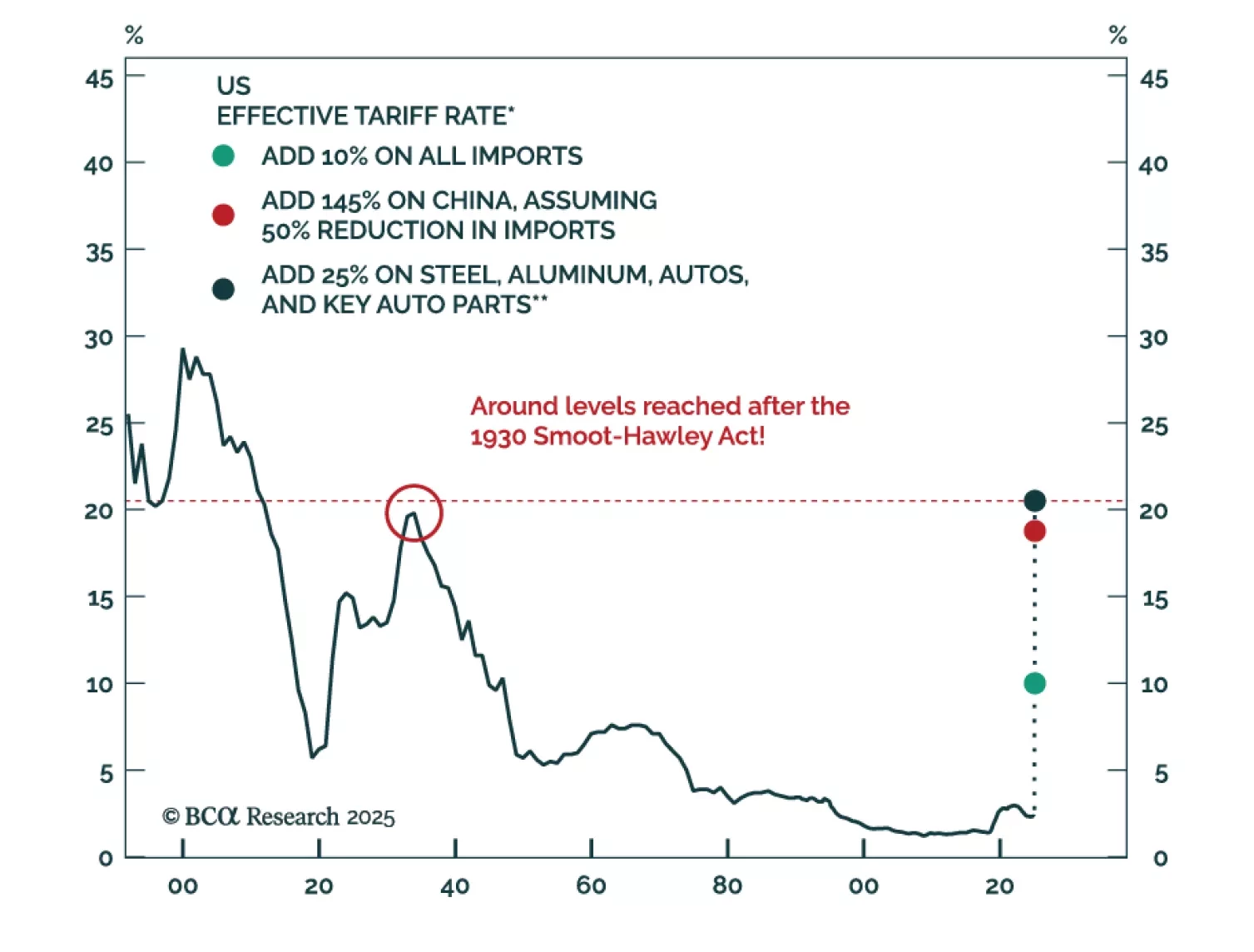

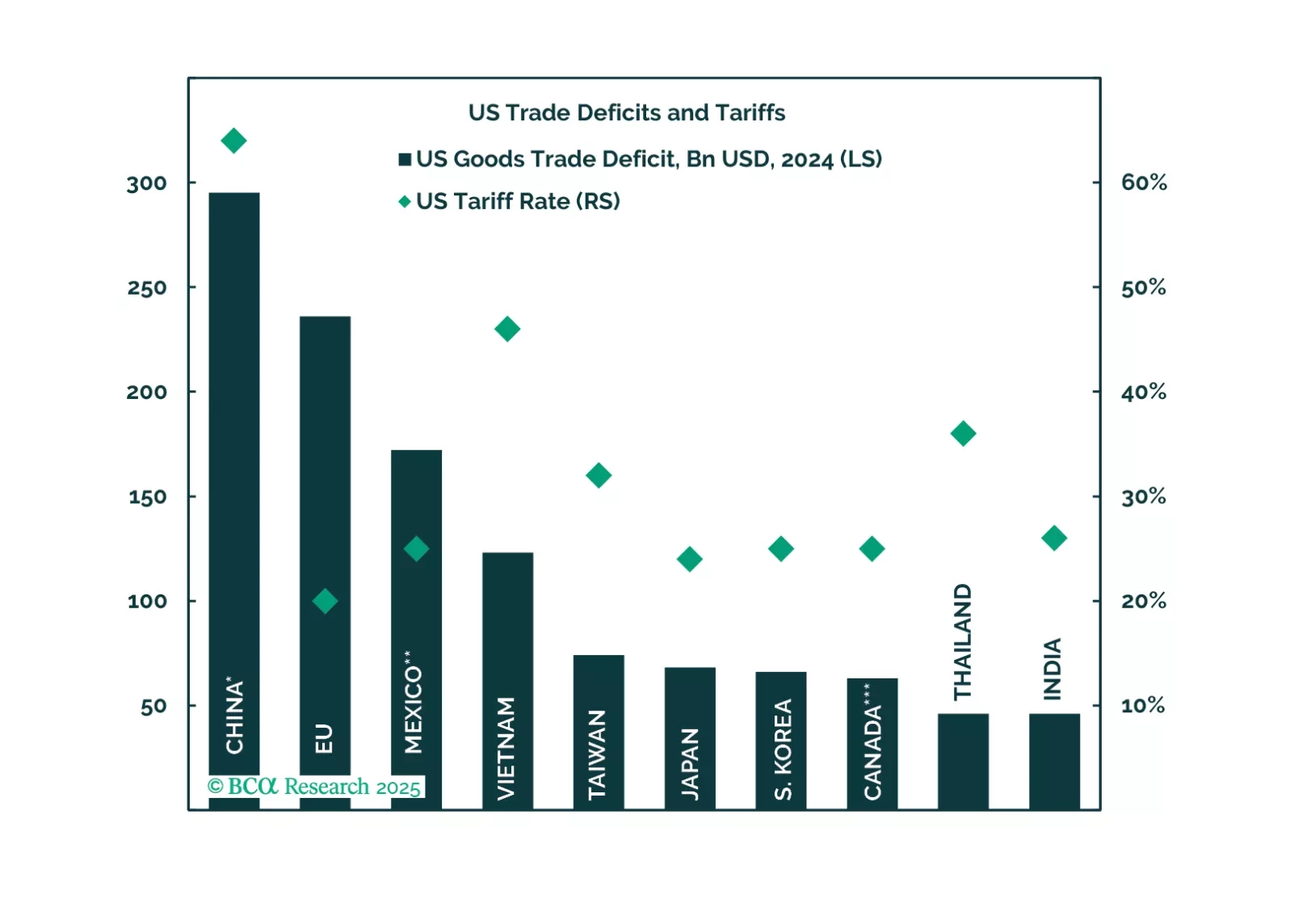

While the market welcomed the pause in Liberation Day tariffs, we believe investors are overly optimistic about the relief from this Trump-driven uncertainty. Even with the pause, current tariff levels remain higher than they were in…

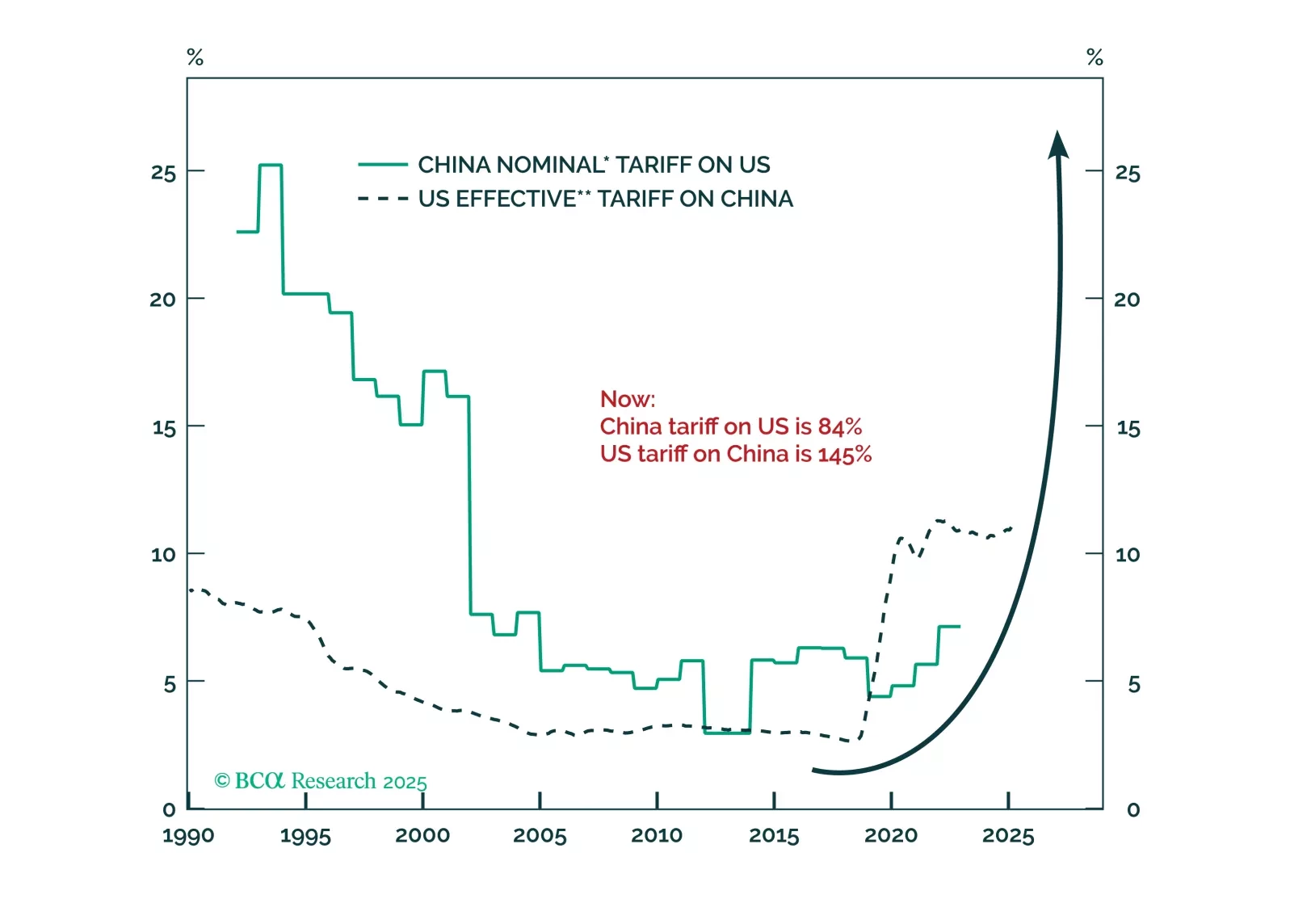

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

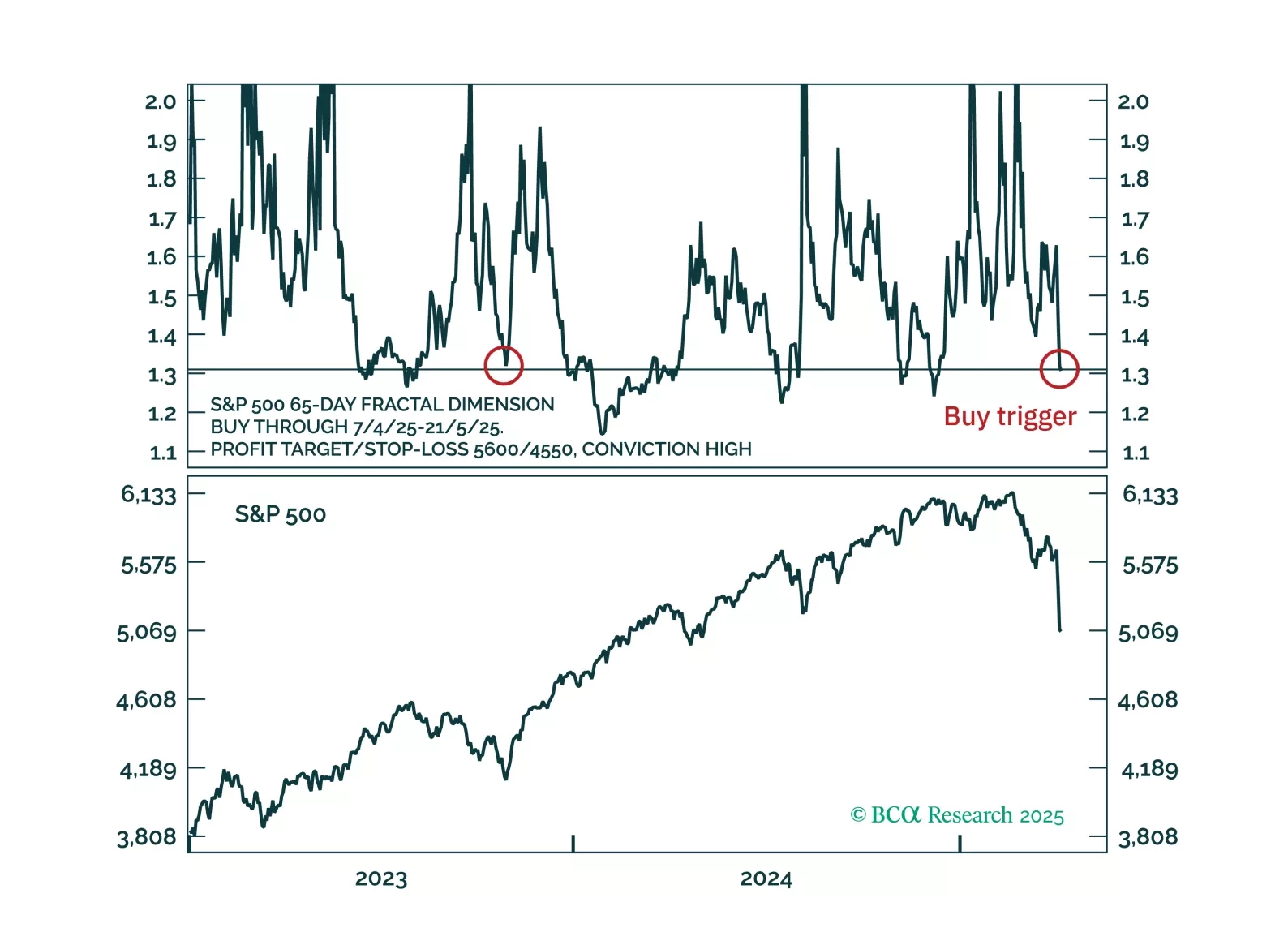

Countertrend buy triggers have been activated for the S&P 500, Nasdaq and Nasdaq versus 30-year T-bond.

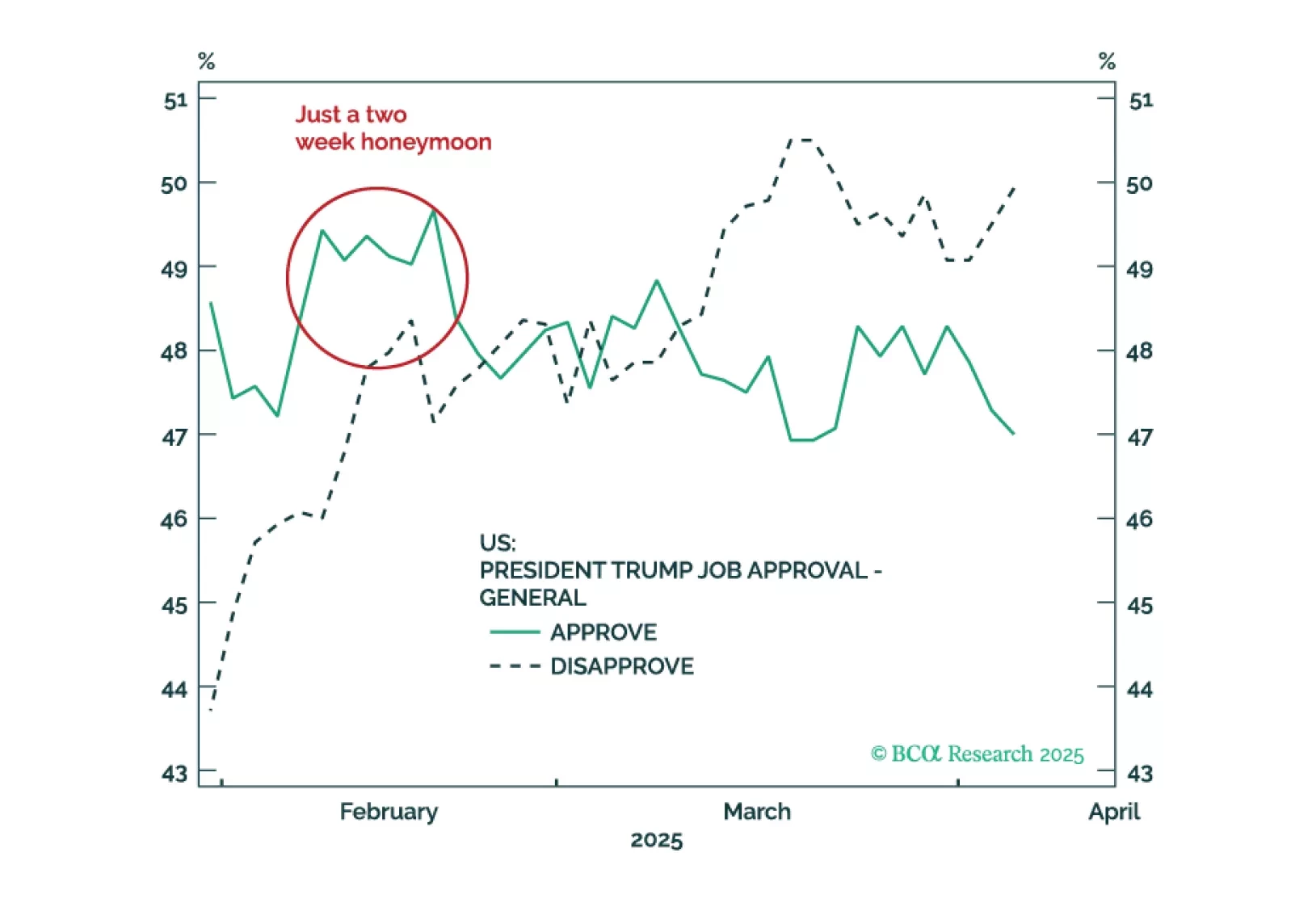

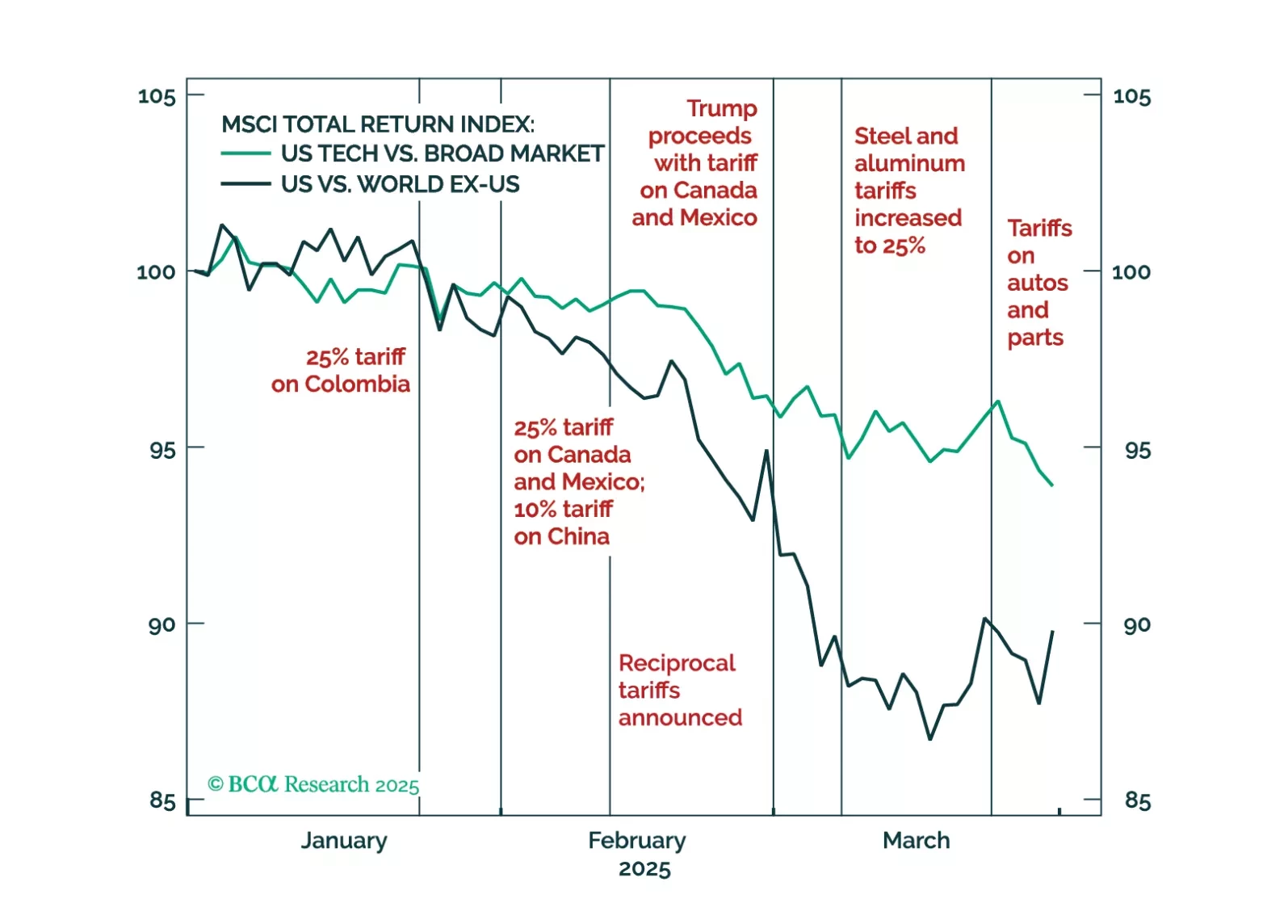

President Trump imposed tariffs on the world in his first 100 days, as we expected. Tariffs may have catalyzed a recession in the US, given the weakness in consumer sentiment and demand. Trump will soon backpedal and grant exemptions…

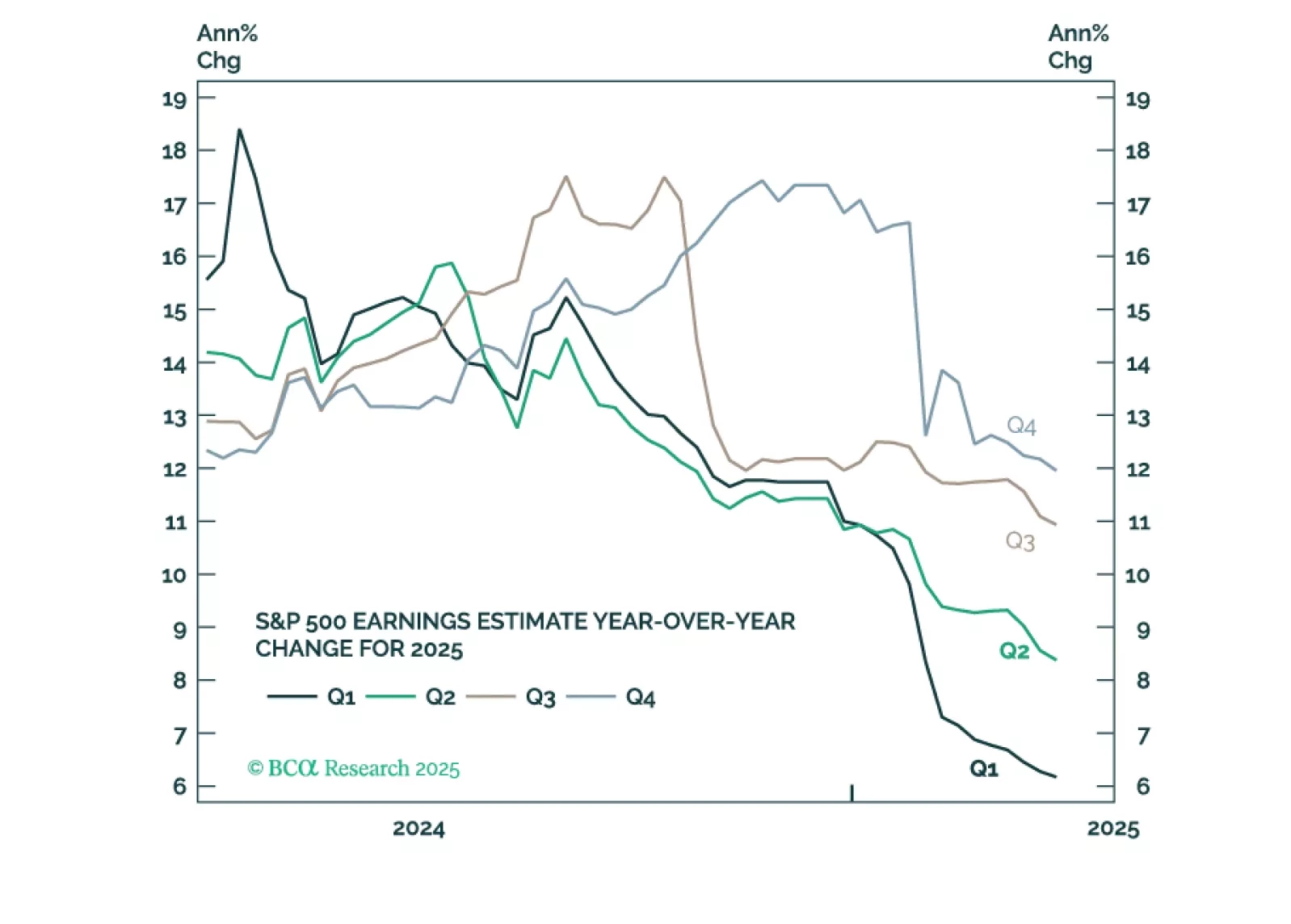

Equities will find a bottom when the full effects of tariffs on earnings and economic growth are priced in. The bottom of the market appears a long way away, and the S&P 500 may end up as low as 4,300, barring any reversals in…

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

The trade war is on everyone’s mind with America’s “Liberation Day” upon us! However, the reality under the surface is that the main macro narrative has been a rotation – nay… exodus – out of US assets into RoW. This was not supposed…