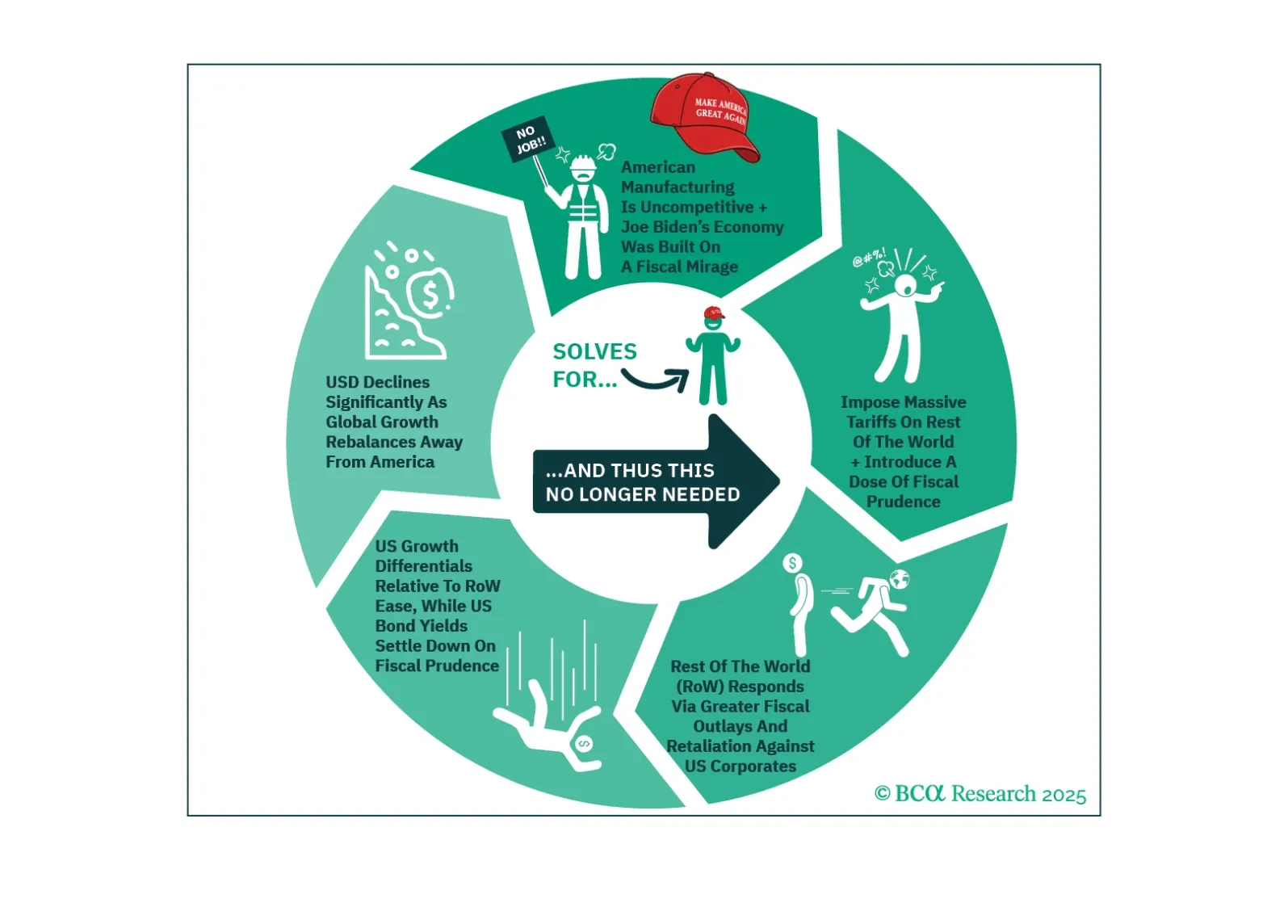

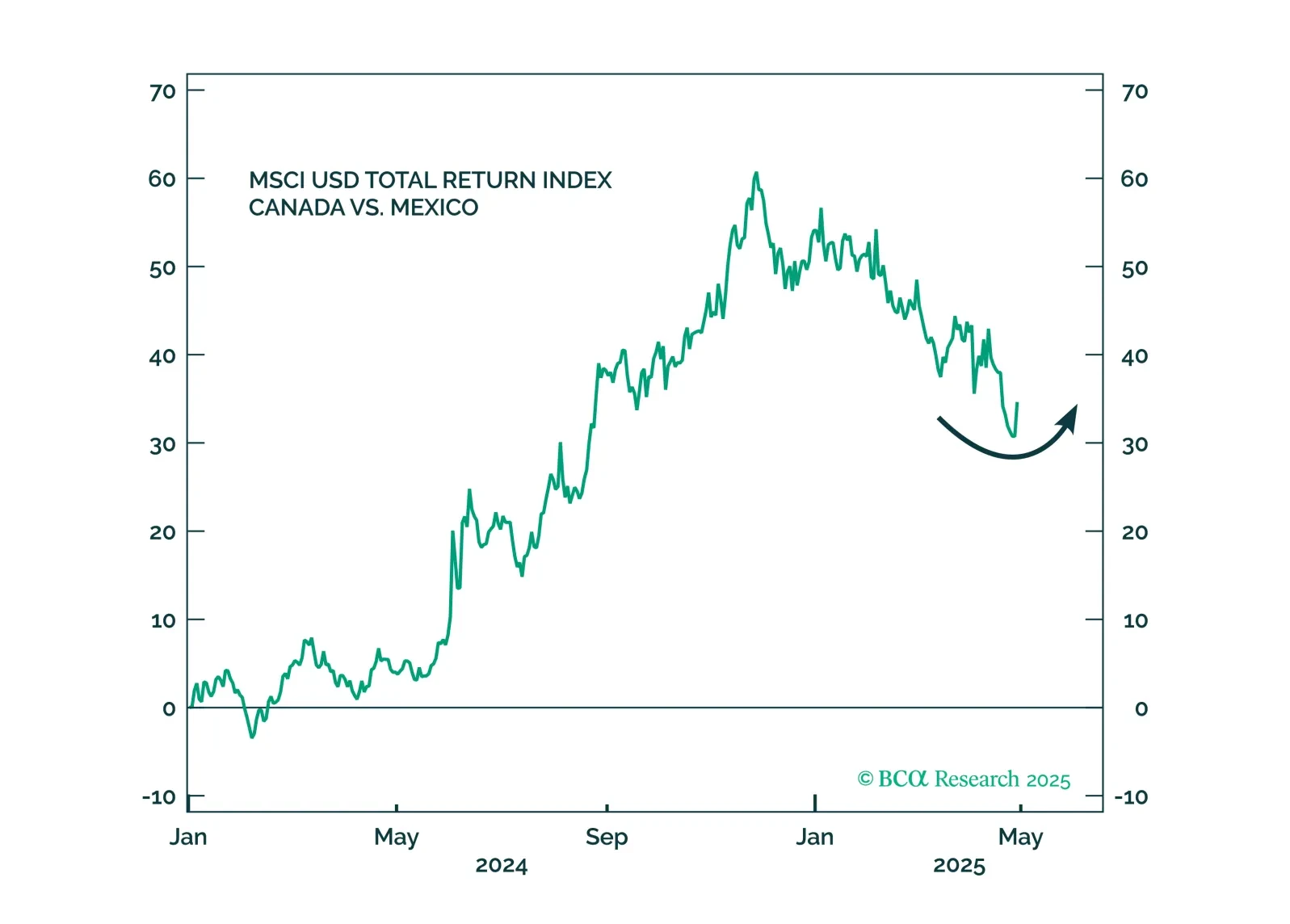

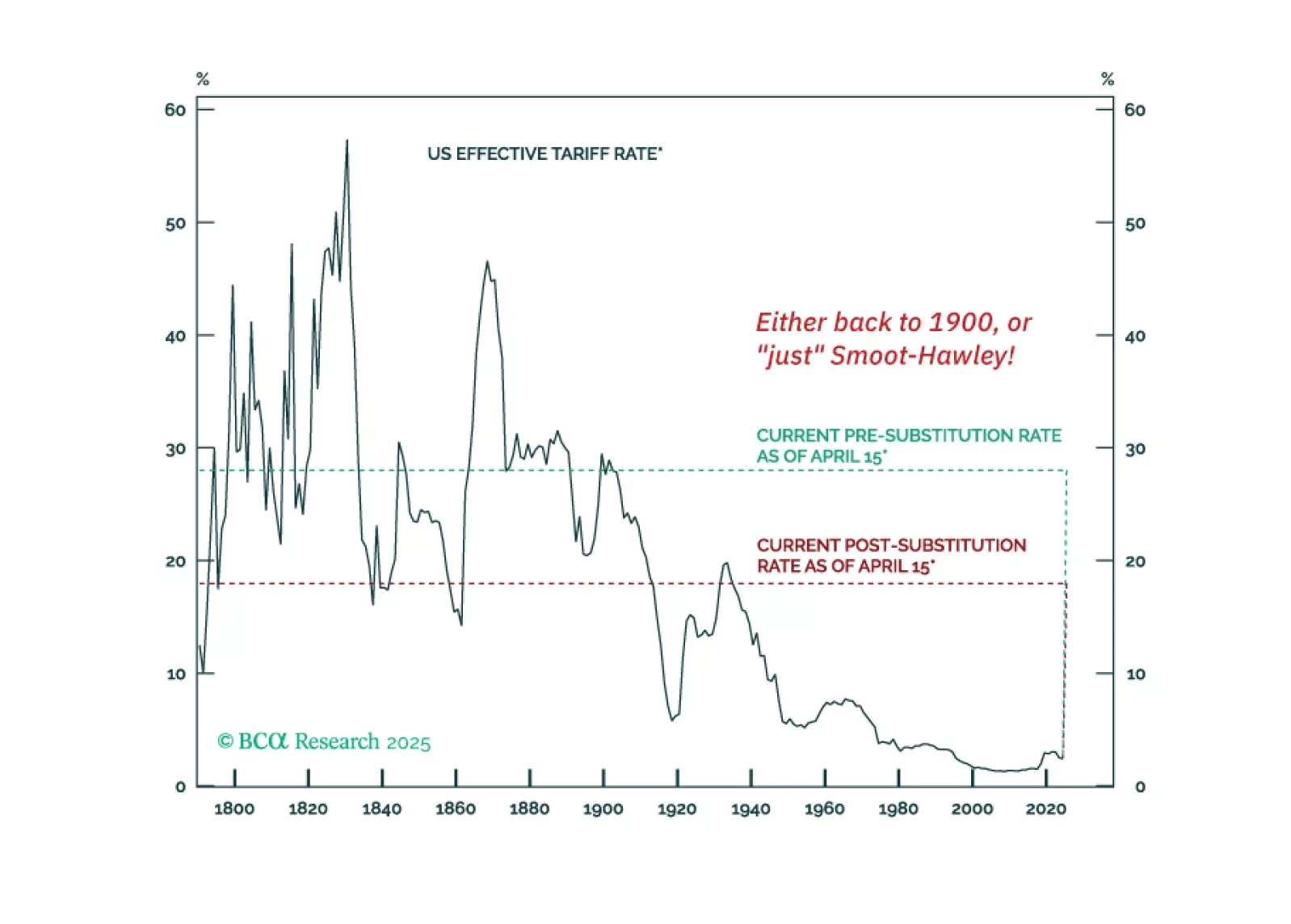

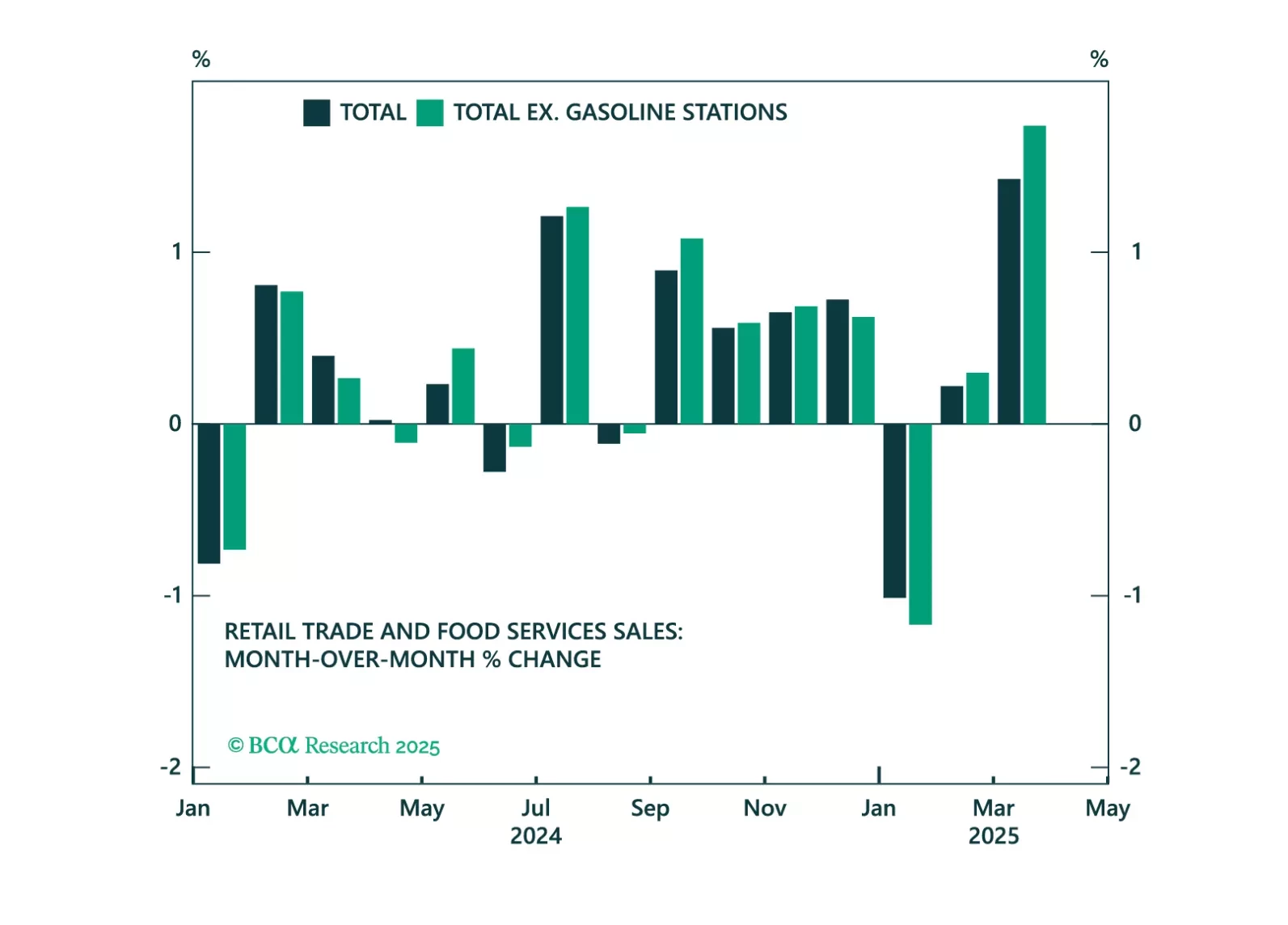

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

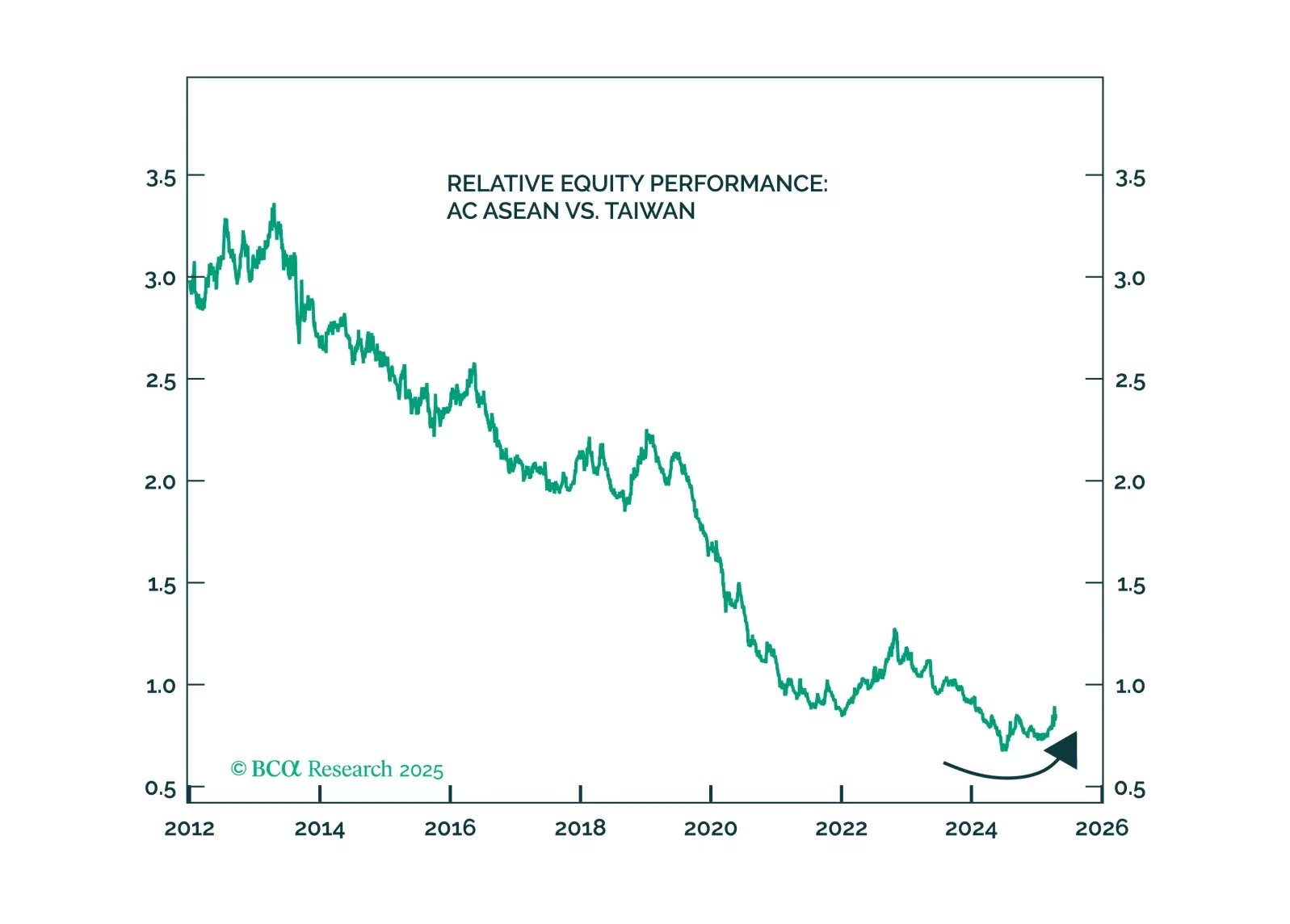

In our Alpha report, we explain how to trade the trade war and then conduct a scenario analysis for global asset allocation. The short version is that a policy induced recession has to be traded based on policy, not hard…

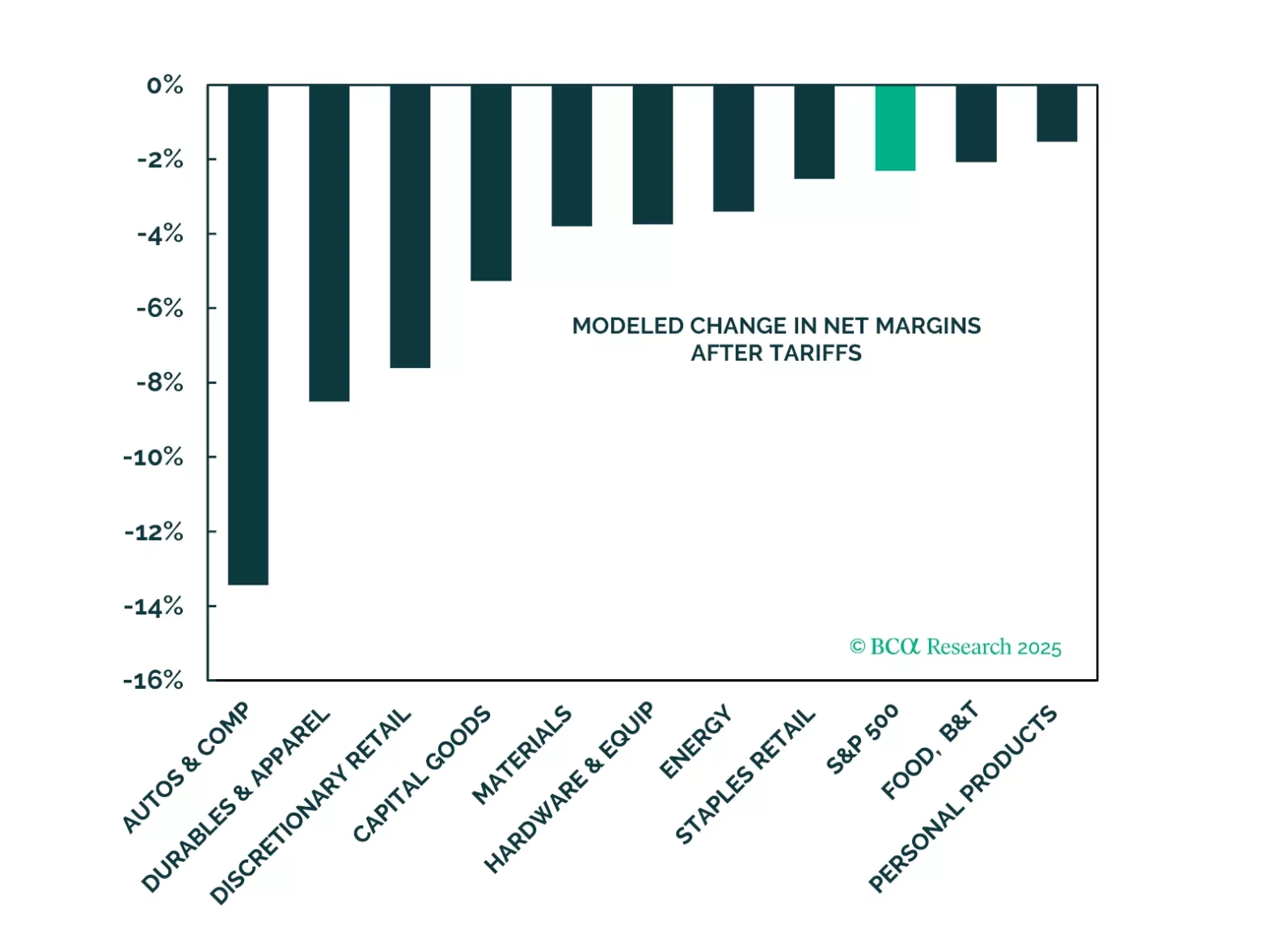

Last week, we hosted two webcasts for our clients globally to discuss the effects of tariffs on US equity sectors, preview the Q1 earnings season, and map out the trajectory of S&P 500 price performance. We also asked the webcast…

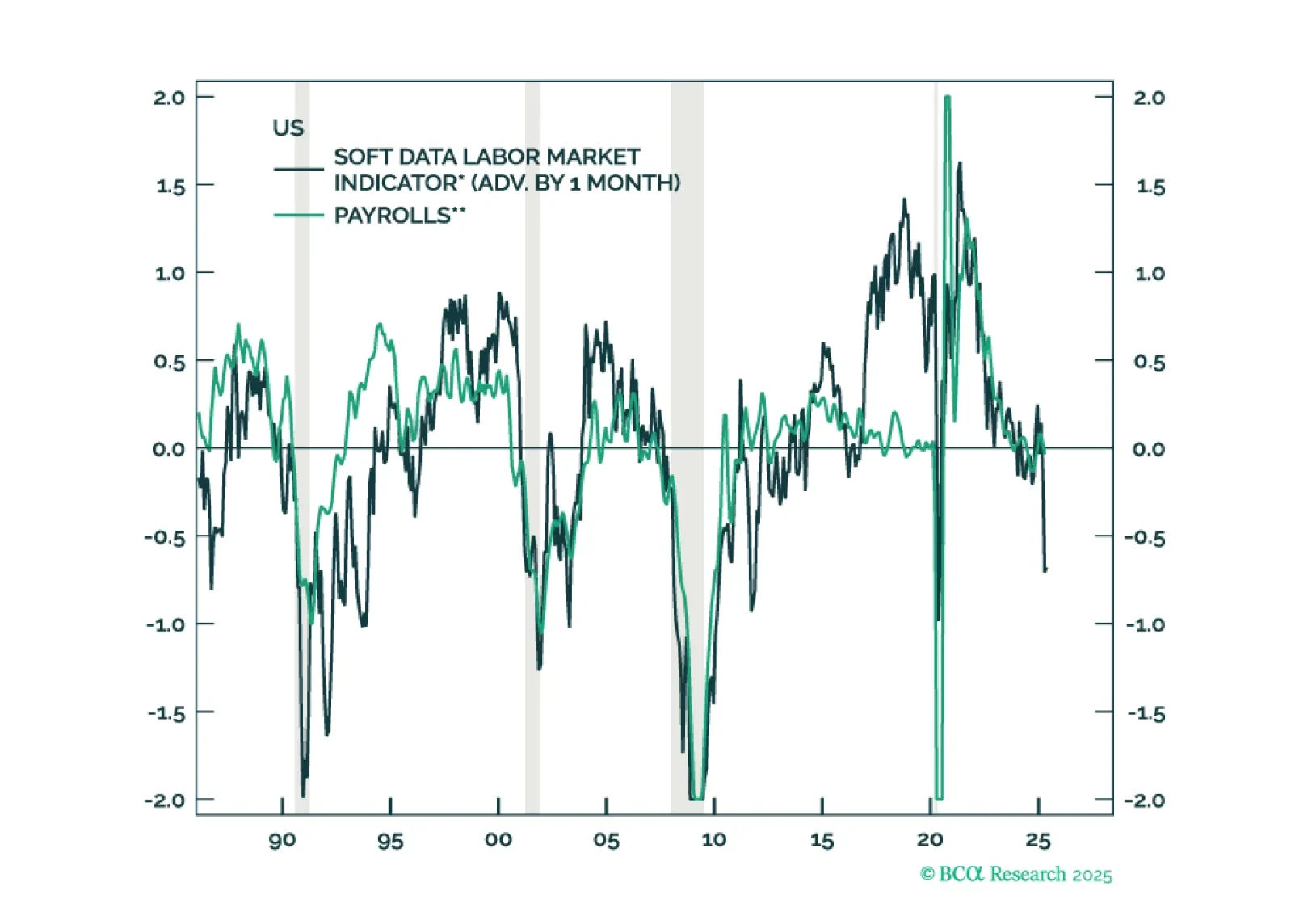

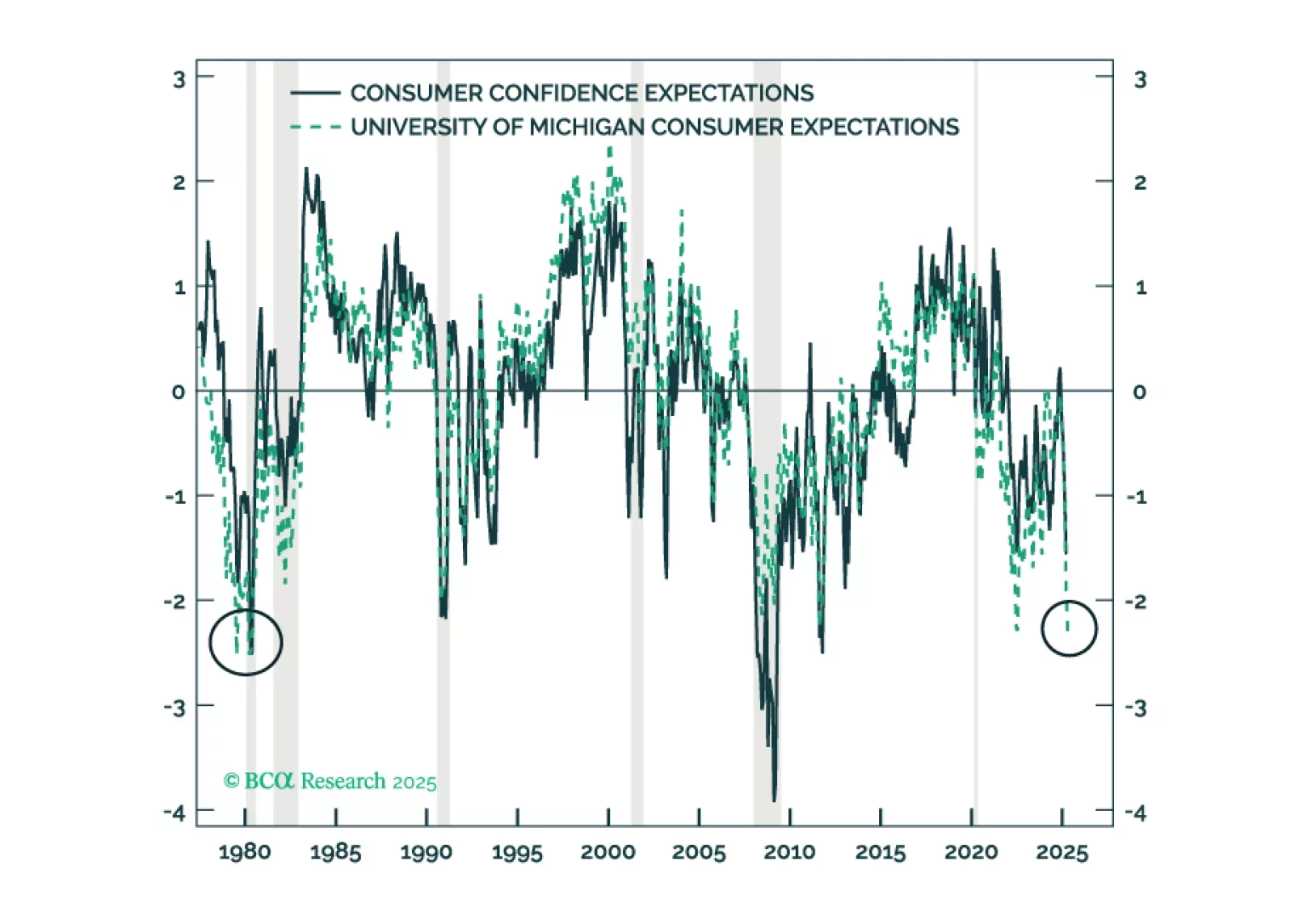

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our…

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.